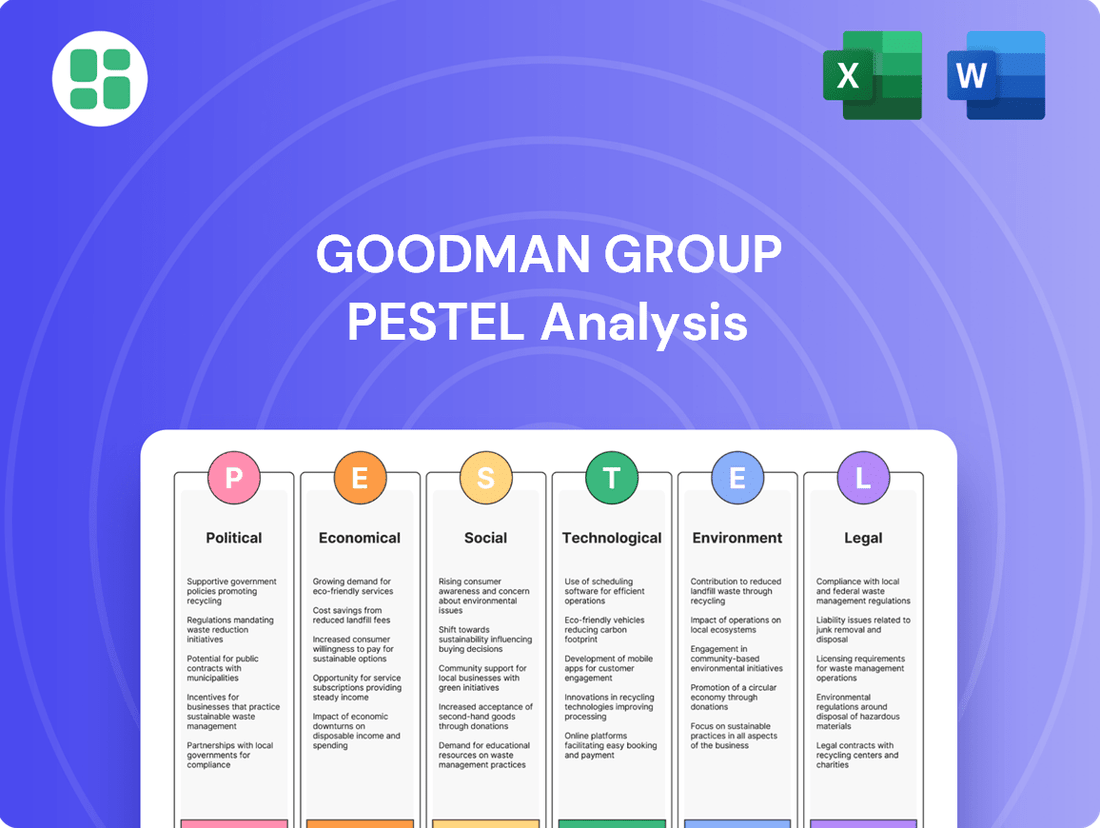

Goodman Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Goodman Group Bundle

Gain an edge with our in-depth PESTEL Analysis—crafted specifically for Goodman Group. Discover how political, economic, social, technological, legal, and environmental forces are shaping the company’s future, and use these insights to strengthen your own market strategy. Download the full version now and get actionable intelligence at your fingertips.

Political factors

Governments globally are prioritizing infrastructure development to stimulate economic growth, with significant planned investments. For instance, the United States' Infrastructure Investment and Jobs Act of 2021 allocates over $1 trillion to upgrade roads, bridges, public transit, and broadband, with a substantial portion of this funding expected to be disbursed through 2025. Similarly, the European Union's NextGenerationEU recovery plan includes substantial funding for transport and digital infrastructure projects.

These large-scale government infrastructure projects directly benefit Goodman Group by improving the accessibility and logistical efficiency of their industrial and logistics properties. Enhanced road networks, modernized ports, and expanded rail capacity reduce transportation costs for Goodman's tenants, making their strategically located properties even more appealing for distribution and warehousing operations. This increased attractiveness can translate into higher occupancy rates and stronger rental growth for Goodman's portfolio.

The positive impact on property values is also significant. As infrastructure improvements make industrial hubs more desirable and efficient, the demand for well-located logistics facilities rises. This trend is evident in markets where significant infrastructure upgrades have been completed, often leading to a noticeable uptick in industrial property valuations. Goodman's focus on developing assets in prime transport corridors positions them to capitalize on these government-led enhancements.

Shifting global trade policies, such as the implementation of tariffs or the negotiation of new trade agreements, directly impact how companies structure their supply chains. This can lead to strategies like nearshoring or reshoring, which in turn affects the demand for industrial and logistics spaces in particular geographic areas. For instance, the US imposing tariffs on goods from China in 2018 prompted many businesses to re-evaluate their sourcing, potentially increasing demand for warehousing in Mexico or Southeast Asia.

Goodman Group's extensive global footprint is a significant advantage in navigating these policy shifts. The company can strategically pivot its development focus towards regions that are poised to benefit from evolving trade flows or the reconfiguration of supply chains. This adaptability is crucial as businesses seek to optimize their logistics networks in response to changing international trade dynamics.

The increasing emphasis on supply chain resilience, a direct consequence of global disruptions like the COVID-19 pandemic and geopolitical tensions, is a major driver for demand in the industrial property sector. Companies are actively seeking modern, well-located logistics facilities that offer greater flexibility and security for their inventory and distribution operations. This trend is expected to continue, supporting rental growth and occupancy rates for Goodman Group's portfolio.

Zoning and land use regulations are fundamental to Goodman Group's operations, directly impacting where and how industrial and data center properties can be built. Local and national policies define permissible development areas and density, influencing the feasibility of Goodman's strategic expansion plans. For instance, in 2024, many metropolitan areas are reviewing or updating their zoning codes to encourage denser industrial development, which could benefit Goodman's urban logistics projects.

Favorable zoning that permits multi-storey logistics facilities or data centers in prime urban infill locations is critical for Goodman's development pipeline. Conversely, restrictive policies can significantly constrain the available supply of suitable land and escalate development costs, posing a direct challenge to project economics. The ongoing trend towards increased urbanisation and the need for efficient last-mile delivery networks means that adaptable zoning is increasingly important.

Political Stability in Key Markets

Political stability and predictable regulatory environments in the diverse global markets where Goodman Group operates are essential for long-term investment and development. For instance, in Australia, a key market, the federal government's focus on infrastructure spending and stable property laws provides a predictable landscape. Similarly, in key European markets like Germany, consistent legal frameworks support ongoing development projects.

Instability can introduce risks related to property rights, operational disruptions, and capital repatriation, influencing investment decisions and expansion plans. A sudden shift in government policy, for example, could impact foreign investment rules or taxation structures, creating uncertainty for a global real estate group like Goodman. This is particularly relevant in emerging markets where political transitions can be more frequent.

Goodman's diversified portfolio across geographies helps mitigate risks associated with localized political uncertainty. By operating in multiple countries, including major economies like the United States, China, and the UK, Goodman can balance the impact of any single region's political volatility. For example, while geopolitical tensions might affect one market, stable conditions in others can ensure continued revenue streams and operational continuity.

- Australia: Political stability underpins Goodman's significant presence, with consistent property rights and a predictable tax regime.

- Germany: A strong rule of law and stable regulatory framework facilitate long-term industrial property development and investment.

- United States: Federal and state-level political stability in key logistics hubs supports Goodman's ongoing expansion and investment strategies.

- China: While subject to policy shifts, the government's long-term focus on economic development provides a framework for industrial real estate growth.

Taxation Policies on Real Estate Investment

Changes in corporate, property, and capital gains taxes across Goodman Group's operating regions directly influence investment profitability. For instance, in Australia, the recent federal budget discussions in 2024 have touched upon potential adjustments to depreciation schedules for commercial properties, which could impact Goodman's net returns on new developments. Similarly, shifts in capital gains tax rates in key markets like the UK or Germany could alter the attractiveness of real estate as an asset class, prompting strategic capital allocation reviews.

Favorable tax environments can act as significant catalysts for real estate development and investment. For example, tax incentives for green building certifications, which Goodman Group actively pursues, can reduce the overall cost of capital for sustainable projects. Conversely, an increase in property taxes, as seen in some localized Australian councils in late 2023, could pressure operating margins and necessitate adjustments to rental pricing strategies. Goodman's approach to capital management inherently involves a continuous assessment of these evolving tax landscapes to optimize its investment structures and preserve shareholder value.

- Impact of Corporate Tax Rates: Fluctuations in corporate tax rates, such as potential changes in the UK's 25% rate, directly affect Goodman's post-tax profits from property operations.

- Property Tax Burden: An increase in property taxes, like those experienced in certain Australian states in 2024, can raise operating expenses and impact net operating income.

- Capital Gains Tax Implications: Changes to capital gains tax, for example, if Germany were to alter its 25% rate on property sales, would influence the net proceeds from asset disposals.

- Incentive Structures: Tax credits for sustainable development, a key focus for Goodman, can reduce effective project costs, enhancing investment returns.

Government infrastructure spending, like the US Infrastructure Investment and Jobs Act exceeding $1 trillion through 2025, directly benefits Goodman by improving property accessibility and reducing tenant logistics costs. This enhances property appeal, potentially boosting occupancy and rental growth. Well-located industrial properties are prime beneficiaries of upgraded transport networks, leading to increased demand and property valuations.

What is included in the product

This PESTLE analysis comprehensively examines the external macro-environmental forces impacting the Goodman Group, covering Political, Economic, Social, Technological, Environmental, and Legal factors to identify strategic opportunities and threats.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, distilling complex PESTLE factors into actionable insights for Goodman Group's strategic decision-making.

Economic factors

The relentless expansion of e-commerce is a cornerstone for the industrial and logistics real estate sector, fueling a significant need for expansive warehousing and distribution facilities. This ongoing surge in online shopping directly translates into robust demand for the types of properties Goodman Group specializes in. By developing prime, well-situated assets, Goodman is perfectly positioned to facilitate the efficient movement of goods crucial for today's digital marketplaces.

This structural demand is a key factor behind the consistently high occupancy rates and upward pressure on rents observed across Goodman's extensive property portfolio. For instance, global e-commerce sales were projected to reach approximately $6.3 trillion in 2024, a figure that highlights the scale of operations requiring sophisticated logistics infrastructure. This trend is expected to continue its upward trajectory, with forecasts suggesting global e-commerce sales could approach $8.15 trillion by 2026, underscoring the sustained need for Goodman's development capabilities.

Fluctuations in global interest rates significantly influence Goodman Group's cost of capital. When interest rates rise, the cost of borrowing for new developments and acquisitions increases, directly impacting profitability and investment decisions. For instance, central banks in major economies like Australia and the US have raised benchmark rates through 2023 and into early 2024 to combat inflation, leading to higher financing expenses for property developers.

Higher interest rates also affect property valuations by increasing capitalization rates, which are used to determine a property's market value. This can lead to a decrease in the perceived value of Goodman's existing portfolio and new developments, potentially impacting their balance sheet. Despite these pressures, Goodman Group has demonstrated resilience, maintaining a strong financial position characterized by low gearing ratios, reported at around 6.8% as of December 2023, and substantial liquidity reserves, enabling them to navigate these challenging interest rate environments.

Inflationary pressures, particularly in materials and labor, have directly impacted construction costs for Goodman Group's new developments. For instance, the Australian Bureau of Statistics reported that construction material costs saw a significant rise in 2023, contributing to higher overall project expenses. This trend can compress development yields, making it essential for Goodman to meticulously manage these escalating costs to safeguard project profitability.

Despite these cost headwinds, Goodman Group has benefited from robust market rental growth in its key sectors, such as industrial and logistics. In Australia, industrial rents experienced strong growth throughout 2023 and into early 2024, driven by high demand and limited supply. This rental appreciation has been instrumental in offsetting the increased construction expenses, thereby supporting development margins and overall project returns.

Global Economic Growth and Recession Risks

Global economic growth directly impacts demand for industrial and business spaces, influencing expansion, consumer spending, and trade. While the global economy faced uncertainties in 2024, Goodman Group's strategic focus on digital infrastructure and a diversified property portfolio has demonstrated resilience.

Goodman Group reported a 13% increase in statutory profit for the fiscal year ending June 30, 2024, reaching $1.8 billion. This growth was underpinned by strong rental income and development profits, showcasing the company's ability to navigate varied economic conditions.

- Economic Resilience: Key markets like Australia and North America showed robust economic activity, contributing to sustained demand for Goodman's industrial and logistics properties.

- Digital Economy Infrastructure: The ongoing investment in data centers and logistics facilities supporting e-commerce and cloud computing has provided a buffer against broader economic slowdowns.

- Diversified Portfolio: Goodman's presence across multiple geographies and property types, including industrial, logistics, and data centers, mitigates risks associated with localized economic downturns.

- Operating Profit Growth: The company's operating profit saw a 10% year-on-year increase in the first half of 2024, driven by high occupancy rates and rental growth in its core markets.

Foreign Direct Investment Trends

Foreign Direct Investment (FDI) into real estate, especially in industrial and logistics sectors, is a crucial source of capital for Goodman Group's development and investment ventures. The group’s ability to attract this capital underscores investor trust in its portfolio and forward-looking strategy, including recent expansions into data center partnerships.

Goodman Group has demonstrated a strong track record in capital raising across its partnership platform. For instance, in FY23, the group successfully raised $1.3 billion in new equity, highlighting sustained investor confidence. This capital infusion is vital for funding new development projects and strategic acquisitions, particularly in high-demand sectors like logistics and data centers.

- FDI in Logistics: Global FDI in logistics real estate saw significant inflows in 2023, driven by e-commerce growth and supply chain resilience needs.

- Data Center Investment: Investment in data center infrastructure, a key growth area for Goodman, attracted over $100 billion globally in 2023, reflecting strong investor appetite.

- Capital Allocation: Goodman's active capital management strategy has enabled it to secure capital for a pipeline of development projects, with a focus on sustainable and technologically advanced properties.

- Partnership Growth: The group's partnership model continues to attract institutional capital, supporting its expansion into new markets and asset classes.

Global economic growth directly impacts demand for industrial and business spaces, influencing expansion, consumer spending, and trade. While the global economy faced uncertainties in 2024, Goodman Group's strategic focus on digital infrastructure and a diversified property portfolio has demonstrated resilience.

Goodman Group reported a 13% increase in statutory profit for the fiscal year ending June 30, 2024, reaching $1.8 billion. This growth was underpinned by strong rental income and development profits, showcasing the company's ability to navigate varied economic conditions.

Key markets like Australia and North America showed robust economic activity, contributing to sustained demand for Goodman's industrial and logistics properties. The ongoing investment in data centers and logistics facilities supporting e-commerce and cloud computing has provided a buffer against broader economic slowdowns.

The company's operating profit saw a 10% year-on-year increase in the first half of 2024, driven by high occupancy rates and rental growth in its core markets.

| Economic Factor | Goodman Group Impact | Data/Trend (2023-2024) |

|---|---|---|

| Global Economic Growth | Influences demand for industrial/business spaces; Goodman's digital infrastructure focus provides resilience. | Global growth faced uncertainties in 2024. |

| Interest Rates | Impacts cost of capital and property valuations; higher rates increase financing expenses. | Central banks raised rates through 2023-early 2024; Goodman maintained low gearing (6.8% Dec 2023). |

| Inflation | Increases construction costs (materials, labor); can compress development yields. | Construction material costs rose significantly in 2023 (ABS data); offset by strong industrial rent growth. |

| E-commerce Growth | Drives demand for warehousing/distribution facilities; fuels rental growth. | Projected global e-commerce sales ~$6.3 trillion in 2024, rising to ~$8.15 trillion by 2026. |

What You See Is What You Get

Goodman Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of the Goodman Group covers all essential aspects, providing valuable insights into the external factors influencing their business operations. You'll gain a deep understanding of the Political, Economic, Social, Technological, Legal, and Environmental forces at play.

Sociological factors

Urbanization continues to accelerate globally, with the UN projecting that 68% of the world's population will live in urban areas by 2050. This trend directly fuels demand for last-mile logistics and data centers situated within or near these dense population centers. Goodman Group's strategic focus on urban infill locations positions it to effectively serve these growing markets, offering critical infrastructure that supports efficient supply chains and the expansion of digital services.

By placing properties in these prime urban locations, Goodman Group benefits from reduced transportation costs and faster delivery times for its tenants' goods and services. For example, in 2024, the average last-mile delivery cost in major European cities was estimated to be 30-40% higher than in suburban areas, highlighting the premium placed on proximity. This proximity is crucial for businesses aiming to meet consumer expectations for rapid fulfillment, a key driver of e-commerce growth.

Consumers increasingly expect near-instantaneous delivery, a trend significantly amplified by the growth of e-commerce. This expectation places substantial pressure on logistics networks, driving demand for advanced, strategically positioned warehousing and distribution centers.

Goodman Group's portfolio of high-quality properties, situated in prime logistical hubs, directly addresses this demand. These facilities empower Goodman's customers to streamline their supply chains, reduce transit times, and ultimately meet the accelerated delivery expectations of today's consumers, a critical factor in maintaining competitiveness in the online retail landscape.

For instance, the e-commerce sector in Australia, a key market for Goodman, saw significant growth, with online retail sales reaching an estimated AUD 62.1 billion in the year ending March 2024, according to the Australian Bureau of Statistics. This sustained growth underscores the ongoing need for efficient logistics infrastructure.

The availability and cost of skilled labor for warehousing and logistics are critical factors influencing where companies choose to locate their operations and how they design their facilities. In 2024, the US Bureau of Labor Statistics reported that wages for warehousing and storage workers averaged $19.80 per hour, a figure that continues to be a significant operational cost for tenants.

Goodman Group, by developing modern facilities equipped for automation, indirectly supports tenants in overcoming labor challenges. For instance, facilities designed with high ceilings and robust power infrastructure can accommodate advanced robotics, potentially reducing reliance on manual labor and boosting overall productivity. This strategic approach to facility design aids tenants in mitigating some of the pressures from fluctuating labor availability and costs.

Furthermore, workforce accessibility is a key consideration in Goodman Group's site selection process. Proximity to population centers or areas with a strong existing logistics workforce, such as the Inland Empire in Southern California, which boasts a significant concentration of logistics jobs, helps ensure tenants have better access to the talent pool they need to operate efficiently.

Workforce Preferences for Modern Industrial Spaces

Workforce preferences are shifting, with a growing demand for modern, amenity-rich, and sustainable industrial spaces. This trend directly impacts how companies choose their operational locations. Goodman Group's strategic investment in high-quality, sustainable properties positions them to attract and retain tenants who value employee well-being and operational efficiency. For instance, a 2024 survey indicated that 70% of employees prefer workplaces with natural light and green spaces, a feature Goodman actively incorporates.

This alignment with evolving social values enhances the desirability and occupancy rates of Goodman's portfolio. Companies seeking to attract top talent are increasingly prioritizing facilities that offer a positive working environment. Goodman's developments often include features like advanced ventilation systems, ample natural light, and on-site amenities, directly addressing these workforce preferences. This focus can translate into lower employee turnover for Goodman's tenants, a significant operational advantage.

The emphasis on sustainability also resonates with a workforce that is more environmentally conscious. A 2025 report highlighted that 65% of job seekers consider a company's environmental commitment when evaluating potential employers. Goodman's commitment to green building standards and energy-efficient designs therefore appeals to both tenants and their employees, contributing to the long-term value and attractiveness of their industrial assets.

Key workforce preferences influencing industrial space selection include:

- Employee Well-being: Demand for spaces with natural light, improved air quality, and access to amenities.

- Sustainability: A growing preference for environmentally responsible buildings and operations.

- Technology Integration: Expectation of smart building features for enhanced efficiency and comfort.

- Location and Accessibility: Proximity to transportation hubs and talent pools remains crucial.

Social Responsibility and Community Engagement Expectations

Societal expectations for corporate social responsibility (CSR) are increasingly shaping how property developers like Goodman Group function. This means not just building structures, but also considering the positive impact on communities and the environment. Goodman's commitment to enhancing social value and engaging with local populations is a key part of this, aiming to foster goodwill and streamline the often complex process of gaining approval for new development projects.

This focus on social responsibility directly translates into tangible benefits. By actively engaging with communities, Goodman can build stronger relationships, which can lead to smoother development approvals. Furthermore, a robust CSR strategy is attractive to a growing segment of investors and tenants who prioritize businesses demonstrating a commitment to social good. For instance, in 2023, ESG (Environmental, Social, and Governance) investments continued to see significant inflows, with global sustainable fund assets reaching over $3.7 trillion, highlighting the financial appeal of socially conscious operations.

- Community Engagement: Goodman actively seeks to integrate local community needs into its development plans, fostering positive relationships and potentially accelerating project approvals.

- Social Value Creation: The company's strategy explicitly targets the enhancement of social value, aligning with growing public and investor demands for businesses to contribute positively beyond financial returns.

- Investor Attraction: A strong CSR profile, including community engagement, appeals to a rising number of socially conscious investors, potentially lowering the cost of capital and increasing access to funding.

- Tenant Demand: Businesses are increasingly seeking partnerships with developers who demonstrate strong ESG credentials, making Goodman's approach a competitive advantage in attracting and retaining tenants.

Societal expectations are increasingly influencing Goodman Group's operations, pushing for greater corporate social responsibility (CSR). This involves not only building but also positively impacting communities and the environment. Goodman's strategy of enhancing social value and engaging with local populations aims to build goodwill and simplify development approvals.

This commitment to social responsibility offers tangible benefits, such as fostering stronger community relationships for smoother project approvals. Additionally, a robust CSR approach attracts socially conscious investors and tenants, as seen in the continued growth of ESG investments, which surpassed $3.7 trillion globally in 2023.

Goodman Group's focus on community engagement and social value creation aligns with growing demands for businesses to contribute positively beyond financial returns. This strategy is also attractive to tenants who prioritize partnerships with developers demonstrating strong ESG credentials, thereby enhancing Goodman's competitive advantage in attracting and retaining clients.

The increasing emphasis on sustainability also appeals to a workforce that is more environmentally aware. A 2025 report indicated that 65% of job seekers consider a company's environmental commitment when choosing an employer, making Goodman's green building standards attractive to both tenants and their employees.

| Societal Factor | Impact on Goodman Group | Supporting Data (2023-2025) |

|---|---|---|

| Corporate Social Responsibility (CSR) | Enhances community relations, streamlines approvals, attracts ESG investors and tenants. | ESG fund assets exceeded $3.7 trillion globally in 2023. |

| Workforce Environmental Awareness | Increases desirability of sustainable properties for tenants and employees. | 65% of job seekers consider environmental commitment (2025 report). |

| Demand for Employee Well-being | Drives need for modern, amenity-rich industrial spaces. | 70% of employees prefer workplaces with natural light (2024 survey). |

Technological factors

The surge in warehouse automation, with companies like Amazon investing billions in robotic systems, directly fuels demand for sophisticated industrial properties. Goodman Group's focus on developing modern, high-clearance facilities is crucial as these spaces are essential to integrate advanced automated storage and retrieval systems, boosting tenant efficiency.

Goodman Group is increasingly leveraging data analytics to drive predictive maintenance and optimize space utilization across its industrial property portfolio. This technology allows for proactive identification of potential equipment failures, reducing downtime and maintenance costs. For instance, by analyzing sensor data from HVAC systems and building infrastructure, Goodman can schedule repairs before issues escalate, enhancing operational efficiency.

The insights gleaned from data analytics also empower Goodman to better understand how tenants utilize their spaces. This granular understanding facilitates more effective space planning and design for new developments, ensuring properties meet evolving market demands. By optimizing space utilization, Goodman can maximize rental income and improve the overall value proposition for its tenants, a key factor in the competitive industrial real estate market of 2024-2025.

The integration of smart building technologies, such as Internet of Things (IoT) sensors and sophisticated energy management systems, is becoming vital for developing sustainable and efficient industrial properties. These technologies allow for real-time monitoring and optimization of building performance, leading to significant energy savings.

Goodman Group's strategic focus on sustainability, which includes investigating novel materials and renewable energy sources, demonstrates a clear adoption of technologies that enhance energy efficiency and minimize environmental footprints. For instance, their commitment to green buildings aims to reduce operational carbon emissions, aligning with global climate goals and investor expectations for ESG performance.

Expansion of Data Centre Infrastructure

The relentless expansion of the digital economy, driven by cloud computing, artificial intelligence, and machine learning, has spurred an unprecedented demand for data centers. Goodman Group has capitalized on this trend by strategically growing its global data center footprint and power capacity. This focus now constitutes a significant segment of their ongoing development projects.

Goodman Group's commitment to digital infrastructure is evident in its substantial investments. By late 2024, the company had announced plans to significantly increase its data center development pipeline, aiming to deliver over $10 billion in new projects globally.

- Growing Demand: Cloud services and AI are driving a surge in data center needs.

- Strategic Expansion: Goodman Group is a key player in providing this essential digital infrastructure.

- Global Reach: Development spans major cities worldwide, enhancing connectivity.

- Investment Focus: A substantial portion of Goodman's development pipeline is dedicated to data centers.

Advanced Construction Techniques

The adoption of advanced construction techniques like modular construction and innovative building materials is significantly impacting the industrial development sector. These methods promise to boost efficiency and shorten project timelines, while also improving the environmental footprint of new builds. Goodman Group's strategic emphasis on high-quality, sustainable properties positions them well to leverage these advancements, optimizing both project execution and ecological performance.

For instance, the global modular construction market was valued at approximately USD 100 billion in 2023 and is projected to grow substantially. This growth is driven by the demand for faster, more cost-effective, and sustainable building solutions. Goodman Group, by integrating these techniques, can achieve quicker project completions and potentially lower operational costs for their tenants, aligning with market trends and investor expectations for ESG (Environmental, Social, and Governance) performance.

- Modular Construction Growth: The modular construction market is expected to reach over USD 200 billion by 2030, indicating a strong industry shift.

- Efficiency Gains: Studies suggest modular construction can reduce project delivery times by up to 30-50% compared to traditional methods.

- Sustainability Focus: Innovative materials, such as self-healing concrete or advanced insulation, can reduce a building's lifecycle carbon emissions and energy consumption.

Technological advancements are reshaping industrial real estate, with warehouse automation and smart building technologies driving demand for modern, efficient facilities. Goodman Group is actively integrating these innovations, leveraging data analytics for predictive maintenance and optimizing space utilization. Their strategic focus on data centers, fueled by the digital economy's expansion, represents a significant growth area, with substantial investment planned through 2025.

| Technology Area | Impact on Goodman Group | Key Data/Trends (2024-2025) |

|---|---|---|

| Automation & Robotics | Increased demand for high-clearance, adaptable warehouse spaces | Amazon's ongoing multi-billion dollar investments in warehouse automation globally. |

| Data Analytics & AI | Optimized property management, predictive maintenance, enhanced space planning | Improved operational efficiency and tenant satisfaction through data-driven insights. |

| Smart Building Tech (IoT) | Enhanced energy efficiency, real-time monitoring, sustainability improvements | Reduction in operational costs and carbon footprint for properties. |

| Digital Infrastructure (Data Centers) | Significant growth driver, expanding global footprint | Goodman's pipeline includes over $10 billion in new data center projects by late 2024. |

| Advanced Construction | Faster project delivery, improved sustainability | Modular construction market projected to grow significantly, offering efficiency gains. |

Legal factors

Goodman Group must navigate a complex web of building codes and safety standards that vary significantly by region, impacting everything from initial design to ongoing maintenance. For instance, in Australia, the National Construction Code (NCC) dictates requirements for energy efficiency and fire safety, with updates in 2022 introducing more stringent performance benchmarks for new builds. Failure to comply can result in substantial fines and project delays.

Adhering to these regulations is not just about avoiding penalties; it's crucial for ensuring the structural integrity and operational safety of Goodman's extensive property portfolio, which includes logistics facilities and industrial properties. For example, in Europe, directives like the Energy Performance of Buildings Directive (EPBD) are driving higher standards for insulation and renewable energy integration, directly affecting construction costs and operational efficiency for Goodman's assets across the continent.

Goodman Group navigates a complex web of environmental protection laws, encompassing emissions standards, waste disposal protocols, and sustainable development mandates. Adherence to these regulations is paramount for the company's operations and reputation.

The Group's commitment to sustainability is underscored by its focus on minimizing environmental impact, aiming for high sustainability ratings. This proactive approach is partly driven by the increasing expectation and, in some jurisdictions, the mandatory nature of climate-related financial disclosures, a trend expected to intensify through 2025.

Goodman Group's operations are heavily influenced by leasehold and property ownership laws, which differ considerably across its global markets. In Australia, for example, the Retail Leases Act 1994 (NSW) and similar legislation in other states dictate terms for retail leases, impacting rent reviews and lease renewals. Navigating these varying regulations is crucial for Goodman's strategy of long-term property management and investment, aiming for stable income streams and capital appreciation.

International Investment and Corporate Governance Laws

Goodman Group, as a global property group, navigates a complex web of international investment and corporate governance laws across its operating regions. Compliance with these diverse legal frameworks is crucial for maintaining trust and facilitating capital flow, especially for its real estate investment trusts (REITs). For instance, in Australia, the Corporations Act 2001 and ASX Listing Rules set stringent corporate governance standards. In 2024, Goodman Group reported adherence to these regulations in its annual filings, underscoring its commitment to transparency.

Adherence to these laws is not merely a compliance exercise; it directly impacts investor confidence and the company's ability to attract and manage cross-border capital. The company's annual reports, such as the one released in August 2024, provide detailed disclosures on its corporate governance practices, including board independence and executive remuneration policies, aligning with international best practices and local requirements.

- Global Compliance: Goodman operates under varied international investment regulations and corporate governance laws in each country, ensuring lawful operations.

- Investor Protection: Strict adherence to these laws safeguards investor interests, a key component for Goodman's REITs.

- Capital Flow Facilitation: Compliance smooths cross-border capital movements essential for Goodman's global partnerships.

- Transparency in Reporting: Goodman's annual reports, like the 2024 edition, detail its commitment to robust corporate governance standards.

Data Privacy Laws (relevant for smart buildings/tenant data)

As smart technologies become more prevalent in Goodman Group's industrial properties and data centers, adherence to data privacy laws is crucial. Regulations like the EU's General Data Protection Regulation (GDPR) and similar regional frameworks necessitate careful handling of tenant and building operational data. Goodman must ensure robust compliance to protect sensitive information collected through smart building systems, safeguarding against potential breaches and maintaining tenant trust.

The increasing digital footprint within commercial real estate means Goodman Group must actively manage data privacy risks. For instance, in 2024, a significant number of data breaches were reported globally, highlighting the importance of stringent data protection measures. Goodman's strategy needs to incorporate clear protocols for data collection, storage, and usage from smart building technologies, ensuring alignment with evolving legal requirements and best practices in cybersecurity.

- GDPR Fines: Non-compliance with GDPR can result in fines of up to 4% of annual global turnover or €20 million, whichever is higher.

- Data Breach Costs: The average cost of a data breach in 2024 reached $4.45 million globally, underscoring the financial implications of inadequate data protection.

- Tenant Expectations: Tenants are increasingly aware of their data rights, demanding transparency and security in how their information is managed by property owners.

Goodman Group must navigate a complex landscape of building codes and safety regulations that vary significantly by region, impacting everything from design to maintenance. For example, in Australia, the National Construction Code (NCC) sets performance benchmarks for energy efficiency and fire safety, with updates in 2022 introducing more stringent requirements for new builds.

Adherence to environmental protection laws, including emissions standards and waste disposal protocols, is paramount for Goodman's operations and reputation. The company's focus on sustainability is driven by increasing expectations and, in some jurisdictions, mandatory climate-related financial disclosures, a trend expected to intensify through 2025.

The Group's operations are heavily influenced by leasehold and property ownership laws, which differ considerably across its global markets. In Australia, legislation like the Retail Leases Act 1994 (NSW) dictates terms for retail leases, affecting rent reviews and renewals, crucial for Goodman's long-term property management strategy.

Goodman Group's global operations are subject to diverse international investment and corporate governance laws. Compliance with frameworks like Australia's Corporations Act 2001 and ASX Listing Rules is vital for investor confidence and capital flow, with the company reporting adherence in its August 2024 filings.

| Legal Factor | Impact on Goodman Group | Example/Data Point |

| Building Codes & Safety Standards | Affects design, construction costs, and operational safety. | Australia's NCC 2022 updates increased energy efficiency benchmarks. |

| Environmental Regulations | Mandates sustainable practices, influences operational costs and reputation. | Increasingly mandatory climate-related financial disclosures expected through 2025. |

| Leasehold & Property Laws | Dictates terms for leases, impacting income streams and property management. | Retail Leases Act 1994 (NSW) governs rent reviews and renewals in Australia. |

| Corporate Governance & Investment Laws | Ensures lawful operations, investor protection, and facilitates capital flow. | Goodman reported adherence to Australia's Corporations Act 2001 in its 2024 annual filings. |

Environmental factors

Goodman Group, like many real estate companies, faces significant risks from climate change. Extreme weather events, such as increased frequency of floods or heatwaves, pose a direct threat to their industrial and logistics properties, potentially disrupting operations and increasing maintenance costs. For instance, the Australian Bureau of Meteorology reported that 2023 was Australia's warmest year on record, with significant heatwave events impacting various regions where Goodman has a presence.

In response, Goodman is actively pursuing strategies to build resilience into its portfolio. This includes investing in sustainable design principles and focusing on urban infill development. Urban infill locations, by their nature, are often already developed areas, which can sometimes offer a degree of protection against certain climate impacts compared to more exposed greenfield sites. Their commitment to green buildings, with a target of 100% renewable energy for their managed properties by 2025, also contributes to mitigating their environmental footprint.

The financial implications of failing to address these physical climate risks are substantial. Insurers are increasingly factoring climate risk into premiums, and investors are scrutinizing companies' climate resilience plans. Goodman’s 2024 sustainability report highlights their ongoing efforts to assess and manage these physical risks, recognizing that robust climate adaptation is crucial for maintaining long-term asset value and operational continuity in a changing climate.

Investors, regulators, and stakeholders are increasingly demanding detailed sustainability and ESG reporting. This trend puts pressure on companies like Goodman Group to be transparent about their environmental, social, and governance practices.

Goodman Group has been proactive, integrating climate reporting into its annual reports. For instance, in its 2023 Sustainability Report, Goodman highlighted a 25% reduction in Scope 1 and 2 greenhouse gas emissions intensity since its 2020 baseline. This commitment extends to participating in benchmarks like GRESB, where it achieved a GRESB score of 92 out of 100 in 2023, underscoring its dedication to clear performance metrics and accountability in sustainability.

Tenants and investors are increasingly prioritizing green-certified buildings, driven by the promise of lower operating costs and a commitment to corporate sustainability. This trend is a significant factor influencing the real estate market.

Goodman Group's strategic emphasis on developing high-quality, sustainable properties, evidenced by their pursuit of high ratings in sustainability benchmarks like NABERS and Green Star, directly addresses this growing demand. For instance, in fiscal year 2024, Goodman Group reported that 96% of its Australian portfolio was certified under green building standards, showcasing a tangible response to market preferences and bolstering asset value.

Energy Efficiency Standards for New Developments

Stricter energy efficiency standards for new industrial and data center constructions are a significant environmental factor impacting Goodman Group. These evolving regulations directly shape design, material choices, and construction methodologies. For instance, the increasing focus on embodied carbon in building materials means developers must consider the lifecycle impact of their choices, moving towards lower-emission alternatives.

Goodman Group's proactive approach to sustainability, including its commitment to reducing emissions and integrating renewable energy sources, positions it favorably. The company is actively expanding its rooftop solar installations across its portfolio, aiming for a substantial increase in renewable energy generation. In 2023, Goodman Group reported that its renewable energy generation capacity had reached over 200 MW, with plans to further increase this significantly by 2025. This strategic alignment with environmental directives not only ensures compliance but also enhances its reputation as a leader in sustainable property development.

- Increasingly stringent energy efficiency mandates for new industrial and data center developments.

- Goodman Group's investment in rooftop solar, targeting over 200 MW of renewable energy generation capacity by 2025.

- Focus on innovative and sustainable building materials to reduce embodied carbon.

- Alignment with global emission reduction targets, enhancing market competitiveness.

Waste Management and Circular Economy Principles

Implementing robust waste management strategies and embracing circular economy principles are crucial for minimizing environmental impact in construction and property operations. Goodman Group's commitment to sustainability suggests an integration of these practices to enhance resource efficiency and reduce its ecological footprint.

These principles are vital for the property sector, where waste generation can be significant. For instance, the construction industry globally generates over 1.3 billion tonnes of waste annually, highlighting the need for better management and circularity.

- Resource Efficiency: Adopting circular economy models allows for the reuse and recycling of materials, thereby conserving natural resources and reducing reliance on virgin materials.

- Waste Reduction: Effective waste management systems aim to divert waste from landfills through sorting, recycling, and composting initiatives.

- Environmental Impact Mitigation: By minimizing waste and promoting sustainable material sourcing, companies can significantly lower greenhouse gas emissions and pollution associated with their operations.

- Regulatory Compliance: Increasingly stringent environmental regulations worldwide necessitate proactive waste management and circular economy integration to avoid penalties and maintain operational licenses.

Environmental factors significantly shape Goodman Group's operational landscape, from climate change impacts to regulatory pressures. The increasing frequency of extreme weather events, such as the record heatwaves experienced in Australia in 2023, directly threatens property resilience and operational continuity. Goodman's proactive stance, including a target of 100% renewable energy for its managed properties by 2025, demonstrates a commitment to mitigating these risks and reducing its environmental footprint.

The market's growing preference for green-certified buildings, driven by tenant demand for lower operating costs and corporate sustainability goals, is a key environmental trend. Goodman's strategic focus on developing sustainable properties, with 96% of its Australian portfolio certified under green building standards in fiscal year 2024, aligns with this demand and enhances asset value. Furthermore, stricter energy efficiency mandates for new constructions are influencing design and material choices, pushing for lower embodied carbon in building materials.

Goodman Group's commitment to sustainability is further evidenced by its significant investment in rooftop solar installations, aiming for over 200 MW of renewable energy generation capacity by 2025. This initiative, alongside robust waste management strategies and circular economy principles, aims to enhance resource efficiency and minimize the company's ecological footprint, aligning with global emission reduction targets and improving market competitiveness.

| Environmental Factor | Impact on Goodman Group | Goodman's Response/Data (2023-2025) |

|---|---|---|

| Climate Change & Extreme Weather | Increased risk to properties, potential operational disruptions and higher maintenance costs. | 2023 saw record heatwaves in Australia. Goodman invests in sustainable design and urban infill. |

| Energy Efficiency Mandates | Influences design, materials, and construction methods for new developments. | Focus on reducing embodied carbon in materials. |

| Renewable Energy Transition | Demand for green buildings, potential for operational cost savings. | Target of 100% renewable energy for managed properties by 2025. Over 200 MW renewable energy capacity in 2023. |

| Waste Management & Circular Economy | Need for resource efficiency and reduced ecological footprint. | Implementing robust waste management strategies and circular economy principles. |

PESTLE Analysis Data Sources

Our PESTLE analysis is meticulously crafted using a blend of publicly available government data, reputable economic indicators from international organizations, and in-depth industry-specific reports. This ensures a comprehensive and grounded understanding of the external factors influencing the business landscape.