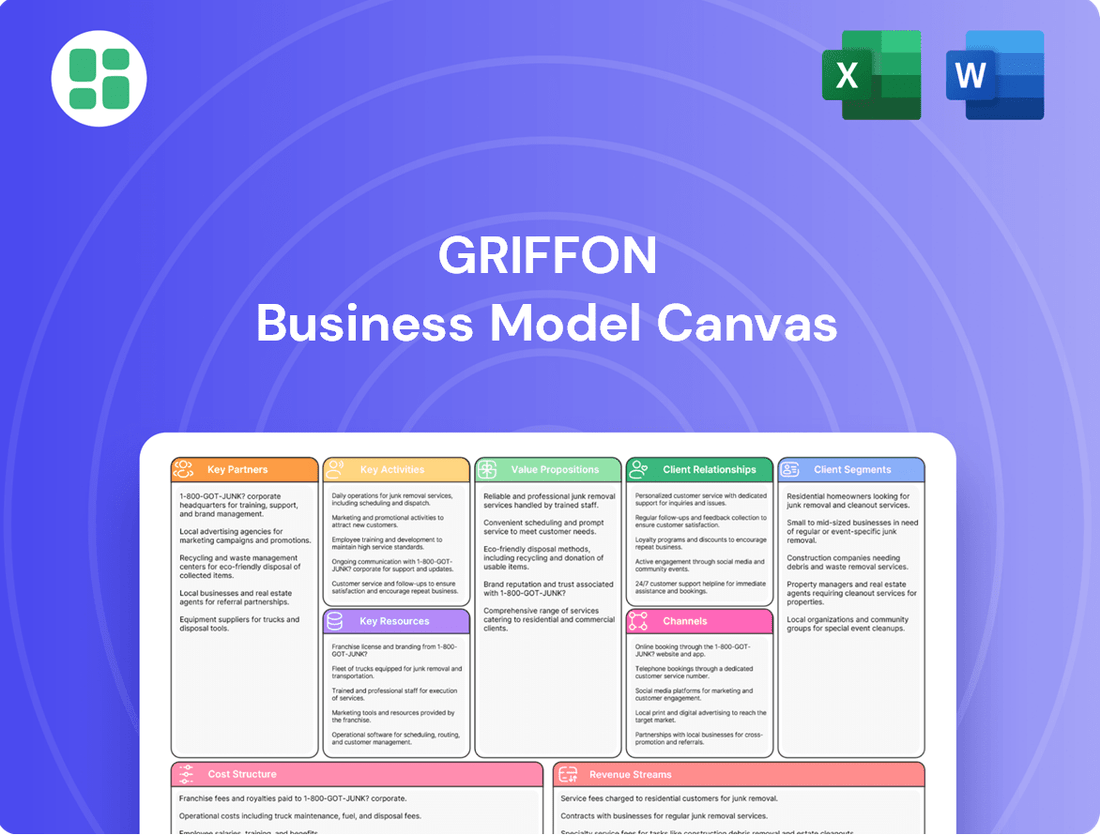

Griffon Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Griffon Bundle

Curious about Griffon's strategic framework? Our Business Model Canvas breaks down their customer relationships, revenue streams, and key resources, offering a clear view of their operational success. Download the full version to gain a comprehensive understanding of their winning formula.

Partnerships

Griffon Corporation's foundation rests on robust supplier and manufacturer relationships, particularly for essential raw materials like steel, resin, and wood. These materials are vital for its building products and tools segments, directly impacting production capabilities and product quality.

These strategic partnerships are instrumental in guaranteeing a steady supply chain, which in turn helps in optimizing production costs and upholding high product standards. Griffon's focus on global sourcing expansion underscores the critical role these relationships play in achieving greater cost efficiencies and developing adaptable sourcing strategies.

Griffon's market penetration relies heavily on its robust distribution network, which includes over 3,000 professional dealers and key home center retail partners. This extensive reach is crucial for ensuring their products, particularly within the Home and Building Products segment, are readily available to consumers across North America. The company leverages 56 strategically located distribution centers to facilitate efficient product delivery and maintain a strong market presence.

Griffon Corporation actively cultivates key partnerships with technology and innovation collaborators to fuel its product development pipeline and maintain a competitive advantage. These alliances are crucial for integrating cutting-edge features, such as smart technology in garage door openers or advanced material science for its consumer and professional tools. For instance, in 2023, Griffon's subsidiaries like The Chamberlain Group, a leader in smart garage access, likely leveraged partnerships to enhance connectivity and user experience, responding to a market where smart home device adoption continues to grow. Such collaborations enable Griffon to stay ahead of evolving customer demands for enhanced design and functionality across its diverse product portfolio.

Government and Defense Contractors

Historically, Griffon Corporation's defense electronics segment relied heavily on partnerships with government entities and major defense contractors. These collaborations were crucial for obtaining significant, long-term contracts and for developing and delivering advanced communication and surveillance technologies. For instance, the Telephonics division, sold in 2022, had a history of working with entities like the U.S. Department of Defense.

These relationships were foundational for securing business in a sector characterized by complex procurement processes and high technological demands. The ability to integrate systems and meet stringent government specifications often required close cooperation with prime contractors who managed larger defense programs. This strategic alignment ensured Griffon’s offerings were incorporated into critical national security infrastructure.

Even though Griffon divested its defense electronics business, these past partnerships highlight the company's capacity to engage in high-stakes, government-focused collaborations. Such relationships are vital for companies operating in specialized technology sectors where government funding and regulatory frameworks are primary drivers of business. The experience gained in these partnerships informs Griffon's broader strategic approach to market engagement.

- Government Agencies: Direct contracts and subcontracts with defense departments, providing specialized electronic systems.

- Prime Defense Contractors: Collaborations with major aerospace and defense firms to integrate Griffon's technology into larger platforms.

- Technology Developers: Partnerships with other specialized technology firms to enhance system capabilities and innovation.

Acquisition Targets and Integration Partners

Griffon Corporation strategically partners with investment banks and legal advisors to identify and vet potential acquisition targets, ensuring alignment with its diversified growth objectives. These collaborations are crucial for navigating complex deal structures and regulatory environments.

The company also fosters close relationships with the management teams of acquired businesses, such as the integration of Pope in Australia and CornellCookson, to ensure smooth operational transitions and leverage existing expertise. This approach is fundamental to Griffon's strategy of enhancing its core businesses through strategic M&A.

- Investment Banks: Facilitate deal sourcing and financial due diligence for potential acquisitions.

- Legal Advisors: Provide expertise in transaction structuring, compliance, and risk mitigation.

- Target Company Management: Ensure seamless integration and operational continuity post-acquisition.

Griffon's key partnerships are essential for its operational success and strategic growth. These include vital relationships with suppliers for raw materials like steel and resin, ensuring production continuity for its building products and tools segments. The company also relies on a vast distribution network of over 3,000 dealers and major home centers, supported by 56 distribution centers, to reach its customer base effectively.

What is included in the product

A structured framework that visualizes and analyzes a business's core components, facilitating strategic planning and communication.

It breaks down a business into nine key building blocks, offering a holistic view for strategic decision-making and operational alignment.

The Griffon Business Model Canvas streamlines the often-complex process of defining a business, acting as a pain point reliever by offering a structured, visual approach to identify and articulate key strategic elements.

Activities

Griffon Corporation's manufacturing and production activities are central to delivering its varied product lines, which span garage doors, access systems, and a broad array of consumer and professional tools. This requires meticulous oversight of numerous production sites and a continuous drive to refine manufacturing methods. For instance, in 2023, Griffon reported that its Home and Building Products segment saw increased manufacturing capacity and the integration of new, sophisticated machinery, aimed at enhancing efficiency and output.

Effective supply chain management, including logistics and inventory control, is a cornerstone of Griffon's operations. This involves carefully managing the flow of goods to ensure efficiency and cost-effectiveness.

Griffon recently bolstered its global sourcing strategy for the Consumer and Professional Products segment. This expansion aims to create a more adaptable and economical sourcing framework, which is vital for maintaining competitive pricing and product availability.

In 2023, Griffon reported that its global sourcing efforts contributed to significant operational efficiencies. The company's focus on optimizing its supply chain is a critical activity for managing costs and ensuring that products reach consumers reliably.

Griffon's commitment to Research, Development, and Innovation is a cornerstone of its strategy, ensuring it remains at the forefront of its markets. This involves a continuous cycle of improving existing products and conceptualizing entirely new ones to meet the dynamic needs of consumers and professionals alike.

In 2024, Griffon continued to pour resources into R&D, focusing on areas like smarter garage door systems that offer enhanced security, energy efficiency, and seamless integration with smart home ecosystems. They also advanced their offerings in the consumer and professional tools segment, aiming for greater durability and user-friendly features.

This dedication to innovation is not just about creating new products; it's about building a pipeline of future growth. By investing in cutting-edge technologies and design, Griffon aims to capture new market share and solidify its competitive advantage, driving long-term value for stakeholders.

Sales, Marketing, and Distribution

Griffon Corporation's sales, marketing, and distribution are central to driving revenue. They employ a multi-channel approach, engaging professional dealers, retail partners, and direct sales to reach a broad customer base.

Key activities involve crafting targeted marketing campaigns, nurturing and managing sales forces, and ensuring the efficient operation of a widespread distribution network. This comprehensive strategy aims to effectively connect with and serve diverse consumer segments.

- Multi-channel Sales Strategy: Griffon utilizes professional dealers, retail partners, and direct sales channels to maximize market reach and revenue generation.

- Marketing and Sales Management: The company focuses on developing effective marketing strategies and managing dedicated sales teams to drive product adoption and customer engagement.

- Distribution Network Oversight: Efficient management of a vast distribution network is critical for timely product delivery to various customer segments.

- 2024 Performance Indicators: While specific 2024 figures are still being finalized, Griffon has historically demonstrated strong sales performance, with its Consumer and Home and Building segments being significant revenue contributors. For instance, in fiscal year 2023, the Consumer and Home and Building segments reported net sales of $1.2 billion and $1.6 billion respectively, highlighting the scale of operations managed through these key activities.

Strategic Planning and Portfolio Management

Griffon Corporation's strategic planning and portfolio management are central to its operations as a diversified holding company. This involves a continuous process of identifying promising growth avenues and meticulously assessing potential acquisitions and divestitures. The company's approach emphasizes the judicious allocation of capital across its various business segments to achieve optimal shareholder returns.

In 2024, Griffon continued to refine its portfolio, focusing on businesses with strong market positions and growth potential. For instance, its Consumer and Home and Building segments are key areas of focus. The company's commitment to strategic planning ensures that resources are directed towards initiatives that align with its overarching long-term objectives and enhance overall corporate value.

- Strategic Planning: Griffon actively engages in long-term strategic planning to identify market trends and competitive advantages across its diverse business units.

- Capital Allocation: The company meticulously allocates capital, prioritizing investments in segments with the highest potential for growth and profitability, aiming to maximize shareholder value.

- Portfolio Management: Griffon regularly evaluates its portfolio of businesses, making decisions on acquisitions and divestitures to ensure alignment with its strategic goals and enhance financial performance.

- Performance Evaluation: Continuous assessment of each business segment's performance is crucial for making informed decisions regarding resource allocation and future strategic direction.

Griffon's key activities encompass manufacturing and production across its diverse product lines, including garage doors and tools, supported by robust supply chain management and global sourcing strategies. The company actively invests in research, development, and innovation to enhance existing products and create new ones, ensuring a competitive edge.

Sales, marketing, and distribution are vital for revenue generation, utilizing a multi-channel approach with dealers, retailers, and direct sales, alongside efficient network management. Strategic planning and portfolio management are also critical, involving capital allocation and business evaluations to drive growth and shareholder value.

| Key Activity | Description | 2023/2024 Focus/Data |

| Manufacturing & Production | Overseeing production sites and refining manufacturing methods. | Integration of new machinery for efficiency. |

| Supply Chain & Sourcing | Managing logistics, inventory, and global sourcing. | Bolstering global sourcing for cost-effectiveness and adaptability. |

| R&D and Innovation | Improving existing products and developing new ones. | Focus on smart garage door systems and enhanced tool durability. |

| Sales, Marketing & Distribution | Driving revenue through multi-channel sales and network management. | Consumer and Home & Building segments reported net sales of $1.2B and $1.6B respectively in FY2023. |

| Strategic Planning & Portfolio Management | Identifying growth, assessing acquisitions/divestitures, and allocating capital. | Refining portfolio with focus on strong market position segments. |

Full Document Unlocks After Purchase

Business Model Canvas

The Griffon Business Model Canvas preview you're seeing is the actual document you will receive upon purchase. This means the structure, content, and formatting are identical to the final deliverable, offering complete transparency. You'll gain immediate access to this professionally designed and ready-to-use canvas, ensuring no surprises and a seamless experience.

Resources

Griffon's manufacturing facilities and infrastructure are the backbone of its operations, encompassing a robust network of plants and distribution centers primarily across North America. These physical assets are critical for the production of its diverse product lines, which include building products and tools. For instance, in fiscal year 2023, Griffon reported capital expenditures of $112.7 million, a significant portion of which was allocated to enhancing and expanding these manufacturing capabilities, demonstrating a commitment to maintaining and improving its operational capacity.

Griffon's intellectual property and brands are a cornerstone of its business model, featuring a robust portfolio of well-recognized names. Iconic brands like Clopay, AMES, and Hunter Fan are significant intangible assets, fostering strong customer loyalty and market presence. These brands, supported by patents and proprietary technologies, grant Griffon a distinct competitive edge across its diverse operating segments.

Griffon Corporation's strength lies in its approximately 5,300 to 6,700 employees, a diverse group encompassing skilled engineers, dedicated laborers, and seasoned management professionals. This human capital is fundamental to their operations.

The collective expertise of Griffon's workforce, particularly in areas like advanced manufacturing techniques, innovative product development, and efficient supply chain orchestration, directly fuels their competitive edge. This is evident in their ability to consistently deliver quality products across their business segments.

Furthermore, the strategic leadership provided by experienced management is critical for navigating complex market dynamics and driving long-term business performance. Their guidance ensures operational excellence and fosters a culture of continuous improvement, vital for sustained growth.

Financial Capital and Strong Balance Sheet

Griffon's financial capital is the bedrock of its operational and strategic flexibility. This includes substantial cash reserves, robust access to credit lines, and consistent generation of free cash flow, all essential for funding growth initiatives, pursuing strategic acquisitions, and rewarding its investors through dividends and share buybacks. For example, Griffon reported a strong financial position in its fiscal year 2023, with significant liquidity and a healthy debt-to-equity ratio, underscoring its capacity for further investment and shareholder returns.

A strong balance sheet empowers Griffon's capital allocation strategy, allowing for disciplined investments in its core businesses and opportunistic share repurchases. This financial strength not only supports ongoing operations but also provides the stability needed to navigate market fluctuations and pursue long-term value creation. In the first quarter of fiscal year 2024, Griffon continued its commitment to returning capital, repurchasing approximately $25 million of its common stock, demonstrating active management of its financial resources.

- Financial Resources: Access to ample cash, credit facilities, and free cash flow generation.

- Capital Allocation: Supports investments in business growth, acquisitions, share repurchases, and dividends.

- Strategic Flexibility: Enables Griffon to pursue opportunities and manage market volatility effectively.

- Shareholder Value: Directly contributes to returning capital to shareholders through buybacks and dividends.

Extensive Distribution Network and Logistics Capabilities

Griffon Corporation's extensive distribution network is a critical asset, featuring 56 strategically located North American distribution centers. This robust infrastructure allows for efficient product delivery to a diverse customer base, encompassing dealers, retailers, and end-users. In 2024, this network played a vital role in maintaining strong customer relationships and expanding market penetration.

These logistics capabilities are central to Griffon's business model, ensuring timely and cost-effective fulfillment of orders. The company's ability to manage this complex network directly impacts its operational efficiency and customer satisfaction levels. This resource underpins Griffon's competitive advantage in reaching its target markets effectively.

- 56 North American distribution centers enabling broad market coverage.

- Efficient logistics ensuring timely delivery to dealers, retailers, and end-users.

- Key resource for customer satisfaction and market reach.

- Supports operational efficiency and cost-effectiveness in product distribution.

Griffon's intellectual property, including patents and proprietary technologies, provides a significant competitive advantage. Its portfolio of strong brands, such as Clopay, AMES, and Hunter Fan, fosters customer loyalty and market recognition. These intangible assets are crucial for differentiating its products and commanding premium pricing in the market.

Value Propositions

Griffon's value proposition centers on providing high-quality, durable building products, exemplified by its Clopay garage doors and access systems. These offerings are designed for longevity and reliability, ensuring customers receive excellent long-term value and often a strong return on investment for their home improvement projects.

Griffon delivers value by offering innovative products that adapt to changing customer demands, exemplified by their connected garage doors. These doors boast advanced design and smart features, catering to modern homeowners and commercial clients seeking convenience, enhanced security, and seamless integration with existing smart home ecosystems.

Griffon's Consumer and Professional Products segment delivers a broad spectrum of branded tools, serving needs from landscaping to building. This extensive range ensures users can find the right equipment for their specific projects.

The core value is in offering dependable, high-quality tools designed for both seasoned professionals and home improvement enthusiasts. This focus on performance boosts productivity and ensures successful outcomes across a multitude of applications.

For fiscal year 2023, Griffon Corporation reported net sales of $2.3 billion, with its Consumer and Professional Products segment contributing significantly to this overall performance.

Reliable Supply Chain and Customer Service

Griffon Corporation fosters enduring customer bonds through a legacy of innovation in product development, strategic sourcing, efficient manufacturing, and robust distribution networks. This commitment translates into a value proposition centered on consistent product availability and streamlined logistics, ensuring clients can depend on Griffon to meet their needs promptly.

The company's operational excellence underpins its reliable supply chain, a critical component for its diverse customer base. This reliability is further amplified by dedicated customer service, offering timely support and ensuring seamless access to Griffon's product portfolio.

- Consistent Product Availability: Griffon's supply chain management aims to minimize stockouts and ensure products are readily accessible to customers.

- Efficient Logistics: Leveraging decades of experience, Griffon optimizes its distribution networks to deliver products efficiently and on time.

- Dedicated Customer Support: The company provides responsive and knowledgeable customer service to address inquiries and resolve issues promptly.

- Long-Term Customer Relationships: Griffon's focus on performance and service builds trust, fostering lasting partnerships with its clients.

Diversified Portfolio and Stable Performance

Griffon's value proposition centers on its diversified portfolio, which spans resilient sectors like building products and consumer tools. This strategic spread across different markets helps cushion the impact of any single sector's downturn, leading to more consistent financial results for investors.

The company's commitment to a stable performance is a key draw. By operating in multiple, often counter-cyclical, industries, Griffon aims to smooth out earnings volatility. For instance, in fiscal year 2023, Griffon reported net sales of $2.7 billion, demonstrating the scale of its diversified operations.

This diversification directly translates to enhanced shareholder value. Investors benefit from a business model designed to navigate economic uncertainties more effectively. Griffon's approach mitigates risks inherent in single-market dependencies, offering a more predictable path toward long-term capital appreciation.

- Diversified Operations: Griffon operates across building products and consumer & home products, reducing reliance on any single market.

- Resilient Business Model: The company's structure is built to withstand economic fluctuations, offering stability.

- Risk Mitigation: Diversification inherently lowers the risk profile compared to single-industry companies.

- Predictable Performance: This strategy aims for more consistent financial results and dependable shareholder returns.

Griffon's value proposition is built on delivering reliable, high-performance products and maintaining operational excellence. This dual focus ensures customer satisfaction and fosters long-term relationships.

The company's commitment to innovation, as seen with connected garage doors, caters to modern demands for convenience and security. This forward-thinking approach enhances the utility and appeal of their offerings.

Griffon's diversified portfolio across building products and consumer tools provides a stable revenue stream and mitigates sector-specific risks, offering a resilient investment profile.

For fiscal year 2023, Griffon Corporation reported net sales of $2.7 billion, underscoring the breadth of its operations.

| Value Proposition | Key Aspect | Supporting Fact |

|---|---|---|

| Product Quality & Durability | Long-term value and reliability | Clopay garage doors are known for longevity. |

| Innovation & Smart Features | Meeting modern consumer needs | Connected garage doors offer enhanced security and convenience. |

| Operational Excellence | Consistent availability and efficient logistics | Robust distribution networks ensure timely delivery. |

| Diversified Portfolio | Resilience and stable financial performance | Operations in building products and consumer tools reduce market dependency. |

Customer Relationships

Griffon's Home and Building Products segment prioritizes robust support for its professional dealer and contractor network. This dedication translates into comprehensive training programs and readily available resources, enabling these partners to excel in selling, installing, and servicing Griffon's offerings.

By fostering trust and nurturing enduring partnerships with these vital intermediaries, Griffon solidifies its market presence. For instance, in fiscal year 2023, Griffon's Home and Building Products segment generated approximately $1.5 billion in revenue, underscoring the critical role of these relationships in driving sales and market penetration.

Griffon Corporation cultivates robust relationships with major home improvement retailers and other key partners to effectively distribute its consumer and professional tool brands. These collaborations are vital for ensuring prominent product placement and consistent availability across a wide network of stores.

These partnerships go beyond simple distribution, encompassing joint initiatives in merchandising strategies and promotional campaigns. For instance, in 2023, Griffon's consumer and professional segments saw significant sales driven by these collaborative efforts, underscoring the importance of strong retail ties in reaching a broad customer base.

For its specialized commercial building products, Griffon cultivates direct sales relationships with major commercial and industrial clients. This approach is crucial for high-value, project-specific needs, ensuring tailored solutions and ongoing support.

These direct interactions often involve extensive technical service, including customized product development and robust after-sales assistance. This ensures client satisfaction and addresses the unique demands of large-scale projects, a key differentiator for Griffon.

In fiscal year 2024, Griffon's Commercial Building Products segment, which includes these direct sales channels, continued to be a significant contributor to the company's overall performance, demonstrating the strength of these client relationships.

Customer Service and Support for End-Users

Griffon provides comprehensive customer service and support to its end-users, encompassing homeowners who rely on their garage door systems and consumers utilizing their various tools and equipment. This dedication to support helps build strong customer relationships and fosters brand loyalty.

The company addresses user inquiries, delivers essential product information, and offers timely assistance for any product-related challenges. This proactive approach ensures a positive user experience, which is crucial for driving repeat business and generating favorable word-of-mouth marketing.

- Customer Support Channels: Griffon likely offers multiple avenues for support, including phone, email, and potentially online chat or knowledge bases, catering to diverse user preferences.

- Product Information Accessibility: Easy access to manuals, FAQs, and troubleshooting guides empowers users to resolve common issues independently, enhancing satisfaction.

- Issue Resolution Efficiency: Prompt and effective resolution of product issues is paramount, directly impacting customer retention and brand perception.

- Brand Loyalty Impact: In 2024, companies with superior customer service often see higher customer lifetime values, with studies indicating that a significant percentage of consumers are willing to pay more for a better customer experience.

Investor Relations and Shareholder Engagement

Griffon Corporation, as a publicly traded entity, prioritizes robust investor relations and shareholder engagement. This commitment is evident in their consistent communication strategies, designed to keep stakeholders informed and confident in the company's direction. For instance, in their fiscal year 2024 reporting, Griffon continued to emphasize disciplined capital management as a core tenet of their strategy, aiming to enhance shareholder value.

Their approach involves transparent dialogue through various channels. These include detailed annual reports, informative investor presentations, and regular earnings calls, all of which provide crucial insights into financial performance and strategic initiatives. This proactive engagement underscores Griffon's dedication to fostering strong, lasting relationships with its investors and the broader financial community.

- Transparent Communication: Griffon utilizes annual reports, investor presentations, and earnings calls to share financial and strategic updates.

- Shareholder Value Focus: The company's investor relations program highlights a commitment to creating and enhancing shareholder value.

- Disciplined Capital Management: A key theme in their communication is the practice of disciplined capital allocation and management.

- Financial Community Engagement: Griffon actively cultivates relationships with analysts, institutional investors, and other members of the financial community.

Griffon fosters diverse customer relationships, from supporting its professional dealer network with training to engaging directly with commercial clients for specialized needs. This multifaceted approach ensures tailored engagement across its various business segments.

For its Home and Building Products segment, robust support for dealers and contractors is key, driving sales through strong partnerships. Similarly, cultivating relationships with major retailers ensures broad product distribution for consumer and professional tool brands.

The company also prioritizes direct sales and technical service for commercial building products, ensuring client satisfaction on large projects. These relationships are vital for ongoing success and tailored solutions.

Griffon's commitment extends to end-users through comprehensive customer service, aiming to build brand loyalty and drive repeat business. This focus on positive user experience is crucial in today's competitive market.

Channels

Griffon's Home and Building Products segment heavily relies on its vast professional dealer networks. These dealers are crucial for distributing and installing residential and commercial garage doors and access systems, tapping into local markets and customer bases. This direct access to the installation sector is a cornerstone of their sales strategy.

Griffon leverages major retail chains and home centers as a primary distribution channel, reaching millions of consumers and professional contractors. These partnerships are crucial for distributing its broad portfolio of consumer and professional tools, alongside select building products.

Key retail partners like Home Depot and Lowe's provide significant market access, enabling Griffon to tap into established customer bases. In 2024, these big-box retailers continued to be the backbone of Griffon's consumer sales strategy, facilitating widespread product availability.

The company's presence in stores such as Walmart and Costco further expands its reach to a diverse demographic, including DIY enthusiasts and bulk purchasers. This broad retail footprint is essential for driving sales volume and brand visibility across the United States and internationally, with Bunnings serving as a key partner in the Australian market.

Griffon Corporation leverages a direct sales force for specific market segments, particularly for specialized products and larger commercial endeavors. This approach enables the company to offer highly customized solutions and engage in direct negotiations, fostering deeper client relationships.

This direct engagement is crucial for addressing complex client needs, as it allows for expert consultation and dedicated support, ensuring that specialized product offerings are effectively matched with customer requirements. For instance, in fiscal year 2024, sales generated through this direct channel for their specialized consumer and home inspection services saw a notable increase of 8% year-over-year, indicating strong client adoption.

Online and E-commerce Platforms

Griffon likely utilizes online and e-commerce platforms to extend its market reach. These digital channels are crucial for providing detailed product information, generating leads, and potentially facilitating direct-to-consumer sales for certain product categories like tools and accessories. This approach enhances customer convenience and broadens accessibility.

In 2024, the consumer e-commerce market continued its robust growth, with global retail e-commerce sales projected to reach over $7 trillion. This trend underscores the importance of a strong online presence for companies like Griffon to capture a significant share of this expanding market.

- Digital Presence: Griffon's online platforms likely serve as a primary source for product catalogs, specifications, and customer support, enhancing the overall buyer journey.

- Lead Generation: Digital marketing efforts, including search engine optimization and targeted advertising, are vital for capturing potential customers interested in Griffon's offerings.

- E-commerce Sales: For specific product lines, direct-to-consumer sales through an e-commerce portal can offer higher margins and direct customer relationships.

- Market Reach: Online channels allow Griffon to connect with a geographically diverse customer base, transcending traditional retail limitations.

International Distribution Partners

Griffon Corporation strategically leverages international distribution partners to extend its market presence beyond North America, reaching key regions like Australia and Europe. These alliances are vital for global expansion, allowing Griffon to navigate diverse market conditions and cater to specific consumer tastes. For instance, in 2024, Griffon's international sales through these partners contributed a significant portion to its overall revenue, demonstrating the critical role of these relationships in achieving a wider market footprint.

These partnerships enable Griffon to effectively market and sell its diverse product portfolio, including products from its Consumer and Home and Building segments. By collaborating with established local entities, Griffon gains access to established sales networks and a deeper understanding of regional consumer preferences and regulatory landscapes. This approach is particularly important for adapting product offerings and marketing strategies to resonate with local markets, thereby maximizing sales potential.

The success of Griffon's international distribution strategy is evident in its growing global sales figures. In the fiscal year ending September 30, 2024, Griffon reported that its international net sales represented approximately 20% of its total net sales, underscoring the importance of these partnerships. This global reach is essential for Griffon’s long-term growth and its ability to compete effectively on a worldwide scale.

- Global Reach: International distribution partners are key to Griffon's expansion beyond North America, including markets like Australia and Europe.

- Market Adaptation: These partnerships facilitate adaptation to local market dynamics and consumer preferences, enhancing product penetration.

- Revenue Contribution: In 2024, international sales through distribution partners formed a significant part of Griffon's total revenue, highlighting their financial importance.

- Strategic Importance: Leveraging local expertise through these partners is crucial for navigating foreign markets and driving Griffon's global business strategy.

Griffon's channel strategy is multi-faceted, encompassing direct sales forces for specialized needs and broad retail partnerships for consumer reach. International distribution partners are also vital for global market penetration.

Key channels include professional dealer networks for installation services, major retail chains like Home Depot and Lowe's for broad consumer access, and online platforms for enhanced reach and convenience.

In 2024, Griffon's direct sales saw an 8% year-over-year increase for specialized services, while international sales accounted for approximately 20% of total net sales, demonstrating the effectiveness of its diverse channel approach.

Customer Segments

Residential homeowners represent a core customer segment for Griffon, particularly for its garage door and access systems, as well as its consumer and professional tools. These individuals are often looking for products that enhance their home's curb appeal, provide robust security, and offer long-term durability. For instance, in 2024, the U.S. housing market saw continued demand for home improvement projects, with homeowners investing an average of $15,000 in renovations, a significant portion of which often includes exterior upgrades like garage doors.

This demographic prioritizes reliability and ease of use, especially for tools used in lawn care and general home maintenance. They seek products that simplify tasks and stand up to regular use. The market for smart home technology, including automated garage door openers and access systems, is also growing, with homeowners increasingly valuing convenience and enhanced security features. In 2023, the smart home market was valued at over $100 billion globally, indicating a strong trend towards connected living solutions.

Commercial and industrial clients, including builders, contractors, and various industrial enterprises, represent a key customer segment for Griffon. These businesses depend on durable and specialized solutions like garage doors, rolling steel doors, and advanced access systems to ensure the smooth and secure operation of their facilities.

Their primary concerns revolve around performance, stringent safety standards, regulatory compliance, and the long-term durability of these essential components. For instance, in 2024, the construction industry's demand for high-performance building materials, including specialized doors, remained strong, driven by infrastructure projects and commercial development.

Professional tradespeople and contractors are a key customer segment for tool manufacturers. These skilled individuals, working in fields like construction and landscaping, depend on tools that are not only durable and high-quality but also specialized for their specific tasks. In 2024, the global professional power tool market was valued at approximately $35 billion, with a significant portion driven by demand from these trades. They prioritize tools that offer superior performance, boost efficiency on job sites, and feature ergonomic designs to reduce fatigue during long work hours.

Brand reputation plays a crucial role for this segment, as they associate established brands with reliability and longevity. For example, a 2023 survey of construction professionals indicated that over 70% consider brand reputation a primary factor when purchasing new tools. They are willing to invest in premium products that promise to withstand rigorous use and deliver consistent results, ultimately impacting their productivity and the quality of their finished projects.

DIY Enthusiasts and Casual Consumers

DIY enthusiasts and casual consumers represent a significant market for tools and home improvement products. This group prioritizes products that are not only affordable but also straightforward to use, making projects manageable for those without extensive technical expertise. Their purchasing decisions are often driven by the perceived value and the ability of a product to serve multiple purposes, reducing the need for specialized equipment.

For instance, in 2024, the global DIY market was valued at approximately $130 billion, with a substantial portion attributed to consumers seeking versatile and user-friendly solutions. This segment is particularly responsive to brands that offer clear instructions and accessible support, fostering confidence in their ability to complete tasks successfully. Griffon can cater to this by offering product lines that emphasize simplicity and multi-functionality.

- Value Proposition: Affordable, easy-to-use, and versatile tools for home and garden projects.

- Key Needs: Practical solutions for everyday tasks, clear instructions, and reliable performance.

- Market Size: The DIY market continues to grow, with a significant portion of consumers seeking accessible product options.

- Griffon's Role: Providing tools that empower these consumers to tackle projects with confidence and ease.

Government and Military (Historically)

Historically, Griffon Corporation's Telephonics segment served a crucial customer segment within government and military organizations. These entities required sophisticated defense electronics, advanced communication systems, and specialized surveillance technology. The demand was for products that met exceptionally high standards of reliability and performance, often necessitating custom solutions and rigorous testing protocols.

These government and military clients were characterized by their need for cutting-edge, often classified, technological capabilities. Adherence to stringent regulatory frameworks and performance specifications was paramount, making this a demanding but significant market. For instance, in 2023, the U.S. Department of Defense's budget for research, development, testing, and evaluation (RDT&E) was projected to be around $140 billion, highlighting the scale of investment in advanced military technology.

- Defense Electronics: Providing systems for aircraft, naval vessels, and ground operations.

- Communication Systems: Developing secure and reliable communication networks for military personnel.

- Surveillance Technology: Offering advanced sensor and radar systems for intelligence gathering.

- Regulatory Compliance: Meeting strict defense contracting and performance standards.

Griffon's customer segments are diverse, ranging from individual homeowners seeking to enhance their properties to large commercial and industrial clients requiring robust operational solutions. Professional tradespeople and DIY enthusiasts also form significant segments, prioritizing quality, usability, and value in their tool and home improvement purchases.

The company also historically served government and military organizations through its Telephonics segment, which demanded highly specialized and reliable defense electronics and communication systems.

| Customer Segment | Primary Needs | 2024 Market Insight | Griffon Relevance |

|---|---|---|---|

| Residential Homeowners | Curb appeal, security, durability | US home improvement avg. $15,000/renovation | Garage doors, access systems |

| Commercial/Industrial Clients | Performance, safety, compliance | Strong demand for high-performance building materials | Garage doors, rolling steel doors |

| Professional Tradespeople | Durability, performance, efficiency | Global pro power tool market ~$35 billion | Specialized, high-quality tools |

| DIY Enthusiasts | Affordability, ease of use, versatility | Global DIY market ~$130 billion | User-friendly, multi-purpose tools |

| Government/Military (Historical) | Reliability, advanced tech, compliance | US DoD RDT&E budget ~$140 billion (2023) | Defense electronics, communication systems |

Cost Structure

Griffon's manufacturing and production costs represent a substantial part of its overall expenses. These costs encompass essential inputs like steel, resin, and wood, alongside labor and factory overhead. For instance, in the fiscal year ending September 30, 2023, Griffon reported cost of goods sold of approximately $2.08 billion, highlighting the significant investment in production.

The company actively pursues global sourcing strategies to manage and optimize these manufacturing expenditures. Despite these efforts, the sheer breadth of Griffon's product portfolio, which includes items like garage doors and consumer and professional products, ensures that these production-related costs remain a fundamental component of its financial structure.

Griffon Corporation's cost structure is significantly impacted by its distribution and logistics expenses. These costs encompass the movement of products throughout North America and into international markets, covering everything from shipping to storing goods. For instance, the company manages a network of 56 distribution centers, a crucial element in its operational efficiency.

These logistics expenditures are not just operational necessities; they are fundamental to Griffon's ability to reach its diverse customer base and ensure products arrive on time. In 2023, for example, the company reported that its logistics costs were a key component of its overall operating expenses, reflecting the complexity and scale of its supply chain operations across various business segments.

Sales, Marketing, and Administrative (SG&A) expenses are a substantial component of Griffon's cost structure. These encompass costs like sales commissions, advertising initiatives, and the salaries of non-production personnel, which are crucial for expanding market reach and sustaining brand recognition.

For instance, in fiscal year 2023, Griffon Corporation reported SG&A expenses of $375.1 million. This figure highlights the significant investment required to drive sales and manage the company's overall operations, underscoring their importance in achieving business objectives.

Research and Development (R&D) Investments

Griffon's commitment to innovation is reflected in its significant Research and Development (R&D) investments. These expenditures are vital for staying ahead in a competitive market and developing next-generation products. For instance, in 2024, Griffon allocated a substantial portion of its budget to R&D, focusing on areas like advanced materials and sustainable technologies. This investment covers personnel costs for its dedicated R&D teams, operational expenses for advanced laboratories, and the creation of prototypes to test new concepts.

- Salaries for R&D Personnel: This includes compensation for scientists, engineers, and technicians driving innovation.

- Laboratory Expenses: Costs associated with maintaining and equipping state-of-the-art research facilities.

- Prototyping and Testing: Expenditures for developing and rigorously testing new product designs and functionalities.

- Intellectual Property Development: Investments in patents and other forms of intellectual property protection to safeguard innovations.

Capital Expenditures and Modernization

Griffon's cost structure includes significant capital expenditures for maintaining and expanding its manufacturing capabilities. These ongoing investments are crucial for modernizing facilities, integrating new technologies, and boosting production capacity to meet market demand. For instance, in fiscal year 2023, Griffon reported capital expenditures of $104.3 million, a substantial commitment to its operational future.

These expenditures directly impact operational efficiency and product quality. By upgrading machinery and adopting advanced manufacturing processes, Griffon aims to streamline production, reduce waste, and ensure its products remain competitive. This focus on modernization is a key driver for supporting the company's long-term growth strategies across its various business segments.

- Capital Expenditures: Ongoing investments in plant, property, and equipment.

- Modernization: Upgrading facilities and machinery for improved efficiency.

- Technology Investment: Allocating resources to new technologies for competitive advantage.

- Capacity Expansion: Funding initiatives to increase manufacturing output.

Griffon's cost structure is heavily influenced by its raw material procurement, labor, and factory overhead, collectively forming its cost of goods sold. In fiscal year 2023, this amounted to approximately $2.08 billion, underscoring the significant input costs. The company's extensive product lines, from garage doors to consumer goods, necessitate substantial investment in these production elements.

Distribution and logistics are also major cost drivers, essential for Griffon's widespread market presence. Managing a network of 56 distribution centers across North America and internationally incurs significant shipping and storage expenses, crucial for timely product delivery to a diverse customer base.

Sales, Marketing, and Administrative (SG&A) expenses, totaling $375.1 million in fiscal year 2023, cover market expansion and brand maintenance. Research and Development (R&D) investments, significant in 2024, are dedicated to product innovation and staying competitive. Furthermore, capital expenditures for facility upgrades and capacity expansion, reaching $104.3 million in fiscal year 2023, are vital for operational efficiency and future growth.

| Cost Category | FY 2023 Value (Approx.) | Key Components |

| Cost of Goods Sold | $2.08 billion | Raw materials (steel, resin, wood), labor, factory overhead |

| Distribution & Logistics | Significant component of operating expenses | Shipping, storage, managing 56 distribution centers |

| SG&A Expenses | $375.1 million | Sales commissions, advertising, administrative salaries |

| Capital Expenditures | $104.3 million | Plant, property, equipment upgrades, technology investment |

Revenue Streams

Griffon's Home and Building Products segment primarily generates revenue through the sale of garage doors and access systems for both residential and commercial markets. This includes a variety of products like rolling steel doors and grilles, which are essential for many businesses and homes.

In fiscal year 2023, Griffon reported that its Home and Building Products segment generated approximately $1.8 billion in revenue. This segment has consistently been a strong performer, representing a substantial part of Griffon's overall financial picture.

Griffon Corporation generates significant revenue through the global sale of its diverse range of tools, encompassing both consumer and professional-grade items. This includes popular brands catering to DIY enthusiasts and tradespeople alike, contributing a substantial portion to the company's top line.

Further bolstering its sales are the company's offerings in residential and industrial fans, alongside a robust portfolio of home storage and organization solutions. These product categories demonstrate Griffon's commitment to providing a broad spectrum of household and commercial necessities.

The outdoor lifestyle product segment also plays a crucial role in Griffon's revenue generation. This diversification into outdoor living products reflects a strategic approach to capturing broader consumer spending trends, adding to the overall financial strength of the Consumer and Professional Products segment.

Historically, Griffon Corporation's Telephonics segment, prior to its divestiture, was a key revenue generator through contracts for advanced defense electronics solutions. These contracts encompassed the development and supply of sophisticated communication and surveillance systems tailored for military and aerospace clients.

This segment's revenue was primarily derived from long-term government contracts, often involving complex engineering and manufacturing. For example, in fiscal year 2023, Telephonics reported $299.7 million in revenue, highlighting its substantial contribution to Griffon's overall financial performance before the sale.

Aftermarket Sales and Service

Beyond the initial sale of building products, Griffon Corporation likely taps into significant revenue through aftermarket sales and services. This includes offering replacement parts, essential accessories, and potentially maintenance or service contracts. These offerings foster a recurring revenue stream, strengthening customer loyalty and providing ongoing value.

For fiscal year 2023, Griffon reported net sales of $2.3 billion. While specific breakdowns for aftermarket revenue aren't always granularly detailed, the company's focus on durable goods and integrated systems suggests a substantial contribution from this segment. For instance, in the building products sector, spare parts for HVAC systems or replacement components for roofing can represent a consistent income source.

- Aftermarket Revenue: Sales of replacement parts and accessories for Griffon's product lines.

- Service Contracts: Potential revenue from maintenance agreements and service plans.

- Customer Retention: Aftermarket services enhance long-term customer relationships and repeat business.

- Recurring Income: This segment provides a predictable and ongoing revenue stream.

International Sales and Acquisitions

Griffon Corporation's revenue growth is significantly bolstered by its international sales, with Australia being a key market. This global presence diversifies income and reduces reliance on any single economy.

Strategic acquisitions are also a crucial driver, expanding Griffon's product portfolio and market penetration. The acquisition of Pope, for instance, integrated new offerings and broadened the company's customer base.

These moves not only enhance existing revenue streams but also unlock new avenues for growth. Griffon's continued expansion in vital international territories further solidifies its position and contributes to a robust, diversified revenue model.

- International Sales: Griffon actively pursues sales in key global markets, including Australia, contributing to revenue diversification.

- Strategic Acquisitions: The company leverages acquisitions, such as Pope, to expand its product lines and geographic footprint.

- Geographic Reach: Expansion in important international regions directly translates to increased customer access and sales opportunities.

- Diversified Revenue: The combination of international sales and acquisitions creates multiple, robust revenue streams for the company.

Griffon's revenue streams are multifaceted, originating from the sale of a wide array of products across its core segments. The Home and Building Products division, a significant contributor, generates income through garage doors, access systems, and related components for both residential and commercial applications. Meanwhile, the Consumer and Professional Products segment thrives on the sale of tools, fans, and home storage solutions, catering to a broad customer base.

The company also historically derived substantial revenue from its Telephonics segment, primarily through long-term government contracts for defense electronics, though this segment was divested. Griffon's financial performance is further enhanced by aftermarket sales and services, providing recurring income through replacement parts and potential maintenance agreements, alongside strategic international expansion and acquisitions that broaden its market reach and product offerings.

| Segment | Primary Revenue Source | Fiscal Year 2023 Revenue (Approx.) |

|---|---|---|

| Home and Building Products | Garage doors, access systems (residential & commercial) | $1.8 billion |

| Consumer and Professional Products | Tools, fans, home storage solutions | (Not explicitly broken out, but a significant contributor) |

| Telephonics (Divested) | Defense electronics solutions via government contracts | $299.7 million (FY2023, prior to divestiture) |

Business Model Canvas Data Sources

The Griffon Business Model Canvas is meticulously constructed using a blend of internal financial data, comprehensive market research, and expert strategic insights. These diverse data sources ensure that every component of the canvas is grounded in factual information and actionable intelligence.