Gold Fields Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gold Fields Bundle

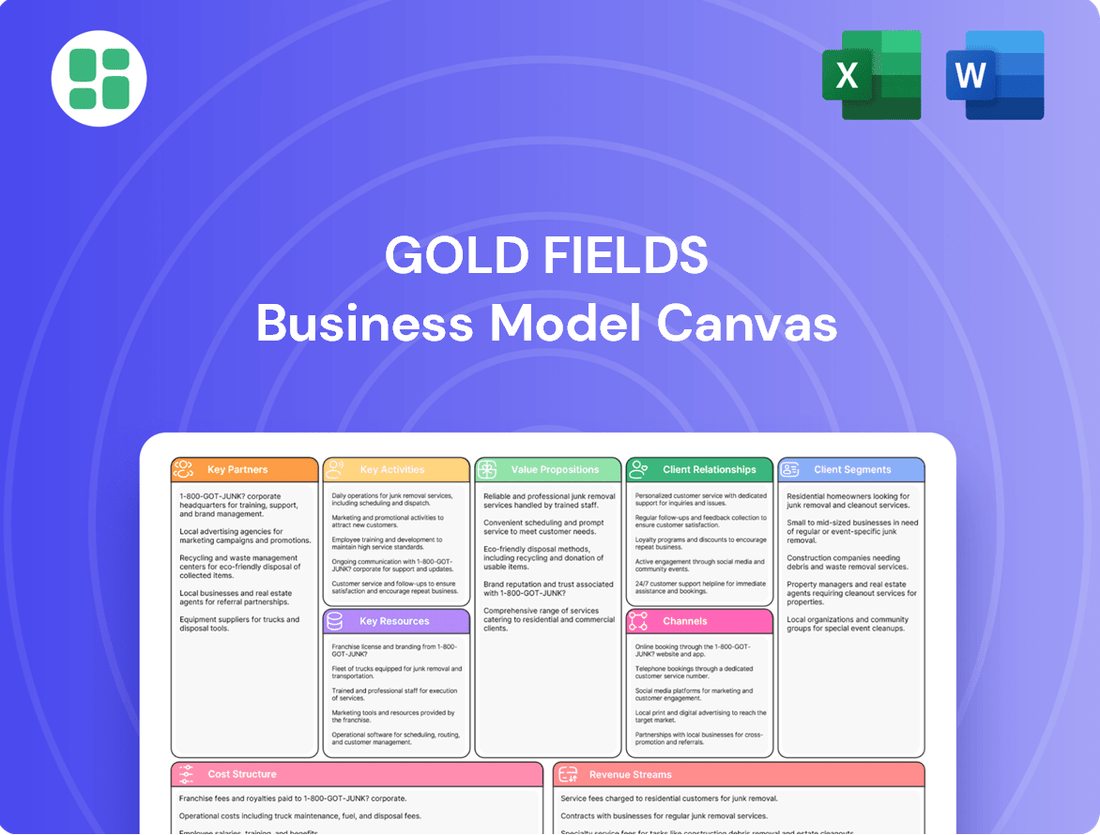

Discover the intricate workings of Gold Fields's success with our comprehensive Business Model Canvas. This detailed breakdown illuminates their customer relationships, revenue streams, and key resources, offering a powerful blueprint for strategic understanding. Download the full version to unlock actionable insights for your own ventures.

Partnerships

Gold Fields actively pursues strategic joint ventures to broaden its operational reach and mitigate risks, exemplified by its Gruyere JV in Australia and the Santa Cecilia JV in Chile. These collaborations provide access to untapped mineral deposits and allow for the pooling of specialized knowledge, which accelerates project development and boosts operational effectiveness.

These partnerships are instrumental in diversifying Gold Fields' global presence and optimizing the deployment of capital for major mining undertakings. For instance, the Gruyere project, a 50:50 joint venture with Gold Road Resources, commenced production in 2019 and is projected to produce approximately 300,000 ounces of gold in 2024.

Gold Fields depends on equipment and technology suppliers for critical components like excavators, drills, and processing plants. For instance, in 2023, the company continued its investment in fleet modernization and automation, a trend expected to accelerate. These partnerships are vital for accessing innovations that boost ore recovery rates and reduce operational costs.

Gold Fields actively partners with local communities and Indigenous groups to secure its social license to operate, understanding these relationships are fundamental to sustainable mining. In 2024, the company continued its commitment to fostering these bonds through targeted social and economic development programs, aiming for mutually beneficial outcomes.

These collaborations are built on open dialogue and a focus on local priorities, including initiatives designed to boost local employment and support community-driven projects. For instance, by investing in skills development and local procurement, Gold Fields aims to create lasting economic benefits that extend beyond the mine's lifespan.

Government and Regulatory Bodies

Gold Fields actively collaborates with governments and regulatory bodies worldwide to secure and maintain essential mining licenses and permits. This engagement ensures adherence to evolving environmental, social, and governance (ESG) standards, which are increasingly critical for responsible resource management and investor confidence. For instance, in 2024, Gold Fields continued its dialogue with various national governments regarding proposed changes to mining legislation and fiscal regimes, aiming to balance operational viability with national resource benefit.

These partnerships are fundamental for navigating the complex landscape of national and international mining laws, thereby guaranteeing operational stability and enabling robust long-term strategic planning. The company's commitment to compliance is demonstrated through ongoing engagement with bodies like the Minerals Council of Australia and the Minerals and Metals Association of South Africa, reflecting a proactive approach to regulatory alignment.

- License and Permit Acquisition: Ongoing dialogue with mining ministries and environmental agencies to secure and renew exploration and operational licenses across various jurisdictions.

- Regulatory Compliance: Proactive engagement with national and international bodies to ensure adherence to evolving ESG regulations, safety standards, and reporting requirements.

- Policy Influence: Participation in consultations and industry forums to contribute to the development of sound mining policies and fiscal frameworks.

- Community and Social License: Working with government entities to foster positive relationships and ensure alignment with national development goals and community expectations.

Financial Institutions and Investors

Gold Fields maintains vital relationships with banks and investment funds to secure capital for its extensive exploration, development, and operational needs. These partnerships are foundational to its growth strategy, enabling investments in new projects and the expansion of existing operations.

The company utilizes various financial instruments, including revolving credit facilities and project financing, to support its capital requirements. For instance, in 2023, Gold Fields had a significant revolving credit facility in place, demonstrating its reliance on these banking relationships for liquidity and investment capacity. These facilities are crucial for managing cash flow and funding upcoming capital expenditures.

Strong investor relations are paramount for Gold Fields, ensuring sustained access to capital markets and fostering market confidence. This ongoing dialogue with shareholders and potential investors is key to maintaining a stable financial footing and supporting the company's long-term strategic objectives.

- Banking Relationships: Access to revolving credit facilities and syndicated loans for operational and capital expenditure funding.

- Investment Funds: Partnerships with institutional investors and private equity firms for project-specific financing and strategic investments.

- Investor Relations: Maintaining open communication with shareholders to ensure market confidence and continuous access to equity capital.

- Financing Activities: In 2023, Gold Fields actively managed its debt and equity structures, leveraging financial institution support for its strategic growth initiatives.

Gold Fields cultivates key partnerships with joint venture partners, equipment suppliers, and financial institutions to drive its operational success and growth. These collaborations are crucial for accessing new resources, leveraging technological advancements, and securing the necessary capital for large-scale mining projects.

In 2024, the company continued to emphasize collaboration with local communities and governments, recognizing that strong social licenses and regulatory compliance are fundamental to sustainable operations. These relationships are vital for navigating complex legal frameworks and ensuring long-term operational stability and investor confidence.

| Partnership Type | Key Collaborators | 2024 Focus/Impact |

|---|---|---|

| Joint Ventures | Gold Road Resources (Gruyere) | Operational optimization and resource expansion |

| Equipment & Technology Suppliers | Global mining equipment manufacturers | Fleet modernization, automation, and efficiency gains |

| Financial Institutions | Major banks and investment funds | Capital access for exploration, development, and operations |

| Governments & Regulators | National mining ministries, environmental agencies | License acquisition, regulatory compliance, policy engagement |

| Local Communities & Indigenous Groups | Community leaders, local organizations | Social license, economic development, skills training |

What is included in the product

A structured framework outlining Gold Fields' approach to creating, delivering, and capturing value, detailing key partners, activities, resources, cost structure, and revenue streams.

The Gold Fields Business Model Canvas acts as a pain point reliever by providing a structured framework to map out and address critical business challenges, enabling clearer problem-solving.

Activities

Gold Fields' core activity involves extensive exploration, both on existing mine sites (brownfield) and in new territories (greenfield). This is crucial for discovering new gold deposits and growing their mineral reserves, which directly fuels future production. In 2024, the company continued to invest significantly in these efforts, recognizing that replenishing reserves is key to long-term sustainability.

The process includes detailed geological mapping, extensive drilling campaigns to sample rock formations, and sophisticated resource modeling. These scientific approaches help assess the economic viability and size of potential gold deposits. This diligent work ensures that Gold Fields maintains a robust pipeline of projects to sustain its operations for years to come.

Mine development and construction is a cornerstone of Gold Fields' operations, encompassing the meticulous planning, design, and building of essential mining infrastructure. This includes everything from sinking new shafts to erecting sophisticated processing plants and all the necessary supporting facilities. It's about laying the groundwork for future production and growth.

Significant investments in this area are evident in projects like Salares Norte in Chile and the Windfall project in Canada. These undertakings represent substantial capital expenditure and a commitment to expanding the company's operational footprint and future output.

The efficient and timely execution of these development projects is absolutely critical. Successfully bringing new mines online and scaling up production capacity directly impacts Gold Fields' ability to meet market demand and achieve its strategic production targets, underscoring the importance of robust project management.

Gold Fields' primary activity is the safe and efficient extraction of gold ore from its nine operating mines globally. This encompasses both open-pit and underground mining techniques, adapted to the unique geology of each site. For instance, in 2023, Gold Fields produced 2.3 million ounces of gold, demonstrating the scale of these operations.

Achieving operational excellence is paramount to meeting production goals and controlling expenses in these mining endeavors. The company's focus on safety and efficiency directly impacts its cost per ounce, a critical metric for profitability. In the fiscal year ending December 31, 2023, Gold Fields reported a total cash cost of $1,044 per ounce, highlighting the importance of this operational focus.

Gold Processing and Refining

Gold Fields' key activities include the intricate processing and refining of extracted gold ore. This involves crushing and grinding the ore to liberate the gold, followed by chemical treatments like cyanidation to dissolve the gold. The recovered gold is then smelted and refined to achieve high purity, typically 99.99% for bullion. This entire process demands significant capital investment in specialized metallurgical equipment and skilled personnel.

Efficient processing is paramount to maximizing gold recovery rates and ensuring the final product meets stringent market specifications. For instance, in 2023, Gold Fields reported a total gold production of 2.35 million ounces, with processing efficiency directly impacting this output. The company continuously invests in optimizing these operations to enhance yield and reduce costs.

- Metallurgical Expertise: Requires skilled metallurgists to manage complex chemical and physical separation processes.

- Advanced Processing Plants: Operates sophisticated facilities for crushing, grinding, leaching, and refining.

- Recovery Optimization: Focuses on maximizing the percentage of gold extracted from the ore.

- Product Purity: Refines gold to high standards for sale in global markets.

Environmental, Social, and Governance (ESG) Management

Gold Fields actively integrates high environmental, social, and governance (ESG) standards across its operations, focusing on climate change mitigation, water stewardship, and responsible tailings management. This dedication is fundamental to their mission of generating lasting value beyond mining.

Their commitment to robust ESG practices is crucial for maintaining a social license to operate and ensuring the company's long-term sustainability. In 2023, Gold Fields reported a 12% reduction in Scope 1 and 2 greenhouse gas emissions intensity compared to their 2019 baseline, demonstrating tangible progress in climate action.

- Climate Change Mitigation: Targeting a 30% reduction in Scope 1 and 2 GHG emissions intensity by 2030 (vs. 2019 baseline).

- Water Stewardship: Aiming for 50% of operations to have water management plans aligned with the Water Stewardship Framework by 2025.

- Tailings Management: Adhering to the Global Industry Standard on Tailings Management (GISTM) for all facilities.

- Community Development: Investing in local communities through various programs focused on education, health, and economic empowerment.

Gold Fields' key activities revolve around the entire lifecycle of gold mining, from finding new deposits to safely extracting and processing the ore. This includes extensive exploration, developing new mines, operating existing ones efficiently, and refining the gold to meet market standards. A strong focus on ESG principles underpins all these operations, ensuring responsible and sustainable practices.

| Key Activity | Description | 2023/2024 Relevance/Data |

| Exploration & Resource Development | Discovering and assessing new gold deposits through geological studies and drilling. | Continued investment in greenfield and brownfield exploration to replenish reserves. |

| Mine Development & Construction | Planning, designing, and building mining infrastructure. | Ongoing development at projects like Windfall (Canada). |

| Mining Operations | Safe and efficient extraction of gold ore using various mining methods. | Produced 2.35 million ounces of gold in 2023; total cash cost was $1,044 per ounce. |

| Processing & Refining | Crushing, leaching, and smelting ore to produce high-purity gold. | Focus on maximizing recovery rates and product purity to meet market demands. |

| ESG Integration | Implementing environmental, social, and governance standards. | Reduced Scope 1 & 2 GHG emissions intensity by 12% (vs. 2019 baseline) in 2023. |

What You See Is What You Get

Business Model Canvas

The Gold Fields Business Model Canvas preview you are viewing is not a mockup; it is an exact representation of the document you will receive upon purchase. You will gain immediate access to this complete, professionally structured Business Model Canvas, ready for your strategic planning needs. Rest assured, what you see is precisely what you will get, ensuring no surprises and full usability.

Resources

Gold Fields' primary key resource is its substantial gold mineral reserves and resources, spread across its worldwide operations. These reserves, classified as proven and probable, are the bedrock of the company's future production and inherent worth.

As of December 31, 2023, Gold Fields reported attributable gold reserves of 50.4 million ounces, a slight decrease from 51.2 million ounces in 2022, reflecting production and depletion. The company also holds significant mineral resources, totaling 130.5 million ounces, which represent potential future additions to reserves.

Accurate and ongoing estimation of these mineral assets is fundamental for Gold Fields' strategic direction, capital allocation, and ultimately, shareholder value creation. These figures guide exploration efforts and mine development plans.

Gold Fields' operations rely heavily on its extensive mining infrastructure and equipment, encompassing critical assets like mining machinery, processing plants, and power generation facilities across its nine mines. These physical assets are the backbone of gold extraction, processing, and the subsequent logistics required to bring the product to market.

In 2023, Gold Fields reported capital expenditure of $629 million, a significant portion of which is allocated to maintaining and upgrading this vital infrastructure. This investment underscores the company's commitment to ensuring its operational capabilities remain modern and efficient, directly impacting the cost and safety of gold production.

Gold Fields relies on a highly skilled workforce, including geologists, mining engineers, metallurgists, and environmental specialists. This expertise is crucial for efficient exploration, extraction, and processing, as well as maintaining high safety and environmental standards.

In 2023, Gold Fields reported a total workforce of approximately 8,000 employees and contractors. The company's commitment to human capital development is evident through ongoing training programs aimed at enhancing operational excellence and fostering innovation across its global operations.

Capital and Financial Strength

Gold Fields' access to significant capital, encompassing equity, debt, and robust cash flows, is a vital resource. This financial backing fuels ongoing operations, exploration initiatives, and substantial development projects. For instance, in 2023, Gold Fields reported total assets of approximately $12.1 billion, reflecting its substantial financial base.

A strong financial position enables strategic investments and provides resilience against market volatility. This financial strength is the bedrock for the company's growth ambitions and its capacity to deliver value to shareholders.

Key financial resources include:

- Access to diverse funding sources: Equity issuance, debt markets, and retained earnings.

- Strong operating cash flows: Generated from mining activities, supporting reinvestment and debt servicing. In 2023, Gold Fields generated $1.6 billion in cash flow from operations.

- Healthy balance sheet: Characterized by manageable debt levels and sufficient liquidity to meet financial obligations.

- Ability to raise capital: Demonstrated through successful debt issuances and equity offerings when strategic opportunities arise.

Intellectual Property and Operational Know-how

Gold Fields' proprietary mining techniques and processing methodologies are core intellectual property, honed over decades. This accumulated know-how, including advanced ore handling and extraction methods, is critical for optimizing production efficiency and managing the diverse geological challenges encountered across their global operations. For instance, their investment in innovative tailings management systems, a key operational best practice, contributes significantly to environmental sustainability and cost control.

This deep operational expertise allows Gold Fields to maintain a competitive edge by enhancing resource recovery rates and minimizing operational costs. Their commitment to continuous innovation in these areas, such as the development of more efficient comminution circuits, directly impacts their ability to achieve superior financial performance. In 2023, Gold Fields reported a total gold production of 2.37 million ounces, a testament to the effectiveness of their operational know-how.

- Proprietary mining techniques: Advanced methods for ore extraction and resource definition.

- Processing methodologies: Optimized techniques for gold recovery and metal separation.

- Operational best practices: Accumulated experience in safety, efficiency, and environmental management.

- Innovation in efficiency: Ongoing investment in R&D for improved production and cost reduction.

Gold Fields' key resources are its vast gold reserves, extensive mining infrastructure, skilled workforce, significant capital access, and proprietary operational knowledge. These elements collectively underpin the company's ability to explore, extract, and process gold efficiently and profitably.

The company's mineral reserves and resources are its most fundamental asset, guiding future production and valuation. In 2023, Gold Fields held 50.4 million attributable gold ounces in reserves, alongside 130.5 million ounces in resources, highlighting significant potential for continued operations.

Operational infrastructure, including machinery and processing plants, is crucial for gold extraction. The company invested $629 million in capital expenditure in 2023, much of which supports this vital physical asset base, ensuring efficiency and safety.

A workforce of approximately 8,000 employees and contractors in 2023 provides the necessary expertise for all facets of mining. Their skills in geology, engineering, and metallurgy are essential for optimizing production and maintaining high operational standards.

Access to capital, evidenced by $1.6 billion in cash flow from operations in 2023 and total assets of approximately $12.1 billion, enables ongoing investment in exploration, development, and operational improvements.

Proprietary mining techniques and processing methodologies represent intellectual capital that enhances recovery rates and manages operational costs. This expertise, combined with operational best practices, contributed to Gold Fields' production of 2.37 million ounces of gold in 2023.

| Key Resource | Description | 2023 Data/Relevance |

| Mineral Reserves & Resources | The foundation for future gold production and company valuation. | 50.4 million attributable gold ounces in reserves; 130.5 million ounces in resources. |

| Mining Infrastructure | Physical assets essential for extraction, processing, and logistics. | Capital expenditure of $629 million in 2023 allocated to maintaining and upgrading infrastructure. |

| Skilled Workforce | Expertise in geology, engineering, metallurgy, and environmental management. | Approximately 8,000 employees and contractors in 2023. |

| Access to Capital | Financial backing for operations, exploration, and development projects. | $1.6 billion cash flow from operations; total assets of $12.1 billion. |

| Proprietary Knowledge | Advanced mining techniques and processing methodologies for efficiency. | Contributed to 2.37 million ounces of gold production in 2023. |

Value Propositions

Gold Fields provides a steady stream of gold from its mines spread across the globe, which helps to lower risks for both customers and investors. This global spread means production remains stable even if one region faces difficulties.

In 2024, Gold Fields reported attributable gold production of 2.46 million ounces, demonstrating its ability to maintain output across its diverse asset base. This consistent performance underscores the value of its geographically spread operations.

The company's operations span South America, Australia, and Africa, ensuring that challenges in one area do not significantly disrupt the overall supply. This multi-continental presence offers a dependable source of gold.

Gold Fields is dedicated to upholding stringent Environmental, Social, and Governance (ESG) standards, offering investors a product that is not only valuable but also ethically and responsibly sourced. This focus on responsible mining is a core element of their business model, ensuring a positive impact beyond just financial returns.

The company's commitment extends to tangible actions in areas like decarbonization and water stewardship. For instance, in 2023, Gold Fields reported a 10% reduction in Scope 1 and 2 greenhouse gas emissions compared to their 2019 baseline, demonstrating a clear path towards sustainability that resonates with socially conscious investors.

Furthermore, robust community engagement programs are integral to their operations. By fostering strong relationships with local communities, Gold Fields secures its social license to operate, which is crucial for long-term operational stability and enhances the company's reputation as a responsible corporate citizen.

Gold Fields offers investors a compelling entry into the gold market, built on a foundation of robust financial performance. For instance, in 2023, the company reported a significant increase in attributable gold production and solid earnings, demonstrating its operational efficiency and market resilience.

The company's strategic growth projects, such as the development of its South Deep mine in South Africa and exploration activities in Australia, are designed to enhance future production and profitability. This forward-looking approach is crucial for sustained shareholder value. Gold Fields' commitment to disciplined capital allocation ensures that investments are made judiciously, balancing growth with shareholder returns.

This focus on sustainable value creation translates into a strong proposition for investors seeking superior returns in the gold sector. The company's financial strength, coupled with a promising growth pipeline, positions it as an attractive investment for those looking to capitalize on the gold market's potential.

Economic and Social Development for Host Communities

Gold Fields actively drives economic and social progress in its host communities, extending its impact far beyond mining operations. This is achieved through prioritizing local employment, which in 2023 saw 83% of its workforce employed from host communities across its operations. Furthermore, a significant portion of procurement spending is directed towards local suppliers, fostering business growth and economic diversification within these regions.

Targeted social investment programs are a cornerstone of Gold Fields' community development strategy. These initiatives focus on critical areas such as education, health, and infrastructure, aiming to create sustainable, long-term benefits. For instance, in 2023, Gold Fields invested over $20 million in community development projects globally, directly impacting thousands of lives.

- Local Employment: 83% of Gold Fields' workforce in 2023 comprised individuals from host communities, demonstrating a direct economic contribution.

- Local Procurement: Significant investment in local suppliers stimulates regional economies and supports small and medium-sized enterprises.

- Social Investment: Over $20 million allocated in 2023 to education, health, and infrastructure projects enhances community well-being and resilience.

- Social License: These efforts cultivate strong, positive relationships with communities, securing a vital social license to operate and promoting regional stability.

High-Quality Gold Products

Gold Fields is committed to producing gold bullion that adheres to stringent international purity and integrity standards. This focus on quality is paramount for its core customers in the refining and bullion sectors, ensuring Gold Fields' product is universally recognized and valued.

This unwavering commitment to high product standards directly translates into enhanced market credibility and the ability to command premium pricing. For instance, in 2024, the global demand for investment-grade gold remained robust, with central banks continuing to be significant net purchasers, underscoring the importance of purity and trust in the market.

- International Purity Standards: Gold Fields' bullion meets London Bullion Market Association (LBMA) Good Delivery standards, a benchmark for quality in the global precious metals market.

- Market Acceptance: This adherence ensures Gold Fields' products are readily accepted by refiners and bullion dealers worldwide, facilitating seamless transactions.

- Premium Pricing Potential: High-quality, certified gold allows Gold Fields to achieve better pricing compared to unrefined or lower-purity sources, directly impacting revenue.

- Customer Trust: Consistent delivery of high-quality gold builds long-term trust with key market participants, a critical asset in the commodities sector.

Gold Fields offers a reliable supply of gold, underpinned by its geographically diverse operations. This global footprint, with mines in South America, Australia, and Africa, mitigates production risks and ensures a stable output. In 2024, the company reported attributable gold production of 2.46 million ounces, highlighting its consistent performance across these varied regions.

The company's commitment to Environmental, Social, and Governance (ESG) principles provides a responsible investment opportunity. Gold Fields actively pursues decarbonization, achieving a 10% reduction in Scope 1 and 2 greenhouse gas emissions by 2023 compared to 2019. Strong community engagement, including prioritizing local employment (83% in 2023) and procurement, secures its social license to operate.

Gold Fields delivers high-quality gold bullion that meets stringent international standards, such as LBMA Good Delivery. This adherence to purity ensures market acceptance and premium pricing potential. In 2024, the robust demand for investment-grade gold, particularly from central banks, reinforces the value of such trusted, high-purity products.

| Value Proposition | Description | Key Metrics/Data |

|---|---|---|

| Geographic Diversification & Production Stability | Provides a steady and reliable supply of gold through mines spread across multiple continents, reducing operational risks. | 2.46 million ounces attributable gold production in 2024. Operations in South America, Australia, Africa. |

| Commitment to ESG & Responsible Sourcing | Offers ethically and responsibly sourced gold, appealing to socially conscious investors. Focus on decarbonization and community development. | 10% reduction in Scope 1 & 2 GHG emissions (2023 vs 2019). 83% local workforce employment (2023). Over $20 million invested in community projects (2023). |

| High-Quality Gold Product | Supplies gold bullion meeting international purity and integrity standards, ensuring market acceptance and premium pricing. | Adherence to LBMA Good Delivery standards. Robust demand for investment-grade gold in 2024. |

Customer Relationships

Gold Fields prioritizes open and honest communication with its investors. They achieve this through consistent financial reports, investor briefings, and direct interaction, ensuring stakeholders receive up-to-date and thorough information on the company's progress and strategic direction.

This commitment to transparency is crucial for building confidence and attracting ongoing investment. For instance, in the first half of 2024, Gold Fields reported a net debt of $1.2 billion, a key figure investors closely monitor for financial health.

Gold Fields actively fosters robust relationships with its host communities through consistent dialogue, accessible grievance mechanisms, and joint development projects. This approach ensures a deep understanding of local requirements and a proactive response to concerns, cultivating widespread backing for their mining operations.

In 2024, Gold Fields reported investing $73.5 million in community development programs globally, demonstrating a tangible commitment to shared value creation. These initiatives are crucial for securing and maintaining their social license to operate, a fundamental aspect of sustainable mining.

Gold Fields maintains robust relationships with governments and regulatory agencies, crucial for operational continuity and expansion. In 2024, the company continued its proactive engagement, ensuring compliance with evolving mining laws and environmental standards across its global operations. This focus on adherence and transparent communication helps secure permits and fosters a stable operating environment.

These liaisons are fundamental to Gold Fields' strategy, enabling contributions to policy discussions that shape the future of responsible mining. By actively participating in these dialogues, Gold Fields aims to align its business practices with national development goals and promote sustainable resource management. Such collaboration is vital for long-term success and social license to operate.

Supplier Partnerships and Collaboration

Gold Fields cultivates enduring partnerships with its suppliers, built on principles of fairness, a commitment to local sourcing, and a drive for joint innovation. This approach not only secures a dependable supply chain but also actively contributes to the economic development of the communities where they operate.

These strategic alliances are crucial for optimizing operational performance and managing costs effectively. For instance, in 2024, Gold Fields continued its focus on local procurement, with a significant portion of its operational spend directed towards local suppliers across its various mining regions.

- Supplier Engagement: Gold Fields prioritizes building strong, long-term relationships with suppliers, fostering trust and mutual benefit.

- Local Procurement: The company actively seeks to source goods and services from local businesses, supporting community development and reducing logistical complexities. In 2024, this commitment saw increased investment in local supplier capacity building programs.

- Collaborative Innovation: Partnerships extend to joint efforts in developing new technologies and improving operational efficiencies, leading to enhanced sustainability and productivity.

- Supply Chain Resilience: By nurturing these relationships, Gold Fields ensures a more robust and reliable supply chain, mitigating risks associated with global disruptions.

Media and Public Relations

Gold Fields actively cultivates its public image and communicates its core values and operational performance through diverse media channels. This strategic approach ensures a unified message reaches a wide audience, reinforcing brand identity and stakeholder trust.

The company prioritizes transparency by publishing comprehensive sustainability reports, detailing its environmental, social, and governance (ESG) efforts. Furthermore, proactive engagement with news outlets and media platforms is a cornerstone of its public relations strategy, aiming to foster a positive and informed public perception.

- Media Engagement: Gold Fields regularly issues press releases and responds to media inquiries to ensure accurate reporting on its operations and initiatives.

- Sustainability Reporting: In 2023, Gold Fields released its Integrated Annual Report, which includes detailed information on its ESG performance, a key component of its public communication.

- Reputation Management: A strong public image is crucial for maintaining stakeholder confidence, attracting investment, and securing social license to operate in its various jurisdictions.

Gold Fields focuses on building strong, trust-based relationships with its diverse stakeholders, including investors, communities, governments, and suppliers. This multi-faceted approach is essential for securing its social license to operate and ensuring long-term business sustainability.

The company actively engages with investors through transparent financial reporting and direct communication, aiming to foster confidence and attract continued investment. For instance, in the first half of 2024, Gold Fields reported a net debt of $1.2 billion, a critical metric for financial health assessment.

Community engagement is paramount, with significant investment in development programs. In 2024, Gold Fields invested $73.5 million globally in community initiatives, underscoring its commitment to shared value and maintaining a positive social license.

Furthermore, robust relationships with governments and suppliers are maintained through proactive dialogue and local procurement strategies, which in 2024 continued to support local economies and ensure supply chain resilience.

| Stakeholder Group | Key Engagement Strategies | 2024 Data/Focus |

|---|---|---|

| Investors | Financial reports, investor briefings, direct interaction | Net debt of $1.2 billion (H1 2024) |

| Host Communities | Dialogue, grievance mechanisms, development projects | $73.5 million invested in community development programs |

| Governments & Regulators | Proactive engagement, compliance, policy discussion | Continued focus on evolving mining laws and environmental standards |

| Suppliers | Fairness, local sourcing, joint innovation | Increased focus on local procurement and supplier capacity building |

Channels

Gold Fields' primary sales strategy involves direct engagement with major international gold refiners and reputable bullion dealers. This approach streamlines the process of getting their mined gold into the market.

By selling directly, Gold Fields ensures efficient transactions and maintains strong market access for its core product, gold bullion. This is a well-established and direct method for gold mining companies to reach the global market.

In 2024, Gold Fields continued to leverage these direct relationships, a testament to the enduring efficiency of this sales channel in the gold industry. For instance, their sales to refiners and dealers are crucial for their revenue generation, as seen in their consistent production figures, which remained robust throughout the year.

Gold Fields leverages financial markets and stock exchanges as key channels to access capital and engage with its investor base. Its primary listings on the Johannesburg Stock Exchange (JSE) and the New York Stock Exchange (NYSE), where its shares and American Depositary Shares (ADSs) are traded, are crucial for providing liquidity and enhancing global visibility.

These public listings are vital for attracting a broad spectrum of investors, including significant institutional players and individual shareholders. For instance, as of early 2024, Gold Fields' market capitalization on the NYSE reflects investor confidence and the company's standing within the global mining sector, providing a benchmark for its valuation and access to further equity financing when needed.

Gold Fields leverages its corporate website and digital platforms as primary channels for transparent communication, publishing key documents like annual reports, financial results, and sustainability reports. These platforms ensure all stakeholders have immediate and broad access to crucial company information.

In 2023, Gold Fields reported a revenue of $4.2 billion, underscoring the importance of these digital channels in disseminating performance data efficiently to investors and the public.

Investor Presentations and Conferences

Gold Fields actively engages with the investor community through presentations at major industry conferences and dedicated roadshows. These platforms facilitate direct interaction, allowing for in-depth discussions about the company's strategy and performance, and importantly, address investor queries directly. In 2024, Gold Fields continued its commitment to transparent communication, participating in key mining investment forums to showcase its operational highlights and growth prospects, thereby attracting and retaining capital.

These investor relations activities are vital for building and maintaining trust. For instance, Gold Fields' participation in events like the Denver Gold Forum and the BMO Capital Markets Global Mining & Critical Materials Conference provides visibility and a direct line to potential and existing shareholders. Such engagement is crucial for securing the necessary funding for ongoing projects and future expansion, reinforcing investor confidence in the company's long-term value proposition.

- Investor Presentations: Regular updates on operational performance, financial results, and strategic initiatives.

- Industry Conferences: Participation in key mining and investment events to showcase the company's value proposition.

- Roadshows and One-on-One Meetings: Direct engagement with institutional investors and analysts to foster relationships and address specific concerns.

- Investor Confidence: These channels are fundamental in attracting new investment and maintaining the confidence of the existing shareholder base.

Community Engagement Forums and Local Offices

Gold Fields actively engages with host communities through local offices and dedicated engagement forums. These platforms are crucial for maintaining its social license to operate, fostering open communication and addressing community concerns directly. For instance, in 2024, the company continued its commitment to transparent dialogue, with numerous community meetings held across its operational sites.

These channels serve as vital conduits for understanding and responding to local needs, facilitating the co-creation and implementation of development initiatives. By maintaining a direct presence, Gold Fields builds trust and mutual understanding, essential for long-term sustainability. The company's investment in these community relations programs underscores their importance in its overall business model.

- Local Offices: Serve as physical points of contact for community members, facilitating direct interaction and information sharing.

- Community Forums: Provide structured platforms for dialogue, allowing for the discussion of operational impacts and community development priorities.

- Grievance Mechanisms: Ensure that community concerns are heard, logged, and addressed systematically, promoting accountability and responsiveness.

- Local Development Initiatives: Co-designed and implemented with communities, these programs aim to create shared value and enhance local well-being.

Gold Fields' channels primarily focus on direct sales to international refiners and bullion dealers, ensuring efficient market access for its gold. They also utilize financial markets, notably the JSE and NYSE, for capital raising and investor engagement, with their market capitalization reflecting their standing. Furthermore, their corporate website and digital platforms are key for transparent communication, disseminating financial reports and operational updates to a global audience.

These channels are critical for both revenue generation and strategic financing. For instance, in 2023, Gold Fields' direct sales to refiners and dealers contributed significantly to their $4.2 billion revenue. Their dual listing on the JSE and NYSE in early 2024 provided a strong platform for investor relations and capital access.

| Channel Type | Key Activities | 2023/2024 Relevance |

|---|---|---|

| Direct Sales | Selling gold to refiners and bullion dealers | Core revenue generation; efficient market access |

| Financial Markets | Listing on JSE and NYSE, equity financing | Capital raising, investor relations, global visibility |

| Digital Platforms | Corporate website, annual reports, financial results dissemination | Transparency, stakeholder information access |

| Investor Engagement | Conferences, roadshows, one-on-one meetings | Building trust, attracting investment, addressing queries |

Customer Segments

Institutional and individual investors, including large investment funds and asset managers, are key to Gold Fields' financial health. They invest for capital growth, dividends, and direct access to the gold market, relying on detailed financial data and strategic analysis to guide their decisions. For instance, as of late 2024, Gold Fields' market capitalization hovered around $10 billion, reflecting the significant capital these investors deploy.

Gold refiners and bullion dealers represent Gold Fields' core direct clientele, purchasing the company's physical gold output for further processing and distribution. These businesses rely on a steady influx of high-purity gold to meet their own operational demands and market supply chains.

In 2024, the global gold refining market is robust, with major players like Valcambi and Metalor Technologies handling significant volumes. Gold Fields' ability to consistently deliver gold meeting stringent purity standards, often above 99.99%, is crucial for securing ongoing sales agreements with these partners.

These customer segments are vital for Gold Fields' revenue generation, as they are the primary conduits through which the company's mined gold enters the broader market. Cultivating and maintaining strong, reliable relationships with these key refiners and dealers is therefore paramount to ensuring the efficient and profitable sale of Gold Fields' precious metal production.

Governments and regulatory bodies are crucial partners for Gold Fields, influencing everything from exploration permits to operational compliance. In 2023, Gold Fields paid approximately $1.2 billion in taxes and royalties globally, highlighting the significant financial relationship. Their approval is vital for maintaining mining licenses and ensuring adherence to environmental standards, directly impacting Gold Fields' ability to operate and grow.

Local Communities and Indigenous Peoples

Local communities and Indigenous Peoples represent a critical customer segment for Gold Fields, as their proximity to mining operations means they are directly affected by the company's presence and activities. Maintaining a strong social license to operate hinges on fostering positive and mutually beneficial relationships with these groups. This involves prioritizing local employment opportunities and actively pursuing shared value creation initiatives that benefit both the company and the communities.

Gold Fields recognizes the importance of these relationships for its long-term sustainability. For instance, in 2023, the company invested over $100 million in community development programs globally, focusing on areas such as education, health, and infrastructure. These investments are designed to address local needs and contribute to the economic and social well-being of the people living near its mines.

- Social License to Operate: The support and acceptance of local communities are essential for Gold Fields to continue its mining operations without significant disruption.

- Local Employment and Economic Contribution: These communities are a primary source of labor, and Gold Fields' operations contribute significantly to the local economy through wages, procurement, and taxes. In 2023, Gold Fields’ operations supported approximately 40,000 direct and indirect jobs globally.

- Shared Value Creation: Initiatives aimed at improving local infrastructure, education, and healthcare directly benefit these communities, aligning with Gold Fields' commitment to creating shared value.

- Indigenous Partnerships: Where applicable, Gold Fields engages in specific partnerships with Indigenous Peoples, respecting their rights, culture, and traditional territories, ensuring their voices are heard in decision-making processes.

Suppliers and Business Partners

Gold Fields' suppliers and business partners form a vital network, encompassing providers of everything from specialized mining equipment and advanced technology to essential logistical services and expert consulting. These relationships are fundamental to maintaining operational efficiency and accessing critical, specialized knowledge. In 2024, Gold Fields continued to foster these collaborations, recognizing their direct impact on the quality and reliability of inputs and services, which are paramount for successful mining operations.

The company's engagement with its supply chain in 2024 underscored a commitment to securing high-quality materials and services. This strategic focus ensures that Gold Fields can meet its production targets and maintain its competitive edge in the global mining industry. The performance of these partners directly influences Gold Fields' ability to execute its projects effectively and sustainably.

- Operational Efficiency: Reliable suppliers ensure timely delivery of critical components and services, minimizing downtime and maximizing productivity.

- Technological Advancement: Partnerships with technology providers bring innovative solutions to the forefront, enhancing safety, efficiency, and environmental performance.

- Cost Management: Strategic sourcing and strong supplier relationships contribute to effective cost control and value optimization across the supply chain.

- Risk Mitigation: Diversifying suppliers and building robust partnerships helps to mitigate risks associated with supply chain disruptions.

Gold Fields serves a diverse range of customers, from large institutional investors seeking capital growth and dividends to gold refiners and bullion dealers who are the direct purchasers of its refined product. Governments and regulatory bodies are also key stakeholders, influencing operational permits and compliance, as evidenced by Gold Fields' substantial tax and royalty payments. Furthermore, local communities and Indigenous Peoples are crucial for maintaining a social license to operate, with the company investing significantly in their development.

Cost Structure

Mining operations costs are a substantial part of Gold Fields' business, encompassing labor, energy, consumables, and equipment maintenance. These expenses fluctuate with production volume and the intricacy of extraction processes. For instance, in 2023, Gold Fields reported total operating costs of $2,618 million, highlighting the significant investment required to extract gold.

Labor costs, including wages and benefits for a global workforce, represent a major component. Similarly, energy consumption, vital for powering heavy machinery and processing plants, is a considerable outlay, with electricity and fuel prices directly impacting this category. In 2023, Gold Fields' cost of sales was $2,618 million, with a significant portion attributed to these operational necessities.

Consumables like explosives, chemicals for processing, and other materials are essential for mining and contribute to the overall cost structure. The ongoing maintenance and repair of specialized mining equipment, from excavators to haul trucks, also demand significant financial resources to ensure operational continuity and safety. Efficiently managing these diverse operational expenditures is paramount to maintaining profitability in the gold mining sector.

Exploration and development capital expenditure is a significant component of Gold Fields' cost structure, representing long-term investments crucial for future production. These costs cover the entire process from identifying new gold deposits to developing new mines or expanding existing ones, such as the ongoing work at Salares Norte and Windfall. For instance, in 2023, Gold Fields reported capital expenditure of $515 million, with a substantial portion allocated to growth projects and exploration, underscoring its commitment to sustained investment for longevity.

Processing and refining costs are significant expenditures for Gold Fields, encompassing the entire journey from raw ore to finished gold. These costs cover essential steps like crushing, grinding, and leaching, as well as the final refining stages. For instance, in 2023, Gold Fields reported total cash costs of $1,060 per ounce, with processing being a major component of this figure.

The intensity of these costs is directly tied to factors such as the ore's hardness and mineralogy, the specific technologies employed in the treatment plants, and the fluctuating price of energy, a key input. Optimizing these operational aspects, perhaps through more efficient grinding circuits or advanced leaching techniques, is crucial for managing and potentially lowering overall production expenses.

Environmental Compliance and Rehabilitation Costs

Gold Fields faces substantial expenses to adhere to rigorous environmental standards, embed sustainable operational methods, and manage mine closure and site rehabilitation. These outlays are critical for minimizing ecological footprints and securing the ongoing approval from communities to operate. For instance, in 2023, the company reported environmental expenditure, including rehabilitation provisions, totaling approximately $105 million. This reflects a commitment to responsible resource management, directly aligning with their Environmental, Social, and Governance (ESG) objectives.

These costs are not merely regulatory burdens but strategic investments in long-term viability. They encompass:

- Environmental Monitoring and Reporting: Ongoing efforts to track and report on air and water quality, biodiversity, and waste management, ensuring compliance with permits and regulations.

- Sustainable Practices Implementation: Investments in technologies and processes that reduce water usage, energy consumption, and greenhouse gas emissions, such as renewable energy projects at mines like South Deep.

- Mine Closure and Rehabilitation: Setting aside funds and executing plans for the eventual closure of mining sites, which includes land reclamation, revegetation, and ensuring the long-term stability of former mining areas.

General and Administrative (G&A) Expenses

General and Administrative (G&A) expenses represent the corporate overhead that supports Gold Fields' operations, including executive salaries, administrative staff compensation, and essential services like legal and consulting fees. Effective management of these costs is crucial for maintaining the company's financial resilience.

In 2023, Gold Fields reported G&A expenses of approximately $215 million. Streamlining these administrative functions is a key focus for improving overall operational efficiency and profitability, directly impacting the bottom line.

- Corporate Overhead: Costs associated with running the headquarters and supporting functions.

- Administrative Staff Salaries: Compensation for non-operational personnel.

- Legal and Consulting Fees: Expenses for external professional services.

- Other Non-Operational Expenses: Miscellaneous costs not directly tied to mining activities.

Gold Fields' cost structure is heavily influenced by its large-scale mining operations, which involve significant outlays for labor, energy, consumables, and equipment maintenance. These expenditures are directly tied to production levels and the complexity of extraction methods. In 2023, the company's total operating costs amounted to $2,618 million, underscoring the substantial investment required for gold extraction.

Key cost drivers include a global workforce's wages and benefits, alongside substantial energy consumption for machinery and processing. Consumables like explosives and chemicals, plus the continuous maintenance of specialized equipment, also contribute significantly. For instance, 2023 saw total cash costs reach $1,060 per ounce, with processing being a major factor.

Capital expenditure for exploration and development, such as at Salares Norte and Windfall, represents long-term investments crucial for future production, totaling $515 million in 2023. Furthermore, environmental compliance and rehabilitation efforts, including provisions, cost approximately $105 million in 2023, reflecting a commitment to sustainability.

General and Administrative (G&A) expenses, covering corporate overhead and professional services, were around $215 million in 2023. Efficiently managing these diverse costs is vital for Gold Fields' profitability and operational resilience.

| Cost Category | 2023 (USD Million) | Key Components |

| Operating Costs | 2,618 | Labor, Energy, Consumables, Maintenance |

| Capital Expenditure | 515 | Exploration, Mine Development, Growth Projects |

| Environmental Expenditure | 105 | Monitoring, Rehabilitation, Sustainable Practices |

| General & Administrative (G&A) | 215 | Corporate Overhead, Staff Salaries, Legal Fees |

Revenue Streams

Gold Fields' primary revenue stream comes from selling the gold they mine and refine. This means their income directly depends on how much gold they can extract and the price of gold in the global market. For instance, in the first half of 2024, Gold Fields reported a significant increase in revenue, driven by higher gold prices and improved production volumes.

Gold Fields leverages by-product sales, such as copper and silver, as a significant revenue enhancer in certain operations. For instance, in 2023, the company's South Deep mine in South Africa reported gold equivalent production that factored in the contribution of these valuable by-products.

These additional revenue streams from by-products not only boost the overall revenue per ounce of gold equivalent but also offer a crucial hedge against the inherent volatility of gold prices. This diversification of income sources strengthens the financial resilience of the company's mining portfolio.

Gold Fields utilizes strategic hedging activities not as a primary revenue generator, but as a crucial risk management tool. These programs aim to secure a predetermined price for a portion of their anticipated gold output, thereby stabilizing revenue and safeguarding against adverse price movements. This approach is vital for predictable cash flow generation and financial planning.

Investment Income

Gold Fields also generates revenue through investment income, which includes interest earned on its substantial cash reserves and short-term investments. For instance, in 2023, the company reported significant cash and cash equivalents, providing a base for interest income generation. This stream, while often secondary to core mining operations, offers a supplementary boost to overall financial performance.

This supplementary income can also arise from dividends received from strategic equity holdings in other mining companies. These investments, though not the primary focus, contribute to the company's diversified revenue profile. Such income enhances the financial resilience of Gold Fields by providing returns from assets beyond its direct operational control.

- Interest Income: Earned on cash balances and short-term financial instruments.

- Dividend Income: Received from strategic equity investments in other entities.

- Contribution: Enhances overall financial performance and provides diversification.

Future Revenue from New Projects

Future revenue is significantly bolstered by new development projects in Gold Fields' pipeline. Salares Norte in Chile and Windfall in Canada are key growth drivers, poised to contribute substantially to gold production once fully operational and ramped up. Successful execution of these projects is critical for unlocking these future revenue streams.

The company anticipates considerable revenue generation from these upcoming ventures. For instance, Salares Norte, a high-grade gold-copper project, is projected to commence production in 2025, with an estimated average annual production of 230,000 ounces of gold over its initial 10 years. Windfall, in Quebec, Canada, is also expected to begin production in 2025, with an anticipated average annual output of 225,000 ounces of gold over its first decade.

- Salares Norte Project: Expected to commence production in 2025, contributing an estimated 230,000 ounces of gold annually for the first 10 years.

- Windfall Project: Also slated for production in 2025, with an anticipated average of 225,000 ounces of gold per year over its initial decade.

- Long-Term Growth: These projects represent crucial long-term growth opportunities, enhancing Gold Fields' future production profile and revenue generation capabilities.

Beyond direct gold sales, Gold Fields benefits from by-product revenues, primarily copper and silver, extracted during gold mining operations. These additional commodities contribute to the company's overall financial performance and offer a degree of diversification against gold price volatility.

Strategic financial activities also contribute to revenue. This includes interest earned on substantial cash reserves and short-term investments, as well as dividends from any equity stakes held in other companies. For example, Gold Fields maintained significant liquidity throughout 2023, supporting interest income generation.

Looking ahead, new development projects are set to significantly bolster future revenue. The Salares Norte project in Chile and the Windfall project in Canada are anticipated to commence production in 2025, adding substantial annual gold output to the company's portfolio.

| Revenue Stream | Description | 2023/2024 Data Point |

|---|---|---|

| Gold Sales | Primary revenue from mined and refined gold. | Revenue increased in H1 2024 due to higher gold prices and production. |

| By-product Sales | Income from copper and silver extracted during gold mining. | South Deep mine's 2023 production factored in by-product contributions. |

| Investment Income | Interest on cash reserves and dividends from equity holdings. | Significant cash and cash equivalents reported in 2023. |

| New Projects (Future) | Anticipated revenue from Salares Norte and Windfall projects. | Salares Norte to produce ~230k oz gold/year; Windfall ~225k oz gold/year from 2025. |

Business Model Canvas Data Sources

The Gold Fields Business Model Canvas is built upon a foundation of comprehensive financial reports, extensive market research, and internal operational data. These diverse sources ensure a robust understanding of our value proposition, customer segments, and cost structures.