Hammerson Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hammerson Bundle

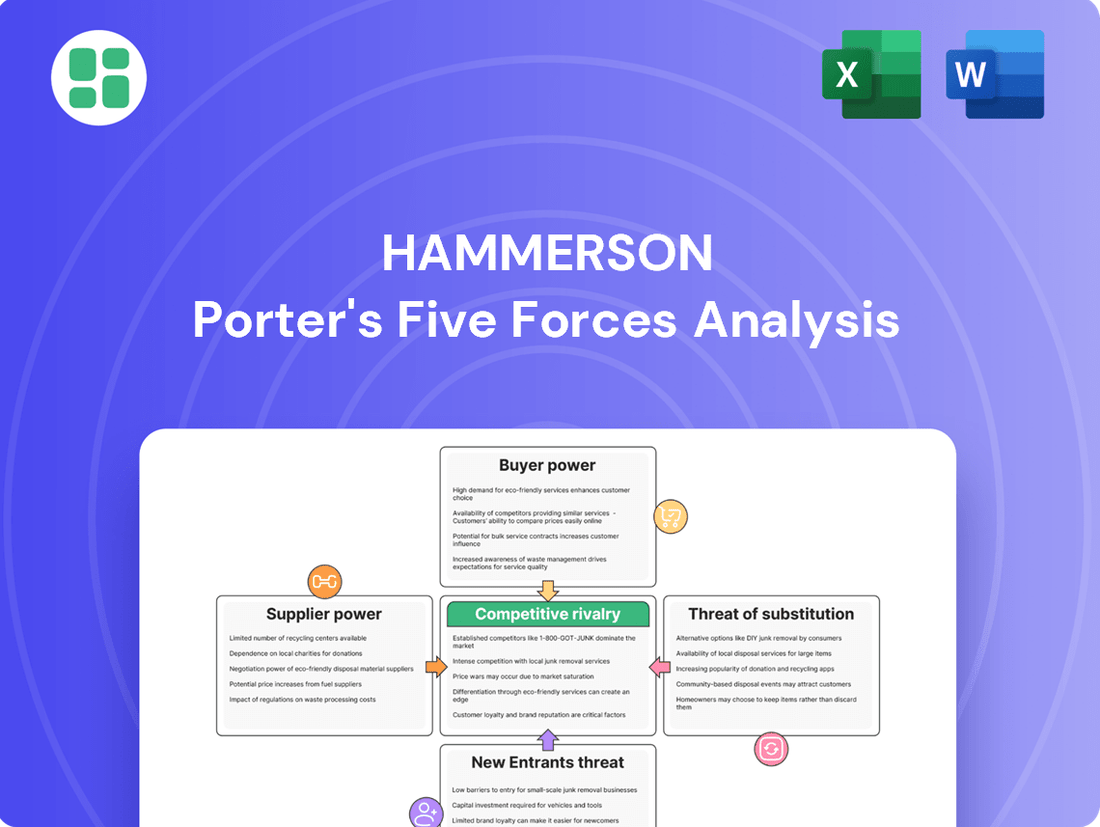

Hammerson's competitive landscape is shaped by powerful forces, from the intense rivalry among existing players to the ever-present threat of substitute retail experiences. Understanding these dynamics is crucial for navigating the retail property sector.

The complete report reveals the real forces shaping Hammerson’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The bargaining power of suppliers for Hammerson, a real estate investment trust, is significantly influenced by the concentration within their respective industries. For critical services like construction or specialized maintenance, if only a handful of companies dominate the market, these few suppliers can command higher prices and more favorable terms from Hammerson. This is because Hammerson would have fewer alternatives for these essential inputs.

In 2024, the construction sector, a key supplier base for REITs like Hammerson, continued to experience consolidation in certain regions. For instance, reports indicated that the top 10 construction firms in the UK accounted for a substantial portion of the total industry revenue, suggesting a degree of concentration that could amplify their bargaining power. Similarly, specialized technology vendors for building management systems or retail analytics might also exhibit concentrated market structures, giving them leverage.

Conversely, if Hammerson can source materials or services from a wide array of providers, the supplier's ability to dictate terms diminishes. A fragmented supplier landscape, where many smaller companies compete for Hammerson's business, typically results in more competitive pricing and greater flexibility for Hammerson. This allows Hammerson to negotiate more effectively, reducing the overall cost of its operations and development projects.

Suppliers providing highly specialized or unique services, like custom architectural designs for Hammerson's premium shopping centers or proprietary building management systems, wield considerable bargaining power. For instance, a firm offering a unique, energy-efficient HVAC solution, critical to a flagship property's operational efficiency and tenant comfort, could command higher prices.

Hammerson would face substantial switching costs and potential quality degradation if it sought to replace such specialized suppliers. This difficulty in finding comparable alternatives strengthens the supplier's position, allowing them to negotiate more favorable terms, impacting Hammerson's operational costs and project timelines.

The costs and complexities Hammerson faces when switching suppliers significantly influence supplier bargaining power. For instance, the expense and time involved in re-qualifying construction partners or dismantling and replacing existing IT infrastructure tied to specific suppliers can be substantial. This makes it more difficult for Hammerson to switch, thus strengthening the leverage of their current suppliers in price negotiations.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward, meaning they start developing or managing properties themselves, is generally low for Hammerson. This is because real estate development is incredibly capital-intensive and demands highly specialized expertise, which most of Hammerson's typical suppliers, like construction firms or material providers, do not possess. For instance, a construction company would need substantial capital to acquire land, navigate complex planning permissions, and manage ongoing property operations, a significant departure from their core business.

While theoretically possible, the barriers to entry for forward integration in the real estate sector are substantial. Consider the sheer scale of development projects; a single retail park or shopping centre can cost hundreds of millions of pounds to build and maintain. This financial hurdle, coupled with the need for deep market knowledge and tenant relations, makes it an unattractive proposition for most suppliers.

In 2024, the UK construction sector, a key supplier group for Hammerson, faced challenges including rising material costs and labor shortages, further deterring such companies from undertaking large-scale property development. For example, the Office for National Statistics reported a 5.2% increase in construction material prices in the year leading up to April 2024, adding to the already high capital requirements.

- Low Likelihood: Suppliers typically lack the vast capital and specialized expertise needed for property development.

- Capital Intensity: Developing properties requires hundreds of millions in investment, a barrier for most suppliers.

- Market Barriers: Understanding tenant needs and managing retail spaces are complex, non-core competencies for suppliers.

- Economic Headwinds: In 2024, factors like rising material costs in construction make diversification into development even less appealing for potential suppliers.

Importance of Hammerson to Supplier's Business

The bargaining power of suppliers to Hammerson is influenced by how crucial Hammerson is to their overall business. If Hammerson accounts for a substantial portion of a supplier's revenue, that supplier's leverage is weakened. They are more likely to offer competitive pricing and favorable terms to secure Hammerson's continued patronage, particularly as Hammerson concentrates on prime urban retail and leisure destinations.

For instance, a supplier of specialized retail fit-out materials might find their bargaining power reduced if Hammerson represents over 15% of their annual sales. In such scenarios, suppliers are incentivized to maintain a strong relationship, potentially absorbing some cost increases rather than risking the loss of a major client. This dynamic is amplified when considering Hammerson's strategic focus, which can create specific demand for unique services or products.

- Supplier Dependence: A supplier's reliance on Hammerson for a significant revenue stream directly curtails their ability to dictate terms.

- Market Concentration: If the supplier serves a niche market where Hammerson is a dominant buyer, their bargaining power diminishes.

- Hammerson's Strategic Focus: Hammerson's emphasis on high-quality, landmark destinations means suppliers offering unique or essential services for these projects may have slightly more leverage, but overall dependence remains a key factor.

- Alternative Buyers: The availability of comparable buyers for the supplier's goods or services also influences their bargaining strength with Hammerson.

The bargaining power of suppliers for Hammerson is moderate, primarily due to the fragmented nature of many supply chains, though specialized services can command higher leverage. In 2024, Hammerson's significant scale as a property developer and owner means it can often negotiate favorable terms with general suppliers, especially those reliant on its business. However, for unique or critical components, like advanced building management systems or specialized construction expertise, suppliers with limited competition can exert more influence, driving up costs.

The threat of forward integration by suppliers is low for Hammerson. The immense capital required for property development and management, coupled with the specialized expertise in leasing, tenant relations, and asset management, presents substantial barriers. For instance, a typical construction firm would need hundreds of millions in investment to acquire land and undertake a major retail development, a venture far outside their core competencies.

Hammerson's bargaining power is enhanced when it represents a substantial portion of a supplier's revenue, as this reduces the supplier's incentive to push for unfavorable terms. Conversely, suppliers of highly specialized or proprietary services, where Hammerson has few alternatives and high switching costs, can exert more influence. For example, a unique, energy-efficient HVAC system provider for a flagship property could leverage its position due to the complexity of replacement.

| Factor | Impact on Hammerson | 2024 Context |

|---|---|---|

| Supplier Concentration | Higher concentration increases supplier power. | Continued consolidation in UK construction firms in 2024, with top 10 firms holding significant market share. |

| Switching Costs | High switching costs empower suppliers. | Significant costs and time to re-qualify construction partners or replace IT infrastructure. |

| Forward Integration Threat | Generally low due to high capital and expertise barriers. | Rising material costs (e.g., 5.2% increase in UK construction materials up to April 2024) further deter suppliers from property development. |

| Supplier Dependence on Hammerson | Low dependence strengthens supplier power. | Suppliers who rely heavily on Hammerson for revenue (e.g., >15% of sales) have less leverage. |

What is included in the product

Analyzes the competitive intensity within Hammerson's retail property markets by examining buyer and supplier power, the threat of new entrants and substitutes, and existing rivalry.

Effortlessly gauge competitive intensity and identify potential threats with a visual representation of each force, simplifying complex strategic challenges.

Customers Bargaining Power

Hammerson's primary customers are retailers and other businesses that lease space in its shopping centers and mixed-use developments. The bargaining power of these customers is significantly influenced by the concentration of retailers within Hammerson's portfolio. If a small number of large, well-known retailers occupy a substantial portion of Hammerson's rentable space, they gain considerable leverage.

For instance, if anchor tenants like major fashion brands or department stores represent a large percentage of Hammerson's total rental income, they can negotiate more favorable lease terms, potentially demanding lower rents or significant incentives to remain in place. This concentration can limit Hammerson's flexibility in rent setting and tenant mix optimization.

The ease with which retailers can find comparable alternative retail or mixed-use spaces in prime locations across Europe directly influences their bargaining power. A saturated market with many high-quality alternatives would empower customers to demand better terms from Hammerson.

In 2024, the European retail real estate market saw a varied landscape. While prime locations in major cities remained in demand, secondary markets experienced higher vacancy rates. This disparity means Hammerson's bargaining power is strongest in its most sought-after destinations, where alternative options for retailers are more limited.

Switching costs for retailers significantly influence their bargaining power with property owners like Hammerson. These costs encompass not only the physical relocation expenses, such as fitting out a new space and marketing the new location, but also the potential disruption to their established customer base and brand presence. For instance, a retailer might incur tens of thousands of pounds in fit-out costs alone when moving to a new unit, not to mention the marketing spend required to inform customers of the change.

Hammerson's strategy to mitigate this bargaining power involves proactively addressing the evolving needs of both its retail tenants and the end consumers. By investing in property upgrades, offering flexible lease terms, and enhancing the overall customer experience within its shopping centers, Hammerson aims to make its locations more attractive and reduce the incentive for retailers to seek alternatives. This focus on tenant retention and customer satisfaction directly impacts the switching costs perceived by retailers.

Price Sensitivity of Retailers

Retailers' sensitivity to rent and service charges is a significant factor influencing their bargaining power. When profit margins are tight due to intense competition or economic slowdowns, retailers become more inclined to negotiate lease terms. For instance, in 2024, many retail sectors experienced margin pressures, making them more receptive to discussions about rent reductions or more adaptable lease structures.

Increased online competition and changing consumer spending habits further amplify retailers' price sensitivity. This heightened awareness of costs, including occupancy expenses, empowers them to demand more favorable lease agreements from landlords like Hammerson. They are more likely to push for lower rents or clauses that offer flexibility during periods of reduced sales.

The bargaining power of customers, in this context, is directly linked to the retailers' own financial health and market position. Retailers facing declining footfall or struggling to compete with e-commerce giants are more likely to pass on cost savings, including lower rents, to maintain their own competitiveness. This dynamic directly impacts Hammerson's ability to maintain rental income.

- Price Sensitivity: Retailers' profit margins and competitive landscape directly influence their sensitivity to rent and service charge costs.

- Economic Impact: Downturns and increased online competition heighten this sensitivity, leading to demands for rent reductions and flexible leases.

- Negotiation Leverage: Retailers facing margin pressures are more empowered to negotiate favorable lease terms with landlords.

- Market Dynamics: Retailers' ability to compete influences their capacity to pass on cost savings, impacting landlord revenue.

Threat of Backward Integration by Customers

The threat of backward integration by customers, particularly retailers, is a factor in Hammerson's operating environment. This means customers could potentially develop or own their own retail spaces, thereby bypassing Hammerson's offerings. However, this is generally a limited threat.

While individual retailers are unlikely to undertake such a significant investment, large retail chains might consider it for their flagship locations. Nevertheless, developing and managing prime retail property is not typically a core competency for most retailers, making widespread backward integration improbable.

For instance, in 2024, the retail property sector saw continued focus on omnichannel strategies, with retailers investing more in their online presence and in-store experiences rather than direct property ownership for the majority of their footprint. This suggests that the capital and expertise required for backward integration remain a significant barrier for most. Hammerson's portfolio of prime shopping centres and retail destinations offers advantages that are difficult for most retailers to replicate internally.

- Limited Likelihood: Individual retailers rarely possess the capital or expertise for backward integration into property development.

- Flagship Exception: Very large retail chains might consider owning flagship stores, but this is not a mainstream strategy.

- Core Competency Mismatch: Retailers' primary focus remains on merchandising and sales, not property management.

- 2024 Context: Retailers in 2024 prioritized digital investment and store optimization over large-scale property acquisition.

The bargaining power of Hammerson's customers, primarily retailers, is shaped by their price sensitivity and the availability of alternatives. In 2024, many retailers faced margin pressures, making them more inclined to negotiate rents and seek flexible lease terms.

High switching costs, including relocation expenses and potential disruption to customer bases, can limit retailers' leverage. However, Hammerson's ability to attract and retain tenants is crucial, especially given the varied performance of European retail markets in 2024, with prime locations outperforming secondary ones.

The threat of backward integration by retailers is generally low, as property development and management are not their core competencies. Retailers in 2024 continued to prioritize digital investments and store optimization over significant property ownership.

| Factor | Influence on Retailer Bargaining Power | 2024 Context/Example |

|---|---|---|

| Price Sensitivity | High sensitivity due to tight margins empowers negotiation for lower rents. | Retailers in sectors like apparel experienced margin pressures, increasing rent negotiation. |

| Availability of Alternatives | More alternatives in prime locations increase retailer leverage. | Prime city locations in Europe remained competitive, offering retailers options. |

| Switching Costs | High costs (fit-out, marketing, customer disruption) can reduce leverage. | Fit-out costs can run into tens of thousands of pounds, deterring frequent moves. |

| Backward Integration Threat | Generally low due to lack of core competency and high investment. | Retailers focused on omnichannel strategies rather than property development in 2024. |

Preview Before You Purchase

Hammerson Porter's Five Forces Analysis

This preview showcases the complete Hammerson Porter's Five Forces Analysis, detailing the competitive landscape for the company. You are viewing the exact, professionally formatted document that will be delivered instantly upon purchase, ensuring no discrepancies or missing sections. This comprehensive analysis is ready for immediate use, providing valuable insights into Hammerson's strategic positioning within the retail property sector.

Rivalry Among Competitors

Hammerson contends with a significant number of competitors within the European real estate sector, including major Real Estate Investment Trusts (REITs), established property developers, and substantial institutional investors. These entities often focus on similar retail and mixed-use assets, creating a crowded marketplace.

Prominent rivals such as Land Securities Group and British Land possess substantial portfolios and market capitalizations, directly challenging Hammerson for prime assets and tenant acquisition. For instance, as of early 2024, Land Securities reported a portfolio valued at approximately £12.6 billion, while British Land's stood around £10.1 billion, illustrating the scale of competition Hammerson faces.

The European retail real estate market is anticipated to experience a healthy recovery, with prime locations projected to see rental growth in 2025. This positive outlook suggests a dynamic environment where demand can comfortably absorb supply.

In such a growing market, competitive rivalry among retail property owners like Hammerson is likely to be less intense. When demand outstrips available space, the pressure to undercut competitors on rent or offer excessive incentives diminishes, allowing for more stable operations and potentially stronger returns.

Hammerson actively differentiates its retail spaces by focusing on creating unique, sustainable destinations that blend shopping with community experiences. This strategy aims to attract a diverse range of shoppers and tenants, thereby reducing direct competition based solely on price.

By curating a mix of retailers and offering engaging amenities, Hammerson seeks to build customer loyalty and command premium rents. For instance, in 2024, Hammerson continued its strategy of investing in experiential elements within its centers, such as food and beverage offerings and leisure facilities, to enhance footfall and dwell time.

Exit Barriers

High exit barriers, particularly the illiquidity of substantial real estate assets and the considerable capital investments involved, can significantly fuel competitive rivalry. Companies find themselves compelled to remain active and compete vigorously, even when market conditions are unfavorable, to mitigate the risk of incurring substantial financial losses.

For instance, Hammerson, a prominent European retail property company, faces substantial exit barriers. The sheer scale of its property portfolio, often comprising large shopping centers, means that divesting these assets quickly and without significant price erosion is extremely difficult. This illiquidity locks companies into the market, intensifying the competitive landscape as they strive to maintain occupancy rates and rental income.

- Illiquidity of Real Estate Assets: Large, specialized properties are not easily or quickly sold, trapping capital.

- High Capital Investment: Significant upfront costs in development and maintenance create a strong disincentive to exit.

- Intensified Rivalry: Companies may be forced to compete aggressively to survive, even in downturns, to avoid realizing losses on their investments.

- Strategic Implications: High exit barriers can lead to prolonged periods of intense competition, impacting profitability and strategic flexibility.

Industry Concentration

The European retail and mixed-use REIT market exhibits a moderate level of concentration. While Hammerson is a significant player, the presence of numerous regional and niche competitors prevents extreme dominance by a few entities.

This fragmentation means Hammerson faces rivalry not only from other large, established REITs but also from smaller, more agile players who may have a stronger foothold in specific local markets. The competitive landscape is therefore dynamic, requiring constant adaptation.

- Market Fragmentation: The European retail and mixed-use REIT market is not dominated by a single entity, allowing for a broader range of competitive pressures.

- Regional Competitors: Hammerson contends with numerous regional REITs that possess deep understanding and market share within their specific geographic areas.

- Niche Players: Specialized REITs focusing on particular retail formats or mixed-use developments also contribute to the competitive intensity.

- Impact on Rivalry: The diverse competitive set intensifies rivalry, pushing companies like Hammerson to innovate and optimize their portfolios to maintain market position.

Hammerson faces substantial competitive rivalry from a broad spectrum of European real estate players, including large REITs, developers, and institutional investors. This competition is amplified by the illiquidity of real estate assets and high capital investments, which trap companies in the market and force them to compete vigorously. For instance, as of early 2024, Land Securities' portfolio was valued around £12.6 billion, highlighting the scale of rivals Hammerson must contend with. The market's moderate concentration, with numerous regional and niche competitors, further intensifies this rivalry.

| Competitor | Approximate Portfolio Value (Early 2024) | Focus Areas |

|---|---|---|

| Land Securities Group | £12.6 billion | Prime retail, London developments |

| British Land | £10.1 billion | Retail parks, urban logistics, London |

| Hammerson | (Specific 2024 figures vary, but historically significant in European retail) | Prime retail destinations, mixed-use |

SSubstitutes Threaten

The most significant substitute for Hammerson's physical retail spaces is the ever-expanding world of online shopping and e-commerce. This digital alternative allows consumers to browse, compare, and purchase goods from the comfort of their homes, directly bypassing the need to visit a shopping center.

The relentless growth of e-commerce presents a substantial threat. For instance, global e-commerce sales were projected to reach approximately $6.3 trillion in 2024, a figure that continues to climb year after year. This trend means consumers have an ever-wider array of options for fulfilling their shopping needs, directly impacting footfall and, consequently, the demand for space from Hammerson's tenants.

Mixed-use properties, like those owned by Hammerson, face significant competition from a broad spectrum of alternative leisure and entertainment choices. Consumers have a plethora of options beyond integrated destinations, including standalone cinemas, diverse restaurant offerings, cultural institutions such as museums and theaters, and a growing array of outdoor and experiential activities.

This wide availability of substitutes means that consumers can easily divert their leisure time and disposable income away from Hammerson's properties. For instance, the UK cinema market, a key component of many retail and leisure destinations, saw admissions reach approximately 100 million in 2023, indicating a strong preference for dedicated cinema experiences. Similarly, the food service industry in the UK generated an estimated £110 billion in revenue in 2023, highlighting the significant draw of standalone dining establishments.

The ease with which consumers can access these alternatives directly impacts the demand for Hammerson's integrated destinations. If consumers perceive greater value, convenience, or novelty in a standalone activity, they are less likely to choose a mixed-use development for their leisure pursuits. This constant pressure from substitutes necessitates that Hammerson continually innovate and enhance its tenant mix and experiential offerings to remain competitive.

The rise of direct-to-consumer (DTC) online sales presents a significant threat to Hammerson. Brands are increasingly bypassing traditional retail spaces, like those Hammerson offers, to sell directly to shoppers online. This shift reduces brand reliance on physical locations, potentially impacting demand for retail leases.

In 2024, e-commerce continued its robust growth, with online retail sales projected to account for a substantial portion of total retail spending globally. For instance, online sales in the UK, a key market for Hammerson, saw continued year-on-year increases, demonstrating the growing consumer preference for digital channels. This trend directly challenges the traditional brick-and-mortar model that Hammerson's business is built upon.

Remote Work Trends and Urban Migration

The rise of remote work presents a significant threat of substitution for Hammerson's urban-centric portfolio. As companies embrace flexible work arrangements, the demand for traditional office spaces and the associated retail and leisure footfall could diminish. For instance, a 2024 survey indicated that 58% of US companies plan to offer hybrid work options, potentially reducing the need for daily commutes and city-center engagement.

This shift impacts Hammerson's mixed-use developments, which rely on a synergistic relationship between office workers, shoppers, and leisure visitors. If fewer people are required to be physically present in urban cores, the demand for retail units and entertainment venues within these estates could face pressure from alternative consumption patterns, such as online shopping and home-based leisure activities.

However, this threat is somewhat mitigated by a counter-trend: the creation of vibrant urban hubs. Many companies and cities are investing in making city centers attractive destinations for reasons beyond just work, fostering a demand for high-quality retail, dining, and cultural experiences that can coexist with hybrid work models. For example, London's West End continues to see investment in experiential retail, aiming to draw visitors back despite remote work trends.

- Remote Work Impact: A significant portion of the workforce, estimated at over 50% in many developed economies by 2024, now operates with hybrid or full remote arrangements.

- Substitution Risk: This trend directly substitutes the need for physical presence in urban office environments, potentially reducing footfall for Hammerson's retail and leisure tenants.

- Urban Hub Resilience: Conversely, investments in creating compelling urban experiences and amenities can offset some of this substitution threat by drawing people to city centers for non-work-related activities.

- Data Point: In 2023, UK retail sales volume saw a modest increase of 1.5%, suggesting that while online shopping is prevalent, physical retail still holds appeal, especially in well-curated urban environments.

Shifting Consumer Preferences

Shifting consumer preferences present a significant threat of substitutes for Hammerson. As shoppers increasingly value convenience, sustainability, and unique experiences, traditional retail formats face pressure from alternative consumption methods. For instance, the rise of online shopping, offering unparalleled convenience and often competitive pricing, directly substitutes for physical store visits.

Furthermore, a growing demand for sustainable products and ethical consumption challenges brick-and-mortar retailers to adapt their offerings. Hammerson, as a major retail property owner, needs to actively transform its spaces into more than just shopping destinations. This means integrating experiential retail, community hubs, and services that cater to these evolving desires, thereby reducing the attractiveness of substitutes.

In 2024, the retail sector continued to grapple with these shifts. Data from the British Retail Consortium indicated that while online sales growth moderated, the demand for experiential elements within physical retail remained strong. Hammerson's strategy to repurpose retail spaces for mixed-use, including residential and leisure, aims to directly address this threat by offering a more integrated and appealing consumer proposition.

- Evolving Consumer Demands: Consumers in 2024 increasingly prioritize convenience, sustainability, and memorable experiences over traditional transactional shopping.

- Digital and Experiential Alternatives: Online retail, subscription services, and entertainment venues offer compelling substitutes that divert spending from physical retail centers.

- Hammerson's Strategic Response: The company is adapting by focusing on creating mixed-use destinations that incorporate leisure, dining, and community spaces alongside retail.

- Mitigation through Transformation: By offering unique, curated experiences and integrating diverse amenities, Hammerson aims to enhance the appeal of its properties and reduce the threat posed by substitute offerings.

The threat of substitutes for Hammerson's physical retail spaces is substantial, primarily driven by the continued expansion of e-commerce and evolving consumer preferences. Global e-commerce sales were projected to reach approximately $6.3 trillion in 2024, a figure that underscores the convenience and accessibility of online shopping as a direct substitute for visiting physical centers.

Beyond online retail, a wide array of alternative leisure and entertainment options also poses a threat. Standalone cinemas, diverse dining establishments, and cultural attractions offer consumers choices that can divert spending and time away from mixed-use developments. For example, the UK food service industry generated an estimated £110 billion in revenue in 2023, highlighting the significant draw of dedicated dining experiences.

Furthermore, the rise of direct-to-consumer (DTC) online sales and the increasing prevalence of remote work arrangements present further substitution risks. As brands increasingly sell directly to consumers online, their reliance on traditional retail spaces diminishes. Similarly, hybrid work models can reduce the need for physical presence in urban centers, impacting footfall for retail and leisure tenants within Hammerson's portfolio.

| Substitute Category | Key Characteristics | 2024/2023 Data Point | Impact on Hammerson |

|---|---|---|---|

| E-commerce | Convenience, price comparison, wide selection | Global e-commerce sales projected at $6.3 trillion (2024) | Reduces footfall, tenant demand |

| Standalone Leisure | Specialized experiences (e.g., cinemas, dining) | UK food service revenue: £110 billion (2023) | Diverts consumer time and spending |

| Direct-to-Consumer (DTC) | Brand control, direct customer relationships | Continued growth in online retail sales | Decreased reliance on physical retail leases |

| Remote/Hybrid Work | Flexibility, reduced commuting | 58% of US companies offering hybrid work (2024) | Lower urban footfall, reduced demand for associated retail/leisure |

Entrants Threaten

Entering the real estate investment and development sector, particularly for large-scale retail and mixed-use properties like those Hammerson operates, demands immense capital. For instance, major development projects can easily run into hundreds of millions or even billions of pounds, a significant hurdle for most aspiring competitors.

This high financial barrier effectively limits the pool of potential new entrants. Only well-capitalized entities, such as large institutional investors or established property companies, can realistically consider entering this market, thereby reducing the immediate threat of widespread new competition.

Securing prime land in desirable urban locations across Europe, where Hammerson's properties are concentrated, presents a substantial hurdle for potential new entrants. The scarcity of suitable sites, particularly in established and high-demand retail hubs, significantly raises the cost and complexity of market entry.

For instance, in 2024, prime retail rents in major European cities like London and Paris continued their upward trajectory, reflecting the intense competition for limited, high-quality physical spaces. This escalating land acquisition cost acts as a formidable barrier, deterring new players from establishing a significant physical presence in Hammerson's core markets.

Established players like Hammerson leverage significant economies of scale in property management, leasing, and development, which are crucial for efficient operations and cost reduction. Their extensive experience in creating and managing successful retail destinations provides a deep understanding of market dynamics and tenant needs, making it difficult for newcomers to replicate this expertise. For instance, Hammerson's portfolio, valued at £4.9 billion as of December 2023, showcases the scale of operations that new entrants would need to overcome.

Regulatory and Planning Hurdles

The real estate development sector is heavily regulated, with new entrants facing significant challenges from complex and time-consuming approval processes across different European countries. For instance, obtaining planning permission in the UK can take over a year, with some major projects experiencing delays of 18-24 months. This regulatory landscape creates a substantial barrier, requiring considerable expertise and resources to navigate effectively.

These regulatory and planning hurdles act as a deterrent to potential new competitors. The need for extensive documentation, environmental impact assessments, and adherence to local zoning laws demands a deep understanding of each market's specific requirements. This complexity inherently limits the ease with which new firms can enter and establish themselves, particularly in established markets like London or Paris.

- Regulatory Complexity: Navigating diverse planning laws and environmental regulations across European jurisdictions is a major barrier.

- Lengthy Approval Times: Obtaining necessary permissions can take well over a year, tying up capital and delaying project commencement.

- High Compliance Costs: Meeting regulatory standards often involves significant upfront investment in studies, legal fees, and design modifications.

Brand Loyalty and Tenant Relationships

Hammerson benefits from deeply entrenched brand loyalty and established tenant relationships, making it difficult for new entrants to gain a foothold. Its strong reputation for creating desirable retail destinations means retailers are keen to secure space within its portfolio.

For instance, in 2024, Hammerson continued to focus on its premium portfolio, including flagship centers like Westfield London and Westfield Stratford City. These centers consistently attract high footfall and sales for their tenants, reinforcing Hammerson's appeal.

- Established Retailer Partnerships: Hammerson has cultivated long-term relationships with a wide array of retailers, from major anchor stores to smaller independent brands, fostering a stable and desirable tenant mix.

- Brand Reputation: The company's brand is synonymous with high-quality shopping experiences and successful retail environments, creating a strong pull factor for both tenants and consumers.

- High Entry Barriers: New entrants would face significant challenges in replicating Hammerson's established network and brand equity, requiring substantial investment in property acquisition, development, and marketing to attract and retain tenants and shoppers.

The threat of new entrants for Hammerson is relatively low due to substantial capital requirements and the scarcity of prime locations. For example, developing a major retail center can cost hundreds of millions of pounds, a significant barrier for most potential competitors.

Regulatory hurdles and lengthy approval processes across European jurisdictions further deter new players. Obtaining planning permission alone can take over a year, as seen with UK projects experiencing 18-24 month delays in 2024, adding considerable cost and complexity.

Hammerson's established economies of scale in property management and development, coupled with strong brand equity and retailer relationships, create significant competitive advantages. Its portfolio, valued at £4.9 billion as of December 2023, demonstrates the scale new entrants must contend with.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | High cost of land acquisition and development (hundreds of millions to billions of pounds). | Limits entry to well-capitalized institutional investors or established firms. |

| Location Scarcity | Limited availability of prime urban retail sites in high-demand European cities. | Increases acquisition costs and complexity for new market entrants. |

| Regulatory & Planning | Complex and time-consuming approval processes (e.g., UK planning permission >1 year). | Requires significant expertise, resources, and capital to navigate, delaying market entry. |

| Economies of Scale | Established efficiencies in property management, leasing, and development. | Newcomers struggle to match operational costs and expertise of incumbents like Hammerson. |

| Brand & Relationships | Strong brand reputation and deep-rooted tenant partnerships. | Difficult for new entrants to attract prime tenants and replicate Hammerson's market appeal. |

Porter's Five Forces Analysis Data Sources

Our Hammerson Porter's Five Forces analysis is built upon a robust foundation of data, drawing from Hammerson's annual reports, investor presentations, and publicly available financial statements. We supplement this with industry-specific market research reports and data from reputable real estate analytics firms to capture a comprehensive view of the retail property sector.