Griffon Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Griffon Bundle

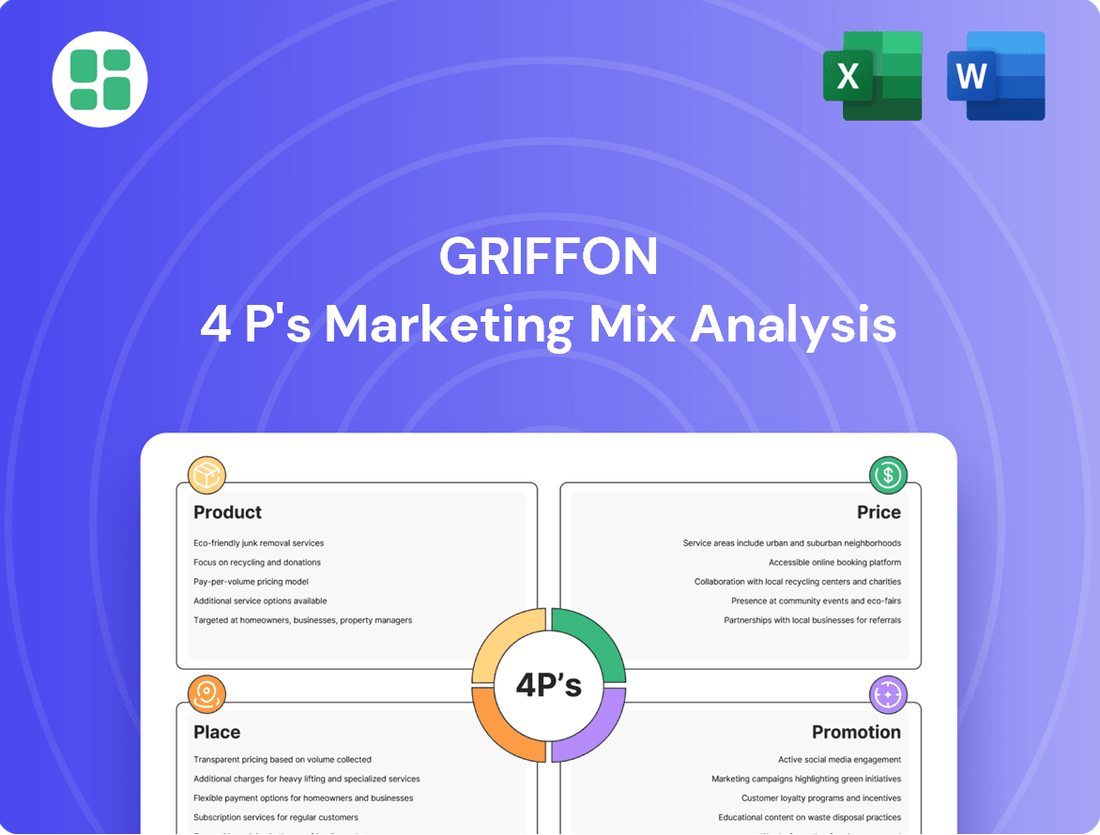

Discover how Griffon leverages its product innovation, strategic pricing, efficient distribution, and impactful promotions to dominate its market. This analysis unpacks the core elements driving their success.

Go beyond the basics—get access to an in-depth, ready-made Marketing Mix Analysis covering Griffon's Product, Price, Place, and Promotion strategies. Ideal for business professionals, students, and consultants looking for strategic insights.

Product

Griffon Corporation's diverse portfolio is a key strength, spanning both the Home and Building Products (HBP) and Consumer and Professional Products (CPP) segments. This broad product offering helps mitigate risks associated with any single market. For instance, in 2023, Griffon reported net sales of $2.3 billion, with a significant portion derived from these distinct segments, showcasing the breadth of their market penetration.

The HBP segment, featuring established brands like Clopay and Cornell, offers a comprehensive range of garage doors and rolling steel doors for residential and commercial applications. Meanwhile, the CPP segment, encompassing brands such as AMES and Hunter, delivers a wide array of consumer and professional tools, fans, and home organization solutions. This dual focus allows Griffon to tap into different consumer needs and economic cycles, contributing to its overall financial resilience.

Griffon's commitment to innovation and development is a cornerstone of its marketing strategy, ensuring it stays ahead in competitive markets. This focus is particularly evident in its Home and Building Products (HBP) segment through its Clopay brand.

Clopay is actively expanding its manufacturing capacity for sectional garage doors and investing in state-of-the-art equipment. This strategic move aims to meet the growing demand for premium products, including those with enhanced functionality and smart connectivity features. For instance, in fiscal year 2023, Griffon reported capital expenditures of $151.7 million, a significant portion of which is directed towards capacity expansion and modernization within its HBP segment, reflecting this dedication to product enhancement.

Griffon's product strategy is designed to capture diverse market needs by offering both premium and value-driven options. This dual approach is evident across its business segments, ensuring broad customer appeal and market penetration.

In the Home & Building Products (HBP) segment, Clopay exemplifies this strategy by providing a comprehensive range of residential sectional garage doors. These offerings span various price points, including sophisticated premium products such as the VertiStack Avante, alongside more budget-conscious selections.

This product segmentation allows Griffon to effectively serve a wide spectrum of consumers, from those seeking high-end, feature-rich solutions for residential properties to customers prioritizing cost-effectiveness in commercial settings. For fiscal year 2023, Griffon's HBP segment reported net sales of $751.7 million, demonstrating the significant market presence achieved through this varied product strategy.

Strategic Acquisitions for Portfolio Expansion

Griffon’s strategic acquisitions are a cornerstone of its portfolio expansion, directly impacting its product and market presence. This approach is designed to bolster its competitive edge by integrating complementary businesses and technologies. For instance, the July 2024 acquisition of Pope by AMES Australasia, a Griffon subsidiary, significantly broadened AMES's product range within the Australian residential watering solutions sector. This move is projected to enhance market penetration and solidify Griffon's standing in its key operational areas.

These strategic moves are not just about growth; they are about synergistic integration to achieve greater market share and operational efficiencies. Griffon’s management team consistently evaluates opportunities that align with its long-term vision for market leadership. The company’s financial reports for the fiscal year ending September 2024 are expected to reflect the initial impact of such acquisitions, with analysts closely watching for revenue growth and margin improvements stemming from these strategic integrations.

- Strategic Acquisitions: Griffon actively seeks acquisitions to broaden its product offerings and expand market reach.

- Recent Example: The July 2024 acquisition of Pope by AMES Australasia enhanced AMES's residential watering products in Australia.

- Market Penetration: Acquisitions are targeted to deepen market penetration and strengthen competitive positioning in core categories.

- Synergistic Integration: The strategy focuses on integrating new businesses to achieve greater market share and operational efficiencies.

Quality and Brand Reputation

Griffon Corporation places significant emphasis on its quality and brand reputation, recognizing these as cornerstones of its marketing strategy. The company actively cultivates strong customer relationships by leveraging its portfolio of respected, industry-leading brands. This focus ensures consistent product quality across its diverse offerings.

Brands such as Clopay in the garage door sector and AMES in the tools and outdoor products market boast decades of proven performance. This extensive history is built on continuous product innovation and robust manufacturing processes. For instance, Clopay has been a leader in garage door solutions for over five decades, consistently delivering on durability and design.

Maintaining a sterling reputation for quality and reliability is paramount for Griffon, especially given its presence in both professional and consumer markets. This commitment fosters deep customer loyalty and drives repeat business. In 2023, Griffon reported that its brand strength contributed to a significant portion of its sales, with key brands like AMES seeing continued market share gains in the competitive home improvement sector.

- Brand Equity: Griffon's brands, like Clopay and AMES, have established strong recognition and trust over many years.

- Product Innovation: Decades of investment in R&D have solidified their reputations for reliable and innovative products.

- Customer Loyalty: Consistent quality and brand trust translate into high customer retention and repeat purchases.

- Market Position: The company's strong brand reputation supports its premium positioning in both professional and consumer segments.

Griffon's product strategy centers on a diversified portfolio across its Home and Building Products (HBP) and Consumer and Professional Products (CPP) segments. This includes established brands like Clopay for garage doors and AMES for tools, offering both premium and value-oriented options to capture a broad customer base.

The company actively invests in product enhancement and capacity expansion, exemplified by Clopay's increased manufacturing for sectional garage doors with advanced features. Griffon also strategically acquires businesses, such as Pope in July 2024, to expand its product lines and market reach, aiming for synergistic integration and greater market share.

| Segment | Key Brands | Product Focus | FY2023 Net Sales (Millions USD) | Strategic Focus |

|---|---|---|---|---|

| HBP | Clopay, Cornell | Residential & Commercial Garage Doors, Rolling Steel Doors | $751.7 | Capacity expansion, premium product development |

| CPP | AMES, Hunter | Consumer & Professional Tools, Fans, Home Organization | $1,548.3 | Market share growth, product innovation |

What is included in the product

This analysis offers a comprehensive examination of Griffon's marketing strategies across Product, Price, Place, and Promotion, providing actionable insights for strategic decision-making.

Streamlines marketing strategy by clearly defining the 4Ps, alleviating the pain of scattered or unclear marketing efforts.

Provides a clear, actionable framework for marketing decisions, relieving the stress of uncertainty and improving campaign effectiveness.

Place

Griffon's Home and Building Products (HBP) segment, spearheaded by Clopay, leverages a formidable distribution network comprising 56 strategically located centers across North America. This extensive infrastructure is crucial for the timely and efficient delivery of their residential and commercial garage doors, as well as rolling steel doors, to a wide array of customers.

This widespread operational footprint ensures broad market accessibility, directly translating into enhanced customer convenience and responsiveness. For instance, in 2023, Clopay's distribution efficiency contributed to their market leadership in residential garage doors, a testament to the network's effectiveness.

Griffon Corporation employs a robust multi-channel sales approach to maximize market penetration and cater to diverse customer needs. This strategy ensures their products are accessible across various retail landscapes and professional networks.

For their building products, Griffon leverages an extensive network of over 3,000 professional dealers. Additionally, they partner with major home center retail chains, including prominent players like Home Depot and Menards, to reach a broader consumer base. This dual approach allows them to capture both professional contractor sales and DIY project demand.

The Consumer and Professional Products (CPP) segment further amplifies this multi-channel strategy on a global scale. Key distribution partners include giants like Home Depot, Lowe's, Walmart, Costco, and in Australia, Bunnings. This broad retail presence in 2024 and projected into 2025 underscores Griffon's commitment to widespread product availability and customer convenience.

Griffon Corporation boasts a strong North American foundation but also maintains a considerable global reach, especially in Australia and Europe for its Consumer and Professional Products segments. This international presence is further bolstered by its September 2024 completed global sourcing expansion, a move designed to enhance profitability and broaden its operational scope. This strategic initiative diversifies market exposure and streamlines supply chain operations, contributing to a more resilient global business model.

Investment in Distribution Infrastructure

Griffon Corporation is actively bolstering its distribution infrastructure to support growth and operational efficiency. This strategic focus ensures they can effectively serve an expanding customer base and capitalize on market opportunities. These investments are vital for maintaining a competitive edge in the current market landscape.

Clopay, a key segment of Griffon, exemplifies this commitment. They are expanding capacity at their Troy facility, a move designed to streamline production and handle higher volumes. Furthermore, significant investments have been made in new distribution centers strategically located in burgeoning markets.

Notable new distribution centers are being established in Austin, Texas, and Phoenix, Arizona. These locations were chosen for their rapid growth and increasing demand for Clopay's products. This expansion directly addresses the need to improve logistics and guarantee product availability.

These infrastructure enhancements are critical for several reasons:

- Enhanced Efficiency: Upgrading facilities and adding new distribution points reduces transit times and operational costs.

- Meeting Demand: The investments ensure Griffon can meet the rising demand for its products in key growth regions.

- Improved Availability: Strategic placement of distribution centers guarantees products are accessible to customers when and where they are needed.

- Competitive Advantage: A robust distribution network provides a significant advantage in a market where timely delivery is paramount.

Direct Sales to Professional Dealers

Griffon's building products often reach professional dealers directly, facilitating specialized service and robust support. This direct channel cultivates strong customer relationships, allowing for customized solutions tailored to both commercial and residential projects. This strategy is key to building loyalty and ensuring that the intricate demands of building products are met with expert guidance.

This direct engagement is crucial for meeting the specific needs of professional dealers. For instance, in 2023, Griffon's Consumer and Professional Products segment, which includes many building products, generated approximately $1.4 billion in revenue, showcasing the scale of their dealer network.

- Direct Sales Channel: Prioritizes specialized service and support for professional dealers.

- Customer Relationships: Fosters strong ties and enables tailored solutions for diverse applications.

- Expert Assistance: Ensures complex building product needs are met with knowledgeable support.

- Market Reach: Supports a significant portion of building product distribution, as evidenced by the Consumer and Professional Products segment's substantial revenue.

Griffon's extensive distribution network, featuring 56 centers for its Home and Building Products segment and partnerships with major retailers like Home Depot and Lowe's for its Consumer and Professional Products, ensures broad market accessibility. This strategic placement of over 3,000 professional dealers and key retail partners in 2024 highlights their commitment to customer convenience and product availability across North America and globally, particularly in Australia.

Griffon's place strategy is deeply rooted in its expansive and efficient distribution infrastructure. With 56 distribution centers for its Home and Building Products, primarily serving residential and commercial garage doors, Griffon ensures timely delivery across North America. This physical presence is augmented by strategic retail partnerships, including major home improvement stores, and a global reach that extends to Australia and Europe.

The company's commitment to enhancing its distribution capabilities is evident in recent investments. For example, new distribution centers in Austin, Texas, and Phoenix, Arizona, were established to capitalize on rapid regional growth. This focus on infrastructure is critical for meeting increasing demand and maintaining a competitive edge through improved logistics and product accessibility.

| Segment | Distribution Channels | Key Retail Partners (2024) | Geographic Focus |

|---|---|---|---|

| Home and Building Products (HBP) | 56 Distribution Centers, Professional Dealers | N/A (Primarily B2B) | North America |

| Consumer and Professional Products (CPP) | Global Retail Networks, Direct Sales | Home Depot, Lowe's, Walmart, Costco, Bunnings (Australia) | North America, Europe, Australia |

Full Version Awaits

Griffon 4P's Marketing Mix Analysis

The preview you see here is the exact same Griffon 4P's Marketing Mix Analysis document that you will receive instantly after purchase. This comprehensive analysis is fully complete and ready for your immediate use, ensuring no surprises. You can buy with full confidence, knowing you're getting the actual, high-quality content.

Promotion

Griffon's marketing efforts are finely tuned to its two primary segments: Home and Building Products (HBP) and Consumer and Professional Products (CPP). For HBP, the focus is on reaching professional dealers and major home center retailers, showcasing product innovation and long-lasting quality for both homes and businesses.

In contrast, the CPP segment targets a wider consumer audience through its retail partners, emphasizing the practical benefits and lifestyle improvements offered by its tools and home goods. This segmented approach ensures marketing messages resonate with the specific needs and purchasing drivers of each customer group.

Griffon's brand-centric communication strategy is deeply rooted in the equity of its flagship brands like Clopay, AMES, Hunter, and ClosetMaid. This approach leverages decades of consumer trust and market recognition to create impactful marketing campaigns. For instance, Clopay, a leader in garage doors, consistently benefits from its strong brand recall, a key factor in its market dominance.

Marketing efforts prominently feature these established brand names, reinforcing their perceived value and driving consumer preference. This focus ensures that Griffon's diverse portfolio, which saw net sales of $2.4 billion in fiscal year 2023, is presented with a unified and recognizable identity. The consistent messaging across these brands builds a strong foundation for customer loyalty and market penetration.

Griffon Corporation has significantly invested in its digital commerce capabilities, recognizing the shift in consumer and professional buyer behavior. This focus aims to create a more seamless and engaging online experience, directly impacting sales and brand loyalty.

In 2024, Griffon's digital initiatives are crucial for reaching a wider audience and driving transactions. The company's commitment to enhancing online engagement is designed to capture market share in an increasingly digital-first environment, directly supporting their 4P's marketing mix.

Industry Recognition and Awards

Griffon Corporation, through its Clopay brand, actively uses industry recognition and awards as a key promotional tool, highlighting product quality and innovation. This strategy directly supports the Promotion aspect of their marketing mix.

For instance, Clopay's VertiStack Avante garnered significant attention, being named 'Hottest New Product' at the International Door Association Expo. It also secured other design awards, validating its market appeal and engineering excellence.

These accolades function as strong third-party endorsements, bolstering Clopay's credibility. This, in turn, attracts both industry professionals and end consumers, driving interest and potential sales.

The impact of such awards is substantial, reinforcing Griffon's commitment to delivering high-quality, innovative products within the garage door sector. This recognition can translate into increased market share and brand loyalty.

Public Relations and Investor Communications

Griffon Corporation actively manages its public relations and investor communications, going beyond product-focused marketing. This strategic approach ensures stakeholders are informed about the company's financial health and future direction.

The company utilizes various channels, including press releases and earnings calls, to disseminate information. For instance, Griffon's Q1 2024 earnings call on February 7, 2024, provided insights into their performance and strategic priorities.

These efforts are crucial for transparency and shaping market perception. Griffon's investor presentations, such as those shared in late 2023 and early 2024, detail their progress and outlook, reinforcing investor confidence.

- Press Releases: Regular updates on company news and financial results.

- Earnings Calls: Direct engagement with investors and analysts to discuss performance.

- Investor Presentations: Detailed overviews of strategy, operations, and financial outlook.

- Transparency: Building trust through open communication about financial performance and strategic initiatives.

Griffon's promotional strategy leverages brand equity and industry recognition to drive sales and build loyalty. Awards like Clopay's 'Hottest New Product' designation at the 2023 International Door Association Expo serve as powerful third-party endorsements, reinforcing product quality and innovation. This focus on tangible validation, coupled with robust digital commerce initiatives in 2024, aims to capture market share and enhance customer engagement across both its Home and Building Products and Consumer and Professional Products segments.

Price

Griffon leverages value-based pricing, ensuring its product costs align with the benefits customers receive. This approach is evident in its building products segment, where garage doors are priced considering aesthetic appeal, advanced features, and their contribution to a property's long-term value, catering to both homeowners and businesses.

In the consumer and professional tools division, Griffon's pricing strategy reflects the strength of its brands, the superior durability of its products, and a keen awareness of prevailing market prices. This careful calibration allows them to capture market share while maintaining profitability.

Griffon's Consumer and Professional Products (CPP) segment, particularly its tools and home organization lines, employs a competitive pricing strategy. This approach is crucial for remaining attractive to consumers shopping at major retailers.

The company actively monitors market demand and competitor pricing to set its prices. For instance, in the face of reduced consumer demand in North America during 2024, Griffon has likely made strategic pricing adjustments to maintain market share and affordability.

Griffon Corporation strategically adjusts its pricing to counteract increasing expenses, such as those stemming from tariffs, while aiming to maintain customer demand. This selective approach to price changes is a key component of their marketing mix. For instance, during fiscal year 2024, the company navigated rising material costs by implementing targeted price increases on certain product lines, which, according to their Q3 2024 earnings call, had a minimal impact on sales volume.

The company's ongoing efforts to diversify its global sourcing network are designed to enhance cost efficiencies. This expansion into new sourcing regions, which gained momentum in late 2023 and continued through early 2024, is expected to provide greater flexibility in managing input costs and, consequently, pricing decisions. Griffon's management has indicated that for fiscal year 2025, they foresee a stable cost and price environment, with any significant price adjustments being contingent upon substantial shifts in their input expenditures.

Profitability-Focused Pricing for HBP

Griffon's Home and Building Products (HBP) segment demonstrates robust profitability, consistently achieving EBITDA margins above 30%. This strong performance suggests a pricing strategy that effectively captures value, likely driven by market leadership and product innovation. The segment's pricing reflects the inherent strength and resilience of its business model.

The pricing approach in the HBP segment is clearly geared towards maintaining high profitability.

- Consistent Profitability: HBP segment EBITDA margins have reliably surpassed 30%.

- Value Capture: Pricing strategy supports premium margins, reflecting market leadership and innovation.

- Resilient Business Model: Pricing indicates the segment's ability to withstand market pressures and maintain strong performance.

Capital Allocation and Shareholder Value

Griffon's approach to capital allocation, while not a direct pricing tactic, significantly impacts its financial health and market competitiveness. The company's robust free cash flow generation in fiscal 2024, amounting to $338.2 million, demonstrates strong financial discipline. This financial strength allows for strategic investments in product innovation and pricing flexibility, ultimately benefiting consumers through enhanced product value and competitive pricing.

The company's commitment to shareholder returns, including share repurchases and dividends, underscores its financial stability. This financial prudence not only rewards investors but also provides Griffon with the resources to maintain its competitive edge. For instance, the substantial free cash flow enables continued investment in research and development, ensuring products remain attractive and competitively priced in the marketplace.

- Fiscal 2024 Free Cash Flow: $338.2 million, highlighting strong operational performance.

- Shareholder Returns: Used free cash flow for share repurchases and dividends, enhancing shareholder value.

- Financial Stability: Demonstrates disciplined financial management, supporting long-term growth.

- Investment Capacity: Enables continued investment in product development and competitive pricing strategies.

Griffon's pricing strategy is a dynamic blend of value-based, competitive, and cost-plus approaches, tailored to its diverse product segments. The Home and Building Products (HBP) segment consistently achieves over 30% EBITDA margins, showcasing effective value capture through market leadership and innovation. Conversely, the Consumer and Professional Products (CPP) segment employs competitive pricing to remain appealing in retail environments, adjusting for market demand and competitor pricing as seen in 2024.

Griffon strategically implements price increases to offset rising expenses, such as tariffs, while aiming to preserve customer demand. For fiscal year 2024, targeted price adjustments on specific product lines had a minimal impact on sales volume, indicating successful price management. The company anticipates a stable cost and price environment for fiscal year 2025, with significant price changes contingent on input cost fluctuations.

The company's robust free cash flow, reaching $338.2 million in fiscal 2024, underpins its pricing flexibility and investment in product development. This financial strength allows Griffon to maintain competitive pricing while enhancing product value for consumers.

| Segment | Pricing Strategy Focus | Key Pricing Drivers | Indicative Performance (FY24) |

|---|---|---|---|

| Home and Building Products (HBP) | Value-Based | Market leadership, innovation, long-term property value | EBITDA Margins > 30% |

| Consumer and Professional Products (CPP) | Competitive, Value-Based | Brand strength, product durability, market prices, retailer appeal | Strategic adjustments for demand |

4P's Marketing Mix Analysis Data Sources

Our 4P's Marketing Mix Analysis leverages a robust set of data sources, including official company reports, press releases, and product documentation. We also incorporate industry analysis, market research, and competitive intelligence to provide a comprehensive view of a brand's strategy.