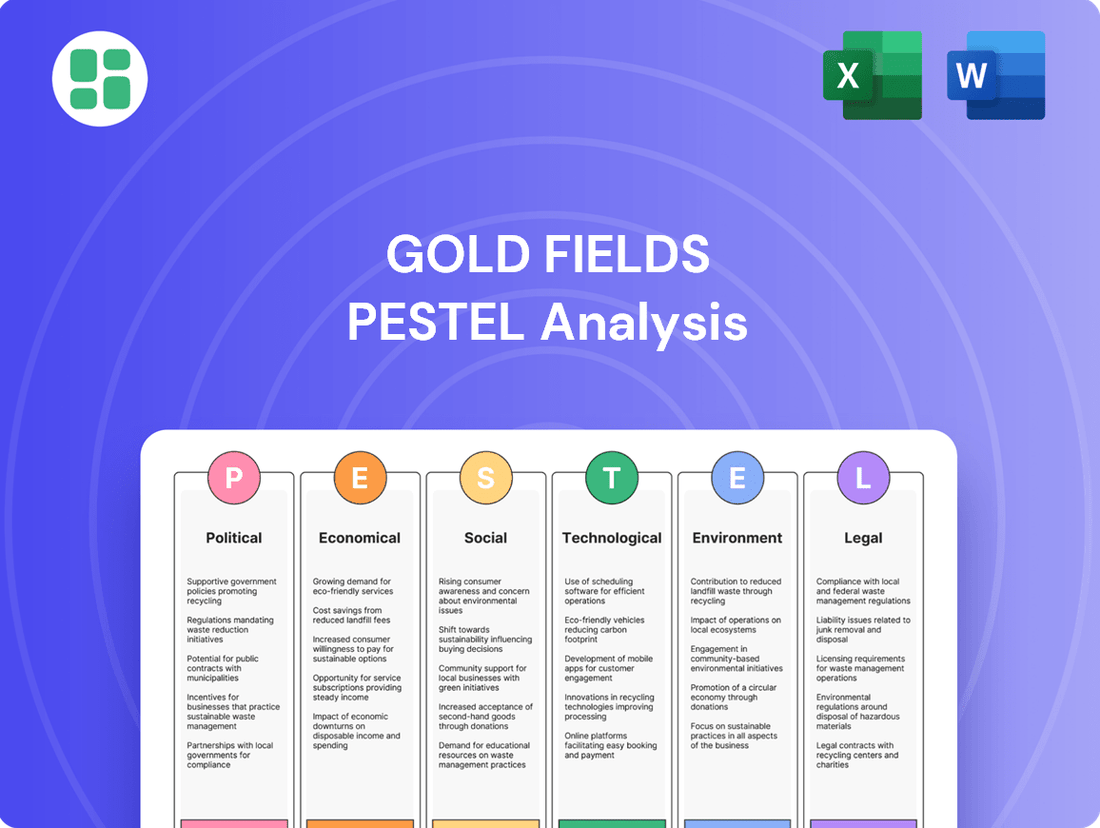

Gold Fields PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gold Fields Bundle

Uncover the critical Political, Economic, Social, Technological, Legal, and Environmental factors shaping Gold Fields's future. Our expert-crafted PESTLE analysis provides the essential intelligence you need to anticipate market shifts and identify strategic opportunities. Download the full version now and gain a competitive edge.

Political factors

Political stability in Gold Fields' key operating regions, including South Africa, Ghana, Chile, Peru, Australia, and Canada, significantly shapes its operational landscape. For instance, South Africa, a major operational base, has seen periods of political uncertainty impacting policy consistency, which can affect mining regulations and investor confidence. In 2024, the nation continued to navigate complex socio-economic challenges that influence the mining sector's stability.

Changes in government or policy shifts can introduce considerable risk, potentially affecting mining license renewals, taxation regimes, and environmental regulations. For example, a change in administration in Ghana could lead to a review of existing mining contracts or the introduction of new fiscal policies, as seen in past instances where governments sought to increase revenue from natural resources. Such shifts necessitate robust risk management and adaptive strategic planning from Gold Fields.

Australia and Canada, generally stable jurisdictions, still present political risks, albeit typically lower. These can include evolving indigenous land rights legislation or carbon pricing policies that impact operational costs. Gold Fields' long-term planning and investment decisions are therefore intrinsically linked to the political climate and the predictability of regulatory frameworks in each of these diverse operating countries.

Government mining policies significantly shape Gold Fields' profitability and operational agility. Changes in royalty rates, tax structures, and the complexity of permitting processes directly influence operational costs and project timelines. For instance, a shift towards higher royalty demands or more stringent environmental permitting in a key operating region like Australia could reduce net profit margins and delay new mine development.

Recent and anticipated regulatory shifts present a dynamic landscape for Gold Fields. In 2024, countries like Ghana, where Gold Fields has substantial operations, continue to review their mining fiscal regimes, potentially impacting revenue streams. Similarly, evolving environmental, social, and governance (ESG) regulations globally necessitate ongoing adaptation and investment in compliance, affecting capital expenditure and operational flexibility across its international portfolio.

Broader geopolitical tensions, such as ongoing conflicts and shifts in global alliances, directly impact Gold Fields' operations by disrupting supply chains and potentially limiting market access in affected regions. Trade disputes and the imposition of international sanctions can also lead to increased operational costs and hinder investment flows, making it more challenging for the company to expand its international footprint.

Resource Nationalism

Resource nationalism poses a significant risk for Gold Fields, as governments in its operating regions, particularly in Africa, may push for increased state ownership or higher royalty rates on mineral extraction. For instance, in 2024, several African nations continued to review mining codes, with some proposing higher taxes on resource companies to capture more of the economic rent. This trend could directly impact Gold Fields' profitability and operational flexibility, potentially leading to renegotiated contracts or increased capital requirements to satisfy local ownership demands.

The potential for governments to seek a larger share of mining profits is a constant consideration. In 2024, discussions around sovereign wealth funds and direct state participation in mining projects intensified in countries like Ghana and South Africa. Such moves could reduce Gold Fields' net returns and potentially limit its ability to repatriate profits, impacting its overall financial performance and investment decisions for future projects.

This evolving political landscape could affect Gold Fields' ownership structures and operational autonomy in several ways:

- Increased state equity requirements: Governments might mandate higher percentages of ownership for state-owned entities in mining concessions.

- Higher royalty and tax burdens: Expect potential increases in royalty rates or corporate taxes on mining profits, directly impacting profitability.

- Contract renegotiations: Existing agreements could be subject to review and revision to align with new nationalistic policies.

- Operational restrictions: Governments may impose stricter regulations on exploration, development, and export of minerals.

Government Support and Infrastructure

Governments in Gold Fields' key operating regions, such as Australia and South Africa, play a crucial role in providing essential infrastructure and maintaining security. In Australia, for instance, significant government investment in transport networks, like roads and rail, directly benefits Gold Fields by reducing logistical costs and improving access to mine sites. This contrasts with South Africa, where infrastructure challenges, including power supply reliability, can increase operational expenditures.

The stability of the legal and regulatory framework is paramount. Gold Fields operates within jurisdictions that generally offer a predictable mining code, which is vital for long-term investment planning. However, shifts in fiscal policies or mining regulations, as seen with potential resource nationalism discussions in some African nations, can introduce uncertainty and impact profitability. For example, changes in royalty rates or local content requirements can directly alter a mine's economic viability.

Gold Fields' operational efficiency and cost structure are significantly influenced by the level of government support. Regions with robust infrastructure and a stable, transparent legal system allow for smoother operations and lower capital expenditure on essential services. Conversely, areas requiring substantial private investment in infrastructure or facing regulatory volatility can lead to higher operating costs and increased risk premiums. In 2023, Gold Fields reported capital expenditure of $1.06 billion, a portion of which is directly tied to navigating and sometimes supplementing government-provided infrastructure.

- Government Investment in Infrastructure: Australia's ongoing investment in regional infrastructure projects directly supports Gold Fields' logistics and supply chain efficiency.

- Regulatory Stability: A predictable legal framework in countries like Australia and Peru is crucial for Gold Fields' long-term investment decisions and risk management.

- Security and Law Enforcement: The effectiveness of government security forces in operating regions impacts the safety of personnel and assets, influencing insurance costs and operational continuity.

- Fiscal Policy Impact: Changes in mining royalties, taxes, and local ownership requirements, as experienced in South Africa, can directly affect Gold Fields' net profit and investment returns.

Political stability across Gold Fields' operating regions, including South Africa, Ghana, Australia, and Canada, directly impacts operational continuity and investment. Fluctuations in government policies, such as changes in mining tax regimes or royalty rates, can significantly affect profitability and strategic planning, as seen in ongoing fiscal reviews in Ghana and South Africa during 2024.

Resource nationalism remains a key political factor, with governments in some African nations, like Ghana, continuing to explore ways to increase their stake in mining revenues through higher taxes or state ownership. This trend necessitates adaptive strategies for Gold Fields to navigate potential contract renegotiations and evolving local content requirements.

Government infrastructure development and regulatory frameworks are critical. While stable jurisdictions like Australia offer predictable mining codes, infrastructure limitations in regions like South Africa can increase operational costs. For instance, Gold Fields' 2023 capital expenditure of $1.06 billion reflects investments influenced by varying levels of government support and infrastructure availability.

The geopolitical landscape, including trade relations and global stability, influences supply chains and market access. Evolving environmental, social, and governance (ESG) regulations globally also require continuous adaptation and investment in compliance, impacting capital expenditure across Gold Fields' international portfolio.

What is included in the product

This PESTLE analysis delves into the Political, Economic, Social, Technological, Environmental, and Legal factors impacting Gold Fields, offering a comprehensive understanding of the external landscape.

It provides actionable insights for strategic decision-making, identifying key opportunities and potential challenges for the company.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, turning complex external factors into actionable insights for strategic decision-making.

Economic factors

Global gold price volatility significantly impacts Gold Fields' financial performance. For instance, a sustained increase in gold prices, as seen with projections for 2024 and into 2025, directly boosts revenue and profitability. Conversely, price dips can compress margins and affect investment returns, influencing decisions on capital allocation and exploration budgets.

Current and forecasted gold prices are critical drivers for Gold Fields' strategic planning. Higher anticipated prices for 2024 and 2025 encourage decisions to ramp up production and accelerate development of new projects, aiming to capitalize on favorable market conditions. This forward-looking approach helps the company optimize its asset portfolio and operational efficiency.

Gold Fields is positioned for strong financial results, with expectations of a bumper profit for H1 2025. This outlook is underpinned by a combination of higher gold prices and anticipated increases in production volumes, reflecting the company's ability to leverage market trends for enhanced shareholder value.

Inflation significantly impacts Gold Fields' operating expenses, with rising energy, labor, and raw material costs directly squeezing profitability. For instance, in the first half of 2024, the company reported a notable increase in its all-in sustaining costs (AISC) compared to the previous year, largely driven by these inflationary pressures.

Gold Fields is actively implementing cost management strategies, focusing on operational efficiencies and supply chain optimization to mitigate the effects of inflation. This includes leveraging technology for improved resource utilization and negotiating favorable terms with suppliers to lock in prices for key inputs.

Fluctuations in currency exchange rates significantly impact Gold Fields' financial performance. For instance, a stronger US Dollar generally reduces the value of earnings reported in local currencies like the South African Rand (ZAR) or Ghanaian Cedi (GHS) when translated back to USD. Conversely, a weaker USD can boost reported earnings. This dynamic directly affects operational costs, as expenses incurred in local currencies become more or less expensive in USD terms.

In 2023, Gold Fields reported that a 10% depreciation in the ZAR against the USD would have a positive impact on its earnings, while a 10% appreciation would have a negative one, highlighting the sensitivity to this particular currency pair. Similarly, movements in the Australian Dollar (AUD) influence costs and revenues in that region. These currency shifts present both opportunities for cost savings and risks of increased expenses, necessitating robust hedging strategies.

Global Economic Growth and Demand

Global economic growth significantly impacts gold demand. During periods of robust economic expansion, industrial and jewelry demand for gold tends to rise, while its appeal as a safe-haven investment may lessen. Conversely, economic slowdowns or recessions often boost gold's attractiveness as a store of value, leading to increased investment demand.

These fluctuating demand dynamics directly influence Gold Fields' market outlook and sales volumes. For instance, a strong global economy in 2024 could support higher jewelry and industrial offtake, potentially increasing sales. However, if recessionary fears escalate, investment demand might surge, benefiting Gold Fields through higher gold prices, even if physical sales volumes see less of a boost.

- Global GDP Growth Projections: The International Monetary Fund (IMF) projected global GDP growth at 3.2% for 2024, a slight slowdown from 3.4% in 2023, indicating a generally stable but moderating economic environment.

- Inflationary Pressures: Persistent inflation in major economies in late 2023 and early 2024 continued to make gold an attractive hedge against currency debasement for investors.

- Interest Rate Environment: Central bank policies, particularly interest rate decisions in 2024, played a crucial role. Higher rates can increase the opportunity cost of holding non-yielding assets like gold, potentially dampening investment demand.

- Jewelry Demand Trends: In 2023, jewelry demand showed resilience, particularly in emerging markets, contributing to overall gold consumption. This trend is expected to continue into 2024, albeit with sensitivity to local economic conditions and gold prices.

Interest Rates and Access to Capital

Prevailing interest rates significantly influence Gold Fields' operational costs and investment capacity. Higher rates, like the Bank of England's base rate holding steady at 5.25% as of early 2024, increase the expense of servicing existing debt and securing new financing for capital expenditures, potentially delaying or scaling back expansion plans. Conversely, a stable or declining rate environment would lower borrowing costs, making it more attractive to fund new projects and acquisitions.

Access to global capital markets is crucial for Gold Fields' strategic growth and maintaining robust liquidity. In 2023, the company successfully refinanced a significant portion of its debt, demonstrating its ability to tap into financial markets. However, a tightening global credit environment or increased perceived risk in the mining sector could restrict the availability of capital, forcing a reliance on internal cash flows or more expensive financing options.

- Borrowing Costs: Elevated interest rates directly increase the cost of debt for Gold Fields, impacting profitability and cash flow available for reinvestment.

- Capital Expenditure: Higher borrowing costs can make large-scale capital projects, such as mine development or upgrades, less financially viable, potentially leading to project deferrals.

- Access to Capital: The overall health and liquidity of global financial markets determine how easily Gold Fields can raise funds through debt or equity for expansion and operational needs.

- Liquidity Management: Favorable interest rates and accessible capital markets support efficient working capital management and ensure the company can meet its short-term financial obligations.

Economic factors like global GDP growth and inflation directly influence gold demand and Gold Fields' operational costs. The IMF projected 3.2% global GDP growth for 2024, a slight moderation from 2023, suggesting a stable but less dynamic economic landscape. Persistent inflation in 2024 continued to make gold an attractive hedge, benefiting investment demand. These trends shape Gold Fields' sales volumes and profitability, requiring careful management of operating expenses against fluctuating commodity prices.

| Economic Factor | 2023 Data/Trend | 2024 Projection/Trend | Impact on Gold Fields |

|---|---|---|---|

| Global GDP Growth | 3.4% | 3.2% (IMF) | Stable demand, potential for slight moderation in industrial/jewelry offtake. |

| Inflation | Persistent in major economies | Continued concern, supporting gold as a hedge | Increased operating costs (energy, labor, materials), but potentially higher gold prices. |

| Interest Rates | Holding steady at elevated levels (e.g., BoE 5.25% early 2024) | Central bank decisions key; higher rates increase borrowing costs | Higher debt servicing costs, potential impact on capital expenditure viability. |

| Currency Exchange Rates | USD strength impacted ZAR/GHS earnings | Continued volatility expected | Affects translation of local currency costs/revenues to USD; requires hedging. |

Full Version Awaits

Gold Fields PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Gold Fields PESTLE Analysis details the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain immediate access to this professionally structured analysis upon completing your purchase.

Sociological factors

Maintaining a strong social license to operate is absolutely crucial for Gold Fields, as it directly impacts their ability to conduct business without disruption. Positive community relations are the bedrock of this license, ensuring local acceptance and support for mining operations.

Gold Fields actively pursues this by focusing on robust community engagement programs, prioritizing local employment opportunities, and investing in socio-economic development initiatives. These efforts are designed to build trust and create shared value, thereby mitigating potential social risks and conflicts.

In 2024 alone, Gold Fields demonstrated this commitment by investing a significant US$16.6 million in various socio-economic development projects. This substantial investment underscores their dedication to fostering positive relationships and ensuring a lasting positive social impact in the communities where they operate.

Gold Fields navigates complex labor relations across its global operations, with significant union presence in key regions like South Africa. Wage negotiations are a constant focus, and the company reported engaging in discussions with various unions throughout 2023 and into early 2024, aiming for mutually agreeable outcomes to prevent disruptive labor disputes. The company's commitment to fair labor practices is underscored by its stated goal of ensuring the physical and psychological safety of its workforce, a critical element in maintaining productive labor relations.

Gold Fields demonstrates a strong commitment to health and safety, evidenced by its no-fatality record since April 2024 and the implementation of a comprehensive Group-wide safety program. This focus is crucial for maintaining operational efficiency and a positive reputation, as safety incidents can lead to significant disruptions and financial penalties.

The company's dedication to regulatory compliance and ongoing safety initiatives directly impacts its social license to operate. A robust safety record enhances community trust and stakeholder confidence, contributing positively to Gold Fields' overall social responsibility profile and long-term sustainability.

Demographic and Cultural Considerations

Gold Fields recognizes the vital importance of its workforce and local community demographics, including cultural sensitivities and traditional land rights. In 2024, the company reaffirmed its commitment by supporting the updated ICMM Indigenous Peoples and Mining Position Statement. This involves conducting comprehensive gap analyses across its operations in relevant countries to ensure alignment with best practices.

Adapting operational and engagement strategies is key to respecting and integrating these diverse factors. Gold Fields' approach focuses on building strong relationships and understanding local contexts. For instance, in Australia, where Indigenous land rights are a significant consideration, the company actively engages with Traditional Owners on heritage management and employment opportunities.

- Demographic Profile: Gold Fields operates in regions with diverse populations, necessitating tailored approaches to workforce management and community relations.

- Cultural Sensitivities: Understanding and respecting local customs, beliefs, and social structures is paramount for successful operations and stakeholder engagement.

- Traditional Land Rights: Acknowledging and upholding the rights of Indigenous Peoples and local communities to their traditional lands is a core principle guiding Gold Fields' activities.

- Adaptation Strategies: The company actively modifies its operational plans and communication methods to ensure respect for cultural norms and land rights, as evidenced by its gap analysis initiative following the 2024 ICMM statement update.

Local Content and Procurement

Gold Fields demonstrates a strong commitment to local content, focusing on procurement from businesses within its host communities and setting ambitious local employment targets. This approach is integral to their strategy for creating social value.

The economic impact on host communities is substantial. In 2024, Gold Fields achieved significant milestones: 52% of its workforce was drawn from these local areas, and an impressive US$1.12 billion was spent with host community suppliers and contractors. These figures highlight a direct contribution to local economic development and community empowerment.

- Local Employment: In 2024, 52% of Gold Fields' workforce was sourced from host communities, demonstrating a commitment to local job creation.

- Procurement from Host Communities: The company spent US$1.12 billion with host community suppliers and contractors in 2024, directly boosting local economies.

- Economic Benefits: This focus on local content generates significant economic multipliers within host communities, fostering sustainable development.

- Social Value Creation: By prioritizing local procurement and employment, Gold Fields enhances its social license to operate and builds stronger community relationships.

Gold Fields' commitment to its workforce and surrounding communities is evident in its 2024 performance, with 52% of its employees hailing from host communities and a substantial US$1.12 billion spent on local suppliers and contractors. These figures underscore a deep integration into local economies, fostering economic benefits and strengthening the company's social license to operate.

The company actively respects and integrates diverse demographic profiles and cultural sensitivities, a critical aspect of its global operations. In 2024, Gold Fields reinforced its commitment to Indigenous Peoples' rights by supporting the updated ICMM Indigenous Peoples and Mining Position Statement, undertaking gap analyses to align operations with best practices.

Gold Fields' proactive approach to labor relations, including ongoing wage negotiations and a focus on workforce safety, is central to maintaining operational stability. The company's dedication to a safe working environment, highlighted by its no-fatality record since April 2024, directly supports productive labor relations and community trust.

| Sociological Factor | Gold Fields' Action/Data (2024/Early 2025) | Impact |

|---|---|---|

| Community Engagement & Social Investment | US$16.6 million invested in socio-economic development projects. | Builds trust, mitigates social risks, strengthens social license. |

| Local Employment & Procurement | 52% of workforce from host communities; US$1.12 billion spent with host community suppliers. | Drives local economic development, creates shared value. |

| Labor Relations & Safety | Ongoing wage negotiations; no-fatality record since April 2024. | Ensures operational stability, fosters positive workforce relations. |

| Indigenous Peoples' Rights & Cultural Sensitivity | Gap analyses following updated ICMM statement. | Ensures alignment with best practices, respects traditional land rights. |

Technological factors

Gold Fields is actively embracing automation and digitalization to boost its mining operations. This includes deploying autonomous vehicles and implementing remote operating centers, which significantly improve safety by reducing human exposure to hazardous environments.

The integration of advanced systems like smart sensors and AI-powered automation is expected to drive substantial gains in operational efficiency and productivity. Projections indicate that by 2025, over 60% of new gold mining equipment will incorporate AI for enhanced performance.

While these technologies offer clear benefits, challenges remain, such as the substantial capital investment required for implementation and the need for a skilled workforce to manage and maintain these sophisticated systems.

Innovations in geological modeling and geophysical surveys are significantly boosting gold exploration accuracy. For instance, advancements in seismic imaging and AI-driven data analysis allow for more precise identification of potential ore bodies, reducing the cost and time of initial exploration phases. This is crucial as finding new, economically viable deposits becomes increasingly challenging.

Drilling techniques are also seeing rapid evolution, with automated and directional drilling improving efficiency and safety. These technologies allow for better sample collection and faster penetration of rock, directly impacting the speed at which exploration projects can progress. The industry is seeing a trend towards smaller, more targeted drilling campaigns based on sophisticated geological models.

Ore processing is benefiting from technologies like bio-mining and enhanced gravity concentration, which are raising gold recovery rates and lowering environmental footprints. Bio-mining, using microorganisms to extract gold, offers a more sustainable approach, while improved gravity methods can capture finer gold particles previously lost. For example, some advanced gravity circuits are achieving recovery rates exceeding 95% for certain ore types.

Data analytics and predictive maintenance are transforming Gold Fields' operations. By analyzing vast datasets, the company can forecast equipment failures, optimizing maintenance schedules and minimizing costly downtime. This proactive approach directly improves resource utilization, ensuring that machinery operates at peak efficiency.

In 2023, Gold Fields reported a significant focus on digital transformation initiatives. While specific figures for predictive maintenance savings are proprietary, the broader industry trend shows that companies leveraging advanced analytics can reduce unplanned downtime by as much as 20-30%, leading to substantial cost savings and increased production output.

Renewable Energy Integration

Gold Fields is actively integrating renewable energy into its mining operations, a key technological factor. The company is investing in solar and wind power to reduce its environmental footprint and enhance operational efficiency.

A significant initiative is the US$195 million solar and wind energy project at its St Ives mine, slated for commissioning in early 2026. This project is designed to supply 73% of the mine's electricity needs from renewable sources.

- Reduced Carbon Emissions: Shifting to renewables directly cuts greenhouse gas emissions from mining activities.

- Improved Energy Security: On-site renewable generation lessens reliance on volatile fossil fuel markets and grid instability.

- Lower Operational Costs: Renewable energy sources offer predictable and often lower long-term energy expenses compared to traditional power.

- Technological Advancement: Adopting advanced solar and wind technologies demonstrates Gold Fields' commitment to innovation in sustainable mining.

Tailings Management and Monitoring Technologies

Technological advancements are significantly reshaping tailings management. Real-time monitoring systems, utilizing sensors and IoT devices, provide continuous data on TSF stability, crucial for preventing failures. For instance, Gold Fields actively sponsors research into these advanced monitoring systems, aiming to bolster safety and environmental protection at their facilities.

Digital twin models offer a virtual replica of TSFs, allowing for predictive analysis of potential issues and optimized operational strategies. Coupled with improved construction methods that enhance structural integrity, these technologies collectively elevate the safety and environmental performance of tailings storage facilities.

- Real-time Monitoring: Deployment of advanced sensor networks for immediate data on TSF conditions.

- Digital Twins: Creation of virtual replicas for predictive maintenance and scenario planning.

- Improved Construction: Innovations in TSF design and building techniques to enhance stability.

- Research Sponsorship: Gold Fields' commitment to advancing TSF monitoring technology through research partnerships.

Technological advancements are central to Gold Fields' strategy, driving efficiency and safety through automation and digitalization. The company is integrating AI and advanced sensor systems, with over 60% of new gold mining equipment expected to feature AI by 2025 to boost performance.

Innovations in geological modeling and drilling techniques are enhancing exploration accuracy and speed, while bio-mining and advanced gravity concentration are improving gold recovery rates and sustainability. Data analytics and predictive maintenance are also key, with the broader industry seeing up to a 30% reduction in unplanned downtime through these approaches.

Gold Fields is heavily investing in renewable energy, with a US$195 million project at its St Ives mine set to supply 73% of electricity needs from solar and wind by early 2026, reducing emissions and operational costs.

Furthermore, technologies like real-time monitoring and digital twins are transforming tailings management, significantly bolstering safety and environmental protection at their facilities.

| Technology Area | Key Advancement | Impact/Benefit | 2024/2025 Data/Projection |

| Automation & Digitalization | Autonomous vehicles, remote operating centers | Improved safety, operational efficiency | Over 60% of new gold mining equipment to incorporate AI by 2025 |

| Exploration & Extraction | AI-driven geological modeling, advanced drilling | Increased exploration accuracy, faster project progression | AI-driven data analysis improving ore body identification |

| Processing & Recovery | Bio-mining, enhanced gravity concentration | Higher gold recovery rates, reduced environmental footprint | Advanced gravity circuits achieving >95% recovery for certain ores |

| Operations Management | Data analytics, predictive maintenance | Minimized downtime, optimized maintenance schedules | Industry trend: 20-30% reduction in unplanned downtime via analytics |

| Energy | Solar and wind power integration | Reduced carbon emissions, improved energy security, lower costs | US$195M St Ives project to supply 73% renewable energy by early 2026 |

| Tailings Management | Real-time monitoring, digital twins | Enhanced TSF stability, predictive analysis, improved safety | Sponsorship of research into advanced monitoring systems |

Legal factors

Gold Fields operates within diverse legal frameworks across its host countries, each dictating the acquisition, maintenance, and renewal of mining licenses and concessions. These regulations are critical for securing operational rights and ensuring tenure stability. For instance, the company's Windfall project in Canada is currently navigating its environmental permit process, a key legal hurdle for continued development.

Recent legislative shifts or upcoming reforms can significantly alter the landscape for mining companies. Changes in royalty structures, environmental compliance mandates, or local content requirements can directly impact profitability and operational feasibility. Staying abreast of these legal developments is paramount for Gold Fields to manage risks and capitalize on opportunities.

Gold Fields operates under a complex web of environmental laws governing emissions, water usage, waste disposal, and land reclamation. Failure to comply can lead to significant fines, operational shutdowns, and reputational damage. The company's commitment to environmental stewardship is underscored by its ISO 14001:2015 certification across all operations, demonstrating a structured approach to managing environmental impacts.

Gold Fields navigates a complex web of labor laws across its global operations, impacting minimum wage, mandated working hours, and the right to collective bargaining. For instance, in South Africa, the Basic Conditions of Employment Act sets crucial standards, while Australia's Fair Work Act governs similar aspects. Adherence to these diverse legal frameworks is paramount for maintaining operational continuity and employee relations.

The company demonstrates a commitment to international human rights standards, aligning its practices with conventions like the UN Guiding Principles on Business and Human Rights. This commitment is further solidified by its adherence to the Voluntary Principles on Security and Human Rights, ensuring responsible engagement with security forces and the protection of community rights at its mine sites.

Corporate Governance and Anti-Corruption Laws

Gold Fields must navigate a complex web of legal requirements concerning corporate governance and anti-corruption across its operating regions and listing exchanges. These regulations mandate robust transparency and ethical conduct, directly impacting operational integrity and investor confidence. For instance, the company's 2024 Annual Report, filed with the US SEC in March 2025, details its adherence to stringent disclosure standards.

The company's commitment to combating bribery and corruption is underscored by its comprehensive policies and procedures, designed to ensure compliance with international legislation like the US Foreign Corrupt Practices Act (FCPA). This framework is crucial for maintaining its license to operate and for fostering trust with stakeholders globally.

- Regulatory Compliance: Gold Fields operates under diverse legal frameworks, including those in South Africa, Australia, Peru, and Ghana, each with specific corporate governance and anti-corruption mandates.

- FCPA Adherence: The company's 2024 Form 20-F filing highlights its ongoing compliance efforts with the US Foreign Corrupt Practices Act, a key piece of anti-bribery legislation.

- Transparency Initiatives: Legal requirements often push for greater transparency in financial reporting and operational dealings, which Gold Fields addresses through its public disclosures and internal controls.

- Risk Mitigation: Robust anti-corruption policies are vital for mitigating legal penalties, reputational damage, and operational disruptions stemming from non-compliance.

International Trade and Sanctions Laws

International trade agreements, tariffs, and sanctions significantly impact Gold Fields' global operations. Fluctuations in trade policies can affect the cost of imported equipment and the profitability of gold sales in different markets. For instance, the imposition of new tariffs or trade barriers in key gold-consuming nations could lead to reduced demand or higher operational expenses.

Navigating these complex international legal landscapes is crucial for business continuity. Gold Fields must remain agile, adapting its supply chain and sales strategies to comply with evolving trade regulations and sanctions regimes. The company's ability to manage these legal challenges directly influences its global market access and financial performance.

- Trade Policy Impact: Changes in international trade agreements can alter the cost of essential mining equipment and the market value of exported gold.

- Sanctions Compliance: Adherence to global sanctions regimes is paramount to avoid penalties and maintain operational integrity in affected regions.

- Geopolitical Influence: Geopolitical tensions often trigger new trade restrictions or sanctions, necessitating constant legal and operational adjustments for multinational mining firms like Gold Fields.

- Market Access: Compliance with international trade laws ensures continued access to global markets for Gold Fields' products, safeguarding revenue streams.

Gold Fields' operations are subject to varying legal frameworks concerning mining rights, environmental protection, and labor standards across its global sites. For example, the company's 2024 sustainability report details its compliance with South Africa's Mineral and Petroleum Resources Development Act and Australia's Native Title Act, which govern land access and community engagement.

Changes in legislation, such as potential increases in royalty rates or stricter environmental regulations, pose direct risks and opportunities. The company's proactive engagement with regulators aims to shape favorable outcomes, as seen in its ongoing dialogue regarding proposed mining reforms in Ghana.

Adherence to anti-corruption laws like the US Foreign Corrupt Practices Act is critical for maintaining its license to operate and investor confidence. Gold Fields' 2024 Form 20-F filing, submitted in March 2025, outlines its robust compliance programs and internal controls.

International trade policies and sanctions can impact operational costs and market access. Gold Fields actively monitors these developments to ensure compliance and mitigate potential disruptions to its supply chain and sales, particularly concerning its exports to regions subject to evolving trade agreements.

Environmental factors

Climate change poses significant physical risks to Gold Fields' operations, including extreme weather events impacting mine sites and water scarcity affecting processing. The company is actively responding through its decarbonization strategy, aiming to reduce its carbon footprint across all scopes.

Gold Fields has set ambitious targets, including a 30% reduction in Scope 1 and 2 greenhouse gas emissions by 2030, with a focus on transitioning to renewable energy sources. In 2024, the company reported progress towards these goals, highlighting investments in solar power projects and energy efficiency initiatives across its global portfolio.

The company's 2024 Climate Change and Environment Report provides detailed performance data against its 2030 decarbonization targets. This includes specific metrics on renewable energy generation and consumption, as well as efforts to address Scope 3 emissions, which are often the most challenging to control.

Gold Fields faces significant operational challenges due to water scarcity, particularly in its Australian and Chilean operations, which are situated in arid regions. In response, the company is implementing robust water stewardship strategies, focusing on reducing its reliance on fresh water sources. This includes substantial investments in water recycling and desalination technologies to treat and reuse water required for mining processes.

The company's commitment extends to community engagement, with initiatives aimed at supporting local water supply and management. For instance, Gold Fields actively works on improving water infrastructure and efficiency in the areas surrounding its mines, demonstrating a focus on shared water resources. In 2023, Gold Fields reported a 6% reduction in its overall freshwater withdrawal intensity compared to 2022, a testament to these ongoing efforts.

Gold Fields places significant emphasis on the responsible management of mining waste, particularly tailings. Their strategy centers on preventing environmental contamination and ensuring the long-term stability of tailings storage facilities through adherence to best practices and continuous monitoring.

The company is actively pursuing innovative solutions for safe and responsible waste disposal, reflecting a deep commitment to environmental stewardship. This proactive approach is underscored by their ambitious 2030 targets for tailings management, aiming to set new industry benchmarks.

Biodiversity and Land Rehabilitation

Gold Fields is actively working to reduce its footprint on biodiversity, implementing strategies to protect ecosystems during its mining activities. The company has a strong commitment to land rehabilitation and restoring disturbed areas once mining concludes, aiming for a nature-positive outcome.

Specific initiatives include:

- Biodiversity Action Plans: Developing and implementing site-specific plans to manage and conserve biodiversity, often involving partnerships with local conservation groups.

- Land Rehabilitation Programs: Undertaking progressive rehabilitation of mined-out areas, focusing on re-establishing native vegetation and supporting local wildlife.

- Water Management: Implementing responsible water management practices to minimize impacts on aquatic ecosystems and surrounding water sources.

- Nature-Positive Targets: Setting ambitious goals to achieve a net positive impact on biodiversity at its operations, as highlighted in its 2023 Sustainability Report which detailed progress on its nature-positive journey.

Energy Consumption and Efficiency

Gold mining is incredibly energy-intensive, and Gold Fields is actively working to boost efficiency and lessen its dependence on fossil fuels. This focus is crucial for both environmental responsibility and long-term cost management.

The company is investing in newer, more efficient equipment and exploring renewable energy sources like solar and wind power for its operations. These initiatives aim to shrink their carbon footprint and make energy use more economical. For instance, in 2023, Gold Fields reported that renewable energy accounted for 17% of their total electricity consumption, a significant step towards their target of 40% by 2030.

- Energy Demand: Gold mining requires substantial power for extraction, processing, and ventilation.

- Efficiency Investments: Gold Fields is upgrading to energy-efficient machinery and exploring alternative power sources.

- Renewable Energy Adoption: As of 2023, 17% of Gold Fields' electricity came from renewables, with a goal of 40% by 2030.

- Decarbonisation Goals: The company prioritizes energy resilience and cost-effective emission reductions in its decarbonisation strategy.

Environmental regulations continue to tighten globally, impacting mining operations and requiring significant investment in compliance and sustainable practices. Gold Fields is proactively addressing these by integrating environmental considerations into its strategic planning and operational execution.

PESTLE Analysis Data Sources

Our Gold Fields PESTLE analysis is built on a robust foundation of data from international financial institutions, government publications, and reputable industry research firms. We leverage reports on global economic trends, regulatory changes, and technological advancements to ensure comprehensive insights.