Gold Fields Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gold Fields Bundle

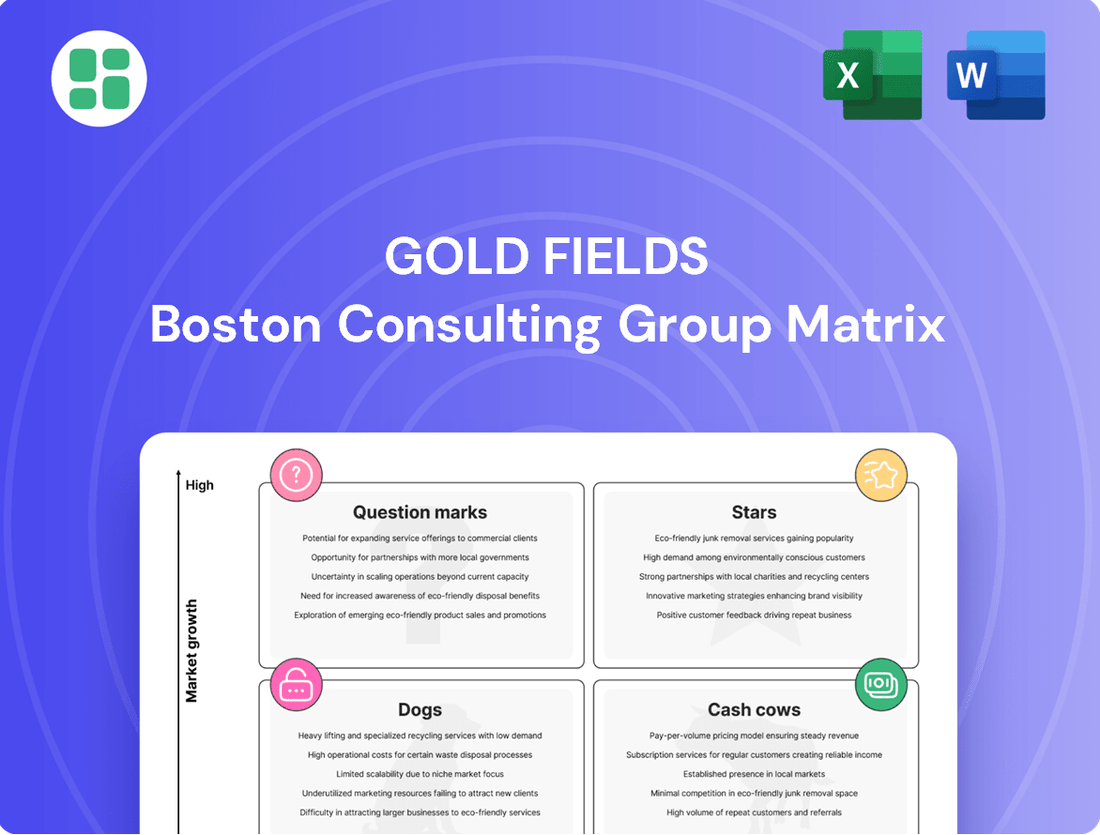

Uncover the hidden potential and challenges within this company's product portfolio using the Gold Fields BCG Matrix. See at a glance which assets are fueling growth and which might be holding it back. Ready to transform this insight into decisive action?

Don't miss out on the comprehensive analysis that goes beyond this snapshot. Purchase the full Gold Fields BCG Matrix to gain a detailed understanding of each product's position, enabling you to make informed strategic decisions and optimize your investments.

Stars

The Salares Norte mine in Chile is a prime example of a Star in the Gold Fields BCG Matrix. Having recently started production, it's currently in a significant ramp-up phase, with projections showing an impressive 580,000 gold equivalent ounces expected in 2025. This new operation is a cornerstone of Gold Fields' expansion plans, designed to substantially increase the company's total gold output and generate robust cash flow.

With its projected low-cost operations and an extensive mine life, Salares Norte is poised to become a leading asset in a rapidly expanding market. Despite facing some initial hurdles, like weather-related delays, its successful commissioning and ongoing ramp-up highlight its strong potential to emerge as a major contributor to Gold Fields' overall portfolio.

The Windfall Project in Canada is a cornerstone of Gold Fields' future growth strategy, with initial production anticipated in 2028. This significant gold deposit is notable for being one of Canada's largest and ranks among the world's top 10 for head grade, suggesting robust future output capabilities.

Gold Fields is actively progressing with detailed engineering and the environmental permitting stages for Windfall, underscoring a substantial commitment of capital and resources. The project's location within a stable mining jurisdiction, coupled with its high-grade potential, firmly positions it as a high-growth, high-market share asset for the company's portfolio.

Gold Fields' binding agreement to acquire 100% of Gold Road Resources, anticipated to conclude in the latter half of 2025, will fully consolidate its ownership of the Gruyere mine in Australia. This move transforms Gruyere into a wholly-owned asset, boosting Gold Fields' market share and operational command in a prime Australian gold region.

The integration of Gruyere as a 100% owned asset is expected to enhance Gold Fields' production by approximately 300,000 to 350,000 ounces of gold annually, contributing significantly to their overall output targets. This consolidation allows for greater realization of operational synergies and strengthens Gold Fields' position in the Australian gold market.

High-Grade Brownfield Expansions

Gold Fields is strategically focusing on high-grade brownfield expansions within its established, successful mines. This approach aims to maximize value and prolong the operational life of these assets.

A prime example is the development of the Swiftsure and Invincible Footwall South open pits at the St Ives operation in Australia. These expansions significantly boosted production in the latter half of 2024.

These targeted expansions capitalize on existing infrastructure and the deep operational knowledge already present. The goal is to increase output and solidify market share in areas with proven, abundant resources.

- St Ives Expansion Impact: The Swiftsure and Invincible Footwall South projects at St Ives contributed to a notable increase in production during H2 2024, demonstrating the effectiveness of brownfield development.

- Leveraging Existing Assets: These expansions are designed to utilize current infrastructure and expertise, reducing capital expenditure and accelerating time to production.

- Resource Rich Areas: The focus remains on proven, resource-rich locations, ensuring a higher probability of success and incremental value creation from mature assets.

- Growth in Mature Operations: High-grade brownfield expansions represent a key growth driver for Gold Fields, enhancing the performance of existing, high-potential mines.

Future High-Potential Greenfield Discoveries

Gold Fields actively pursues greenfields exploration, aiming to uncover new, high-grade gold deposits. This forward-looking strategy is essential for replenishing reserves and building a robust pipeline of future production assets.

In 2024, Gold Fields allocated a significant portion of its capital to exploration, with a particular emphasis on greenfields projects. For instance, exploration activities in regions like Canada and Australia are designed to identify untapped potential.

These early-stage discoveries are crucial for the company's long-term sustainability and growth trajectory. Successful greenfields finds can transform into cornerstone assets, driving future cash flows and enhancing shareholder value.

- Greenfields Exploration Focus: Gold Fields prioritizes identifying new, high-grade deposits through greenfields exploration to secure future growth.

- Strategic Investment: In 2024, the company continued to invest in exploration, particularly in promising jurisdictions for new discoveries.

- Long-Term Value Creation: Successful greenfields finds are vital for reserve replacement and developing future production assets that can become Stars.

- Portfolio Enhancement: This disciplined approach ensures a continuous pipeline of quality assets, bolstering the overall strength of Gold Fields' portfolio.

Stars represent high-growth, high-market share assets within the BCG Matrix. Gold Fields' Salares Norte, Windfall Project, and Gruyere mine exemplify this category. These assets are characterized by their significant production potential, strategic importance, and projected strong future performance.

Salares Norte, in its ramp-up phase, is expected to produce 580,000 gold equivalent ounces in 2025, positioning it as a major growth driver. The Windfall Project, with its high-grade potential and anticipated 2028 production start, is a key future Star. Gruyere, now fully owned by Gold Fields, will add 300,000-350,000 ounces annually, solidifying its Star status.

| Asset | Status | Projected 2025 Production (koz) | Market Share | Growth Potential |

|---|---|---|---|---|

| Salares Norte | Ramp-up | 580 | High | Very High |

| Windfall Project | Development | N/A (Production 2028) | High | Very High |

| Gruyere (100% owned) | Operational | 300-350 (annualized) | High | High |

What is included in the product

This BCG Matrix overview provides clear descriptions and strategic insights for Stars, Cash Cows, Question Marks, and Dogs within the Gold Fields portfolio.

The Gold Fields BCG Matrix simplifies complex portfolio decisions, alleviating the pain of resource allocation uncertainty.

Cash Cows

Gold Fields' established Australian mines, such as Granny Smith, St Ives (excluding new expansions), and Agnew, are true cash cows. These operations are consistently strong performers, churning out significant gold and, importantly, generating substantial adjusted free cash flow.

In FY 2024, these mature Australian assets were the bedrock of Gold Fields' financial performance, contributing a considerable share of the company's overall free cash flow. Their reliability is a key strength.

Operating in a stable mining environment like Australia means these mines don't need heavy investment to keep them going. This allows them to provide steady, predictable returns, acting as the financial backbone for Gold Fields.

The Tarkwa mine in Ghana stands as a cornerstone of Gold Fields' operations, functioning as a classic cash cow. Its substantial production capacity consistently generates significant revenue, making it a vital contributor to the company's financial health. In fiscal year 2024, Tarkwa was a major driver of adjusted free cash flow from operations, underscoring its reliable income-generating capabilities.

Despite facing some operational hurdles, Tarkwa's performance remains robust, solidifying its status as a key asset in a strategically important region. The mine's established market presence and predictable output ensure a steady stream of income for Gold Fields, reinforcing its position as a dependable cash cow.

The South Deep Mine in South Africa, a cornerstone of Gold Fields' portfolio, is a prime example of a cash cow. This long-life, mechanized underground operation has navigated past difficulties and is demonstrating a significant operational turnaround. For the first quarter of 2025, South Deep reported strong production figures, underscoring its improved predictability and cost management.

With substantial reserves and a history of consistent contribution, South Deep reliably generates significant cash flow for Gold Fields. Its ongoing recovery and improved stability solidify its position as a dependable cash-generating asset, crucial for the company's financial health.

Cerro Corona Mine, Peru

The Cerro Corona mine in Peru, though nearing the end of its operational life, remains a significant cash generator for Gold Fields. In 2023, it contributed approximately 273,000 gold equivalent ounces, demonstrating its continued production capacity.

Gold Fields is strategically focused on maximizing cash flow from Cerro Corona through 2030 by reprocessing existing low-grade stockpiles. This approach allows the company to extract remaining value without substantial new capital expenditure, aligning with the 'cash cow' strategy.

- Cerro Corona's 2023 Production: Approximately 273,000 gold equivalent ounces.

- Strategic Focus: Maximizing cash flow through stockpile reprocessing until 2030.

- Investment Approach: 'Milking' the asset for efficient cash generation, not growth.

Stable, Long-Life Assets

Gold Fields' portfolio includes stable, long-life assets that are crucial for consistent production and strong cash flow. These mines, often in established regions, benefit from optimized operations and predictable output, serving as the company's financial bedrock.

These assets typically require minimal investment for maintenance or expansion, freeing up surplus cash. This cash can then be strategically allocated towards new growth initiatives or distributed to shareholders, bolstering the company's overall financial strength.

- Stable Production: These assets provide a reliable stream of gold, underpinning the company's financial stability.

- Robust Cash Flow: Their mature operations generate significant cash, allowing for reinvestment or shareholder returns.

- Low Growth, High Share: They represent established, high-market share components within a low-growth sector.

- Strategic Importance: These mines are fundamental to Gold Fields' ability to fund expansion and maintain financial health.

Gold Fields' cash cows are its mature, low-cost, and high-volume mines. These operations consistently generate significant adjusted free cash flow with minimal need for new capital investment. They form the financial backbone of the company, providing stable returns and funding for growth initiatives.

In FY2024, the Australian mines like Granny Smith and St Ives, along with Tarkwa in Ghana, exemplified this category. South Deep, following its turnaround, is also increasingly demonstrating cash cow characteristics, contributing substantially to adjusted free cash flow. Cerro Corona, while nearing end-of-life, continues to be managed for maximum cash generation through stockpile reprocessing.

| Mine | Region | FY2024 Contribution (Adjusted Free Cash Flow) | Strategic Role |

| Granny Smith | Australia | Significant | Stable Cash Generation |

| St Ives | Australia | Significant | Stable Cash Generation |

| Tarkwa | Ghana | Major Driver | Reliable Income Stream |

| South Deep | South Africa | Growing Contribution | Improved Stability & Cash Flow |

| Cerro Corona | Peru | Managed for Cash | Stockpile Reprocessing |

Delivered as Shown

Gold Fields BCG Matrix

The BCG Matrix preview you are currently viewing is the exact, fully formatted document you will receive upon purchase. This comprehensive report, designed for strategic clarity, contains no watermarks or demo content, ensuring you get a professional and ready-to-use analysis of your business portfolio.

Dogs

Gold Fields' divestment of its 45% stake in the Asanko Gold Mine in Ghana in March 2024 strongly suggests it was classified as a 'Dog' in their BCG Matrix. This strategic move indicates the asset likely possessed a low market share in a mature or declining market, offering limited growth potential.

The rationale behind divesting a 'Dog' asset like Asanko typically involves its inability to generate significant returns or strategic advantage, potentially draining capital and management focus. In 2023, Asanko Gold reported production of 243,000 ounces, a figure that, while substantial, may not have met Gold Fields' internal growth or profitability hurdles for a core asset, especially considering the capital expenditure required for future development.

Gold Fields might maintain minor equity stakes in junior mining ventures that lack substantial operational influence or strategic alignment. These investments, often characterized by a small market presence and unpredictable growth, can underperform relative to expectations.

Such holdings, if they consistently fail to deliver sufficient returns or strategic advantages, can become problematic cash drains, consuming capital without bolstering the primary business. For instance, Gold Fields' sale of its O3 Mining stake in early 2025 illustrates the potential divestment of such non-core assets.

Assets facing ongoing, substantial operational hurdles, resulting in persistently elevated costs and production shortfalls, would fall into the Dogs category if these problems lack a clear resolution path. These could be mines where extraction becomes increasingly difficult or where geological complexities consistently hamper efficiency.

While Gold Fields reported a robust recovery in the latter half of 2024 for mines like Gruyere, St Ives, South Deep, and Cerro Corona, any asset that fails to sustain this positive momentum and re-enters a phase of prolonged underperformance due to unaddressed challenges would be a prime candidate for the Dogs quadrant. For instance, if a mine's all-in sustaining cost (AISC) remains significantly above the industry average and its production volume consistently misses targets for an extended period, it would signal a potential Dog.

Such underperforming assets would represent a drain on the company's capital and management attention, diverting resources that could otherwise be invested in more promising ventures. Their contribution to overall group profitability and market standing would be negligible, potentially even negative, if the losses incurred outweigh any marginal output.

Assets with Declining Reserves and No Replacement

Mines facing a rapid depletion of their mineral reserves without viable replacement strategies or successful exploration efforts in their vicinity can transition into Dogs. These assets would eventually have a declining production profile and diminished market share in the long run. For instance, if a mine's reserves are projected to be depleted within five years and no new discoveries are made, its future revenue streams become highly uncertain.

While Gold Fields emphasizes reserve replacement, any mine where this challenge becomes insurmountable would eventually be considered for divestment or closure, as its long-term viability is compromised. In 2023, Gold Fields reported a total attributable gold equivalent reserve of 49.3 million ounces, highlighting the continuous effort required to maintain a healthy reserve base. A mine failing to contribute to this replacement effort, despite significant operational costs, would fall into the Dog category.

Consider the following characteristics of such assets:

- Declining Production: Output significantly decreases as accessible ore diminishes.

- High Operating Costs: Extraction becomes more expensive per unit as reserves deplete.

- Limited Future Investment: Lack of new discoveries or viable expansion plans deters further capital allocation.

- Potential for Divestment: Assets may be sold off or closed if they no longer meet profitability thresholds.

Operations in High-Risk Jurisdictions

Operations in high-risk jurisdictions, while potentially offering unique opportunities, can also present significant challenges for companies like Gold Fields. If the company were to expand or maintain operations in areas experiencing heightened political instability, unpredictable regulatory shifts, or escalating security threats, these ventures could be classified as 'Dogs' within a BCG Matrix framework. Such conditions often translate into elevated operational expenditures, diminished profit margins, and a weakened capacity to retain or grow market presence.

Gold Fields' strategic emphasis on enhancing its portfolio's quality through investments in more stable mining regions underscores a deliberate strategy to mitigate these risks. This approach indicates a preference for jurisdictions offering greater predictability and a more secure operating environment, thereby steering clear of areas that might present elevated levels of risk and uncertainty.

- Risk Mitigation: Gold Fields' strategy prioritizes investment in stable jurisdictions to reduce exposure to political instability and regulatory volatility.

- Portfolio Quality: The company aims to improve its overall portfolio by focusing on regions with lower operational risks and more predictable market conditions.

- Cost and Profitability Impact: Operations in high-risk areas can lead to increased costs and reduced profitability, potentially classifying them as 'Dogs' in a BCG analysis.

Dogs in Gold Fields' portfolio are assets with low market share in mature or declining markets, offering minimal growth potential and often requiring significant capital without commensurate returns. The divestment of its 45% stake in Asanko Gold Mine in March 2024 is a prime example, signaling Asanko's likely classification as a Dog due to its inability to meet Gold Fields' growth or profitability hurdles, despite producing 243,000 ounces in 2023.

These underperforming assets can become capital drains, diverting resources from more promising ventures and potentially leading to divestment if profitability thresholds are not met. Mines facing reserve depletion without viable replacement strategies, such as those with reserves projected to be depleted within five years and no new discoveries, also fall into this category, jeopardizing long-term viability.

Operations in high-risk jurisdictions, characterized by political instability or regulatory volatility, can also be classified as Dogs if they lead to elevated costs and diminished profit margins. Gold Fields' strategy to invest in more stable mining regions highlights its effort to mitigate these risks and improve overall portfolio quality.

| Asset Category | Characteristics | Gold Fields Example (Indicative) | 2023 Production (if applicable) | Strategic Implication |

|---|---|---|---|---|

| Dogs | Low Market Share, Low Growth, High Costs, Declining Production, High Risk | Asanko Gold Mine (divested March 2024) | 243,000 ounces (Asanko in 2023) | Divestment or closure to reallocate capital |

Question Marks

Gold Fields' broader greenfields exploration portfolio represents its commitment to discovering future mineral wealth. These early-stage projects are strategically located in areas with high geological potential, but they are in their infancy, meaning they have no current market share and their commercial viability is far from certain.

These ventures are inherently high-risk, high-reward propositions. They demand substantial capital outlay with no guarantee of return, facing significant geological and operational uncertainties. For instance, in 2024, Gold Fields continued its exploration efforts across various promising regions, investing millions in these nascent opportunities.

While a successful greenfields find could eventually transform into a 'Star' performer within the BCG matrix, the reality is that many of these early-stage explorations will not yield commercially viable deposits. This high attrition rate is characteristic of the 'Question Mark' category, where potential is high, but the path to success is fraught with challenges and the outcome remains very much in question.

Gold Fields actively explores and invests in early-stage development projects, recognizing their potential to shape future production. These ventures, while not yet producing, represent significant opportunities in emerging or growing markets, but currently hold minimal to no market presence. For example, in 2024, the company continued its focus on projects like the Salares Norte mine in Chile, which, while moving towards production, still represented a significant development investment with future revenue streams yet to be fully realized.

Gold Fields strategically invests in junior exploration companies, offering a pathway to early-stage discoveries and future growth. These positions are inherently high-risk, high-reward, reflecting the speculative nature of junior mining ventures. For instance, in 2024, many junior explorers focused on critical minerals like lithium and rare earths, with some seeing significant share price volatility based on initial drilling results.

Integration of New Technologies and Methodologies

Gold Fields' exploration into advanced mining technologies, such as autonomous drilling and AI-driven geological surveying, positions these initiatives as Question Marks within their BCG Matrix. These are high-growth areas, but their current integration is experimental, requiring significant capital for research and development. For instance, investments in automated haulage systems, while promising for efficiency gains, are still being scaled across operations, with pilot programs showing mixed but encouraging results in their 2024 operational reviews.

The company's focus on novel processing techniques, aimed at extracting more value from lower-grade ores or tailings, also falls into this category. These methodologies offer the potential for substantial cost reduction and increased recovery rates, critical for future competitiveness. However, they are often in early-stage deployment, meaning their economic viability and scalability are not yet fully established. This necessitates ongoing investment and careful monitoring of performance metrics.

- Technological Investment: Gold Fields is actively investing in areas like AI for resource modeling and automation in underground operations, reflecting a commitment to future-proofing its asset base.

- Early Adoption Risk: Innovations in areas such as bio-leaching for gold extraction, while environmentally advantageous, are still being tested for commercial viability and consistent performance across diverse ore bodies.

- R&D Expenditure: Significant portions of the 2024 capital expenditure budget were allocated to these emerging technologies, underscoring their strategic importance but also their inherent risk profile.

- Potential for Disruption: Successful implementation of these new technologies could significantly alter Gold Fields' cost structure and competitive positioning, but their current unproven nature places them firmly in the Question Mark quadrant.

Potential Future Acquisitions of Early-Stage Deposits

Gold Fields actively seeks bolt-on mergers and acquisitions to strengthen its portfolio. This strategy involves identifying early-stage, high-potential deposits or companies that fit its expansion goals.

These potential acquisitions are considered 'Question Marks' in the BCG matrix. They present significant growth opportunities but currently hold a small market share and demand substantial future investment and integration to unlock their value.

- Strategic Alignment: Acquisitions are evaluated based on their fit with Gold Fields' long-term growth strategy and existing operational footprint.

- Resource Potential: Focus is placed on deposits with promising geological characteristics and estimated resource upside.

- Risk Assessment: Thorough due diligence is conducted to understand technical, environmental, social, and governance risks associated with early-stage assets.

- Valuation and Synergies: Potential acquisition targets are assessed for their valuation and the synergies they could bring to Gold Fields' operations.

Question Marks in Gold Fields' BCG Matrix represent early-stage projects and technologies with high growth potential but uncertain market share. These ventures, often in greenfields exploration or advanced R&D, require significant investment with no guaranteed returns. For example, in 2024, the company continued to invest in innovative exploration techniques and potential acquisitions, all categorized as Question Marks due to their nascent stage and speculative nature.

These initiatives are crucial for Gold Fields' long-term growth, aiming to discover future revenue streams or enhance operational efficiency. However, their success hinges on overcoming significant geological, technical, and market risks. The company's 2024 capital allocation reflects a strategic balance between established operations and these high-potential, high-risk ventures.

The success rate for Question Marks is inherently low; many will not mature into profitable ventures. Nevertheless, the potential rewards, such as discovering a world-class deposit or successfully implementing disruptive technology, justify the ongoing investment. Gold Fields' approach involves careful selection, rigorous evaluation, and continuous monitoring of these opportunities.

Gold Fields' exploration activities and investments in new technologies in 2024 exemplify the Question Mark category. These are areas with significant upside, but they are in their infancy, demanding substantial capital and facing considerable uncertainty regarding future market share and profitability.

| Initiative Type | Description | 2024 Focus/Investment Area | Market Share (Current) | Growth Potential | Risk Level |

|---|---|---|---|---|---|

| Greenfields Exploration | Discovering new mineral deposits in unexplored areas. | New geological regions, advanced geophysical surveys. | Negligible | High | Very High |

| Advanced Technology R&D | Developing and testing new mining and processing technologies. | AI for resource modeling, autonomous drilling, bio-leaching. | Low/Experimental | High | High |

| Potential Acquisitions | Identifying and evaluating early-stage mining assets or companies. | Junior explorers, promising undeveloped deposits. | Small/None | High | High |

BCG Matrix Data Sources

Our Gold Fields BCG Matrix is constructed using a blend of internal financial performance data, publicly available company reports, and independent market research. This ensures a comprehensive view of our mining assets' market share and growth potential.