Griffon Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Griffon Bundle

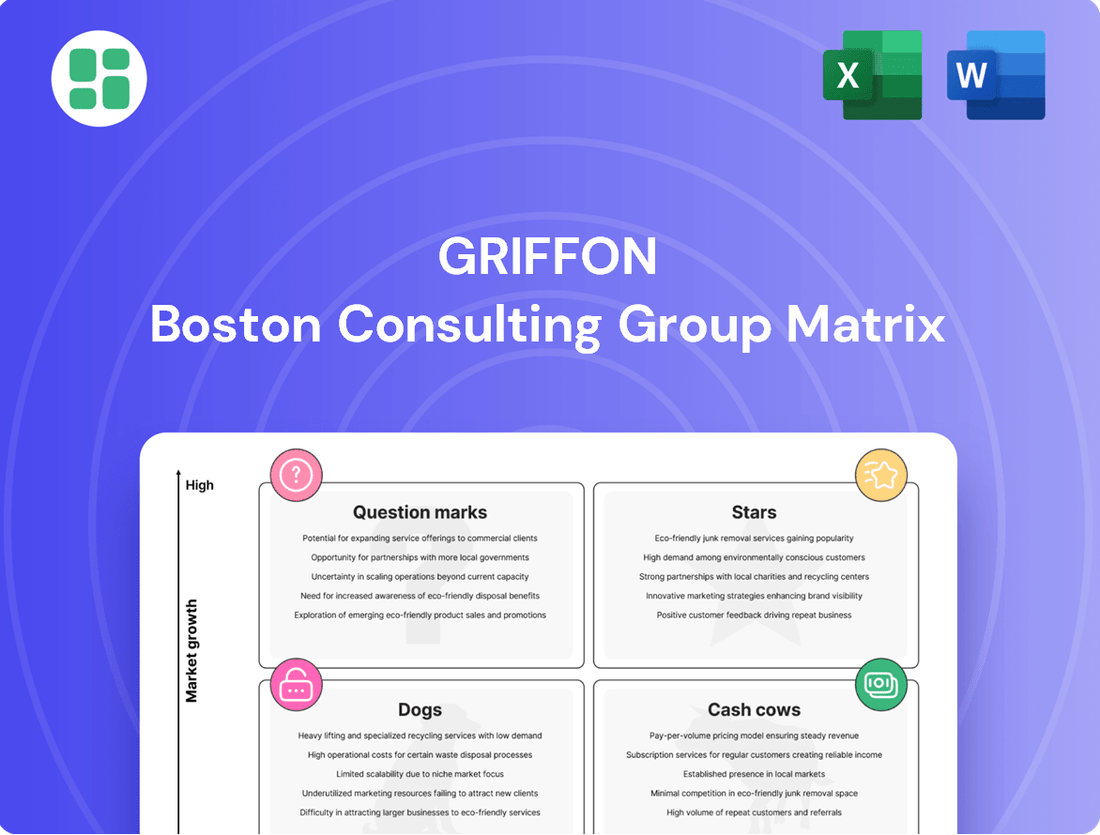

The BCG Matrix is a powerful tool for understanding your product portfolio's health. It categorizes products into Stars, Cash Cows, Question Marks, and Dogs, offering a clear visual of market share and growth potential. Ready to transform your strategic planning and make informed investment decisions?

Dive into the full BCG Matrix report for a comprehensive breakdown of each product's position and actionable insights. Unlock the secrets to optimizing your resource allocation and driving future growth. Purchase the complete BCG Matrix today and gain the strategic clarity your business needs to thrive.

Stars

Griffon's Home and Building Products (HBP) segment is focusing on premium garage door offerings, like Clopay's high-end residential lines. This strategic move involves significant investment in expanding manufacturing capacity and acquiring advanced equipment. The company sees a strong opportunity in this higher-value segment, which is experiencing faster growth.

The rationale behind this investment is clear: garage door home improvements offer a high return on investment for homeowners. Griffon aims to leverage its dominant market position by targeting this more lucrative, upwardly mobile segment of the market. This push for premium products is designed to meet the growing consumer demand for sophisticated and aesthetically pleasing residential solutions.

Smart Access Systems Integration represents a key strategic initiative within Griffon's Home and Building Products (HBP) segment, specifically targeting the burgeoning smart home market. This focus on connectivity for garage doors and access systems positions Griffon to capitalize on evolving consumer demand for integrated home automation solutions.

Griffon's product development pipeline in HBP is heavily weighted towards enhancing connectivity, a move designed to leverage its established market presence in a high-growth, technology-centric sector. This strategic direction necessitates significant investment in research and development, alongside dedicated efforts in market education to foster widespread adoption of these advanced access systems.

The July 2024 acquisition of Pope by AMES Australasia, a Griffon subsidiary, marks a significant strategic move into Australia's burgeoning residential watering products market. This acquisition positions Griffon as a key player in a region with substantial growth potential for these essential home and garden items.

While Pope's current revenue contribution is modest, it diversifies AMES's offerings and firmly establishes Griffon's presence in the Australian market. This expansion is anticipated to drive considerable market share gains in the residential watering sector.

Capacity Expansion for High-Demand Products

Griffon Corporation is strategically investing in capacity expansion at its Clopay facility in Troy, Ohio, during 2025. This move is directly aimed at meeting the escalating customer demand for their premium sectional doors. The company is also enhancing its technological capabilities at this site to support this growth.

This expansion signifies a clear commitment to scaling production for products that are currently experiencing robust demand and showing significant growth potential. By increasing capacity, Griffon aims to reinforce its leading position in these sought-after product categories and ensure they can capture the full market opportunity.

- 2025 Investment: Griffon is allocating capital to expand production capacity and upgrade technology at Clopay's Troy, Ohio facility.

- Demand Focus: The expansion targets premium sectional doors, a product line experiencing heightened customer interest.

- Market Share Protection: This proactive scaling is essential to prevent losing market share due to an inability to fulfill growing customer orders.

Targeted Residential Market Share Gains in HBP

Griffon's Home & Building Products (HBP) segment has demonstrated impressive performance, even amidst a tougher overall market. This success is largely attributed to strategic market share gains, especially within the garage door sector. For instance, in the fiscal year 2023, Griffon reported that its HBP segment saw a notable increase in residential volume, contributing to its strong profitability. This focus on specific, growing sub-segments within the residential building products market has allowed Griffon to effectively capture demand and expand its footprint.

- Residential Volume Growth: Griffon's HBP segment experienced increased residential volume in fiscal year 2023, a key driver of its success.

- Garage Door Market Share: The company specifically highlighted market share gains within the garage door category as a significant contributor to its HBP segment's strong performance.

- Profitability Resilience: Despite broader market challenges, Griffon's HBP segment maintained strong profitability, underscoring effective operational management and strategic focus.

- Targeted Segment Success: These gains indicate a successful strategy of targeting and capturing demand in robust sub-segments of the residential building products market.

Stars, in the context of the Griffon BCG Matrix, represent business units or product lines that are experiencing high growth and hold a significant market share. These are the shining stars of the company, generating substantial revenue and profit. Griffon's strategic focus on premium garage doors and smart access systems within its Home and Building Products segment aligns with the characteristics of a Star. The company's investments in capacity expansion and technology for these areas underscore their potential for continued high growth and market leadership.

Griffon's Home & Building Products (HBP) segment, particularly its premium garage door offerings and smart access systems, can be viewed as Stars within its portfolio. In fiscal year 2023, this segment demonstrated robust performance with increased residential volume and market share gains in the garage door sector, indicating strong growth and a leading position. The company's ongoing investments in capacity and technology for these product lines in 2025 further solidify their Star status, as they are poised to capitalize on high demand and technological advancements in the smart home market.

The strategic emphasis on premium garage doors and smart access systems positions Griffon's HBP segment as a Star. This is supported by the segment's notable increase in residential volume and market share gains in fiscal year 2023, contributing to strong profitability despite broader market challenges. The planned 2025 investments in capacity expansion and technological upgrades at Clopay's Troy, Ohio facility are designed to fuel further growth in these high-demand, premium product lines, reinforcing their position as key drivers of Griffon's success.

Griffon's Home & Building Products (HBP) segment, especially its premium garage doors and smart access systems, exhibits Star characteristics. The segment saw increased residential volume and market share gains in fiscal year 2023, contributing to robust profitability. Planned 2025 investments in capacity expansion and technology at the Clopay facility in Troy, Ohio, are aimed at supporting the high demand for premium sectional doors and smart home integration, further solidifying these as high-growth, market-leading products for Griffon.

| Business Unit/Product Line | Market Growth Rate | Relative Market Share | BCG Matrix Category |

|---|---|---|---|

| HBP - Premium Garage Doors | High | High | Star |

| HBP - Smart Access Systems | High | High | Star |

| AMES Australasia - Residential Watering Products (Post Pope Acquisition) | High (Projected) | Growing | Potential Star/Question Mark |

What is included in the product

The Griffon BCG Matrix categorizes business units by market share and growth, guiding investment decisions.

A clear visual of your portfolio's strengths and weaknesses, simplifying strategic resource allocation.

Cash Cows

North American Garage Door Systems, primarily driven by Clopay Corporation, stands as a dominant force in the garage door market, holding the largest share in North America. This business unit, part of Griffon's Home and Building Products segment, operates within a mature and stable industry landscape.

Despite the market's maturity, the garage door systems consistently achieve impressive EBITDA margins exceeding 30%, positioning them as a significant profit engine for Griffon. These robust earnings translate into substantial free cash flow, a critical resource that fuels other company initiatives and shareholder distributions.

Under its Cornell and Cookson brands, Griffon produces rolling steel doors and grilles. These products are essential for commercial, industrial, institutional, and retail sectors, serving well-established markets where Griffon has a dominant presence.

These offerings represent a stable and predictable source of income for Griffon. Despite not experiencing rapid growth, they are key contributors to the Health and Beauty Products (HBP) segment's strong profitability, demonstrating their status as cash cows.

Griffon's Consumer and Professional Products (CPP) segment, featuring brands like True Temper, Razor-Back, and Jackson, represents an established portfolio of consumer hand tools. These iconic brands benefit from long-standing customer loyalty in mature markets, ensuring stable sales and consistent cash flow generation for the company.

In fiscal year 2024, Griffon Corporation reported that its Consumer and Outdoor Products segment, which encompasses these hand tools, generated approximately $750 million in net sales. The company's strategic global sourcing initiatives continue to bolster the profitability of these mature product lines, reinforcing their position as cash cows.

Traditional Residential and Commercial Fans

Traditional residential and commercial fans, including brands like Hunter Fan, are considered Cash Cows for Griffon Corporation. These products are in mature markets, meaning demand is stable and predictable, which translates into consistent revenue streams. In 2024, the Consumer and Professional Products (CPP) segment, which houses these fans, continued to be a significant contributor to Griffon's profitability, benefiting from the company's global sourcing efforts that have enhanced margins.

- Hunter Fan's strong market share in residential, industrial, and commercial fan segments.

- Mature market positioning ensures predictable demand and steady revenue generation.

- Global sourcing initiatives are actively improving the profitability of these fan products.

- These fans represent a stable, cash-generating asset for Griffon Corporation.

Home Storage and Organization Solutions

Griffon Corporation's ClosetMaid brand, a key player in its Consumer and Professional Products (CPP) segment, represents a classic cash cow. This brand provides home storage and organization solutions, a market characterized by consistent demand and relative stability. ClosetMaid's established presence likely translates to a substantial market share, allowing for strong sales generation with potentially reduced marketing spend due to its recognized brand equity.

The steady demand for home organization products ensures a reliable revenue stream for ClosetMaid. This stability, coupled with potentially lower promotional costs, means the brand generates significant cash flow for Griffon. For instance, the home organization market, while diverse, has seen consistent growth, with projections indicating continued expansion driven by consumer interest in decluttering and optimizing living spaces. In 2024, the global home organization market was valued at approximately $11.5 billion and is expected to grow.

- ClosetMaid's strong brand recognition in the home storage sector supports its cash cow status.

- The stable and consistent consumer demand for organization products ensures predictable revenue.

- Lower promotional investment due to brand maturity contributes to robust cash generation.

- The home organization market's steady growth provides a favorable environment for continued cash flow.

Cash cows within Griffon's portfolio are business units or brands that operate in mature, stable markets, generating consistent and substantial cash flow with limited need for significant investment. These entities leverage established brand recognition and customer loyalty to maintain their market position. Their predictable earnings are vital for funding growth initiatives in other parts of the company or for returning capital to shareholders.

| Business Unit/Brand | Market Position | Fiscal Year 2024 Contribution | Key Characteristics |

|---|---|---|---|

| North American Garage Door Systems (Clopay) | Largest market share in North America | Exceeding 30% EBITDA margins | Mature industry, stable demand, high profitability |

| Rolling Steel Doors & Grilles (Cornell, Cookson) | Dominant presence in commercial/industrial sectors | Stable and predictable income | Essential products for well-established markets |

| Consumer Hand Tools (True Temper, Razor-Back, Jackson) | Long-standing customer loyalty in mature markets | Approximately $750 million in segment net sales | Established brands, consistent cash flow generation |

| Residential & Commercial Fans (Hunter Fan) | Strong market share in fan segments | Significant profitability contributor | Mature markets, predictable revenue, improving margins |

| ClosetMaid | Key player in home storage and organization | Steady demand, reliable revenue stream | Strong brand equity, consistent cash generation |

Full Transparency, Always

Griffon BCG Matrix

The Griffon BCG Matrix analysis you are currently previewing is the identical, fully completed document you will receive immediately after your purchase. This means you'll get the complete strategic breakdown, ready for immediate application in your business planning and decision-making processes. Rest assured, there are no watermarks, demo sections, or missing components; just the comprehensive, professionally formatted analysis you see.

Dogs

Griffon's Consumer and Professional Products (CPP) segment likely includes older or niche product lines. These might be facing reduced consumer interest, especially in North America and the UK. Think of products that aren't as popular anymore or compete in smaller, shrinking markets.

These types of products typically hold a small slice of a market that isn't growing, or is even shrinking. They can end up costing the company more in resources than they bring in through sales, making them prime candidates for being sold off or phased out.

Within Griffon Corporation's Home and Building Products (HBP) segment, certain commercial building product sub-segments are showing signs of weakness. These areas, characterized by low growth and low market share, are likely experiencing reduced demand or facing stiff regional competition, impacting their profitability. For instance, specific types of commercial insulation or niche HVAC components might fall into this category, struggling to gain traction in a competitive market.

These underperforming sub-segments represent potential cash drains for Griffon. Their limited market presence and slow growth rates mean they are unlikely to generate significant returns. In 2024, the broader commercial construction market has seen varied performance, with some sectors robust while others lag, directly affecting these specific product lines.

Strategically, these areas may require a thorough re-evaluation. Options could include divesting these underperforming assets, investing minimally to maintain a presence without significant capital outlay, or seeking innovative solutions to revitalize their market position. The focus would be on preventing further erosion of resources and redirecting capital to more promising segments within the HBP division.

Within Griffon's Consumer and Professional Tools segment, basic hand tools like hammers and screwdrivers often fall into the Dogs category. These items typically lack strong brand loyalty or unique features, making them highly susceptible to price wars. In 2024, the market for these tools is characterized by intense competition, with many manufacturers offering similar products, squeezing profit margins significantly.

Less Efficient Legacy Manufacturing Facilities

Less efficient legacy manufacturing facilities often represent the Dogs in a Griffon BCG Matrix. These plants might be burdened by operational inefficiencies, especially if they haven't seen recent modernization or capacity upgrades. This can lead to higher production costs, making the products manufactured there less competitive.

These products, often with low market share and minimal profit contribution, tie up valuable capital in aging infrastructure. For instance, in 2024, a significant portion of older industrial plants reported higher energy consumption per unit produced compared to newer facilities, directly impacting profitability.

- Operational Inefficiencies: Legacy facilities may lack automation and advanced process controls, leading to higher labor costs and slower production cycles.

- Higher Production Costs: Without recent investment, these plants often have older machinery that is less energy-efficient and more prone to breakdowns, increasing operational expenses.

- Low Market Share Products: Products from these facilities might be in mature or declining markets, further exacerbating their status as Dogs.

- Capital Tied Up: The capital invested in these underperforming assets could be better utilized in more promising growth areas of the business.

Older Home Storage Solutions with Declining Appeal

Within the Griffon Corporation's portfolio, certain older home storage solutions, particularly those under the ClosetMaid brand, are exhibiting characteristics of a Dog in the BCG Matrix. These are often products that are less innovative or aesthetically outdated, struggling to keep pace with the market's demand for more modular and design-forward options.

These legacy product lines face declining sales and diminishing market relevance. They are failing to attract new consumer trends, leading to a shrinking market share. For instance, basic wire shelving systems or older laminate closet organizers might fall into this category, especially when compared to the rise of customizable, integrated closet systems or sleek, minimalist storage units.

- Declining Market Share: Products like older, non-adjustable wire shelving units from ClosetMaid are seeing their market share erode as consumers opt for more sophisticated, customizable storage.

- Low Growth Potential: The demand for these basic, less aesthetically appealing storage solutions is stagnant or declining, offering little prospect for future growth.

- Reduced Profitability: With lower sales volumes and increased competition from more modern alternatives, the profitability of these older product lines is likely diminishing.

- Strategic Consideration: Griffon Corporation may need to consider phasing out or significantly re-innovating these "Dog" products to reallocate resources to more promising areas of its business.

Products classified as Dogs within Griffon's portfolio are those with low market share in low-growth or declining industries. These often include older product lines or legacy manufacturing operations that are no longer competitive. In 2024, the challenge for these segments is their inability to generate substantial revenue or profit, often requiring more investment than they return.

These "Dogs" can drain resources and management attention. For example, certain basic hand tools or older home storage solutions might fit this description, facing intense competition and limited consumer interest. Strategically, Griffon often considers divestment or minimal investment to manage these underperforming assets.

The financial implications are clear: these segments contribute little to overall growth and can negatively impact profitability. Griffon's approach typically involves either revitalizing these products through innovation or divesting them to reallocate capital to higher-potential business units.

For instance, in 2024, legacy manufacturing facilities with outdated technology represent a significant challenge, leading to higher operational costs and reduced competitiveness compared to more modern plants. This directly affects the profitability of the products manufactured within them.

Question Marks

Griffon's foray into next-generation smart home access systems, particularly connected garage doors, positions them within the rapidly expanding smart home market. This segment is projected to reach $157 billion globally by 2023, with smart access solutions being a key driver.

While Griffon has a solid foundation in traditional access systems, their presence in the high-growth, technology-intensive smart access niche is likely nascent. This means they are likely a Question Mark on the BCG matrix, requiring substantial investment to capture market share against established tech players and innovative startups.

In the Consumer Tools sector, new product development often falls into the Question Mark category of the BCG Matrix. These are typically innovative tool lines featuring advanced materials, improved ergonomics, or integrated smart technology. For instance, a company might launch a new line of cordless power tools with enhanced battery life and Bluetooth connectivity.

These cutting-edge products, while holding high growth potential, are in their nascent stages of market penetration. They require significant investment in marketing and distribution to gain traction and build brand awareness. Without successful market acceptance, these ventures risk becoming Dogs, consuming resources without generating substantial returns.

Griffon's Consumer and Professional Products (CPP) division is actively exploring new emerging international markets beyond its successful Australian venture, aiming to replicate its growth strategy. These markets, while offering significant long-term potential, currently represent low market share for Griffon, necessitating substantial upfront investment.

For instance, in Southeast Asia, markets like Vietnam and Indonesia are showing robust economic growth, with their consumer spending projected to increase. Vietnam's retail market alone was valued at over $148 billion in 2023, presenting a prime opportunity for expansion. Griffon will need to invest in localized marketing campaigns and establish strong distribution networks to compete effectively.

Similarly, Latin America, particularly Brazil and Mexico, offers untapped potential for CPP. Brazil's e-commerce market is expected to reach $100 billion by 2025, indicating a growing digital consumer base. Griffon's entry strategy will likely involve partnerships with local retailers and a focus on building brand awareness to capture market share in these dynamic economies.

Sustainable Building Product Innovations

Griffon's investment in sustainable building products would position them in a high-growth market, fueled by rising environmental awareness. For instance, the global green building materials market was valued at approximately $254.8 billion in 2023 and is projected to reach $547.5 billion by 2030, growing at a CAGR of 11.6%.

These innovative products would likely be classified as Stars or Question Marks in the BCG matrix due to their high growth potential but potentially low initial market share. Significant investment would be required to build brand recognition and scale production to compete effectively.

- Market Growth: The demand for sustainable building materials is projected to see substantial growth, indicating a favorable market environment.

- Investment Needs: Capturing market share in these emerging segments will necessitate considerable capital for research, development, and marketing.

- Competitive Landscape: While the market is expanding, initial market penetration for Griffon's specialized sustainable offerings might be low, requiring strategic efforts to gain traction.

- Potential Returns: Successful establishment in this sector could lead to significant long-term returns as environmental regulations and consumer preferences continue to favor sustainable options.

Advanced Automation and Robotics in Construction Tools

Griffon's investment in advanced automation and robotics for construction tools could place it in the "Question Mark" category of the BCG matrix. This segment is characterized by high market growth potential, driven by increasing demand for efficiency and precision on job sites.

The global construction robotics market, for instance, was valued at approximately $3.5 billion in 2023 and is projected to reach over $10 billion by 2030, exhibiting a compound annual growth rate (CAGR) of around 16%. This significant growth trajectory indicates the opportunity for new entrants like Griffon.

However, Griffon would likely enter this market with a relatively low market share, facing established, specialized technology firms. Significant capital investment would be necessary for research and development, acquiring cutting-edge technology, and building brand awareness to gain traction.

- High Growth Potential: The construction automation market is expanding rapidly, offering substantial revenue opportunities.

- Low Market Share: Griffon would be a new entrant, needing to establish its presence against established players.

- High Investment Needs: Significant R&D and market penetration costs are anticipated to compete effectively.

- Strategic Importance: This segment aligns with industry trends towards technological advancement and operational efficiency.

Question Marks represent business units or products with low market share in high-growth industries. For Griffon, this could include their emerging smart home access systems, which require significant investment to gain traction against established competitors in a rapidly expanding market. Similarly, new international ventures in markets like Southeast Asia or Latin America, while offering high growth potential, start with low market share for Griffon, necessitating substantial capital for marketing and distribution to compete effectively.

BCG Matrix Data Sources

Our BCG Matrix leverages a robust blend of financial disclosures, market research reports, and competitive analysis to provide a comprehensive view of business unit performance.