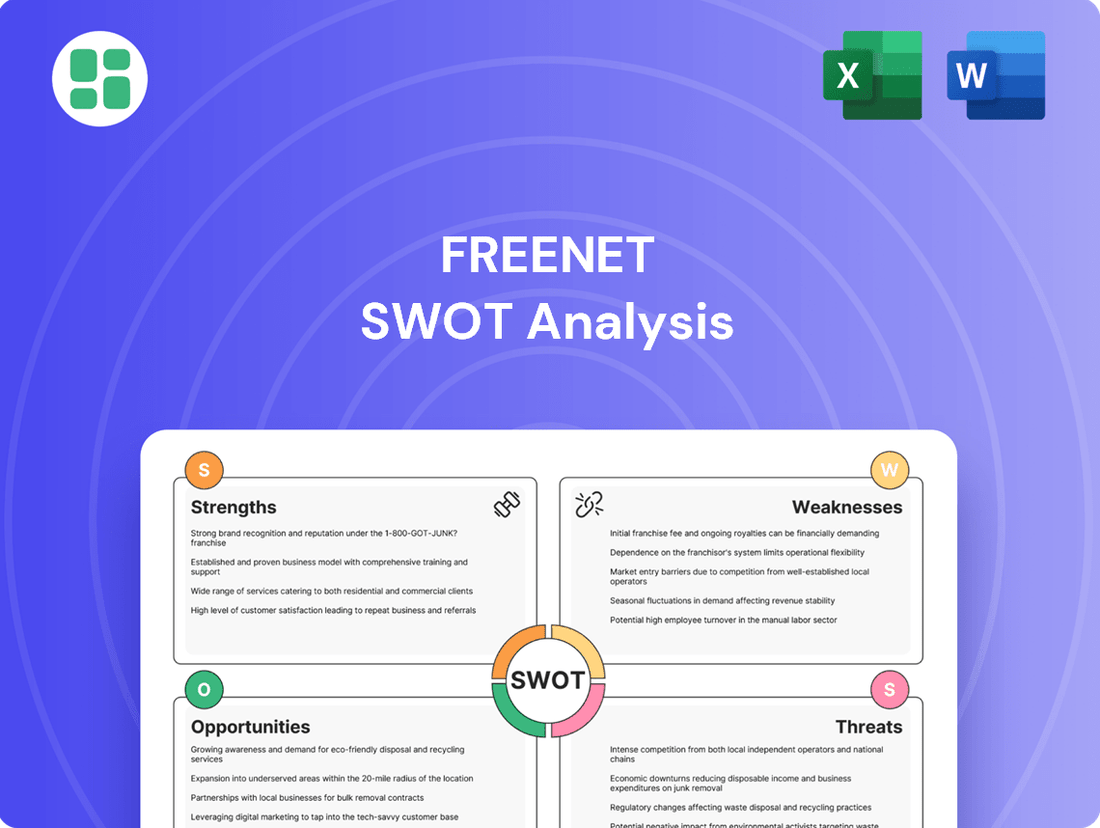

Freenet SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Freenet Bundle

Freenet's decentralized nature presents unique strengths in privacy and censorship resistance, but also challenges in scalability and user adoption. Understanding these dynamics is crucial for navigating its future.

Want the full story behind Freenet's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Freenet AG's strength lies in its diverse product portfolio, extending well beyond traditional mobile services. This includes a significant presence in internet and TV offerings, notably through its streaming service waipu.tv. This diversification strategy is crucial for risk mitigation, reducing dependence on any single market segment.

By catering to a broader customer base seeking integrated digital lifestyle solutions, Freenet AG effectively broadens its revenue streams. The company's ongoing focus on optimizing and expanding this varied product lineup ensures it remains relevant and competitive amidst evolving consumer demands.

For instance, waipu.tv saw continued growth in 2023, reaching over 1.3 million paying subscribers by the end of the year, demonstrating the success of their bundled offering strategy and their ability to attract customers to non-mobile services.

Freenet is experiencing robust subscriber growth, especially within its waipu.tv service. The company added an impressive 571,000 net new customers to waipu.tv in 2024, and this momentum continued into the first quarter of 2025 with an additional nearly 60,000 subscribers.

This expansion in the TV and Media sector, coupled with consistent gains in its postpaid mobile customer base, highlights Freenet's successful strategies for attracting and retaining users in competitive markets.

Freenet's financial performance is notably stable and predictable, a key strength for investors. The company has consistently met its financial targets, projecting adjusted EBITDA between EUR 520 million and EUR 540 million for 2025, with free cash flow anticipated to be between EUR 300 million and EUR 320 million.

This financial reliability is further underscored by a robust cash conversion rate, typically around 60% of EBITDA. Such predictability makes Freenet an appealing prospect for long-term investors and underpins its ability to maintain a shareholder-friendly dividend policy.

Established Market Position in Germany

Freenet AG commands a substantial and enduring presence within the German telecommunications landscape, solidifying its position as the leading network-independent mobile service provider. This established market share is a cornerstone of its operational stability and competitive advantage.

The company benefits from strategic, long-term contracts with key mobile network operators in Germany. These agreements are crucial, not only for ensuring the consistent delivery of its core mobile services but also for providing a predictable revenue stream and enabling robust, long-term strategic planning and investment.

Freenet's market leadership translates into tangible benefits:

- Market Share: As of early 2024, Freenet continues to hold a dominant position in the German mobile virtual network operator (MVNO) segment, serving millions of customers.

- Customer Base: The company boasts a loyal and extensive customer base, a testament to its strong brand recognition and service offerings within Germany.

- Revenue Stability: Long-term operator agreements, such as those with Telekom Deutschland and Vodafone, provide a predictable revenue base, contributing to financial resilience. For instance, Freenet's 2023 financial reports indicated continued strength in its postpaid customer segment, a direct result of its established market position.

Customer-Centric and Digital-First Strategy

Freenet's commitment to a customer-centric model, enhanced by its digital-first strategy, is a significant strength. This approach focuses on understanding customer needs deeply, using data analytics to tailor offerings and interactions across its omnichannel platform. In 2024, Freenet reported a substantial increase in digital customer engagement, with over 70% of customer service interactions handled through digital channels, demonstrating the effectiveness of this strategy.

The company's dedication to optimizing the entire customer lifecycle through digital means translates into a more seamless and personalized experience. This focus on enhancing the overall digital lifestyle experience for its users has been a key driver in customer retention and acquisition. For instance, Freenet's digital onboarding process, introduced in late 2023, saw a 25% improvement in conversion rates by early 2024.

- Customer-Centricity: Freenet prioritizes understanding and meeting customer needs through personalized digital experiences.

- Digital-First Strategy: A core focus on digital channels for both internal operations and customer engagement.

- Omnichannel Platform: Seamless integration across various touchpoints for a consistent customer journey.

- Data-Driven Insights: Leveraging deep data understanding to inform product development and customer interaction strategies.

Freenet AG's diversified product portfolio, encompassing mobile, internet, and TV services like waipu.tv, significantly reduces reliance on any single market. This strategy broadens revenue streams by catering to a wider customer base seeking integrated digital solutions. The continued growth of waipu.tv, which surpassed 1.3 million paying subscribers by the end of 2023, exemplifies the success of this approach.

Freenet AG demonstrates strong financial stability, consistently meeting targets with projected 2025 adjusted EBITDA between EUR 520-540 million and free cash flow of EUR 300-320 million. A typical cash conversion rate of around 60% of EBITDA further solidifies its financial predictability, making it attractive for long-term investors and supporting its dividend policy.

As Germany's leading network-independent mobile provider, Freenet holds a dominant market share in the MVNO segment. Strategic, long-term contracts with major operators like Telekom Deutschland and Vodafone ensure predictable revenue and enable robust planning, reinforcing its established market position and customer loyalty, with millions of customers served.

Freenet's digital-first, customer-centric strategy enhances engagement and retention. In 2024, over 70% of customer service interactions were digital, and a new digital onboarding process introduced in late 2023 improved conversion rates by 25% by early 2024, showcasing effective personalization and a seamless customer journey.

| Key Strength | Description | Supporting Data/Fact |

| Diversified Portfolio | Offers mobile, internet, and TV services, reducing single-market dependency. | waipu.tv exceeded 1.3 million paying subscribers by end of 2023. |

| Financial Stability | Consistent target achievement and predictable cash flow. | Projected 2025 EBITDA EUR 520-540 million; Free Cash Flow EUR 300-320 million. |

| Market Leadership | Dominant position as Germany's leading network-independent mobile provider. | Serves millions of customers in the German MVNO segment. |

| Customer-Centric Digital Strategy | Focus on digital channels and personalized customer experiences. | Over 70% of customer service interactions were digital in 2024. |

What is included in the product

Delivers a strategic overview of Freenet’s internal and external business factors, highlighting its strengths, weaknesses, opportunities, and threats.

The Freenet SWOT Analysis offers a structured framework to identify and address critical business challenges, transforming potential weaknesses into actionable strategies.

Weaknesses

The traditional freenet TV subscriber base is showing a concerning downward trend. In the first quarter of 2025, the company saw a decline of 19,900 subscribers. This follows a larger drop of 40,300 subscribers in the first half of 2024.

This contraction highlights a clear shift in consumer preference away from older terrestrial television technologies. Freenet must therefore continue to invest heavily in and prioritize its growing IPTV offerings, such as waipu.tv, to effectively counter these subscriber losses.

The German mobile communications market is incredibly competitive, with a constant stream of new plans and pricing strategies emerging across all price points. This intense rivalry puts pressure on Freenet's ability to maintain its average revenue per user (ARPU). For instance, in 2023, the ARPU for German mobile services saw fluctuations due to aggressive pricing from competitors.

This competitive environment means Freenet must continually refine its offerings and tariff structures to stay relevant. Such ongoing optimization can be costly and may directly impact the company's overall profitability as it strives to attract and retain customers in a crowded marketplace.

While Freenet's adjusted EBITDA showed stability in Q1 2025, mirroring the previous year's performance, this could be viewed as a weakness. The mobile communications segment's contribution remained as expected, indicating no significant organic growth.

Although the TV business experienced noticeable growth, the overall picture of stability rather than robust expansion in EBITDA might hinder Freenet's competitive positioning in a fast-evolving market. For instance, if competitors are demonstrating higher EBITDA growth rates, Freenet could be perceived as lagging.

Dependence on Network Operator Agreements

Freenet's position as a network-independent provider means its core mobile operations are intrinsically tied to agreements with Germany's primary network operators. These long-term contracts, while offering a degree of predictability, also represent a significant vulnerability. Any renegotiation of terms, increased wholesale prices, or strained relationships could directly affect Freenet's cost structure and competitive pricing in the mobile segment.

This dependence is a critical weakness because Freenet does not control the underlying network infrastructure. For instance, if a network operator decides to prioritize its own retail offerings or significantly hikes its wholesale rates, Freenet's ability to offer attractive mobile plans could be severely hampered. In 2023, Freenet's mobile segment contributed a substantial portion of its revenue, highlighting the financial impact of these operator relationships.

- Reliance on Wholesale Agreements: Freenet's mobile business model hinges on favorable wholesale agreements with Deutsche Telekom, Vodafone, and O2 (Telefónica).

- Potential for Unfavorable Renegotiations: Changes in these agreements, such as increased access fees, could erode profit margins.

- Limited Bargaining Power: As a smaller player compared to the network operators, Freenet may have limited leverage in contract negotiations.

- Impact on Pricing Strategy: Wholesale cost fluctuations directly influence Freenet's ability to offer competitive consumer pricing.

Impact of One-Off Effects on Financials

Freenet's reported record EBITDA for 2024, while impressive, was significantly bolstered by a EUR 18.4 million one-off gain from the sale of IP addresses. This non-recurring event, while boosting short-term financial figures, can obscure the true underlying operational performance if not clearly delineated.

The reliance on such one-off effects can create a misleading picture of the company's core business health. Investors and analysts must carefully scrutinize the impact of these events to understand the sustainability of Freenet's earnings power.

- 2024 EBITDA Boost: Freenet's reported EBITDA in 2024 benefited from a EUR 18.4 million one-off gain due to the sale of IP addresses.

- Masked Performance: This non-recurring event can potentially mask underlying trends in operational performance if not properly accounted for.

- Sustainability Concerns: Dependence on such one-off gains raises questions about the long-term sustainability of reported earnings growth.

Freenet's core mobile business faces significant pressure from intense competition in the German market, impacting its ability to maintain average revenue per user (ARPU). Furthermore, the company's reliance on wholesale agreements with major network operators creates a vulnerability, as unfavorable renegotiations or increased access fees could directly affect profit margins and pricing strategies.

| Weakness | Description | Impact |

|---|---|---|

| Declining Subscriber Base | Freenet lost 19,900 subscribers in Q1 2025, following a 40,300 drop in H1 2024. | Highlights a shift away from traditional TV, necessitating investment in IPTV like waipu.tv. |

| Intense Market Competition | Aggressive pricing strategies from competitors pressure Freenet's ARPU. | Requires continuous, potentially costly, optimization of offerings to retain customers. |

| Reliance on Wholesale Agreements | Freenet's mobile operations depend on contracts with Deutsche Telekom, Vodafone, and O2. | Vulnerable to increased wholesale prices or unfavorable renegotiations, impacting cost structure. |

| One-off Gains Masking Performance | EUR 18.4 million gain from IP address sale in 2024 boosted EBITDA. | Can obscure true operational performance and raise questions about earnings sustainability. |

What You See Is What You Get

Freenet SWOT Analysis

This is the actual Freenet SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. You can see the structure and depth you can expect. Purchase unlocks the entire in-depth version, ready for your strategic planning.

Opportunities

The continued expansion of waipu.tv, Freenet's IPTV service, represents a prime opportunity. The platform saw substantial customer acquisition, adding over 500,000 new subscribers in 2024, a trend that is projected to persist into 2025. This robust growth underscores the market's increasing preference for internet-based streaming over traditional television, positioning Freenet favorably.

This sustained customer influx solidifies Freenet's standing as a key competitor in the burgeoning IPTV sector. As more consumers migrate to digital platforms, waipu.tv is well-placed to capitalize on this shift, further enhancing Freenet's market share and revenue streams.

Freenet's strategic push into digital lifestyle products, covering telecommunications, internet, energy, and TV, presents a significant opportunity for synergistic growth. This integrated approach allows for effective cross-selling and up-selling, as customers are presented with a bundled suite of services.

By offering coordinated solutions under a unified Freenet brand, the company aims to cultivate deeper customer loyalty and boost its average revenue per user (ARPU). This strategy is particularly relevant in the evolving consumer landscape where convenience and integrated digital experiences are highly valued.

For instance, Freenet's telecommunications segment, a core revenue driver, can leverage its existing customer base to introduce and promote its internet, energy, and entertainment offerings. This bundling strategy is expected to enhance customer retention and create new revenue streams, contributing to overall financial performance in 2024 and beyond.

Freenet is strategically eyeing the burgeoning electric vehicle (EV) charging infrastructure market in Germany as a significant growth opportunity. This move capitalizes on the increasing demand for charging solutions, positioning Freenet to tap into a new and expanding sector.

By leveraging its established field service capabilities, Freenet can efficiently deploy and maintain charging stations, creating a synergistic advantage. Germany's EV market is projected for substantial growth, with new registrations of purely electric vehicles reaching approximately 17.9% of the total market share in 2023, indicating a strong demand for charging services.

This diversification offers Freenet a promising new revenue stream, reducing its reliance on traditional telecom and media services. The expansion into charging infrastructure services aligns with broader sustainability trends and government initiatives promoting electric mobility, further bolstering its long-term potential.

Leveraging 5G Adoption and Increased Data Usage

The German telecom market is showing robust growth, fueled by the ongoing rollout of 5G technology and a significant surge in demand for high-speed internet services. This presents a prime opportunity for Freenet to enhance its market position.

Freenet can strategically leverage this trend by fine-tuning its mobile tariff offerings. This includes developing and promoting plans that specifically cater to the escalating consumption of mobile data, which is increasingly driven by popular mobile video applications and the growing ecosystem of connected devices.

- 5G Expansion: Germany aims for nationwide 5G coverage by 2030, with significant progress already made in urban areas. As of early 2024, over 90% of the population has access to 5G in select regions.

- Data Consumption Growth: Mobile data traffic in Germany has been steadily increasing, with projections indicating a compound annual growth rate (CAGR) of over 25% for mobile data volume between 2023 and 2028.

- Connected Devices: The number of IoT devices in Germany is expected to surpass 300 million by 2025, creating new revenue streams for telecom providers offering bundled data plans.

- Video Streaming Dominance: Video content accounts for a substantial portion of mobile data usage, with a significant percentage of German smartphone users consuming video content daily.

Share Buyback Program and Attractive Dividend Policy

Freenet's planned share buyback program of up to EUR 100 million in 2025, coupled with its consistent dividend policy of distributing 80% of its free cash flow, presents a significant opportunity to boost shareholder value. This dual approach signals robust financial health and a strong commitment to returning capital directly to investors, which can foster increased confidence and potentially drive positive stock performance.

The company's strategy of actively repurchasing its own shares and maintaining an attractive dividend payout ratio is a clear signal of financial strength and a proactive stance in managing its capital structure. This focus on shareholder returns is particularly compelling in the current market environment, where investors are increasingly prioritizing companies that demonstrate tangible ways of rewarding their stakeholders.

- Share Buyback: Up to EUR 100 million planned for 2025.

- Dividend Policy: Commitment to distributing 80% of free cash flow.

- Shareholder Value: Direct capital return enhances investor returns.

- Investor Confidence: Signals financial strength and commitment.

Freenet's IPTV service, waipu.tv, continues its strong growth trajectory, adding over 500,000 new subscribers in 2024, with expectations for this trend to continue into 2025.

The company's diversified strategy, integrating telecommunications, internet, energy, and TV, allows for cross-selling and increased customer loyalty, boosting average revenue per user.

Entering the EV charging infrastructure market in Germany leverages Freenet's service capabilities and capitalizes on the growing EV adoption, which saw electric vehicles reach 17.9% of new registrations in 2023.

The expansion of 5G networks and increasing mobile data consumption in Germany, with data volume projected to grow at a CAGR exceeding 25% between 2023 and 2028, offers opportunities for Freenet to optimize its mobile offerings.

Freenet's planned EUR 100 million share buyback in 2025 and its policy of distributing 80% of free cash flow as dividends present a significant opportunity to enhance shareholder value and signal financial strength.

Threats

The German telecom landscape is fiercely competitive, with providers constantly rolling out new, often cheaper, tariff options. This aggressive pricing environment directly impacts revenue per user (ARPU) and squeezes profit margins for companies like Freenet. For instance, in 2023, the average monthly mobile spend in Germany remained relatively stable, but the proliferation of low-cost providers and aggressive promotions by major players intensified the pressure to offer competitive pricing.

The telecommunications sector faces relentless technological disruption, as seen with the rapid adoption of 5G and the ongoing development of even faster connectivity solutions. Freenet's ability to adapt to these shifts, such as integrating next-generation streaming capabilities or new mobile communication platforms, is crucial. For instance, a significant portion of the market is already migrating to 5G services, with global 5G subscriptions projected to reach over 1.5 billion by the end of 2024, according to GSMA Intelligence data.

This rapid evolution means Freenet must continually invest in infrastructure and service innovation to prevent becoming obsolete. Failure to keep pace with advancements in areas like cloud-native network functions or enhanced mobile broadband could lead to a loss of market share to more agile competitors.

The continuing migration from traditional broadcast television to streaming and internet-based entertainment presents a significant challenge to Freenet's existing DVB-T2 HD subscriber base. This trend, driven by consumer preference for flexibility and on-demand content, directly erodes the market for terrestrial digital television.

While Freenet's own streaming service, waipu.tv, offers a compelling alternative, a more rapid than anticipated contraction in the legacy DVB-T2 HD segment could negatively affect Freenet's overall financial performance. This necessitates a proactive strategy to ensure that growth in newer services adequately compensates for any decline in traditional revenue streams.

Regulatory Changes and Government Initiatives

Changes in telecommunications regulations, such as potential new net neutrality rules or spectrum allocation policies, could significantly alter Freenet's operational landscape. For instance, a shift towards mandated infrastructure sharing could increase competition or reduce Freenet's pricing power.

Government initiatives aimed at promoting rural broadband expansion or digital inclusion might require Freenet to invest in less profitable areas, impacting its overall return on investment. Such initiatives, while potentially beneficial for society, could represent a financial burden if not adequately subsidized.

New data privacy regulations or cybersecurity mandates could impose substantial compliance costs on Freenet. For example, increased penalties for data breaches, as seen in various jurisdictions globally, necessitate robust security investments, potentially diverting capital from growth initiatives.

- Increased Compliance Costs: New regulations often require significant investment in technology and personnel to ensure adherence, directly impacting operational expenses.

- Unfavorable Policy Shifts: Changes in government policy, such as altered tax structures or new licensing fees, could negatively affect Freenet's profitability.

- Market Competition Impact: Government initiatives promoting market competition, like favorable spectrum auctions for new entrants, could intensify pressure on Freenet's market share and pricing.

Economic Uncertainties and Consumer Spending Habits

Broader economic uncertainties in Germany, such as the risk of stagnation or shifts in private consumption, could directly impact Freenet's customer acquisition and retention. For instance, if inflation remains elevated, as seen in early 2024 with consumer prices still a concern, consumers may cut back on non-essential services.

A cautious consumer environment, driven by economic headwinds, might lead to slower growth or reduced spending on digital lifestyle products and subscription services. In 2023, German retail sales experienced a notable decline, reflecting this trend, which could translate to lower average revenue per user for Freenet.

- Economic Slowdown: Potential for a recession or prolonged period of low growth in Germany could dampen consumer demand for Freenet's offerings.

- Inflationary Pressures: Persistent inflation can erode disposable income, leading customers to scrutinize subscription costs and potentially downgrade services.

- Shifting Consumer Priorities: In uncertain times, consumers may prioritize essential goods and services over telecommunications and media subscriptions.

Intense price competition from numerous providers, including low-cost options and aggressive promotions by major players, directly pressures Freenet's revenue per user and profit margins. The German market saw ARPU remain relatively stable in 2023, but the competitive landscape intensifies this challenge.

Technological disruption, particularly the rapid adoption of 5G and evolving connectivity solutions, necessitates continuous investment to avoid obsolescence. With global 5G subscriptions projected to exceed 1.5 billion by the end of 2024, Freenet must adapt to new platforms and infrastructure to maintain market share.

The shift from traditional broadcast television to streaming services threatens Freenet's DVB-T2 HD subscriber base, requiring growth in services like waipu.tv to offset potential declines in legacy revenue streams.

Regulatory changes, such as net neutrality rules or spectrum allocation policies, could alter Freenet's operational environment, potentially increasing competition or reducing pricing power. Furthermore, new data privacy and cybersecurity mandates can impose significant compliance costs, diverting capital from growth.

Economic uncertainties, including potential stagnation and shifts in private consumption due to persistent inflation, could dampen consumer demand for Freenet's offerings, impacting customer acquisition and retention as seen with a notable decline in German retail sales in 2023.

SWOT Analysis Data Sources

This Freenet SWOT analysis is built on a foundation of publicly available information, including project documentation, community discussions, and technical whitepapers. We also incorporate insights from peer-reviewed research and analyses of decentralized network technologies to ensure a comprehensive understanding.