Goodman Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Goodman Group Bundle

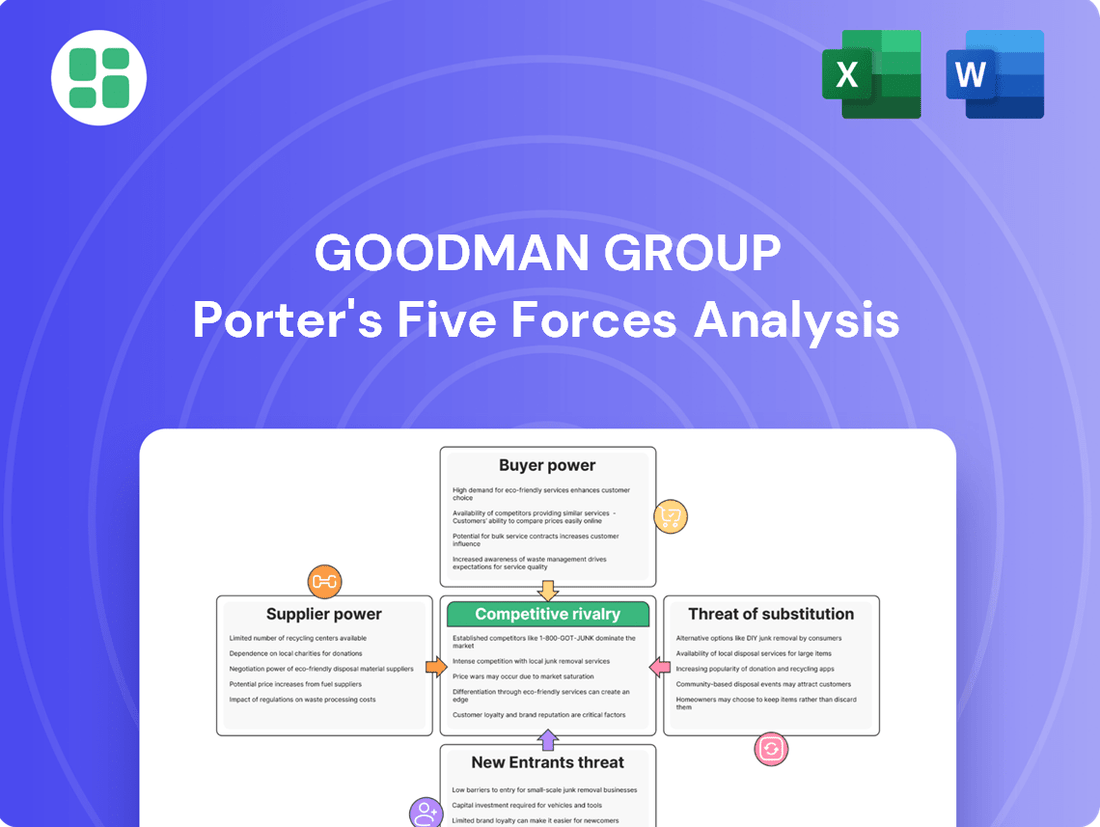

Goodman Group navigates a competitive landscape shaped by powerful buyer bargaining, moderate supplier leverage, and the ever-present threat of substitutes. Understanding these forces is crucial for any stakeholder looking to grasp their market position.

The complete report reveals the real forces shaping Goodman Group’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Goodman Group's reliance on acquiring suitable land in prime, often urban, locations grants landowners considerable leverage. This is particularly true in 2024, where limited supply in high-demand areas can drive up land acquisition costs significantly, directly impacting development feasibility and profitability.

The escalating costs of construction materials and the availability of skilled labor in 2024 also bolster the bargaining power of suppliers. For instance, global supply chain disruptions and increased demand for construction services can lead to higher prices for essential materials like steel and concrete, squeezing project margins and giving suppliers more influence over terms.

As Goodman Group expands its portfolio into high-tech industrial properties and data centers, its dependence on specialized equipment and technology providers increases. These suppliers, especially those offering unique or proprietary solutions for automation, smart warehousing, and data center infrastructure, can exert significant bargaining power. Their ability to command higher prices stems from the specialized nature of their products and the substantial switching costs associated with integrating their technology into Goodman's facilities.

The availability of skilled labor for construction, development, and ongoing property management significantly impacts supplier power for Goodman Group. Labor shortages, especially in specialized trades like carpentry or electrical work, can escalate wages and project expenses, thereby increasing the leverage of workers and their unions.

Utility Providers for Data Centers

Utility providers wield significant bargaining power over data center operators like Goodman Group. This is primarily because data centers require a constant, high-volume supply of reliable electricity, making them heavily dependent on these essential services. In many regions, utility providers operate as regulated monopolies, limiting competition and further strengthening their position.

The criticality of uninterrupted power for data centers means that any disruption or unfavorable terms from a utility provider can have severe operational and financial consequences. Goodman Group's substantial investment in data center development, as of early 2024, amplifies this reliance. For instance, a typical large-scale data center can consume tens or even hundreds of megawatts of power, a volume that few alternative solutions can match.

- Essential Service Dependency: Data centers cannot function without a consistent and robust electricity supply, making utility providers indispensable partners.

- Monopolistic Tendencies: In many geographical areas, utility provision is a natural monopoly, granting providers considerable leverage.

- High Consumption Volumes: The immense power demands of data centers mean they are high-value customers, but also highly dependent on the utility's capacity.

- Limited Alternatives: While on-site generation is possible, it is often prohibitively expensive and complex for the primary power source, reinforcing reliance on grid providers.

Financing and Capital Providers

Goodman Group's development projects are inherently capital-intensive, necessitating substantial financing. This reliance on external capital means that the group must consider the influence of capital providers.

While Goodman typically maintains a robust financial standing and cultivates strong relationships with lenders and investors, the broader market conditions, including fluctuating interest rates and the general availability of capital, can shift the bargaining power of these financing entities. For instance, during periods of tight credit or rising interest rates, lenders may exert greater influence, potentially demanding more favorable terms or higher returns.

- Capital Intensity: Goodman's development pipeline requires significant capital outlay, making access to finance a critical factor.

- Market Conditions: Fluctuations in interest rates and capital availability directly impact the leverage Goodman has with its financing partners.

- Lender Influence: In tighter credit markets, lenders can command better terms, increasing their bargaining power.

- Investor Relations: Maintaining strong relationships with a diverse base of institutional investors is key to mitigating supplier power in this segment.

Goodman Group's bargaining power with its suppliers is influenced by several factors, including the availability of raw materials, specialized equipment, and skilled labor. In 2024, the company's significant investments in data centers and high-tech industrial properties mean it's increasingly reliant on specialized technology providers, whose unique offerings can give them considerable leverage. This is compounded by the capital-intensive nature of development, where financing partners can gain influence, especially in tighter credit markets.

The escalating costs of construction materials, such as steel and concrete, and the demand for skilled labor in 2024 directly impact Goodman's supplier relationships. Shortages in specialized trades can drive up wages, increasing project expenses and giving labor suppliers more sway. Similarly, utility providers, particularly for data centers, hold substantial power due to the critical need for constant, high-volume electricity, often operating in monopolistic markets.

| Supplier Type | Influence Factor | 2024 Impact Example |

|---|---|---|

| Landowners | Limited supply in prime locations | Increased acquisition costs in high-demand urban areas |

| Material Suppliers | Global supply chain disruptions, demand for construction | Higher prices for steel and concrete, squeezing margins |

| Technology Providers | Specialized/proprietary solutions for data centers | Higher pricing for unique automation and infrastructure tech |

| Labor Providers | Shortages in specialized trades | Escalating wages for carpentry, electrical work |

| Utility Providers | Critical need for electricity, monopolistic markets | Increased leverage due to data center's high consumption |

| Financing Partners | Capital intensity, market interest rates | Greater lender influence in tighter credit markets |

What is included in the product

This analysis unpacks the competitive forces shaping Goodman Group's industry, revealing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes.

Effortlessly identify and mitigate competitive threats with a visual breakdown of each force, enabling proactive strategy adjustments.

Customers Bargaining Power

Goodman Group's customer base is heavily weighted towards large e-commerce and logistics companies. These tenants, such as Amazon or DHL, often require extensive, purpose-built facilities in prime locations, giving them considerable leverage. For example, a major logistics player seeking millions of square feet of warehouse space can command significant negotiation power, potentially influencing rental rates and lease terms.

Goodman's high portfolio occupancy, reaching 97.7% in FY24, typically diminishes customer bargaining power by limiting available space. This strong demand for Goodman's properties suggests tenants have fewer alternatives, strengthening Goodman's negotiating position.

However, a 'flight to quality' trend is emerging, where tenants increasingly prioritize modern, sustainable, and high-specification facilities. While this can empower tenants in older, less desirable properties, it simultaneously reinforces Goodman's advantage with its prime, well-appointed assets, effectively segmenting the market and enhancing its premium offering.

Switching costs for tenants are a key factor in their bargaining power. Relocating a large-scale logistics or data center operation is incredibly expensive and disruptive, which can limit a tenant's ability to negotiate favorable terms once a lease is signed. For instance, the cost of fitting out a new facility, including specialized infrastructure for data centers, can run into millions of dollars.

Goodman Group actively works to increase these switching costs. By fostering long-term relationships and offering integrated solutions, they make it more difficult and costly for tenants to leave. This strategy effectively locks in customers, thereby reducing their short-term bargaining power and strengthening Goodman's position.

Diverse Customer Base and Industries

Goodman Group’s broad customer base across various sectors, including e-commerce, automotive, food warehousing, and life sciences, significantly dilutes the bargaining power of any single customer. This diversification means no single industry or client segment dominates Goodman's revenue streams, reducing the leverage individual customers might otherwise wield.

For example, in 2024, Goodman's portfolio is strategically balanced, with a substantial portion of its rental income derived from a wide array of industries, not solely reliant on the volatile e-commerce sector. This broad industry exposure limits the ability of any one customer group to demand significant concessions, as Goodman can shift focus and resources to other sectors if necessary.

- Diversified Industry Exposure: Goodman's presence in sectors like automotive and life sciences, beyond e-commerce, spreads risk and reduces reliance on any single customer segment.

- Reduced Concentration Risk: Serving multiple industries limits the impact of downturns or demands from any one sector, thereby weakening individual customer bargaining power.

- Strategic Portfolio Management: In 2024, Goodman continues to actively manage its portfolio to maintain this diversification, ensuring no single customer or industry holds excessive influence.

REIT Investors' Influence

For Goodman Group, the investors in its Real Estate Investment Trusts (REITs) represent a significant customer base whose bargaining power stems from their collective capital allocation decisions. These investors, seeking consistent income and capital appreciation, can influence Goodman's strategic direction by shifting their investments based on performance and dividend policies. For instance, a strong investor sentiment favoring higher distributions might pressure Goodman to prioritize payout ratios over reinvestment in growth initiatives.

The bargaining power of these REIT investors is amplified by the transparency and accessibility of information in the financial markets. Investors can easily compare Goodman's performance against peers, influencing their willingness to invest or divest. This can lead to pressure on Goodman to maintain competitive yields and demonstrate effective asset management to retain investor capital. In 2024, REITs globally continued to navigate a complex economic environment, with investor focus sharpening on yield sustainability and portfolio resilience.

- Investor Demand: High investor demand for stable income streams can bolster Goodman's REITs, reducing customer bargaining power.

- Yield Expectations: Shifting investor expectations for dividend yields directly impact Goodman's ability to attract and retain capital.

- Market Liquidity: The ease with which investors can buy or sell Goodman's REIT units influences their leverage in negotiations.

- Performance Benchmarking: Investors' ability to compare Goodman's REIT performance against industry benchmarks empowers them to demand better returns or switch to competitors.

Goodman's customer base is concentrated among large logistics and e-commerce firms, granting them significant negotiation leverage due to their substantial space requirements and the specialized nature of their facilities.

The high occupancy rate of 97.7% in FY24 for Goodman's portfolio generally reduces customer bargaining power by limiting available space, thereby strengthening Goodman's negotiating position.

While a 'flight to quality' trend empowers tenants seeking modern, sustainable assets, it also reinforces Goodman's advantage with its prime properties, segmenting the market and enhancing its premium offering.

Switching costs for tenants are substantial, involving millions in fitting out new facilities, which limits their ability to negotiate favorable terms once a lease is secured.

| Factor | Impact on Goodman's Customer Bargaining Power | Supporting Data (FY24 unless noted) |

|---|---|---|

| Tenant Size & Needs | High | Key tenants like Amazon, DHL require extensive, purpose-built facilities. |

| Portfolio Occupancy | Lowers Power | 97.7% occupancy limits tenant alternatives. |

| 'Flight to Quality' | Mixed (Increases for prime, decreases for older assets) | Tenants prioritize modern, sustainable facilities. |

| Switching Costs | Lowers Power | Millions in costs for relocating specialized operations. |

| Customer Diversification | Lowers Power | Broad exposure across e-commerce, automotive, life sciences limits individual customer leverage. |

| REIT Investor Base | Moderate | Collective capital allocation decisions influence strategic direction; transparency enhances leverage. |

Same Document Delivered

Goodman Group Porter's Five Forces Analysis

This preview showcases the complete Goodman Group Porter's Five Forces Analysis, offering a thorough examination of competitive forces within its industry. The document you see here is precisely what you'll receive—fully formatted and ready for immediate download and use after purchase.

Rivalry Among Competitors

The industrial property sector is highly competitive, featuring global giants like Prologis and GLP alongside a multitude of regional and local developers. Goodman Group must contend with these diverse players for prime land acquisition, property development, and tenant attraction, particularly in crucial markets where competition for resources is intense.

Goodman Group actively differentiates itself by concentrating on premium, sustainable properties situated in prime locations. These sites are strategically chosen for their proximity to major consumption hubs and robust transport networks, increasingly including a focus on data centers. This approach aims to sidestep direct price competition by appealing to customers who value quality and accessibility.

In 2024, Goodman's commitment to high-quality, well-located assets is reflected in its development pipeline and portfolio performance. The group continues to invest in modern, efficient facilities that meet evolving customer needs, such as those in the logistics and data sectors. This strategy helps to insulate Goodman from intense rivalry by offering superior value propositions.

The significant capital required to develop and own large-scale industrial and data center properties acts as a substantial barrier to entry for smaller competitors. This capital intensity, however, fuels intense rivalry among established, well-capitalized global players like Goodman. For instance, Goodman's substantial development pipeline, often exceeding billions of dollars in value, demonstrates the scale of investment needed to compete effectively in this sector.

Market Growth and Moderation

The industrial real estate sector, including Goodman Group's operational areas, has experienced robust expansion fueled by the e-commerce boom and the ongoing need for supply chain efficiency. However, recent trends indicate a degree of moderation in both demand and rental rate increases across various geographic markets. This cooling could heighten the competitive landscape for securing high-quality tenants and desirable development sites.

For instance, while the global industrial property market saw significant investment in 2023, with transaction volumes remaining strong in many regions, the pace of rental growth has started to normalize compared to the peaks of 2021-2022. This moderation suggests that developers and property owners, like Goodman, will face increased pressure to differentiate their offerings and secure pre-lease agreements.

- E-commerce and Supply Chain Drivers: Continued growth in online retail and the strategic repositioning of supply chains remain fundamental demand drivers for industrial and logistics space.

- Market Moderation: Signs of slowing rent growth and demand normalization are appearing in some key markets, potentially increasing competition.

- Intensified Competition: The moderating market conditions are expected to intensify competition among industrial real estate players for prime assets and tenant mandates.

- Development Opportunities: Securing attractive development land and obtaining necessary approvals will become more challenging as competition for these resources increases.

Data Center Specialization

Goodman Group's growing focus on data centers, which represent a substantial part of its current development pipeline, places it in a dynamic yet highly specialized and competitive market segment. This specialization demands distinct technical knowledge and significant capital investment, differentiating Goodman from developers focused on more conventional industrial properties.

The data center sector is experiencing robust demand, driven by cloud computing and digital transformation. For instance, global data center construction spending was projected to reach over $200 billion in 2024, highlighting the market's scale and growth potential. However, this also attracts intense competition from established players and new entrants alike, all vying for market share and skilled resources.

- Specialized Expertise: Developing data centers requires proficiency in areas like power infrastructure, cooling systems, and network connectivity, which are distinct from general industrial construction.

- High Capital Requirements: The upfront investment for data center development is considerably higher than for traditional warehousing, necessitating strong financial backing and access to capital.

- Intense Competition: Goodman competes with global hyperscale providers, specialized data center developers, and even large tech companies building their own facilities, intensifying rivalry.

The industrial property sector is highly competitive, with global giants and regional players vying for prime land and tenants. Goodman Group differentiates itself through premium, sustainable properties in strategic locations, aiming to avoid direct price wars. This focus on quality and accessibility is crucial as market moderation in 2024 may intensify competition for desirable assets.

The substantial capital needed for large-scale industrial and data center development acts as a barrier for smaller firms but fuels intense rivalry among well-funded global entities. Goodman's extensive development pipeline, often valued in the billions, underscores the significant investment required to remain competitive.

Goodman's expansion into data centers places it in a specialized, capital-intensive market segment demanding unique technical expertise. While global data center construction spending was projected to exceed $200 billion in 2024, this growth attracts fierce competition from both established players and new entrants.

| Key Competitor Type | Examples | Competitive Focus |

|---|---|---|

| Global Industrial REITs | Prologis, GLP | Scale, logistics network, tenant relationships |

| Regional Developers | Various local firms | Local market knowledge, specific site acquisition |

| Data Center Specialists | Equinix, Digital Realty | Technical infrastructure, power, connectivity |

| Hyperscale Cloud Providers | Amazon (AWS), Microsoft (Azure), Google (GCP) | In-house development, proprietary technology |

SSubstitutes Threaten

Customers are increasingly investing in technologies to maximize their current logistics footprints. For instance, advanced warehouse management systems (WMS) and automation solutions can boost throughput and storage density. This trend, driven by efficiency gains, presents a potential substitute for Goodman Group’s new property development by reducing the demand for additional physical space.

Onshoring and nearshoring trends, while potentially boosting demand for industrial space in certain locales, can also reshape supply chains. This might lessen the requirement for vast, globally connected logistics centers, representing a demand shift rather than a direct substitution for Goodman Group's core offerings.

In urban centers where land is at a premium, multi-story warehouses are emerging as a direct substitute for traditional, ground-level distribution centers. This trend is particularly relevant as e-commerce continues to drive demand for efficient, close-to-consumer storage solutions. Goodman Group is actively investing in and developing these vertical logistics facilities, recognizing their strategic advantage in high-density markets.

For instance, Goodman's focus on urban logistics includes projects that maximize space utilization through vertical construction. This approach directly counters the threat from alternative logistics models that might bypass traditional warehousing altogether, such as direct-to-consumer delivery networks or micro-fulfillment centers that require less extensive infrastructure. Goodman's 2024 strategy emphasizes these types of innovative urban solutions.

Direct-to-Consumer Models and Local Fulfillment

The increasing sophistication of direct-to-consumer (DTC) delivery, exemplified by companies like Amazon's expanding network of urban fulfillment centers, presents a significant threat. These advancements allow for faster, more localized delivery, potentially diminishing the need for traditional, large-scale distribution hubs. For instance, Amazon's continued investment in last-mile delivery infrastructure in 2024 aims to shorten delivery times, making it easier for consumers to receive goods quickly without needing to rely on Goodman Group's existing distribution channels.

This shift towards hyper-local fulfillment centers could lead consumers to favor businesses that can offer same-day or next-day delivery from nearby facilities. As of early 2024, the e-commerce sector continues to see growth in localized delivery strategies, with many retailers exploring micro-fulfillment solutions to compete with established players. This trend directly challenges the cost-effectiveness and necessity of extensive, centralized warehousing operations.

- DTC Growth: E-commerce sales in 2024 are projected to continue their upward trajectory, increasing consumer expectation for rapid delivery.

- Local Fulfillment Investment: Major logistics players and retailers are investing heavily in urban micro-fulfillment centers, aiming to reduce last-mile costs and delivery times.

- Consumer Preference: A growing segment of consumers prioritizes speed and convenience, making localized inventory and delivery a key competitive factor.

- Reduced Reliance: Advances in last-mile technology and localized inventory management reduce consumer dependence on traditional, large-scale distribution networks.

Functional Obsolescence of Older Facilities

Older industrial properties, especially those built before the widespread adoption of advanced logistics features like higher clear heights and modern sustainability certifications, are increasingly becoming functionally obsolete. This obsolescence doesn't mean they are direct replacements for Goodman's state-of-the-art facilities, but it does create a significant "flight to quality" in the market.

This trend means that businesses are actively seeking out newer, more efficient spaces, often leading to the decommissioning or repurposing of older, less functional industrial stock. For instance, in 2024, the demand for industrial space with clear heights exceeding 30 feet remained robust across major global markets, a feature often absent in older buildings.

- Functional Obsolescence: Older industrial sites lacking modern clear heights and sustainability features are becoming less desirable.

- Flight to Quality: Businesses are prioritizing newer, high-specification facilities over older, less efficient ones.

- Market Impact: This drives demand for modern developments like those offered by Goodman Group, while devaluing older, outdated stock.

The threat of substitutes for Goodman Group's properties is evolving, driven by technological advancements and shifting consumer behaviors. Innovations in logistics technology, such as advanced warehouse management systems and automation, can optimize existing space, potentially reducing the need for new developments. Furthermore, the rise of direct-to-consumer (DTC) models and localized fulfillment centers presents a challenge, as these alternatives can bypass traditional, large-scale distribution hubs. For instance, e-commerce sales growth in 2024 continues to fuel expectations for rapid delivery, prompting significant investment in urban micro-fulfillment centers by major players to shorten last-mile times.

The increasing preference for speed and convenience among consumers means that localized inventory and efficient last-mile delivery are becoming critical competitive factors. This trend can diminish reliance on extensive, centralized warehousing operations. Additionally, older industrial properties that lack modern features like high clear heights and sustainability certifications are becoming functionally obsolete, leading businesses to seek out newer, high-specification facilities. This "flight to quality" benefits modern developers like Goodman Group while devaluing outdated stock.

| Substitute Type | Key Driver | Impact on Goodman Group | 2024 Data/Trend |

|---|---|---|---|

| Logistics Technology Optimization | Efficiency gains, automation | Reduced demand for new physical space | Increased adoption of WMS and automation solutions |

| Direct-to-Consumer (DTC) & Localized Fulfillment | Faster delivery expectations, last-mile efficiency | Potential bypass of large distribution hubs | Continued e-commerce growth, investment in urban micro-fulfillment centers |

| Functional Obsolescence of Older Stock | Lack of modern features (clear heights, sustainability) | "Flight to quality" favoring new developments | Robust demand for industrial space with >30ft clear heights |

Entrants Threaten

The industrial property development sector, particularly for prime, large-scale assets, demands immense capital investment. This high barrier to entry significantly deters new players from easily entering the market. For instance, Goodman Group's substantial ongoing development pipeline, which stood at approximately $10.8 billion in completed and under-development projects as of December 2023, underscores the sheer scale of financial commitment required.

Goodman's established financial strength and its ability to forge deep capital partnerships further solidify this barrier. By leveraging its robust balance sheet and relationships with institutional investors, Goodman can readily fund its extensive projects, making it challenging for less capitalized newcomers to compete on a similar scale.

Goodman's strategic advantage hinges on its ability to secure prime, hard-to-access land near key consumption hubs and transportation networks. This scarcity, coupled with the significant challenge of obtaining adequate power supply, particularly for data centers, creates a substantial hurdle for any new players attempting to enter the market.

In 2024, the cost of industrial land in major metropolitan areas, where Goodman often operates, continued its upward trajectory. For instance, prime logistics sites in Sydney and Melbourne saw land values increase by an average of 10-15% year-on-year, making initial land acquisition a significant capital outlay for potential competitors. Furthermore, the energy capacity required for modern industrial facilities, especially those supporting e-commerce and data storage, is increasingly difficult and costly to secure, with grid connection approvals and upgrades often taking years and substantial investment.

Goodman's extensive expertise in property development and management acts as a formidable barrier to new entrants. Their deep understanding of the entire lifecycle, from initial acquisition to ongoing leasing and maintenance, is a significant advantage.

Newcomers struggle to replicate Goodman's integrated capabilities and established customer relationships. For instance, in 2024, Goodman reported a development pipeline valued at approximately $15 billion, showcasing their ongoing commitment and capacity in this area.

Regulatory and Permitting Hurdles

The threat of new entrants for Goodman Group, particularly in its industrial and data center development sectors, is significantly mitigated by substantial regulatory and permitting hurdles. Navigating complex zoning regulations, environmental permits, and local government approvals for large-scale industrial and data center developments is a time-consuming and challenging process. This regulatory burden acts as a deterrent for new entrants, requiring significant upfront investment in expertise and time before any physical development can commence.

These hurdles are not trivial. For instance, in 2024, the average time to secure all necessary permits for a major industrial development in key markets like Australia or Europe could extend to 18-24 months, with associated costs potentially reaching millions of dollars in consultancy and application fees. This lengthy and intricate process requires specialized knowledge of planning laws and environmental impact assessments, creating a high barrier to entry.

- High Capital Outlay: New entrants need substantial capital not just for construction but also for navigating the extensive approval processes.

- Expertise Requirement: Deep understanding of diverse and often changing regulatory landscapes is essential, which smaller or less experienced firms may lack.

- Extended Project Timelines: Delays in obtaining permits can significantly push back project completion, impacting financial projections and investor confidence.

- Geographic Specificity: Regulations vary greatly by jurisdiction, meaning a new entrant must master multiple complex legal frameworks to operate effectively across different regions.

Established Customer Relationships and Reputation

Goodman Group's deep-rooted relationships with a diverse global customer base present a significant barrier to new entrants. These aren't just transactional ties; they are partnerships built on trust and the consistent delivery of essential infrastructure and customized solutions. For instance, Goodman's focus on providing integrated services, from development to property management, fosters loyalty among its clients, many of whom are large, sophisticated corporations with complex logistical needs.

This established trust and reputation are formidable hurdles for any newcomer. New entrants would struggle to replicate the years of relationship building and the proven track record that Goodman possesses. In 2024, Goodman continued to strengthen these bonds, evidenced by its ongoing development projects and long-term lease agreements with key clients across its operational regions, underscoring the difficulty for new players to capture significant market share quickly.

- Customer Loyalty: Goodman's long-standing relationships translate into high customer retention rates, making it challenging for new competitors to attract and secure clients.

- Reputational Advantage: A strong reputation for reliability and quality service built over years acts as a significant deterrent to potential new entrants.

- Sophisticated Tenant Base: Large, discerning tenants often prioritize proven partners like Goodman, who can offer integrated solutions and a deep understanding of their operational requirements.

The threat of new entrants for Goodman Group is considerably low due to the immense capital required for industrial property development, especially for large-scale, prime assets. Goodman's significant development pipeline, valued at approximately $15 billion in 2024, highlights the substantial financial commitment necessary, a barrier that deters smaller or less capitalized competitors.

Furthermore, Goodman's established financial strength and its ability to secure deep capital partnerships allow it to fund extensive projects, making it difficult for newcomers to match its scale and competitive advantage. The scarcity of prime land, coupled with challenges in securing adequate power supply for modern facilities, adds another layer of difficulty for potential entrants.

Regulatory hurdles and the need for specialized expertise in navigating complex planning and environmental regulations also act as significant deterrents. Securing permits for major industrial developments in 2024 could take 18-24 months and cost millions, a daunting prospect for new players.

Goodman's deep-rooted customer relationships, built on trust and integrated service offerings, foster strong loyalty. This established reputation and proven track record make it challenging for new entrants to attract and retain the sophisticated tenant base that prioritizes reliable partners like Goodman.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a foundation of robust data, including company annual reports, industry-specific market research, and government economic indicators. This blend of sources ensures a comprehensive understanding of competitive dynamics and strategic positioning.