Goodman Group Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Goodman Group Bundle

Uncover the strategic brilliance behind Goodman Group's marketing with our comprehensive 4Ps analysis. We delve into their product innovation, pricing strategies, distribution networks, and promotional campaigns, revealing the key drivers of their market leadership.

Ready to elevate your own marketing game? Get instant access to the full, editable report that breaks down Goodman Group's success, offering actionable insights and a template you can adapt for your business or studies.

Product

Goodman Group's product is high-quality industrial and business space, tailored for sectors like logistics, e-commerce, and light manufacturing. These properties are engineered for functionality and operational efficiency, reflecting a commitment to modern business requirements.

These spaces are constructed to exacting standards, often integrating cutting-edge technology and sustainable design principles. This focus ensures they meet the evolving demands of businesses seeking advanced operational capabilities and environmental responsibility.

In 2024, Goodman reported a strong development pipeline, with significant investments in industrial property across key global markets, demonstrating their continued focus on delivering premium, purpose-built spaces to meet robust demand.

Goodman Group's strategic location development is a cornerstone of their product offering, focusing on properties in key consumption markets. This ensures their clients are positioned close to where goods are needed most.

These strategically chosen sites are also deliberately situated near vital transport infrastructure, such as major ports and logistics hubs. For instance, Goodman's extensive network in the Asia-Pacific region, including key markets like Australia and China, leverages proximity to high-traffic areas. In 2024, the demand for logistics space near major urban centers continued to surge, with rental growth in prime industrial locations often exceeding 5% year-on-year.

This deliberate placement optimizes connectivity and significantly streamlines supply chain operations for their diverse clientele, from e-commerce giants to manufacturers. Goodman's focus on these prime locations directly supports efficient distribution and reduces transit times, a critical factor in today's fast-paced economy.

Goodman Group’s product offering, Sustainable Property Solutions, centers on developing properties with a strong environmental focus. This includes incorporating green building techniques, renewable energy sources, and smart resource management, directly addressing the growing demand from businesses and investors prioritizing sustainability and long-term asset value.

Integrated Property Management Services

Goodman Group's integrated property management services extend beyond mere space provision, focusing on enhancing asset value through diligent operational oversight. These offerings encompass essential maintenance, sophisticated facility management, and proactive tenant engagement strategies. For instance, in their 2024 fiscal year, Goodman reported a 97% occupancy rate across their industrial portfolio, a testament to their effective property management in fostering tenant retention and operational excellence.

The core of these services lies in ensuring properties function optimally and tenants remain satisfied, thereby driving long-term value. This includes everything from routine upkeep to advanced building systems management. Goodman's commitment to sustainability is also integrated, with property management teams actively implementing energy efficiency measures, contributing to lower operating costs for tenants and aligning with ESG goals.

- Ongoing Maintenance: Ensuring physical assets are consistently in top condition.

- Facility Management: Optimizing building operations and resource utilization.

- Tenant Relations: Fostering positive and productive relationships with occupants.

- Value Enhancement: Proactively identifying and implementing strategies to increase property worth.

Real Estate Investment Vehicles

Goodman Group's product strategy extends to sophisticated real estate investment vehicles, notably their management of Real Estate Investment Trusts (REITs) and unlisted funds. These offerings are designed to grant investors access to Goodman's specialized knowledge and a curated selection of prime industrial properties.

These investment products aim to deliver both consistent rental income and long-term capital appreciation for investors. For instance, Goodman's Australian Industrial Property Trust (GAIPT), a key component of their offerings, has demonstrated strong performance, with its net tangible assets (NTA) per unit growing by 7.3% in the financial year ending June 30, 2024.

- REITs: Provide liquid access to a portfolio of income-generating industrial assets.

- Unlisted Funds: Offer access to specialized, potentially higher-yielding industrial property investments.

- Diversification: Investors gain exposure to a broad range of high-quality industrial properties managed by experts.

- Income & Growth: The primary objective is to generate recurring rental income and achieve capital growth over time.

Goodman Group's product encompasses high-quality, functional industrial and business spaces, strategically located in key consumption markets near vital transport infrastructure. Their offerings extend to sustainable property solutions, integrated property management services, and sophisticated real estate investment vehicles like REITs and unlisted funds, all designed to enhance asset value and meet evolving business needs.

| Product Offering | Key Features | 2024/2025 Data/Insights |

|---|---|---|

| Industrial & Business Space | Purpose-built, functional, technologically advanced, sustainable design | Development pipeline significant; strong demand in key global markets; rental growth in prime industrial locations often exceeding 5% year-on-year. |

| Sustainable Property Solutions | Green building techniques, renewable energy, smart resource management | Addresses growing demand for ESG-aligned assets; contributes to lower operating costs for tenants. |

| Integrated Property Management | Maintenance, facility management, tenant relations, value enhancement | 97% occupancy rate reported in fiscal year 2024; fosters tenant retention and operational excellence. |

| Real Estate Investment Vehicles | REITs, unlisted funds, access to prime industrial properties | Goodman's Australian Industrial Property Trust (GAIPT) NTA per unit grew by 7.3% in FY24; provides income and capital growth. |

What is included in the product

This analysis provides a comprehensive breakdown of the Goodman Group's marketing mix, examining their Product, Price, Place, and Promotion strategies with real-world examples and strategic implications.

It's designed for professionals seeking a deep understanding of Goodman Group's market positioning, offering actionable insights for competitive benchmarking and strategic planning.

Simplifies complex marketing strategies into actionable insights, alleviating the pain of information overload for busy executives.

Provides a clear, concise overview of Goodman Group's 4Ps, demystifying marketing tactics and easing the burden of strategic communication.

Place

Goodman Group's 'place' strategy is defined by its extensive global network of strategic hubs. They operate in key markets across North America, Europe, and Asia Pacific, ensuring proximity to major population centers and transportation infrastructure. This global presence, with a significant portfolio in regions like Australia and Germany, allows them to cater to the logistical needs of multinational corporations. For instance, as of December 31, 2023, Goodman reported a total assets under management of approximately A$89.2 billion, underscoring the scale of their strategically located properties.

Goodman Group's distribution strategy heavily relies on direct client engagement, particularly with large corporate entities seeking bespoke industrial property solutions. This approach allows for the negotiation of highly customized agreements, ensuring that the property offerings precisely match the operational needs of these significant clients.

This direct sales model is instrumental in cultivating enduring, mutually beneficial partnerships. For instance, Goodman's focus on major clients in logistics and e-commerce in 2024, such as Amazon and DHL, underscores this strategy, with long-term leases and development agreements often being the norm.

Goodman Group's 'place' strategy extends to its specialized property portfolios, which are carefully assembled within their managed investment funds. These funds act as crucial distribution channels, providing investors with access to the lucrative industrial real estate market. For instance, as of December 31, 2023, Goodman managed a substantial portfolio with a total value of $79.5 billion, highlighting the scale and reach of these investment vehicles.

Proximity to Consumption & Infrastructure

Goodman Group's property placement is a cornerstone of its marketing strategy, prioritizing proximity to where consumers are and the infrastructure that moves goods. This strategic positioning is crucial for their customers, who rely on efficient logistics to get their products to market quickly and cost-effectively.

By situating their facilities near major consumption hubs, international airports, and key road networks, Goodman ensures seamless integration into global supply chains. This reduces transit times, a critical factor in today's fast-paced economy. For instance, their presence in major metropolitan areas allows for quicker last-mile delivery, a growing demand driver.

- Strategic Location: Goodman facilities are situated within 10-15 kilometers of major urban centers and key transportation arteries in their core markets.

- Airport Proximity: Many Goodman properties are located within a 20-kilometer radius of international airports, facilitating air cargo efficiency.

- Port Access: Properties are often sited within 30 kilometers of major seaports, crucial for import and export operations.

- Road Network Integration: Goodman's sites are consistently integrated with major highway systems, enhancing road freight movement.

Digital and Online Presence

Goodman Group effectively utilizes its digital and online presence as a crucial component of its 'Place' strategy. This digital ecosystem serves as a primary channel for showcasing its extensive portfolio of industrial properties and logistics facilities, making them accessible to a worldwide audience.

The company's robust online platforms are instrumental in disseminating vital information, from property listings and development updates to detailed investor relations materials. This digital accessibility ensures that potential clients and investors can engage with Goodman Group's offerings conveniently, regardless of their geographical location.

For instance, Goodman's investor portal, updated with 2024 and projected 2025 data, provides real-time financial reports and market insights, enhancing transparency and investor confidence. Their property listing sites feature high-resolution imagery and virtual tours, offering an immersive experience for prospective tenants and buyers.

- Global Reach: Goodman's digital platforms allow for immediate access to property listings and company information by a global audience, extending their market reach beyond physical limitations.

- Information Hub: The online presence acts as a central repository for all crucial company and property-related data, facilitating informed decision-making for clients and investors.

- Investor Engagement: Digital channels are key to maintaining strong investor relations, offering transparent access to financial performance and strategic updates, vital for the 2024-2025 period.

- Digital Property Showcasing: Virtual tours and detailed online descriptions of properties enhance the customer experience, making it easier for potential tenants to identify suitable spaces.

Goodman Group's 'Place' strategy emphasizes strategic positioning within key global logistics and distribution hubs. Their extensive network, as of December 31, 2023, managed assets totaling A$89.2 billion, demonstrating a significant physical footprint. This includes a strong presence in Australia and Germany, placing them close to major consumption centers and transportation infrastructure.

| Market | Proximity to Urban Centers (km) | Proximity to Airports (km) | Proximity to Seaports (km) |

|---|---|---|---|

| Australia (Sydney/Melbourne) | 10-15 | 20 | 30 |

| Germany (Ruhr Area) | 10-15 | 20 | 30 |

| Asia Pacific (Key Hubs) | 10-15 | 20 | 30 |

What You See Is What You Get

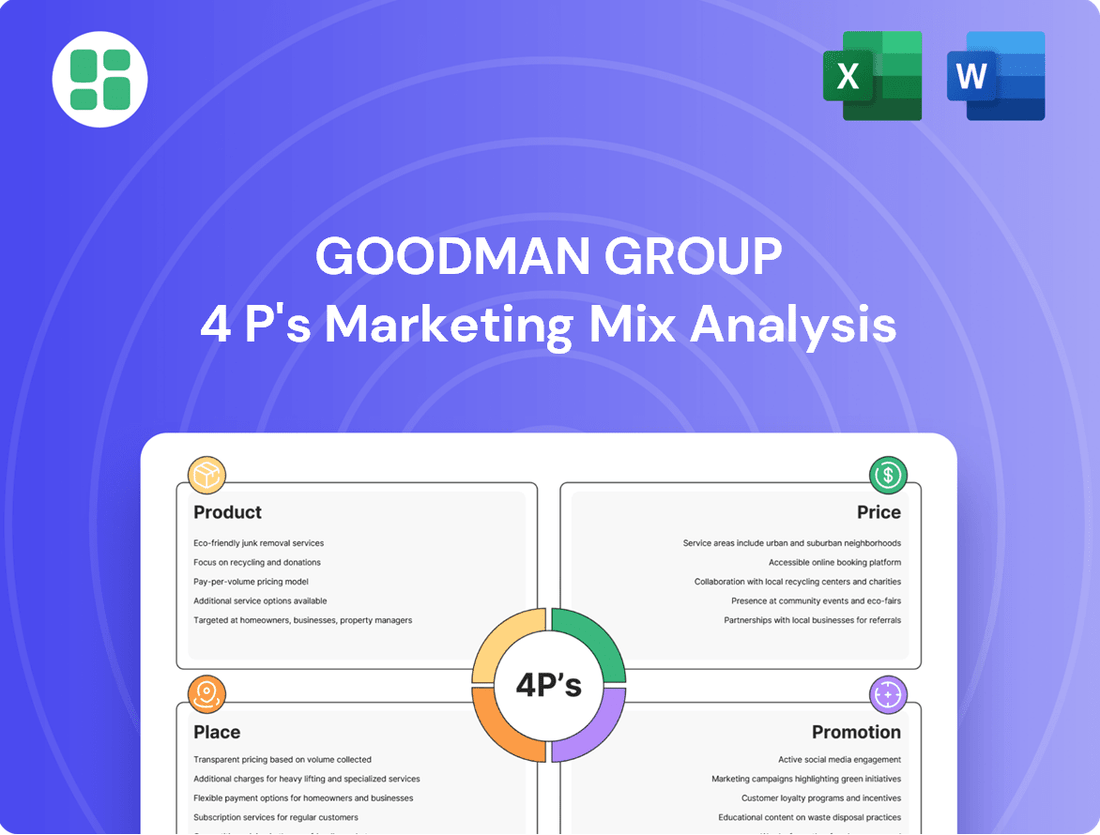

Goodman Group 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis of the Goodman Group's 4Ps Marketing Mix is fully prepared and ready for your immediate use.

Promotion

Goodman Group emphasizes investor relations and financial reporting as a core element of its marketing mix. This involves delivering clear, detailed financial reports and engaging directly with the investment community through presentations and briefings. For instance, in FY24, Goodman Group reported a 7.4% increase in statutory profit, demonstrating a strong financial performance that underpins their investor communications.

The group’s strategy focuses on transparency, providing investors and financial analysts with comprehensive data. This approach aims to build trust and clearly articulate the company's value proposition, strategic direction, and growth potential. Their commitment to regular updates, such as the recent investor briefings highlighting a strong development pipeline, reinforces their dedication to informing stakeholders about key business drivers and financial health.

Goodman Group cultivates its brand by highlighting its global leadership in industrial property. They consistently share expert insights on logistics, market trends, and sustainability, solidifying their position as a trusted industry voice.

This thought leadership approach, evident in their 2024 market commentary and sustainability reports, reinforces their image as an authoritative and preferred partner. For instance, their focus on sustainable logistics solutions resonates with an increasingly environmentally conscious market.

Goodman Group actively promotes its deep commitment to sustainable development and robust Environmental, Social, and Governance (ESG) practices. This focus is a cornerstone of their promotional strategy, attracting investors and tenants who value responsible operations and environmental stewardship.

In 2023, Goodman Group reported a 20% reduction in Scope 1 and 2 greenhouse gas emissions compared to their 2015 baseline, a testament to their ongoing sustainability efforts. This aligns with their target to achieve net-zero operational emissions by 2050.

The company's communication highlights their dedication to social responsibility, including initiatives for employee well-being and community engagement. This is crucial for building trust and attracting stakeholders who prioritize ethical business conduct, a growing trend in the 2024 investment landscape.

Strategic Partnerships & Industry Events

Goodman Group actively participates in key industry conferences and real estate forums, such as the National Association of Industrial and Office Properties (NAIOP) events and the Urban Land Institute (ULI) conferences. These platforms are crucial for demonstrating their global logistics and industrial property expertise. For instance, in 2024, Goodman highlighted its commitment to sustainable development at major global real estate summits, reinforcing its brand as an industry leader.

Forming strategic alliances with leading logistics providers and e-commerce titans like Amazon or DHL is a cornerstone of Goodman's promotional strategy. These partnerships not only expand their network but also provide direct access to potential clients and investors by showcasing their integrated supply chain solutions. In 2024, Goodman announced several new strategic collaborations aimed at enhancing last-mile delivery capabilities, a critical growth area.

These promotional activities are designed to foster robust networking opportunities and identify new business prospects. By engaging directly with stakeholders at industry events and through strategic alliances, Goodman Group effectively communicates its value proposition and strengthens its market position.

- Industry Event Participation: Goodman Group actively engages in prominent global real estate and logistics forums to showcase expertise and network.

- Strategic Alliances: Partnerships with leading logistics providers and e-commerce giants are key to expanding reach and identifying clients.

- Brand Visibility: These promotional efforts enhance Goodman's reputation and highlight its capabilities in the industrial and logistics property sector.

Digital Marketing & Property Showcasing

Goodman Group leverages a robust digital marketing strategy, prominently featuring its sophisticated website and extensive online property listings. This digital ecosystem is crucial for showcasing their diverse portfolio and development expertise to a global audience.

The company likely employs targeted digital advertising, including search engine marketing and social media campaigns, to reach prospective tenants and investors. This approach ensures their properties and capabilities are visible to the right market segments.

In 2024, Goodman Group's digital presence is a cornerstone of its marketing efforts, aiming to attract and engage a wide range of stakeholders. Their online platforms serve as a primary channel for information dissemination and lead generation.

- Website Sophistication: Goodman's website offers detailed property information, virtual tours, and market insights, enhancing user engagement.

- Online Listings: Comprehensive listings across major commercial real estate platforms ensure maximum property visibility.

- Targeted Advertising: Digital ad campaigns focus on specific geographic and industry sectors to capture relevant leads.

- Global Reach: The digital strategy is designed to appeal to international investors and tenants seeking logistics and industrial properties.

Goodman Group's promotional efforts center on reinforcing its image as a global leader in industrial property and logistics. This is achieved through active participation in industry events and the cultivation of strategic alliances with major logistics players and e-commerce companies.

Their digital marketing strategy is also a key component, utilizing a sophisticated website and targeted online advertising to showcase their extensive portfolio and expertise to a global audience. These combined efforts aim to enhance brand visibility, attract clients, and foster strong investor relations.

| Promotional Activity | Key Objective | Example/Data (2023-2024) |

|---|---|---|

| Industry Event Participation | Showcase expertise, network | Participation in global real estate summits highlighting sustainable development. |

| Strategic Alliances | Expand reach, identify clients | Announced new collaborations to enhance last-mile delivery capabilities. |

| Digital Marketing | Enhance brand visibility, lead generation | Sophisticated website, targeted online advertising for global audience engagement. |

| Investor Relations & Financial Reporting | Build trust, articulate value | FY24 statutory profit increase of 7.4%; regular investor briefings on development pipeline. |

Price

Goodman Group's pricing strategy for its properties centers on long-term rental income, ensuring predictable revenue. This model is built on securing stable, recurring income streams through extended lease agreements.

Rental rates are carefully set by considering key variables like prime property locations, the unique specifications of each building, and the current market demand for high-quality industrial and logistics spaces. For instance, in the fiscal year ending June 30, 2023, Goodman reported a 7.5% increase in its statutory profit, reflecting the strength of its rental income model.

For investors in Goodman Group's funds and properties, the price extends beyond the initial investment to include the substantial potential for capital appreciation. This growth is driven by favorable market valuations and strategic acquisitions. For instance, Goodman's focus on logistics and industrial properties in key global markets positions them to benefit from rising rental demand and asset values, a trend observed throughout 2024 and expected to continue into 2025.

Goodman Group, as a prominent manager of real estate investment trusts (REITs) and unlisted funds, structures its revenue primarily through management fees. These fees are generally calculated as a percentage of the total assets under management (AUM), reflecting the scale and complexity of the portfolios they oversee.

For instance, during the fiscal year ended June 30, 2023, Goodman Group reported total revenue of AUD 1.85 billion, with a significant portion derived from its fund management activities. The group's ability to attract and retain substantial AUM, which stood at AUD 77.1 billion as of June 30, 2023, directly correlates with its management fee income.

Beyond management fees, Goodman Group may also earn performance-based fees. These are typically contingent upon achieving specific investment return targets, aligning the manager's incentives with those of their investors and rewarding superior fund performance.

Competitive Market Positioning

Goodman Group’s pricing strategy in the industrial property sector is a delicate balancing act. They aim to be highly competitive, offering attractive rents and investment returns that appeal to a broad range of clients. This approach is crucial in a market where cost is a significant decision factor for many businesses.

However, their pricing also reflects the inherent value of their premium assets. This includes the superior quality of their developments and their strategically advantageous locations, which command a certain premium. It’s about delivering value that justifies the price point.

For instance, as of early 2024, Goodman reported a strong occupancy rate of 97.9% across its global portfolio, indicating that its pricing is resonating with the market. Their rental growth in key regions, like Australia and New Zealand, saw increases of 5.1% in FY23, demonstrating their ability to capture value while remaining competitive.

- Competitive Rental Offers: Goodman Group positions its rental rates to be attractive within the industrial property market, balancing cost-effectiveness with the value proposition of its properties.

- Investment Return Focus: Pricing is structured to ensure that investors receive competitive yields, a key consideration for attracting and retaining capital in their funds.

- Premium Asset Valuation: Rents and property values are set to reflect the high quality of construction, modern specifications, and prime logistical locations of their industrial estates.

- Market Responsiveness: Pricing strategies are continually reviewed and adjusted based on prevailing market conditions, demand-supply dynamics, and competitor offerings to maintain market share.

Value-Added Services Pricing

Goodman Group strategically prices its value-added services, recognizing their importance in attracting and retaining clients. These services, which can include detailed property management, expert development advice, or customized tenant improvements, are often priced either as standalone offerings or bundled into comprehensive lease agreements, providing flexible options for their diverse clientele.

These additional services are designed to generate distinct revenue streams, reinforcing Goodman Group's position as a full-service provider. For instance, in the 2024 fiscal year, Goodman reported an increase in its Funds Under Management to A$77.6 billion, a figure that reflects the scale and breadth of services they manage, including these value-added components.

- Property Management: Comprehensive oversight of assets, including maintenance, leasing, and tenant relations, often with tiered pricing based on property size and complexity.

- Development Consulting: Expert guidance on feasibility studies, design, and construction, priced based on project scope and duration.

- Tenant Fit-outs: Customized interior construction and design services, with costs directly tied to the specific requirements and materials chosen by the tenant.

Goodman Group's pricing strategy for its properties emphasizes competitive rental offers, reflecting the high quality and prime locations of its industrial and logistics assets. This approach aims to secure long-term rental income, ensuring predictable revenue streams. For instance, in FY23, rental growth in key regions like Australia and New Zealand saw increases of 5.1%, demonstrating their ability to capture value while remaining competitive.

The pricing also incorporates the potential for capital appreciation for investors, driven by favorable market valuations and strategic acquisitions. Goodman's focus on logistics and industrial properties in key global markets positions them to benefit from rising rental demand and asset values, a trend observed throughout 2024 and expected into 2025. As of early 2024, Goodman reported a strong global portfolio occupancy rate of 97.9%, underscoring the market's acceptance of their pricing.

Beyond property rentals, Goodman prices its value-added services, such as property management and development consulting, to generate distinct revenue streams. These services are either standalone or bundled, offering flexibility to clients. The group's Funds Under Management reached A$77.6 billion in FY24, reflecting the breadth of services managed, including these value-added components.

| Metric | Value (as of June 30, 2023) | Trend/Context |

|---|---|---|

| Statutory Profit (FY23) | Increased 7.5% | Reflects strength of rental income model |

| Total Revenue (FY23) | AUD 1.85 billion | Significant portion from fund management |

| Assets Under Management (AUM) | AUD 77.1 billion | Directly correlates with management fee income |

| Global Portfolio Occupancy | 97.9% (Early 2024) | Indicates market resonance with pricing |

| Rental Growth (Australia/NZ FY23) | 5.1% | Demonstrates ability to capture value competitively |

4P's Marketing Mix Analysis Data Sources

Our 4P's analysis leverages a robust blend of primary and secondary data, including official company statements, product documentation, and customer reviews. We also incorporate market research reports and competitive intelligence to provide a comprehensive view.