Goodman Group SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Goodman Group Bundle

The Goodman Group's strategic position is defined by its robust operational strengths and significant market opportunities, yet it also faces potential threats and internal weaknesses that warrant careful consideration. Understanding these dynamics is crucial for anyone looking to invest, partner, or compete in their space.

Want the full story behind Goodman Group's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Goodman Group's strength lies in its position as a global integrated property group, focusing on owning, developing, and managing industrial and business spaces. This integrated model provides a comprehensive approach to property lifecycle management.

The group's strategic advantage is amplified by its presence in key consumption markets and proximity to vital transport infrastructure worldwide. As of FY24, Goodman reported a substantial global portfolio, with assets under management reaching approximately $79.8 billion AUD, underscoring its significant scale and reach.

This global footprint, combined with a focus on high-quality, sustainable properties, allows Goodman to effectively serve a diverse international client base. Their strategic locations are crucial for capitalizing on demand in major economic centers, ensuring consistent occupancy and rental income.

Goodman Group showcased exceptional financial performance in FY24, with operating profit climbing 15% to $2,049.4 million and operating EPS increasing by 14%. This robust growth surpassed their initial projections, highlighting effective operational execution and strategic capital deployment.

The Group's financial strength is further underscored by its conservative capital structure, featuring low gearing of just 8.4%. Coupled with substantial liquidity reserves of $3.8 billion, Goodman possesses significant financial flexibility to pursue new development opportunities and strategic acquisitions, positioning them well for continued expansion.

Goodman Group demonstrates robust operational performance with consistently high occupancy rates. For fiscal year 2024, the occupancy stood at an impressive 97.7%, and for the first half of fiscal year 2025, it remained strong at 97.1%. This indicates a sustained high demand for their industrial and logistics properties.

The company is also experiencing healthy rental growth, with like-for-like net property income increasing by 4.9% in FY24 and 4.7% in 1H25. A key driver for future growth is the fact that Goodman's portfolio is significantly under-rented, with an average of 24% upside potential, suggesting ample opportunity for rental income increases.

Leadership in Data Centre Development

Goodman Group demonstrates significant leadership in data center development, positioning itself as a crucial global provider of digital economy infrastructure. This strength is underscored by their substantial development pipeline, with data centers representing 46% of their work in progress as of the first half of 2025. Their impressive global power bank of 5.0 GW spread across 13 major cities further solidifies their prominent role in this rapidly expanding sector.

This strategic focus translates into tangible advantages:

- Global Reach: Presence in 13 major global cities provides access to diverse markets and customer bases.

- Development Pipeline: 46% of their work in progress in 1H25 is dedicated to data centers, indicating a strong commitment to growth.

- Infrastructure Capacity: A 5.0 GW global power bank signifies their ability to support large-scale data center operations.

- Market Position: Established as a key provider for the digital economy, capitalizing on increasing demand for data storage and processing.

Commitment to Sustainability and Resilient Design

Goodman Group's strong commitment to sustainability is a significant strength. The company consistently achieves high ratings in the Global Real Estate Sustainability Benchmark (GRESB), reflecting its dedication to environmentally responsible practices. For instance, in the 2023 GRESB Real Estate Assessment, Goodman achieved an A rating and was recognized as a leader in sustainability within the sector.

This focus on sustainability translates into tangible actions, such as reducing emissions through the adoption of renewable energy sources and the use of innovative, low-carbon materials in their developments. These initiatives not only contribute to a healthier planet but also position Goodman favorably with environmentally conscious investors and stakeholders.

Furthermore, Goodman's emphasis on resilient property design is crucial in today's climate. By building properties that can withstand environmental challenges, they enhance the long-term value and operational stability of their assets. This forward-thinking approach aligns perfectly with the growing demand for properties that meet stringent environmental, social, and governance (ESG) criteria, a trend that is expected to intensify through 2025.

Key aspects of their sustainability and resilience efforts include:

- High GRESB Scores: Consistently recognized for leading sustainability performance.

- Emissions Reduction: Active implementation of renewable energy and sustainable materials.

- Resilient Design: Focus on building properties that withstand environmental impacts.

- ESG Alignment: Meeting the increasing demands of ESG-focused investors.

Goodman Group's integrated property model, spanning ownership, development, and management, provides a robust foundation for its operations. This comprehensive approach is further bolstered by its strategic positioning in key consumption markets with access to vital transport links, a factor evident in its substantial AUD $79.8 billion in assets under management as of FY24.

The company's financial health is a significant strength, with a 15% rise in operating profit to $2,049.4 million in FY24 and a conservative gearing of 8.4%. This financial resilience, supported by $3.8 billion in liquidity, equips Goodman to capitalize on growth opportunities.

High occupancy rates, consistently above 97% (97.7% in FY24 and 97.1% in 1H25), and a significant rental upside potential of 24% highlight the strong demand for their properties and effective asset management.

Goodman's leadership in data center development, with 46% of its work in progress in 1H25 dedicated to this sector and a 5.0 GW global power bank, positions it strongly within the digital economy. Their commitment to sustainability, evidenced by high GRESB ratings and resilient property design, further enhances their market appeal and long-term asset value.

| Strength | Description | Supporting Data/Fact |

| Integrated Property Model | Comprehensive management across the property lifecycle. | Global integrated property group. |

| Strategic Market Access | Presence in key consumption markets near transport hubs. | AUD $79.8 billion AUM (FY24); presence in 13 major cities. |

| Financial Robustness | Strong profitability and conservative capital structure. | 15% operating profit growth to $2,049.4m (FY24); 8.4% gearing; $3.8bn liquidity. |

| Operational Excellence | High occupancy and rental growth potential. | 97.7% occupancy (FY24); 24% rental upside potential. |

| Data Center Leadership | Significant investment and capacity in digital infrastructure. | 46% of WIP in data centers (1H25); 5.0 GW global power bank. |

| Sustainability Focus | Commitment to ESG principles and resilient design. | High GRESB ratings (e.g., A rating in 2023); focus on renewable energy and low-carbon materials. |

What is included in the product

This SWOT analysis offers a comprehensive breakdown of Goodman Group's internal capabilities and external market dynamics, identifying key strengths, weaknesses, opportunities, and threats.

Identifies key areas for improvement and competitive advantage, guiding strategic focus.

Weaknesses

Goodman Group's statutory results for FY24 revealed a loss of $98.9 million. This figure, while impacting the bottom line, was largely driven by significant revaluation adjustments within its extensive property portfolio.

These revaluation movements, though affecting statutory reporting, did not diminish the strength of Goodman's underlying operational performance. The company continues to demonstrate robust activity in its core business segments, highlighting a resilience in its operational profitability despite the statutory accounting impact.

Goodman Group's profitability is highly susceptible to shifts in global interest rates. For instance, a 1% increase in interest rates could significantly raise the Group's cost of capital, impacting its ability to finance new developments and acquisitions. This sensitivity is particularly pronounced given that capitalization rates, which directly influence property valuations, often move in tandem with broader interest rate trends.

Goodman Group's strategic pivot towards data centers, while promising for future growth, presents a significant challenge due to its high capital intensity. Developing these specialized facilities requires considerably more investment than traditional logistics properties, creating a substantial hurdle for expansion.

This increased capital demand necessitates robust financial strategies, as evidenced by Goodman's recent $4 billion capital raising placement. Such moves are crucial to fuel the extensive development pipeline and maintain momentum in this high-growth but capital-hungry sector.

Exposure to Global Macroeconomic Uncertainty

Goodman Group's operations are significantly influenced by global macroeconomic uncertainty, a factor that can lead to hesitations in customer decision-making within the logistics sector. This pervasive uncertainty, especially concerning trade policies and economic growth forecasts, directly impacts the demand for industrial and logistics properties.

The current economic climate, marked by persistent inflation and interest rate hikes in major economies throughout 2024 and early 2025, exacerbates market volatility. This volatility can translate into delayed leasing agreements and slower development pipelines for Goodman.

- Global Economic Slowdown Concerns: Forecasts for global GDP growth in 2024 and 2025 indicate a moderation, potentially dampening consumer spending and business investment, which are key drivers for logistics demand.

- Trade Policy Uncertainty: Ongoing geopolitical tensions and shifts in international trade agreements create unpredictability for supply chains, making businesses more cautious about expanding their logistics footprints.

- Rising Interest Rates: Central banks' efforts to combat inflation through higher interest rates increase the cost of capital for development and can impact tenant affordability for industrial space.

Dependence on Specific Property Segments

Goodman's strategic focus on industrial logistics and data centers, while currently a boon, presents a notable weakness due to its inherent concentration risk. A slowdown or adverse shift in demand within these particular real estate sectors could significantly and disproportionately affect the Group's overall financial performance.

This specialization means that Goodman's revenue streams are heavily reliant on the continued health of these specific markets. For instance, a projected global industrial property vacancy rate increase of 0.5% in 2025, according to a recent industry forecast, could directly translate to reduced rental income and asset valuations for Goodman.

- Concentration Risk: Over-reliance on logistics and data centers creates vulnerability to sector-specific downturns.

- Market Sensitivity: Performance is closely tied to demand fluctuations in these niche property segments.

- Reduced Diversification: Limited exposure to other real estate classes restricts the ability to offset sector-specific challenges.

Goodman's significant exposure to the logistics and data center sectors creates a notable concentration risk. A downturn in either of these specific markets could disproportionately impact the Group's overall financial health. This reliance makes the company particularly sensitive to shifts in demand within these specialized real estate segments.

The high capital intensity of data center development also presents a challenge, requiring substantial ongoing investment to maintain growth momentum. This necessitates robust financial planning and capital raising, as seen with their recent $4 billion placement, to support the expansive development pipeline in this capital-hungry sector.

Furthermore, Goodman's profitability is highly sensitive to global interest rate movements. A 1% increase in rates, for example, could substantially raise the cost of capital, hindering new development financing and potentially impacting property valuations as capitalization rates adjust.

What You See Is What You Get

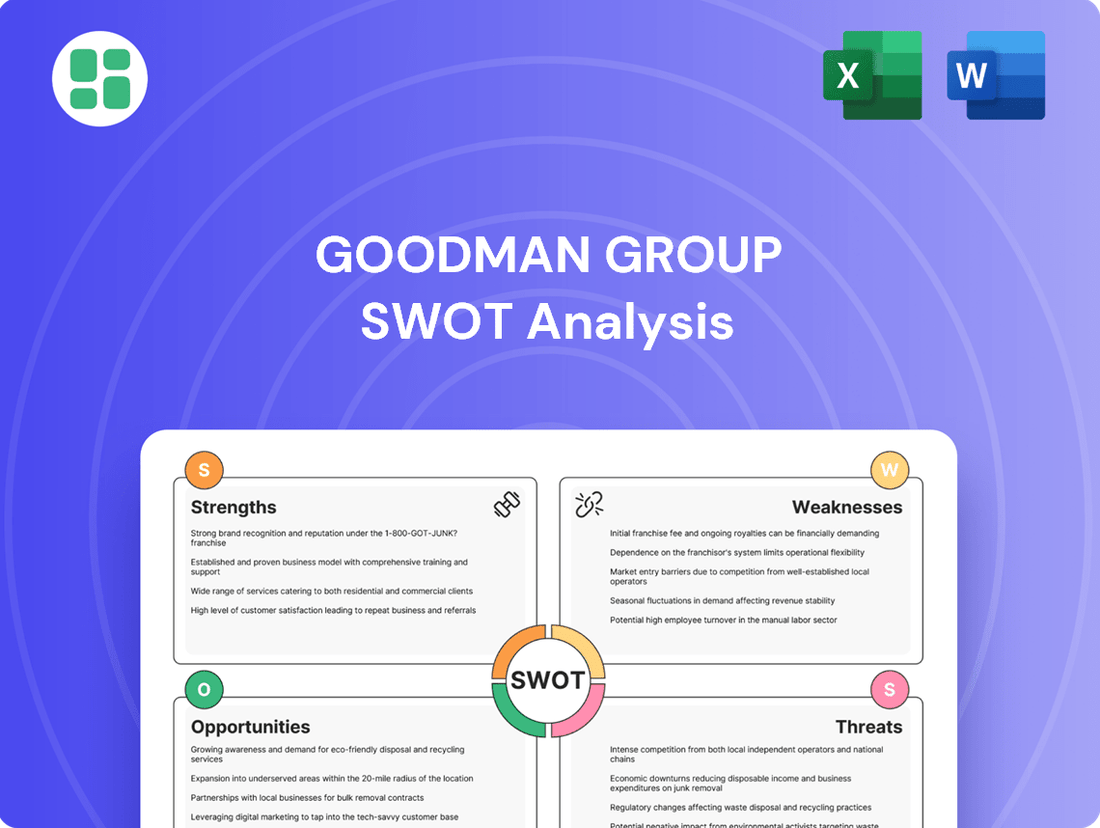

Goodman Group SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It offers a comprehensive overview of Goodman Group's Strengths, Weaknesses, Opportunities, and Threats, providing actionable insights for strategic planning.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, detailing Goodman Group's competitive landscape and internal capabilities.

Opportunities

The digital economy's rapid expansion, fueled by e-commerce, cloud services, AI, and machine learning, creates a substantial opportunity for Goodman Group. This trend is evident in the projected global data center market growth, which is expected to reach over $300 billion by 2026, indicating a strong demand for specialized infrastructure.

Goodman Group is strategically positioned to benefit from this surge by focusing on developing large-scale, high-value data centers. Their existing global power bank further strengthens their capability to meet the increasing energy demands of these critical digital hubs, aligning with the growing need for robust digital infrastructure worldwide.

The relentless growth of e-commerce is a significant tailwind for Goodman, fueling a robust demand for sophisticated logistics and warehousing spaces. This trend is particularly evident in markets like Australia, where online retail sales are projected to reach AUD 100 billion by 2025, underscoring the need for efficient distribution networks.

Businesses are heavily investing in supply chain optimization, seeking to leverage automation and advanced technologies to streamline operations. Goodman is well-positioned to capitalize on this by offering tailored, tech-enabled logistics solutions that enhance speed and reduce costs for their clients.

Goodman's strategic focus on urban infill sites presents a significant opportunity for value creation through redevelopment. These prime locations are ripe for increasing density, potentially transforming existing assets into multi-storey logistics facilities, residential units, or even data centers, thereby unlocking latent value within their substantial property holdings.

Leveraging Partnerships and Capital for Expansion

Goodman Group's robust capital position, bolstered by its capacity to secure substantial funding through strategic partnerships and equity placements, offers significant financial agility. This financial strength is crucial for capitalizing on emerging growth avenues, especially within the rapidly expanding data center sector. For instance, in FY24, Goodman reported a strong development pipeline valued at $16.5 billion, demonstrating their capacity to fund significant expansion projects.

This financial flexibility allows Goodman to actively pursue and invest in new opportunities that align with market demand, thereby driving expansion and enhancing their global presence. The Group's ability to tap into capital markets effectively, as evidenced by successful capital raisings in recent years, positions them well to fund large-scale developments and acquisitions.

- Strong Capital Position: Goodman's ability to raise significant capital provides flexibility for growth initiatives.

- Data Center Focus: Capital can be strategically deployed to expand in the high-demand data center market.

- Global Expansion: Financial resources support the widening of their international operational footprint.

- Partnership Leverage: Collaborations enable access to further funding and expertise for new projects.

Enhanced Value from Sustainable Development Practices

Goodman's proactive stance on sustainability, demonstrated by its commitment to reducing emissions and integrating renewable energy sources across its portfolio, is a significant opportunity. This focus on environmental, social, and governance (ESG) principles can unlock competitive advantages in the market.

The increasing demand for sustainable properties from both tenants and investors presents a clear avenue for enhanced value. Properties that align with ESG criteria often attract higher occupancy rates and command stronger rental growth, ultimately boosting asset valuations.

- ESG Appeal: In 2024, a significant percentage of institutional investors indicated that ESG factors heavily influence their real estate investment decisions, with a growing preference for properties with strong sustainability credentials.

- Tenant Demand: Businesses are increasingly prioritizing leased spaces that meet their own sustainability targets, leading to higher demand for green-certified buildings and potentially longer lease terms.

- Valuation Uplift: Studies in late 2024 and early 2025 have shown that sustainable buildings can achieve a valuation premium of 5-10% compared to conventional assets, reflecting lower operating costs and higher tenant appeal.

Goodman's strategic focus on urban infill sites presents a significant opportunity for value creation through redevelopment. These prime locations are ripe for increasing density, potentially transforming existing assets into multi-storey logistics facilities, residential units, or even data centers, thereby unlocking latent value within their substantial property holdings.

The digital economy's rapid expansion, fueled by e-commerce, cloud services, AI, and machine learning, creates a substantial opportunity for Goodman Group. This trend is evident in the projected global data center market growth, which is expected to reach over $300 billion by 2026, indicating a strong demand for specialized infrastructure.

Goodman's robust capital position, bolstered by its capacity to secure substantial funding through strategic partnerships and equity placements, offers significant financial agility. This financial strength is crucial for capitalizing on emerging growth avenues, especially within the rapidly expanding data center sector. For instance, in FY24, Goodman reported a strong development pipeline valued at $16.5 billion, demonstrating their capacity to fund significant expansion projects.

The increasing demand for sustainable properties from both tenants and investors presents a clear avenue for enhanced value. Properties that align with ESG criteria often attract higher occupancy rates and command stronger rental growth, ultimately boosting asset valuations.

Threats

The uncertain global economic and trade environment presents a significant threat to Goodman Group. This uncertainty can lead to delayed decision-making from customers within the logistics sector, potentially impacting the pace of new leasing agreements and development projects. Prolonged market volatility further exacerbates this risk, creating a less predictable operating landscape.

Slower global growth, a likely consequence of economic slowdowns, directly affects the demand for industrial and business space. This reduced demand can translate into lower rental income for Goodman's existing portfolio and potentially slow down the progress and profitability of its development pipeline. For instance, the IMF projected global growth to moderate to 2.9% in 2024, down from 3.0% in 2023, highlighting the prevailing economic headwinds.

Rising interest rates and shifts in capitalization rates pose a significant threat to Goodman Group. Continued increases in borrowing costs can directly impact the group's ability to finance new developments and acquisitions, potentially slowing growth. This also leads to a higher cost of capital, squeezing profit margins on new projects.

These market dynamics can negatively affect property valuations. As capitalization rates move upwards, the implied value of income-producing properties decreases, which directly impacts Goodman's Net Tangible Assets. For instance, a 0.25% increase in capitalization rates could lead to a substantial reduction in asset values across their portfolio, even if underlying rental income remains robust.

The direct consequence of these valuation pressures is a hit to Goodman's statutory profit. While operational performance might be strong, the revaluation of assets due to higher interest rates and cap rates can result in significant paper losses, impacting reported earnings for the fiscal year. This disconnect between operational strength and accounting valuation is a key challenge.

While Goodman Group enjoys the advantage of limited supply in its core industrial property and data center markets, these sectors are experiencing a significant uptick in competition. This intensified rivalry stems from a growing number of developers and Real Estate Investment Trusts (REITs) actively pursuing similar opportunities.

This heightened competition could potentially lead to downward pressure on rental growth and occupancy rates for Goodman in the long term. Furthermore, it may compress development margins as companies vie for prime locations and talent. For instance, in the industrial property sector, global investment in logistics and industrial real estate reached an estimated $200 billion in 2024, indicating a crowded investment landscape.

Geopolitical Risks and Supply Chain Disruptions

Geopolitical instability and potential trade disruptions pose a significant threat to Goodman Group. Events like the ongoing conflicts in Eastern Europe and the Middle East, coupled with shifts in global trade policies, can directly impact international supply chains. This, in turn, can affect the demand for logistics facilities, a core part of Goodman's business.

Such uncertainties can lead to reduced customer activity and heightened market uncertainty. For instance, a slowdown in global trade could mean less need for large-scale warehousing and distribution centers. This uncertainty might also slow down the commencement of new development projects and dampen leasing activity as businesses adopt a more cautious approach to expansion.

- Trade Tensions: Ongoing trade disputes, particularly between major economic blocs, can disrupt the flow of goods and impact demand for logistics infrastructure.

- Regional Conflicts: Geopolitical hotspots can lead to supply chain rerouting or slowdowns, affecting the utilization and demand for storage and distribution.

- Regulatory Changes: Unexpected changes in trade regulations or tariffs can create volatility, impacting the cost-effectiveness of global logistics networks.

Property Valuation Declines and Impact on NTA

For fiscal year 2024, Goodman Group experienced a significant $5.1 billion reduction in its total property portfolio value due to revaluation movements. This downturn directly translated to a 3.5% decrease in Net Tangible Assets (NTA) per security, impacting shareholder equity.

The persistence of negative revaluations, driven by evolving market conditions and shifts in investor sentiment, poses an ongoing threat. Such trends can continue to erode financial metrics and potentially dampen investor confidence in the group's asset base.

- Property Portfolio Decline: A $5.1 billion drop in total portfolio value for FY24.

- NTA Impact: Net Tangible Assets per security fell by 3.5%.

- Market Sensitivity: Ongoing negative revaluations threaten financial health and investor perception.

The increasing competition within Goodman's core markets presents a notable threat. As more developers and REITs target industrial and data center opportunities, rental growth and development margins could face downward pressure. Global investment in logistics real estate, for example, reached approximately $200 billion in 2024, underscoring this crowded investment landscape.

Geopolitical instability and trade disruptions also pose risks, potentially impacting supply chains and the demand for logistics facilities. For instance, shifts in global trade policies can lead to rerouting or slowdowns, affecting the utilization of storage and distribution spaces.

Market conditions, including rising interest rates and evolving capitalization rates, continue to threaten Goodman's property valuations. A 0.25% increase in cap rates could significantly reduce asset values, impacting Net Tangible Assets and potentially leading to negative statutory profits due to revaluations, as seen with a $5.1 billion reduction in Goodman's property portfolio value in FY24.

| Threat Category | Specific Risk | Impact on Goodman | Supporting Data/Trend |

|---|---|---|---|

| Market & Economic Conditions | Rising Interest Rates & Cap Rates | Increased financing costs, reduced property valuations, lower profit margins. | A 0.25% increase in cap rates can significantly decrease asset values. FY24 saw a $5.1 billion reduction in property portfolio value due to revaluations. |

| Competition | Intensified Rivalry in Industrial & Data Centers | Downward pressure on rental growth and development margins. | Global logistics real estate investment reached ~$200 billion in 2024, indicating a highly competitive environment. |

| Geopolitical Factors | Trade Tensions & Regional Conflicts | Disrupted supply chains, reduced demand for logistics facilities, slower project development. | Ongoing global conflicts and policy shifts can impact international trade flows and demand for warehousing. |

SWOT Analysis Data Sources

This Goodman Group SWOT analysis is built upon a foundation of robust data, including the company's official financial reports, comprehensive market research from reputable industry analysts, and expert commentary from seasoned professionals within the real estate and investment sectors.