Gold Fields Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gold Fields Bundle

Gold Fields faces significant competitive pressures, from the bargaining power of its buyers to the threat of new entrants in the mining sector. Understanding these forces is crucial for navigating the volatile gold market.

The complete report reveals the real forces shaping Gold Fields’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Suppliers of specialized equipment and technology for gold mining, such as advanced drilling rigs or sophisticated geological modeling software, hold considerable bargaining power. The gold mining industry relies on a narrow set of manufacturers capable of producing these highly technical and often proprietary solutions. For instance, in 2024, the global market for mining machinery, a key input for companies like Gold Fields, is characterized by a few dominant players, limiting competitive sourcing options.

This concentration means Gold Fields may face higher procurement costs for essential machinery and critical spare parts. The high cost and complexity of switching to alternative suppliers or technologies further entrench the bargaining power of these specialized providers, potentially impacting Gold Fields' operational expenses and capital expenditure plans.

Access to a highly skilled workforce, encompassing geologists, mining engineers, and specialized technical operators, is fundamental for Gold Fields' operations. The availability of such expertise directly influences project success and efficiency.

In 2024, the global mining sector continued to face challenges in securing specialized talent, particularly in emerging markets. For instance, a report by the International Mining Association indicated a 15% year-over-year increase in demand for experienced mining engineers, leading to higher recruitment costs and potentially longer project initiation phases for companies like Gold Fields.

Shortages of this specialized labor in key mining regions can significantly escalate labor costs and empower workers with greater bargaining power. This directly impacts Gold Fields' operational expenses and can introduce delays to critical project timelines, affecting overall profitability and production targets.

Energy, especially electricity and fuel, represents a substantial cost for mining operations. In 2024, global energy prices continued to be a significant factor, with Brent crude oil averaging around $83 per barrel for the year. This volatility, coupled with the often isolated locations of mines, grants considerable bargaining power to energy providers who can dictate terms due to limited alternative sources.

Beyond fuel, chemical reagents like cyanide, essential for gold extraction, also contribute to supplier leverage. If the production and distribution of these critical consumables are controlled by a few key players, as seen with certain specialized chemical suppliers in the mining sector, they can exert influence over pricing and availability.

Environmental and Social Services

Gold Fields' commitment to Environmental, Social, and Governance (ESG) standards significantly influences its supplier relationships in environmental and social services. The company depends on specialized consultants for environmental impact assessments, social impact studies, and community engagement programs. These services require niche expertise and strict adherence to evolving regulatory frameworks, which can consolidate power among a limited number of qualified providers.

The specialized nature of ESG services means fewer suppliers can meet Gold Fields' rigorous requirements. This scarcity, coupled with the critical need for compliance and effective community relations, allows these specialized suppliers to command higher fees. For instance, in 2024, the global ESG consulting market was valued at over $15 billion, with demand driven by companies like Gold Fields seeking to navigate complex sustainability mandates.

- Niche Expertise: Suppliers possess specialized knowledge in environmental science, social impact assessment, and stakeholder engagement, which is not readily available internally or from generalist service providers.

- Regulatory Compliance: Adherence to strict environmental laws and social licensing requirements necessitates suppliers with proven track records and deep understanding of legal frameworks.

- Limited Supplier Pool: The number of firms with the necessary accreditation, experience, and capacity to deliver high-quality ESG services for large-scale mining operations is relatively small.

- Strategic Importance: The effectiveness of these services directly impacts Gold Fields' reputation, operational continuity, and ability to secure and maintain its social license to operate, giving suppliers leverage.

Logistics and Infrastructure Services

Gold Fields' reliance on logistics and infrastructure services, such as transportation and port access, is a key factor in its bargaining power of suppliers. Operating mines across diverse global locations, including South Africa, Australia, and South America, means that the availability and cost of these services can significantly impact operational efficiency and profitability.

In regions where infrastructure is underdeveloped or the number of specialized service providers is limited, these suppliers can wield considerable influence. For instance, disruptions in shipping routes or port congestion can lead to substantial delays and increased costs for moving ore and supplies. In 2024, global shipping costs saw fluctuations due to geopolitical events and demand shifts, directly affecting mining companies like Gold Fields.

- Geographic Dependence: Gold Fields' operations in countries like Peru and Ghana, which may have less developed transportation networks, increase supplier leverage.

- Specialized Needs: Moving large volumes of ore and heavy equipment requires specialized logistics providers, limiting the pool of available suppliers.

- Infrastructure Costs: The cost of accessing ports and maintaining transportation links can represent a significant portion of operational expenses, giving suppliers pricing power.

Suppliers of critical mining inputs, like specialized equipment and essential chemicals, hold significant leverage over Gold Fields. This is due to the concentrated nature of manufacturers for advanced machinery and the limited number of producers for chemicals like cyanide, essential for gold extraction. For example, in 2024, the global mining machinery market was dominated by a few key players, restricting Gold Fields' sourcing options and potentially increasing costs for vital equipment and spare parts.

The high cost and complexity associated with switching suppliers for these specialized inputs further solidify the bargaining power of existing providers. This situation can directly impact Gold Fields' operational expenses and capital expenditure, as seen with the continued reliance on a narrow base of technology providers in 2024.

Furthermore, the availability of skilled labor and energy resources presents another avenue for supplier power. In 2024, the mining sector experienced a notable shortage of experienced mining engineers, with demand increasing by 15% year-over-year, driving up recruitment costs. Similarly, energy providers, particularly for electricity and fuel, exert influence due to the often remote locations of mines and the volatility of global energy prices, with Brent crude averaging around $83 per barrel in 2024.

| Supplier Category | Key Factors Influencing Bargaining Power | Impact on Gold Fields | 2024 Data/Context |

|---|---|---|---|

| Specialized Equipment Manufacturers | High R&D costs, proprietary technology, limited producers | Higher procurement costs, limited sourcing options | Concentrated global mining machinery market |

| Chemical Reagent Suppliers (e.g., Cyanide) | Production complexity, distribution control, regulatory requirements | Pricing and availability leverage | Dependence on a few key chemical producers |

| Skilled Labor Providers | Shortage of specialized expertise (geologists, engineers) | Increased labor costs, recruitment challenges, project delays | 15% year-over-year increase in demand for mining engineers |

| Energy Providers (Electricity, Fuel) | Geographic isolation of mines, volatile global energy prices | Significant operational cost factor, pricing power | Brent crude oil averaged ~$83/barrel in 2024 |

| Logistics & Infrastructure Services | Underdeveloped infrastructure in some regions, specialized transport needs | Increased transportation costs, potential for delays | Fluctuations in global shipping costs due to geopolitical events |

What is included in the product

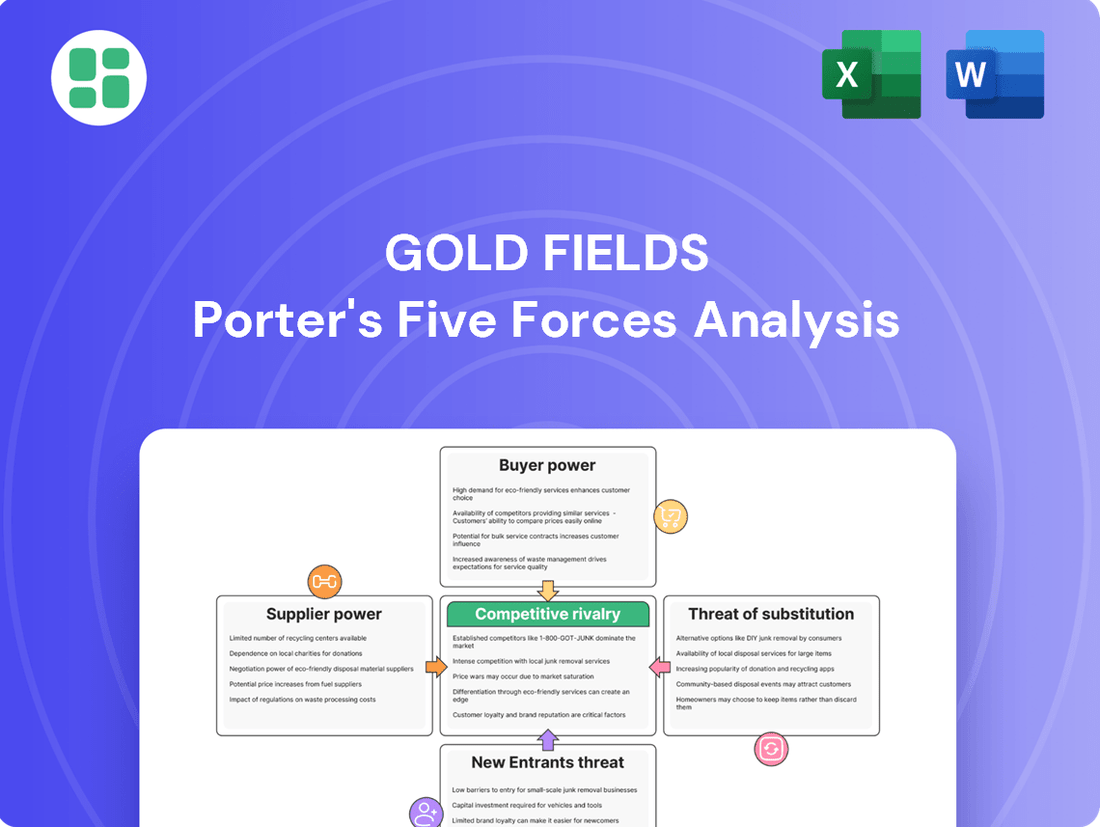

Gold Fields' competitive landscape is meticulously examined through Porter's Five Forces, revealing the intensity of rivalry, buyer and supplier power, threat of substitutes, and barriers to entry.

Easily identify and mitigate competitive threats with a visual breakdown of industry power dynamics.

Customers Bargaining Power

Gold's status as a largely undifferentiated commodity significantly amplifies customer bargaining power. This means that gold from Gold Fields is essentially the same as gold from any competitor, making price the primary deciding factor for buyers.

The interchangeability of gold means customers can readily switch suppliers if they find a better price elsewhere. This lack of product differentiation directly weakens Gold Fields' ability to dictate terms or command premium pricing, as seen in the global gold market where price discovery is highly transparent.

For instance, the average price of gold in 2024 has hovered around $2,300 per ounce, a figure influenced by broad market dynamics rather than any single producer's unique offering. This price sensitivity underscores the substantial leverage customers hold in transactions involving gold.

Gold Fields operates within a globally dispersed market, serving a wide array of buyers from central banks and bullion dealers to industrial consumers and individual investors. This broad customer base, encompassing numerous distinct entities across different geographies and sectors, inherently limits the leverage any single buyer or small coalition of buyers can exert.

The fragmentation means that Gold Fields is not overly reliant on any particular customer segment. For instance, in 2023, Gold Fields' revenue was generated from a diverse mix of sales channels, with no single customer accounting for more than a small percentage of total sales, underscoring the dispersed nature of its demand.

The bargaining power of customers in the gold market is virtually nonexistent. The price of gold is set on a global scale, influenced by complex macroeconomic factors, central bank policies, and investor demand, not by individual buyer negotiations. Gold Fields, like other major producers, operates as a price-taker, accepting the prevailing market rate for its product.

High Liquidity and Transparency

The gold market’s high liquidity and transparency significantly limit customer bargaining power. Real-time price discovery on exchanges and over-the-counter markets means buyers have immediate access to prevailing prices, preventing them from demanding substantially lower rates from producers like Gold Fields. This level of transparency ensures fair market value is readily apparent to all participants.

- Market Liquidity: The global gold market is exceptionally liquid, facilitating rapid and efficient transactions.

- Price Transparency: Information on gold prices is widely available and updated constantly, leaving little room for information asymmetry.

- Impact on Bargaining: Buyers cannot easily leverage their purchasing power for significant price concessions due to the readily available market data.

- 2024 Gold Prices: As of early 2024, gold prices have shown volatility, trading in the range of $2,000 to over $2,300 per ounce, reflecting global economic factors and demand.

Limited Forward Integration by Customers

Customers of gold, like jewelry makers or electronics firms, generally lack the expertise or inclination to mine gold themselves. This inability to integrate backward significantly curtails their leverage over suppliers such as Gold Fields.

For instance, in 2024, the global jewelry industry, a major consumer of gold, primarily sources its materials through established supply chains rather than investing in mining operations. This dynamic reinforces Gold Fields' position by limiting the direct threat of customers becoming competitors.

- Limited Backward Integration: Key customer industries, such as jewelry manufacturing and electronics, do not possess the capital, technology, or strategic focus required for backward integration into gold mining.

- Reduced Customer Leverage: This lack of integration capability means customers cannot credibly threaten to mine their own gold, thereby diminishing their bargaining power against Gold Fields.

- Supplier Reliance: Consequently, these customer segments remain reliant on established gold producers like Gold Fields for their supply needs, strengthening Gold Fields' market position.

Customer bargaining power in the gold market is notably low, primarily due to gold's undifferentiated nature and the market's high liquidity and transparency. Buyers cannot easily negotiate lower prices because gold's value is determined by global forces, not individual buyer influence.

The inability of customers, like jewelry manufacturers, to integrate backward into mining further limits their leverage. They remain dependent on producers like Gold Fields for supply, reinforcing the producer's strong market position.

For example, the average gold price in 2024 has fluctuated, with significant market-driven movements, such as trading above $2,300 per ounce at certain points, underscoring that price is set by broader economic factors rather than customer negotiation.

| Factor | Impact on Customer Bargaining Power | Relevance to Gold Fields |

|---|---|---|

| Product Differentiation | Low (Gold is a commodity) | Customers can easily switch suppliers based on price. |

| Market Liquidity & Transparency | Low (High liquidity, real-time pricing) | Prevents customers from demanding significant price concessions. |

| Backward Integration Potential | Low (Customers cannot mine gold) | Customers remain reliant on producers like Gold Fields for supply. |

| Customer Concentration | Low (Dispersed customer base) | No single customer holds significant leverage over Gold Fields. |

Preview the Actual Deliverable

Gold Fields Porter's Five Forces Analysis

This preview showcases the complete Gold Fields Porter's Five Forces Analysis, identical to the document you will receive immediately after purchase. You are viewing the actual, professionally written analysis, ensuring no surprises or placeholder content. Once your transaction is complete, you'll gain instant access to this fully formatted and ready-to-use strategic document.

Rivalry Among Competitors

Gold Fields faces fierce competition from global giants such as Newmont, Barrick Gold, and AngloGold Ashanti. These diversified producers command substantial resources and production capacities, often vying for the same mineral rights and operational advantages.

Competitive rivalry in the gold sector is intense, driven by cost efficiency and production volume. As gold is a commodity, producers must focus on minimizing their All-in Sustaining Costs (AISC) to remain profitable, particularly when gold prices fluctuate. For instance, in 2024, many gold miners are targeting AISC below $1,000 per ounce to ensure healthy margins.

Companies actively compete to maximize output from their current operations and to bring new, lower-cost mines online. This push for volume and efficiency is crucial for market share and profitability. Gold Fields, for example, aims to achieve significant production growth from its South American and Australian assets in the coming years, emphasizing operational excellence to keep costs down.

Sustaining production levels in the gold mining industry hinges on successful exploration and the ongoing replacement of reserves, a critical battleground for competitive advantage. Companies are locked in a constant race to identify and secure new gold deposits, directly impacting their long-term viability and market position.

This intense competition for attractive assets is evident in the significant capital expenditure directed towards exploration. For instance, in 2023, major gold producers allocated billions to exploration activities, with companies like Barrick Gold and Newmont investing over $500 million each, underscoring the drive to discover and acquire promising resources.

Environmental, Social, and Governance (ESG) Performance

Competitive rivalry in the gold mining sector is intensifying as companies like Gold Fields increasingly focus on Environmental, Social, and Governance (ESG) performance. This focus is critical for attracting investment and maintaining social licenses to operate. Companies are actively competing to showcase superior environmental management, robust community relations, and strong governance structures. For instance, in 2023, Gold Fields reported a 19% reduction in Scope 1 and 2 greenhouse gas emissions intensity compared to its 2019 baseline, a metric that directly influences investor perception and potential capital access.

The drive for better ESG credentials means competitors are locked in a battle to be seen as leaders in sustainability. This isn't just about compliance; it's a strategic differentiator. Superior ESG performance can lead to lower capital costs and enhanced brand reputation. In 2024, many mining firms are setting ambitious targets for water usage reduction and biodiversity protection, areas where demonstrable progress can significantly impact their standing among a growing pool of ESG-conscious investors.

- ESG as a Competitive Differentiator: Companies are vying to outperform on environmental stewardship, community engagement, and governance.

- Investor Attraction: Strong ESG credentials are vital for attracting capital from a widening base of sustainability-focused investors.

- Social License to Operate: Demonstrating commitment to local communities and responsible operations is crucial for maintaining operational continuity.

- Performance Benchmarking: Companies are increasingly benchmarking their ESG metrics, such as emissions reduction and safety records, against peers.

Mergers and Acquisitions Activity

Mergers and acquisitions (M&A) activity in the gold mining sector has been a significant driver of competitive rivalry. Major companies are actively pursuing consolidation to gain economies of scale, broaden their asset portfolios, and realize cost efficiencies, thereby intensifying the competitive landscape as firms vie for strategic advantages and increased market presence.

This trend is evident in the substantial deal values seen in recent years. For instance, in 2023, the global mining sector witnessed a surge in M&A, with gold mining being a prominent area. Barrick Gold's acquisition of a significant stake in Lumina Gold for approximately $1.1 billion in early 2023 exemplifies this consolidation drive.

The pursuit of scale through M&A directly impacts competitive dynamics by creating larger, more dominant players. These larger entities often possess greater financial leverage and operational efficiencies, putting pressure on smaller or less consolidated competitors. This can lead to a scenario where only the fittest, often those involved in strategic mergers, can effectively compete.

- Increased Scale: M&A allows companies to achieve greater operational scale, leading to improved cost efficiencies and enhanced bargaining power with suppliers.

- Asset Diversification: Consolidation enables companies to diversify their geographical and geological asset bases, reducing reliance on single mining operations or regions.

- Cost Reduction: Merging entities can realize significant cost savings through the elimination of redundant functions, optimized supply chains, and shared overheads.

- Market Share Growth: Strategic acquisitions are a direct route to increasing market share and solidifying a company's position within the industry, thereby intensifying rivalry.

Competitive rivalry among gold miners is intense, with companies like Gold Fields constantly battling for market share and operational efficiency. This competition is further amplified by the pursuit of attractive exploration assets, a critical factor for long-term viability. The industry is also seeing a significant trend towards consolidation through mergers and acquisitions, creating larger entities with greater economies of scale and market influence.

The drive for cost efficiency is paramount, with many miners aiming for All-in Sustaining Costs (AISC) below $1,000 per ounce in 2024. Environmental, Social, and Governance (ESG) performance is emerging as a key differentiator, influencing investor attraction and the social license to operate. Companies are actively benchmarking their ESG metrics, such as emissions reduction, to gain a competitive edge.

| Competitor | 2023 Production (Moz) | 2024 AISC Target (USD/oz) | Key 2023 ESG Initiative |

|---|---|---|---|

| Newmont | 5.9 | <1000 | Water stewardship programs |

| Barrick Gold | 4.0 | <1000 | Renewable energy integration |

| AngloGold Ashanti | 2.1 | <1000 | Community development projects |

| Gold Fields | 2.4 | <1000 | GHG emissions reduction (19% vs 2019) |

SSubstitutes Threaten

Other precious metals like silver, platinum, and palladium present a significant threat of substitutes for gold as investment alternatives. For instance, in 2024, while gold prices saw fluctuations, platinum also experienced notable price movements, offering investors alternative avenues for wealth preservation and inflation hedging. The attractiveness of these substitutes can directly impact demand for gold, especially when their relative price performance or market sentiment shifts favorably.

Gold, as a store of value, faces significant competition from a broad spectrum of financial assets. Government bonds, equities, real estate, and major fiat currencies all offer alternative avenues for wealth preservation and growth. For instance, in early 2024, the US Treasury 10-year yield hovered around 4.2%, making bonds an attractive, albeit lower-risk, alternative to gold for income-seeking investors.

Investor sentiment and economic conditions heavily influence the demand for these substitutes. When interest rates rise, as they did through much of 2022-2023, fixed-income assets become more appealing, potentially drawing capital away from gold. Similarly, a robust stock market performance or a strong real estate outlook can divert investor interest from precious metals.

The perceived stability and liquidity of major currencies like the US dollar or the Euro also present a competitive threat. During periods of global economic uncertainty, investors might favor these currencies, especially if they are backed by strong economies, over gold. This dynamic can directly impact gold's demand as a safe-haven asset.

Cryptocurrencies, especially Bitcoin, have emerged as a significant substitute for gold, often referred to as digital gold. Their appeal stems from a perceived scarcity and a decentralized structure, offering an alternative store of value.

While still subject to considerable price swings, the increasing adoption and integration of cryptocurrencies into mainstream financial discussions suggest a potential shift in investment flows. This could divert capital that historically sought refuge in physical gold.

As of early 2024, the global cryptocurrency market capitalization hovered around $1.6 trillion, demonstrating its growing influence. This digital asset class presents a tangible threat by offering an alternative investment avenue for wealth preservation and speculative growth, potentially impacting demand for traditional safe-haven assets like gold.

Recycled Gold Supply

The threat of substitutes for newly mined gold is significant, largely due to the substantial recycled gold supply. This recycled gold, primarily sourced from old jewelry and industrial electronics, directly competes with primary production. In 2023, for instance, the World Gold Council reported that recycled gold accounted for approximately 25% of the total global gold supply, a figure that can fluctuate based on gold prices and economic conditions.

This readily available secondary source can temper the demand for newly extracted gold. When gold prices rise, the incentive to recycle existing gold increases, thereby boosting the substitute supply. For companies like Gold Fields, this dynamic means that even if demand for gold remains robust, a larger portion of that demand can be met by recycled material, potentially limiting the pricing power and sales volume of newly mined gold.

- Recycled Gold's Market Share: Recycled gold constituted roughly 25% of the global gold supply in 2023, acting as a direct substitute for newly mined ounces.

- Price Sensitivity: Higher gold prices incentivize greater recycling efforts, increasing the availability of substitutes and potentially capping price appreciation for primary gold.

- Impact on Producers: For mining companies like Gold Fields, a strong recycled supply can moderate demand for their new production, influencing revenue and profitability.

- Economic Indicator: The volume of recycled gold can also serve as an economic indicator, reflecting consumer behavior and the liquidation of assets during periods of financial stress.

Industrial and Jewelry Material Alternatives

In industrial uses like electronics and dentistry, and also in jewelry, other metals or materials can step in for gold, particularly when its price gets too high. For instance, palladium and platinum are sometimes used in electronics, and while gold's unique qualities are hard to match exactly, cost pressures can push consumers and industries towards these alternatives when it makes financial sense.

The threat of substitutes for gold is moderate. While gold possesses unique properties like excellent conductivity and tarnish resistance, making direct substitution challenging in certain high-tech applications, its high price can incentivize the use of alternatives. In 2024, the average price of gold fluctuated, reaching highs around $2,400 per ounce, which can indeed make alternative materials more attractive for some industrial processes and jewelry designs.

- Industrial Substitution: In electronics, palladium and silver are often considered substitutes for gold due to their conductivity, though gold generally offers superior corrosion resistance.

- Jewelry Substitution: Platinum, palladium, and even high-quality sterling silver can serve as substitutes for gold in jewelry, particularly when gold prices surge.

- Cost-Driven Shifts: Significant price increases in gold can accelerate the adoption of these substitutes, especially in applications where performance differences are marginal or acceptable.

- Technological Advancements: Ongoing research into new alloys and materials may further enhance the viability of substitutes in both industrial and consumer markets.

The threat of substitutes for gold, particularly from other precious metals like silver, platinum, and palladium, remains a key consideration. In 2024, these metals offered alternative investment avenues with their own price dynamics, impacting gold's demand as a store of value and inflation hedge.

The rise of cryptocurrencies, notably Bitcoin, presents a growing substitute threat, often dubbed digital gold. Their perceived scarcity and decentralized nature appeal to investors seeking alternative stores of value, potentially diverting capital from traditional safe havens like gold, with the crypto market cap around $1.6 trillion in early 2024.

Recycled gold, accounting for approximately 25% of the global supply in 2023, acts as a direct substitute for newly mined gold, especially when prices are high, influencing demand and pricing power for producers like Gold Fields.

In industrial uses and jewelry, alternative metals such as palladium, platinum, and silver can substitute for gold, particularly when gold prices, which fluctuated around $2,400 per ounce in 2024, become prohibitive, driving cost-conscious shifts.

| Substitute Category | Key Alternatives | 2024 Price Context (Approx.) | Impact on Gold Demand |

|---|---|---|---|

| Other Precious Metals | Silver, Platinum, Palladium | Platinum prices showed notable movements; Silver prices also fluctuated. | Offers alternative investment and hedging options. |

| Digital Assets | Bitcoin | Market Cap ~$1.6 trillion (early 2024) | Appeals as a scarce, decentralized store of value. |

| Recycled Gold | Existing Gold (Jewelry, Electronics) | 25% of 2023 Global Supply | Meets demand, potentially limiting new production sales. |

| Industrial/Jewelry Materials | Palladium, Platinum, Silver, Sterling Silver | Gold ~ $2,400/oz (highs) | Cost-driven adoption when gold prices surge. |

Entrants Threaten

The gold mining industry demands immense upfront investment, creating a significant barrier to entry. Exploration, mine construction, processing plants, and essential infrastructure all require substantial capital, often running into billions of dollars. For instance, developing a new large-scale gold mine can easily cost over $1 billion.

These high capital requirements effectively deter potential new competitors from entering the market. Established companies like Gold Fields, with their existing infrastructure and access to financing, possess a considerable advantage. The sheer scale of investment needed makes it incredibly challenging for smaller or newer entities to challenge the market position of industry veterans.

New gold mining projects encounter a labyrinth of complex and time-consuming regulatory processes. These often include obtaining numerous permits related to environmental impact assessments, land use rights, water allocation, and operational safety, varying significantly by jurisdiction.

Successfully navigating these extensive hurdles necessitates substantial investments in time, specialized expertise, and considerable financial resources. For instance, the permitting process for a new mine can easily span several years and cost tens of millions of dollars, acting as a significant deterrent for potential new entrants.

The threat of new entrants in the gold mining sector is significantly influenced by the diminishing availability of easily accessible, high-quality mineral deposits. Discovering and securing economically viable, high-grade gold reserves is becoming increasingly difficult and expensive.

Most of the world's readily exploitable gold deposits have already been mined. Consequently, any new company entering the market faces substantial hurdles, requiring massive investments in high-risk exploration activities or the costly acquisition of existing, often mature, mining operations.

Need for Specialized Expertise and Technology

The gold mining industry presents a substantial threat of new entrants due to the immense need for specialized expertise and advanced technology. Successfully navigating gold extraction and processing demands deep knowledge in geology, engineering, and complex operational management. New players must either cultivate this expertise internally or acquire it through costly means, creating a significant hurdle to entry.

Furthermore, the capital investment required for cutting-edge extraction and processing technologies is a considerable barrier. Companies like Gold Fields invest heavily in areas such as advanced exploration geophysics and automation. For instance, in 2023, the global mining sector saw significant investments in digitalization and automation, with companies focusing on improving efficiency and safety, further raising the bar for newcomers.

- High Capital Expenditure: New entrants face substantial upfront costs for acquiring land, specialized equipment, and developing necessary infrastructure.

- Technological Sophistication: Advanced exploration, extraction, and processing technologies are crucial for profitability, requiring significant R&D or acquisition.

- Regulatory Hurdles: Navigating complex environmental, safety, and mining regulations in various jurisdictions demands specialized legal and compliance expertise.

- Skilled Workforce: Access to a qualified workforce, including geologists, mining engineers, and metallurgists, is essential and often scarce.

Social License to Operate and Community Relations

The threat of new entrants in the mining sector is significantly influenced by the need for a social license to operate. Gaining and maintaining this crucial approval from local communities and governments is paramount for any mining venture. New players often struggle to establish the trust and rapport that established companies like Gold Fields have painstakingly built over years of engagement, making their entry more challenging.

This lack of established community relations can translate into substantial delays and increased costs for new entrants. For instance, in 2024, several mining projects globally faced significant community opposition, leading to extended permitting processes and heightened operational risks. Gold Fields, conversely, benefits from its long-standing presence and proven commitment to community development initiatives, which often smooth the path for its operations.

- Social License Hurdles: New entrants must invest heavily in building trust and demonstrating commitment to local communities, a process that can take years and significant capital.

- Established Relationships: Companies like Gold Fields leverage existing, positive relationships with stakeholders, reducing the risk of project disruption due to social opposition.

- Regulatory Scrutiny: Governments often favor experienced operators with a track record of responsible mining practices, creating a higher barrier for new, unproven entities.

- Community Investment: In 2023, Gold Fields reported significant investments in community projects across its operating regions, totaling millions of dollars, underscoring the importance of social capital.

The threat of new entrants in gold mining remains low due to exceptionally high capital requirements, often exceeding $1 billion for a single mine, and the difficulty in securing economically viable, high-grade gold reserves. Navigating complex, multi-year permitting processes, which can cost tens of millions, further deters new players. Established companies benefit from existing infrastructure and financing access, creating a significant competitive advantage.

| Barrier to Entry | Estimated Cost/Timeframe | Impact on New Entrants |

|---|---|---|

| Capital Expenditure | >$1 billion per major mine | Prohibitive for most new companies |

| Exploration & Reserve Acquisition | High cost, low success rate | Requires significant risk capital |

| Permitting & Regulatory Compliance | Several years, tens of millions $ | Time-consuming and resource-intensive |

| Technological Sophistication | Substantial R&D/acquisition costs | Raises operational efficiency bar |

Porter's Five Forces Analysis Data Sources

Our Gold Fields Porter's Five Forces analysis is built upon a foundation of comprehensive data, including Gold Fields' annual reports and sustainability reports, alongside industry-specific publications from reputable mining associations and market research firms.

We also leverage data from financial databases like Bloomberg and S&P Capital IQ, as well as regulatory filings and macroeconomic indicators, to provide a robust assessment of the competitive landscape.