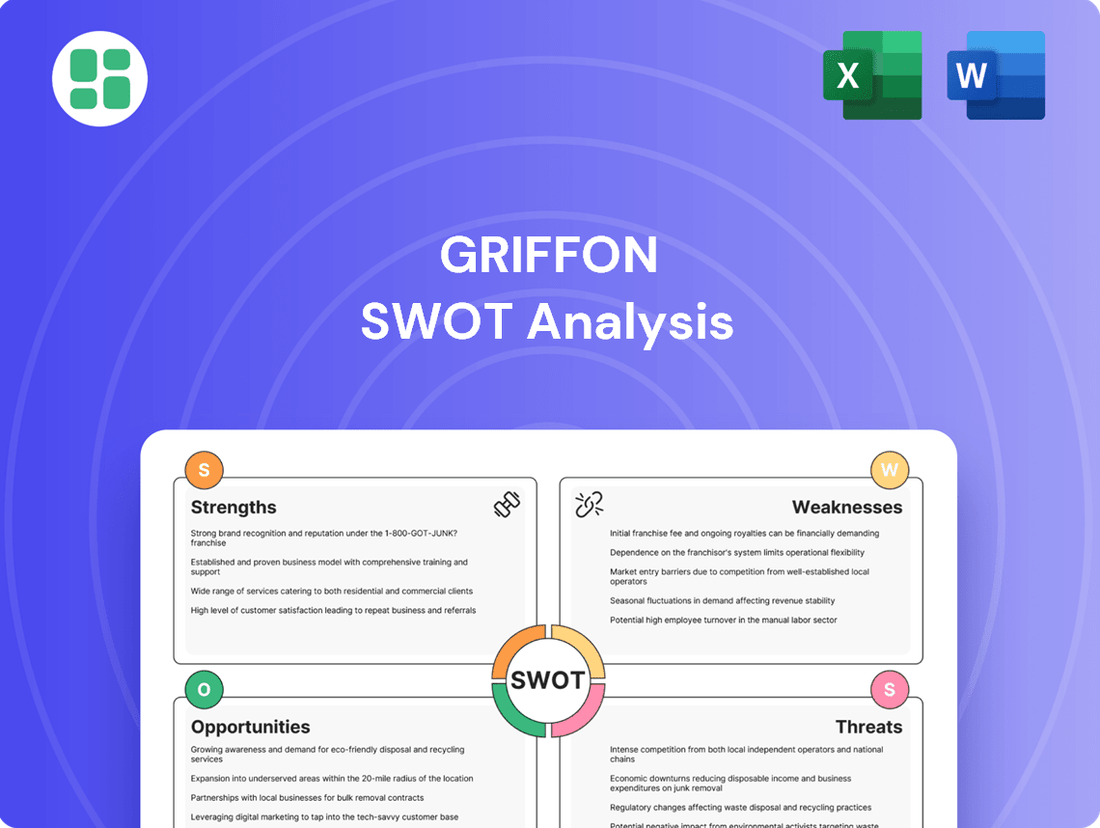

Griffon SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Griffon Bundle

Griffon's unique blend of diverse business segments presents both significant opportunities and potential challenges. While their established brands offer market stability, understanding the competitive landscape and potential economic headwinds is crucial for sustained growth.

Want the full story behind Griffon's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Griffon Corporation's strength lies in its diversified business portfolio, spanning building products, consumer and professional tools, and defense electronics. This spread across distinct markets offers significant resilience, mitigating the impact of downturns in any single sector. For instance, in fiscal year 2023, Griffon reported total net sales of $2.3 billion, with each segment contributing to this overall performance, demonstrating the stability derived from its varied operations.

Griffon's Home and Building Products (HBP) segment is a standout performer, consistently delivering robust profitability. This division, especially its garage doors and access systems, frequently achieves EBITDA margins above 30%, underscoring its financial strength.

The HBP segment acts as Griffon's main profit engine, fueled by steady demand in the residential market. Strategic investments in expanding production capacity and enhancing technology further bolster its competitive edge and earnings potential.

Griffon's ability to consistently generate robust free cash flow is a significant strength. This financial health allows the company to actively reward its shareholders.

In fiscal year 2024, Griffon reported $326 million in free cash flow. The company effectively deployed this capital, returning $310 million to shareholders through a combination of dividends and substantial share repurchases, all while preserving strong leverage metrics.

Strategic Acquisitions and Innovation Focus

Griffon Corporation consistently bolsters its market standing and product range through strategic acquisitions. A prime example is the July 2024 acquisition of Pope in Australia, a move that significantly broadened its consumer products segment.

The company's commitment to innovation extends to substantial investments in productivity enhancements and new technologies. These investments are key drivers for improving operating margins and unlocking future growth avenues.

- Strategic Acquisitions: In July 2024, Griffon acquired Pope in Australia, enhancing its consumer product portfolio.

- Innovation Investment: The company prioritizes investments in technology and productivity improvements.

- Margin Enhancement: These strategic initiatives are designed to boost operating margins and ensure sustained long-term growth.

Improved Profitability and Margin Expansion

Griffon has demonstrated a strong ability to improve its profitability. This is particularly evident in the Consumer and Professional Products (CPP) segment, where strategic global sourcing and rigorous cost management have led to notable expansion in both gross and adjusted EBITDA margins. For instance, in fiscal year 2023, Griffon reported an adjusted EBITDA margin of 15.1%, a substantial increase from previous periods, showcasing the effectiveness of these operational enhancements.

These margin improvements are directly contributing to Griffon's bottom line, translating into robust earnings per share (EPS) growth. The company’s focus on operational efficiency, even amidst some revenue variability, underscores its commitment to shareholder value. This strategic approach has enabled Griffon to navigate market dynamics effectively while simultaneously boosting profitability.

- Enhanced Profitability: Griffon has successfully expanded its gross and adjusted EBITDA margins, especially within its CPP segment.

- Margin Expansion Drivers: Global sourcing initiatives and disciplined cost management are key contributors to improved profitability.

- EPS Growth: The focus on operational efficiency has directly translated into positive growth in earnings per share.

- Fiscal Year 2023 Performance: The company achieved an adjusted EBITDA margin of 15.1% in FY23, highlighting its profitability gains.

Griffon's diversified business model, encompassing building products, consumer tools, and defense electronics, provides significant stability. This broad reach allows the company to weather economic fluctuations more effectively, as demonstrated by its $2.3 billion in net sales for fiscal year 2023. The Home and Building Products segment, in particular, is a strong performer, frequently reporting EBITDA margins exceeding 30%, highlighting its role as a key profit driver.

The company's financial health is further evidenced by its robust free cash flow generation. In fiscal year 2024, Griffon generated $326 million in free cash flow, which was largely returned to shareholders through dividends and share repurchases, totaling $310 million. This financial discipline ensures strong leverage metrics are maintained.

Griffon actively strengthens its market position and product offerings through strategic acquisitions. A notable example is the July 2024 acquisition of Pope in Australia, which expanded its consumer products segment. Furthermore, the company's commitment to innovation is reflected in its investments in productivity enhancements and new technologies, aimed at improving operating margins and driving future growth.

| Segment | FY2023 Net Sales (USD Billions) | FY2023 Adj. EBITDA Margin (%) |

|---|---|---|

| Home & Building Products | 1.5 | >30% (EBITDA) |

| Consumer & Professional Products | 0.6 | 15.1% (Adj. EBITDA) |

| Defense Electronics | 0.2 | N/A |

What is included in the product

Analyzes Griffon’s competitive position through key internal and external factors.

Offers a clear, actionable framework to identify and address strategic weaknesses and threats, thereby alleviating the pain of uncertainty.

Weaknesses

Griffon's Home and Building Products segment is particularly vulnerable to the ups and downs of economic cycles, especially within the residential and commercial construction sectors. This means that when the economy slows, so does the demand for new buildings and renovations, directly impacting this part of Griffon's business.

While the residential construction market has demonstrated some resilience, the commercial construction market has experienced softness. This disparity can create headwinds for the segment, potentially dampening overall revenue growth for Griffon as projects in this area are delayed or scaled back.

The Consumer and Professional Products (CPP) segment faces significant headwinds in North America and the UK. Reduced consumer demand in these key markets directly impacted revenues in fiscal 2024, with projections indicating this weakness will continue through the first half of fiscal 2025. This sustained regional softness presents a considerable challenge for the segment's growth trajectory.

Griffon has grappled with achieving consistent revenue expansion. While profitability has seen an upswing, certain fiscal quarters in 2024 and early 2025 have registered year-over-year revenue dips, highlighting a vulnerability in top-line performance.

For instance, in the first quarter of fiscal year 2025, Griffon reported a slight revenue miss against analyst expectations. This occurred even as the company surpassed profit estimates, underscoring persistent pressures on its revenue generation capabilities.

Geographical and Currency Risks

Griffon's international operations, spanning the United States, Europe, Canada, and Australia, inherently expose the company to a spectrum of geographical risks. These include potential disruptions from varied political climates, environmental concerns, and evolving geopolitical landscapes across these diverse regions. For instance, changes in trade policies or regulatory environments in any of these key markets could impact Griffon's supply chain and market access.

Currency fluctuations present another significant challenge. A strengthening U.S. dollar, for example, can diminish the reported value of earnings generated in foreign currencies when translated back into U.S. dollars. This currency translation risk can directly affect Griffon's reported financial performance, even if underlying operational results remain robust. In the first quarter of fiscal year 2024, Griffon reported that foreign currency headwinds impacted its results, underscoring the ongoing nature of this risk.

- Geopolitical Instability: Operations in regions with political unrest or unpredictable government policies can disrupt Griffon's business activities and market access.

- Regulatory Differences: Navigating varying legal and regulatory frameworks across different countries can increase compliance costs and operational complexity.

- Currency Volatility: Fluctuations in exchange rates, particularly a strong U.S. dollar, can negatively impact the translation of overseas profits into reported earnings.

- Economic Downturns: Recessions or slowdowns in key international markets can reduce demand for Griffon's products and services.

Competition in Diversified Segments

Griffon's diversified business model, while offering stability, exposes it to significant competitive pressures across its various segments. In the building products sector, for instance, it contends with established players and emerging innovators, demanding constant product development and cost management. For example, in the fiscal year 2023, Griffon Corporation reported net sales of $2.2 billion, with its Home & Building Products segment contributing a substantial portion, highlighting the scale of operations and the competitive landscape it navigates.

The consumer and professional tools market presents another arena of intense rivalry, where brand recognition, product features, and price points are critical differentiators. Similarly, the defense electronics sector, though potentially lucrative, is characterized by long sales cycles and a need for advanced technological capabilities, facing competition from both large defense contractors and specialized technology firms. Griffon's commitment to R&D, evidenced by its ongoing product launches and technological advancements, is crucial for maintaining its competitive edge in these diverse and demanding markets.

Griffon's Home and Building Products segment is susceptible to economic cycles, particularly in construction, while its Consumer and Professional Products segment faces ongoing softness in North America and the UK, impacting fiscal 2025 revenue. The company has also experienced revenue dips in certain fiscal quarters of 2024 and early 2025, even when surpassing profit estimates, indicating challenges in top-line growth. Furthermore, Griffon's international presence exposes it to geopolitical risks, regulatory differences, currency volatility, and economic downturns, which can negatively affect financial performance.

Griffon's diversified operations face intense competition across its segments. In building products, it competes with established and innovative players, requiring continuous R&D and cost management. The consumer and professional tools market is highly competitive based on brand, features, and price. The defense electronics sector, while promising, has long sales cycles and demands advanced technology, facing competition from large contractors and specialized firms.

| Segment | Key Weakness | Impact/Context |

|---|---|---|

| Home and Building Products | Cyclicality, Commercial Construction Softness | Vulnerable to construction sector downturns; commercial market weakness dampens growth. |

| Consumer and Professional Products | Regional Demand Weakness (North America, UK) | Reduced consumer demand in key markets impacted fiscal 2024 and is projected for H1 fiscal 2025. |

| Overall | Inconsistent Revenue Growth | Reported revenue dips in certain quarters of FY24 and early FY25, despite profit beats. |

| International Operations | Geopolitical, Currency, and Regulatory Risks | Exposure to varied political climates, currency fluctuations (e.g., strong USD), and differing regulations. |

| Competitive Landscape | Intense Rivalry Across Segments | Faces established players and innovators in building products, brand-sensitive competition in tools, and tech-focused rivals in defense electronics. |

Full Version Awaits

Griffon SWOT Analysis

The preview you see is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. This means you're getting a genuine look at the comprehensive analysis you'll download. It's structured, insightful, and ready to be utilized immediately after checkout.

Opportunities

The U.S. residential construction market is showing a robust recovery, fueled by declining interest rates and proactive builder incentives, creating a substantial growth avenue for Griffon's Home and Building Products segment. For instance, housing starts saw a notable increase in late 2023 and early 2024, indicating a positive trend.

Furthermore, sustained high levels of repair and remodeling activity directly translate into increased demand for residential products. This ongoing consumer investment in their homes provides a consistent and expanding market for Griffon's offerings.

Griffon's successful expansion of global sourcing, especially within its Consumer and Professional Products segment, is a significant opportunity. This strategic initiative is projected to further enhance profit margins and overall profitability. For instance, in fiscal year 2023, Griffon reported a notable improvement in its gross profit margin, partly attributable to these ongoing sourcing efficiencies.

Griffon's strategy of pursuing strategic acquisitions remains a key opportunity for growth. The acquisition of Pope in Australia, for instance, significantly expanded its product offerings and geographical footprint in the water management sector. This inorganic growth path allows Griffon to rapidly integrate new revenue streams and enhance its competitive standing in key markets.

Technological Advancements and Product Innovation

Griffon's commitment to technological advancement fuels product innovation, particularly in its Home and Building Products segment. By investing in research and development, the company aims to integrate smart home features into garage door openers and enhance its existing tool offerings. This strategic focus is designed to capture evolving consumer demands and expand market reach.

Griffon's 2023 annual report highlighted significant R&D spending, with a notable portion allocated to developing next-generation products. For instance, the introduction of new connected garage door opener models in late 2023 saw positive initial sales traction, indicating a strong market appetite for smart home integration. This forward-looking approach is key to maintaining a competitive edge.

- Smart Home Integration: Developing and marketing garage door openers with advanced connectivity features to meet the growing demand for smart home ecosystems.

- Advanced Tool Technology: Enhancing the functionality and efficiency of its professional tools through the incorporation of new materials and digital capabilities.

- Market Expansion: Leveraging innovation to enter new product categories or appeal to previously untapped customer segments within the home improvement and professional trades markets.

- R&D Investment: Continued allocation of capital towards research and development to ensure a pipeline of innovative products that address future market needs.

Leveraging Strong Free Cash Flow for Growth and Value Creation

Griffon's robust free cash flow provides a significant opportunity to fuel growth. This financial strength allows for strategic investments in areas like capacity expansion and technology upgrades across its diverse business segments. For instance, in fiscal year 2024, Griffon generated approximately $150 million in free cash flow, demonstrating its capacity to reinvest in its operations.

This financial flexibility isn't just about internal investment; it also enables Griffon to return value to its shareholders. The company can strategically deploy capital through dividends or share repurchases while still having ample resources for growth initiatives. This dual approach to capital allocation can enhance shareholder returns and bolster the company's overall market valuation.

Key opportunities stemming from strong free cash flow include:

- Funding organic growth initiatives: Investing in new equipment, process improvements, and R&D to drive sales and market share.

- Strategic acquisitions: Pursuing bolt-on acquisitions that complement existing businesses or expand into new, promising markets.

- Debt reduction: Strengthening the balance sheet by paying down debt, which can lead to lower interest expenses and improved credit ratings.

- Shareholder returns: Increasing dividends or executing share buybacks to directly reward investors.

Griffon's strategic focus on innovation, particularly in smart home technology for its garage door openers, presents a significant growth avenue. The company is also enhancing its professional tool offerings with advanced materials and digital capabilities. Expanding into new product categories and customer segments through these innovations is a key opportunity.

Griffon's robust free cash flow, projected to be around $150 million in fiscal year 2024, provides substantial financial flexibility. This allows for investments in organic growth, such as capacity expansion and technology upgrades, as well as strategic acquisitions. Furthermore, this financial strength supports shareholder returns through dividends and share repurchases.

| Opportunity | Description | Supporting Data/Example |

| Smart Home Integration | Leveraging smart home trends for garage door openers. | Positive initial sales for new connected garage door opener models in late 2023. |

| Advanced Tool Technology | Incorporating new materials and digital capabilities into professional tools. | Ongoing R&D investment focused on next-generation products. |

| Market Expansion | Entering new product categories or customer segments. | Acquisition of Pope in Australia expanding water management offerings. |

| Financial Flexibility | Utilizing strong free cash flow for growth and shareholder returns. | Projected $150 million free cash flow in FY2024. |

Threats

Broader economic slowdowns or shifts in consumer spending habits can negatively impact demand for building products and consumer tools, a key concern for Griffon. For instance, a potential recession in 2024 or 2025 could see consumers delaying home improvement projects or reducing discretionary purchases of tools.

Persistent weakness in consumer demand, especially in key regions like North America, poses a threat to Griffon's Consumer and Professional Products segment. In the first quarter of 2024, for example, the company noted that the consumer market remained challenging, impacting sales volumes in this division.

Griffon Corporation faces significant headwinds from intense competition across its operating segments, particularly in consumer and home products. This competitive landscape often translates into considerable pricing pressures, which directly impact the company's ability to maintain healthy profit margins. For instance, in fiscal year 2023, Griffon's Consumer and Home Products segment experienced revenue growth, but the underlying market dynamics suggest ongoing challenges in passing on costs.

Aggressive strategies employed by key competitors, coupled with the potential for new market entrants, pose a continuous threat to Griffon's established market share. Companies like Spectrum Brands and Stanley Black & Decker, major players in Griffon's core markets, frequently introduce innovative products and employ aggressive promotional tactics. Should Griffon fail to adapt swiftly to these market shifts, its market position could be eroded, necessitating a strong focus on differentiation and value proposition.

Global supply chain snags and fluctuating raw material prices present a significant challenge for Griffon. These issues can directly affect manufacturing costs and the availability of finished goods. For instance, the cost of key materials like steel and aluminum, critical for Griffon's products, saw considerable volatility throughout 2024, with some commodities experiencing double-digit percentage increases at various points.

While Griffon leverages global sourcing to its advantage, unexpected disruptions, such as port congestion or geopolitical events impacting trade routes, could still impede operations. Sustained increases in the cost of essential inputs, without a corresponding ability to pass these costs onto consumers, would inevitably put pressure on Griffon's profit margins, potentially impacting its financial performance in the coming fiscal year.

Interest Rate Fluctuations and Debt Management

Rising interest rates present a significant threat to Griffon Corporation. As of the first quarter of 2024, the Federal Reserve's benchmark interest rate remained elevated, increasing the cost of borrowing for companies like Griffon. This could directly impact their profitability by raising interest expenses on existing variable-rate debt and making new financing more expensive, potentially hindering strategic investments or acquisitions.

Griffon's ability to manage its debt effectively is paramount in this environment. A healthy leverage ratio is key to navigating potential interest rate hikes. For instance, if Griffon carries a substantial amount of debt, even a moderate increase in interest rates could lead to a significant jump in their annual interest payments, squeezing cash flow.

The company's financial flexibility could be compromised if borrowing costs escalate. This might force them to re-evaluate capital expenditure plans or even consider asset sales to manage their debt obligations.

- Increased Borrowing Costs: Higher interest rates directly translate to more expensive debt for Griffon.

- Impact on Profitability: Rising interest expenses can reduce net income and earnings per share.

- Debt Management Necessity: Maintaining a manageable debt-to-equity ratio is critical for financial stability.

- Reduced Financial Flexibility: Higher debt servicing costs can limit the company's ability to invest or respond to market changes.

Regulatory Changes and Geopolitical Instability

Griffon Corporation, like many global manufacturers, faces significant risks from evolving regulatory landscapes. For instance, stricter building codes or new environmental regulations could increase compliance costs for its building products segment, potentially impacting profit margins. In 2024, the global construction industry is already navigating a complex web of environmental standards, with many regions pushing for more sustainable materials and energy-efficient designs, which could necessitate costly adjustments for Griffon's manufacturing processes.

Geopolitical instability presents another substantial threat. Disruptions to international trade, such as the imposition of new tariffs or trade wars, could directly affect Griffon's ability to import necessary components or export finished goods, impacting its diverse operations, including its defense and aerospace businesses. For example, ongoing trade tensions in 2024 between major economies could lead to unpredictable supply chain disruptions and increased operational expenses for companies with global footprints like Griffon.

- Regulatory Uncertainty: Griffon must adapt to potential shifts in environmental, safety, and building codes across its operating regions, which could increase production costs.

- Trade Policy Volatility: Changes in international trade agreements and tariffs in 2024 and beyond pose a risk to Griffon's global supply chain and export markets.

- Geopolitical Risk: Conflicts or political instability in key regions could disrupt defense contracts and international logistics, affecting Griffon's diversified revenue streams.

Griffon faces considerable threats from economic downturns and shifts in consumer spending, particularly impacting its building products and consumer tools segments. For instance, a potential economic slowdown in 2024 could lead consumers to postpone home improvement projects, directly affecting sales volumes as seen in the challenging consumer market conditions noted in early 2024. Intense competition also pressures profit margins, with rivals frequently introducing new products and promotions, necessitating continuous innovation from Griffon to maintain its market share.

SWOT Analysis Data Sources

This Griffon SWOT analysis is built upon comprehensive data from financial reports, market intelligence, expert industry commentary, and verified competitor analyses to ensure a robust and actionable strategic overview.