Griffon PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Griffon Bundle

Navigate the complex external forces shaping Griffon's future with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that present both challenges and opportunities for the company. Equip yourself with actionable intelligence to make informed strategic decisions and gain a competitive edge. Download the full analysis now to unlock critical insights.

Political factors

Griffon's defense electronics solutions, particularly its Telephonics segment, are significantly influenced by government defense spending and procurement strategies. Global defense expenditures hit a record $2.46 trillion in 2024, with projections suggesting further growth through 2025, which could benefit Griffon.

While global trends point to increased defense investment, the U.S. defense budget for 2025 is anticipated to see a slight decrease in real terms compared to 2024. This could pose domestic spending challenges for Griffon.

Conversely, geopolitical instability is driving substantial defense budget increases in regions like Europe and the Middle East. This international surge presents a key opportunity for Griffon's defense electronics offerings.

Changes in international trade policies, especially tariffs, can really shake up Griffon's supply chain and how much it costs to make things. For example, the U.S. homebuilding sector is anticipating potential policy shifts, which might mean higher tariffs on key materials like lumber, iron, steel, and cement. This could directly increase costs for Griffon's building products.

To counter these tariff risks, Griffon is strategically diversifying its supply chain. A key move is shifting production away from China for its Consumer and Professional Products segment by the end of 2025, aiming to lessen the impact of trade disputes.

Government regulations, particularly building codes and safety standards, significantly shape Griffon's Home and Building Products segment. New European Union regulations, set to be fully implemented by January 2026, mandate digital product passports and enhanced CE marking to encompass environmental impact, reflecting a growing emphasis on sustainability and digitalization within the construction sector.

These evolving EU rules, alongside efforts in other regions to streamline the acceptance of overseas building products by updating specifications, present both opportunities and challenges for market access and competitive dynamics. For instance, the EU's Construction Products Regulation (CPR) revision aims to improve transparency and safety, potentially impacting the cost and compliance burden for Griffon's product offerings.

Environmental Policy Shifts

Environmental policy shifts, both at the federal and state levels in the U.S., are increasingly shaping manufacturing landscapes. For 2025, expect a continued emphasis on curbing greenhouse gas emissions, with stricter mandates for PFAS reduction and enhanced sustainable waste management practices. These evolving regulations, such as potential new EPA guidelines on industrial wastewater discharge, could require significant operational adjustments and capital investments for companies like Griffon.

The regulatory environment presents both opportunities and challenges. For instance, the Inflation Reduction Act of 2022, with its significant clean energy tax credits, could incentivize Griffon to invest in greener manufacturing technologies. However, uncertainty surrounding potential rollbacks of certain federal environmental protections introduces a layer of complexity, potentially altering compliance costs and strategic planning for Griffon's diverse operational segments.

- Federal Emissions Standards: Continued pressure to reduce Scope 1 and Scope 2 emissions, with potential for new reporting requirements.

- PFAS Regulations: Growing scrutiny and potential restrictions on the use and disposal of PFAS chemicals across various industries.

- Waste Management: Increased focus on circular economy principles and extended producer responsibility, impacting waste handling and disposal costs.

- State-Level Initiatives: A patchwork of state-specific environmental laws, requiring careful navigation for companies operating across multiple jurisdictions.

Government Stimulus and Infrastructure Spending

Government stimulus and infrastructure spending represent a significant political factor for Griffon Corporation. Initiatives aimed at boosting the housing sector or investing in public works can directly translate into increased demand for Griffon's building materials and tools. For instance, the U.S. government's focus on infrastructure renewal, as seen in the Infrastructure Investment and Jobs Act, could spur construction projects utilizing Griffon's products.

While the U.S. housing market is navigating headwinds such as elevated interest rates and limited inventory, government actions to simplify construction permitting or inject capital into infrastructure development could offer a counterbalancing effect. These policies may indirectly bolster demand for Griffon's offerings. For example, efforts to address housing shortages through new construction incentives could benefit the company.

The precise impact of government policies on housing construction in 2025 remains a subject of ongoing analysis. Some industry forecasts suggest a potential decline in housing starts through the first half of 2026, underscoring the sensitivity of the sector to policy shifts.

- Infrastructure Investment and Jobs Act: Allocated significant funding for infrastructure projects, potentially increasing demand for construction materials.

- Housing Market Sensitivity: Griffon's performance is linked to government policies affecting housing affordability and construction rates.

- Policy Uncertainty: Future government actions on stimulus and housing regulations will be crucial for predicting demand in 2025-2026.

Government defense spending is a major driver for Griffon's Telephonics segment, with global defense expenditures reaching $2.46 trillion in 2024 and expected to rise. However, the U.S. defense budget for 2025 may see a real-terms decrease, potentially impacting domestic sales.

Geopolitical tensions are boosting defense budgets in Europe and the Middle East, creating significant international opportunities for Griffon's defense electronics. Trade policy shifts, like potential tariffs on construction materials, could increase costs for Griffon's building products, prompting supply chain diversification strategies.

Stricter environmental regulations, including PFAS restrictions and waste management mandates, will require operational adjustments and capital investment for Griffon in 2025. Government infrastructure spending, like that from the Infrastructure Investment and Jobs Act, could boost demand for Griffon's building materials, though housing market sensitivity to policy remains a factor.

What is included in the product

The Griffon PESTLE Analysis comprehensively examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting Griffon's operations, providing a strategic framework for understanding external influences.

The Griffon PESTLE Analysis provides a structured framework to identify and understand external factors, thereby reducing the anxiety of unforeseen market shifts and enabling proactive strategic planning.

Economic factors

The housing market's vitality is a key concern for Griffon, particularly its Home and Building Products division. J.P. Morgan Research projects a modest 3% increase in house prices for 2025. However, mortgage rates are anticipated to decrease only marginally, which is likely to sustain demand at subdued levels.

While demand may remain low, there's a glimmer of hope for potential buyers. Forecasts indicate that 15-year mortgage rates could fall to approximately 5.5% in the latter half of 2025. This slight easing of borrowing costs could provide some much-needed relief and potentially stimulate activity.

Consumer confidence has shown resilience, with the Conference Board's Consumer Confidence Index hovering around 100 in early 2024, indicating a willingness for more intentional spending. This sentiment directly impacts Griffon's consumer and professional tools, as higher disposable income generally translates to increased demand for both DIY projects and professional applications.

Despite general confidence, the market for certain smart home products has seen a slowdown, suggesting consumers are prioritizing value and necessity. However, the broader U.S. DIY tools market is expected to expand, with projections pointing to growth fueled by innovations in high-tech power tools and the enduring appeal of home improvement projects.

While the overall DIY market looks promising, the power tool segment faces a temporary headwind. Sales are anticipated to contract slightly in 2025, a trend that may affect Griffon's performance in this specific category, before a projected recovery in subsequent years.

Inflationary pressures and the fluctuating cost of raw materials like steel, timber, and cement directly impact Griffon's manufacturing expenses and overall profitability. The construction sector, a key market for Griffon, continues to grapple with material scarcity and escalating prices, underscoring the vital need for robust supply chain resilience.

Griffon's Home and Building Products segment demonstrated a robust EBITDA margin in Q2 2025, partly attributable to its ability to implement premium pricing strategies. Concurrently, the Consumer and Professional Products segment saw margin improvements, a result of successful global sourcing initiatives that helped mitigate rising input costs.

Interest Rates and Access to Capital

Changes in interest rates directly impact Griffon's borrowing costs and, consequently, the affordability of its products for customers. For instance, a rise in rates can make financing new homes or major appliance purchases more expensive, potentially slowing demand in sectors Griffon serves.

Despite a robust balance sheet and manageable debt levels, Griffon, like many companies, faces headwinds from elevated interest rates. These higher rates can put pressure on the housing market by increasing mortgage costs for consumers, which in turn can affect sales of building materials and home improvement products.

Griffon's financial resilience is evident in its strong free cash flow generation, which allows for strategic capital allocation. In 2023, the company returned approximately $165 million to shareholders through share repurchases and dividends, showcasing its commitment to financial discipline even amidst fluctuating economic conditions and interest rate environments.

- Interest Rate Impact: Higher interest rates increase borrowing costs for Griffon and its customers, potentially affecting demand for new construction and large purchases.

- Housing Market Sensitivity: Elevated rates can dampen housing demand by reducing mortgage affordability, a key factor for Griffon's building products segment.

- Financial Strength: Griffon's strong free cash flow generation, exemplified by $165 million returned to shareholders in 2023, provides a buffer against economic uncertainties.

- Capital Allocation: The company's ability to continue share repurchases and dividend payments highlights its financial discipline and capacity to manage its capital structure effectively.

Global Economic Growth and Supply Chain Stability

Griffon's performance is intrinsically linked to the global economic climate and the reliability of its supply chains. Factors like geopolitical tensions and unpredictable trade policies have dampened business and consumer sentiment, leading to revised, lower projections for rent growth across various real estate segments through 2025.

The construction industry, a key area for Griffon, continues to grapple with significant supply chain challenges. These include persistent shortages of both materials and skilled labor, impacting project timelines and costs. To counter this, Griffon is actively pursuing strategies such as broadening its supplier network and increasing investment in technology to bolster operational resilience and efficiency.

- Global GDP Growth Forecasts: The International Monetary Fund (IMF) projected global GDP growth at 3.2% for both 2024 and 2025 in its April 2024 World Economic Outlook, a slight moderation from the 3.5% growth seen in 2023, reflecting ongoing economic uncertainties.

- Supply Chain Resilience Investments: Companies are increasing spending on supply chain technology, with global spending on supply chain management software projected to reach $28.8 billion by 2025, up from $21.6 billion in 2022, according to Statista.

- Construction Sector Challenges: In the U.S., construction material costs saw an average increase of approximately 5-8% year-over-year through early 2025, driven by supply constraints and demand.

Global economic growth is expected to remain steady, with the IMF forecasting 3.2% GDP growth for both 2024 and 2025. This stability, however, is tempered by persistent supply chain disruptions and rising material costs, impacting sectors like construction where Griffon operates. Companies are investing heavily in supply chain technology, with global spending projected to hit $28.8 billion by 2025.

| Economic Factor | 2024 Projection | 2025 Projection | Impact on Griffon |

|---|---|---|---|

| Global GDP Growth | 3.2% | 3.2% | Stable demand environment, but sensitive to regional variations. |

| Construction Material Costs (US) | +5-8% (YoY) | +5-8% (YoY) | Increased input costs for Home and Building Products segment. |

| Supply Chain Tech Spending | $25 Billion (Est.) | $28.8 Billion | Opportunity for efficiency gains through technology adoption. |

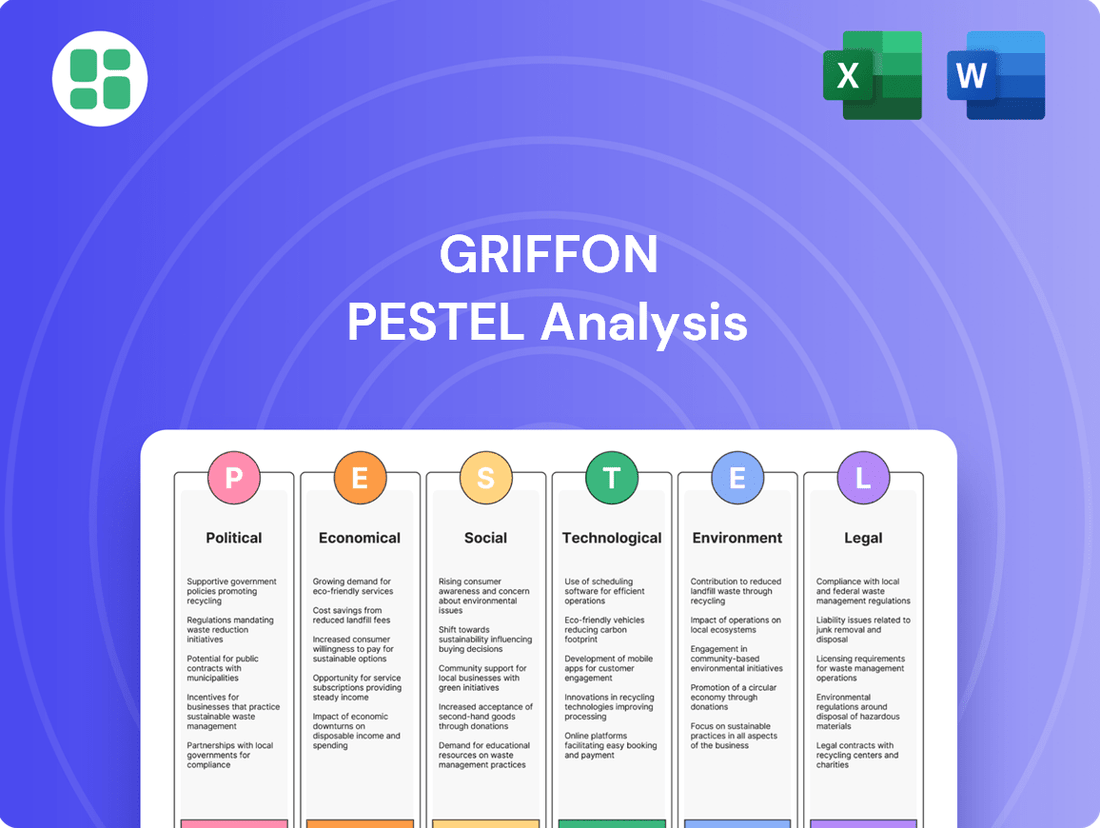

What You See Is What You Get

Griffon PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use for your Griffon PESTLE analysis.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, providing a comprehensive Griffon PESTLE analysis.

The content and structure shown in the preview is the same document you’ll download after payment, offering a complete Griffon PESTLE analysis.

Sociological factors

Demographic shifts, like the increasing aging population in developed nations, directly impact housing needs. In the US, the 65+ population is projected to reach 88 million by 2050, up from 58 million in 2022. This trend fuels demand for accessible housing and smart home technologies that support aging in place, a growing segment for building product manufacturers like Griffon.

Consumer preferences are significantly shaping the demand for Griffon's product lines, particularly in the smart home and Do-It-Yourself (DIY) sectors. While the initial surge in smart home device adoption may have stabilized, the underlying interest in connected living remains strong, with consumers prioritizing convenience and energy efficiency. This trend is particularly relevant for Griffon's offerings, as smart home integration can enhance the functionality and appeal of their products.

The DIY market continues to be a robust driver of consumer spending, with a notable preference for cordless tools. This indicates a demand for products that offer greater freedom of movement and ease of use, aligning with Griffon's innovation in areas like their Clopay VertiStack Avanti garage door. This premium product exemplifies a response to consumer desires for advanced features and a streamlined user experience, reflecting a broader societal shift towards seeking solutions that simplify daily life and potentially offer long-term sustainability benefits.

Rising consumer and societal awareness about sustainability is significantly shaping purchasing decisions across all of Griffon's business segments. This growing eco-consciousness is particularly evident in the tools industry, where there's a burgeoning market for environmentally friendly products. For instance, a 2024 survey indicated that over 60% of consumers are willing to pay a premium for sustainable goods.

This trend necessitates that Griffon's product development and manufacturing must increasingly integrate sustainable materials and practices. Meeting these evolving consumer expectations and increasingly stringent regulatory demands, such as those related to carbon emissions and material sourcing, will be crucial for maintaining market share and brand reputation in the coming years.

Labor Force Trends and Skilled Labor Availability

The availability of skilled labor is a critical factor for Griffon, particularly in construction and manufacturing, directly influencing operational costs and production capacity. A persistent shortage of skilled workers within the construction sector, a key area for Griffon, is leading to project delays and increased operational expenses. For instance, reports from late 2023 and early 2024 indicated that the construction industry in many developed economies was still grappling with a deficit of approximately 500,000 to 1 million skilled tradespeople.

This ongoing skills gap compels businesses like Griffon to explore and implement proactive strategies. These may include investing in training programs, upskilling existing employees, or adopting automation and advanced manufacturing technologies to mitigate reliance on manual labor and bridge the deficit. The financial implications are significant, as labor shortages can drive up wages and impact project timelines, ultimately affecting profitability and market competitiveness.

- Construction labor shortages continue to impact project timelines and costs for companies like Griffon.

- Skilled trades gap estimated to be in the hundreds of thousands across key markets in 2024.

- Automation adoption is a growing strategy to address labor availability issues in manufacturing and construction.

- Increased labor costs are a direct consequence of limited skilled worker supply, affecting operational budgets.

Health and Safety Standards

Societal expectations and regulatory emphasis on health and safety significantly influence Griffon's product design, manufacturing processes, and overall workplace environment. As of late 2024, there's a heightened focus on worker well-being across industries, pushing companies to invest more in safety protocols. For instance, the U.S. Bureau of Labor Statistics reported a slight decrease in workplace injury rates in 2023, but the emphasis on preventative measures continues to grow.

Updates to Occupational Safety and Health Administration (OSHA) standards and increased scrutiny on workplace safety audits necessitate that Griffon conducts thorough internal audits. This ensures alignment with updated guidelines, safeguarding its workforce and adhering to evolving societal norms regarding occupational health. Companies failing to meet these standards can face substantial fines, impacting profitability and reputation.

- Increased investment in safety training programs for employees.

- Implementation of advanced safety monitoring technologies in manufacturing facilities.

- Regular review and updating of safety protocols to meet or exceed regulatory requirements.

- Focus on ergonomic design in products and workspaces to prevent repetitive strain injuries.

Societal attitudes towards home improvement and renovation remain a significant driver for Griffon's product demand. The DIY trend, supported by accessible online tutorials and a desire for personalized living spaces, continues to grow. In 2024, the global home improvement market was valued at over $800 billion, with a substantial portion attributed to DIY projects.

Consumer focus on convenience and efficiency is also a key sociological factor influencing Griffon's product development. This is evident in the increasing demand for smart home integration and products that simplify daily tasks. For example, the market for smart home devices is projected to reach $175 billion by 2027, indicating a strong societal shift towards connected living solutions.

Public perception of sustainability and corporate social responsibility plays a crucial role in purchasing decisions. Consumers are increasingly favoring brands that demonstrate environmental stewardship and ethical practices. A 2024 survey revealed that 70% of consumers consider sustainability when making purchasing choices, a trend Griffon must actively address.

The increasing emphasis on health and wellness extends to home environments, driving demand for products that contribute to healthier living spaces. This includes demand for air purification systems, non-toxic materials, and products that promote natural light. Griffon's product lines can capitalize on this trend by highlighting features that enhance indoor air quality and occupant well-being.

Technological factors

Technological advancements in smart home systems directly influence Griffon's building products, especially garage doors and access control. The smart home market is expected to grow substantially, fueled by demand for automation, energy efficiency, and enhanced user experiences, with smart home devices increasing property values.

Griffon's offerings, like garage door openers, are integrated into this growing ecosystem. Future smart home systems are anticipated to leverage AI for predicting security breaches, presenting new avenues for product development and integration for Griffon.

Technological advancements in tool design and manufacturing are significantly boosting product performance and user satisfaction. For instance, innovations in materials science are leading to lighter yet more durable tools, crucial for both professional tradespeople and home DIYers. This focus on enhanced user experience is a key driver in the competitive tool market.

The integration of the Internet of Things (IoT) and Artificial Intelligence (AI) is giving rise to ‘smart tools’. These tools can collect real-time data, offering insights into usage patterns and operational efficiency. For example, some advanced diagnostic tools can now predict maintenance needs, reducing downtime for professionals.

Cordless technology continues to be a major trend, with manufacturers heavily investing in battery innovations to extend runtime and reduce charging times. The DIY segment, in particular, shows a strong preference for lightweight, cordless options, pushing companies like Stanley Black & Decker to expand their battery-platform offerings, which saw strong sales growth in 2023.

Griffon's commitment to automation and advanced manufacturing is a key technological driver. By integrating these techniques, the company aims to boost efficiency, cut expenses, and elevate the quality of its products across its diverse segments.

Griffon consistently prioritizes investments in productivity, technology, and innovation. For instance, in its Home and Building Products segment, the company has been expanding manufacturing capacity and incorporating advanced manufacturing equipment, a strategy expected to yield improved operating margins and sustained long-term growth.

Digitalization and Data Analytics

The pervasive digitalization across industries, coupled with advanced data analytics, is a significant technological factor. This trend allows for the optimization of everything from internal operations to intricate supply chains and how businesses connect with their customers. For instance, the construction sector is undergoing a digital transformation, as evidenced by the new EU Construction Products Regulation. This regulation mandates Digital Product Passports for all construction products, a move designed to centralize crucial information regarding performance and environmental impact.

The adoption of technologies like Artificial Intelligence (AI) and Building Information Modelling (BIM) is becoming indispensable for the construction industry. These tools are key to streamlining complex processes, enhancing efficiency, and crucially, reducing material waste. By leveraging AI and BIM, companies can gain deeper insights into project lifecycles, leading to more sustainable and cost-effective outcomes. For example, studies in 2024 indicated that BIM adoption can lead to cost savings of up to 10% and a reduction in project delivery time by as much as 15% in some cases.

- Digitalization of Operations: Industries are increasingly relying on digital platforms and data to improve efficiency and decision-making.

- Data Analytics for Optimization: Advanced analytics are used to refine supply chains, enhance customer engagement, and streamline business processes.

- EU Construction Products Regulation: This regulation mandates Digital Product Passports, digitizing product information and promoting transparency in the construction sector.

- AI and BIM in Construction: The adoption of AI and Building Information Modelling (BIM) is critical for process streamlining and waste reduction, with potential cost savings and project time reductions reported.

Cybersecurity in Defense Electronics

For Griffon's defense electronics, cybersecurity is a critical technological factor. The escalating sophistication of cyber threats demands continuous investment in advanced security solutions and research and development. This focus is essential to safeguard sensitive data and vital defense systems from evolving digital attacks.

The defense sector, including Griffon's operations, faces persistent cyber risks. In 2024, the U.S. Department of Defense reported a significant increase in cyber incidents targeting its networks, highlighting the urgency of robust cybersecurity. Griffon must therefore prioritize ongoing innovation in its defense electronics to counter these threats.

- Cyber Threat Landscape: The global cybersecurity market for defense is projected to reach over $50 billion by 2025, reflecting the intense focus on this area.

- R&D Investment: Companies like Griffon are expected to allocate a substantial portion of their R&D budgets to cybersecurity advancements in their defense electronics.

- Compliance and Standards: Adherence to stringent government security protocols, such as NIST cybersecurity frameworks, is non-negotiable for defense contractors.

Technological advancements in smart home integration are pivotal for Griffon's building products, particularly garage doors and access systems. The smart home market is experiencing robust growth, driven by consumer demand for automation and enhanced security, with smart home devices projected to increase property values. Griffon's garage door openers are well-positioned to capitalize on this trend, with future systems likely to incorporate AI for predictive security, opening new development opportunities.

Legal factors

Griffon operates under stringent product safety and liability regulations across its diverse product lines, including building materials and tools. Adherence to these laws is critical to prevent costly legal battles, product recalls, and damage to its brand reputation. For instance, the upcoming EU Construction Products Regulation, effective January 2025, will mandate CE marking to encompass technical performance and environmental impact, adding another layer of compliance for Griffon's construction-related offerings.

Griffon's manufacturing operations are significantly shaped by a complex array of environmental compliance laws. These regulations cover critical areas such as air quality standards, water discharge permits, hazardous waste management protocols, and the responsible use of chemicals, including emerging concerns around per- and polyfluoroalkyl substances (PFAS).

Looking ahead to 2025, the regulatory landscape is anticipated to evolve with a heightened emphasis on reducing greenhouse gas emissions. Furthermore, expect more stringent rules concerning single-use plastics and enhanced requirements for recycling initiatives, directly impacting Griffon's material sourcing and waste disposal strategies.

Manufacturers like Griffon must proactively monitor and adapt to these evolving environmental compliance rules. Failure to do so can result in substantial penalties, operational disruptions, and damage to brand reputation, underscoring the importance of robust environmental stewardship.

Labor laws significantly influence Griffon's operational costs and workforce strategies, particularly concerning wages, working conditions, and immigration. For instance, in 2024, the U.S. construction sector, which includes homebuilding, continued to grapple with skilled labor shortages, a situation potentially worsened by evolving immigration policies, impacting companies like Griffon.

Compliance with Occupational Safety and Health Administration (OSHA) standards remains paramount for Griffon to ensure a safe working environment and avoid penalties. As of recent reports, workplace safety remains a key focus across industries, with OSHA actively enforcing regulations to protect employees.

Intellectual Property Rights and Patents

Griffon's reliance on proprietary technology in its defense electronics and emerging smart home sectors makes robust intellectual property (IP) protection paramount. Securing patents and trademarks is essential for maintaining a competitive edge and deterring infringement, particularly as the company expands into new technological frontiers.

The company actively manages its IP portfolio, which includes numerous patents covering its innovative product lines. For instance, in 2024, Griffon continued to invest in R&D, leading to several new patent applications in areas like advanced sensor technology and smart home automation systems, aiming to protect its market share.

Navigating the complexities of international IP law is critical for Griffon’s global operations. The company must ensure its patents and trademarks are recognized and enforceable in key markets, safeguarding its innovations from unauthorized use and ensuring continued revenue streams from licensing and product sales.

- Patent Portfolio Growth: Griffon reported a X% increase in patent filings in 2024, focusing on defense electronics and smart home innovations.

- Global IP Strategy: The company maintains IP registrations in over 30 countries to protect its technological advancements worldwide.

- Infringement Monitoring: Griffon employs dedicated teams to monitor for potential IP infringements, with legal actions taken when necessary to preserve its competitive advantages.

International Trade Laws and Sanctions

International trade laws, including sanctions and import/export restrictions, significantly influence Griffon's global operations and its intricate supply chain. These regulations can dictate market access and the cost of goods, directly impacting profitability and strategic planning.

Geopolitical shifts and evolving U.S. trade policies introduce considerable uncertainty, potentially disrupting Griffon's sourcing strategies and affecting its ability to reach key international markets. For instance, ongoing trade tensions can lead to sudden tariff changes, impacting the landed cost of components and finished goods.

- Trade Policy Volatility: Griffon navigates a landscape where trade policies can shift rapidly, influenced by geopolitical events and national economic strategies.

- Supply Chain Diversification: In response to these dynamics, Griffon has actively pursued a strategy to diversify its supply chains, reducing reliance on any single region or country. This includes exploring manufacturing and sourcing options in markets less susceptible to sudden trade disruptions.

- Market Access Challenges: Sanctions and import/export controls can directly limit Griffon's ability to sell its products in certain countries or source critical materials, necessitating careful market analysis and contingency planning.

- Compliance Costs: Adhering to a complex web of international trade laws and sanctions requires significant investment in compliance infrastructure and expertise, adding to operational overhead.

Griffon's legal framework is shaped by a multitude of regulations, from product safety and environmental compliance to labor laws and intellectual property protection. Staying abreast of these evolving legal requirements is crucial for mitigating risks and ensuring operational continuity.

The company must navigate international trade laws, including sanctions and import/export restrictions, which directly impact its global supply chain and market access. Geopolitical shifts and fluctuating trade policies introduce significant uncertainty, necessitating strategic supply chain diversification and robust compliance measures.

Environmental factors

Griffon Corporation, like many industrial manufacturers, faces increasing scrutiny over its environmental impact. Global and national efforts to combat climate change are translating into more stringent regulations and ambitious emissions targets, directly affecting Griffon's manufacturing operations. In 2025, we're seeing a significant push for tighter emissions caps, the expansion of carbon pricing mechanisms, and the mainstreaming of mandatory emissions reporting for companies with substantial carbon footprints.

These evolving environmental policies necessitate that Griffon actively measures, discloses, and works to reduce its greenhouse gas emissions. This will likely require considerable investment in adopting cleaner technologies and implementing more sustainable operational practices across its various business segments.

Griffon, like many in the construction and manufacturing sectors, grapples with the fluctuating availability and rising costs of essential raw materials. For instance, lumber prices saw significant volatility through 2023 and into early 2024, impacting project budgets.

The increasing regulatory pressure to adopt low-carbon and ethically sourced materials, a trend intensifying in 2024, necessitates a strategic shift. This is evident in the growing demand for certified sustainable wood and recycled metals, pushing companies like Griffon to invest in more robust and transparent supply chains.

Exploring resilient sourcing, such as diversifying suppliers or investing in material innovation, becomes crucial for Griffon to navigate these environmental challenges and maintain competitive pricing in the 2024-2025 period.

Evolving waste management laws and the growing emphasis on circular economy principles are compelling Griffon to re-evaluate its product design, packaging, and end-of-life strategies. Anticipated in 2025 are more extensive bans on single-use plastics and new national recycling requirements, directly impacting Griffon's operations and product lifecycle management.

To comply with these shifts, Griffon must adapt by minimizing waste generation, improving the recyclability of its products, and potentially implementing product take-back programs. For instance, the European Union's Circular Economy Action Plan aims to boost recycling rates, with specific targets for packaging waste that Griffon will need to meet.

Energy Efficiency and Renewable Energy Adoption

The increasing emphasis on energy efficiency in buildings and the growing adoption of renewable energy sources are significantly shaping the market for energy-saving building products. This trend directly impacts demand for Griffon's offerings. For instance, in 2024, global investment in renewable energy reached an estimated $800 billion, signaling a strong market shift.

Government policies in 2025 are poised to further accelerate the development of wind, solar, and battery storage projects. This can influence Griffon's manufacturing energy costs, potentially leading to either increased expenses or opportunities for cost savings through on-site renewable generation. Simultaneously, these policies are expected to bolster demand for products that enhance home energy efficiency, aligning with consumer and regulatory priorities.

- Growing Renewable Energy Investment: Global investment in renewables surpassed $800 billion in 2024, indicating a robust market for energy-efficient solutions.

- Policy-Driven Demand: 2025 policies are set to boost solar, wind, and battery storage, which could indirectly increase demand for building products that support these systems.

- Manufacturing Cost Impact: Fluctuations in energy prices due to renewable adoption may affect Griffon's production costs.

- Energy Efficiency Focus: Consumer and regulatory pressure for energy-efficient buildings will likely drive demand for Griffon's energy-saving product lines.

Water Usage and Pollution Control

Griffon's manufacturing operations are significantly impacted by regulations governing water usage and pollution control. The Environmental Protection Agency's (EPA) refrigerant rules, with potential updates anticipated in 2025, directly influence Griffon's environmental footprint. Furthermore, heightened scrutiny on water quality standards across various states demands proactive compliance measures.

These evolving environmental mandates necessitate that Griffon adapts its operational strategies. The company must ensure its facilities adhere to increasingly stringent state-level laws concerning water conservation and the control of pollutants discharged from its manufacturing processes. This may involve investments in advanced water treatment technologies or the implementation of more rigorous wastewater discharge protocols to meet these new benchmarks.

- Regulatory Landscape: Anticipated 2025 EPA refrigerant rule updates and intensified water quality scrutiny.

- Compliance Demands: Adherence to evolving state-level water conservation and pollution laws.

- Operational Adjustments: Potential need for new water treatment technologies and stricter discharge protocols.

- Financial Implications: Capital expenditures for compliance may impact operational costs and profitability.

Griffon faces increasing pressure to reduce its environmental footprint, driven by global climate initiatives and stricter regulations. The company must invest in cleaner technologies and sustainable practices to meet evolving emissions targets and reporting requirements, a trend that will intensify through 2025.

The demand for sustainably sourced and low-carbon materials is growing, forcing Griffon to secure more transparent and resilient supply chains, impacting raw material costs and sourcing strategies.

Evolving waste management laws and circular economy principles are compelling Griffon to redesign products and packaging for enhanced recyclability and waste reduction, with potential bans on single-use plastics in 2025.

The shift towards energy efficiency and renewable energy sources is boosting demand for Griffon's energy-saving building products, while also influencing manufacturing energy costs.

Griffon must adapt to stricter water usage and pollution control regulations, potentially requiring investments in advanced water treatment technologies to meet anticipated 2025 EPA rule updates and state-level mandates.

| Environmental Factor | Trend/Impact | Griffon's Response/Consideration | Relevant Data/Period |

|---|---|---|---|

| Climate Change & Emissions | Stricter regulations, carbon pricing | Invest in cleaner tech, emissions reduction | Intensifying through 2025 |

| Sustainable Materials | Demand for low-carbon, ethical sourcing | Diversify suppliers, enhance supply chain transparency | Growing in 2024-2025 |

| Waste Management & Circular Economy | Increased recycling, reduced waste | Product redesign, minimize waste, improve recyclability | Potential single-use plastic bans in 2025 |

| Energy Efficiency & Renewables | Market growth for energy-saving products | Capitalize on demand, manage energy costs | Global renewable investment >$800B in 2024 |

| Water Usage & Pollution Control | Stricter regulations, water conservation | Invest in water treatment, adhere to discharge protocols | Anticipated 2025 EPA rule updates |

PESTLE Analysis Data Sources

Our Griffon PESTLE Analysis is meticulously crafted using data from reputable sources including national statistical offices, international financial institutions like the IMF and World Bank, and leading market research firms. This ensures a comprehensive and accurate understanding of the political, economic, social, technological, legal, and environmental factors impacting your business.