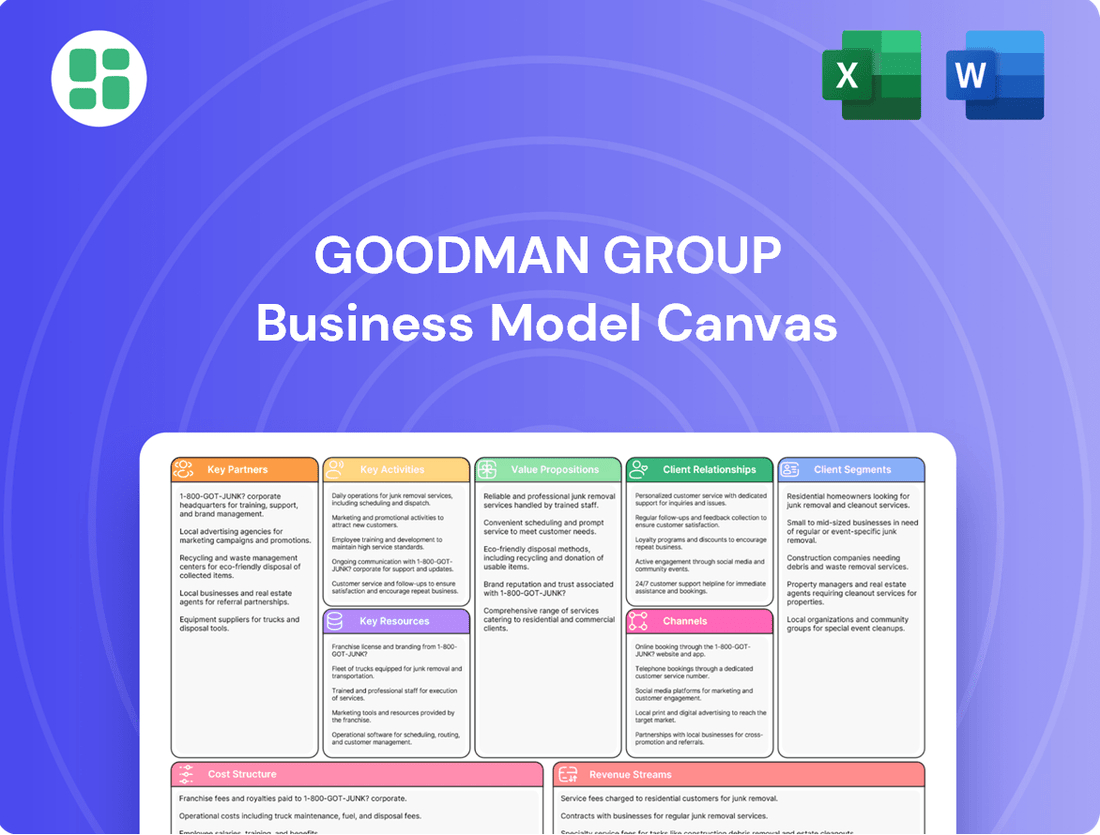

Goodman Group Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Goodman Group Bundle

Unlock the strategic blueprint behind Goodman Group's innovative business model. This comprehensive Business Model Canvas details how they create and deliver value, manage key resources, and build strong customer relationships. Discover the core components that drive their success and gain actionable insights for your own ventures.

Ready to dissect Goodman Group's proven strategy? Our full Business Model Canvas provides a clear, section-by-section breakdown of their customer segments, value propositions, revenue streams, and more. Download the complete, editable document to accelerate your strategic planning and competitive analysis.

Partnerships

Goodman Group’s capital partners and investors are fundamental to its operational success, enabling significant growth and development. These include major infrastructure funds and superannuation funds, which provide the essential capital for Goodman's extensive property portfolio and ongoing development projects.

These strategic alliances are particularly vital for funding large-scale, capital-intensive ventures like data centers. For instance, in fiscal year 2024, Goodman successfully raised approximately $1.5 billion in new equity through various capital initiatives, directly supporting its development pipeline and enhancing its financial flexibility.

The strong relationships with these institutional investors offer Goodman substantial liquidity, allowing the company to capitalize on future investment opportunities and maintain a robust development pipeline. This access to capital is a cornerstone of Goodman's strategy to expand its global footprint and meet growing market demand.

Goodman collaborates with a global network of construction firms and specialist contractors to bring its extensive portfolio of logistics and data centre projects to life. These relationships are crucial for ensuring projects are completed on time and to a high standard, meeting Goodman's exacting design and sustainability requirements.

In 2024, Goodman continued to leverage these partnerships to manage its significant development pipeline. For instance, the group's ongoing expansion in key markets like Australia and Europe relies heavily on the expertise and capacity of these construction partners to deliver complex, large-scale facilities efficiently.

Goodman Group’s collaborations with local governments and planning authorities are critical for navigating the complex approval processes required for their development projects. These partnerships are fundamental to obtaining zoning variances, building permits, and environmental clearances, which are essential for transforming strategically located land into functional industrial and logistics spaces.

In 2024, Goodman continued to engage with these bodies to facilitate urban regeneration and the development of new logistics hubs. For instance, their ongoing work in key markets like Australia and Europe relies heavily on favorable planning outcomes. The company's ability to secure planning approvals directly impacts its development pipeline and the pace at which it can deliver new assets, underscoring the significance of these relationships.

Technology and Infrastructure Providers

Goodman Group's strategic alliances with technology and infrastructure providers are crucial for its expanding data center operations. These partnerships are vital for securing essential resources such as reliable power supply and advanced digital networking capabilities, which are fundamental to building and operating high-performance data centers. For instance, in 2024, Goodman continued to forge these essential links, recognizing that access to cutting-edge power solutions and robust connectivity underpins their ability to meet the growing demands of cloud computing and digital services.

These collaborations ensure Goodman's data centers are equipped with the latest technological advancements, facilitating seamless data flow and enhanced operational efficiency. The focus is on providers who can offer scalable and sustainable infrastructure, supporting the long-term growth and resilience of their data center portfolio. This strategic approach allows Goodman to deliver state-of-the-art facilities that meet the stringent requirements of their global clientele.

- Power Supply Partnerships: Collaborations with energy companies to ensure consistent and often renewable power sources for data centers.

- Digital Infrastructure Providers: Alliances with telecommunications and network providers for high-speed, low-latency connectivity.

- Technology Integration Specialists: Working with firms that specialize in integrating advanced cooling, security, and IT infrastructure.

- Sustainability Technology Providers: Partnering with companies offering solutions for energy efficiency and environmental impact reduction in operations.

Key Client Tenants and Hyperscale Operators

Goodman cultivates enduring alliances with its principal clients, notably major players in e-commerce, logistics, and hyperscale data centers. These relationships are foundational to their business model, ensuring consistent demand and long-term revenue streams.

These partnerships frequently involve the development of bespoke, built-to-suit facilities and comprehensive turnkey solutions. This approach directly addresses the unique operational and technological needs of these critical customers, solidifying Goodman's position as a preferred partner.

- Major Clients: Goodman's key tenants include global e-commerce giants and leading logistics providers, indicating a strong reliance on companies driving significant demand for modern industrial and logistics space.

- Hyperscale Data Centers: The inclusion of hyperscale data centre operators highlights Goodman's strategic expansion into a high-growth sector requiring specialized infrastructure.

- Built-to-Suit Solutions: By offering customized development, Goodman ensures client satisfaction and secures long-term leases, often exceeding 10-15 years, demonstrating the value of these deep client relationships.

- 2024 Focus: In 2024, Goodman continues to prioritize these strategic partnerships, aiming to expand its portfolio of specialized facilities to meet the evolving demands of its key client base.

Goodman's key partnerships extend to financial institutions and capital providers, including infrastructure and superannuation funds, which are crucial for funding its extensive development pipeline. In fiscal year 2024, Goodman successfully raised approximately $1.5 billion in new equity, directly supporting its growth initiatives and enhancing its financial capacity to pursue new investment opportunities globally.

What is included in the product

A detailed breakdown of Goodman Group's operations, outlining their core customer segments, value propositions, and key partnerships within the logistics and industrial property sectors.

This Business Model Canvas offers a strategic overview of Goodman Group's approach to property development, investment, and management, highlighting their customer-centric strategies and revenue streams.

The Goodman Group Business Model Canvas provides a clear, visual roadmap to identify and address potential business challenges.

It simplifies complex strategies, making it easier to pinpoint and resolve operational pain points.

Activities

Goodman Group actively engages in the design, planning, and construction of industrial, logistics, and data center properties. This core activity involves managing a substantial development pipeline, ensuring efficient and sustainable project delivery.

In fiscal year 2024, Goodman Group's development pipeline remained robust, with a focus on strategically located assets that cater to the growing demand in e-commerce and data infrastructure. The company consistently invests in enhancing its development capabilities to meet evolving market needs.

Goodman Group actively manages its extensive global property portfolio, emphasizing long-term ownership to secure consistent rental income and achieve capital appreciation. This hands-on approach involves identifying strategic acquisition opportunities and enhancing asset value through targeted redevelopment projects.

The group prioritizes maintaining robust occupancy levels across its diverse property holdings, a key driver for its recurring income streams. For instance, as of December 31, 2023, Goodman reported a strong portfolio occupancy rate of 98.2%, demonstrating effective asset management.

Goodman Group's key activity in funds management and capital allocation involves expertly managing real estate investment trusts (REITs) and various partnerships. They actively raise capital from a broad investor base, channeling these funds into their extensive industrial property portfolio while offering investors access to their specialized expertise.

Prudent capital management is central to this. In 2024, Goodman continued its focus on debt reduction and strategic capital recycling, a process where they sell mature assets to reinvest in new development opportunities. This approach helps optimize their property portfolio and maintain a strong financial position.

Leasing and Tenant Relationship Management

Goodman Group's key activities revolve around actively managing its property portfolio, which includes industrial, logistics, and data centre spaces. A significant part of this is securing and keeping tenants through smart leasing strategies and strong tenant relationships. This focus is crucial for maintaining high occupancy rates and ensuring a steady stream of rental income, which is the bedrock of their business.

For instance, in the fiscal year ending June 30, 2024, Goodman Group reported a strong occupancy rate across its global portfolio, demonstrating the effectiveness of their tenant relationship management. They achieved an occupancy of 98% in their Australian industrial portfolio, a testament to their ability to retain and attract businesses to their prime locations. This high occupancy directly translates to stable and predictable revenue streams.

- Tenant Acquisition and Retention: Implementing targeted leasing campaigns and proactive engagement to attract new customers and retain existing ones in their industrial, logistics, and data centre properties.

- Lease Administration: Efficiently managing lease agreements, rent collection, and ensuring compliance with lease terms to maintain operational smoothness and financial predictability.

- Customer Service Excellence: Providing responsive and high-quality service to tenants, addressing their needs promptly to foster long-term relationships and minimize vacancies.

- Portfolio Optimization: Continuously evaluating tenant needs and market trends to adapt leasing strategies and property offerings, thereby maximizing rental income and asset value.

Sustainability and Innovation Initiatives

Goodman Group actively pursues sustainability by integrating renewable energy sources across its portfolio and piloting innovative, low-carbon construction materials. In 2024, the group continued its focus on reducing operational emissions, a key driver for customer acquisition and retention in the logistics and industrial property sectors.

This strategic emphasis on sustainability directly addresses evolving customer preferences for environmentally responsible properties. By prioritizing these initiatives, Goodman enhances the long-term resilience and attractiveness of its business model, anticipating future regulatory changes and market demands.

- Renewable Energy Integration: Continued expansion of solar power installations on logistics facilities, contributing to reduced carbon footprints.

- Innovative Material Trials: Testing and adoption of low-embodied carbon materials in new developments to lower the environmental impact of construction.

- Emissions Reduction Targets: Progress towards achieving science-based targets for reducing Scope 1, 2, and 3 emissions across operations and developments.

- Customer Demand Alignment: Responding to increasing tenant and investor demand for sustainable and energy-efficient industrial and logistics spaces.

Goodman Group's key activities include the strategic acquisition and development of industrial, logistics, and data center properties. They manage a significant global development pipeline, focusing on creating assets that meet the growing demands of e-commerce and digital infrastructure. This involves meticulous planning and efficient execution to ensure projects are delivered on time and to high standards.

A core function is the active management of their extensive property portfolio, aiming for long-term ownership to generate consistent rental income and capital growth. This includes identifying opportunistic acquisitions and undertaking value-enhancing redevelopment projects. For example, as of December 31, 2023, Goodman reported a strong portfolio occupancy rate of 98.2%, underscoring their effective asset management and tenant retention strategies.

Furthermore, Goodman excels in funds management, expertly operating Real Estate Investment Trusts (REITs) and various investment partnerships. They are adept at raising capital from a diverse investor base, channeling these funds into their development pipeline while providing investors access to their specialized real estate expertise. This capital allocation strategy is supported by prudent financial management, including debt reduction and strategic asset recycling as seen in their 2024 focus.

| Key Activity | Description | 2024 Data Point/Focus |

|---|---|---|

| Property Development | Design, planning, and construction of industrial, logistics, and data center properties. | Focus on strategically located assets to meet e-commerce and data infrastructure demand. |

| Portfolio Management | Long-term ownership and active management of global property assets. | Achieved 98.2% portfolio occupancy as of December 31, 2023. |

| Funds Management | Managing REITs and partnerships, raising capital from investors. | Continued focus on debt reduction and strategic capital recycling in 2024. |

| Sustainability Initiatives | Integrating renewable energy and low-carbon materials in developments. | Progress towards achieving science-based targets for emissions reduction. |

What You See Is What You Get

Business Model Canvas

The Goodman Group Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means you're seeing the complete, professionally formatted Business Model Canvas exactly as it will be delivered, ensuring no discrepancies or unexpected changes. You'll gain immediate access to this same, ready-to-use resource for your strategic planning needs.

Resources

Goodman Group's extensive global property portfolio and land bank represent a core strength, encompassing industrial, logistics, and data centre assets. This diverse inventory, strategically located in key urban centers worldwide, provides a significant competitive edge.

As of December 31, 2023, Goodman managed a substantial portfolio valued at approximately $79.7 billion. This includes a significant land bank, offering a robust pipeline for future development and value creation.

Goodman Group's financial capital and liquidity are foundational to its business model. The company leverages substantial financial resources, including significant cash reserves and substantial undrawn credit facilities, to fuel its ambitious property acquisition and development pipeline. For instance, as of December 31, 2023, Goodman reported total assets of approximately A$75.4 billion, underscoring the scale of its financial backing.

These robust financial resources are crucial for Goodman to undertake large-scale development projects and ensure smooth operational management. The group's ability to raise capital through strategic partnerships further enhances its financial flexibility, allowing it to pursue growth opportunities effectively and maintain a strong financial position in a dynamic market.

Goodman Group’s deep expertise in industrial property and logistics is a cornerstone of its business model. This specialized knowledge encompasses everything from pinpointing prime locations to managing complex development projects and overseeing ongoing property operations.

This expertise is increasingly extending into the burgeoning digital infrastructure sector, particularly data centers. Goodman’s ability to navigate the unique demands of these properties, from power requirements to cooling systems, is a significant competitive advantage.

As of early 2024, Goodman manages a substantial portfolio, with a significant portion dedicated to industrial and logistics assets. Their fund management capabilities, leveraging this deep sector knowledge, have attracted substantial capital, underscoring the value of their expertise in securing and enhancing returns for investors.

Established Brand Reputation and Global Network

Goodman Group's established brand reputation and global network are cornerstones of its business model, enabling it to attract and retain a diverse clientele. This reputation is cultivated through a consistent track record of delivering high-quality, sustainable properties and generating strong returns for its stakeholders.

The company's extensive international network, encompassing customers, partners, and investors, serves as a powerful engine for securing new business opportunities and accessing vital capital. This global reach allows Goodman to tap into diverse markets and leverage established relationships for growth.

- Global Reach: Goodman operates in key markets across North America, Europe, Asia and Australia, demonstrating its extensive geographical footprint.

- Customer Loyalty: The group consistently achieves high customer retention rates, a testament to its reliable service and quality developments.

- Investor Confidence: Goodman's strong financial performance and sustainable practices attract a broad base of institutional investors, bolstering its capital-raising capabilities.

- Partnership Strength: The company fosters long-term relationships with strategic partners, facilitating joint ventures and expanding its development pipeline.

Technology Platforms and Data Analytics Capabilities

Goodman Group leverages advanced technology platforms and data analytics to drive operational efficiency and optimize its extensive property portfolio. These capabilities are crucial for managing complex assets like data centers, ensuring high performance and customer satisfaction.

The company's investment in technology allows for sophisticated data analysis, providing insights that inform strategic decisions and enhance customer productivity. This focus on digital transformation underpins their ability to offer cutting-edge solutions in the logistics and data center sectors.

- Advanced Property Management Software: Facilitates seamless operations across a global portfolio, improving asset utilization and reducing operating costs.

- Data Analytics for Portfolio Optimization: Utilizes big data to identify trends, predict market movements, and enhance investment strategies, particularly in high-growth areas like data centers.

- Customer Productivity Tools: Implements digital solutions to empower customers, enabling them to operate more efficiently within Goodman's managed spaces.

- Investment in Digital Infrastructure: Significant capital allocation towards building and maintaining robust IT infrastructure to support data-intensive operations and future growth.

Goodman Group's key resources include its extensive global property portfolio and land bank, valued at approximately $79.7 billion as of December 31, 2023, providing a strong foundation for development. Its substantial financial capital, with total assets around A$75.4 billion as of the same date, ensures liquidity for acquisitions and operations. Deep expertise in industrial property and logistics, now extending to data centers, drives value creation. Finally, its established brand reputation and global network facilitate customer acquisition and capital raising.

Value Propositions

Goodman offers tenants premium industrial, logistics, and data center properties situated in prime consumption hubs with excellent transport links. These spaces are purpose-built to boost customer efficiency via integrated digital, mechanized, and automated solutions.

For instance, in 2024, Goodman continued its focus on developing highly functional urban logistics sites, with a significant portion of its development pipeline dedicated to these strategically important locations. This commitment ensures tenants benefit from proximity to end consumers, reducing delivery times and operational costs.

Investors benefit from Goodman's deep expertise in industrial and digital infrastructure, accessed through their real estate investment trusts and strategic partnerships. This specialization allows for targeted investments in high-demand sectors.

Goodman's strategy emphasizes long-term ownership and active management of its properties. This approach is designed to cultivate stable, recurring income streams and achieve sustainable capital appreciation for its investors.

In 2024, Goodman Group reported a strong performance, with its Funds Under Management reaching approximately $77.1 billion AUD, demonstrating significant investor confidence and the scale of its operations in delivering stable returns.

Goodman provides crucial digital infrastructure, boasting a substantial 5.0 GW global power bank to fuel large-scale data centers. These facilities are strategically located in metropolitan areas to ensure low latency, a critical factor for modern digital operations.

The company is actively adapting its offerings, moving towards fully fitted facilities and comprehensive turnkey solutions. This evolution directly addresses the growing and specific demands of hyperscaler and colocation customers seeking ready-to-deploy digital infrastructure.

For Partners: Reliable and Experienced Development/Investment Partner

Partners choose Goodman for its established history of success and robust financial backing, making it a dependable ally for significant property ventures. The group's extensive development expertise ensures projects are managed efficiently and effectively, reducing risk for collaborators.

Goodman Group provides a stable and experienced foundation for joint ventures and co-investments, particularly in large-scale property developments. This partnership offers access to Goodman's deep market knowledge and its capacity to execute complex projects, fostering mutual growth and value creation.

- Proven Track Record: Goodman's consistent delivery of high-quality, large-scale property projects underscores its reliability as a development partner.

- Strong Financial Position: With a solid balance sheet, Goodman offers financial stability and the capacity for substantial co-investments. For instance, as of December 31, 2023, Goodman reported total assets under management of approximately $77.1 billion.

- Development Capabilities: The group possesses end-to-end development expertise, from site acquisition and planning to construction and asset management, ensuring comprehensive project oversight.

- Joint Venture Opportunities: Goodman actively seeks strategic partnerships to leverage capital and expertise, creating mutually beneficial opportunities in key global markets.

For Communities: Sustainable Development and Economic Contribution

Goodman Group actively pursues sustainable development, aiming to reduce carbon emissions across its portfolio. For instance, in 2023, they achieved a 10% reduction in Scope 1 and 2 emissions compared to their 2022 baseline, demonstrating a tangible commitment to environmental stewardship.

Their operations directly bolster local economies, creating employment opportunities and supporting regional growth. In 2024, Goodman projects the creation of over 5,000 direct and indirect jobs through its development pipeline in Australia alone.

Furthermore, Goodman's developments often include essential infrastructure, enhancing community functionality and long-term value. Their recent logistics hub development in Melbourne included upgrades to local road networks and public transport access, benefiting thousands of residents.

Key contributions to communities include:

- Reduced Environmental Impact: Implementing strategies to lower carbon footprints and increase renewable energy use in properties.

- Job Creation: Generating employment opportunities throughout the construction and operational phases of their projects.

- Infrastructure Development: Investing in and improving local infrastructure, such as roads and utilities.

- Economic Stimulation: Contributing to local GDP through direct investment and supply chain engagement.

Goodman provides tenants with strategically located, high-quality industrial, logistics, and data center properties. These sites are designed for operational efficiency, incorporating advanced digital and automated solutions to enhance customer productivity. For example, in 2024, Goodman emphasized urban logistics development, placing tenants close to consumers to shorten delivery times and cut costs.

Investors gain access to specialized real estate through Goodman's investment trusts and partnerships, benefiting from their deep sector knowledge. The group's focus on long-term ownership and active asset management aims to deliver stable, recurring income and capital growth. In 2024, Goodman's Funds Under Management reached approximately $77.1 billion AUD, reflecting strong investor trust.

Goodman offers critical digital infrastructure, including a 5.0 GW global power bank for data centers in metropolitan areas, ensuring low latency. They are evolving to provide fully fitted, turnkey solutions for hyperscale and colocation clients. Partners rely on Goodman's proven success and financial strength for major property ventures, leveraging their extensive development expertise.

Goodman acts as a stable partner for joint ventures, offering deep market insights and project execution capabilities for large-scale developments. Their commitment to sustainability is evident, with a 10% reduction in Scope 1 and 2 emissions achieved in 2023. The group also stimulates local economies by creating jobs, projecting over 5,000 in Australia in 2024, and enhances communities through infrastructure improvements.

| Value Proposition | Target Audience | Key Features/Benefits |

|---|---|---|

| Premium Industrial, Logistics & Data Center Properties | Tenants | Prime locations, enhanced efficiency via integrated digital/automated solutions, reduced delivery times. |

| Specialized Real Estate Investment Access | Investors | Deep expertise in industrial/digital infrastructure, stable income streams, capital appreciation. |

| Critical Digital Infrastructure | Hyperscalers, Colocation Clients | 5.0 GW global power bank, low-latency metropolitan data centers, turnkey solutions. |

| Dependable Partnership & Development Expertise | Partners, Joint Venture Participants | Proven track record, financial stability, end-to-end development capabilities, access to global markets. |

Customer Relationships

Goodman Group fosters enduring partnerships with its principal tenants and investors through dedicated account management, ensuring a deep understanding of their evolving requirements. This personalized approach allows them to deliver bespoke property and operational solutions, a strategy that has contributed to their robust tenant retention rates, which consistently exceed industry averages.

Goodman Group's proactive property management and maintenance services are a cornerstone of their customer relationships, ensuring assets operate efficiently and last longer. This commitment directly translates to tenant satisfaction, a key driver for their consistently high occupancy rates, which stood at 97.9% across their global portfolio as of December 31, 2023.

Goodman Group prioritizes transparent investor relations through regular financial reporting, including quarterly updates and comprehensive annual reports. In 2024, Goodman continued its commitment to providing detailed operational and financial performance data, ensuring investors have the necessary insights for informed decision-making.

Community Engagement and Corporate Social Responsibility

Goodman actively fosters relationships with the communities in which it operates, often channeling these efforts through the Goodman Foundation. This engagement is crucial for building trust and maintaining its social license to operate.

Corporate Social Responsibility (CSR) is woven into the fabric of Goodman's business strategy. In 2024, Goodman continued its commitment to sustainability, with initiatives focused on environmental stewardship and community well-being.

- Community Investment: Goodman Foundation supports various charitable causes, with a focus on education and community development.

- Environmental Initiatives: In 2024, Goodman reported a significant reduction in carbon emissions across its portfolio, aligning with its sustainability targets.

- Employee Volunteering: The company encourages employee participation in volunteer programs, strengthening local ties and fostering a sense of purpose.

- Stakeholder Dialogue: Regular engagement with local stakeholders ensures that community concerns are addressed and integrated into business planning.

Lease and Partnership Agreement Management

Goodman Group formalizes customer relationships through comprehensive lease agreements with its diverse tenant base, ranging from logistics companies to e-commerce giants. These agreements are meticulously managed to ensure clarity on terms, responsibilities, and rental escalations, fostering predictable revenue streams.

Partnership agreements are equally critical, formalizing relationships with co-investors in its various funds and developments. These contracts outline investment structures, profit sharing, and governance, crucial for attracting and retaining capital. As of 2024, Goodman manages a significant portfolio, with the strength of these agreements underpinning its operational stability and investor confidence.

- Lease Agreements: Formal contracts with tenants defining property use, rent, and duration, ensuring predictable income.

- Partnership Agreements: Contracts with co-investors detailing fund structures, profit distribution, and governance.

- Mutual Benefit: Both lease and partnership agreements are designed to create long-term value and stability for all parties involved.

- Contractual Framework: The robust management of these formal agreements is a cornerstone of Goodman's business model, ensuring operational efficiency and financial security.

Goodman Group cultivates strong customer relationships through dedicated account management and proactive property services, ensuring high tenant retention and satisfaction. These relationships are formalized through detailed lease and partnership agreements, providing a stable foundation for revenue and capital attraction.

The company's commitment to transparency with investors, evident in regular financial reporting, further solidifies these crucial partnerships. Community engagement, often channeled through the Goodman Foundation, builds trust and supports its social license to operate.

| Relationship Type | Key Elements | 2023/2024 Data Points |

|---|---|---|

| Tenant Relationships | Dedicated Account Management, Bespoke Solutions, Proactive Maintenance | Tenant retention exceeding industry averages; Occupancy rate of 97.9% as of Dec 31, 2023 |

| Investor Relationships | Transparent Financial Reporting, Regular Updates | Continued detailed operational and financial data provision in 2024 |

| Community Relationships | Goodman Foundation Support, CSR Initiatives | Focus on education, community development, and carbon emission reduction in 2024 |

| Formal Agreements | Lease Agreements, Partnership Agreements | Meticulously managed contracts ensuring clarity, predictable revenue, and capital attraction |

Channels

Goodman Group leverages its global direct sales and leasing teams to cultivate strong relationships with potential and existing customers. This direct engagement fosters a deep understanding of tenant needs, enabling the delivery of highly customized property solutions and efficient lease management.

In 2024, Goodman's direct sales and leasing efforts are crucial for maintaining its high occupancy rates, which consistently outperform industry averages. For instance, their focus on customer relationships contributed to a strong leasing performance across their extensive industrial property portfolio throughout the year.

Goodman collaborates with a network of external real estate brokers and advisors. This strategic alliance is crucial for expanding its market presence, allowing Goodman to connect with a wider pool of prospective tenants actively seeking industrial and logistics space. For instance, in 2024, Goodman reported a significant leasing pipeline, partly attributed to the insights and leads generated through these broker relationships.

These partnerships also play a vital role in identifying and evaluating new site acquisition opportunities. By leveraging the specialized market knowledge of these advisors, Goodman can pinpoint locations with high growth potential and strategic importance for its portfolio. This external expertise augments Goodman's internal capabilities, ensuring a more comprehensive approach to portfolio expansion and site selection.

The Investor Relations team is crucial for maintaining strong connections with both institutional and individual investors. They are the primary point of contact, disseminating vital information about Goodman's diverse funds and publicly traded entities, thereby fostering trust and encouraging investment. For instance, in 2024, Goodman Group actively engaged with its investor base through numerous briefings and reporting cycles, highlighting its strategic progress and financial performance.

Financial advisors also serve as key intermediaries, bridging the gap between potential investors and Goodman's investment opportunities. Their expertise helps guide clients, ensuring they understand the value proposition and align investments with their financial goals. This collaborative approach is essential for broadening Goodman's investor reach and securing capital for its growth initiatives.

Company Website and Digital Platforms

Goodman Group leverages its corporate website and digital platforms as crucial channels to communicate its extensive property portfolio and business activities. These platforms are vital for engaging with a broad spectrum of stakeholders, from potential investors to customers seeking industrial space.

The company's digital presence acts as a central hub for critical information, including financial reports, sustainability initiatives, and operational updates. For instance, as of the first half of fiscal year 2024, Goodman reported a strong pipeline of development projects, with its digital platforms providing real-time updates on progress and strategic outlook.

- Portfolio Showcase: Detailed information and visuals of Goodman's global industrial and logistics properties.

- Investor Relations: Access to financial results, annual reports, and market announcements.

- Sustainability Hub: Updates on ESG (Environmental, Social, and Governance) performance and initiatives.

- Customer Engagement: Information on available properties and services for businesses.

Industry Conferences and Networking Events

Goodman Group actively participates in key industry gatherings. In 2024, this included significant presence at major real estate expos and logistics forums, offering direct engagement with potential clients and partners. These events are crucial for understanding evolving market dynamics in logistics and technology.

The company leverages these conferences not just for visibility but for tangible business development. For instance, Goodman's presence at the 2024 Global Logistics Forum facilitated discussions that led to several new partnership inquiries. This proactive approach ensures they remain at the forefront of industry innovation and client needs.

- Industry Conferences: Goodman Group's participation in events like the annual Council on Tall Buildings and Urban Habitat (CTBUH) conference provides insights into sustainable urban development and future building technologies.

- Networking Opportunities: These events are vital for fostering relationships with potential tenants, investors, and technology providers, crucial for expanding their portfolio and service offerings.

- Market Intelligence: Attending forums such as the World Economic Forum's discussions on supply chain resilience in 2024 allows Goodman to gather critical market intelligence and identify emerging trends in the logistics sector.

- Partnership Development: Goodman uses these platforms to scout for and solidify collaborations with technology firms specializing in AI and automation for warehouse management, aiming to enhance operational efficiency.

Goodman Group utilizes a multi-faceted approach to reach its diverse customer base. Direct sales and leasing teams are paramount, fostering deep client relationships and understanding specific needs for tailored property solutions. This direct engagement was a key driver for Goodman's strong leasing performance in 2024, maintaining high occupancy rates across its industrial portfolio.

External real estate brokers and advisors significantly expand Goodman's market reach, generating valuable leads for both tenants and new site acquisitions. In 2024, these partnerships were instrumental in building a robust leasing pipeline and identifying strategic growth locations.

The company also leverages its corporate website and digital platforms as central hubs for information, showcasing its portfolio and ESG initiatives. These digital channels provide real-time updates, such as the progress of development projects reported in early fiscal year 2024.

Industry conferences and forums are vital for market intelligence and business development, allowing direct engagement with clients and partners. Goodman's participation in events like the 2024 Global Logistics Forum facilitated new partnership inquiries and provided insights into supply chain resilience.

Customer Segments

Large-scale e-commerce and logistics companies, including major online retailers and third-party logistics (3PL) providers, represent a critical customer segment for Goodman Group. These businesses demand modern, highly efficient, and strategically positioned warehouses and distribution centers to streamline their increasingly complex supply chains. The rapid growth of the digital economy directly fuels their need for advanced infrastructure, as evidenced by the projected 12.2% compound annual growth rate (CAGR) for global e-commerce sales reaching an estimated $8.1 trillion by 2025.

Global hyperscale data centre operators represent a rapidly growing and increasingly significant customer segment for Goodman Group. These are major technology companies, including leading cloud service providers and burgeoning AI firms, that demand vast, high-power, and low-latency data centre infrastructure to support their expanding digital operations.

Data centres now constitute a substantial portion of Goodman's work in progress. For instance, in fiscal year 2023, Goodman reported that data centres represented approximately 25% of its development pipeline by value, a notable increase from previous years, underscoring the segment's critical importance to the group's growth strategy.

Manufacturers and distributors are a core customer segment for Goodman Group. These are companies deeply involved in the physical production and movement of goods, requiring substantial industrial real estate. Think of them as the backbone of the supply chain, needing space for everything from assembly lines to vast warehouses. In 2024, the demand for efficient logistics and manufacturing hubs remained robust, driven by global trade patterns and the need to optimize supply chain operations.

These businesses actively seek properties that directly impact their bottom line by improving operational efficiency. This often translates to a need for strategically located facilities with excellent access to transportation networks, whether that's highways, ports, or rail. Goodman Group's focus on prime industrial locations directly addresses this requirement, ensuring their customers can move products quickly and cost-effectively. For instance, Goodman's portfolio in key logistics corridors aims to reduce transit times and associated costs for these clients.

Institutional Investors (e.g., Pension Funds, Sovereign Wealth Funds)

Institutional investors, such as pension funds and sovereign wealth funds, are key customers for Goodman Group. These sophisticated entities seek stable, income-producing real estate, with a particular focus on industrial and logistics properties. They are attracted to Goodman's expertise in managing these assets through its various funds and partnerships.

These investors are driven by the pursuit of long-term capital appreciation and consistent, recurring distributions. For example, in fiscal year 2023, Goodman reported a strong performance in its funds under management, which are largely comprised of capital from these institutional clients, demonstrating their confidence in Goodman's investment strategies.

- Target Assets: Industrial and logistics real estate with stable income potential.

- Investment Vehicles: Goodman's managed funds and strategic partnerships.

- Investment Objectives: Long-term capital growth and recurring income distributions.

- Commitment: Significant capital allocation driven by trust in Goodman's management and market positioning.

Specialized Industries (e.g., Life Sciences, Automotive)

Goodman Group recognizes that certain industries have very specific property needs that go beyond standard warehousing. For instance, the life sciences and healthcare sectors often require facilities with precise temperature and humidity controls, specialized ventilation systems, and robust security measures to protect sensitive materials and research. Similarly, the automotive industry might need large, flexible spaces for vehicle assembly, testing, and distribution, often with high power requirements and specialized loading docks.

This focus on specialized industries is a key differentiator for Goodman. By understanding and catering to these unique operational demands, they can offer tailored solutions that enhance efficiency and productivity for their clients. For example, in 2024, Goodman continued to invest in developing advanced logistics facilities that can accommodate the complex supply chains of sectors like pharmaceuticals and advanced manufacturing.

These specialized facilities are crucial for supporting innovation and growth within these demanding sectors. Goodman's ability to provide bespoke property solutions allows companies in life sciences, automotive, and other niche industries to focus on their core business operations, confident that their infrastructure meets the highest operational standards.

Key aspects of Goodman's specialized industry offerings include:

- Tailored environmental controls: Facilities equipped for precise temperature, humidity, and air quality management, vital for life sciences and pharmaceuticals.

- Enhanced infrastructure: High-capacity power, specialized loading bays, and robust connectivity to support advanced manufacturing and automotive operations.

- Regulatory compliance: Property designs that meet stringent industry-specific regulations and safety standards.

- Strategic location: Sites chosen for proximity to research hubs, transportation networks, and key markets relevant to specialized industries.

Emerging technology companies, particularly those in the artificial intelligence (AI) and cloud computing sectors, represent a vital and rapidly expanding customer base for Goodman Group. These firms require highly specialized, scalable, and energy-efficient data center facilities to support their intensive computational needs and rapid growth.

The demand for advanced data center infrastructure is directly correlated with the exponential growth in data generation and processing. For instance, global data volume is projected to increase significantly, with estimates suggesting it could reach over 180 zettabytes by 2025, driving the need for more robust digital infrastructure.

Goodman Group's strategy includes developing and providing these cutting-edge facilities, often in key technological hubs, to meet the unique requirements of these tech-forward businesses. This segment is crucial for Goodman's future growth, aligning with global digital transformation trends.

Cost Structure

Goodman Group's cost structure is heavily influenced by property acquisition and development. A significant portion of their expenditure goes into securing land and existing properties, which are crucial for their industrial, logistics, and data centre portfolios. These acquisition costs are fundamental to their expansion strategy.

The development and construction of new facilities represent another substantial cost. This encompasses everything from initial planning and design phases to the actual building of state-of-the-art industrial and logistics spaces. For instance, in the fiscal year ended June 30, 2024, Goodman Group reported significant capital expenditure on development projects, reflecting the ongoing investment in their property pipeline.

Goodman Group incurs ongoing costs such as property management fees, maintenance and repair expenses, utilities, property taxes, and insurance across its vast global portfolio. These are essential expenditures to uphold the quality and operational efficiency of its industrial properties. For instance, in the fiscal year ending June 30, 2023, Goodman reported property operating expenses of approximately A$572 million, highlighting the significant investment in maintaining its asset base.

Financing and capital costs are a significant part of Goodman Group's expense. This includes interest paid on loans and other debt used to fund their extensive property development and investment activities. For instance, in the fiscal year ending June 30, 2023, Goodman Group reported finance costs of approximately A$515 million, reflecting the substantial capital required for their global operations.

Employee Salaries and Administrative Overheads

Employee salaries and administrative overheads are a significant component of Goodman Group's operating expenses, reflecting the cost of supporting its integrated business model. These costs encompass wages, benefits, and other compensation for its global workforce, alongside expenses related to managing corporate functions, marketing initiatives, and general administrative activities.

In 2024, Goodman Group continued to invest in its human capital and operational infrastructure. The company's integrated model, which spans development, ownership, and management of industrial and logistics properties, necessitates a substantial team of skilled professionals across various disciplines. This includes property development, asset management, leasing, finance, and operations.

- Global Workforce Costs: Salaries and benefits for employees worldwide, crucial for managing a diversified property portfolio.

- Administrative Expenses: Costs associated with central functions like finance, legal, human resources, and IT.

- Marketing and Corporate Overheads: Expenditures on brand promotion, business development, and general corporate governance.

Sustainability and Technology Investment Costs

Goodman Group's investment in sustainability and technology is a significant and growing component of its cost structure. These investments are strategically focused on enhancing long-term value, not just immediate operational efficiency. For instance, the company has been actively pursuing renewable energy solutions across its portfolio.

In 2024, Goodman Group continued to allocate substantial capital towards integrating sustainable practices and advanced technologies. These expenditures are crucial for meeting evolving environmental regulations and customer demands for greener logistics and industrial spaces. This proactive approach aims to future-proof its assets and operations.

- Renewable Energy Installations: Costs associated with solar panel installations and other on-site renewable energy generation systems across their global property portfolio.

- Green Building Technologies: Investments in energy-efficient lighting, HVAC systems, water conservation measures, and sustainable building materials.

- Technology Platforms: Expenditure on digital infrastructure, data analytics tools, and software for optimizing property management, energy consumption, and operational workflows.

- Research and Development: Funding for exploring and implementing new sustainable technologies and innovative operational solutions.

Goodman Group's cost structure is dominated by property acquisition and development, with significant ongoing expenses for property management, maintenance, and financing. In the fiscal year ending June 30, 2023, finance costs alone were approximately A$515 million, underscoring the capital intensity of their operations. Investments in sustainability and technology are also increasing, reflecting a commitment to long-term asset value and operational efficiency.

| Cost Category | Description | Fiscal Year 2023 Impact (Approximate) |

|---|---|---|

| Property Acquisition & Development | Securing land, existing properties, and constructing new facilities. | Major capital expenditure driver. |

| Property Operations & Maintenance | Management fees, repairs, utilities, taxes, and insurance. | A$572 million in property operating expenses. |

| Financing Costs | Interest on debt used for funding development and investments. | A$515 million in finance costs. |

| Employee & Administrative Costs | Salaries, benefits, corporate overheads, marketing. | Essential for integrated business model management. |

| Sustainability & Technology | Renewable energy, green building tech, digital platforms. | Growing investment for future-proofing assets. |

Revenue Streams

Goodman Group's primary revenue stream is derived from rental income generated by its vast portfolio of industrial, logistics, and data center properties. This consistent income source provides a stable foundation for the company's operations.

In the fiscal year 2023, Goodman reported statutory profit of $1.7 billion, with a significant portion attributed to its rental operations. The group manages a global portfolio valued at over $70 billion, underscoring the scale of its rental income generation.

Goodman Group generates substantial revenue through property management fees. These fees are derived from overseeing properties within its various partnerships and also from managing assets belonging to third-party clients.

This revenue stream encompasses both base management fees, which are standard charges for oversight, and additional fees for specialized property services. In the fiscal year 2023, Goodman reported that its property services segment, which includes these management fees, contributed significantly to its overall earnings.

Goodman Group generates significant income from development and construction fees, which are earned upon the successful completion of new properties. This includes both fees for their own developments and profits from projects built for third parties or those pre-sold during construction.

In the fiscal year 2024, Goodman Group's active development pipeline continued to be a strong contributor, with development profits playing a key role in their revenue mix. This stream is directly tied to their ability to execute on their extensive project pipeline.

Fund Management Fees and Performance Fees

Goodman Group generates revenue through fund management fees and performance fees earned from its various real estate investment trusts and partnerships. These fees are a cornerstone of their business model, reflecting their expertise in managing capital for investors.

The recurring fund management fees are typically a percentage of the assets under management, providing a stable income stream. Performance fees, on the other hand, are contingent on achieving specific investment return hurdles, aligning Goodman's interests with those of its capital partners.

- Fund Management Fees: A percentage of Assets Under Management (AUM) for the funds Goodman manages.

- Performance Fees: Incentives paid when investment performance exceeds predefined benchmarks or targets.

For the fiscal year ending June 30, 2024, Goodman's total revenue was A$2.5 billion, with a significant portion attributable to these fee-based income streams.

Capital Gains from Strategic Property Sales

Goodman Group actively manages its property portfolio, generating capital gains by strategically selling certain assets. This approach, while prioritizing long-term ownership, enables the company to optimize its holdings and redeploy capital into new, potentially more lucrative ventures.

- Strategic Property Sales: Goodman Group generates revenue through the sale of properties that no longer align with its long-term strategy or offer opportunities for capital appreciation.

- Portfolio Optimization: This divestment process allows Goodman to refine its portfolio, focusing on core assets and reinvesting in higher-yielding opportunities.

- Capital Recycling: The capital realized from these sales is then recycled back into the business, funding new developments and acquisitions.

- Example Data: While specific figures for individual property sales are not publicly detailed in the Business Model Canvas, Goodman’s overall strategy involves active capital management, which historically contributes to its financial performance. For instance, in the fiscal year ending June 30, 2023, Goodman reported a statutory profit of $2.0 billion, partly reflecting the value generated through its portfolio management activities.

Goodman Group's revenue streams are diversified, with rental income from its extensive logistics and industrial property portfolio forming the core. This is complemented by fees generated from property management, development activities, and fund management. Strategic property sales also contribute, allowing for capital recycling and portfolio optimization.

| Revenue Stream | Description | Fiscal Year 2023/2024 Data (Illustrative) |

|---|---|---|

| Rental Income | Income from leasing properties in its global portfolio. | Significant portion of $1.7 billion statutory profit (FY23). Portfolio valued over $70 billion. |

| Property Management Fees | Fees for managing properties within partnerships and for third parties. | Contributes significantly to earnings via property services segment. |

| Development & Construction Fees | Fees and profits from developing new properties. | Active development pipeline a strong contributor in FY24. |

| Fund Management & Performance Fees | Fees based on Assets Under Management (AUM) and investment performance. | Total revenue of A$2.5 billion (FY24), with substantial fee-based income. |

| Capital Gains from Property Sales | Revenue from selling strategically selected assets. | Part of overall portfolio management contributing to $2.0 billion statutory profit (FY23). |

Business Model Canvas Data Sources

The Goodman Group Business Model Canvas is built upon a foundation of robust financial reporting, extensive market analysis, and internal operational data. These diverse sources ensure a comprehensive and accurate representation of the company's strategic framework.