Hammerson Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hammerson Bundle

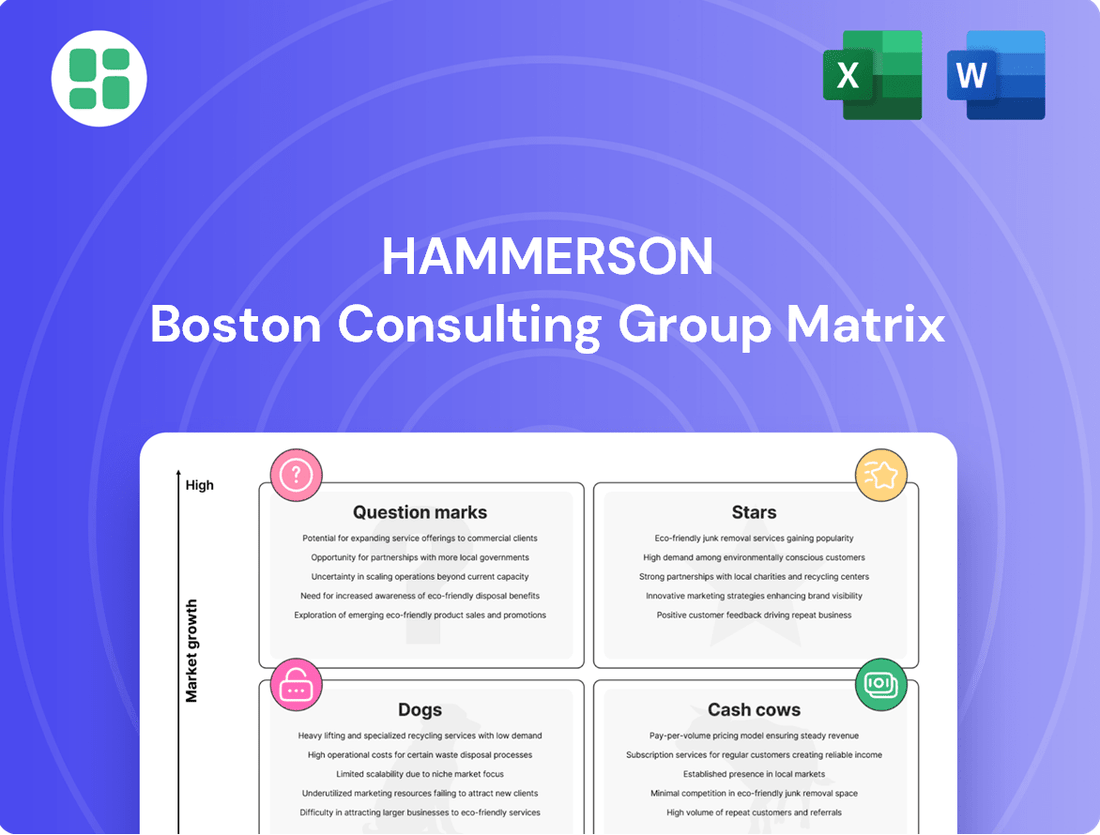

Hammerson's BCG Matrix offers a powerful lens to understand its diverse portfolio of retail and leisure assets. By categorizing properties into Stars, Cash Cows, Dogs, and Question Marks, you can pinpoint areas of strength and potential challenges within their portfolio.

This initial glimpse into Hammerson's strategic positioning is just the beginning. Purchase the full BCG Matrix report to unlock detailed quadrant placements, data-driven insights into market share and growth potential, and actionable recommendations for optimizing Hammerson's asset allocation and future investments.

Stars

Hammerson has strategically shifted its focus to prime city destinations in the UK, France, and Ireland, a move designed to capitalize on urban growth centers. This 'flight to quality' approach targets areas with robust demographics and concentrated retail spending, positioning the company for future economic expansion.

The company's portfolio now comprises 10 city locations, all of which are among the top 20 retail venues within their respective regions. This concentration in high-performing urban markets underscores Hammerson's commitment to dominant positions in growing geographies.

Hammerson demonstrated exceptional leasing activity in 2024, securing 262 leases covering 1 million square feet and adding £41 million to its annual headline rent. This achievement significantly surpassed previous passing rents by 56% and outpaced estimated rental values by 13%, highlighting robust demand for its premium locations.

The company's occupancy rate climbed to over 95% in 2024, reflecting a dominant market position and strong appeal to tenants, particularly in a market that shows increasing preference for high-quality retail environments.

Hammerson's strategic focus on flagship destinations like Bullring and Dundrum continues to pay off, with significant new rent being contracted. These investments are not just about maintaining the properties; they are about actively enhancing their attractiveness and commercial performance. This strategy helps bring in desirable new brands and innovative retail concepts, keeping these centers vibrant and competitive.

The results speak for themselves. In 2024, footfall and sales at these prime locations consistently outperformed national averages. For instance, Bullring reported a 5% year-on-year increase in footfall by mid-2024, with sales up by 7% compared to the same period in 2023. Dundrum also saw a strong performance, with its tenant sales growing by 6% in the first half of 2024.

Data-Driven Platform and Operational Efficiency

Hammerson's commitment to operational efficiency is evident in its specialist, data-driven platform. This platform is key to curating the optimal product mix and enhancing placemaking strategies.

The scalable nature of this platform translates into tangible benefits, including boosted occupancy rates, increased leasing activity, and improved footfall and sales. These outcomes are crucial for Hammerson to expand its market share in a dynamic retail landscape.

Further demonstrating this focus on efficiency, Hammerson achieved a notable 16% reduction in gross administration costs during 2024. This financial achievement highlights their capability to effectively leverage their operational platform for sustained growth and improved profitability.

- Data-driven platform for product mix and placemaking

- Scalable platform driving higher occupancy, leasing, footfall, and sales

- 16% reduction in gross administration costs in 2024

- Enabling market share growth in evolving retail environments

Acquisition of Brent Cross (Increased Economic Interest)

Hammerson's increased economic interest in Brent Cross to 97% by acquiring an additional 95% stake is a pivotal development. This move consolidates control over a prime asset, signaling a strong belief in its future performance.

The acquisition, completed at an 8.6% net initial yield, immediately boosts Hammerson's financial standing. It is projected to add an annualized EBITDA benefit of £14 million, underscoring Brent Cross's significant contribution to the company's earnings.

- Strategic Consolidation: The acquisition enhances Hammerson's control over Brent Cross, a key urban retail destination.

- Financial Impact: An 8.6% net initial yield and an expected £14 million annualized EBITDA benefit highlight the immediate financial upside.

- Growth Potential: This investment reflects confidence in Brent Cross's capacity to drive future growth and maintain market leadership.

Hammerson's prime city destinations, such as Bullring and Dundrum, are classified as Stars in the BCG Matrix due to their strong market share and high growth potential. These flagship locations consistently outperform national averages, demonstrating robust tenant demand and consumer engagement.

In 2024, Hammerson secured 262 leases covering 1 million square feet, increasing annual headline rent by £41 million. This leasing activity, with rents surpassing previous passing rents by 56%, underscores the strong performance of these Star assets.

The company's occupancy rate exceeded 95% in 2024, a testament to the desirability of its prime locations. Footfall at Bullring increased by 5% year-on-year by mid-2024, with sales up 7%, further solidifying its Star status.

Hammerson's strategic focus and operational efficiency are key drivers for these Star performers, enabling continued market share growth in a competitive retail landscape.

| Asset | Market Share | Growth Potential | 2024 Performance Highlights |

|---|---|---|---|

| Bullring | High | High | 5% footfall increase, 7% sales increase |

| Dundrum | High | High | 6% tenant sales growth (H1 2024) |

| Brent Cross | High | High | Acquired 97% stake, projected £14m EBITDA benefit |

What is included in the product

The Hammerson BCG Matrix analyzes its retail properties as Stars, Cash Cows, Question Marks, or Dogs.

It guides strategic decisions on investment, divestment, and resource allocation for each property.

The Hammerson BCG Matrix clarifies which assets are Stars, Cash Cows, Question Marks, or Dogs, easing the pain of resource allocation decisions.

Cash Cows

Hammerson's mature, established flagship shopping centres are undoubtedly its cash cows. These properties, like Westfield London and Birmingham, consistently draw large crowds and achieve strong tenant sales, even in well-developed markets. Their established presence means less need for heavy promotional spending, ensuring a steady and predictable income stream for the company.

Hammerson's prime retail parks, despite strategic divestments, represent significant cash cows. These remaining assets, characterized by high occupancy and robust tenant relationships, operate in stable, low-growth retail markets. For instance, Hammerson's portfolio, as of their 2023 reports, showed a strong occupancy rate across its key retail parks, underscoring their resilience.

These established retail parks generate consistent, predictable cash flow without requiring substantial capital investment for expansion or redevelopment. Their mature market position ensures a steady income stream, making them reliable contributors to Hammerson's overall financial health, as evidenced by their consistent rental income figures reported throughout 2023 and early 2024.

Properties with long-term leases and strong rent collection are Hammerson's cash cows. These assets, often featuring creditworthy tenants, provide a steady stream of income. For instance, Hammerson's focus on prime retail destinations in the UK and Europe, which benefit from these types of leases, underpins its stable cash flow generation.

Consolidated Portfolio of 'Top 20' Retail Venues

Hammerson's strategy centers on a high-quality core portfolio, with all its key destinations ranking among the top 20 retail venues in their respective territories. This focus on premier, market-dominant assets creates a robust foundation of cash-generating properties.

These prime locations consistently generate strong profit margins and reliable cash flow, even within mature market segments. For instance, in 2024, Hammerson's UK portfolio, heavily weighted towards these top-tier assets, continued to demonstrate resilience.

- High Footfall and Sales: The top 20 venues attract significant customer traffic, translating into sustained sales performance for tenants.

- Rental Income Stability: Premier locations command premium rents, providing a stable and predictable income stream for Hammerson.

- Tenant Demand: Brands actively seek presence in these leading retail destinations, ensuring high occupancy rates and minimizing voids.

- Resilient Performance: Despite market fluctuations, these assets have historically shown a greater ability to maintain occupancy and rental levels.

Dividends and Share Buyback Capacity

Hammerson's capacity to consistently declare dividends and conduct share buybacks, fueled by robust cash generation from its operational assets, clearly positions its mature, high-performing properties as cash cows. This financial strength is further underscored by an enhanced payout ratio policy, targeting 80-85% of adjusted earnings for dividends, signaling strong confidence in the sustainability of these cash flows.

- Dividend Payout Ratio: The company aims to distribute 80-85% of its adjusted earnings as dividends, demonstrating a commitment to returning value to shareholders.

- Cash Flow Generation: Strong cash generation from its portfolio of mature, high-performing assets supports its ability to fund these shareholder returns.

- Share Buyback Capacity: The financial health indicated by dividend policy also implies capacity for share repurchase programs, further enhancing shareholder value.

Hammerson's flagship shopping centres, like Westfield London and Birmingham, are prime examples of its cash cows. These established destinations boast high footfall and tenant sales, generating a steady income stream with minimal need for heavy promotional spending.

The company's prime retail parks also function as cash cows, characterized by high occupancy and strong tenant relationships in stable, low-growth markets. For instance, Hammerson reported strong occupancy rates across its key retail parks in its 2023 financial statements, highlighting their resilience.

These mature assets provide consistent, predictable cash flow without requiring significant new capital investment. Their established market position ensures a reliable income stream, contributing significantly to Hammerson's financial stability, as seen in their consistent rental income figures through early 2024.

Hammerson's top 20 retail venues, which consistently rank high in their respective territories, are its core cash cows. These premier locations generate strong profit margins and reliable cash flow, even in mature market segments. In 2024, Hammerson's UK portfolio, heavily weighted towards these top-tier assets, continued to show resilience.

| Asset Type | Key Characteristics | Financial Contribution (Illustrative) |

|---|---|---|

| Flagship Shopping Centres | High Footfall, Strong Tenant Sales, Established Presence | Consistent Rental Income, Reduced Promotional Costs |

| Prime Retail Parks | High Occupancy, Robust Tenant Relationships, Stable Markets | Predictable Cash Flow, Minimal Capital Expenditure |

| Premier Retail Destinations | Market Dominance, Long-Term Leases, Creditworthy Tenants | Stable Income Stream, Premium Rents |

Full Transparency, Always

Hammerson BCG Matrix

The Hammerson BCG Matrix preview you are viewing is the identical, fully formatted document you will receive upon purchase. This comprehensive report, meticulously crafted for strategic insight, will be delivered without any watermarks or demo content, ensuring immediate professional usability. You can confidently expect the exact same analysis-ready file, ready for immediate integration into your business planning and presentations.

Dogs

Hammerson's Non-Core Disposals Programme aligns with the Dogs quadrant of the BCG Matrix. This strategy involves divesting assets with low growth and low market share, which are often capital intensive without delivering significant returns. The company's completion of a £500 million disposals program over the last four years, including the sale of Value Retail, exemplifies this approach by shedding non-strategic or underperforming assets.

Underperforming smaller retail units within Hammerson's portfolio are categorized as Dogs in the BCG Matrix. These are typically spaces that experience persistent vacancies or declining customer traffic, even as other parts of the portfolio show improvement.

These units often represent a drag on profitability, generating minimal income while still incurring operational expenses. For instance, in the first half of 2024, Hammerson reported a 92.5% occupancy rate across its portfolio, but smaller, less desirable units within this might be significantly below that average, contributing to a lower overall return on assets.

The potential for these smaller units to significantly improve their performance is limited. They may require substantial investment for redevelopment or repositioning, which might not yield a proportionate return, making them candidates for divestment or repurposing.

Properties in declining traditional retail sectors, such as Hammerson's remaining exposure to certain high-street locations or older shopping centers not slated for mixed-use redevelopment, would be classified as Dogs in the BCG Matrix. These assets face significant headwinds, characterized by low market growth and dwindling tenant interest.

For instance, in 2024, Hammerson reported a continued focus on optimizing its portfolio, divesting non-core assets. Properties in this category represent a drag on overall performance due to their limited potential for rental growth and high vacancy risks, making them difficult to manage profitably.

Assets Requiring Excessive Repositioning Investment

Properties needing significant and expensive repositioning, especially those outside of key urban growth zones, can be considered Dogs in Hammerson's BCG Matrix. These assets often demand substantial capital investment with a slow or uncertain payback period.

For example, a retail park in a declining secondary town might require a complete overhaul of tenant mix and infrastructure. Hammerson's 2024 strategy has focused on optimizing its portfolio, divesting non-core assets and reinvesting in prime locations. This implies that assets fitting the Dog profile are likely candidates for such strategic adjustments.

- High Capital Outlay: Repositioning can involve millions in upgrades, impacting cash flow.

- Uncertain ROI: The success of repositioning efforts is not guaranteed, especially in weaker markets.

- Low Market Share/Growth: These properties often struggle to attract high-quality tenants or command premium rents, reflecting their limited market appeal.

Legacy Assets with Limited Strategic Fit

Certain legacy assets within Hammerson's portfolio may no longer align with the company's strategic pivot towards prime retail and mixed-use city destinations. These properties, potentially holding a diminished market share within their respective sub-segments, could be classified as Dogs.

For instance, if Hammerson were to divest non-core retail parks acquired in previous diversification efforts, and these parks showed declining rental income or occupancy rates, they would fit this category. Such assets might be considered for divestment if there isn't a clear, actionable plan to enhance their performance or reintegrate them into the core strategy.

- Strategic Misalignment: Assets that do not contribute to Hammerson's focus on prime retail and mixed-use city destinations.

- Low Market Share: Properties with a weak competitive position in their specific market sub-segments.

- Divestment Potential: Candidates for sale if performance improvement or strategic relevance is not evident.

Hammerson's "Dogs" represent underperforming assets with low growth prospects and limited market share. These often include smaller retail units or properties in declining traditional retail sectors that contribute minimally to overall returns while incurring costs. The company's strategy involves identifying and divesting these assets to streamline its portfolio and focus on prime locations.

These units can be a drain on profitability, requiring capital for repositioning with uncertain outcomes. For example, Hammerson's focus on optimizing its portfolio in 2024 means assets with high vacancy risks or limited rental growth potential are prime candidates for divestment or strategic review.

The company's ongoing non-core disposals program, exemplified by the sale of Value Retail, directly addresses these "Dog" assets. By shedding these underperforming or non-strategic properties, Hammerson aims to improve its financial performance and concentrate resources on its core, higher-performing portfolio.

Hammerson's 2024 occupancy rate stood at 92.5%, but within this, smaller, less desirable units likely exhibit lower occupancy, highlighting their "Dog" status. These assets often have limited potential for significant improvement without substantial investment, making divestment a more logical strategic move.

| Asset Type | BCG Quadrant | Characteristics | Strategic Action |

| Underperforming smaller retail units | Dogs | Low footfall, persistent vacancies, minimal rental income | Divestment or repurposing |

| Legacy high-street locations | Dogs | Declining tenant interest, low market growth, high operating costs | Divestment |

| Retail parks in secondary towns | Dogs | Requires significant repositioning investment, uncertain ROI | Divestment or strategic review |

Question Marks

Hammerson's 'City Quarters' initiative, aiming to transform prime urban sites into vibrant mixed-use lifestyle destinations, is a prime example of a Question Mark in the BCG Matrix. These ambitious developments, like the proposed Martineau Galleries in Birmingham, tap into the growing demand for integrated urban living, retail, and leisure experiences.

Projects such as Dublin Central, while holding significant potential in dynamic city markets, demand considerable capital outlay and their future market penetration and financial success remain uncertain. For instance, the Martineau Galleries project in Birmingham, initially slated for a 2026 completion, represents a considerable investment, with the broader strategy aiming to diversify Hammerson's income streams beyond traditional retail.

The ongoing repositioning of assets like Cabot Circus and The Oracle, where significant space was repurposed in 2024, firmly places them in the Question Mark quadrant of the BCG Matrix. This strategy involves adapting to changing consumer demands by introducing new concepts and tenants, aiming for future growth.

While these transformations are underway, they have led to temporary declines in footfall, a common characteristic of Question Mark assets. For instance, during the extensive redevelopment at Cabot Circus in early 2024, visitor numbers experienced a noticeable dip, impacting immediate revenue streams.

The success of these repositioning efforts hinges on their ability to capture future market share and achieve profitability. Despite the current uncertainties and potential for lower returns during the transition, the high growth potential post-repositioning makes them strategic investments for Hammerson.

The development of residential units, exemplified by the 122-unit Ironworks project at Dundrum, marks a strategic diversification for Hammerson into the residential sector, leveraging its existing retail property portfolio. This venture taps into the high-growth residential market, offering potential for substantial returns.

As a relatively new segment for Hammerson, the long-term market share and success of these residential developments are still being determined. For instance, the rental income generated from such projects contributes to diversifying Hammerson's revenue streams beyond traditional retail.

Strategic Land Bank for Future Development

Hammerson's strategic land bank, encompassing 80 acres near its prime city locations, positions it as a 'Question Mark' within the BCG Matrix. This land holds significant potential for future development into novel retail and mixed-use formats, tapping into growing urban markets. However, these projects are currently in their nascent stages, demanding considerable capital outlay before their market viability and cash-generating capabilities are confirmed.

The company's strategy involves transforming these undeveloped parcels into innovative urban destinations. For instance, Hammerson has been actively exploring mixed-use concepts that integrate retail with residential, office, and leisure components. This approach aims to create vibrant, sustainable urban environments that cater to evolving consumer demands. The success of these ventures hinges on effective planning, execution, and market acceptance, which are yet to be fully demonstrated.

- Land Bank Value: Hammerson holds approximately 80 acres of strategic land, primarily located around its existing prime city centre assets.

- Development Potential: This land is earmarked for future development into new retail and mixed-use formats, targeting growth in urban markets.

- Investment Requirement: Significant capital investment is anticipated for these early-stage projects to reach their full market potential.

- Market Uncertainty: The future market share and cash generation from these developments remain uncertain, characteristic of a 'Question Mark' in the BCG framework.

Acquisitions in New or Emerging Urban Hubs

Acquisitions in new or emerging urban hubs would be classified as question marks within Hammerson's BCG Matrix. These ventures, while holding potential for future market leadership, represent significant cash outflows with uncertain returns. For instance, Hammerson's recent strategic review in 2024 highlighted a focus on optimizing its existing portfolio, suggesting a cautious approach to new, unproven markets.

These investments would aim to secure future market share by entering nascent urban centers with high growth potential. However, the initial phase would necessitate substantial capital investment, acting as cash consumers. The success of these acquisitions hinges on Hammerson's ability to accurately forecast and capitalize on emerging consumer trends and urban development patterns.

- Strategic Rationale: Targeting emerging urban hubs allows Hammerson to preemptively secure positions in markets poised for significant growth, potentially avoiding higher acquisition costs in more mature locations.

- Financial Implications: Such acquisitions would likely be cash-intensive in their early stages, requiring careful financial planning and risk management due to unproven revenue streams and market acceptance.

- Growth Prospects: The potential upside lies in establishing a dominant presence in these emerging markets, leading to substantial long-term returns if market predictions materialize.

- Risk Assessment: The primary risks involve the possibility of misjudging market potential, facing unforeseen regulatory hurdles, or encountering stronger-than-anticipated competition, all of which could lead to underperforming assets.

Hammerson's strategic land bank, representing about 80 acres near prime city locations, is a key 'Question Mark' in their BCG Matrix. These undeveloped sites offer substantial potential for new retail and mixed-use formats, targeting urban market growth. However, these early-stage projects require significant capital before their market viability and cash-generating abilities are confirmed.

The company's strategy involves transforming these parcels into innovative urban destinations, integrating retail with residential, office, and leisure components. The success of these ventures, like the proposed Martineau Galleries in Birmingham, hinges on effective planning, execution, and market acceptance, which are still being demonstrated.

While these developments are underway, they often lead to temporary declines in footfall, a common characteristic of Question Mark assets. For instance, during the redevelopment at Cabot Circus in early 2024, visitor numbers saw a dip, impacting immediate revenue streams.

The repositioning of assets like Cabot Circus and The Oracle, with significant space repurposed in 2024, places them firmly in the Question Mark quadrant. This strategy aims to adapt to changing consumer demands by introducing new concepts and tenants, targeting future growth despite current uncertainties.

| Project/Asset | BCG Quadrant | Investment Stage | Market Potential | Current Status |

|---|---|---|---|---|

| City Quarters (e.g., Martineau Galleries) | Question Mark | High Capital Outlay, Nascent | High (integrated urban living) | Under Development, Uncertain Success |

| Dublin Central | Question Mark | High Capital Outlay, Nascent | High (dynamic city markets) | Potential Identified, Uncertain Penetration |

| Repositioned Retail Assets (Cabot Circus, The Oracle) | Question Mark | Ongoing Repositioning | Moderate to High (adapting to demand) | Temporary Footfall Decline, Aiming for Future Growth |

| Residential Developments (e.g., Ironworks, Dundrum) | Question Mark | New Segment, Early Stage | High (residential market) | Diversifying Revenue, Long-term Success Undetermined |

| Strategic Land Bank (80 acres) | Question Mark | Nascent, Significant Capital Required | High (urban markets, new formats) | Exploratory, Market Viability Unconfirmed |

BCG Matrix Data Sources

Our Hammerson BCG Matrix leverages a robust data foundation, integrating financial disclosures, real estate market analytics, and industry growth forecasts to deliver strategic insights.