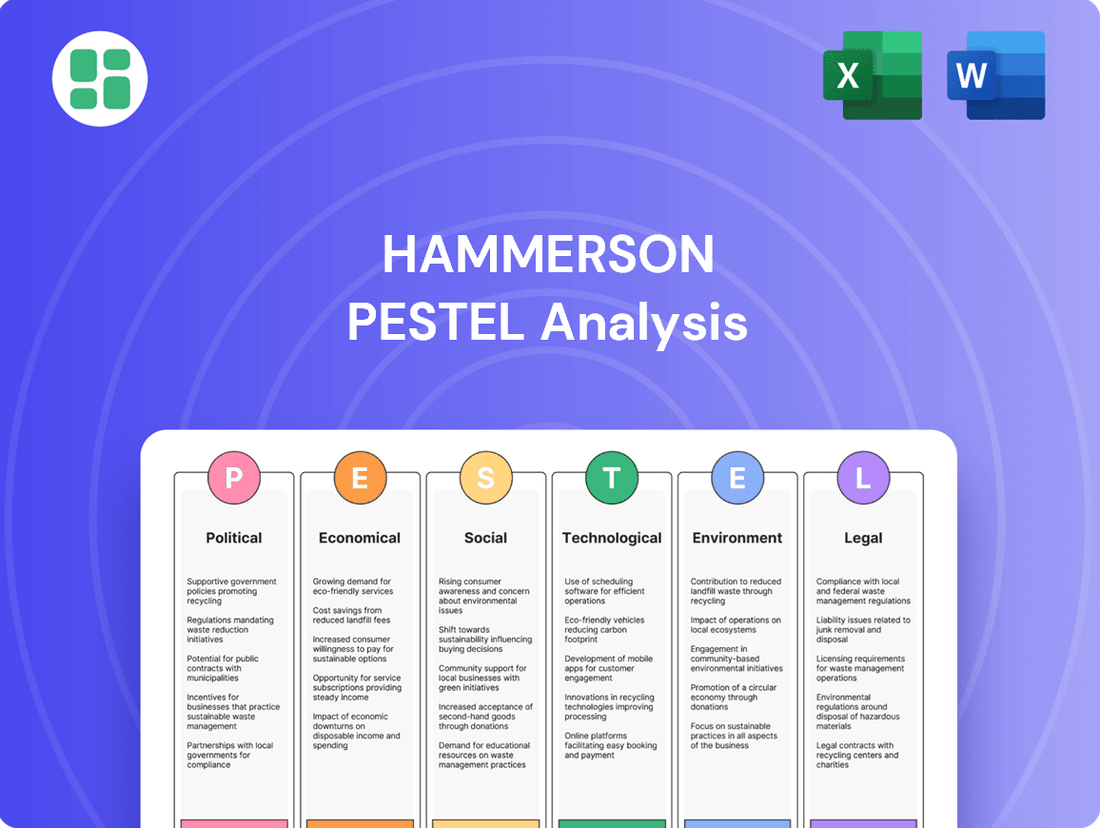

Hammerson PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hammerson Bundle

Navigate the complex external forces shaping Hammerson's retail and office spaces with our expert PESTLE analysis. Understand how political shifts, economic volatility, and evolving social trends are impacting the company's strategic direction. Download the full version now to gain actionable intelligence and sharpen your own market foresight.

Political factors

Government policies championing urban regeneration and the revitalization of high streets directly influence Hammerson's strategic direction towards city-center retail and mixed-use developments. For instance, the UK government's commitment to reducing commercial vacancies, demonstrated by initiatives like High Street Rental Auctions commencing in December 2024, could create avenues for Hammerson to secure new, dynamic tenants. However, these policies might also reshape landlord-tenant relationships and rental expectations within its portfolio.

Changes to business rates and property taxation directly impact Hammerson's profitability. The UK government's extension of business rates relief for retail, hospitality, and leisure sectors through to March 2026 offers vital breathing room for Hammerson's tenants. However, the long-term implications of potential permanent rate reductions from April 2026 onwards require careful observation.

Political stability in the UK, France, and Ireland is paramount for Hammerson, directly impacting investor confidence and the predictability of regulatory environments. For instance, the UK's upcoming general election in 2024 could lead to shifts in property taxation or planning regulations, influencing Hammerson's strategic decisions.

The regulatory landscape presents both opportunities and challenges. A notable development is the proposed ban on upwards-only rent reviews in new UK commercial leases, slated to take effect from July 2025. This legislative change necessitates a proactive adjustment of Hammerson's leasing strategies to mitigate potential impacts on rental income streams.

Planning and Zoning Regulations

Planning and zoning regulations, both at the local and national levels, significantly shape how Hammerson can develop and utilize its properties and land holdings. These rules dictate what can be built, where, and for what purpose, directly impacting the company's strategic growth and investment decisions.

The UK's National Planning Policy Framework (NPPF), with its latest reforms implemented in late 2024, now prioritizes supporting housing and infrastructure development. This shift could unlock new avenues for Hammerson, particularly in mixed-use developments that integrate residential and commercial spaces, potentially boosting asset value and rental income streams.

- NPPF Reforms (Late 2024): Emphasis on housing and infrastructure could create new development opportunities.

- Zoning Impact: Regulations directly influence Hammerson's ability to repurpose or develop its extensive property portfolio.

- Mixed-Use Potential: Evolving policies may favor integrated developments, aligning with Hammerson's strategic direction.

Trade Agreements and International Relations

Hammerson's European presence means it's influenced by the EU's trade policies and the UK's post-Brexit trade relationships. These agreements shape the economic landscape, impacting retailer confidence and consumer purchasing power across the continent. For instance, the EU's continued focus on single market integration, alongside evolving trade deals with nations like the United States, can create both opportunities and challenges for the retail sector Hammerson serves.

Global economic shifts and trade policies directly affect retailer demand and consumer spending within Hammerson's key European markets. For example, disruptions to global supply chains or new tariffs imposed between major economic blocs can increase operational costs for retailers, potentially leading to reduced expansion or investment in prime retail spaces. As of early 2025, ongoing negotiations regarding future trade frameworks between the UK and the EU continue to be a point of attention for businesses with cross-border operations.

- EU Single Market Dynamics: The strength and accessibility of the EU single market remain a critical factor, influencing the ease with which retailers can operate and expand across member states.

- Post-Brexit Trade Landscape: The specific trade agreements and regulatory alignment between the UK and the EU continue to evolve, impacting the operational costs and market access for businesses trading between these regions.

- Global Economic Sentiments: Broader international trade relations and economic stability in key global markets can indirectly influence investor confidence and consumer spending patterns in Hammerson's European territories.

Government policies supporting urban regeneration, such as the UK's High Street Rental Auctions from December 2024, can create new leasing opportunities for Hammerson. However, evolving regulations like the proposed ban on upwards-only rent reviews in new UK leases from July 2025 necessitate strategic adjustments to rental income forecasts.

Changes in business rates and property taxation directly impact Hammerson's profitability, with UK retail reliefs extended to March 2026 providing short-term support. The UK's upcoming 2024 general election introduces political uncertainty, potentially altering property tax or planning regulations that affect Hammerson's investment decisions.

Planning reforms in the UK's NPPF, updated in late 2024, now emphasize housing and infrastructure, potentially benefiting Hammerson's mixed-use development strategies. Zoning regulations continue to dictate property utilization, directly influencing the company's portfolio development and strategic growth plans.

What is included in the product

This PESTLE analysis comprehensively examines the external macro-environmental factors impacting Hammerson across Political, Economic, Social, Technological, Environmental, and Legal dimensions, providing actionable insights for strategic decision-making.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, making the Hammerson PESTLE analysis a readily accessible tool for strategic discussions.

Economic factors

Fluctuations in interest rates significantly influence Hammerson's cost of borrowing and the valuation of its extensive property portfolio. Higher rates increase debt servicing expenses, while lower rates can boost asset values.

While forecasts suggest UK interest rates might stabilize or even see a modest decrease by 2025, the full impact of previous rate hikes continues to exert financial pressure on Hammerson and its retail tenants. For instance, the Bank of England's base rate, which stood at 5.25% as of late 2023, has a direct bearing on Hammerson's financing costs.

Consumer spending is a key engine for retail property success. In 2025, many European nations anticipate a rise in real incomes, which should translate into increased retail expenditure. Hammerson's shopping centers experienced higher visitor numbers and sales in 2024, and a strong outlook for 2025 indicates sustained demand, even as European consumers express a generally cautious optimism about their spending intentions.

Inflationary pressures directly affect Hammerson's operational expenses and the real value of its rental income. For instance, rising energy and construction costs in 2024 likely increased maintenance and refurbishment budgets. Furthermore, persistent inflation can erode consumer spending power, potentially impacting footfall and sales at Hammerson's retail properties.

While the European real estate market anticipated positive momentum in 2025, driven by projected GDP growth and stable labor markets, Hammerson's financial performance in 2024 painted a different picture. The company reported a net loss for the full year, largely due to significant property impairments, underscoring the difficult economic climate and its impact on asset valuations.

Retail Market Dynamics and Occupancy Rates

The European retail market is showing robust signs of recovery, characterized by increasing rental growth and heightened retailer engagement. This positive trend directly benefits Hammerson's strategically located retail assets.

Hammerson reported an impressive occupancy rate exceeding 95% in 2024, a testament to the enduring appeal of prime retail destinations. This high occupancy is fostering rental growth, and the company anticipates sustained strong demand for its premium locations throughout 2025.

- Retail Recovery: European retail sector strengthening with positive rental growth.

- Retailer Activity: Increased engagement and demand from retailers for prime spaces.

- Hammerson Occupancy: Achieved over 95% occupancy in 2024, indicating strong market position.

- Future Outlook: Expectation of continued high demand for Hammerson's prime retail assets in 2025.

Property Valuations and Investment Volumes

Property valuations and investment transaction volumes are crucial metrics for Real Estate Investment Trusts (REITs) like Hammerson. These indicators reflect the health of the property market and the REIT's ability to generate returns.

Looking ahead to 2025 and 2026, a gradual uptick in retail investment transactions and trading volumes is expected. This suggests renewed investor confidence in the sector. Prime retail locations, in particular, are anticipated to see sustained rental growth and enhancements in their capital values.

This positive trend points towards a favorable outlook for capital appreciation and overall returns for REITs invested in prime retail assets. For instance, the European retail property market saw investment volumes reach approximately €25 billion in 2024, a notable increase from previous years, with projections for continued growth.

- Anticipated increase in retail investment transactions and traded volumes for 2025-2026.

- Prime retail locations expected to experience continued rental growth.

- Improvements in capital values are projected for prime retail assets.

- Positive outlook for capital growth and total returns in the retail property sector.

Economic factors significantly shape Hammerson's performance, from borrowing costs influenced by interest rates to consumer spending driving retail sales. While 2024 presented challenges, including property impairments, the outlook for 2025 suggests a more positive economic environment with anticipated GDP growth and stabilizing inflation across Europe.

Hammerson's financial health is closely tied to the broader economic climate. For instance, the Bank of England's base rate, at 5.25% in late 2023, directly impacts Hammerson's financing expenses. Despite a net loss reported for 2024, the company's high occupancy rates exceeding 95% in 2024 and the European retail market's strengthening rental growth in 2025 provide a foundation for recovery.

The anticipated rise in real incomes across Europe in 2025 is expected to boost consumer spending, benefiting Hammerson's retail properties. This aligns with the projected increase in retail investment transactions and trading volumes for 2025-2026, signaling renewed investor confidence in prime retail locations.

Hammerson's operational costs are also affected by inflation, which can impact maintenance budgets and the real value of rental income. However, the overall economic picture for 2025 indicates a potential easing of inflationary pressures, which could support both consumer purchasing power and business profitability.

| Economic Indicator | 2024 Status/Outlook | Impact on Hammerson |

| Interest Rates (UK Base Rate) | 5.25% (late 2023), potential stabilization/modest decrease by 2025 | Affects borrowing costs and property valuations. Higher rates increase expenses. |

| Consumer Spending | Cautious optimism, but anticipated rise in real incomes in Europe for 2025 | Drives retail sales and footfall in Hammerson's centers. |

| Inflation | Pressures on operational costs and real rental income in 2024 | Rising energy/construction costs impact budgets; can erode consumer spending power. |

| GDP Growth (Europe) | Projected growth for 2025 | Supports overall market health and investment sentiment. |

| Retail Investment Volumes | €25 billion (approx. in 2024), expected increase for 2025-2026 | Indicates renewed investor confidence and potential for capital appreciation. |

Full Version Awaits

Hammerson PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Hammerson PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You can be confident that the insights and structure you see are precisely what you'll gain.

Sociological factors

Consumers are increasingly prioritizing experiences over mere product acquisition, a trend significantly influencing how retail spaces are designed and tenanted. This shift means Hammerson's centers must offer more than just shops; they need to become destinations that integrate leisure, dining, and community activities.

Hammerson is actively responding to this by diversifying its tenant mix, aiming to create vibrant hubs that cater to a broader range of consumer needs and desires. This strategic pivot acknowledges that despite the rise of online shopping, physical retail remains crucial, with a substantial 80% of retail transactions still having some interaction with a brick-and-mortar store.

Europe's increasing urbanization is a key driver for Hammerson, as a substantial portion of the population, projected to reach over 80% in many Western European countries by 2025, will reside in urban centers. This trend directly supports Hammerson's strategic focus on prime city destinations, where footfall and consumer spending are concentrated.

The company's commitment to developing sustainable and vibrant urban destinations aligns with demographic shifts, aiming to attract a diverse mix of shoppers and foster community engagement. By leveraging these strong urban demographics, Hammerson is well-positioned to capitalize on the evolving consumer landscape in key European cities.

Consumers are increasingly prioritizing brands that demonstrate strong ethical and sustainability credentials. This shift directly impacts retailer decisions, pushing them towards sourcing and operating practices that resonate with these values, which in turn influences the types of retail spaces they occupy. For instance, a 2024 survey indicated that 65% of shoppers are more likely to purchase from a brand with a clear commitment to sustainability.

Hammerson’s strategic focus on Environmental, Social, and Governance (ESG) principles, including its Net Zero by 2030 target and emphasis on social value, directly addresses this growing consumer demand. By integrating sustainability into its property management and tenant selection, Hammerson aims to attract and retain retailers who align with these evolving societal expectations, thereby enhancing the appeal and long-term viability of its retail destinations.

Work-Life Balance and Leisure Trends

The growing societal focus on work-life balance and leisure is reshaping consumer behavior, directly impacting the retail and leisure sectors. This shift means that traditional retail spaces need to evolve to incorporate more experiential elements. For Hammerson, this translates into a strategic imperative to diversify tenant mixes beyond pure retail.

Hammerson is proactively responding to these trends by integrating more leisure and community-focused offerings into its properties. This includes introducing flagship cinemas, diverse entertainment venues, and spaces designed for social interaction. For instance, their strategy emphasizes placemaking, aiming to transform shopping centers into vibrant destinations that cater to a broader range of consumer needs and preferences.

The company's approach acknowledges that consumers increasingly seek experiences rather than just products. This is supported by data showing continued growth in the experience economy. For example, a 2024 report indicated that spending on leisure and entertainment services outpaced retail sales growth in key European markets where Hammerson operates.

- Evolving Consumer Priorities: Increased demand for leisure, entertainment, and social experiences influences tenant selection in Hammerson's portfolio.

- Strategic Integration: Hammerson is actively incorporating leisure and community hubs, such as cinemas and entertainment venues, to enhance property appeal.

- Placemaking Focus: The company's strategy centers on creating destinations that offer a blend of retail, leisure, and community amenities.

- Market Responsiveness: This adaptation aligns with broader economic trends where experiential spending is a significant growth driver.

Community Engagement and Social Value Creation

There's a growing demand for property developers like Hammerson to actively contribute to the well-being of the areas where they build and manage properties. This means going beyond just providing retail or office space and actively fostering positive social impact.

Hammerson's commitment to Environmental, Social, and Governance (ESG) principles is evident in their focus on social value creation. They aim to integrate local community needs directly into their business model, ensuring their developments resonate with and benefit the people living and working nearby.

Placemaking is a key aspect of this strategy, with Hammerson actively working to revitalize urban centers. For instance, their recent efforts in 2024 and projected into 2025 involve initiatives designed to make cities more vibrant and engaging places to live, work, and visit, reflecting a tangible commitment to community enrichment.

- Community Needs Integration: Hammerson's ESG strategy prioritizes understanding and addressing the specific needs of local communities in their operational areas.

- Placemaking Initiatives: The company actively engages in projects aimed at enhancing the social and economic vitality of urban environments.

- Social Value Agenda: Hammerson is driving a proactive agenda to ensure their developments deliver tangible benefits to the local social fabric.

Societal expectations are increasingly shaping the retail landscape, with consumers prioritizing ethical brands and sustainable practices. This aligns with Hammerson's commitment to ESG principles, including its Net Zero by 2030 target, which resonates with a growing consumer base. For example, data from 2024 indicated that 65% of shoppers favor brands with a clear sustainability commitment.

The shift towards experiences over possessions is a significant sociological factor, compelling Hammerson to evolve its properties into mixed-use destinations. By integrating leisure, dining, and community spaces, Hammerson aims to create vibrant hubs that cater to modern consumer desires. This strategy is supported by evidence showing experiential spending outpaced retail sales growth in key European markets in 2024.

Urbanization trends, with over 80% of Western Europeans expected to live in cities by 2025, bolster Hammerson's focus on prime urban locations. This demographic shift ensures a concentrated customer base for its centers. The company's placemaking initiatives aim to enhance urban vitality and social value, directly addressing the growing demand for community-focused development.

Technological factors

The persistent expansion of e-commerce demands a seamless omnichannel strategy, integrating online channels with physical retail spaces. Hammerson's approach emphasizes developing experiential destinations that provide unique value for shoppers and brands alike, acknowledging that brick-and-mortar locations still underpin a significant portion of retail activity.

Physical stores are essential, facilitating at least 80% of all retail transactions, making them critical touchpoints for customer engagement and brand presence. This underscores the need for Hammerson to continue investing in creating compelling in-person shopping environments that complement their digital offerings.

Smart building technologies and the Internet of Things (IoT) are transforming how Hammerson manages its properties. By integrating these systems, Hammerson can significantly boost operational efficiency and energy management. For instance, real-time data from IoT sensors can pinpoint areas of high energy consumption, enabling targeted reductions. This proactive approach to property management, informed by data, is crucial in today's climate-conscious market.

The tenant experience is also a major beneficiary of these advancements. Smart systems can optimize environmental controls like lighting and temperature, creating more comfortable and productive spaces. Furthermore, enhanced security features, powered by IoT, provide greater peace of mind for occupants. Hammerson's investment in these areas directly addresses evolving tenant expectations for modern, responsive, and secure environments, a trend that gained significant momentum through 2024 and is projected to continue into 2025.

Hammerson's adoption of data analytics and AI is crucial for understanding shopper habits and market shifts. For instance, by analyzing footfall data and sales figures from its 2023 portfolio, Hammerson can identify which retail concepts resonate most with consumers in specific locations, informing leasing strategies. This allows for a more precise tenant mix, ensuring properties attract and retain high-performing brands.

Leveraging these technologies also sharpens operational efficiency. AI can predict maintenance needs for buildings, reducing downtime and costs, while data analytics can optimize energy consumption across Hammerson's shopping centers. In 2024, Hammerson continued to invest in digital platforms to enhance customer engagement, using data to personalize marketing campaigns and improve the overall visitor experience, a trend expected to accelerate.

PropTech Innovations

The real estate technology (PropTech) sector is rapidly evolving, with innovations like virtual reality (VR) for immersive property tours and blockchain for secure, transparent transactions significantly reshaping how properties are bought, sold, and managed. Hammerson can leverage these advancements to create more engaging customer experiences and streamline its operational processes.

By integrating VR, Hammerson can offer virtual viewings, reducing the need for physical travel and expanding its reach to a global audience. For instance, a significant portion of property viewings are expected to incorporate virtual elements in the coming years, with some reports suggesting over 70% of buyers are comfortable with virtual tours. Blockchain technology offers potential for faster, more secure property transactions, reducing administrative burdens and costs.

These PropTech innovations also open doors to new investment models. Fractional ownership, facilitated by blockchain, could allow Hammerson to attract a broader investor base and unlock liquidity in its assets. The global PropTech market was valued at over $20 billion in 2023 and is projected to grow substantially, indicating a strong trend towards digital integration in real estate.

- Virtual Reality (VR): Enhances property viewing experiences, allowing remote exploration and reducing physical site visits.

- Blockchain Technology: Streamlines transactions, improves security, and enables new ownership models like fractionalization.

- Customer Experience: PropTech can personalize interactions and provide more convenient access to properties and information.

- Operational Efficiency: Automation and digital platforms can reduce costs and speed up processes in property management and sales.

Digital Marketing and Customer Engagement

Digital marketing is no longer just an option; it's a necessity for attracting and keeping shoppers and retailers engaged. Hammerson recognizes this, investing in advanced digital strategies to cater to the changing expectations of both customers and their retail tenants.

This focus on digital engagement is crucial for Hammerson's goal of driving sustainable, long-term income. By enhancing their properties through better placemaking and commercialization, supported by robust digital marketing, they aim to create more value.

For instance, in 2023, Hammerson reported that their digital platforms and marketing efforts contributed to increased footfall and dwell time in their key destinations. Their investment in data analytics helps tailor marketing campaigns, leading to better conversion rates for their retail partners.

- Digital Investment: Hammerson's commitment to digital marketing is a strategic imperative to stay competitive in the evolving retail landscape.

- Customer Retention: Advanced digital strategies are key to fostering loyalty among shoppers and providing valuable services to retailers.

- Income Growth: Enhanced placemaking and commercialization, powered by digital marketing, are designed to boost long-term revenue streams.

- Data-Driven Approach: Utilizing data analytics allows Hammerson to personalize marketing efforts and demonstrate ROI to occupiers.

Technological advancements are reshaping retail and property management. Hammerson is leveraging technologies like AI and IoT for operational efficiency, tenant comfort, and data-driven insights into shopper behavior. The company's investment in digital platforms in 2024 aimed to boost customer engagement through personalized marketing, a trend expected to continue.

Legal factors

The legal landscape for commercial property, particularly leasehold reforms, significantly influences Hammerson's operational model. New legislation, such as the Leasehold Reform (Ground Rent) Act 2022, has already capped ground rents for many new leases, and further reforms are anticipated, potentially impacting existing agreements and Hammerson's rental income streams.

Ongoing discussions around enhancing tenant protections, including potential extensions to lease security and limitations on upward-only rent reviews, necessitate Hammerson's proactive engagement with evolving legal frameworks. Adapting lease structures to comply with these anticipated changes, which aim to create a fairer market, is crucial for maintaining tenant relationships and future investment attractiveness.

Hammerson must adhere to strict health and safety regulations across its portfolio of shopping centres and retail destinations. This includes compliance with fire safety legislation, ensuring adequate emergency exits and fire suppression systems are in place, as demonstrated by ongoing safety audits and upgrades across its UK sites.

As a landlord, Hammerson has a legal duty to maintain safe public spaces, encompassing accessibility standards for disabled visitors and ensuring structural integrity. For instance, in 2024, the company continued investments in accessibility improvements at key locations like Westfield London, aligning with evolving legal requirements.

Hammerson, like all businesses, must navigate the complex landscape of data protection regulations, most notably the General Data Protection Regulation (GDPR). This means meticulously safeguarding the vast amounts of customer and tenant data they collect, from leasing agreements to footfall analytics.

Failure to comply can result in severe financial penalties; for example, GDPR fines can reach up to 4% of global annual turnover or €20 million, whichever is higher. In 2023, the Information Commissioner's Office (ICO) in the UK, a key regulator for Hammerson, issued fines totaling over £1 million for data protection breaches across various sectors.

Implementing strong data governance frameworks and transparent privacy policies is therefore not just a legal necessity but a crucial element in maintaining tenant and customer trust. This commitment to data security is vital for Hammerson's reputation and operational continuity.

Environmental Regulations and EU Taxonomy

Environmental regulations are becoming stricter, with the EU Taxonomy significantly impacting how sustainable real estate investments are assessed and reported. This framework mandates detailed disclosures on the environmental performance of economic activities.

Hammerson, as a major player, must comply with the Corporate Sustainability Reporting Directive (CSRD). Starting with its 2024 financial year, reported in 2025, the company will need to detail its Taxonomy eligibility and alignment. This means clearly stating which of its operations meet the EU's environmental criteria.

- EU Taxonomy: A classification system for sustainable economic activities, influencing investment flows.

- CSRD Compliance: Hammerson must report on sustainability metrics, including Taxonomy alignment from FY2024.

- Investment Influence: Stricter regulations and reporting requirements shape investor decisions towards more sustainable properties.

Building and Planning Permissions

Hammerson must navigate intricate building codes and secure planning permissions for all new and redevelopment projects, a process that directly impacts project viability and schedules. For instance, in the UK, the planning system aims to deliver sustainable development, but delays in obtaining approvals can significantly affect Hammerson's ability to bring new retail or office spaces to market. The company's 2023 annual report highlights ongoing engagement with local authorities to progress its development pipeline.

Shifts in national planning frameworks, such as the National Planning Policy Framework (NPPF) in the UK, can introduce new requirements or alter existing ones, potentially influencing the cost and feasibility of Hammerson's development strategies. These changes can necessitate design modifications or impact the density and type of development permitted, creating both challenges and opportunities. The NPPF's focus on sustainability and design quality, updated in 2023, requires careful consideration in all new schemes.

- Planning Permission Delays: Delays in securing planning permission can add significant costs and extend project timelines for Hammerson's developments.

- Policy Changes: Amendments to the National Planning Policy Framework (NPPF) in 2023 introduced stricter guidelines on design and sustainability, impacting development feasibility.

- Local Authority Engagement: Hammerson actively engages with local planning authorities to ensure compliance and smooth project progression, a key factor in its 2024 development plans.

Hammerson must navigate evolving leasehold reforms, with potential impacts on rental income and tenant relationships, necessitating adaptation of lease structures. Strict adherence to health and safety regulations, including fire safety and accessibility standards, remains paramount, with ongoing investments in compliance across its portfolio, such as accessibility upgrades at Westfield London in 2024.

Data protection laws like GDPR require meticulous safeguarding of customer and tenant data, with significant penalties for non-compliance, as highlighted by ICO fines in 2023. Environmental regulations, including the EU Taxonomy and CSRD, are increasingly influencing investment decisions and requiring detailed sustainability reporting from FY2024, impacting Hammerson's reporting in 2025.

Securing planning permissions and adhering to national planning frameworks, like the updated NPPF in 2023, are critical for development viability, with delays and policy changes impacting project costs and feasibility. Hammerson's 2023 annual report underscores its active engagement with local authorities to manage its development pipeline effectively.

Environmental factors

Hammerson is increasingly focusing on the physical risks posed by climate change. This means they are looking closely at how things like extreme weather events – think floods, heatwaves, or storms – could impact their shopping centers and other properties. To get ahead of this, Hammerson began conducting updated physical climate risk assessments in 2024.

As part of this proactive approach, Hammerson also updated its reporting aligned with the Taskforce on Climate-related Financial Disclosures (TCFD) framework. This update specifically incorporated nature-related disclosures, recognizing the interconnectedness of climate and biodiversity impacts on their assets.

Hammerson is actively pursuing a Net Zero Carbon target by 2030, a commitment that necessitates ongoing emission reductions across its property portfolio. This ambitious goal drives strategic decisions and operational changes within the company.

The company reported a positive step in its sustainability journey, achieving an 8.3% reduction in like-for-like emissions during 2024 compared to the previous year. This demonstrates tangible progress towards its Net Zero objectives.

Improving energy efficiency and boosting renewable energy use are critical environmental goals. Hammerson's Net Zero Asset Plans (NZAPs) are designed to help cut carbon emissions. For instance, their 2023 sustainability report highlighted a 7% reduction in Scope 1 and 2 emissions intensity compared to their 2019 baseline, driven by energy efficiency upgrades and renewable energy procurement.

Smart building technology offers a powerful way to manage energy consumption and lower operational expenses. By implementing advanced systems that monitor and control heating, cooling, and lighting, Hammerson can optimize energy use across its retail portfolio. This not only supports environmental targets but also contributes to cost savings, a key consideration in the current economic climate where energy prices remain volatile.

Waste Management and Circular Economy Principles

Hammerson's commitment to waste management and circular economy principles is central to its environmental strategy. By focusing on waste avoidance, recycling, and reuse, the company is actively aligning its operations and tenant guidelines with these forward-thinking concepts. This proactive approach is crucial for reducing environmental impact and fostering sustainable business practices within its retail destinations.

The company has set an ambitious target to achieve Net Zero for Resource Use by 2030. This goal signifies a strong dedication to a circular economy, aiming for the amount of waste avoided, recycled, or re-used to surpass the total materials consumed. This ambitious objective underscores Hammerson's commitment to resource efficiency and minimizing its ecological footprint across its portfolio.

- Waste Avoidance: Prioritizing reduction at the source through design and operational efficiency.

- Recycling and Reuse: Implementing robust systems for sorting and processing waste materials for secondary use.

- Net Zero Resource Use Target: Aiming to exceed materials consumed with waste avoided, recycled, or re-used by 2030.

- Tenant Engagement: Collaborating with tenants to promote sustainable waste management practices within retail spaces.

Biodiversity and Nature-Related Disclosures

Beyond just carbon emissions, there's a significant and increasing focus on protecting biodiversity and transparently reporting on how businesses impact nature. This shift reflects a growing understanding that environmental responsibility extends to the broader ecosystem.

Hammerson demonstrated this commitment in 2024 by completing Nature Assets Plans (NAPs) for all its destinations. These plans are crucial for understanding and managing the company's impact on local biodiversity. Furthermore, Hammerson has integrated nature-related disclosures into its Task Force on Climate-related Financial Disclosures (TCFD) reporting, showcasing a comprehensive approach to environmental stewardship.

This proactive stance aligns with evolving regulatory expectations and investor demands for greater accountability regarding nature-related risks and opportunities. For instance, the Taskforce on Nature-related Financial Disclosures (TNFD) framework, which Hammerson is adopting, aims to standardize such reporting globally.

Key aspects of Hammerson's approach include:

- Completion of Nature Assets Plans (NAPs): All Hammerson destinations had NAPs finalized in 2024, providing a detailed assessment of nature-related dependencies and impacts.

- Integration into TCFD Reporting: Nature-related disclosures are now part of Hammerson's TCFD reporting, offering a holistic view of environmental performance.

- Alignment with TNFD Framework: The company's actions are in line with the growing adoption of the TNFD framework, which provides guidance on nature-related financial disclosures.

- Enhanced Environmental Stewardship: These initiatives underscore a broader commitment to managing and improving the company's environmental footprint beyond climate change.

Hammerson is actively addressing climate change risks, with updated physical climate risk assessments conducted in 2024 and nature-related disclosures integrated into its TCFD reporting. The company is committed to achieving Net Zero Carbon by 2030, demonstrating progress with an 8.3% reduction in like-for-like emissions in 2024.

Energy efficiency and renewable energy are key environmental goals, supported by Net Zero Asset Plans. Hammerson also targets Net Zero for Resource Use by 2030, emphasizing waste avoidance, recycling, and reuse. In 2024, Nature Assets Plans were completed for all destinations to manage biodiversity impacts.

| Environmental Factor | Key Initiatives/Data (2024/2025 Focus) | Impact/Objective |

| Climate Change Risk | Updated physical climate risk assessments; TCFD reporting with nature disclosures | Mitigate physical risks from extreme weather; enhance transparency |

| Emissions Reduction | 8.3% reduction in like-for-like emissions (2024); Net Zero Carbon target by 2030 | Achieve Net Zero operations |

| Energy Efficiency & Renewables | Net Zero Asset Plans (NZAPs); 7% reduction in Scope 1 & 2 emissions intensity (vs. 2019) | Optimize energy consumption; increase renewable energy use |

| Resource Management & Circular Economy | Net Zero Resource Use target by 2030; focus on waste avoidance, recycling, reuse | Minimize waste; promote circular economy principles |

| Biodiversity | Completion of Nature Assets Plans (NAPs) for all destinations (2024); TNFD framework alignment | Understand and manage impact on local biodiversity |

PESTLE Analysis Data Sources

Our Hammerson PESTLE Analysis draws on a robust blend of official government publications, reputable financial news outlets, and leading industry research firms. This comprehensive approach ensures all political, economic, social, technological, legal, and environmental factors are grounded in current, verifiable data.