Gold Fields SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gold Fields Bundle

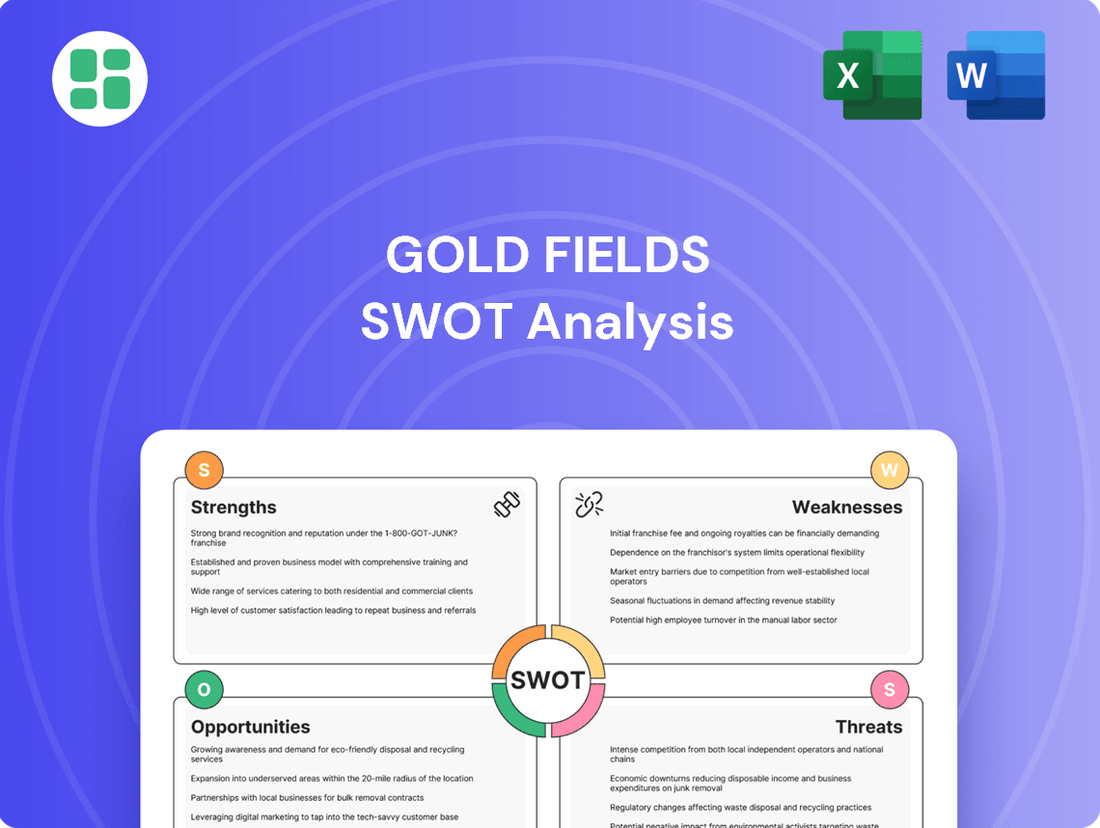

Our Gold Fields SWOT analysis reveals critical strengths like robust operational efficiency and a strong global presence, alongside significant opportunities for expansion in emerging markets. However, it also highlights potential weaknesses such as geopolitical risks in certain operating regions and threats from fluctuating commodity prices.

Want to truly understand the forces shaping Gold Fields' future? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

Gold Fields boasts a globally diversified operational footprint, encompassing nine mines spread across Australia, South Africa, Ghana, Chile, and Peru. This extensive geographical spread, further bolstered by a key project in Canada, significantly reduces the company's exposure to risks tied to any single mining region. This diversification is crucial for maintaining a stable production base, as evidenced by Gold Fields' consistent output across these varied locations.

Gold Fields has showcased a remarkable financial recovery, with projections indicating a substantial rise in headline earnings per share for the first half of 2025. This positive outlook is fueled by favorable gold prices and an uptick in production volumes.

This enhanced profitability has directly benefited shareholders, evidenced by a significant dividend distribution in 2024. For instance, the company declared a final dividend of 30 US cents per share for the 2023 financial year, reflecting its robust financial standing and dedication to investor returns.

Gold Fields boasts impressive proved and probable gold mineral reserves totaling 44.3 million ounces as of year-end 2023. This is further bolstered by a substantial 30.4 million ounces in measured and indicated gold mineral resources. This vast resource base offers a significant long-term production runway, ensuring operational continuity and stability for many years to come.

Commitment to ESG and Sustainable Practices

Gold Fields demonstrates a strong commitment to Environmental, Social, and Governance (ESG) principles, as shown by its detailed sustainability reports covering climate change and environmental impact. This dedication is further underscored by its consistent inclusion in the FTSE Russell ESG Rating for 20 consecutive years, a testament to its responsible mining operations.

This focus on sustainability not only bolsters Gold Fields' corporate image but also resonates with the growing investor demand for ethically and environmentally sound investments. For instance, in 2023, the company reported a 24% reduction in Scope 1 and 2 greenhouse gas emissions intensity compared to its 2019 baseline, aligning with its net-zero ambitions.

- Commitment to ESG: Gold Fields actively reports on its environmental and social performance.

- Sustained ESG Recognition: The company has been recognized by FTSE Russell for ESG for 20 years straight.

- Investor Appeal: Strong ESG practices attract investors prioritizing sustainable businesses.

- Environmental Performance: Achieved a 24% reduction in Scope 1 and 2 GHG emissions intensity by 2023 (vs. 2019 baseline).

Successful Ramp-up of Key Growth Projects

Gold Fields has successfully advanced its Salares Norte mine in Chile, a critical growth project that is now nearing commercial production. This achievement is particularly noteworthy given the initial hurdles, underscoring the company's capability in managing complex, large-scale developments. The ramp-up performance at Salares Norte is a primary contributor to Gold Fields' projected production growth for 2025.

The company anticipates that Salares Norte will significantly boost its overall output. For instance, in the first quarter of 2024, Salares Norte produced 54,600 ounces of gold, contributing to Gold Fields' total production of 559,400 ounces. This ramp-up is expected to continue, with the mine aiming for steady-state throughput, which will be a major driver for the company's 2025 production targets.

Key milestones achieved include:

- Progress towards commercial production at Salares Norte.

- Demonstrated ability to overcome initial project challenges.

- Salares Norte is a key factor in Gold Fields' 2025 production increase forecast.

Gold Fields' globally diversified asset base, spanning Australia, South Africa, Ghana, Chile, and Peru, significantly mitigates country-specific operational and political risks. This geographical spread ensures production stability and resilience, as demonstrated by consistent output across its nine mines.

The company's financial health shows a strong upward trend, with projected increases in headline earnings per share for the first half of 2025, driven by favorable gold prices and improved production. This financial strength translated into a notable dividend payout in 2024, with a final dividend of 30 US cents per share declared for the 2023 financial year, reflecting a commitment to shareholder returns.

Gold Fields possesses substantial gold reserves and resources, totaling 44.3 million ounces of proved and probable reserves and 30.4 million ounces of measured and indicated resources as of year-end 2023. This extensive mineral inventory provides a robust foundation for long-term production and operational continuity.

The successful advancement of the Salares Norte project in Chile towards commercial production is a key strength, showcasing Gold Fields' project execution capabilities. This project is anticipated to be a significant contributor to the company's projected production growth in 2025, with early output of 54,600 ounces in Q1 2024.

| Metric | 2023 (Year-End) | Q1 2024 | 2025 Projection |

|---|---|---|---|

| Proved & Probable Reserves (Moz) | 44.3 | N/A | N/A |

| Measured & Indicated Resources (Moz) | 30.4 | N/A | N/A |

| Salares Norte Production (koz) | N/A | 54.6 | Significant increase |

| Total Production (koz) | 2,765.5 | 559.4 | Growth expected |

What is included in the product

Analyzes Gold Fields’s competitive position through key internal and external factors, highlighting its operational strengths and market opportunities while acknowledging potential weaknesses and threats.

Offers a clear, actionable roadmap for identifying and addressing critical challenges within the Gold Fields mining operations.

Weaknesses

Gold Fields faced significant operational hurdles in the first half of 2024, leading to production shortfalls across several key mines. Sites like South Deep, Gruyere, St. Ives, and Cerro Corona were particularly affected by challenges ranging from adverse weather patterns to difficult ground conditions encountered underground.

These disruptions directly impacted the company's ability to meet its production targets, forcing a revision of its overall guidance for the year. For instance, initial production figures indicated a notable dip, underscoring the sensitivity of its operations to external and internal factors.

The recurring nature of these issues at different locations points to underlying vulnerabilities in maintaining consistent operational performance, a critical weakness for a global mining entity like Gold Fields.

Gold Fields encountered a higher cost base in 2024, with All-in Sustaining Costs (AISC) and All-in Costs (AIC) rising. This was influenced by reduced production volumes and prevailing mining inflation.

While the company anticipates cost improvements in 2025, persistently elevated costs pose a significant risk to profit margins, particularly if gold prices experience a downturn. Effective cost management is therefore paramount for maintaining Gold Fields' profitability.

Gold Fields' financial health and production targets are heavily tied to the performance of its major mines, like Salares Norte and South Deep. If these key operations face significant disruptions, it can have a substantial negative impact on the company's overall financial results and its ability to meet production goals.

Significant Environmental Compliance Burden

Gold Fields faces a significant financial strain due to environmental compliance mandates. The company anticipates substantial ongoing and projected regulatory investments, estimated to be in the hundreds of millions of dollars annually, to meet evolving standards. This commitment to sustainability, particularly in reducing carbon emissions, directly increases operational expenditures, potentially impacting capital allocation flexibility.

Key aspects of this environmental compliance burden include:

- Increased operational costs: Investments in new technologies and processes to reduce emissions and manage waste add to the day-to-day running expenses.

- Capital expenditure requirements: Significant upfront capital is needed for upgrades to infrastructure and equipment to meet environmental regulations.

- Potential for fines and penalties: Non-compliance can result in substantial financial penalties, further impacting profitability.

- Resource allocation challenges: The need for substantial environmental investment may divert funds from other strategic growth initiatives or shareholder returns.

Need for Rebuilding Operational Flexibility

Gold Fields is currently navigating a period where it needs to re-establish operational flexibility after a phase heavily focused on developing its asset portfolio. This rebuilding process is essential for long-term stability but could mean that performance might see some ups and downs in the immediate future.

This transitional phase demands significant time and ongoing investment to ensure that production across its various mining sites becomes more consistent and predictable. For instance, the company's 2024 guidance anticipates production levels that reflect this ongoing optimization effort.

- Rebuilding Operational Flexibility: Following a development-heavy period, Gold Fields must re-establish agility in its operations.

- Near-Term Performance Fluctuations: The rebuilding phase may lead to continued variability in performance in the short term.

- Investment and Time Required: Achieving consistent and predictable production across its diverse asset base necessitates sustained investment and patience.

- Transitional Volatility: Investors should anticipate a transitional period marked by potential volatility as operational efficiencies are restored.

Gold Fields' operational consistency remains a key weakness, with production shortfalls in H1 2024 at mines like South Deep and Gruyere due to adverse weather and ground conditions. This led to revised annual guidance, highlighting the vulnerability of its output to external and internal disruptions.

Elevated costs, particularly All-in Sustaining Costs (AISC), are a concern, driven by reduced production and mining inflation in 2024. While cost improvements are projected for 2025, persistently high expenses could squeeze profit margins, especially if gold prices decline.

The company faces substantial financial strain from environmental compliance mandates, with projected annual investments in the hundreds of millions of dollars to meet evolving standards, particularly for carbon emission reduction. This increases operational expenditures and may affect capital allocation.

Gold Fields is in a transitional phase, rebuilding operational flexibility after a period focused on asset development. This rebuilding requires significant investment and time, potentially leading to continued performance fluctuations in the near term as efficiencies are restored.

| Mine/Factor | H1 2024 Impact | Key Challenge | Cost Impact (2024) |

|---|---|---|---|

| South Deep | Production Shortfall | Difficult Ground Conditions | Increased Operational Costs |

| Gruyere | Production Shortfall | Adverse Weather | Increased Operational Costs |

| Environmental Compliance | Increased Capex/Opex | Carbon Emission Reduction | Hundreds of Millions Annually |

| Operational Flexibility | Performance Fluctuations | Rebuilding Phase | Investment Required |

Preview the Actual Deliverable

Gold Fields SWOT Analysis

This is a real excerpt from the complete Gold Fields SWOT analysis. Once purchased, you’ll receive the full, editable version, providing a comprehensive understanding of the company's strategic position.

Opportunities

The current environment of strong gold prices, reaching historic peaks and trading well above historical averages, presents a significant opportunity for Gold Fields. For instance, gold prices in early 2024 consistently traded above $2,000 per ounce, a level that was considered a major milestone just a few years prior.

Higher gold prices directly translate into increased revenues and improved profitability margins for the company. This favorable market condition allows for greater cash flow, which can be reinvested in exploration and development, or distributed to shareholders.

The ramp-up at Salares Norte in Chile is a key driver for Gold Fields, with commercial production slated for Q3 2025 and reaching steady-state throughput by Q4 2025. This project is projected to add approximately 200,000-250,000 gold equivalent ounces annually once fully operational.

This significant production increase is expected to boost Gold Fields' total gold equivalent production by over 15% in 2025, reaching an estimated 2.7 million ounces, up from around 2.3 million ounces in 2024. Salares Norte is anticipated to operate at a competitive all-in sustaining cost (AISC) of $800-$900 per ounce, enhancing the company's overall profitability.

The Windfall project in Canada, now fully owned by Gold Fields after acquiring Osisko Mining, is a significant long-term growth driver. This advanced stage project is on track for a final investment decision in early 2026, with environmental approvals also being pursued.

Securing these approvals will pave the way for future production increases and strengthen Gold Fields' overall portfolio. Windfall is recognized as one of the world's largest gold deposits, particularly notable for its high head grade.

Strategic Acquisitions and Portfolio Optimization

Gold Fields has actively pursued strategic acquisitions to bolster its portfolio, exemplified by the acquisition of Gold Road Resources in Australia. This move, completed in early 2024, significantly enhanced Gold Fields' Australian presence and asset quality, aiming to consolidate operations and improve efficiency. Such strategic moves are crucial for upgrading the company's asset base and securing long-term growth.

The company's ongoing strategy includes identifying and executing bolt-on mergers and acquisitions (M&A) to further strengthen its market position. This approach not only allows for the integration of complementary assets but also presents opportunities to optimize existing operations and unlock synergies.

- Portfolio Enhancement: The acquisition of Gold Road Resources in early 2024 added significant high-quality assets in Australia, reinforcing Gold Fields' strategic focus on tier-one mining jurisdictions.

- Operational Synergies: Consolidating assets through acquisitions aims to eliminate inefficiencies and improve operational performance across the expanded portfolio.

- Future Growth: Continued exploration and targeted M&A are key to securing future growth prospects and maintaining a competitive edge in the global gold mining sector.

Technological Advancements and Digital Mining

The ongoing evolution and integration of digital mining technologies, including automation and artificial intelligence, offer Gold Fields a significant opportunity to boost operational efficiency and cut expenses. For instance, the adoption of autonomous drilling systems, as seen in various mining operations globally, can yield substantial productivity improvements. Gold Fields’ commitment to innovation in these areas is projected to strengthen its competitive position in the market.

These technological advancements are not just about efficiency; they also directly contribute to a safer working environment. By automating hazardous tasks, Gold Fields can reduce the risk of accidents and injuries, aligning with its commitment to responsible mining practices. This focus on safety, coupled with efficiency gains, makes embracing digital mining a strategic imperative.

- Enhanced Operational Efficiency: Digital mining technologies like autonomous haulage and drilling can increase uptime and throughput.

- Cost Reduction: Automation leads to lower labor costs and optimized resource utilization.

- Improved Safety: Reducing human exposure to hazardous environments is a key benefit.

- Competitive Advantage: Early adoption of advanced technologies can differentiate Gold Fields from competitors.

Gold Fields is well-positioned to capitalize on the robust gold price environment, with prices consistently trading above $2,000 per ounce in early 2024. This favorable market condition directly translates into enhanced revenues and improved profitability margins for the company, providing ample cash flow for strategic reinvestment and shareholder returns.

The company's growth pipeline is strong, with the Salares Norte project in Chile expected to add 200,000-250,000 gold equivalent ounces annually from 2025, boosting total production by over 15%. Furthermore, the Windfall project in Canada, a significant long-term asset, is progressing towards a final investment decision in early 2026, promising future production increases.

Strategic acquisitions, such as the early 2024 purchase of Gold Road Resources in Australia, are actively strengthening Gold Fields' portfolio and consolidating its presence in tier-one mining jurisdictions. These moves, combined with a focus on digital mining technologies for enhanced efficiency and safety, create a competitive advantage and unlock further growth potential.

| Project | Status | Expected Annual Production (koz Au eq.) | Key Opportunity |

|---|---|---|---|

| Salares Norte | Commercial production by Q3 2025 | 200-250 | Significant production increase, competitive AISC |

| Windfall | FID expected early 2026 | N/A (Long-term growth driver) | High-grade deposit, future production |

| Gold Road Resources Acquisition | Completed early 2024 | N/A (Portfolio enhancement) | Strengthened Australian presence, asset quality |

Threats

Gold Fields' mining operations face significant risks from operational volatility, particularly due to severe weather events. For instance, in 2024, heavy rainfall impacted operations at the Gruyere mine, and harsh winter conditions affected the Salares Norte site, leading to disruptions and increased costs.

These environmental factors directly threaten production targets and can escalate operational expenses, highlighting the vulnerability of mining activities to climate change and its unpredictable manifestations.

While gold prices have been strong, they are inherently volatile, influenced by global economic shifts, geopolitical tensions, and investor sentiment. For instance, in early 2024, gold prices reached record highs, exceeding $2,400 per ounce, demonstrating this sensitivity.

A significant downturn from these elevated levels could directly reduce Gold Fields' revenue and profitability, even if the company excels operationally. This market-driven price risk is a core challenge for all gold mining companies.

The gold mining sector, including companies like Gold Fields, is navigating a landscape of heightened regulatory oversight and increasingly stringent environmental standards. This means more rigorous compliance requirements for everything from carbon emissions to how water is managed and how mining waste, known as tailings, is stored. For instance, in 2023, the World Bank reported that the cost of compliance with environmental regulations in the mining sector globally saw an average increase of 8% year-over-year, directly impacting operational budgets.

These evolving rules demand significant and ongoing investment in new technologies and operational adjustments. Gold Fields, like its peers, must allocate capital to ensure adherence to these standards, which can affect project timelines and overall profitability. Failure to meet these requirements isn't just a financial risk; it can lead to substantial fines or even temporary shutdowns of mining operations, as seen in several Latin American jurisdictions in late 2024 where non-compliant water discharge practices led to production halts.

Geopolitical and Social Risks in Operating Regions

Gold Fields' international operations mean it's susceptible to geopolitical shifts and social instability in its operating regions. These factors can manifest as unexpected government policy changes, social unrest affecting operations, or difficulties in obtaining or extending crucial mining permits. For example, the ongoing negotiations for the Damang mine lease renewal in Ghana underscore the complexities of government relations and licensing. These situations can disrupt operations and create uncertainty for investments.

These geopolitical and social risks can significantly impact Gold Fields' financial performance and operational stability. For instance, in 2023, the company reported that its South American operations faced heightened political scrutiny, leading to a temporary halt in exploration activities at one site, impacting projected resource growth. Such events can lead to increased operating costs due to security measures or delays in production, ultimately affecting revenue streams.

- Government Policy Changes: Fluctuations in mining regulations, taxation, or local content requirements can directly affect profitability and operational feasibility.

- Social Unrest: Community relations and potential for local protests or strikes can disrupt mining activities, leading to production losses and increased security costs.

- Licensing and Permitting: Delays or denials in renewing or obtaining mining licenses, as seen with the Damang mine in Ghana, can hinder exploration and production plans.

- Political Instability: Changes in government or political leadership can lead to shifts in economic policy, potentially impacting foreign investment and mining contracts.

Inflationary Pressures and Rising Input Costs

Gold Fields is grappling with persistent inflationary pressures, especially concerning general mining expenses. This trend directly translates to an elevated cost of sales, potentially squeezing overall profitability. For instance, rising energy prices, a significant component of mining operations, directly impact operational expenditures.

The benefits derived from higher gold prices can be significantly diminished by escalating costs for essential inputs like labor, energy, and raw materials. This dynamic necessitates a proactive approach to cost management to preserve healthy profit margins.

- Rising Energy Costs: Global energy prices, a key input for mining, have seen significant volatility. For example, Brent crude oil futures averaged around $83 per barrel in Q1 2024, a notable increase from previous periods, directly affecting fuel and electricity expenses for Gold Fields.

- Labor Cost Inflation: Wage demands in key mining regions are increasing due to cost-of-living adjustments and labor market tightness, adding to operational overheads.

- Material and Equipment Costs: The cost of essential mining consumables, spare parts, and new equipment also continues to trend upwards, impacting capital expenditure and maintenance budgets.

Effectively navigating these increasing input costs is paramount for Gold Fields to maintain its competitive edge and ensure sustainable profitability in the current economic climate.

Gold Fields faces significant threats from operational disruptions due to extreme weather. For example, heavy rainfall in 2024 impacted the Gruyere mine, and winter conditions affected Salares Norte, leading to increased costs and production setbacks.

The company's profitability is vulnerable to gold price volatility, as seen with prices exceeding $2,400 per ounce in early 2024. A sharp decline from these highs could severely impact revenue, even with strong operational performance.

Heightened regulatory oversight and stricter environmental standards globally are increasing compliance costs. In 2023, the World Bank noted an 8% year-over-year rise in compliance costs for the mining sector, directly affecting budgets and potentially leading to production halts if not met, as evidenced by incidents in Latin America in late 2024.

Geopolitical instability and social unrest in operating regions pose risks, including policy changes and permit delays, as illustrated by the Damang mine lease negotiations in Ghana. Such events can disrupt operations and create investment uncertainty, with South American operations facing scrutiny in 2023 leading to exploration halts.

Persistent inflationary pressures, particularly on energy, labor, and materials, are driving up operating expenses. For instance, Brent crude oil averaged around $83 per barrel in Q1 2024, increasing fuel costs and impacting overall profitability.

SWOT Analysis Data Sources

This Gold Fields SWOT analysis is built upon a foundation of robust data, including their official financial reports, comprehensive market intelligence, and insights from industry experts. These sources provide a reliable basis for understanding the company's current standing and future potential.