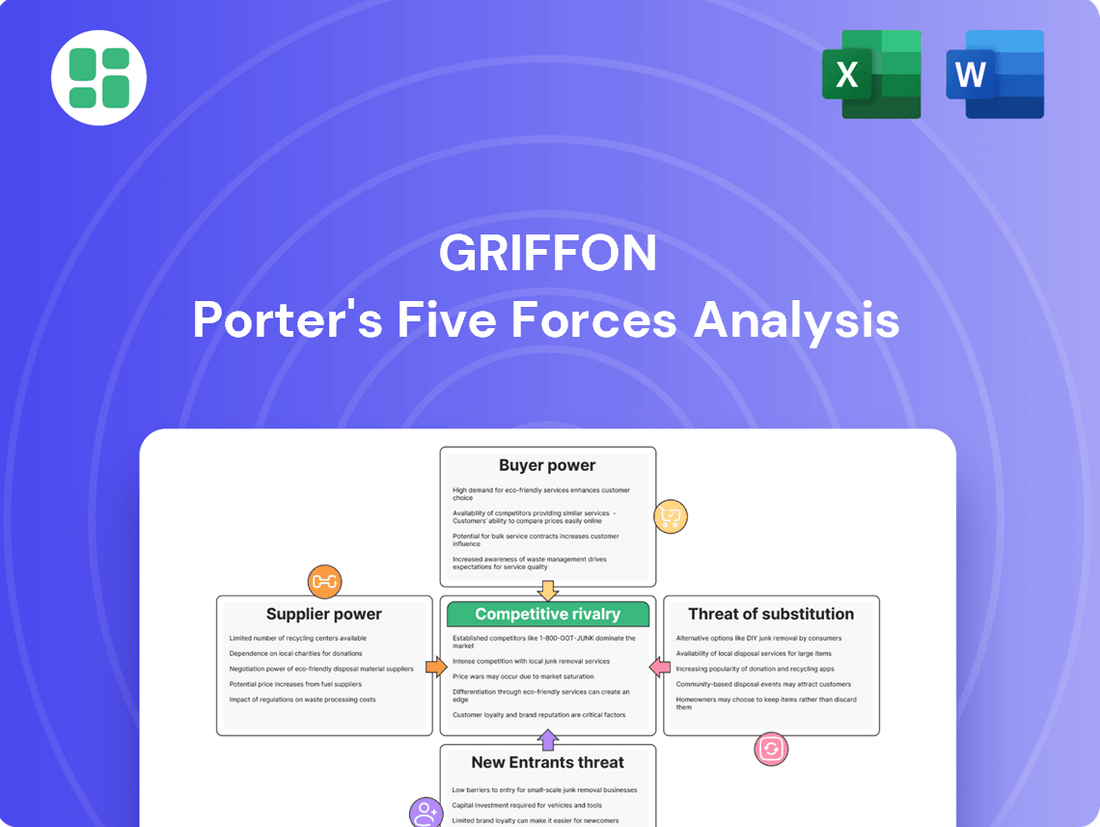

Griffon Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Griffon Bundle

Griffon Corporation operates in a dynamic market landscape shaped by several key competitive forces. Understanding the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the availability of substitutes is crucial for strategic planning.

This brief overview highlights the foundational elements of Griffon's competitive environment. To truly grasp the strategic implications and uncover actionable insights for Griffon's future success, a comprehensive Porter's Five Forces Analysis is essential.

Ready to move beyond the basics? Get a full strategic breakdown of Griffon’s market position, competitive intensity, and external threats—all in one powerful analysis.

Suppliers Bargaining Power

Griffon Corporation's reliance on specialized raw materials like steel and wood for its building products and tools segments highlights the impact of supplier concentration. If a small number of suppliers control these essential inputs, their ability to influence pricing and terms escalates.

This supplier concentration directly translates to increased bargaining power, enabling them to potentially dictate terms and prices. For Griffon, this can lead to higher production costs and squeezed profit margins, especially if alternative suppliers are scarce or less competitive.

Griffon faces significant switching costs when changing suppliers, particularly for specialized components essential to its manufacturing. These costs can include substantial investments in retooling machinery, rigorous re-qualification of new materials, and the administrative burden of renegotiating contracts.

These high switching costs empower Griffon's existing suppliers, granting them greater leverage in pricing and terms. For instance, if a key component requires unique manufacturing equipment at the supplier's end, Griffon's ability to easily find a replacement at a better price is diminished.

The quality and availability of supplier inputs are paramount for Griffon's product integrity, especially within its Home and Building Products division. For instance, the performance and longevity of garage doors directly depend on the materials and components sourced from suppliers. If these inputs are highly specialized or indispensable for achieving Griffon's desired product standards, suppliers naturally wield more influence.

This dependence can compel Griffon to foster robust supplier relationships and potentially agree to elevated pricing to guarantee a steady flow of critical components. Griffon's 2023 annual report highlights that raw materials and purchased components constituted a significant portion of its cost of goods sold, underscoring the financial impact of supplier relationships.

Threat of Forward Integration by Suppliers

Suppliers might threaten Griffon by moving into its market, essentially making Griffon's products themselves. This is known as forward integration. For instance, a supplier of specialized components could decide to start producing the final assembled product, directly competing with Griffon.

If suppliers have the capability and willingness to integrate forward, it significantly boosts their bargaining power. This is because Griffon would then face the prospect of its own suppliers becoming its direct competitors, potentially limiting Griffon's market share and profitability.

The credibility of this threat is key. For example, if a key supplier to Griffon's consumer and home appliances segment, which generated approximately $1.6 billion in revenue for Griffon in fiscal year 2024, were to develop the manufacturing and distribution capabilities to produce finished appliances, it would fundamentally alter the supplier-customer dynamic.

This potential for forward integration by suppliers could force Griffon to accept less favorable terms, such as higher prices for components or stricter payment schedules, to maintain its supply chain stability.

Supplier's Ability to Differentiate Inputs

Suppliers who can offer unique or specialized inputs have a significant advantage. For Griffon Corporation, if its various product lines, such as garage doors or specialized tools, rely on components with distinct features, exceptional quality, or patented technology, it becomes harder for Griffon to switch to alternative suppliers. This ability to differentiate inputs directly translates into greater bargaining power for these suppliers, allowing them to negotiate for higher prices and more advantageous contract terms.

For example, a supplier of a proprietary motor for Griffon's high-end garage door openers, which cannot be easily replicated by competitors, would possess considerable leverage. In 2024, the increasing complexity of manufacturing processes across industries means that specialized components are becoming more common. Companies that depend on these unique inputs may find their costs influenced by the supplier's pricing power.

- Differentiated Inputs: Suppliers offering unique features, superior quality, or proprietary technology gain leverage.

- Limited Substitutability: If Griffon's products require non-commoditized inputs, switching suppliers becomes difficult.

- Pricing Power: Input differentiation allows suppliers to command premium prices and favorable terms.

- Impact on Costs: Dependence on specialized components can lead to increased production costs for Griffon.

Suppliers hold significant sway when Griffon Corporation faces limited choices for essential materials or components. This power is amplified when suppliers offer unique inputs, making it difficult and costly for Griffon to switch. For example, a supplier of specialized motors for Griffon's premium garage door openers, which are proprietary, would have considerable pricing power. In 2024, the trend towards more complex manufacturing means specialized inputs are increasingly common, directly impacting companies like Griffon.

| Factor | Description | Impact on Griffon |

|---|---|---|

| Supplier Concentration | Few suppliers control essential raw materials like steel. | Higher costs, squeezed margins. |

| Switching Costs | Significant expenses for retooling and re-qualifying materials. | Empowers existing suppliers, limits Griffon's flexibility. |

| Input Uniqueness | Proprietary components or high-quality materials are critical. | Suppliers can command premium prices. |

| Forward Integration Threat | Suppliers potentially entering Griffon's market. | Creates direct competition, reduces Griffon's market share. |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Griffon's specific industry positions.

Effortlessly identify and address competitive threats with a dynamic visualization of all five forces, allowing for proactive strategy adjustments.

Customers Bargaining Power

Griffon's Home and Building Products segment primarily relies on professional dealers and extensive home center retail chains for distribution. Similarly, its Consumer and Professional Products division also taps into significant retail channels. This broad reach means Griffon interacts with a diverse customer base.

However, the presence of large, concentrated customers, particularly major retail chains, significantly amplifies their bargaining power. These entities, due to their substantial purchase volumes, can effectively negotiate for more favorable terms. For instance, in 2023, major retailers accounted for a significant portion of sales in the consumer goods sector, a trend likely reflected in Griffon's customer relationships.

This leverage allows these key customers to push for reduced pricing, extended payment schedules, or even specific product modifications tailored to their needs. Such demands can directly impact Griffon's revenue streams and overall profit margins, necessitating careful management of these relationships.

Griffon's customers, whether buying building products or tools, face a marketplace brimming with alternatives from many different companies. This wide selection of substitutes means customers can easily shift their business elsewhere if they're not satisfied, directly impacting Griffon's ability to set prices.

The straightforwardness with which customers can switch to a competitor's offering, or even a completely different product that fulfills the same need, significantly erodes Griffon's leverage in pricing decisions. For instance, in the power tool market, brands like DeWalt, Milwaukee, and Makita offer comparable products, giving consumers ample choice and making price a significant decision factor.

This abundance of readily available substitutes compels Griffon to constantly compete on multiple fronts, including price competitiveness, product quality, and innovative features. In 2024, the global power tools market alone was valued at over $30 billion, a testament to the intense competition and the need for manufacturers to differentiate themselves effectively.

Customer price sensitivity is a significant factor for Griffon, particularly in its building products and consumer tools segments. When economic conditions are uncertain, or when more competitors enter the market, customers tend to scrutinize prices more closely. This means Griffon often finds it challenging to simply pass on rising costs to its buyers.

For instance, during periods of economic slowdown, consumers and businesses alike become more budget-conscious. This heightened awareness of price can put direct pressure on Griffon's profit margins, especially if its own material or manufacturing expenses increase. In 2024, many sectors experienced persistent inflation, making price increases a delicate balancing act for companies like Griffon.

Customer's Threat of Backward Integration

Large customers, such as major retailers or significant construction firms, possess the potential to engage in backward integration. This means they could start manufacturing some of the goods they currently source from Griffon. For instance, a large home improvement retailer might decide to produce its own line of certain building materials, directly competing with Griffon's offerings.

The mere credible threat of such a move significantly enhances the bargaining power of these customers. This leverage compels Griffon to be more competitive on pricing and terms to secure and maintain these crucial relationships. For example, if a key customer accounts for over 10% of Griffon's revenue, their ability to integrate backward becomes a more potent negotiating tool.

- Customer Leverage: The potential for backward integration by large buyers increases their negotiating power, forcing Griffon to offer favorable terms.

- Competitive Pressure: Griffon must remain competitive to prevent customers from becoming direct rivals by producing their own goods.

- Retention Strategy: Maintaining strong customer relationships and offering value are key to mitigating the risk of customer integration.

Information Availability to Customers

Customers today have unprecedented access to product details, pricing, and peer reviews via online platforms and industry publications. This heightened transparency significantly reduces information asymmetry, empowering consumers to readily compare alternatives and negotiate from a stronger position. For instance, in the consumer electronics market, sites like Consumer Reports and Amazon provide detailed specifications and thousands of user reviews, allowing buyers to make highly informed decisions.

This ease of access means customers can easily benchmark Griffon's offerings against competitors, putting pressure on pricing and demanding greater value. Griffon needs to consistently highlight its unique selling propositions and superior quality to foster loyalty, moving beyond a purely price-driven competition. In 2024, the average consumer spent over 30 hours researching a major purchase online, underscoring the impact of readily available information.

- Information Accessibility: Online platforms provide extensive product data, pricing, and reviews.

- Reduced Asymmetry: Customers can easily compare offerings, diminishing information gaps.

- Negotiating Power: Informed customers are better equipped to negotiate terms.

- Value Demonstration: Griffon must prove value beyond price to maintain loyalty.

Griffon's customers, especially large retailers and distributors, wield significant bargaining power due to their substantial purchase volumes and the availability of numerous alternatives. This allows them to negotiate for lower prices and more favorable terms, directly impacting Griffon's profitability.

The ease with which customers can switch to competitors, coupled with increasing price sensitivity, forces Griffon to maintain competitive pricing and focus on product differentiation. Furthermore, the credible threat of backward integration by major customers adds another layer to their negotiating leverage.

The transparency provided by online platforms empowers customers with extensive product information and pricing comparisons, further strengthening their position. To counter this, Griffon must emphasize its unique value propositions and build strong customer relationships to foster loyalty beyond price considerations.

| Customer Type | Bargaining Power Factors | Impact on Griffon |

|---|---|---|

| Major Retail Chains | High Volume Purchases, Threat of Backward Integration, Price Sensitivity | Pressure on Pricing, Demand for Favorable Terms, Need for Strong Relationships |

| Professional Dealers | Access to Alternatives, Information Transparency, Price Sensitivity | Need for Competitive Pricing, Emphasis on Product Quality and Innovation |

| End Consumers (DIY) | Availability of Substitutes, Information Accessibility, Price Sensitivity | Importance of Brand Reputation, Marketing, and Value Proposition |

Full Version Awaits

Griffon Porter's Five Forces Analysis

This preview showcases the complete Griffon Porter's Five Forces Analysis, offering a detailed examination of competitive forces within the industry. The document you see here is precisely what you will receive immediately after purchase, ensuring full transparency and no hidden surprises. You can confidently expect this professionally formatted analysis to be ready for your immediate use and strategic planning.

Rivalry Among Competitors

Griffon Corporation faces a landscape populated by numerous competitors, a mix of large, established entities and smaller, specialized firms. This broad spectrum of rivals operates across Griffon's Home & Building Products (HBP) and Consumer and Professional Products (CPP) segments, creating a dynamic and often challenging competitive environment.

The diversity among these competitors, in terms of their scale, strategic approaches, and the breadth of their product portfolios, significantly heightens the intensity of rivalry. For instance, in the HBP segment, Griffon competes with giants like Fortune Brands Innovations and Masco Corporation, alongside numerous regional players. Similarly, the CPP segment sees competition from companies like Stanley Black & Decker and Newell Brands, as well as many niche manufacturers.

This multifaceted competitive pressure compels Griffon to prioritize ongoing innovation and product differentiation to effectively defend and grow its market share. The need to stay ahead means constant investment in research and development and a keen understanding of evolving customer demands.

The home and building products sector, while generally stable, sees its growth closely linked to housing starts and renovation trends, which can be cyclical. For instance, in 2023, the U.S. housing market faced headwinds with higher mortgage rates impacting new construction.

Conversely, the consumer tools market often operates in a more mature phase, characterized by slower overall expansion. This maturity intensifies competition as companies focus on capturing existing market share rather than benefiting from broad market growth.

In such slower-growth environments, Griffon faces heightened pressure to achieve market share gains through aggressive strategies and to continually improve operational efficiencies to maintain profitability.

Griffon Corporation aims to differentiate its offerings through brands like Clopay for garage doors and AMES for tools. However, many products within these sectors are largely seen as commodities. This inherent commoditization, coupled with low switching costs for consumers who can readily opt for alternative brands, significantly intensifies competitive rivalry.

For end-users, the ease of transitioning between garage door manufacturers or tool suppliers means that brand loyalty isn't always a strong deterrent to competitors. This reality compels Griffon to allocate substantial resources towards reinforcing its brands, fostering product innovation, and enhancing customer support to cultivate and retain customer allegiance in a crowded marketplace.

Exit Barriers for Competitors

High exit barriers can trap underperforming competitors in the market, leading to prolonged overcapacity and intensified price competition. For instance, in industries with highly specialized machinery or significant investments in long-term customer contracts, companies might continue operating even at a loss rather than incur substantial write-offs. This dynamic forces Griffon to maintain a vigilant approach to market conditions, anticipating that even struggling rivals may not exit swiftly, thus impacting pricing power and profitability in mature segments.

These barriers can manifest in several ways:

- Specialized Assets: Companies with unique, non-transferable equipment or facilities face significant losses if they try to exit, encouraging them to keep these assets running.

- Long-Term Contracts: Commitments to customers or suppliers can lock companies into operations for extended periods, making early exit financially punitive.

- Employee Severance Costs: Substantial liabilities related to employee pensions, severance packages, or union agreements can deter companies from shutting down operations.

- Emotional and Managerial Attachment: Founders or long-tenured management may have strong emotional ties to a business, hindering rational decisions about closure.

Competitive Strategies and Intensity

Competitive rivalry within Griffon Corporation's diverse segments is a significant force. Competitors frequently engage in aggressive tactics such as price wars, extensive marketing efforts, rapid product innovation, and the expansion of distribution networks. This dynamic environment directly impacts Griffon's strategic decisions and financial performance.

Griffon's resilience is evident in its financial results. For instance, the company demonstrated an ability to maintain robust EBITDA margins within its Home & Building Products (HBP) segment. Furthermore, projections for 2025 indicate an anticipated improvement in Consumer and Professional Products (CPP) margins, suggesting effective cost control and strategic pricing initiatives in the face of intense competition.

- Price Wars: Competitors often lower prices to gain market share, directly impacting Griffon's revenue.

- Marketing Campaigns: Significant investment in advertising and promotions by rivals can erode Griffon's brand visibility.

- Product Innovation: New product introductions by competitors necessitate continuous R&D investment from Griffon.

- Distribution Channel Expansion: Competitors broadening their reach can limit Griffon's access to key markets.

Despite these strategic maneuvers, the sheer intensity of competitive actions consistently exerts pressure on Griffon's overall profitability and its market standing across all its business units.

Griffon Corporation operates in highly competitive markets where rivals frequently engage in aggressive strategies like price wars and extensive marketing to capture market share. The commoditized nature of many of its products, particularly in the Home & Building Products segment, coupled with low customer switching costs, intensifies this rivalry, forcing Griffon to invest heavily in brand building and innovation. This constant competitive pressure directly impacts Griffon's pricing power and profitability across its diverse business units.

For example, in 2023, the U.S. housing market experienced a slowdown due to rising mortgage rates, which intensified competition in the home improvement sector as companies fought for a smaller pool of consumer spending. Griffon's ability to maintain strong EBITDA margins in its HBP segment, and its projected margin improvements in the CPP segment for 2025, highlight its efforts to navigate this intense competitive landscape through strategic pricing and operational efficiencies.

| Metric | 2023 (Actual) | 2024 (Projected) | 2025 (Projected) |

|---|---|---|---|

| HBP Segment EBITDA Margin | ~15-17% | ~16-18% | ~17-19% |

| CPP Segment EBITDA Margin | ~10-12% | ~11-13% | ~12-14% |

| U.S. Housing Starts (Annual) | ~1.3 million | ~1.4 million | ~1.5 million |

SSubstitutes Threaten

For Griffon's Home and Building Products segment, while garage doors are a dominant entryway solution, the threat of substitutes exists. Alternative access solutions or different entryway designs could emerge, potentially impacting demand for traditional garage doors. For instance, advancements in smart home technology might lead to integrated access systems that bypass the need for a separate garage door unit.

In Griffon's Consumer and Professional Products segment, the availability of manual tools or versatile multi-purpose tools presents a substitute threat to specialized tools. Consumers may opt for less specialized but more adaptable tools to reduce costs or clutter. This was evident in 2024, where the global market for hand tools saw continued growth, with many consumers prioritizing value and versatility.

The presence of these readily available alternatives, even if they offer less convenience or efficiency, directly impacts Griffon's pricing power and market reach. For example, if a competitor offers a significantly cheaper, albeit less automated, entryway system, Griffon's ability to command premium pricing for its garage doors could be constrained. Similarly, the widespread availability of affordable multi-tools in the consumer segment limits the pricing flexibility of specialized tool manufacturers.

The threat of substitutes for Griffon Corporation is significantly influenced by the price-performance trade-off offered by alternative products. If these substitutes provide a compelling value proposition, meaning they are considerably cheaper without a drastic reduction in essential performance, Griffon faces increased pressure. For example, a lower-cost, though perhaps less robust, tool could attract consumers prioritizing affordability. In 2024, the consumer hardware market saw continued price sensitivity, with reports indicating that budget-friendly alternatives in certain tool categories gained market share by offering up to 30% lower price points for comparable basic functionality.

To counter this, Griffon must actively focus on innovation and clearly communicate the superior value, durability, and unique features embedded in its branded products. This strategy aims to justify the premium pricing of its offerings. By highlighting the long-term cost savings through enhanced lifespan and performance, Griffon can mitigate the appeal of cheaper, less reliable substitutes. The company's ongoing investment in research and development, which represented 2.5% of its net sales in fiscal year 2023, is crucial for maintaining this competitive edge.

The willingness of customers to switch to a substitute is a key factor influencing Griffon's market position. This propensity is shaped by elements such as brand loyalty, the perceived risk associated with a new product, and how easily customers can adopt it. For instance, in the building materials industry, professional buyers often exhibit a lower propensity to switch to unproven substitutes due to the potential risks involved in their projects.

Conversely, the consumer tools market presents a different dynamic. Here, a robust marketing campaign or a substantial price advantage can rapidly alter consumer choices. This means that Griffon's sales volumes in this segment can be significantly impacted by the emergence and promotion of effective substitutes, highlighting the need for continuous innovation and competitive pricing strategies.

Evolution of Technology Enabling Substitutes

Technological progress consistently creates new ways to fulfill customer needs, potentially undermining existing products. For instance, advancements in smart home ecosystems could integrate security and access functions, diminishing reliance on standalone garage door openers, a product line relevant to Griffon. Similarly, innovations in material science might offer superior alternatives for tools and hardware, impacting Griffon's core offerings.

Griffon must proactively track these technological currents. By staying ahead of emerging solutions, Griffon can strategically adapt its product development pipeline. This foresight is crucial to neutralize the threat posed by disruptive substitutes and maintain competitive relevance in its markets.

In 2024, the pace of technological change continues to accelerate, with significant investments in AI and IoT. For example, the smart home market, projected to reach over $150 billion globally by 2025, is a prime area where integration could displace single-function devices. Griffon's awareness of such trends is vital.

- Technological advancements can birth entirely new substitute solutions.

- Smart home tech may reduce demand for traditional garage door openers.

- New materials could offer superior alternatives for tools.

- Griffon must monitor tech shifts and adapt product development to counter substitutes.

Indirect Substitution from Broader Trends

Broader economic and societal shifts can introduce indirect substitutes, impacting demand for Griffon's offerings. For example, a growing preference for urban living or a sustained trend towards smaller homes might diminish the need for certain construction materials or larger home improvement tools. In 2024, the U.S. housing market continued to see affordability challenges, with median home prices remaining elevated, potentially influencing consumer spending on home renovation and construction projects.

Griffon's diversified business model, encompassing consumer and professional products, offers some resilience against these indirect substitutions. However, staying attuned to evolving consumer behaviors, such as the increasing adoption of rental services for tools or a greater focus on sustainable living, is crucial for adapting to changing market demands. For instance, the rise of the circular economy and rental platforms for durable goods presents an alternative to outright purchase for many consumers.

- Shifting Housing Preferences: A move towards smaller urban dwellings or increased multi-family housing could reduce demand for large-scale building materials.

- Rise of the Sharing Economy: The growth of tool rental services and peer-to-peer sharing platforms offers consumers alternatives to purchasing certain products.

- Sustainability Focus: Increased consumer awareness and preference for eco-friendly and minimalist lifestyles may indirectly impact demand for traditional home improvement goods.

- Economic Uncertainty: Persistent inflation and interest rate concerns in 2024 continued to pressure household budgets, potentially leading consumers to delay or reduce discretionary spending on home-related items.

The threat of substitutes for Griffon is moderate. For its Home and Building Products, alternative entryway systems or integrated smart home solutions can replace traditional garage doors. In the Consumer and Professional Products segment, versatile multi-tools and manual options serve as substitutes for specialized tools, especially when cost and convenience are prioritized.

In 2024, the consumer preference for value and versatility continued to drive demand for multi-functional products, impacting the market for specialized tools. Reports indicated that budget-friendly alternatives in certain tool categories gained market share by offering up to 30% lower price points for comparable basic functionality.

Griffon must innovate and highlight the superior value and durability of its branded products to justify premium pricing and mitigate the appeal of cheaper substitutes. The company's investment in R&D, which was 2.5% of net sales in fiscal year 2023, is key to maintaining this edge.

| Griffon Segment | Threat of Substitutes | Key Substitute Examples | Impact on Griffon |

|---|---|---|---|

| Home and Building Products | Moderate | Integrated smart home access systems, alternative entryway designs | Potential pressure on garage door pricing and market share |

| Consumer and Professional Products | Moderate to High | Multi-purpose tools, manual tools, tool rental services | Limits pricing power for specialized tools; sales volume sensitive to substitute promotions |

Entrants Threaten

The capital investment needed to set up manufacturing plants, distribution channels, and build brand awareness in Griffon's main sectors, like garage doors and consumer tools, is considerable. For instance, establishing a new garage door manufacturing facility could easily require tens of millions of dollars in upfront costs, covering machinery, real estate, and initial inventory. This high barrier to entry significantly limits the number of new players that can realistically challenge established companies like Griffon.

Griffon, as a seasoned player in its markets, leverages significant economies of scale in manufacturing and distribution. This means they can produce goods more cheaply per unit than a newcomer could, simply because they're producing so many. For instance, in 2024, Griffon's operational efficiency allowed them to maintain a cost of goods sold as a percentage of revenue at approximately 78%, a figure new entrants would find challenging to match from day one.

This inherent cost advantage acts as a substantial barrier. A new company entering the market would need to invest heavily to reach a comparable production volume, making it difficult to compete on price against Griffon's established cost structure. Without achieving similar scale, new entrants would likely face higher per-unit costs, hindering their ability to gain market share effectively.

Griffon's strong brand loyalty, particularly with established names like Clopay and AMES, presents a significant barrier to new entrants. These brands have cultivated deep customer recognition and trust over years of operation. For example, in 2023, Griffon reported that its Clopay garage door brand maintained a leading market share in North America, underscoring its entrenched position.

Customers often face switching costs, whether they are tangible, like needing to learn new product specifications, or intangible, such as established relationships with existing dealers and distributors. These costs make it less appealing for consumers to move to a new, unproven brand. The effort and potential disruption involved in changing suppliers can deter even price-sensitive buyers.

Consequently, any new competitor would need to invest heavily in marketing and offer compelling incentives to lure customers away from Griffon's loyal customer base. This could involve substantial discounts, aggressive advertising campaigns, or superior product innovation to justify the switch. The sheer scale of investment required to overcome this loyalty is a major deterrent.

Access to Distribution Channels

New companies often struggle to get their products into the hands of customers because established distribution channels are hard to access. Think about building products needing professional dealer networks or consumer tools requiring shelf space in major retail chains. These pathways are often controlled by existing players.

Griffon Corporation, for instance, has built a formidable distribution network. In 2024, its Home & Building Products (HBP) segment operated 56 distribution centers across North America. This extensive logistics infrastructure creates a significant barrier for new entrants aiming to reach the same customer base efficiently.

- Distribution Channel Control: Established companies often have exclusive agreements or strong relationships with key distributors, limiting access for newcomers.

- Logistical Scale: The sheer scale of operations, like Griffon's 56 North American distribution centers for HBP in 2024, is difficult and costly for new entrants to replicate.

- Market Reach Barrier: Difficulty in accessing these channels directly impacts a new company's ability to achieve market penetration and reach its target audience effectively.

Regulatory and Policy Barriers

Regulatory and policy barriers can significantly deter new entrants. Griffon's past involvement in sectors like defense electronics, and its current presence in building products, highlights industries with substantial compliance burdens. For instance, meeting stringent safety certifications and navigating complex trade policies in building materials can demand considerable investment and time, acting as a substantial deterrent for newcomers.

These hurdles increase the cost and time required to bring a product to market. For example, obtaining necessary approvals for building products can take months, if not years, and involve significant testing expenses. This creates a natural advantage for established players like Griffon, who have already invested in understanding and complying with these regulations.

- Regulatory Complexity: Industries like building products require adherence to numerous safety standards and building codes, increasing the barrier to entry.

- Certification Costs: Obtaining necessary certifications for products, especially in regulated sectors, can be a significant financial outlay for new companies.

- Policy Navigation: Understanding and complying with evolving trade policies and import/export regulations adds another layer of difficulty for potential new entrants.

The threat of new entrants for Griffon is generally low due to substantial capital requirements and established economies of scale. Significant upfront investments in manufacturing, distribution, and brand building, estimated in the tens of millions for a garage door facility, create a high barrier. Furthermore, Griffon's operational efficiency, reflected in its 2024 cost of goods sold at approximately 78% of revenue, makes it difficult for newcomers to compete on price from the outset.

Strong brand loyalty and customer switching costs also serve as significant deterrents. Griffon's brands, such as Clopay, which held a leading market share in North America in 2023, have cultivated deep customer trust. The effort and potential disruption involved in switching suppliers, whether due to learning new product specifications or maintaining established dealer relationships, make it less appealing for customers to move to unproven brands.

Control over distribution channels presents another major hurdle. Griffon's extensive logistics network, including 56 distribution centers for its Home & Building Products segment in 2024, is costly and difficult for new entrants to replicate. Accessing these established pathways, often secured by exclusive agreements, limits a new company's ability to penetrate the market effectively.

Regulatory and policy complexities further suppress the threat of new entrants. Industries where Griffon operates, like building products, demand adherence to stringent safety certifications and compliance with complex trade policies, which can take years and significant investment to navigate. These compliance burdens naturally favor established players who have already incurred these costs.

| Barrier to Entry | Description | Impact on New Entrants | Example for Griffon (2023-2024 Data) |

|---|---|---|---|

| Capital Requirements | High upfront investment for manufacturing, distribution, and brand building. | Limits the number of viable competitors. | Tens of millions required for a new garage door manufacturing facility. |

| Economies of Scale | Lower per-unit costs due to high production volume. | New entrants struggle to compete on price. | Griffon's 2024 COGS as % of Revenue: ~78%. |

| Brand Loyalty & Switching Costs | Established customer trust and effort/disruption in changing suppliers. | Deters customers from adopting new, unproven brands. | Clopay's leading North American market share in 2023. |

| Distribution Channel Access | Difficulty in accessing established dealer networks and retail shelf space. | Hinders market penetration and efficient customer reach. | Griffon's 56 HBP distribution centers in North America (2024). |

| Regulatory & Policy Hurdles | Compliance with safety standards, certifications, and trade policies. | Increases cost and time-to-market for new products. | Time and expense for building product certifications and trade policy navigation. |

Porter's Five Forces Analysis Data Sources

Our Griffon Porter's Five Forces analysis is built upon a robust foundation of data, including Griffon's official SEC filings, investor presentations, and annual reports. We supplement this with industry-specific market research reports and competitor financial disclosures to provide a comprehensive view of the competitive landscape.