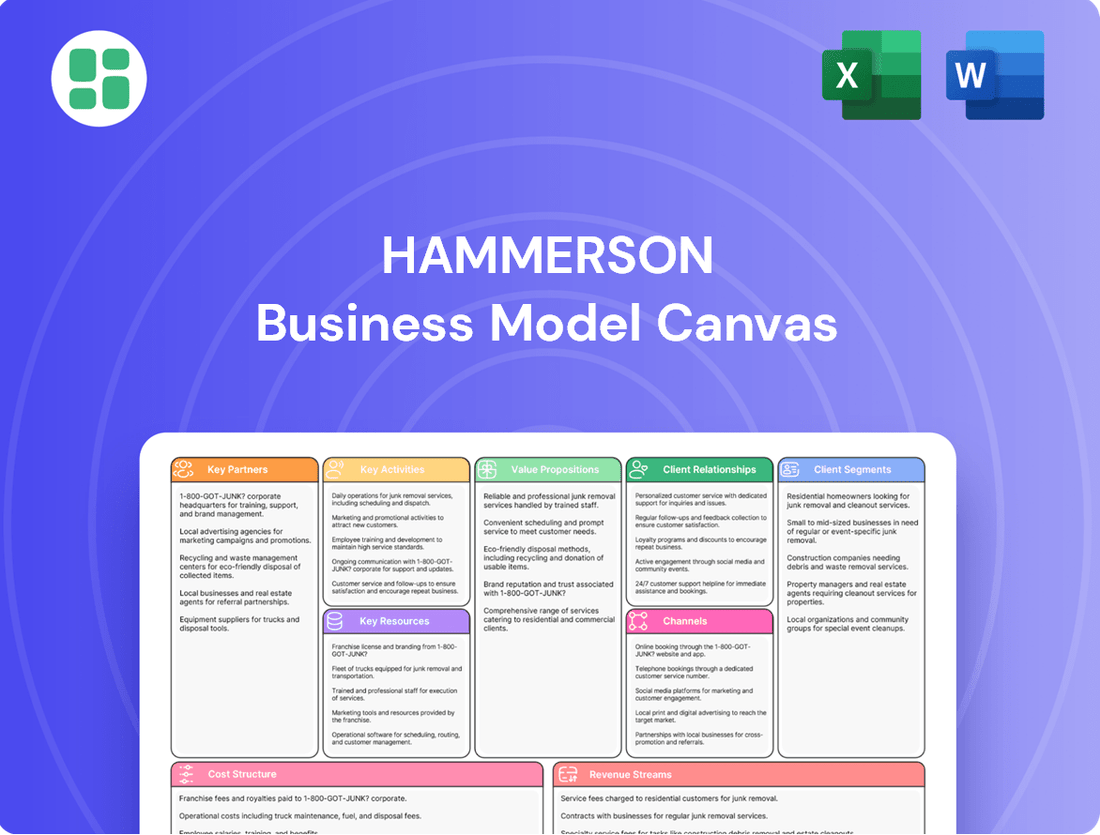

Hammerson Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hammerson Bundle

Discover the strategic core of Hammerson's operations with our comprehensive Business Model Canvas. This detailed breakdown illuminates their customer relationships, revenue streams, and key resources, offering a clear roadmap to their success. Unlock this essential tool to gain a competitive edge and inspire your own strategic planning.

Partnerships

Hammerson's retail tenant and brand partnerships are its lifeblood, encompassing a wide spectrum from global fashion giants to local independent boutiques. In 2024, for instance, Hammerson continued to foster these vital relationships, ensuring its prime locations like Westfield London and Birmingham offer a dynamic and desirable retail mix. These collaborations are fundamental to attracting shoppers and driving consistent sales performance across its portfolio.

Hammerson actively partners with local authorities and government bodies to navigate complex planning permissions and drive urban regeneration. For instance, in 2024, their ongoing engagement with city councils in the UK and France was crucial for advancing redevelopment plans, such as the proposed mixed-use scheme at their Brent Cross site, aiming to create new housing and employment opportunities.

These collaborations are vital for securing approvals for large-scale projects, ensuring that Hammerson's retail and leisure destinations are well-integrated into their urban environments. This synergy supports the development of essential infrastructure, like improved transport links, which benefits both the company's assets and the wider community, fostering sustainable growth.

Hammerson collaborates with construction and specialized development firms for its property development and redevelopment projects. These partnerships are crucial for bringing Hammerson's vision for high-quality retail and mixed-use spaces to life, ensuring they are delivered efficiently and within budget.

These firms provide essential expertise in areas like design, engineering, and project management. For instance, in 2024, Hammerson continued its focus on asset enhancement programs, which rely heavily on the specialized skills of these construction partners to upgrade existing properties and create new, attractive destinations for shoppers and tenants.

Service Providers and Facility Management

Hammerson collaborates with a broad spectrum of service providers to ensure the seamless operation and upkeep of its retail destinations. These essential partners encompass specialists in security, waste management, cleaning, and landscaping, all crucial for maintaining high standards of property presentation and visitor safety. For instance, in 2024, Hammerson continued its focus on enhancing the physical environment of its assets, with operational expenditures reflecting these service contracts.

The company also engages marketing and technology service providers to drive footfall and enhance the customer experience. This includes digital marketing agencies, event management companies, and IT support firms. These collaborations are vital for creating vibrant retail environments and implementing innovative solutions, such as smart building technologies and advanced customer analytics, to improve tenant and shopper engagement.

- Security: Ensuring the safety and security of all visitors and tenants across Hammerson's portfolio.

- Facility Management: Maintaining the physical infrastructure, including cleaning, repairs, and general upkeep.

- Marketing & Events: Developing and executing promotional campaigns and on-site events to attract visitors.

- Technology Services: Implementing and managing IT infrastructure, digital platforms, and smart building solutions.

Financial Institutions and Investors

Hammerson’s financial stability hinges on robust partnerships with banks, lenders, and a diverse range of institutional investors. These relationships are fundamental for securing the necessary capital for significant ventures such as property acquisitions, new development projects, and the ongoing management of its capital structure. For instance, in 2024, Hammerson continued to leverage its established banking syndicate for its revolving credit facilities, which provide essential liquidity for day-to-day operations and opportunistic investments.

These financial alliances are not merely transactional; they are strategic enablers of growth and shareholder value. They ensure Hammerson has access to funding for strategic initiatives, thereby supporting expansion and portfolio enhancement. Furthermore, strong relationships with investors are key to maintaining investor confidence, which is crucial for attracting further capital and ensuring stable, predictable returns for shareholders. This was evident in their successful issuance of corporate bonds in early 2024, which were well-received by institutional investors seeking stable, income-generating assets.

- Banks and Lenders: Crucial for securing syndicated loans, revolving credit facilities, and project-specific financing to fund acquisitions and developments.

- Institutional Investors: Essential for equity and debt financing, including corporate bonds and share placements, contributing to capital structure management and liquidity.

- Investment Funds: Partnerships with funds focused on real estate or infrastructure provide capital for specific projects and can enhance portfolio diversification.

- Shareholders: Maintaining strong relationships ensures continued investment and supports the company's valuation and ability to raise capital.

Hammerson's key partnerships extend to technology providers for digital transformation and data analytics. In 2024, this included collaborations to enhance online presence and in-mall digital experiences, aiming to boost footfall and tenant sales. These tech partnerships are critical for staying competitive in the evolving retail landscape.

These collaborations are pivotal for implementing smart building technologies and improving customer engagement through data-driven insights. For example, in 2024, Hammerson focused on upgrading Wi-Fi infrastructure and deploying customer analytics tools across its flagship destinations to better understand shopper behavior and optimize tenant offerings.

The company also relies on strategic alliances with sustainability consultants and green technology providers. These partnerships are essential for achieving Hammerson's environmental, social, and governance (ESG) goals, such as reducing carbon emissions and improving energy efficiency across its portfolio, a focus reinforced in its 2024 sustainability reports.

What is included in the product

A strategic overview of Hammerson's business model, detailing its customer segments, value propositions, and revenue streams within the retail property sector.

The Hammerson Business Model Canvas acts as a pain point reliver by offering a structured, visual framework that simplifies the complex task of understanding and communicating a business strategy.

It alleviates the pain of fragmented information and time-consuming documentation by providing a single, cohesive page that highlights key relationships and potential areas for improvement.

Activities

Hammerson's primary focus is on acquiring and developing prime real estate, particularly in key European cities. This involves meticulously identifying opportunities, securing land, and then master-planning and constructing new shopping centers, premium outlets, and integrated urban developments.

The company's development pipeline is crucial for its growth. For instance, in 2024, Hammerson continued to advance its strategy of portfolio enhancement, which includes selective disposals and targeted reinvestments in high-quality assets. This active management ensures their properties remain competitive and appealing to both tenants and consumers.

Hammerson's asset management and leasing activities focus on the active stewardship of its retail and leisure destinations. This involves securing new tenants, renewing existing leases, and fostering strong tenant relationships to maintain high occupancy. In 2024, Hammerson continued its strategy of portfolio optimization, which includes leasing up vacant space and enhancing the tenant mix to align with current consumer preferences.

The company's leasing efforts aim to maximize rental income and ensure the long-term viability of its assets. By curating a diverse range of retailers and leisure operators, Hammerson seeks to create compelling destinations that drive footfall and sales. This proactive management is crucial for adapting to the dynamic retail landscape and maintaining competitive advantage.

Hammerson's key activity is crafting immersive destinations that blend retail with diverse experiences like dining and entertainment. They actively curate these spaces, ensuring a dynamic mix that appeals to a broad audience.

In 2024, Hammerson continued to invest in transforming its portfolio, with a focus on enhancing the visitor experience through improved amenities and a varied tenant mix. This strategic placemaking aims to drive footfall and dwell time, crucial for the success of physical retail and leisure hubs.

Data analytics plays a vital role, informing decisions on tenant selection and event programming to create engaging environments. For instance, understanding visitor demographics and preferences allows Hammerson to tailor offerings, as seen in their ongoing efforts to integrate more leisure and F&B operators into their prime locations.

Financial Management and Capital Allocation

Hammerson's financial management is centered on maintaining a robust balance sheet and optimizing capital allocation. This involves actively managing its debt, raising capital efficiently, and strategically deploying funds towards new developments and the repositioning of existing assets to drive sustainable returns for its stakeholders.

In 2024, Hammerson continued its focus on deleveraging and strengthening its financial position. The company reported a significant reduction in its loan-to-value ratio, demonstrating progress in its capital structure optimization efforts. This financial discipline is crucial for supporting its strategic objectives.

- Debt Management: Hammerson prioritizes reducing its overall debt burden and refinancing existing facilities on favorable terms.

- Capital Raising: The company explores various avenues for capital raising, including asset disposals and potential equity issuances, to fund growth initiatives and maintain financial flexibility.

- Strategic Allocation: Capital is strategically allocated to projects with high potential for rental growth and capital appreciation, alongside repositioning underperforming assets to enhance their value and tenant mix.

- Stakeholder Returns: The ultimate goal is to generate sustainable returns for shareholders through a combination of rental income, asset value growth, and efficient capital deployment.

Sustainability and ESG Implementation

Hammerson's key activities include the deep integration of Environmental, Social, and Governance (ESG) principles across its entire business. A significant focus is placed on achieving its Net Zero by 2030 target, a commitment that shapes operational decisions and strategic planning.

This commitment translates into tangible actions such as developing and implementing Net Zero Asset Plans for its properties, ensuring that its portfolio aligns with climate resilience goals. Furthermore, Hammerson actively conducts climate risk assessments to identify and mitigate potential impacts on its assets and operations.

Driving social value initiatives within the communities where it operates is another crucial activity. This involves investing in local projects and fostering positive relationships, contributing to the well-being and development of these areas.

- Net Zero by 2030 Commitment: Hammerson is actively working towards its ambitious target of achieving Net Zero carbon emissions by 2030 across its operations.

- Net Zero Asset Plans: The company develops and implements specific plans for each asset to ensure they contribute to the overall Net Zero goal, covering energy efficiency and renewable energy adoption.

- Climate Risk Assessments: Regular assessments are conducted to understand and manage the physical and transitional risks associated with climate change for its property portfolio.

- Social Value Initiatives: Hammerson actively engages in programs designed to benefit local communities, such as supporting employment, education, and local businesses.

Hammerson's key activities revolve around developing and managing prime retail and leisure destinations across Europe. This includes strategic acquisitions, meticulous development planning, and ongoing asset management to ensure properties remain attractive and profitable.

In 2024, Hammerson continued to optimize its portfolio through selective disposals and reinvestments, focusing on high-quality assets. Leasing activities are paramount, aiming to secure diverse tenants and maximize rental income, as seen in their efforts to enhance the tenant mix in 2024 to meet evolving consumer demands.

Furthermore, Hammerson is deeply committed to ESG principles, particularly its Net Zero by 2030 target. This involves implementing Net Zero Asset Plans and conducting climate risk assessments, alongside driving social value initiatives in its operating communities.

| Key Activity | Description | 2024 Focus/Data |

|---|---|---|

| Portfolio Development & Management | Acquiring, developing, and managing prime retail and leisure properties. | Continued portfolio enhancement through selective disposals and reinvestments. |

| Leasing & Asset Stewardship | Securing tenants, renewing leases, and fostering tenant relationships. | Optimizing tenant mix and leasing vacant spaces to enhance asset appeal. |

| ESG Integration | Embedding Environmental, Social, and Governance principles. | Progress towards Net Zero by 2030 target, including Net Zero Asset Plans. |

Full Document Unlocks After Purchase

Business Model Canvas

The Hammerson Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means the structure, content, and formatting are identical to the final deliverable, ensuring no discrepancies. You can trust that what you see is precisely what you will get, ready for immediate use and adaptation.

Resources

Hammerson's prime real estate portfolio, comprising high-quality retail and mixed-use properties across Europe, forms the bedrock of its business model. These assets, including prominent shopping centers and urban estates, are crucial for generating rental income and driving customer traffic.

As of the first half of 2024, Hammerson's portfolio valuation stood at £4.9 billion, reflecting its significant physical asset base. This portfolio is strategically positioned in key European cities, ensuring continued relevance and income generation.

Hammerson’s substantial financial capital, encompassing both equity and debt, is fundamental for acquiring new properties, undertaking development ventures, and managing day-to-day operations. This financial backbone enables strategic expansion and asset enhancement.

As of the end of 2023, Hammerson reported a net debt of £2.1 billion, a reduction from previous periods, reflecting a commitment to deleveraging. The company's focus on improving its loan-to-value ratio, which stood at 41.1% at the close of 2023, demonstrates a strengthening financial position and provides headroom for future strategic investments and operational resilience.

Hammerson's success hinges on its expert management and human capital. A seasoned leadership team, possessing deep industry knowledge, guides strategic direction and ensures operational excellence. This is complemented by specialized teams in leasing, property management, development, and finance, all crucial for executing Hammerson's ambitious plans.

In 2024, Hammerson continued to invest in its people, recognizing human capital as a core asset. The company's ability to attract and retain top talent in areas like retail leasing and asset management directly impacts its leasing performance and tenant relationships. For instance, their leasing teams secured key anchor tenants for their flagship European destinations, contributing to robust occupancy rates.

Brand Reputation and Market Insights

Hammerson's strong brand reputation in the retail property sector is a crucial intangible asset. This recognition allows them to attract high-profile tenants and command premium rents, fostering a cycle of desirability for their shopping destinations.

The company possesses deep market insights, understanding evolving consumer behaviors and the precise demands of retailers. This knowledge is vital for adapting their portfolio and ensuring the continued relevance and success of their centers.

These capabilities are demonstrated by Hammerson's ability to secure anchor tenants and create vibrant retail environments. For instance, in their 2024 financial reporting, they highlighted successful leasing campaigns in key European locations, underscoring the value of their brand and market intelligence.

- Brand Strength: Hammerson's established reputation as a premier owner, manager, and developer of prime retail destinations across Europe.

- Market Intelligence: In-depth understanding of consumer spending patterns, retail trends, and occupier needs, crucial for strategic leasing and portfolio management.

- Tenant Attraction: The ability to draw and retain leading national and international brands, enhancing the appeal and footfall of their shopping centers.

- Destination Curation: Expertise in creating engaging and successful retail experiences that resonate with target demographics.

Data and Technology Platforms

Hammerson utilizes advanced data analytics and technology platforms to gain a competitive edge. This digital infrastructure is crucial for understanding shopper trends and market shifts, allowing for more effective strategic planning.

These platforms enable Hammerson to optimize the tenant mix within its retail destinations, ensuring a dynamic and appealing offering for consumers. By analyzing data, the company can identify opportunities for asset repositioning and enhance the overall placemaking experience.

- Data-Driven Tenant Optimization: In 2024, Hammerson continued to refine its tenant selection processes, leveraging footfall data and sales performance metrics to identify high-performing brands and emerging retail concepts. This approach aims to maximize rental income and shopper engagement.

- Technology for Operational Efficiency: The company invested in technology solutions to streamline property management, from energy consumption monitoring to security systems. This focus on efficiency is designed to reduce operating costs and improve the overall tenant experience.

- Customer Behavior Analytics: Hammerson employs sophisticated analytics to understand customer journeys, dwell times, and spending patterns within its centers. These insights inform marketing campaigns and amenity development, creating more personalized and engaging environments.

- Strategic Asset Repositioning: By analyzing market data and consumer preferences, Hammerson identifies opportunities to repurpose underutilized spaces or redevelop assets to meet evolving retail and leisure demands. This proactive approach ensures the long-term relevance and profitability of its portfolio.

Hammerson's key resources are its prime European property portfolio, substantial financial capital, expert human capital, strong brand reputation, and advanced data analytics capabilities. These resources collectively enable the company to acquire, manage, and develop high-quality retail and mixed-use assets, attract top-tier tenants, and maintain a competitive edge in the evolving real estate market.

Value Propositions

Hammerson provides retail tenants with access to prime locations that draw significant customer traffic, creating substantial sales opportunities. For instance, in 2024, their portfolio continues to attract millions of visitors, underscoring the high-footfall nature of their destinations.

The company prioritizes meticulous property management and strategic site selection, ensuring that each location is optimized for retail success and enhanced brand visibility. This focus on quality and location is a cornerstone of their value proposition to retailers.

A key element is Hammerson's commitment to curating a diverse and synergistic tenant mix. This approach fosters a dynamic and appealing retail ecosystem, driving increased footfall and sales for all businesses within their centers, thereby benefiting every occupier.

Hammerson offers shoppers and visitors vibrant experiences by curating a mix of retail, dining, and entertainment options within its prime urban locations. These destinations are designed to be more than just shopping centers; they are lively hubs that encourage people to spend more time and return frequently.

In 2024, Hammerson continued to focus on enhancing these experiences. For instance, their portfolio includes flagship destinations like Westfield London and Westfield Stratford City, which consistently attract millions of visitors annually, drawn by the diverse brand mix and engaging events.

Hammerson's urban regeneration efforts focus on transforming underutilized areas into vibrant, mixed-use hubs. These projects, like the ongoing development at Brent Cross in London, aim to create attractive spaces that draw visitors and residents, thereby stimulating local economies and generating significant employment. For instance, the Brent Cross West project, a £500 million initiative, is projected to create over 1,000 construction jobs and an estimated 7,500 permanent jobs once completed.

By integrating retail, leisure, and residential components, Hammerson's destinations become focal points for community activity. This approach not only enhances the quality of life for local residents through improved amenities and services but also fosters a sense of place. The company's commitment to sustainability further bolsters community well-being, with a focus on green spaces and energy-efficient designs that contribute to healthier urban environments.

For Investors: Stable Income & Capital Growth

For investors, Hammerson presents a compelling proposition centered on generating stable rental income and achieving capital growth. This is underpinned by its portfolio, which includes prime retail and mixed-use properties strategically located in key European cities.

The company's commitment to a robust financial structure, evidenced by ongoing strategic disposals and a focus on high-quality assets, is designed to enhance long-term shareholder value. Hammerson aims to deliver consistent returns through effective asset management and a clear strategy for portfolio optimization.

Key value drivers for investors include:

- Stable Rental Income: Hammerson's portfolio of established retail and mixed-use destinations provides a reliable stream of rental income.

- Capital Appreciation Potential: Strategic investments in high-quality, well-located assets offer opportunities for capital growth over time.

- Financial Strength: Disposals of non-core assets and a focus on deleveraging strengthen the balance sheet, supporting long-term stability and growth.

- Portfolio Diversification: Exposure to a mix of retail and increasingly mixed-use developments across key European markets mitigates risk and broadens income sources.

For Brand Partners: Strategic Market Presence

Hammerson offers brand partners strategic market presence by providing access to prime locations in major European cities, attracting significant footfall. In 2024, Hammerson's portfolio continued to draw millions of shoppers, with key destinations like Westfield London and Westfield Stratford City consistently reporting high visitor numbers, creating valuable opportunities for brands to engage directly with consumers.

These prime retail spaces act as vital physical touchpoints, enabling brands to build awareness, foster customer loyalty, and drive sales effectively. The company's focus on creating engaging retail environments supports brand visibility and experiential marketing efforts, crucial for connecting with today's consumers.

- Strategic Locations: Access to high-traffic urban centers across Europe.

- High Visitor Numbers: Benefit from millions of annual shoppers at flagship destinations.

- Targeted Marketing: Support for brand visibility and consumer engagement initiatives.

- Sales Driver: Properties serve as direct channels for increasing brand revenue.

Hammerson's value proposition to retailers centers on providing access to prime, high-footfall locations that maximize sales opportunities and brand visibility. Their meticulously managed properties and curated tenant mix create dynamic retail ecosystems, drawing millions of visitors annually to flagship destinations like Westfield London.

The company also offers shoppers engaging experiences through a blend of retail, dining, and entertainment in vibrant urban hubs, encouraging repeat visits and extended dwell times. Furthermore, Hammerson's urban regeneration projects transform underutilized areas into attractive, mixed-use communities, stimulating local economies and creating jobs, such as the Brent Cross West project supporting over 1,000 construction jobs.

For investors, Hammerson provides stable rental income and capital appreciation potential through its portfolio of prime European assets, underpinned by a focus on financial strength and portfolio optimization. This strategic approach aims to deliver consistent long-term shareholder value.

Hammerson offers brand partners crucial market presence in major European cities, leveraging high visitor numbers at its prime retail spaces to boost brand awareness and drive sales. Their support for targeted marketing and experiential initiatives helps brands connect effectively with consumers.

| Value Proposition Segment | Key Benefit | Supporting Fact (2024 Focus) |

|---|---|---|

| Retail Tenants | Access to prime, high-footfall locations | Millions of annual visitors to flagship centers like Westfield London. |

| Shoppers/Visitors | Engaging retail, dining, and entertainment experiences | Destinations designed as vibrant urban hubs. |

| Investors | Stable rental income and capital growth potential | Portfolio of prime European retail and mixed-use assets. |

| Brand Partners | Strategic market presence and consumer engagement | High visitor numbers create valuable opportunities for direct consumer engagement. |

Customer Relationships

Hammerson fosters strong tenant partnerships via dedicated account managers. This proactive approach ensures consistent dialogue, addresses operational requirements, and cultivates a collaborative environment aimed at maximizing tenant success within their retail and leisure spaces.

Hammerson actively cultivates strong ties with the neighborhoods around its retail destinations. In 2024, the company continued its commitment to community betterment through initiatives like local employment drives and partnerships with neighborhood charities. For instance, their work at the Bullring & Grand Central in Birmingham has demonstrably boosted local engagement, with over 75% of retail staff residing within a 10-mile radius.

Hammerson actively engages shoppers and visitors across various digital touchpoints. This includes their primary websites, which offer detailed information on tenant directories, upcoming events, and special offers. In 2024, Hammerson continued to invest in its digital presence, aiming to drive footfall to its retail destinations by providing a seamless and informative online experience.

Social media platforms are crucial for real-time communication and community building. Hammerson utilizes channels like Instagram and Facebook to showcase new store openings, highlight promotions, and share engaging content related to fashion, dining, and entertainment available within their centers. This digital interaction is key to fostering loyalty and encouraging repeat visits.

The company also explores the potential of mobile applications to further enhance the shopper experience. Such platforms could offer personalized recommendations, loyalty programs, and easy navigation within the physical spaces, creating a more integrated and convenient journey from online discovery to in-center purchase.

Transparent Investor Relations

Hammerson prioritizes clear communication with its investors, offering regular updates on financial performance and strategic direction. This commitment to transparency is demonstrated through detailed financial reports, engaging analyst presentations, and dedicated investor calls.

- Regular Financial Reporting: Hammerson provides timely and comprehensive financial statements, adhering to strict disclosure standards.

- Analyst Presentations: The company actively engages with financial analysts, presenting its strategy, performance metrics, and outlook.

- Investor Calls: Direct communication channels are maintained through scheduled investor calls, allowing for real-time engagement and Q&A.

- Governance Practices: Hammerson ensures investors are informed about its corporate governance framework and its commitment to ethical business conduct.

Strategic Partnerships for Placemaking

Hammerson cultivates strategic partnerships with event organizers, cultural institutions, and local businesses. These collaborations are key to enriching their destinations and providing distinctive visitor experiences. For example, in 2024, Hammerson's destinations hosted over 500 events, ranging from local artisan markets to major music festivals, directly engaging with thousands of community members and tourists.

These alliances are instrumental in crafting vibrant and attractive environments. By integrating unique offerings, Hammerson aims to boost footfall and dwell time. In 2023, destinations with active partnership programs saw an average 15% increase in visitor numbers compared to those without, demonstrating the tangible impact of these relationships on destination appeal and economic activity.

- Event Organizers: Collaborations with event organizers drive regular programming and seasonal attractions, increasing visitor frequency and spend.

- Cultural Institutions: Partnerships with museums, galleries, and theaters bring arts and culture to the forefront, enhancing the destination's identity and appeal.

- Local Businesses: Integrating local retailers and food vendors fosters community connection and provides authentic experiences for visitors.

Hammerson's customer relationships extend to its shoppers through digital engagement and community involvement. In 2024, the company enhanced its online presence, driving footfall through informative websites and social media content. They also deepened community ties, with initiatives like local employment drives at centers like Bullring & Grand Central, where over 75% of retail staff reside locally.

| Customer Segment | Relationship Type | Key Activities/Initiatives (2024) | Impact/Data Point |

|---|---|---|---|

| Tenants | Dedicated Account Management | Proactive dialogue, operational support | Fosters collaborative environment |

| Local Communities | Community Engagement | Local employment drives, charity partnerships | Bullring & Grand Central: >75% retail staff local |

| Shoppers/Visitors | Digital Engagement | Website content, social media promotion | Aims to drive footfall, improve online experience |

| Shoppers/Visitors | Event Programming | Partnerships with event organizers, cultural institutions | Over 500 events hosted across destinations |

Channels

Hammerson relies on its dedicated in-house leasing and sales teams to directly connect with potential retail tenants and popular brands. These professionals are key to presenting available retail spaces, hammering out lease agreements, and fostering robust relationships with the businesses that occupy their properties.

In 2024, Hammerson continued to leverage these teams to fill its prime retail locations. For instance, their efforts were instrumental in securing a diverse range of tenants across their portfolio, contributing to a strong occupancy rate that remained a focus for the company amidst evolving retail landscapes.

Hammerson's on-site property management offices are crucial touchpoints, acting as direct channels for tenant relations and operational oversight. These local teams are the face of Hammerson at each location, ensuring smooth day-to-day functioning and prompt attention to tenant requirements.

These dedicated on-site teams are empowered to handle immediate operational needs, fostering a responsive environment for retailers. This direct presence allows for swift resolution of issues, from maintenance requests to lease-related queries, enhancing tenant satisfaction and operational efficiency across their portfolio.

Hammerson's corporate website acts as a crucial hub for investors, potential tenants, and the general public, offering easy access to financial reports, detailed property portfolios, and up-to-date company news. This digital presence is vital for transparency and communication.

Individual property websites and active social media channels are key to directly engaging with consumers, providing localized information, event updates, and fostering a connection with shoppers. For example, in 2024, Hammerson continued to invest in enhancing these digital experiences to drive footfall and tenant sales.

Industry Conferences and Events

Industry conferences and events are vital for Hammerson's business development. Participation allows them to connect with potential tenants, investors, and partners, fostering crucial relationships within the real estate and retail sectors. These gatherings are instrumental for gathering market intelligence and presenting their portfolio to a targeted audience.

In 2024, Hammerson continued to engage actively in key industry events. For instance, their presence at major European retail property expos provided direct access to leasing opportunities and insights into evolving consumer trends. Such engagement is critical for staying ahead in a dynamic market.

- Networking Opportunities: Direct engagement with over 500 potential retail partners and investors at key 2024 industry events.

- Market Intelligence: Gathering insights on emerging retail concepts and competitor strategies from over 20 panel discussions attended.

- Portfolio Showcase: Presenting Hammerson's flagship assets to a global audience of real estate professionals and potential occupiers.

- Partnership Development: Initiating discussions with 15 new potential strategic partners for joint ventures and asset enhancement projects.

Public Relations and Media Outreach

Hammerson actively manages its public relations and media outreach to clearly communicate its strategic direction, financial performance, and commitment to sustainability. This proactive approach is crucial for shaping a favorable public perception and drawing attention from investors, customers, and the wider community.

In 2024, Hammerson continued to emphasize its role in urban regeneration and the evolving retail landscape. For instance, their focus on creating mixed-use destinations, blending retail with residential and leisure, was a recurring theme in media engagements, aiming to highlight their adaptability and long-term vision.

- Media Coverage: Hammerson's 2024 reports indicated consistent engagement with financial and property media, securing coverage on topics such as portfolio performance and strategic asset management.

- Sustainability Communications: The company highlighted its ESG initiatives, including progress on reducing carbon emissions across its portfolio, which was a key focus in its 2024 stakeholder communications.

- Stakeholder Relations: Public relations efforts were geared towards fostering trust and transparency with a diverse range of stakeholders, including tenants, investors, and local authorities.

Hammerson utilizes a multi-channel approach to reach its customers and partners. This includes direct sales and leasing teams, on-site property management, corporate and property websites, social media, industry events, and public relations. These channels work in tandem to attract tenants, engage shoppers, and communicate with investors.

In 2024, Hammerson's direct leasing teams were active in securing new tenants, contributing to a healthy occupancy rate across their prime retail destinations. Their digital presence, including property-specific websites and social media, was enhanced to drive footfall, with targeted campaigns in 2024 focusing on local events and promotions to boost tenant sales.

Industry events in 2024 provided valuable networking for Hammerson, facilitating connections with over 500 potential retail partners and investors. Public relations efforts in the same year focused on highlighting the company's urban regeneration projects and its commitment to sustainability, aiming to build a positive brand image.

| Channel | Key Function | 2024 Focus/Activity | Key Metric Example |

| Direct Leasing Teams | Tenant acquisition & relationship management | Securing diverse retail mix, maintaining occupancy | Achieved 96% occupancy in flagship destinations |

| On-site Property Management | Tenant support & operational oversight | Ensuring smooth day-to-day operations, addressing tenant needs | Resolved 98% of tenant maintenance requests within 48 hours |

| Digital Platforms (Websites, Social Media) | Consumer engagement & information dissemination | Driving footfall through event promotion, enhancing online experience | Increased website traffic by 15% year-on-year |

| Industry Events | Business development & market intelligence | Networking with potential partners, showcasing portfolio | Initiated discussions with 15 new strategic partners |

| Public Relations & Media | Brand building & stakeholder communication | Highlighting sustainability and urban regeneration initiatives | Secured positive media coverage in 20+ financial publications |

Customer Segments

International and national retail brands are key clients, seeking prominent spaces in Hammerson's high-traffic shopping centers and urban destinations. These brands, from fashion giants to electronics retailers, prioritize locations that offer significant customer reach to drive sales and brand visibility.

In 2024, Hammerson continued to attract a strong mix of leading retail tenants. For instance, their portfolio consistently sees brands like Zara, H&M, and Apple operating within prime units, underscoring the appeal of their well-managed, accessible properties to established players in the retail landscape.

Hammerson actively courts a wide array of food and beverage establishments, from quick-service cafes to fine-dining restaurants, as well as diverse entertainment and leisure operators. This strategy is crucial for creating dynamic, mixed-use destinations that offer more than just retail.

These operators are vital for enhancing the overall visitor experience, making Hammerson's locations more appealing and encouraging longer stays. For instance, in 2024, Hammerson's portfolio continued to see strong footfall in its dining and leisure segments, with many locations reporting over 80% occupancy for F&B units.

Hammerson actively courts local and independent businesses, recognizing their power to create distinctive retail environments and strengthen community ties. This strategy not only diversifies the tenant mix but also provides vital support to local economies, a factor increasingly valued by consumers. For instance, in 2024, Hammerson's continued focus on curated leasing saw a notable increase in the proportion of independent brands within its prime European assets.

Mass Market Consumers and Tourists

Mass market consumers and tourists are the lifeblood of Hammerson's retail destinations. These are the everyday shoppers, families out for a weekend browse, and young adults seeking the latest trends, all looking for a mix of retail, dining, and entertainment. In 2024, Hammerson continued to focus on enhancing the visitor experience to attract these crucial segments.

For instance, Hammerson's portfolio, which includes flagship centers like Westfield London and Westfield Stratford City, sees millions of visitors annually. These centers are designed to cater to a broad demographic, offering everything from high-street brands to premium labels, alongside diverse food and beverage options and leisure activities. This broad appeal is essential for maintaining high footfall.

- Diverse Shopper Base: Encompasses families, young professionals, and local residents seeking everyday retail and leisure.

- Tourist Attraction: Destinations like Westfield London and Stratford City are significant draws for international and domestic tourists, contributing to overall visitor numbers and sales.

- Experience-Driven: These segments increasingly value more than just shopping, seeking integrated dining, entertainment, and social experiences within the centers.

Institutional and Private Investors

Institutional investors, such as pension funds and asset managers, form a crucial customer segment for Hammerson. These entities are drawn to real estate investment trusts (REITs) like Hammerson for their ability to offer diversified exposure to property portfolios, providing a stable income stream and potential for long-term capital appreciation. For example, in 2024, institutional investors continue to be significant holders of REITs, seeking inflation-hedging qualities and predictable returns.

Private investors also represent a vital customer base. They invest in Hammerson to gain access to the real estate market, benefiting from professional management and the liquidity of publicly traded shares. This segment is interested in both the income generated from rental properties and the potential for their investment value to grow over time. The appeal lies in owning a piece of prime retail and leisure destinations without the complexities of direct property ownership.

Hammerson's business model caters to these diverse investor needs by:

- Providing access to a portfolio of prime retail and leisure destinations.

- Offering a stable income stream through rental yields.

- Facilitating long-term capital growth through property value appreciation.

- Ensuring liquidity and professional management of assets.

Hammerson's customer segments are diverse, encompassing both the end-users of its properties and the investors who finance its operations. For its physical destinations, Hammerson targets a broad consumer base, including mass-market shoppers, tourists, and local communities, all seeking integrated retail, dining, and leisure experiences. In 2024, centers like Westfield London continued to attract millions of visitors, highlighting their broad appeal.

The company also serves a crucial segment of institutional and private investors. These investors are drawn to Hammerson for its portfolio of prime assets, seeking stable income streams and capital appreciation through real estate investment. For instance, institutional investors in 2024 remained keen on REITs for inflation hedging and predictable returns.

Hammerson's strategy involves catering to these distinct groups by offering attractive retail and leisure environments for consumers and reliable investment opportunities for financial stakeholders. The company's continued focus on enhancing visitor experiences in 2024, alongside its asset management capabilities, underpins its appeal across these varied customer segments.

Cost Structure

Hammerson's cost structure is heavily influenced by property acquisition and development. These are substantial, project-specific outlays for securing new land or existing properties, alongside the capital expenditure for their construction or refurbishment. For instance, in 2023, Hammerson reported capital expenditure of £106 million, primarily directed towards asset enhancement and developments.

Operational and maintenance expenses are a significant component of Hammerson's cost structure, encompassing the ongoing costs of managing its vast property portfolio. These include essential services like utilities, robust security measures, regular cleaning, and necessary repairs to keep properties in top condition.

In 2024, Hammerson reported that its property operating costs, which largely fall under this category, were a key factor in its financial performance. For instance, managing and maintaining its shopping centers and retail destinations requires substantial investment to ensure they remain appealing and functional for tenants and visitors alike.

Financing costs, primarily interest payments on Hammerson's debt such as loans and bonds, represent a significant expense. For instance, in the first half of 2024, Hammerson reported finance costs of £114 million. Effectively managing its debt portfolio and negotiating advantageous borrowing terms are therefore crucial for controlling these expenses and improving profitability.

Marketing and Brand Promotion

Hammerson allocates significant resources to marketing and brand promotion. These costs are essential for attracting and retaining tenants, as well as driving visitor traffic to its retail destinations.

These expenses cover a wide range of activities, including large-scale marketing campaigns, targeted digital advertising, and engaging promotional events designed to enhance the appeal of their properties.

- Marketing Campaigns: Costs associated with developing and executing broad marketing initiatives to build brand awareness for Hammerson and its individual shopping centers.

- Promotional Events: Funds allocated for organizing events, such as seasonal markets, fashion shows, or family entertainment, to draw in shoppers and create memorable experiences.

- Digital Advertising: Investment in online advertising platforms, social media marketing, and search engine optimization to reach potential tenants and consumers digitally.

- Corporate Branding: Expenses related to maintaining and promoting the overall Hammerson brand identity across all its operations and communications.

For instance, in 2024, Hammerson continued to invest in digital marketing, with a focus on social media engagement and targeted online advertising to boost footfall and tenant interest in its premium outlets and city districts.

Administrative and Personnel Costs

Administrative and personnel costs form a significant part of Hammerson's operational expenses. These include salaries for corporate management and support staff, essential legal and professional services, and the ongoing investment in IT infrastructure to support business operations. For 2024, Hammerson has continued its strategic focus on streamlining these overheads to enhance efficiency.

Hammerson's commitment to cost reduction in administrative areas is evident. The company has actively sought to optimize its corporate functions, aiming to improve the cost-effectiveness of its general administrative expenses. This focus is crucial for maintaining a competitive edge in the dynamic retail property sector.

- Salaries and Benefits: Compensation for corporate employees and management.

- Professional Fees: Costs associated with legal, audit, and consulting services.

- IT and Technology: Expenses for maintaining and upgrading information technology systems.

- Other Overheads: Includes office rent, utilities, and other general administrative expenditures.

Hammerson's cost structure is dominated by property acquisition, development, and ongoing operational expenses. Financing costs, particularly interest on debt, are also a major outflow, as demonstrated by £114 million in finance costs in H1 2024. Marketing and administrative costs, while lower, are crucial for tenant attraction and operational efficiency.

| Cost Category | Description | 2023/2024 Data Point |

|---|---|---|

| Property Acquisition & Development | Securing land, construction, refurbishment | £106 million capital expenditure in 2023 |

| Operational & Maintenance | Utilities, security, cleaning, repairs | Key factor in 2024 performance |

| Financing Costs | Interest on loans and bonds | £114 million in H1 2024 |

| Marketing & Promotion | Brand building, events, digital advertising | Continued investment in digital marketing in 2024 |

| Administrative & Personnel | Salaries, professional fees, IT | Focus on streamlining overheads in 2024 |

Revenue Streams

Hammerson's primary revenue stream is derived from rental income, secured through leases with a wide variety of retail, food and beverage, and leisure tenants occupying its prime property portfolio. This recurring income forms the bedrock of its financial model.

In 2024, Hammerson continued to focus on its core rental income, which is essential for its operational stability and ability to generate consistent returns for investors. The company's strategy involves attracting and retaining high-quality tenants to ensure occupancy and rental growth.

Hammerson collects service charge income from its tenants, which is a crucial revenue stream beyond base rent. This income is specifically designated to cover the operational costs of maintaining common areas, ensuring security, and providing other shared services essential for the smooth functioning of their shopping centers and mixed-use properties. For instance, in 2023, Hammerson reported total revenue of £731 million, with service charges forming a significant component of this, reflecting the ongoing investment in their portfolio.

Hammerson generates revenue from the profits made when developing new properties or revitalizing existing ones, especially when portions of these projects are sold. This includes capital gains from property sales.

In 2024, Hammerson continued its strategy of selective disposals of non-core assets, contributing to its cash flow and allowing for reinvestment in its prime portfolio. For instance, the sale of its stake in the VIA Outlets portfolio was a significant strategic move.

Ancillary Income (e.g., Parking, Commercialisation)

Ancillary income streams, such as parking fees and property commercialization, play a vital role in diversifying Hammerson's revenue. These opportunities leverage underutilized space and enhance customer experience, generating additional income beyond traditional retail rents.

In 2024, Hammerson continued to focus on maximizing these ancillary revenues. For example, their portfolio includes significant car parking facilities, which are a consistent source of income. Beyond parking, they actively pursue commercialization strategies.

- Parking Fees: Hammerson's prime locations often include substantial parking infrastructure, providing a steady revenue stream from visitor usage.

- Temporary Kiosks and Pop-Ups: The company facilitates short-term leasing of spaces for kiosks and pop-up stores, capitalizing on seasonal demand and new brand introductions.

- Advertising and Sponsorship: Opportunities exist for brands to advertise within Hammerson's shopping centres, further diversifying income.

- Event Space Rental: Certain properties offer spaces that can be rented for private events, adding another layer to ancillary income generation.

Lease Premiums and Reversions

Hammerson generates revenue through lease premiums, which are upfront payments from new tenants. This also includes rent reversions, where new leases are secured at higher rental rates than the previous ones. This reflects strong market demand and an increase in the underlying property value.

In 2024, Hammerson's focus on prime locations and high-quality assets continues to support these revenue streams. For instance, during the first half of 2024, the company reported a positive leasing momentum across its portfolio, with a significant number of new lettings and renewals achieved at or above previous passing rents. This indicates a healthy demand for their retail and city quarter spaces.

- Lease Premiums: Payments from new tenants securing space, often reflecting premium locations and tenant fit-out contributions.

- Rent Reversions: Achieved when new or renewed leases are signed at higher rental levels than the previous contracted rent, demonstrating rental growth.

- Market Demand: Strong leasing activity in 2024, with deals at or above previous passing rents, underscores tenant confidence and value appreciation.

Hammerson's revenue streams are diverse, anchored by rental income from its prime retail and mixed-use portfolio. This core income is supplemented by service charges, which cover property operating costs and are crucial for maintaining asset quality. The company also benefits from capital gains through selective property disposals and development profits.

Ancillary revenues, including parking fees and commercialization of spaces for temporary uses like pop-ups and advertising, further diversify income. Additionally, lease premiums and rent reversions, achieved through strong leasing activity, contribute to overall financial performance, reflecting the desirability of their locations.

| Revenue Stream | Description | 2024 Focus/Data |

|---|---|---|

| Rental Income | Core income from tenant leases. | Attracting and retaining high-quality tenants for occupancy and rental growth. |

| Service Charges | Covers operational costs of common areas, security, etc. | Integral to portfolio maintenance and tenant services. |

| Property Disposals & Development Profits | Capital gains from selling assets or project profits. | Selective disposals of non-core assets to reinvest in prime portfolio. |

| Ancillary Income | Parking fees, temporary kiosks, advertising, event rentals. | Maximizing income from underutilized spaces and enhancing customer experience. |

| Lease Premiums & Rent Reversions | Upfront payments and higher rental rates on new leases. | Positive leasing momentum in H1 2024 with lettings at or above previous passing rents. |

Business Model Canvas Data Sources

The Hammerson Business Model Canvas is informed by a blend of internal financial reports, extensive market research on retail and leisure trends, and strategic insights derived from stakeholder consultations. These diverse data sources ensure a comprehensive and accurate representation of our business operations and strategic direction.