Goodman Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Goodman Group Bundle

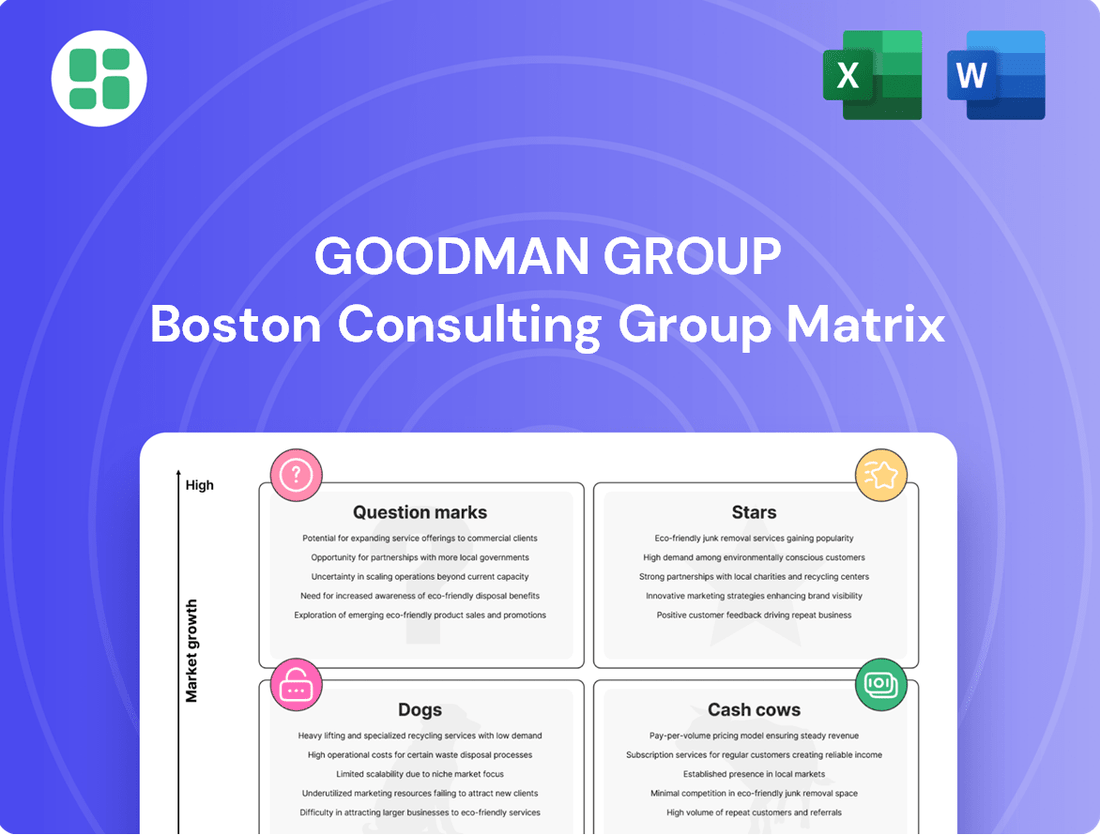

Uncover the strategic positioning of the Goodman Group with our comprehensive BCG Matrix analysis. See which of their offerings are market leaders (Stars), reliable profit generators (Cash Cows), potential growth areas (Question Marks), or underperforming assets (Dogs).

This preview offers a glimpse into the powerful insights the full BCG Matrix provides. Get the complete report to unlock detailed quadrant placements, actionable strategies, and a clear roadmap for optimizing your investment and product portfolio.

Don't miss out on the critical data that drives smart business decisions. Purchase the full BCG Matrix today and gain the competitive edge you need to thrive in today's dynamic market.

Stars

Goodman Group's aggressive expansion into data centre developments, highlighted by a 5.0 GW global power bank across 13 major cities, firmly places this segment as a Star. These ventures are strategically targeting the burgeoning digital economy and the rapidly growing AI sector.

Projects with estimated end values exceeding $10 billion, and a significant portion of work-in-progress (WIP) dedicated to data centres (over 50% by March 2025), underscore this growth. Goodman's dual offering of powered shell and fully fitted turnkey solutions positions them as a key player in this expanding market.

Prime Urban Logistics Hubs represent a Star in Goodman Group's BCG Matrix. The company's strategy of developing multi-storey logistics facilities in sought-after urban areas with low vacancy rates is a key driver of this classification.

These strategically positioned assets are crucial for meeting the growing demand for efficient last-mile delivery and enhancing supply chain resilience. As of December 2024, these hubs boasted impressive occupancy rates of 97.1%, coupled with robust rental growth, underscoring their strong market performance.

The development of these high-intensity use properties in areas where land is scarce highlights Goodman's leadership and competitive advantage in the urban logistics sector.

Goodman Group's development pipeline is a key driver of its success, showcasing impressive profitability. As of March 2025, their work in progress (WIP) stood at a substantial $13.7 billion, with an anticipated yield on cost of 6.7% and new commencements at 6.6%. This strong profitability from development activities is a significant positive indicator.

The company's ability to secure pre-commitments for 60% of its WIP highlights the market's confidence in Goodman's capacity to deliver high-value assets that align with demand. This robust pre-commitment rate is a testament to their strategic foresight and execution capabilities.

Furthermore, the expectation for development earnings to significantly contribute in the latter half of fiscal year 2025 reinforces the strength of this segment. This suggests a well-managed development cycle and a clear path to realizing value from their ongoing projects.

Strategic Capital Raising for Growth

Goodman Group's strategic capital raising demonstrates a proactive approach to growth, particularly in the burgeoning data center sector. Their $4.0 billion equity raise in early 2025 is a significant move to fund expansion in this critical area.

This substantial capital injection directly supports Goodman's ambition to accelerate its investment and development programs, solidifying its position as a leader in digital infrastructure. The company is clearly focused on meeting the increasing global demand for data storage and AI-enabled facilities.

- Strategic Focus: Targeting high-growth data center opportunities.

- Capital Infusion: $4.0 billion equity raise in early 2025.

- Growth Acceleration: Funding to speed up investment and development activities.

- Market Position: Enhancing leadership in digital infrastructure to meet escalating demand.

Integrated 'Own+Develop+Manage' Model

Goodman Group's integrated 'Own+Develop+Manage' model is a significant strength, particularly its profitable development segment. This approach allows them to oversee the entire asset lifecycle, from initial identification to ongoing management, ensuring consistent quality and long-term value creation.

- Integrated Model Strength: Goodman's ability to own, develop, and manage properties provides end-to-end control and value capture.

- Development Profitability: The development arm is a key profit driver within this integrated structure.

- Capital Rotation and Partnerships: Goodman actively rotates capital and collaborates with major investors, securing long-term funding and enhancing its market standing.

- Asset Lifecycle Control: This holistic approach ensures high-quality assets and sustained value across their portfolio.

The data centre segment is a clear Star for Goodman Group, driven by aggressive expansion and a substantial global power bank. This segment is strategically positioned to capitalize on the booming digital economy and the rapid growth of AI technologies.

With projects valued over $10 billion and over 50% of work-in-progress dedicated to data centres as of March 2025, Goodman's dual offering of powered shell and turnkey solutions solidifies its leading role in this expanding market.

Prime Urban Logistics Hubs also shine as Stars within Goodman's portfolio. The company's focus on multi-storey logistics in high-demand urban areas with low vacancy rates is a key differentiator.

These hubs are critical for efficient last-mile delivery and supply chain resilience, evidenced by a 97.1% occupancy rate and strong rental growth as of December 2024.

| Segment | BCG Classification | Key Performance Indicators | Strategic Rationale |

| Data Centres | Star | 5.0 GW global power bank, >50% WIP (Mar 2025), $4.0B equity raise (early 2025) | Capitalizing on digital economy and AI growth |

| Prime Urban Logistics Hubs | Star | 97.1% occupancy (Dec 2024), robust rental growth | Meeting last-mile delivery demand and supply chain resilience |

What is included in the product

The Goodman Group BCG Matrix analyzes business units based on market share and growth, guiding investment decisions.

The Goodman Group BCG Matrix offers a clear, actionable roadmap for resource allocation, alleviating the pain of uncertain investment decisions.

Cash Cows

Goodman's extensive global logistics portfolio, featuring warehouses and facilities in prime, stable markets, functions as a robust cash cow. This established network consistently delivers substantial property investment income.

As of March 2025, the group reported like-for-like net property income growth of 4.5%. Furthermore, occupancy rates across its partnerships remained impressively high at 96.5%, underscoring the portfolio's strong performance and demand.

Goodman's commitment to a long-term ownership strategy is key to its cash cow status. This approach guarantees a steady stream of recurring rental income and predictable, stable cash flow from these mature assets.

Goodman Group's industrial properties are performing exceptionally well, as evidenced by their consistently high occupancy rates. In fiscal year 2024, occupancy stood at 97.7%, followed by 97.1% in the first half of fiscal year 2025, and a strong 96.5% in the third quarter of fiscal year 2025. This demonstrates robust tenant demand and strong retention across their global portfolio.

The company is also achieving significant rental growth, with an average reversion to market rents of 16% as of March 2025. This ability to capture market rent increases directly translates into sustained rental growth and a healthy net property income stream, reinforcing the stability and predictability of cash flows generated by these assets.

Goodman's partnerships are a significant driver of its business, holding a substantial $71.8 billion in external assets under management as of March 2025. This extensive portfolio generates considerable management earnings and provides a steady flow of fee income, underscoring their importance as cash cows.

These collaborations offer a diversified and robust foundation for Goodman's property investments and development ventures. The consistent management fees derived from these well-capitalized partnerships contribute significantly to the group's financial stability.

Furthermore, the strategic internalization of Goodman Property Trust management in New Zealand is designed to optimize returns, reinforcing the focus on maximizing profitability from these key operational areas.

Diversified Global Presence

Goodman Group's diversified global presence acts as a significant strength, positioning its industrial properties as cash cows within the BCG matrix. Operating across Australia, New Zealand, Asia, Europe, the United Kingdom, and the Americas, the company benefits from geographical diversification. This broad reach helps to mitigate risks by spreading operations across various mature markets with stable demand for industrial and logistics space.

This extensive geographic footprint allows Goodman to tap into consistent demand for industrial facilities in established economies. For instance, in fiscal year 2024, Goodman reported a 9.7% increase in statutory profit and a 10.5% rise in underlying profit, demonstrating the resilience and stability derived from its diversified portfolio. The company's strategy focuses on owning and managing high-quality, strategically located properties, which are essential for global supply chains.

- Geographical Diversification: Operations span Australia, New Zealand, Asia, Europe, the UK, and the Americas.

- Risk Mitigation: Spreads operations across mature markets, reducing reliance on any single region.

- Stable Income Streams: Leverages consistent demand for industrial space in established economies.

- Resilience: The diversified portfolio protects against regional economic downturns, as evidenced by their steady profit growth in FY24.

Sustainable and Efficient Existing Properties

Goodman's existing property portfolio, characterized by its focus on sustainability and efficiency, represents a significant cash cow. These properties are designed to minimize operational expenses through features like enhanced energy efficiency and reduced water consumption. For example, Goodman's commitment to green building standards often translates into lower utility bills for tenants, increasing the attractiveness and retention rates of their properties.

This strategic approach ensures a steady and reliable stream of rental income. The long-term viability of these assets is further bolstered by professional property management, which maintains high occupancy levels and tenant satisfaction. In 2024, Goodman reported a strong occupancy rate across its global portfolio, underscoring the consistent cash generation from these mature assets.

- Strong Occupancy Rates: Goodman's existing properties consistently achieve high occupancy, typically above 95% in key markets, ensuring predictable rental income.

- Reduced Operational Costs: Investments in sustainable features, such as solar power and water-saving technologies, lower ongoing expenses, boosting net operating income.

- Tenant Appeal and Retention: Modern, efficient, and well-managed properties attract and retain high-quality tenants, minimizing vacancy periods.

- Stable Cash Flow Generation: The mature nature and operational efficiency of these assets provide a reliable source of distributable cash for the group.

Goodman Group's established logistics portfolio, featuring prime industrial and warehouse facilities, acts as a significant cash cow. These mature assets benefit from stable demand and long-term leases, generating consistent rental income. The group's strategic focus on owning and managing high-quality, well-located properties underpins this reliable cash flow generation.

The group's strong occupancy rates, consistently above 96% in recent reporting periods, highlight the enduring demand for its assets. For instance, as of March 2025, occupancy stood at 96.5%, a testament to the desirability and operational efficiency of its properties. This high occupancy directly translates into predictable and substantial rental income streams.

Goodman's commitment to sustainability further enhances the cash cow status of its properties. Investments in features like solar power and energy-efficient designs reduce operational costs, thereby increasing net operating income. This focus on efficiency not only lowers expenses but also enhances tenant appeal and retention, ensuring sustained rental income and minimizing vacancy risks.

| Metric | FY2024 | H1 FY2025 | Q3 FY2025 (as of March 2025) |

|---|---|---|---|

| Occupancy Rate | 97.7% | 97.1% | 96.5% |

| Like-for-like Net Property Income Growth | N/A | N/A | 4.5% |

| Average Reversion to Market Rents | N/A | N/A | 16% |

Full Transparency, Always

Goodman Group BCG Matrix

The Goodman Group BCG Matrix preview you are viewing is the complete, unedited document you will receive immediately after purchase. This means you'll get the full strategic analysis, ready for immediate application without any watermarks or placeholder content. The report is designed for clarity and professional use, ensuring you have all the necessary insights for your business planning.

Dogs

Older, less strategically located industrial assets within Goodman Group's portfolio might be categorized as Dogs. These properties, often less energy-efficient or situated in areas with waning industrial demand, typically face lower occupancy and require substantial investment to stay competitive, limiting their growth potential.

In 2024, Goodman Group continued its strategy of portfolio optimization. While specific divestments are part of their capital recycling efforts, older or poorly positioned industrial sites that consistently underperform and don't meet modern efficiency standards could be candidates for this classification if they present minimal future growth prospects.

Goodman Group's strategy actively involves rotating assets, exemplified by the sale of a $780 million Australian property portfolio in fiscal year 2024. This move signals a deliberate effort to divest non-core or underperforming assets from its holdings.

These divested properties, though not explicitly categorized within the BCG Matrix, likely represent holdings that previously exhibited low growth and a low market share. Their sale indicates they were no longer considered strategic or sufficiently profitable for long-term inclusion in Goodman's portfolio.

This proactive divestment approach is crucial for Goodman as it allows for the optimization of its overall property portfolio. By shedding less productive assets, the group can free up capital to reinvest in and pursue higher-growth opportunities, thereby enhancing future returns.

Within Goodman Group's portfolio, smaller office parks or business spaces not aligned with their core logistics or data centre focus could be categorized as underperformers. These properties might face challenges like declining occupancy rates and slower rental income growth.

For instance, while Goodman's 2024 financial reports highlight robust performance in their industrial and logistics segments, a segment of their broader business space holdings, particularly older or less strategically located office assets, could be exhibiting signs of stagnation. These spaces may lack the amenities or connectivity that modern businesses demand, leading to reduced leasing activity.

Properties in Weakening Markets

Goodman's Q3 FY25 operational update highlighted ongoing weakness in Mainland China's property fundamentals, leading to a rise in vacancy rates there. This scenario, particularly for assets or sub-portfolios within such challenging markets where Goodman's presence might be less dominant, could align with the characteristics of Dogs in the BCG Matrix. These are segments facing subdued growth prospects and potential underperformance, making sustained profitability difficult.

In these weakening markets, properties might experience extended vacancy periods, impacting rental income and overall asset value. Goodman's strategy in such situations would likely involve careful assessment of each asset's potential for turnaround or divestment to reallocate capital to more promising segments.

- Increased Vacancy: Mainland China's property market saw a rise in vacancy rates in Q3 FY25, a key indicator of market weakness.

- Low Growth Prospects: Properties in these softening regions offer limited potential for capital appreciation or significant rental growth.

- Underperformance Risk: Assets in these markets may struggle to achieve target returns, potentially dragging down overall portfolio performance.

- Strategic Re-evaluation: Goodman may consider divesting or repositioning assets in these Dog segments to focus on higher-growth opportunities.

Assets with High Capital Expenditure Needs and Low Return on Investment

Assets with high capital expenditure needs and low return on investment, often termed as Dogs in a BCG Matrix context for a company like Goodman Group, represent properties requiring significant investment for maintenance, upgrades, or sustainability compliance. These assets typically offer limited potential for rental income growth or capital appreciation, making them inefficient users of capital.

For Goodman Group, such properties could be those in older industrial estates needing substantial retrofitting to meet modern environmental standards or energy efficiency requirements. For instance, a property requiring a $5 million upgrade to achieve a 5-star Green Star rating but only projected to increase its annual rental income by $200,000 would likely fall into this category. This represents a 4% initial return on the capital expenditure, which may be considered low in the context of Goodman's overall portfolio strategy.

- Cash Consumption: These assets drain financial resources without commensurate returns, acting as cash traps for Goodman Group.

- Strategic Reassessment: Properties failing to meet efficiency and sustainability benchmarks are candidates for divestment or strategic repositioning.

- Portfolio Optimization: Goodman's focus on modern, sustainable logistics facilities means older, underperforming assets would be reviewed.

- Return Thresholds: Assets not meeting internal hurdles for return on capital expenditure, such as a minimum 8% yield on new investment, would be flagged.

Dogs within Goodman Group's portfolio represent assets with low market share and low growth prospects. These are typically older or less strategically positioned properties that require significant capital for upgrades and offer minimal potential for future returns. Goodman's active portfolio management strategy, including asset rotation and divestment, aims to reduce the number of these underperforming assets.

In fiscal year 2024, Goodman Group divested a significant Australian property portfolio valued at $780 million. While not explicitly labelled as Dogs, the properties sold likely exhibited characteristics of low growth and market share, aligning with the BCG Matrix definition of Dogs. This divestment underscores Goodman's commitment to optimizing its portfolio by shedding less productive assets.

The Q3 FY25 operational update highlighted challenges in Mainland China's property market, with rising vacancy rates. Assets located in such softening markets, where Goodman's market share might be limited, could be classified as Dogs due to subdued growth prospects and potential underperformance.

Goodman's strategy involves reallocating capital from underperforming assets to higher-growth opportunities, ensuring the portfolio remains modern and efficient. This proactive approach helps maintain overall portfolio value and future profitability.

Question Marks

Goodman Group's early-stage data centre ventures in new geographies, outside its core 13 major cities, are indicative of Stars or Question Marks in the BCG Matrix. These markets offer high growth potential for data centres, a sector experiencing rapid expansion, but Goodman's market share is nascent, necessitating substantial investment and strategic alliances for market penetration. For instance, the global data centre market was valued at approximately $240 billion in 2023 and is projected to grow significantly, with new regions presenting both opportunities and challenges.

New, large-scale speculative logistics developments in emerging markets represent potential question marks for Goodman Group. These ventures target rapidly expanding demand but face less predictable market conditions and a less established Goodman presence, requiring significant upfront capital before revenue is secured.

These projects offer high growth prospects, aligning with the question mark quadrant's profile. For instance, in 2024, emerging markets saw logistics demand surge, with countries like Vietnam experiencing a 15% year-over-year increase in e-commerce penetration, driving the need for modern warehousing solutions.

Goodman's strategic exploration of these nascent markets signifies a willingness to invest in future growth, even with inherent uncertainties. Such developments could involve building large distribution centers in regions like Southeast Asia, where infrastructure development is a key focus for governments aiming to boost trade and attract foreign investment.

Integrating cutting-edge, but not yet fully proven, technologies like advanced robotics or AI-driven automation into existing logistics facilities to boost productivity, without a clear immediate return, could be considered a question mark for Goodman Group. These initiatives, while targeting long-term efficiency, might consume cash without generating proportionate returns in the short term due to initial low market adoption or high implementation costs. For instance, a pilot program for AI-powered inventory management in a large distribution center might cost upwards of $500,000 in the first year, with benefits only materializing over several years.

Acquisitions for Future Regeneration Opportunities

Goodman Group is actively acquiring substantial sites, often brownfield locations, to fuel future regeneration projects. These strategic moves are capital-intensive now, with returns expected much further down the line.

These acquisitions are positioned in markets Goodman anticipates will experience significant growth, aiming to develop high-value assets. The potential for market dominance is high, but the realization of this success is still in the future, placing them in a question mark category within a BCG-like framework.

- Strategic Land Banking: Goodman's focus on acquiring large-scale sites, particularly brownfield ones, secures future development pipelines.

- Long-Term Investment Horizon: These acquisitions are characterized by significant upfront capital expenditure with delayed return on investment.

- Growth Market Focus: Investments are targeted at markets with projected strong growth, aiming to establish future high-value assets.

- Unrealized Potential: The success and market-leading position of these future developments are not yet confirmed, representing a significant opportunity with inherent uncertainty.

Expansion into Niche, High-Intensity Use Properties

Goodman's expansion into niche, high-intensity use properties positions them in potential "question mark" segments of the BCG matrix. These ventures target specialized property types, distinct from their established logistics and data center strengths. While offering high-reward potential, these markets often present significant risks due to limited prior market share and the need for substantial investment to build expertise and gain acceptance.

This strategic move aligns with Goodman's broader objective of achieving higher intensity use outcomes from their properties. Examples of such niche areas could include advanced manufacturing facilities, specialized cold storage for pharmaceuticals, or even urban logistics hubs designed for rapid, last-mile delivery. These sectors are experiencing growth, but Goodman's entry requires careful navigation and a commitment to developing new capabilities.

- Niche Market Entry: Targeting specialized property types beyond core logistics and data centers.

- High-Risk, High-Reward: Ventures into growing markets where Goodman has limited existing share or expertise.

- Investment Requirement: Significant capital outlay needed to establish a foothold and achieve market acceptance.

- Alignment with Strategy: Supports Goodman's focus on 'higher intensity use outcomes' by exploring new facility types.

Question Marks in Goodman Group's portfolio represent new ventures in high-growth potential markets where the company has a low market share. These require significant investment to build presence and gain traction, with uncertain future outcomes. For example, Goodman's expansion into early-stage data center projects in emerging geographies outside its core 13 cities exemplifies this. The global data center market's projected growth, reaching an estimated $339 billion by 2027, highlights the opportunity, but Goodman's nascent position in these new regions necessitates strategic investment for market penetration.

New, large-scale speculative logistics developments in emerging markets also fall into the Question Mark category. These target rapidly expanding demand, such as the 15% year-over-year increase in e-commerce penetration seen in Vietnam in 2024, but face less predictable conditions and require substantial upfront capital before revenue generation.

Integrating unproven, cutting-edge technologies like AI-driven automation into existing facilities, without clear immediate returns, also represents a question mark. A pilot program for AI-powered inventory management might cost over $500,000 in its first year, with benefits realized over several years.

| Venture Type | Market Characteristics | Goodman's Position | Investment Need | Potential Outcome |

| Data Centers (Emerging Geographies) | High Growth Potential, Nascent Market | Low Market Share | Substantial Investment | Uncertain, High Reward Possible |

| Logistics Developments (Emerging Markets) | Rapidly Expanding Demand, Unpredictable Conditions | Less Established Presence | Significant Upfront Capital | Uncertain, High Reward Possible |

| Technology Integration (AI Automation) | Untested Technology, Low Adoption | Limited Implementation Experience | High Initial Costs | Uncertain, Long-Term Efficiency Gains |

BCG Matrix Data Sources

Our BCG Matrix is constructed using robust market data, encompassing financial performance, industry growth rates, and competitive landscape analyses to provide actionable strategic direction.