Freenet PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Freenet Bundle

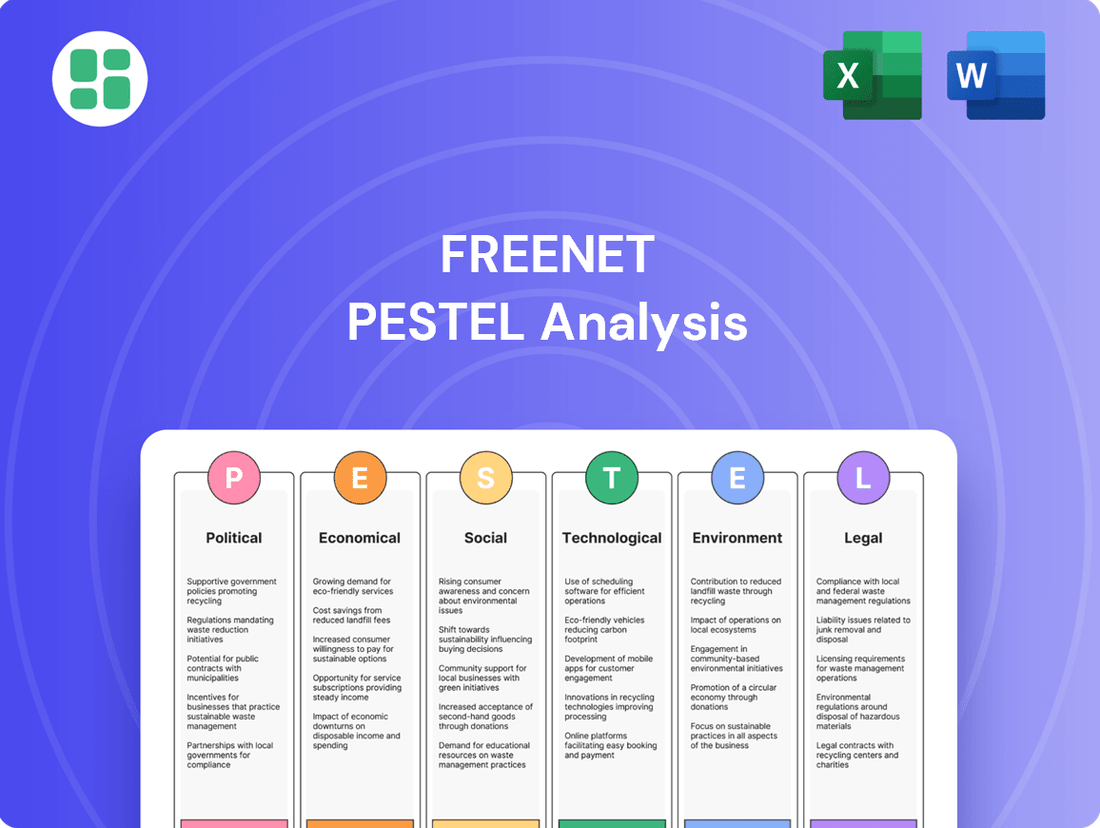

Uncover the critical external factors shaping Freenet's trajectory with our comprehensive PESTLE analysis. From evolving political landscapes to technological advancements, understand the forces that could impact your investment or strategy. Gain a competitive edge by downloading the full, expertly crafted report today.

Political factors

The German government's 'Gigabit Strategy 2030' is a significant political factor for Freenet, setting ambitious goals for nationwide fiber optic network coverage and complete 5G availability across all federal states by 2030. Key interim targets are in place for 2025, pushing for accelerated deployment.

This strategic direction directly shapes Freenet's infrastructure development and service expansion strategies. The government's commitment to facilitating network growth, evidenced by public funding for fiber network projects and legislation designed to simplify network deployment, creates a favorable political climate for Freenet's operations and future investments in telecommunications infrastructure.

Germany's Bundesnetzagentur significantly influences Freenet's operating environment by managing spectrum allocation and setting pricing for wholesale services, aiming for a competitive market. This regulatory oversight ensures that Freenet, along with its competitors, operates within a framework designed to foster innovation and fair play.

The upcoming abolition of the 'Nebenkostenprivileg' in 2024 is a pivotal regulatory shift. This change is expected to open up the market for TV services, directly impacting Freenet's streaming platform, waipu.tv, by potentially increasing competition and altering customer acquisition dynamics.

The German government's focus on promoting domestic competition driven by innovation and performance means Freenet must continually adapt its strategies. This emphasis could lead to pressure on pricing models and necessitate a stronger focus on service differentiation to maintain or grow market share in the evolving telecommunications and media landscape.

The European Union's Digital Decade Strategy, aiming for 100% gigabit connectivity and full 5G coverage by 2030 across all member states, creates a significant regulatory and opportunity landscape for Freenet. This EU-wide push for advanced digital infrastructure harmonizes regulations and fosters cross-border digital service potential.

Freenet, operating within Germany, benefits from this overarching EU strategy which could streamline operations and open new markets. The EU's commitment to funding digital infrastructure and R&D, with substantial investments planned through programs like the Connecting Europe Facility, directly supports the technological advancements Freenet relies on.

Data Protection and Privacy Regulations

Data protection and privacy regulations, such as the EU's General Data Protection Regulation (GDPR) and Germany's Federal Data Protection Act (BDSG), impose stringent requirements on companies like Freenet. These laws dictate how customer data can be collected, processed, stored, and shared, necessitating significant investment in cybersecurity infrastructure and transparent data handling policies. For instance, the GDPR mandates clear consent mechanisms and the right to data erasure, directly impacting Freenet's customer relationship management and marketing strategies.

Compliance with these evolving regulations directly influences Freenet's operational costs and the design of its services. The transposition of directives like the Corporate Sustainability Reporting Directive (CSRD) into national law, effective from 2024 for certain companies, adds further layers of reporting and compliance obligations. Failure to adhere to these rules can result in substantial financial penalties; for example, GDPR fines can reach up to 4% of a company's global annual turnover or €20 million, whichever is higher.

- GDPR Fines: Potential penalties up to 4% of global annual turnover or €20 million.

- CSRD Impact: Increased reporting requirements on data privacy and security practices.

- Customer Trust: Robust data protection is crucial for maintaining and building customer confidence.

- Operational Costs: Investments in cybersecurity and compliance measures are ongoing.

Geopolitical Tensions and Supply Chain Stability

Global geopolitical uncertainties continue to cast a shadow over supply chains, directly impacting the availability and cost of crucial telecommunications equipment and components. While specific data for Freenet's direct exposure isn't publicly detailed, the broader German telecom sector, which Freenet operates within, is actively managing these risks. For instance, the ongoing trade tensions and regional conflicts in 2024 and early 2025 have led to increased shipping costs and longer lead times for electronic parts, a challenge faced by all players in the industry.

These broader industry headwinds can significantly influence Freenet's strategic decisions regarding network expansion and overall operational resilience. The German government, for example, has been actively working to diversify its sourcing of critical infrastructure components, aiming to mitigate reliance on single suppliers amidst these geopolitical shifts. This strategic pivot by the nation could indirectly benefit Freenet by fostering a more stable and predictable procurement environment.

Maintaining a consistent and stable supply of necessary hardware is absolutely critical for Freenet to uphold its service quality and execute its infrastructure expansion plans. In 2024, the average lead time for certain advanced networking chips saw an increase of up to 15% compared to the previous year, a trend attributed to supply chain disruptions stemming from geopolitical events. Freenet's ability to navigate these challenges will be a key determinant of its future growth and competitive standing.

- Increased component costs: Geopolitical instability in key manufacturing regions can drive up the price of essential telecom hardware by 5-10% in 2024-2025.

- Supply chain diversification efforts: Germany's push to reduce reliance on single-source suppliers for critical infrastructure aims to bolster resilience for companies like Freenet.

- Impact on network rollout: Extended lead times for components, potentially reaching 3-6 months for specialized items, could delay Freenet's planned network upgrades.

- Operational resilience: Proactive inventory management and strategic partnerships are crucial for Freenet to mitigate the impact of potential supply disruptions.

Germany's 'Gigabit Strategy 2030' and the EU's Digital Decade Strategy provide a strong political tailwind for Freenet, emphasizing nationwide fiber optic and 5G expansion by 2030. Regulatory bodies like the Bundesnetzagentur play a crucial role in shaping the competitive landscape through spectrum allocation and wholesale pricing. The upcoming abolition of the 'Nebenkostenprivileg' in 2024 is a significant political shift that will impact Freenet's streaming service, waipu.tv, by potentially increasing market competition.

What is included in the product

This Freenet PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing the company, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making by highlighting potential threats and opportunities derived from current market trends and regulatory landscapes.

Provides a concise, actionable PESTLE analysis of Freenet, enabling teams to quickly identify and address external factors impacting their strategies.

Economic factors

Despite a period of economic stagnation in Germany, the telecommunications sector shows resilience. Freenet's revenue saw an increase in 2024, with projections indicating continued growth into 2025, supported by sustained demand for essential telecom services.

Consumer spending on telecommunications in Europe remained steady throughout 2024. This stability highlights Freenet's ability to maintain its market position even amidst broader economic fluctuations, offering a predictable revenue stream.

Inflation across the European Union has seen a notable decline, with the annual rate falling to 2.4% in April 2024, down from 2.4% in March 2024. This easing inflationary pressure is helping to restore consumer purchasing power, potentially boosting demand for discretionary spending on digital services like those offered by Freenet.

Despite the broader EU trend, the German mobile market remains intensely competitive. Freenet faces ongoing price pressures, which could limit its ability to fully capitalize on any increased consumer spending power, particularly concerning data services where competition is fierce.

Freenet's challenge lies in navigating this environment by aligning competitive pricing with the need to maintain healthy profit margins, especially as consumers may remain cautious with their spending even with improved purchasing power.

Germany is seeing substantial investment in its digital infrastructure, with a strong focus on expanding 5G networks and rolling out fiber-to-the-home (FTTH) connections. For instance, the German government's digital strategy aims for nationwide gigabit coverage by 2030, encouraging significant capital expenditure from telecom providers. This robust market growth directly benefits companies like Freenet, which offer network-dependent services.

These infrastructure upgrades are fueled by both public sector support and substantial private sector investment from major telecommunications operators. The German government has allocated billions of euros through various funding programs to accelerate broadband expansion. This creates a fertile ground for Freenet to capitalize on the increasing consumer and business demand for faster, more reliable internet services.

Market Competition and Pricing Pressure

The German telecom sector is a battleground with giants like Deutsche Telekom, Vodafone, and Telefónica, plus agile newcomers such as 1&1 Drillisch. This fierce rivalry naturally squeezes prices, especially in the mobile segment, directly impacting Freenet's average revenue per user (ARPU) and overall market standing.

Freenet actively navigates this landscape by meticulously optimizing its service offerings and pricing structures. This strategic approach is crucial for maintaining customer acquisition and retention in a market where price sensitivity is high.

- Intense Competition: Freenet faces significant competition from major players and emerging disruptors in Germany.

- Price Pressure: The competitive environment leads to ongoing downward pressure on pricing, particularly for mobile services.

- ARPU Impact: This price pressure directly affects Freenet's average revenue per user, a key financial metric.

- Strategic Optimization: Freenet's strategy involves continuous refinement of its tariff portfolio to stay competitive and attractive to customers.

Shift in TV Consumption Habits

The abolition of the 'Nebenkostenprivileg' in summer 2024 has fundamentally reshaped the German TV market. This change, which ended the practice of landlords passing on TV cable costs to all tenants, has directly prompted a significant number of consumers to re-evaluate their television subscriptions. As a result, providers offering flexible, internet-based TV solutions, such as Freenet's waipu.tv, have seen a notable influx of new customers.

This structural shift represents a substantial economic opportunity for Freenet's TV and Media segment. The ability for customers to choose their providers directly, rather than having it bundled, fuels competition and incentivizes growth for agile IPTV services. Freenet is well-positioned to capitalize on this trend, driving both customer acquisition and revenue expansion within this segment.

Furthermore, the broader industry trend away from traditional linear television towards on-demand content consumption aligns perfectly with Freenet's strategic focus on digital lifestyle products. This evolution in viewing habits means that services offering a wide array of streaming content and personalized viewing experiences are increasingly in demand, reinforcing the economic viability of Freenet's digital offerings.

Key economic impacts include:

- Increased customer acquisition for IPTV providers: Millions of German households are now making independent TV subscription choices, opening a large market for services like waipu.tv.

- Revenue growth potential: Direct customer relationships allow for more targeted pricing and service offerings, potentially boosting ARPU (Average Revenue Per User) for Freenet.

- Shift in advertising spend: As viewing habits move towards digital and on-demand, advertising budgets are also expected to follow, benefiting platforms that cater to these new consumption patterns.

- Market consolidation: The changing landscape may lead to consolidation, with stronger digital players like Freenet gaining market share from legacy providers.

Germany's economic landscape in 2024 and projections for 2025 indicate a steady demand for telecommunications services, benefiting Freenet. Despite a competitive German mobile market, a declining inflation rate across the EU to 2.4% in April 2024 is expected to bolster consumer purchasing power for digital services.

Significant investment in German digital infrastructure, including 5G and FTTH, creates a favorable environment for Freenet's network-dependent offerings. The abolition of the 'Nebenkostenprivileg' in summer 2024 is a key economic driver, directly increasing customer acquisition for Freenet's IPTV service, waipu.tv, as millions of households now make independent TV subscription choices.

| Economic Factor | Impact on Freenet | Data/Trend (2024-2025) |

| Consumer Spending Power | Potential for increased demand for digital services | EU inflation at 2.4% (April 2024), restoring purchasing power. |

| Infrastructure Investment | Growth opportunities for network-dependent services | Germany targeting nationwide gigabit coverage by 2030; billions invested in broadband expansion. |

| TV Market Restructuring | Significant customer acquisition for IPTV | Abolition of 'Nebenkostenprivileg' (Summer 2024) driving independent TV choices. |

| Market Competition | Price pressure, impacting ARPU | Intense rivalry in the German mobile market from major players. |

What You See Is What You Get

Freenet PESTLE Analysis

The preview you see here is the exact Freenet PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This comprehensive analysis covers Political, Economic, Social, Technological, Legal, and Environmental factors impacting Freenet. What you’re previewing here is the actual file—fully formatted and professionally structured, giving you a clear understanding of the insights provided.

No placeholders, no teasers—this is the real, ready-to-use Freenet PESTLE Analysis document you’ll get upon purchase, allowing you to immediately leverage its strategic value.

Sociological factors

German consumers are deeply immersed in digital lifestyles, with internet penetration reaching approximately 97% in 2024. This widespread adoption fuels a growing comfort with online activities, from e-commerce to digital entertainment, creating a fertile ground for companies like Freenet.

Freenet's strategic emphasis on digital lifestyle products, including its mobile services and the streaming platform waipu.tv, directly taps into this societal shift. The company's offerings are well-positioned to benefit from consumers' increasing reliance on digital connectivity for daily life.

The demand for robust internet infrastructure and data-heavy applications, particularly mobile video streaming, continues its upward trajectory. This trend is a significant opportunity for Freenet, as it drives the need for its core mobile communication and data services.

Societal trends show a significant move away from traditional broadcast television towards on-demand streaming, with consumers prioritizing flexibility and tailored content. This shift is especially pronounced among younger demographics who readily adopt new technologies and desire a broader range of entertainment choices.

In 2024, the global video streaming market was valued at over $200 billion and is projected to continue its strong growth. This increasing reliance on digital platforms for media consumption directly influences how companies like Freenet engage their audience.

Freenet's waipu.tv strategically addresses this by integrating traditional free-to-air channels with premium pay-TV options and extensive on-demand libraries. This hybrid approach appeals to a wide audience seeking personalized viewing experiences, aligning perfectly with current media consumption patterns.

Societal demand for continuous connectivity is soaring, with mobile data usage showing an uninterrupted upward trend. This surge is largely fueled by the widespread adoption of mobile video applications, active engagement on social media platforms, and the increasing prevalence of connected devices such as smartwatches. Freenet, as a key player in mobile communications, is well-positioned to capitalize on this escalating data consumption.

The global mobile data traffic is projected to grow significantly. For instance, Cisco's Visual Networking Index predicted that global mobile data traffic would increase nearly sevenfold between 2016 and 2021, reaching 1.9 zettabytes per month by 2021. While this data is from a previous period, the trend has demonstrably continued and accelerated. By 2023, Statista reported that global mobile data traffic reached over 120 exabytes per month, a figure expected to climb even higher in the coming years, underscoring the sustained and growing user appetite for data-intensive services.

The ongoing expansion of 5G networks is a critical enabler of this demand, promising higher data speeds and enhanced connectivity. This technological advancement directly supports the consumption patterns driven by video streaming, online gaming, and the burgeoning Internet of Things (IoT) ecosystem, further solidifying the societal reliance on robust mobile data services.

Influence of Social Media and Online Engagement

Social media is a powerful force in Germany, with a significant portion of the population, particularly younger individuals, actively using platforms like Instagram, TikTok, and YouTube for brand discovery and purchase decisions. Freenet must leverage these channels for effective digital marketing and customer engagement to capture this audience.

In 2024, approximately 70% of Germans aged 16-24 reported using social media daily, with a substantial number indicating they discover new products and services through these platforms. This highlights the critical need for Freenet to maintain a strong, interactive online presence.

- Digital Brand Discovery: Over 60% of German consumers aged 18-35 use social media to research brands before making a purchase.

- Engagement is Key: Companies with high social media engagement rates often see increased customer loyalty and brand advocacy.

- Targeted Marketing: Platforms offer sophisticated tools allowing Freenet to reach specific demographic and interest groups with tailored campaigns.

- Customer Service Channel: Many consumers now expect to interact with brands for customer support via social media, with response times being a key factor.

Concerns about Online Safety and Data Privacy

A significant portion of German consumers, around 40% according to a 2024 Bitkom survey, perceive the internet as increasingly unsafe. This widespread apprehension directly influences how individuals engage with online services, making robust cybersecurity and transparent data handling paramount for Freenet. Building and maintaining customer trust is therefore essential for acquiring and retaining users for its digital offerings.

Freenet must actively address these societal concerns to foster confidence in its platforms. This involves clear communication about data protection policies and demonstrating a commitment to safeguarding user information. For instance, in 2024, Freenet highlighted its investments in advanced encryption technologies to protect customer data, a move directly responding to these privacy anxieties.

- Growing Consumer Distrust: Over 40% of Germans feel the internet is becoming more dangerous, impacting their online activities.

- Trust as a Key Differentiator: Freenet's success hinges on building and maintaining trust through strong cybersecurity and data privacy.

- Impact on Business: Addressing safety and privacy concerns is critical for Freenet's customer acquisition and retention strategies in the digital space.

- Proactive Measures: Freenet's 2024 focus on enhanced encryption demonstrates a response to these consumer worries.

German society's increasing reliance on digital platforms for communication, entertainment, and commerce creates a strong demand for Freenet's services. With internet penetration at approximately 97% in 2024, consumers are comfortable with online activities, driving growth for digital lifestyle products.

The shift towards on-demand streaming, with the global video streaming market valued at over $200 billion in 2024, benefits Freenet's waipu.tv. This trend, coupled with soaring mobile data usage fueled by video and social media, positions Freenet to capitalize on escalating data consumption.

Social media's influence on brand discovery, with about 70% of young Germans using it daily for product research in 2024, necessitates Freenet's strong online engagement. However, growing consumer concerns about internet safety, with over 40% perceiving it as more dangerous, underscore the need for Freenet to prioritize cybersecurity and transparent data handling to build trust.

Technological factors

Germany's 5G network expansion is accelerating, with major players like Deutsche Telekom, Vodafone, and O2 aiming for near-ubiquitous coverage by the close of 2025. This robust infrastructure development is a significant technological enabler for Freenet. The increased speed and capacity offered by 5G directly translate to enhanced mobile communication services for Freenet's customer base.

The widespread adoption of 5G is crucial for Freenet as it unlocks new revenue streams through support for burgeoning sectors like the Internet of Things (IoT) and Industry 4.0 applications. These advanced technologies demand higher data throughput and lower latency, which 5G networks provide, thereby driving customer upgrades to more premium and higher-value rate plans.

Freenet stands to gain considerably from the enhanced capabilities of 5G, including the potential for increased average revenue per user (ARPU) driven by greater data consumption. For instance, by the end of 2024, 5G network availability in Germany was estimated to cover over 70% of the population, a figure projected to climb significantly in 2025.

Germany's commitment to its Gigabit Strategy 2030 fuels substantial investment in fiber-optic network deployment, including Fiber-to-the-Home (FTTH) and Fiber-to-the-Building (FTTB). This expansion directly benefits Freenet by enabling the delivery of superior internet and TV services via platforms like waipu.tv, meeting the increasing consumer need for high-speed connectivity.

By July 2024, it's estimated that over 50% of German households will have access to FTTH, a significant leap that presents Freenet with a prime opportunity to leverage this advanced infrastructure. This technological shift supports Freenet's strategy to enhance its digital offerings, capitalizing on the growing demand for seamless, high-bandwidth entertainment and communication solutions.

The continuous evolution of streaming technology, particularly with advancements like dynamic ad substitution (DAS) and dynamic ad injection (DAI), significantly boosts the potential for monetizing IPTV services such as waipu.tv. These innovations enable more tailored content and advertising experiences, which directly benefits user engagement and Freenet's overall revenue generation.

Waipu.tv's technological edge is further amplified by its capacity to provide an extensive selection of on-demand content, a key factor in attracting and retaining subscribers in the competitive streaming market. This vast library, coupled with personalized delivery, strengthens Freenet's market position.

Development of Future Mobile Standards (e.g., 6G)

While the full deployment of 5G networks continues, the telecommunications industry is already looking ahead to 6G. Early research and development are progressing, with commercial availability anticipated around 2029-2030. Freenet needs to stay abreast of these advancements, even if their immediate impact on consumer needs is minimal.

Monitoring the trajectory of 6G is crucial for Freenet's long-term strategic planning. This includes understanding the potential for significantly higher speeds, lower latency, and new applications that will emerge with this next generation of mobile technology. Proactive engagement with these developments ensures Freenet can adapt its infrastructure and service offerings to maintain a competitive edge in the evolving telecommunications landscape.

- 6G Development Timeline: Commercial deployment expected around 2029-2030.

- Technological Advancements: Anticipated improvements in speed, latency, and connectivity capabilities.

- Strategic Importance: Essential for Freenet's long-term network upgrades and service innovation.

- Competitive Preparedness: Monitoring 6G ensures Freenet remains competitive in future mobile markets.

Cybersecurity and Data Security Technologies

Freenet must prioritize advanced cybersecurity and data security technologies due to increasing digitalization and consumer worries about online safety. Protecting customer data and preventing breaches is vital for maintaining trust in their mobile and digital services. For instance, in 2024, the global cybersecurity market was projected to reach over $200 billion, highlighting the significant investment required.

Investing in robust security measures is not just about compliance; it's about safeguarding Freenet's reputation and customer loyalty. Data breaches can lead to substantial financial penalties and long-term damage to brand perception. In 2024, the average cost of a data breach globally was estimated to be around $4.45 million, a figure Freenet would aim to avoid.

Emerging trends include leveraging Artificial Intelligence (AI) for enhanced safety assistance. Freenet can explore AI-powered solutions for threat detection, anomaly identification, and proactive security measures. This proactive approach can significantly bolster their defense against evolving cyber threats.

Key areas of focus for Freenet's technological investment in cybersecurity include:

- Advanced Encryption: Implementing state-of-the-art encryption protocols to protect data at rest and in transit.

- AI-driven Threat Detection: Utilizing machine learning and AI to identify and neutralize sophisticated cyber threats in real-time.

- Secure Cloud Infrastructure: Ensuring that all cloud-based services and data storage meet stringent security standards.

- Regular Security Audits and Penetration Testing: Proactively identifying vulnerabilities through rigorous testing and audits.

The accelerating rollout of 5G across Germany, with coverage projected to exceed 80% by the end of 2025, directly enhances Freenet’s mobile offerings. This advanced infrastructure supports higher data consumption, potentially increasing average revenue per user (ARPU) as customers upgrade to more data-intensive plans. Furthermore, the expansion of fiber-optic networks, with over 60% of German households expected to have FTTH access by mid-2025, bolsters Freenet's IPTV services like waipu.tv by enabling superior streaming quality.

Freenet's strategic focus on technological advancements includes leveraging AI for cybersecurity, a critical area given the global cybersecurity market’s projected growth to over $230 billion in 2025. Implementing AI-driven threat detection and advanced encryption is essential for protecting customer data and maintaining trust, especially as the average cost of a data breach globally is estimated to approach $5 million in 2025. Staying ahead of the curve on next-generation technologies like 6G, with commercial deployment anticipated around 2029-2030, is also vital for Freenet's long-term competitive positioning.

| Technology | Status/Projection (2024-2025) | Impact on Freenet | Key Investment Area |

|---|---|---|---|

| 5G Network Expansion | Coverage expected to exceed 80% by end of 2025. | Enhanced mobile services, higher ARPU potential. | Network infrastructure, service bundling. |

| Fiber-to-the-Home (FTTH) | Over 60% of German households to have access by mid-2025. | Improved IPTV (waipu.tv) performance, new broadband services. | Partnerships for network access, content delivery. |

| AI in Cybersecurity | Global market projected over $230 billion in 2025. | Improved data protection, enhanced customer trust, reduced breach costs. | AI security solutions, encryption, threat detection. |

| 6G Development | Commercial deployment anticipated around 2029-2030. | Long-term competitive advantage, future service innovation. | R&D monitoring, strategic partnerships. |

Legal factors

Freenet's operations are primarily governed by Germany's Telecommunications Act (TKG), which sets the rules for how telecom companies run their networks, offer services, and compete in the market. This legal foundation is crucial for Freenet's business model.

Recent legislative efforts, including amendments to the TKG, have increasingly recognized telecommunications networks as being of 'overriding public interest.' This designation, particularly emphasized in 2021 and subsequent policy discussions, aims to accelerate the rollout of high-speed internet infrastructure across Germany.

These legal shifts are designed to streamline network deployment processes, potentially reducing bureaucratic hurdles and simplifying Freenet's expansion strategies. For example, faster approval procedures for laying fiber optic cables or building new mobile sites could significantly lower the time and cost associated with infrastructure development, boosting Freenet's ability to grow its service offerings.

The General Data Protection Regulation (GDPR) and its German counterparts mandate stringent protocols for Freenet's handling of customer data, affecting everything from collection to storage. This continuous legal requirement shapes Freenet's data management strategies and marketing outreach, directly influencing customer engagement.

Failure to adhere to these data protection laws can result in substantial financial penalties. For instance, under GDPR, fines can reach up to €20 million or 4% of a company's annual global turnover, whichever is higher, posing a significant risk to Freenet's financial stability and public image.

Consumer protection laws in Germany and the EU are quite robust, particularly within the telecommunications and media industries. These regulations focus on ensuring fair practices regarding contracts, the quality of services provided, clear pricing, and effective ways for consumers to resolve disputes. Freenet, like any company in this space, has to make sure its service contracts, how it advertises its offerings, and its customer service all line up with these rules. Failing to do so could lead to legal trouble and unhappy customers.

For instance, Freenet's move to offer more flexible, shorter-term contracts for services like waipu.tv isn't just about consumer preference; it might also be influenced by regulatory trends pushing for less restrictive service agreements. In 2023, the German Federal Network Agency reported a significant number of consumer complaints in the telecommunications sector, highlighting the ongoing importance of compliance with consumer protection mandates.

Antitrust and Competition Law

German and EU antitrust and competition laws are critical for Freenet, as they directly govern fair play in the telecommunications sector. These regulations aim to prevent monopolies and ensure that companies like Freenet can operate without unfair disadvantages. This means Freenet must be mindful of its market share and how its actions might impact competitors.

The enforcement of these laws significantly influences Freenet's strategic decisions, particularly regarding pricing and any potential expansion through mergers or acquisitions. For instance, the German Federal Network Agency (Bundesnetzagentur) actively monitors the market to ensure competitive pricing and access to infrastructure. In 2023, the agency continued its focus on ensuring fair wholesale access conditions, which directly impacts Freenet's ability to offer competitive retail services.

Freenet's operational flexibility and future market opportunities are shaped by the regulator's ongoing scrutiny of competitive practices. The emphasis on fair competition, especially concerning wholesale access to incumbent networks, means Freenet must navigate a landscape where regulatory decisions can open or close avenues for growth. For example, past regulatory interventions have aimed to foster competition in mobile and fixed-line markets by mandating access for alternative providers.

- Regulatory Oversight: German and EU antitrust laws are designed to prevent anti-competitive behavior, ensuring a level playing field in the telecommunications market.

- Strategic Impact: These laws directly affect Freenet's pricing strategies, market conduct, and its ability to pursue mergers and acquisitions.

- Wholesale Market Focus: The regulator's attention to fair wholesale product access from incumbents is crucial for Freenet's operational agility and market growth potential.

- Market Dynamics: The ongoing enforcement of competition law influences market entry, service innovation, and overall consumer choice within the German telecom landscape.

Copyright and Content Licensing Laws

Freenet's media operations, particularly its waipu.tv service, are heavily influenced by copyright and content licensing laws. These regulations govern how Freenet can broadcast, stream, and provide on-demand access to television and media content. Navigating these laws requires continuous negotiation and securing agreements with a multitude of content creators and rights holders.

The financial health of Freenet's media division is directly tied to its ability to maintain favorable licensing terms. For instance, in 2024, the ongoing shifts in digital rights management and the increasing demand for premium content mean that licensing costs can fluctuate significantly. A substantial portion of Freenet's operating expenses is allocated to these content rights, impacting its profitability margins.

Potential changes in copyright legislation or the terms under which content is licensed present a considerable risk. For example, new regulations could impose stricter usage limitations or increase the cost of acquiring popular shows and movies. Freenet's strategic planning must account for these legal uncertainties, as they can directly alter the accessibility and cost of its content library, thereby affecting subscriber acquisition and retention.

- Content Licensing Costs: In 2024, media companies like Freenet face escalating costs for acquiring rights to popular content, driven by increased competition and the proliferation of streaming services.

- Regulatory Compliance: Adhering to evolving copyright laws, including those related to digital streaming and data privacy, requires ongoing legal counsel and technological adaptation.

- Impact on Profitability: Unfavorable changes in licensing agreements or new regulatory burdens can directly reduce Freenet's profit margins on its media services.

- Strategic Negotiation: Freenet's success hinges on its ability to negotiate complex licensing deals that balance content availability with financial sustainability.

Freenet's operations are heavily influenced by German and EU telecommunications law, particularly the Telecommunications Act (TKG), which dictates network operation, service provision, and market competition. Amendments in 2021 underscored the public interest in accelerating high-speed internet, potentially streamlining Freenet's infrastructure expansion by reducing bureaucratic hurdles for activities like fiber optic cable deployment.

Data protection laws, including GDPR, impose strict requirements on Freenet's handling of customer data, impacting everything from collection to storage and marketing. Non-compliance carries significant financial risks, with potential fines up to €20 million or 4% of global annual turnover, directly affecting financial stability and public perception.

Consumer protection laws mandate fair practices in contracts, service quality, pricing, and dispute resolution for Freenet. The German Federal Network Agency noted a significant number of consumer complaints in the telecom sector in 2023, highlighting the ongoing importance of compliance with these regulations for customer satisfaction and legal adherence.

Environmental factors

The Information and Communication Technology (ICT) sector, Freenet's operational domain, is a significant contributor to global greenhouse gas emissions. This impact stems largely from the energy demands of network infrastructure and extensive data centers powering digital services.

Freenet, recognizing this environmental challenge, is integrating energy consumption reduction and carbon footprint minimization into its core sustainability strategy. This commitment involves proactive climate action initiatives and the establishment of ambitious targets, such as aligning Scope 1 and 2 emissions with the 1.5-degree Celsius warming limit by 2030.

The escalating demand for smartphones and digital gadgets is creating a substantial surge in electronic waste. In 2023 alone, the global e-waste generation reached an estimated 62 million metric tons, a figure projected to climb further. This trend puts pressure on companies like Freenet, a key player in mobile and digital services, to actively participate in the circular economy.

Freenet is increasingly expected to champion responsible disposal, robust recycling programs, and explore avenues for device repair and refurbishment. This commitment is not just about environmental stewardship but also aligns with the European Green Deal's ambitious targets for fostering more sustainable business operations across the continent.

Freenet, like many German and EU companies, faces increasing pressure to prioritize Corporate Social Responsibility (CSR) and robust Environmental, Social, and Governance (ESG) reporting. This trend is driven by regulatory changes and growing stakeholder expectations.

Freenet has responded by developing a comprehensive sustainability strategy and issuing a non-financial group statement, aligning with frameworks such as the European Sustainability Reporting Standards (ESRS). This proactive approach underscores their commitment to environmentally sound and socially equitable practices, which significantly impacts how investors and consumers perceive the company.

For instance, in 2023, the EU's Corporate Sustainability Reporting Directive (CSRD) expanded reporting obligations, requiring more detailed ESG disclosures from companies like Freenet. This regulatory push, coupled with a market where sustainable investments are gaining traction, means Freenet's ESG performance directly influences its access to capital and brand reputation.

Sustainable Infrastructure Development

Freenet's expansion of mobile and internet infrastructure faces growing pressure for sustainable development. This means carefully managing the environmental footprint of network deployment, from sourcing materials to energy consumption in new installations. For instance, in 2024, the global telecommunications industry saw a significant push towards renewable energy sources for powering base stations, with some operators aiming for 100% renewable energy by 2030.

Embracing eco-friendly construction and operational practices can bolster Freenet's reputation and ensure compliance with evolving environmental regulations. Companies are increasingly investing in green building certifications for their data centers and employing circular economy principles for equipment lifecycle management. By 2025, it's projected that investments in sustainable infrastructure within the digital sector will continue to rise, driven by both consumer demand and regulatory mandates.

- Increased demand for green network solutions: Consumers and businesses are favoring providers with demonstrable environmental commitments.

- Regulatory compliance and incentives: Governments are implementing stricter environmental standards and offering incentives for sustainable infrastructure. For example, the European Union's Green Deal aims to foster sustainable digital infrastructure.

- Energy efficiency in operations: Reducing the energy consumption of base stations and data centers is a key focus, with advancements in cooling technologies and more efficient hardware being deployed.

- Sustainable material sourcing and waste management: Freenet will need to ensure responsible sourcing of materials for new infrastructure and implement robust recycling programs for old equipment.

Climate Risk and Opportunity Analysis

Freenet has proactively assessed climate risks and opportunities, a crucial step in its 2024 reporting cycle. This analysis helps the company understand how changing weather patterns and potential regulatory shifts, like increased carbon pricing or stricter emissions standards, could affect its infrastructure and service delivery. For instance, extreme weather events can disrupt network operations, leading to service outages and repair costs.

By identifying these vulnerabilities, Freenet can develop strategies to build resilience. This might involve investing in more robust network infrastructure or diversifying energy sources for its data centers. The company's commitment to this analysis underscores its dedication to long-term sustainability and mitigating potential financial impacts stemming from environmental factors.

Key areas of focus in Freenet's climate risk and opportunity analysis include:

- Physical Risks: Assessing the impact of extreme weather events (e.g., floods, storms) on network infrastructure and operational continuity.

- Transition Risks: Evaluating potential financial impacts from policy changes, such as carbon taxes or evolving energy efficiency mandates, which could increase operating costs.

- Opportunities: Identifying potential business growth areas, such as offering green IT solutions or leveraging renewable energy to reduce operational expenses and enhance brand reputation.

Freenet operates within an industry with a significant environmental footprint, driven by energy-intensive networks and data centers. The company is actively integrating sustainability into its strategy, aiming to reduce emissions and minimize its carbon impact. This includes setting targets to align its Scope 1 and 2 emissions with the 1.5-degree Celsius warming limit by 2030.

The growing volume of electronic waste, estimated at 62 million metric tons globally in 2023, presents a challenge and an opportunity for Freenet to champion circular economy principles. The company is increasingly expected to promote responsible disposal, robust recycling, and device repair initiatives, aligning with broader European sustainability goals.

Freenet faces mounting pressure for Corporate Social Responsibility and ESG reporting, driven by regulations like the EU's CSRD, which expanded disclosure requirements in 2023. Strong ESG performance influences investor confidence and brand perception, making it a critical factor for capital access and market standing.

The expansion of digital infrastructure necessitates sustainable development practices, with a growing industry trend towards powering base stations with renewable energy. By 2025, investments in sustainable digital infrastructure are projected to rise, influenced by consumer demand and regulatory mandates.

PESTLE Analysis Data Sources

Our Freenet PESTLE analysis is meticulously constructed using data from reputable sources including government publications, international organizations, and leading industry research firms. This ensures that each factor, from political stability to technological advancements, is grounded in accurate and current information.