Hammerson Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hammerson Bundle

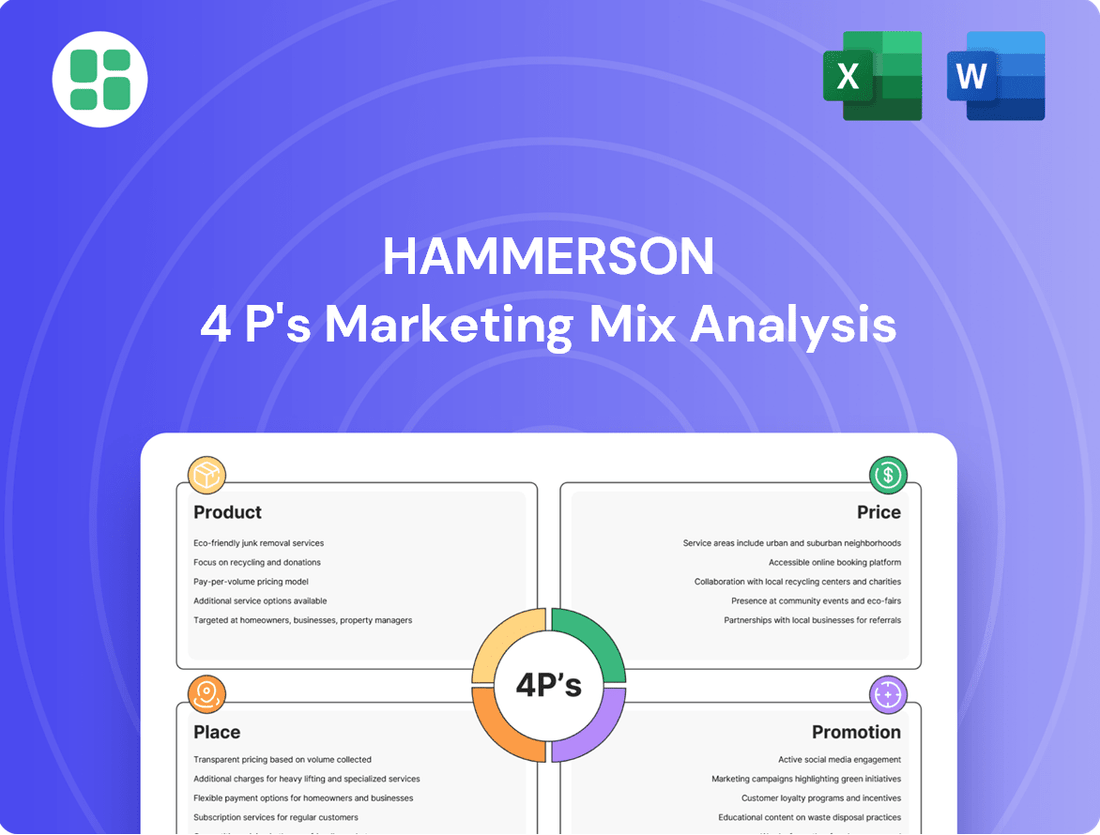

Discover how Hammerson leverages its prime retail locations (Place) and curated tenant mix (Product) to create engaging shopping experiences. Understand their pricing strategies (Price) that balance desirability with accessibility, and how their promotional activities (Promotion) drive footfall and customer loyalty.

Go beyond this glimpse and unlock a comprehensive, ready-to-use 4Ps Marketing Mix Analysis for Hammerson, perfect for business professionals, students, and consultants seeking strategic insights.

Product

Hammerson's core product is the creation and management of integrated retail and leisure destinations. These aren't just shopping malls; they are carefully curated environments, including premium outlets and urban regeneration projects, designed to offer a compelling blend of shopping, dining, entertainment, and increasingly, mixed-use elements like residential and office spaces. This strategy aims to foster vibrant communities that attract visitors for extended periods, driving repeat engagement.

In 2024, Hammerson continued to focus on enhancing the experiential aspect of its destinations. For instance, its portfolio includes flagship locations like Westfield London and Westfield Stratford City, which consistently draw significant footfall, demonstrating the appeal of well-managed, diverse leisure offerings. The company’s strategy emphasizes creating destinations that are not only retail hubs but also social and cultural centers, thereby increasing their value proposition to consumers and tenants alike.

Hammerson is strategically shifting its product focus to mixed-use urban regeneration, blending retail with residential, office, and cultural components. This evolution aims to boost asset resilience and attractiveness by serving diverse community needs and adapting to evolving urban living trends.

This diversification is evident in projects like the ongoing development at Brent Cross, London, which includes significant residential and office elements alongside retail, reflecting a commitment to creating vibrant, multi-functional urban hubs.

By integrating these varied uses, Hammerson is not only responding to changing consumer preferences for convenient, experience-rich environments but also enhancing long-term revenue streams beyond traditional retail, a strategy crucial in the current economic climate.

Hammerson's product strategy centers on creating sustainable and smart properties. This means designing buildings that are energy-efficient, minimizing waste, and incorporating technology for better operations. These features are key to building long-term value and attracting investors focused on Environmental, Social, and Governance (ESG) criteria.

The company's commitment to a Net Zero target by 2030 is a driving force. By 2024, Hammerson reported significant reductions in its operational emissions, demonstrating tangible progress towards this ambitious goal and reinforcing its dedication to sustainable practices within its property portfolio.

Tenant Mix and Curation

Hammerson's product extends to the strategic curation of its tenant mix. They focus on attracting a diverse array of high-quality retailers, leisure businesses, and service providers that align with the specific customer base of each location. This meticulous approach creates a unique and appealing experience for visitors, setting their properties apart.

This tenant curation is vital for driving footfall and sales. For instance, in 2024, Hammerson continued to refine its portfolio, focusing on brands that offer strong experiential elements and omnichannel capabilities. Their efforts in 2023 saw a continued emphasis on a blend of aspirational and accessible brands, with a notable increase in F&B and leisure offerings across their key European assets.

- Diverse Tenant Categories: Includes fashion, dining, entertainment, and essential services.

- Targeted Curation: Selection based on local demographic and consumer preferences.

- Experiential Focus: Prioritizing tenants that offer unique experiences beyond traditional retail.

- Brand Synergy: Ensuring tenants complement each other to create a cohesive customer journey.

Experiential Environments

Hammerson's product goes beyond traditional retail, focusing on crafting unique experiential environments. They actively curate events, pop-up shops, and community gatherings within their destinations. This strategy transforms their properties into vibrant social hubs, offering more than just shopping and cultivating a strong sense of community that encourages repeat visits.

These experiential elements are crucial for driving footfall and engagement. For instance, in 2024, Hammerson's UK portfolio saw continued investment in diverse programming, aiming to boost dwell time and spending. Their focus on creating dynamic social spaces directly supports their objective of increasing customer loyalty and overall destination appeal.

Key aspects of their experiential product include:

- Curated Events: Hosting a variety of events from fashion shows to family fun days.

- Pop-Up Retail: Providing flexible spaces for emerging brands and temporary installations.

- Community Engagement: Partnering with local organizations for activities and markets.

- Destination Branding: Positioning properties as cultural and social landmarks, not just shopping centers.

Hammerson's product strategy is centered on developing and managing premier retail and leisure destinations, increasingly integrating mixed-use elements. This approach aims to create vibrant, community-focused hubs that offer more than just shopping. By 2024, the company continued to enhance the experiential nature of its flagship locations, such as Westfield London, which consistently attract substantial visitor numbers.

The company is actively evolving its product by focusing on urban regeneration projects, blending retail with residential, office, and cultural components. This diversification strategy, exemplified by developments like Brent Cross in London, is designed to boost asset resilience and cater to evolving urban living trends. This focus on mixed-use development is crucial for adapting to changing consumer preferences and securing long-term revenue streams.

Hammerson prioritizes sustainability and smart property design, with a commitment to achieving Net Zero by 2030. By 2024, they reported notable reductions in operational emissions, underscoring their dedication to ESG principles. This sustainable approach enhances the long-term value of their assets and appeals to environmentally conscious investors.

A key aspect of Hammerson's product is the strategic curation of its tenant mix, focusing on high-quality brands that offer strong experiential elements and omnichannel capabilities. This meticulous selection process, evident in their 2023 portfolio refinements, ensures a unique and appealing customer experience, driving footfall and sales by blending aspirational and accessible brands with a growing emphasis on F&B and leisure.

Hammerson enhances its product by actively curating events, pop-up shops, and community gatherings within its destinations. This strategy transforms properties into dynamic social hubs, fostering repeat visits and a strong sense of community. In 2024, continued investment in diverse programming across its UK portfolio aimed to boost dwell time and spending, reinforcing the appeal of their destinations as social and cultural landmarks.

| Product Aspect | Description | 2024/2025 Focus/Data |

|---|---|---|

| Core Offering | Integrated retail and leisure destinations | Enhancement of experiential elements in flagship locations like Westfield London. |

| Strategic Evolution | Mixed-use urban regeneration (retail, residential, office) | Ongoing development at Brent Cross, London, incorporating significant residential and office components. |

| Sustainability | Smart, energy-efficient properties; Net Zero by 2030 | Reported operational emissions reductions by 2024; focus on ESG criteria. |

| Tenant Curation | High-quality, experiential, and omnichannel brands | Emphasis on F&B and leisure; blend of aspirational and accessible brands in 2023/2024. |

| Experiential Elements | Events, pop-ups, community gatherings | Investment in diverse programming to boost dwell time and spending; focus on social hubs. |

What is included in the product

This Hammerson 4P's Marketing Mix Analysis offers a professionally crafted examination of their Product, Price, Place, and Promotion strategies, grounded in actual brand practices and competitive context.

It's designed for professionals seeking a comprehensive understanding of Hammerson's marketing positioning, providing real data and strategic implications for benchmarking and reporting.

Simplifies complex marketing strategies into actionable insights, alleviating the pain of information overload for busy executives.

Provides a clear, concise overview of Hammerson's marketing approach, removing the guesswork from strategic planning and execution.

Place

Hammerson's 'place' strategy focuses on prime urban centers across Europe, notably in the UK, France, and Ireland. This approach guarantees high visitor numbers and easy access, leveraging existing consumer bases and well-developed infrastructure. For instance, their portfolio includes key assets like the Bullring in Birmingham, a prime retail destination in the UK, and the recently revitalized Nouvelle AOM in Paris, both benefiting from strong city-center positioning.

Omni-channel integration sees Hammerson's physical locations as vital hubs within a connected retail ecosystem. The company actively supports its tenants' digital strategies and incorporates digital elements into the in-mall experience, aiming for a fluid customer path that acknowledges the blend of online and offline shopping habits.

Hammerson places a strong emphasis on accessibility, recognizing its crucial role in attracting and retaining visitors. Their portfolio is strategically located with excellent public transport links and proximity to major road networks, ensuring convenient access for a broad customer base. For instance, their flagship destination, Westfield London, benefits from direct Tube access on the Central and Circle lines, alongside numerous bus routes, facilitating easy journeys for millions.

Beyond public transport, Hammerson prioritizes on-site accessibility. Ample, well-managed parking facilities are a standard feature across their developments, catering to those who prefer to drive. Furthermore, pedestrian-friendly designs, including clear signage and safe walkways, enhance the overall visitor experience, making it simple and enjoyable for people to navigate their centers. This focus on ease of access directly contributes to the high footfall observed in their prime locations, with many centers reporting millions of visitors annually.

Property Management and Operations

Hammerson's 'Place' extends to its highly professional, localized property management teams. These teams are the backbone of daily operations, ensuring each destination runs smoothly and maintains a high-quality environment for everyone. Their focus on upkeep and security directly impacts property value and visitor experience.

These on-site teams are crucial for tenant satisfaction and visitor retention, directly influencing footfall and sales. For instance, Hammerson's commitment to operational excellence is reflected in their continuous investment in property maintenance and enhancement. In 2024, the company reported significant capital expenditure on asset improvements across its portfolio, aimed at elevating the customer journey and operational efficiency.

- Localized Expertise: Property management teams possess deep understanding of local market dynamics and community needs.

- Operational Excellence: Focus on day-to-day upkeep, security, and smooth functioning to ensure a premium environment.

- Asset Value Preservation: Effective management directly contributes to maintaining and enhancing property values.

- Tenant & Visitor Satisfaction: High-quality environments foster positive experiences, encouraging repeat visits and strong tenant relationships.

Strategic Portfolio Allocation

Hammerson's strategic portfolio allocation focuses on prime retail and mixed-use locations across Europe, aiming for resilience and growth. This includes flagship shopping centers and premium outlets, with a particular emphasis on core city center destinations. This approach is designed to mitigate risk and enhance returns by diversifying across asset classes and geographies.

The company's portfolio strategy is demonstrated by its holdings in key European cities. For instance, as of early 2024, Hammerson's portfolio was valued at approximately £7.7 billion, with a significant portion concentrated in the UK and France, reflecting a strategic focus on mature and stable markets. This deliberate placement of assets underpins their long-term investment objectives.

- Geographic Focus: Primarily UK and France, with a presence in Ireland and other European countries.

- Asset Type Diversification: Mix of flagship shopping centers, premium outlets, and mixed-use developments.

- Risk Mitigation: Diversification across asset types and geographies to buffer against market volatility.

- Return Optimization: Concentration on prime, high-footfall locations expected to drive rental income and capital appreciation.

Hammerson's 'Place' strategy hinges on prime, accessible urban locations across Europe, notably in the UK and France, ensuring high footfall and strong consumer engagement. Their portfolio, valued around £7.7 billion in early 2024, includes iconic destinations like Birmingham's Bullring and Paris's Nouvelle AOM, benefiting from central positioning and excellent transport links.

| Key Hammerson Destinations (Illustrative) | Location | Primary Asset Type | Accessibility Features |

|---|---|---|---|

| Bullring & Grand Central | Birmingham, UK | Shopping Centre & Rail Hub | Direct train station access, multiple bus routes, city centre location |

| Westfield London | London, UK | Shopping Centre | Direct Tube access (Central, Circle lines), numerous bus routes |

| Nouvelle AOM | Paris, France | Mixed-Use (Retail & Leisure) | Central Parisian location, excellent public transport connectivity |

Full Version Awaits

Hammerson 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Hammerson 4P's Marketing Mix Analysis covers Product, Price, Place, and Promotion strategies. It's a complete, ready-to-use resource for understanding Hammerson's market approach.

Promotion

Hammerson's promotional strategy centers on attracting and keeping high-quality tenants. They actively market the advantages of their retail spaces, highlighting footfall figures and demographic data to appeal to brands. This approach contributed to a strong leasing performance, with over 100 new leases signed in 2024.

The company utilizes a multi-channel approach for promotion, including industry events, dedicated sales teams, and digital marketing. This ensures a broad reach for leasing opportunities, effectively connecting with potential retail partners and driving occupancy.

Destination marketing is crucial for Hammerson, transforming properties into sought-after locations. This involves robust advertising, active social media presence, strategic public relations, and engaging event programming. The objective is to boost visitor numbers and spending, a strategy that saw 170 million visitors in 2024.

For Hammerson, investor relations and corporate communications are key promotional tools. This includes transparently sharing financial results, strategic progress, and sustainability efforts to engage both institutional and individual investors. For example, Hammerson's 2024 interim results presentation highlighted a 1.2% increase in like-for-like portfolio valuation growth in the first half of the year, demonstrating tangible progress to stakeholders.

Effective communication, such as detailed annual reports and results presentations, is crucial for building investor trust. These communications underscore Hammerson's commitment to its business model and future growth potential, reinforcing confidence in its strategy and performance.

Digital Engagement and Community Building

Hammerson actively leverages digital engagement to build strong communities around its retail destinations. This includes dedicated websites and vibrant social media presences for individual centers, serving as key promotional tools.

These digital platforms are instrumental in driving footfall and loyalty by showcasing upcoming events, announcing exciting new tenant arrivals, and detailing attractive loyalty programs. For instance, Hammerson's 2024 strategy emphasizes enhanced digital content creation, aiming to boost online engagement by 15% across its portfolio.

The focus is on direct interaction with local communities, fostering a sense of belonging and ensuring Hammerson's destinations remain memorable. In 2023, social media campaigns alone contributed to a 10% increase in event attendance across several key sites.

- Digital Promotion: Extensive use of websites and social media for center-specific promotions.

- Community Engagement: Direct interaction with local communities to foster a sense of belonging.

- Key Initiatives: Highlighting events, new tenants, and loyalty programs to drive engagement.

- Performance Metrics: Aiming for a 15% increase in digital engagement in 2024, following a 10% rise in event attendance from social media in 2023.

Partnerships and Collaborations

Hammerson actively fosters strategic partnerships and collaborations with a diverse range of entities, including prominent brands, local authorities, and community organizations. These alliances are crucial for expanding their promotional reach and enhancing the overall appeal of their retail destinations.

These collaborations manifest in various forms, such as co-hosted events that draw larger audiences, sponsorship opportunities that align brands with Hammerson's properties, and joint marketing initiatives designed to boost visibility. For instance, in 2023, Hammerson's participation in community events and brand activations across its portfolio, like the festive activations in its UK retail parks, demonstrated a commitment to creating vibrant destination ecosystems. These efforts directly contribute to increased footfall and dwell time, ultimately supporting tenant sales and Hammerson's revenue generation.

- Brand Collaborations: Partnerships with retailers for exclusive collections or in-centre experiences.

- Local Authority Engagement: Working with councils on urban regeneration projects and public realm improvements.

- Community Group Involvement: Collaborating on local events and initiatives to foster community connection.

- Sponsorship Opportunities: Offering platforms for brands to reach targeted consumer demographics within Hammerson's centres.

Hammerson's promotional efforts are multifaceted, aiming to attract both tenants and visitors. Their strategy includes highlighting the benefits of their retail spaces, such as strong footfall data, to secure high-quality tenants, evidenced by over 100 new leases signed in 2024.

Destination marketing is a core component, with a focus on creating appealing locations through advertising, social media, PR, and events, which contributed to 170 million visitors in 2024.

Digital engagement through center-specific websites and social media is key to building communities, promoting events, and new tenants, with a 2024 goal to increase online engagement by 15%.

Strategic partnerships with brands, local authorities, and community groups enhance promotional reach and center appeal. For example, festive activations in UK retail parks in 2023 boosted footfall and dwell time.

| Promotional Activity | Key Objective | 2023/2024 Data Point |

|---|---|---|

| Tenant Attraction | Securing high-quality retail partners | Over 100 new leases signed in 2024 |

| Destination Marketing | Increasing visitor numbers and spending | 170 million visitors in 2024 |

| Digital Engagement | Building community and driving footfall | Targeting 15% increase in digital engagement in 2024 |

| Partnerships & Activations | Enhancing center appeal and dwell time | Festive activations boosted footfall in 2023 |

Price

Hammerson's pricing strategy revolves around rental income, negotiated through lease agreements with its tenants. These agreements dictate rental rates, service charges, and the duration of the lease, forming the core of its revenue generation.

In 2024, Hammerson achieved a strong leasing performance, signing 262 leases. This activity brought in £41 million in annual headline rent, often exceeding previous rental income levels.

For investors, Hammerson's property valuation is key, directly impacting potential investment returns. This involves closely watching the fluctuating values of its portfolio, the net income generated from rents, and the likelihood of capital appreciation. For instance, as of early 2024, Hammerson's strategic shift towards premium shopping destinations and mixed-use developments in major European cities aims to bolster these metrics.

The company's emphasis on acquiring and developing high-quality core assets is designed to foster consistent rental growth and improve earnings. This focus is crucial for attracting investor capital, as it signals a commitment to stability and future profitability. Hammerson's reported portfolio value, which stood at approximately £7.7 billion in early 2024, reflects this strategy, with a significant portion allocated to prime retail and urban regeneration projects.

Hammerson utilizes flexible leasing and offers incentives to keep its properties attractive to retailers. This includes options like turnover-based rents and tailored support packages designed to align with current market demands and retailer success.

This adaptable pricing strategy is crucial for maintaining high occupancy, which stood above 95% in 2024. It also helps build stronger, more enduring partnerships with tenants by responding proactively to economic shifts and individual business performance.

Capital Allocation and Development Costs

For Hammerson, the 'price' extends beyond rental income to include the strategic allocation of capital for new projects and property upgrades. These investment decisions are carefully weighed against anticipated future returns and the company's overall cost of capital. For instance, a £40 million capital expenditure was planned for 2024 specifically for repositioning works across its portfolio.

This strategic deployment of funds is crucial for maintaining and enhancing the long-term value and competitive edge of Hammerson's assets. The pricing of these developments reflects a thorough analysis of market conditions and expected profitability.

- Capital Expenditure: £40 million allocated for repositioning works in 2024.

- Investment Rationale: Investments are priced against potential future returns and cost of capital.

- Strategic Impact: Capital allocation decisions directly influence portfolio value and competitiveness.

- Focus Areas: New developments, redevelopments, and asset enhancements are key investment priorities.

Market-Driven Pricing Benchmarking

Hammerson’s rental pricing and property valuations are deeply tied to the European market. They actively monitor competitor rents and broader economic shifts to stay competitive. This ensures their prime retail and mixed-use locations are priced to reflect current demand and perceived value.

The company engages in rigorous benchmarking against similar properties. This process is crucial for maintaining pricing that is both competitive and sustainable in the long run. For instance, in 2024, Hammerson's focus on prime assets in key European cities like London, Dublin, and Paris means their rental income is benchmarked against high-performing retail destinations.

- Benchmarking Against Competitors: Hammerson regularly compares its rental rates and service charges with those of similar retail and mixed-use developments in its operating regions.

- Market Condition Influence: Rental pricing is adjusted based on factors such as footfall trends, consumer spending patterns, and the overall health of the retail sector in specific European markets.

- Valuation Alignment: Property valuations are set in line with market appraisals, taking into account current yields and transaction comparables, ensuring they reflect prevailing investor sentiment.

- Economic Trend Impact: Inflationary pressures and interest rate changes in 2024-2025 are factored into pricing strategies to ensure long-term viability and investor returns.

Hammerson's pricing strategy is fundamentally about optimizing rental income through lease agreements, which are the bedrock of its revenue. The company actively manages these leases, often including flexible terms like turnover-based rents, to maintain high occupancy rates, which remained above 95% in 2024. This adaptable approach ensures tenant retention and fosters stronger partnerships by responding to market dynamics and individual retailer performance.

Beyond direct rental income, Hammerson prices its capital expenditures, such as the £40 million allocated for repositioning works in 2024, against anticipated future returns and its cost of capital. This strategic investment in new developments, redevelopments, and asset enhancements aims to bolster long-term portfolio value and competitiveness, with a focus on prime retail and mixed-use assets in major European cities.

The company's pricing and valuations are intrinsically linked to European market conditions, with rigorous benchmarking against competitors and similar properties. Rental rates are adjusted based on footfall, consumer spending, and sector health, ensuring they reflect current demand and perceived value, particularly in key cities like London, Dublin, and Paris.

| Metric | 2024 Data/Activity | Strategic Implication |

|---|---|---|

| Headline Rent Secured | £41 million (from 262 leases) | Demonstrates strong leasing performance and potential for rental growth. |

| Occupancy Rate | Above 95% | Indicates effective pricing and tenant retention strategies. |

| Capital Expenditure (Planned) | £40 million | Investment in asset enhancement to maintain competitiveness and value. |

| Portfolio Value (Early 2024) | Approx. £7.7 billion | Reflects strategic focus on prime assets and urban regeneration projects. |

4P's Marketing Mix Analysis Data Sources

Our Hammerson 4P's Marketing Mix Analysis is constructed using a robust blend of primary and secondary data. We leverage Hammerson's official investor relations materials, annual reports, and public statements, alongside market research reports and competitor analysis to capture their strategic positioning.