Gold Fields Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gold Fields Bundle

Gold Fields' marketing strategy is a complex interplay of its product offerings, pricing, distribution, and promotion. Understanding these elements is crucial for anyone looking to grasp their market position and competitive edge.

Dive deeper into the strategic brilliance behind Gold Fields' success by exploring their product innovation, pricing structures, distribution networks, and promotional campaigns. This comprehensive analysis reveals how each 'P' contributes to their overall market impact.

Unlock actionable insights and save valuable time with our ready-made, editable 4Ps Marketing Mix Analysis for Gold Fields. Perfect for business professionals, students, and consultants seeking a competitive advantage.

Product

Gold Fields' fundamental product is gold itself, from the raw ore extracted at its mines to the highly refined gold bullion. This transformation process yields dore bars, a crucial intermediate step before achieving 99.99% purity, meeting the highest market standards.

The value proposition of this refined gold extends beyond its intrinsic worth; it functions as a robust store of value, a hedge against inflation, and a sought-after investment vehicle. In 2024, global gold demand reached approximately 4,847.7 metric tons, underscoring its enduring appeal.

Beyond investment, refined gold is an essential raw material for diverse sectors. The jewelry industry, a significant consumer, accounted for 42% of global gold demand in 2024. Furthermore, technological applications in electronics and dentistry rely on gold's unique properties, highlighting its multifaceted utility.

Gold Fields' mineral reserves and resources extend significantly beyond current production, showcasing a substantial pipeline of future gold supply. As of the end of 2023, the company reported 49.1 million ounces of gold in proven and probable reserves, alongside an additional 34.5 million ounces in measured, indicated, and inferred resources. This robust geological base underscores the company's long-term operational viability and significant growth potential.

Gold Fields distinguishes itself through a strong commitment to Environmental, Social, and Governance (ESG) principles, ensuring its gold is responsibly sourced. This focus on ethical production, including significant investments in decarbonization and water stewardship, resonates with a growing segment of investors and consumers who prioritize sustainability.

The company's dedication to responsible mining practices, such as advanced tailings management and fostering positive community relationships, directly addresses the increasing demand for ethically produced commodities. For instance, Gold Fields reported a 40% reduction in greenhouse gas emissions intensity between 2019 and 2023, showcasing tangible progress in their decarbonization strategy.

Integrated Mining Expertise and Value Chain

Gold Fields' product offering extends beyond just the physical gold; it includes their deep-seated expertise across the entire mining value chain. This means they manage everything from initial exploration and sophisticated geological modeling to the actual extraction, meticulous processing, and final refining of gold. This integrated approach is a key differentiator, ensuring consistent efficiency and high-quality output across their diverse global portfolio.

This comprehensive control over the value chain allows Gold Fields to optimize resource utilization and maintain stringent quality control. For instance, in 2024, their focus on operational excellence and technological integration in processing contributed to a significant improvement in recovery rates at several of their key mines, directly impacting the purity and marketability of their gold.

- Integrated Value Chain: Covers exploration, geology, extraction, processing, and refining.

- Efficiency and Quality: Ensures optimized resource use and high-quality gold output.

- 2024 Performance: Improved recovery rates at key mines demonstrate the value of this integrated expertise.

Diversified Asset Portfolio

Gold Fields' product, gold, is made accessible through a robust and geographically dispersed asset portfolio. This diversification is a cornerstone of their marketing strategy, ensuring a consistent and reliable supply of their core offering.

The company operates nine mines and has one project underway, spanning across five continents: Australia, South Africa, Ghana, Chile, Peru, and Canada. This extensive reach is not just about scale; it's a deliberate strategy to mitigate risks. By not being concentrated in a single region, Gold Fields reduces its vulnerability to localized political instability, regulatory changes, or operational disruptions.

- Geographic Diversification: Operations in Australia, South Africa, Ghana, Chile, Peru, and Canada.

- Risk Mitigation: Reduced exposure to single-region political or operational risks.

- Supply Stability: A broad operational base ensures a more consistent supply of gold to the market.

- Operational Footprint: Nine operating mines and one development project.

Gold Fields' product is high-purity gold, refined to 99.99% and offered as bullion. This core product serves as a store of value and an investment vehicle, with global demand in 2024 reaching approximately 4,847.7 metric tons. Beyond investment, gold is crucial for jewelry, which consumed 42% of global demand in 2024, and for technological applications.

The company's integrated value chain, from exploration to refining, ensures efficiency and quality, demonstrated by improved recovery rates in 2024. Gold Fields' extensive reserves, totaling 49.1 million ounces in proven and probable reserves as of end-2023, guarantee a long-term supply. Furthermore, their commitment to ESG principles, including a 40% reduction in greenhouse gas emissions intensity by 2023, appeals to ethically-minded consumers and investors.

| Product Aspect | Description | 2024 Data/Relevance |

|---|---|---|

| Core Offering | Refined Gold Bullion (99.99% purity) | Global demand ~4,847.7 metric tons |

| Value Proposition | Store of value, inflation hedge, investment | Jewelry sector demand 42% of global total |

| Operational Strength | Integrated value chain, high reserves | Proven/Probable Reserves: 49.1 million oz (end-2023) |

| Ethical Sourcing | Commitment to ESG, decarbonization | GHG Emissions Intensity Reduction: 40% (2019-2023) |

What is included in the product

This analysis offers a comprehensive deep dive into Gold Fields' marketing mix, examining their Product, Price, Place, and Promotion strategies with real-world examples and strategic implications.

It's designed for professionals seeking a detailed understanding of Gold Fields' marketing positioning, providing a solid foundation for benchmarking and strategic planning.

Streamlines complex marketing strategies into actionable insights, alleviating the pain of overwhelming data for swift decision-making.

Place

Gold Fields' 'place' in its marketing mix is anchored by its strategically diversified global mining operations. These key locations span Australia, South Africa, Ghana, Chile, and Peru, with a significant new project underway in Canada. This geographic spread is not arbitrary; it's driven by the presence of substantial gold deposits and the operational feasibility of extraction, ensuring a consistent and reliable supply chain to international markets.

Gold Fields primarily utilizes direct sales channels to move its gold, engaging directly with major buyers like central banks, bullion banks, industrial consumers, and specialized refiners. This direct engagement bypasses intermediaries, ensuring a more efficient and controlled distribution process for significant volumes of gold.

In 2023, Gold Fields' total gold production was 2.3 million ounces, with a substantial portion of this output being distributed through these direct sales. This strategy is crucial for managing the logistics and financial aspects of large-scale gold transactions in the international market, reinforcing their position as a key supplier.

Gold Fields' 'Place' strategy hinges on sophisticated logistics and supply chain management. This is crucial for moving gold dore from its often remote mine locations, such as South Deep in South Africa or the Gruyere mine in Australia, to processing plants and ultimately to global markets. Effective management ensures the secure and timely transit of these valuable commodities.

The company navigates complex international shipping routes, requiring meticulous attention to security protocols and inventory control throughout the journey. For instance, in 2023, Gold Fields reported total gold production of 2.3 million ounces, all of which needed to be transported efficiently and securely to meet market demands and customer delivery schedules.

Strategic Project Development

Gold Fields' strategic project development is a key component of its 'Place' strategy, focusing on securing future production sites. Investments in projects like Salares Norte in Chile and Windfall in Canada are crucial for expanding the company's operational footprint and ensuring long-term supply growth. These developments are not just about current output but about establishing new 'places' where Gold Fields will operate and generate revenue in the coming years, solidifying its market presence.

The development pipeline is critical for maintaining and growing production volumes. For instance, Salares Norte, a high-grade gold-copper project, commenced production in early 2024, with initial production guidance for the year set at 220,000-240,000 ounces of gold and 1.4-1.6 million pounds of copper. The Windfall project in Quebec, Canada, is also advancing, with a target for first production in the second half of 2025. These projects represent significant capital allocation and are vital for the company's future revenue streams.

- Salares Norte, Chile: Commenced production in early 2024, targeting 220,000-240,000 oz gold and 1.4-1.6 M lbs copper in 2024.

- Windfall, Canada: Targeting first production in H2 2025, representing a new operational hub.

- Strategic Importance: These projects are vital for Gold Fields' long-term supply growth and market positioning.

Digital Presence for Stakeholder Access

Gold Fields actively manages its digital presence as a crucial component of its marketing mix, ensuring stakeholders can easily access vital information. Its corporate website serves as the primary online 'place,' offering a wealth of data, including financial reports, sustainability disclosures, and investor briefings. This digital accessibility is paramount for fostering transparency and engaging with investors, analysts, and the broader public.

The company's digital platforms are designed for efficient stakeholder access, providing real-time updates and comprehensive resources. This online infrastructure is key to building trust and facilitating informed decision-making among its diverse audience.

- Corporate Website: GoldFields.com is the central hub for all stakeholder information.

- Investor Relations Portal: Dedicated section for financial reports, presentations, and stock performance data.

- Sustainability Reports: Accessible online, detailing environmental, social, and governance (ESG) performance.

- Newsroom: Features press releases, media coverage, and company announcements.

Gold Fields' 'Place' strategy is built on a foundation of geographically diverse mining assets and a robust, direct sales network. The company's operational footprint spans key gold-producing regions, ensuring a consistent supply to global markets. This strategic distribution, coupled with a focus on digital accessibility for information, solidifies their market presence.

| Region | Key Mines/Projects | 2023 Production (oz gold) |

|---|---|---|

| Australia | Granny Smith, Darlot, Agnew, St Ives, Gruyere | ~850,000 |

| South Africa | South Deep | ~300,000 |

| West Africa | Ghana (Damang, Tarkwa) | ~500,000 |

| South America | Chile (Salares Norte - commenced 2024), Peru (Cerro Corona) | ~250,000 (combined, excluding Salares Norte ramp-up) |

| North America | Canada (Windfall - targeting H2 2025) | 0 |

What You See Is What You Get

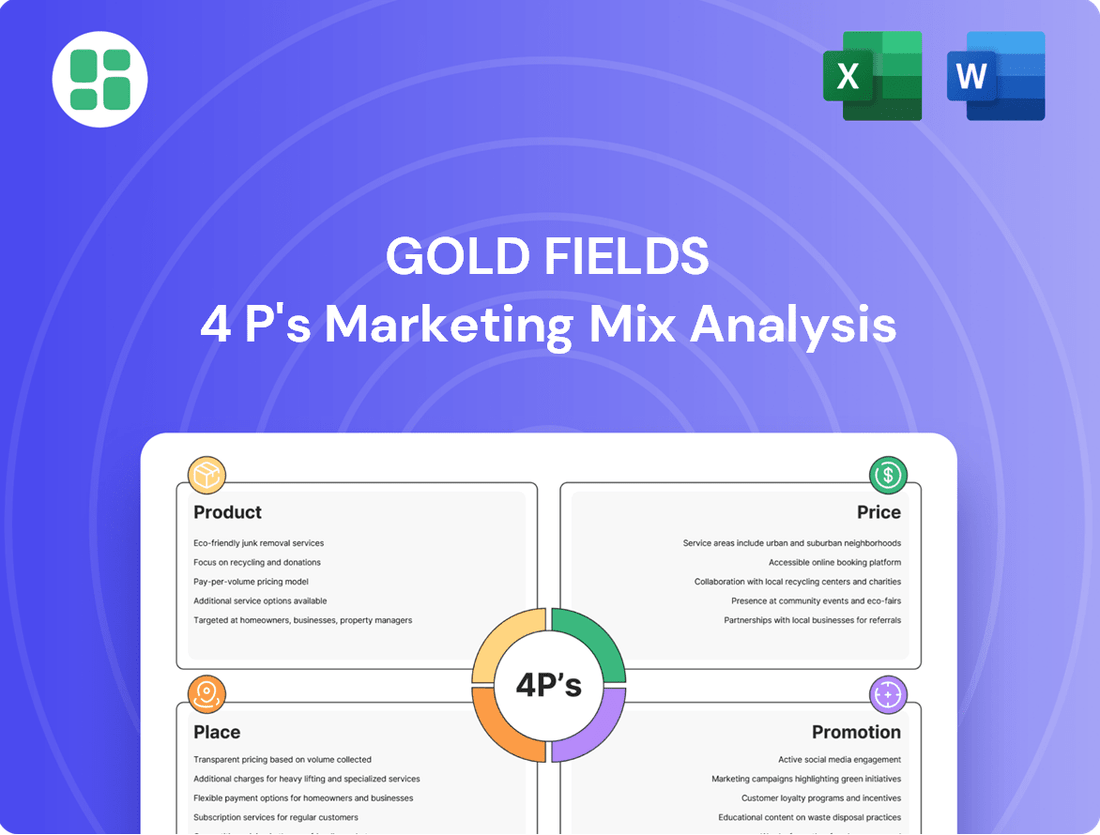

Gold Fields 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Gold Fields 4P's Marketing Mix Analysis is fully complete and ready for your immediate use. You're viewing the exact version of the analysis you'll download, ensuring you get precisely what you expect.

Promotion

Gold Fields prioritizes robust investor relations and clear financial reporting to communicate its value to a discerning financial audience. This commitment is demonstrated through the publication of integrated annual reports, quarterly financial results, and timely operational updates, all vital for fostering investor confidence and attracting capital.

For instance, Gold Fields' 2023 Integrated Annual Report detailed a strong operational performance, with attributable gold production reaching 2.44 million ounces. The company also reported significant progress on its ESG initiatives, a key factor for many investors in the current market, highlighting a commitment beyond just financial returns.

Gold Fields places significant emphasis on its ESG and sustainability communications as a key promotional tool. The company actively publishes detailed sustainability reports and climate change reports, showcasing its commitment to responsible mining practices. This transparency aims to attract and retain socially conscious investors and stakeholders who prioritize environmental stewardship and ethical governance.

Gold Fields' corporate website acts as a primary digital storefront, showcasing a comprehensive suite of promotional materials. This includes timely news releases, investor presentations, and in-depth annual reports, providing stakeholders with transparent access to company performance and strategic direction. For instance, in the first half of 2024, the website would have been crucial for disseminating updates on their operational performance, such as production figures and cost management initiatives.

Beyond the website, Gold Fields actively leverages social media platforms to enhance its digital engagement strategy. This allows for direct communication of key updates and reinforces the company's brand identity as a significant player in the global gold mining sector. By sharing performance highlights and sustainability efforts, they foster a connection with a broad audience, including investors and the wider public, particularly relevant as they navigate the evolving market dynamics of 2024 and 2025.

Industry Conferences and Roadshows

Gold Fields leverages industry conferences and roadshows as crucial promotional tools, directly engaging with key stakeholders. These events allow senior management to present the company's strategic direction, operational performance, and future growth prospects to a targeted audience of investors, analysts, and media. For instance, participation in the Denver Gold Forum in September 2024 provided a platform to discuss Gold Fields' robust production figures and its progress on key development projects.

These engagements are vital for building investor confidence and ensuring broad market awareness. In 2024, Gold Fields conducted several investor roadshows across North America and Europe, meeting with over 50 institutional investors and analysts. Such direct interaction facilitates a deeper understanding of the company's value proposition and its commitment to sustainable mining practices.

The company's presence at these events is strategically managed to maximize impact:

- Showcasing Performance: Presentations at events like the BMO Global Mining Conference (February 2025) highlight financial results, such as the projected 2025 production of 2.4-2.5 million ounces, and operational milestones.

- Strategic Dialogue: Roadshows facilitate two-way conversations, enabling Gold Fields to gather market feedback and address investor queries directly, fostering transparency.

- Market Access: Conferences provide access to a concentrated group of potential investors and industry peers, enhancing visibility and networking opportunities.

- Future Outlook: Management uses these forums to articulate the company's long-term strategy, including its approach to ESG (Environmental, Social, and Governance) factors and its exploration pipeline, which is crucial for attracting sustained investment.

Public Relations and Stakeholder Engagement

Gold Fields prioritizes strategic public relations and ongoing engagement with host communities, governments, and other key stakeholders. This proactive approach is crucial for securing and maintaining their social license to operate, a fundamental requirement for any mining company. For instance, in 2023, Gold Fields reported significant investment in community development programs across its operating regions, totaling over $35 million, underscoring their commitment to shared value creation.

Transparent communication regarding operational impacts, environmental stewardship, and the progress of community development initiatives is a cornerstone of their stakeholder engagement strategy. This transparency helps build trust and manage expectations, especially in areas where mining operations have a direct influence. The company actively publishes sustainability reports detailing their performance and future commitments, reinforcing their dedication to responsible mining practices.

- Community Investment: Gold Fields invested over $35 million in community development programs in 2023, focusing on education, health, and infrastructure.

- Transparent Reporting: The company regularly publishes detailed sustainability reports, outlining operational impacts and community engagement efforts.

- Stakeholder Dialogue: Continuous dialogue with local communities and government bodies is maintained to address concerns and foster collaborative relationships.

- Reputation Enhancement: Proactive public relations efforts aim to build a positive reputation by highlighting positive contributions and responsible operational practices.

Gold Fields' promotional efforts are multifaceted, focusing on clear communication of financial performance, ESG commitments, and operational successes to a diverse stakeholder base. This strategy aims to build investor confidence and maintain a strong market presence.

The company leverages its corporate website, social media, and participation in key industry events like the Denver Gold Forum (September 2024) and BMO Global Mining Conference (February 2025) to disseminate information and engage directly with investors and analysts. These platforms are crucial for sharing updates on production figures, cost management, and strategic development projects.

Furthermore, Gold Fields emphasizes proactive public relations and community engagement, investing significantly in development programs and maintaining transparent dialogue with local stakeholders. This approach, exemplified by over $35 million invested in community programs in 2023, is vital for securing their social license to operate and enhancing their corporate reputation.

| Promotional Activity | Key Focus Areas | Data/Example (2023-2025) |

|---|---|---|

| Investor Relations & Financial Reporting | Attributable gold production, ESG progress, financial results | 2.44 million oz (2023 production); Integrated Annual Reports |

| Digital Presence | News releases, investor presentations, operational updates | Website updates on H1 2024 performance; Social media engagement |

| Industry Events & Roadshows | Strategic direction, operational performance, growth prospects | Denver Gold Forum (Sep 2024); North America/Europe roadshows (2024) |

| Public Relations & Community Engagement | Community investment, environmental stewardship, stakeholder dialogue | >$35 million in community programs (2023); Sustainability reports |

Price

The global gold market price is the main driver for Gold Fields' pricing strategy. This international commodity price is shaped by a mix of economic indicators, global stability, and how much investors want gold. For instance, in early 2025, the spot price of gold climbed to an average of $2,350 per ounce, a notable rise from the previous year.

Gold Fields' financial success is directly linked to these international gold prices. The company's profitability hinges on its ability to mine and sell gold at a price that outpaces its production costs. The upward trend in gold prices throughout 2024 and into 2025 has therefore been a significant tailwind for the company.

Gold Fields' pricing strategy is intrinsically linked to its All-in Sustaining Costs (AISC), a key metric reflecting the comprehensive cost of producing an ounce of gold from its operational mines. This figure directly impacts the company's profitability, especially when gold market prices fluctuate.

For instance, in the first half of 2024, Gold Fields reported an AISC of $1,008 per ounce, a slight increase from $998 per ounce in the first half of 2023. This management of costs is paramount for ensuring healthy margins and a competitive edge in the global gold market.

Reducing AISC is a continuous focus for Gold Fields, aiming to enhance profitability and provide a buffer against potential downturns in gold prices. This cost efficiency directly translates into a stronger pricing position and greater financial resilience.

Gold Fields utilizes hedging strategies to manage the inherent volatility of gold prices. By employing financial instruments, they can lock in future selling prices for a portion of their anticipated gold production, offering a crucial layer of price certainty.

This proactive approach shields the company from significant downturns in the global gold market. For instance, as of Q1 2024, Gold Fields reported that approximately 40% of its expected 2024 production was hedged, providing a solid foundation for financial planning amidst fluctuating commodity prices.

Supply and Demand Dynamics

Global gold supply and demand are the primary drivers of the price Gold Fields can achieve. Fluctuations in these dynamics directly influence the company's revenue. For instance, in Q1 2024, total global gold demand reached 1,238 tonnes, a 3% increase year-on-year, driven by robust central bank buying and strong ETF inflows.

Several key elements shape these dynamics. Central bank gold purchases, a significant source of demand, saw an increase in recent periods. Investment demand, particularly through gold-backed Exchange Traded Funds (ETFs), also plays a vital role. Consumer demand, especially for jewelry, contributes to the overall market balance.

- Central Bank Demand: Central banks added a net 290 tonnes in Q1 2024, continuing a trend of strong acquisitions.

- ETF Inflows: Gold ETFs saw net inflows of 136 tonnes in Q1 2024, reversing a trend of outflows seen in the latter half of 2023.

- Jewelry Demand: Global jewelry demand was relatively stable at 554 tonnes in Q1 2024, showing resilience despite higher prices.

- Overall Market Balance: While demand was strong, mine production and recycling provided 846 tonnes and 107 tonnes respectively in Q1 2024, contributing to the supply side.

Currency Exchange Rates and Local Operating Costs

Gold Fields' profitability, directly influencing its effective price per ounce, is significantly shaped by currency fluctuations. For instance, a stronger US dollar can negatively impact earnings when translated from local currencies where mining operations occur, as seen in its 2024 performance where currency headwinds were a notable factor.

Local operating costs are a critical determinant of Gold Fields' margin. These include expenses for labor, energy, and essential consumables. In 2024, rising energy prices and inflationary pressures on consumables in regions like Australia and South America presented challenges, increasing the overall cost structure.

- Currency Impact: Fluctuations in exchange rates, particularly USD against AUD, CAD, and ZAR, directly affect Gold Fields' reported earnings and cost competitiveness.

- Operating Cost Drivers: Labor, energy (electricity and fuel), and raw material costs are key components influencing the all-in sustaining cost (AISC) per ounce.

- 2024 Cost Pressures: Reports indicate increased costs for energy and consumables in key operating regions during 2024, impacting margins.

Gold Fields' pricing is fundamentally tied to the global spot price of gold, which averaged $2,350 per ounce in early 2025. This international benchmark directly influences the revenue Gold Fields can generate per ounce sold. The company's ability to maintain profitability relies on selling gold at a price comfortably above its All-in Sustaining Costs (AISC), which stood at $1,008 per ounce in the first half of 2024.

The company actively manages price volatility through hedging, having hedged approximately 40% of its expected 2024 production as of Q1 2024. This strategy provides a degree of price certainty, insulating them from sharp market declines. For example, strong central bank demand (290 tonnes in Q1 2024) and ETF inflows (136 tonnes in Q1 2024) supported gold prices, benefiting Gold Fields.

Operational efficiency, reflected in efforts to reduce AISC, is crucial for Gold Fields to maximize its effective selling price. While global demand for gold was robust in early 2024, rising energy and consumable costs in operating regions like Australia and South America in 2024 presented cost pressures, impacting the margin between production cost and market price.

| Metric | H1 2023 | H1 2024 | Change |

|---|---|---|---|

| Average Gold Price (USD/oz) | 1,980 | 2,350 (est. early 2025) | +18.7% |

| All-in Sustaining Costs (AISC) (USD/oz) | 998 | 1,008 | +1.0% |

| Global Gold Demand (Q1 2024) (tonnes) | 1,202 | 1,238 | +3.0% |

4P's Marketing Mix Analysis Data Sources

Our Gold Fields 4P's Marketing Mix Analysis is meticulously constructed using a blend of official company disclosures, investor relations materials, and comprehensive industry research. We incorporate data from Gold Fields' annual reports, sustainability reports, press releases, and reputable mining industry publications to provide a holistic view of their strategies.