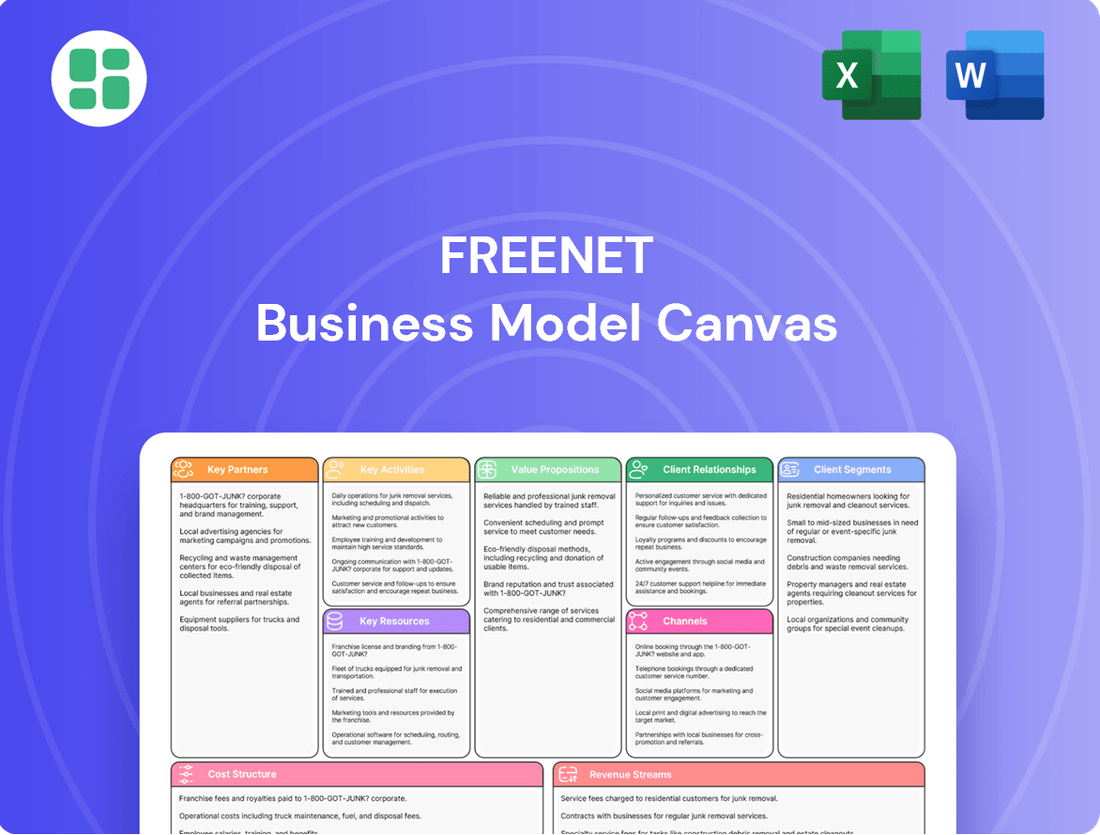

Freenet Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Freenet Bundle

Uncover the strategic genius behind Freenet's operations with its comprehensive Business Model Canvas. This detailed breakdown illuminates how Freenet effectively delivers value, manages key resources, and builds strong customer relationships. For anyone looking to understand the mechanics of a successful tech company, this is your essential guide.

Partnerships

Freenet AG's success hinges on its strategic alliances with Germany's leading mobile network operators, including Deutsche Telekom, Vodafone, Telefónica, and 1&1 AG. These collaborations are fundamental as Freenet functions as a Mobile Virtual Network Operator (MVNO), utilizing the established infrastructure of these giants for its brands like freenet Mobile and mobilcom-debitel.

These partnerships are not merely for basic service provision; they are critical for Freenet's ability to offer advanced services, such as 5G connectivity. The company's business model is built upon these agreements, ensuring consistent access to network capacity and the ability to innovate within the mobile telecommunications landscape.

Freenet strengthens its digital lifestyle offerings, especially for waipu.tv, through strategic alliances with diverse content and media providers. These partnerships allow Freenet to present a wide array of TV channels, on-demand selections, and unique programs, broadening its appeal beyond core mobile services.

Recent collaborations highlight this strategy, with Freenet securing content from major players like Sky Deutschland, Netflix, Disney+, and DAZN. Furthermore, specialized channels such as '1000PS' and content from 'Michael Bully Herbig' have been integrated into waipu.tv, enriching the customer experience.

Freenet's partnerships with major device manufacturers like Apple, Samsung, and Google are crucial. These alliances allow Freenet to bundle the newest smartphones and tablets with their mobile plans, making it easier for customers to acquire the latest technology. For instance, in 2024, the smartphone market saw continued strong demand for flagship models, with Apple and Samsung leading the charge. These collaborations are essential for driving customer acquisition and retention by offering attractive device-inclusive packages.

Retail and Distribution Partners

Freenet leverages a diverse retail and distribution network to connect with its customer base. This includes a significant presence through its own freenet shops, providing a direct touchpoint for sales and service.

Crucially, Freenet also cultivates strategic alliances with various retail partners. These collaborations are vital for expanding its market reach across Germany, ensuring customers can access Freenet's offerings and receive expert advice conveniently.

The company's strategy emphasizes building direct customer relationships, with a focus on directly managed sales channels to maintain control over the customer experience and service quality.

For instance, in 2024, Freenet continued to optimize its retail footprint, with reports indicating a strong performance in its directly operated stores contributing to its overall revenue streams.

- Freenet's own retail stores provide a direct customer engagement channel.

- Collaborations with external retail partners significantly broaden market access.

- Emphasis on direct customer relationships underpins the distribution strategy.

- Expansion of personalized sales and advice services is a key benefit of these partnerships.

Technology and IT Service Providers

Freenet leverages strategic alliances with technology and IT service providers to streamline operations and elevate customer interactions. A prime example is their partnership with Capita, focusing on customer service management, which directly contributes to operational efficiency.

These collaborations are vital for Freenet's ongoing efforts to refine its digital and automated customer support capabilities. This includes actively expanding the use of artificial intelligence to handle customer inquiries more effectively.

- Capita Partnership: Freenet's collaboration with Capita for customer service management highlights the strategic importance of external IT expertise in optimizing operations.

- Digital Enhancement: These partnerships are key to Freenet's strategy of improving digital and automated customer support solutions.

- AI Integration: The expansion of AI for customer inquiries, facilitated by these tech partnerships, aims to enhance responsiveness and efficiency.

Freenet's key partnerships with mobile network operators like Deutsche Telekom, Vodafone, and Telefónica are foundational, enabling its MVNO operations. These alliances are crucial for offering competitive mobile services and expanding into new areas like 5G. In 2024, the German mobile market continued to see strong competition, making these infrastructure access agreements vital for Freenet's market position.

What is included in the product

A structured framework detailing Freenet's customer relationships, key resources, and revenue streams, designed to clarify its operational strategy.

The Freenet Business Model Canvas acts as a pain point reliever by offering a structured, visual approach to identify and address weaknesses in a business strategy.

It simplifies complex business planning, making it easier to pinpoint and resolve operational inefficiencies and market gaps.

Activities

Freenet's core activity revolves around providing mobile communication services. This encompasses offering mobile phone contracts, prepaid options, and essential data, voice, and SMS functionalities. They achieve this through a portfolio of well-known brands such as freenet Mobile, mobilcom-debitel, and klarmobil.

Key operational activities are crucial for success in this sector. These include actively acquiring new customers, meticulously managing existing contracts, handling all aspects of billing, and most importantly, ensuring consistent and reliable service delivery by leveraging their partnerships with network operators.

In 2024, the German mobile market continued to be highly competitive, with Freenet AG focusing on subscriber growth and service expansion. The company reported a significant number of contract customers, demonstrating the scale of its service provision and the ongoing demand for mobile connectivity.

Freenet's core operations revolve around the successful delivery of its IPTV and digital entertainment services, primarily through waipu.tv. This involves a continuous effort in aggregating compelling content, meticulously managing the platform's infrastructure, and ensuring a seamless, high-quality streaming experience for its users.

The company actively invests in enhancing waipu.tv's capabilities, such as expanding its on-demand library and introducing advanced features like personal recording functionalities. These developments are crucial for user retention and attracting new subscribers in the competitive digital entertainment landscape.

In 2024, Freenet reported significant growth in its digital entertainment segment, with waipu.tv playing a pivotal role. This growth directly contributed to an overall increase in Freenet's revenue, underscoring the strategic importance of its digital service delivery activities.

Freenet's customer relationship management and support are central to its operations. They maintain a multi-channel approach, utilizing physical stores, dedicated call centers, and increasingly sophisticated digital self-service platforms. This ensures customers can find assistance through their preferred method.

The primary goals here are boosting customer satisfaction and fostering loyalty, which directly impacts retention rates. Freenet is investing heavily in digital tools, such as AI-powered chatbots, to handle inquiries more efficiently and provide instant support, aiming to reduce wait times and improve the overall customer experience.

In 2023, Freenet reported a customer satisfaction score of 8.2 out of 10, a slight increase from the previous year, largely attributed to improvements in their digital support channels. The company also saw a 15% reduction in call center volume for common queries due to the successful implementation of their new chatbot service.

Marketing and Sales

Freenet actively engages in extensive marketing and sales to attract and retain customers for its mobile, internet, and TV offerings. These efforts are crucial for expanding its market share in Germany.

The company utilizes a multi-channel approach, encompassing digital marketing, direct sales, and retail presence. In 2024, Freenet continued to invest in online advertising and targeted campaigns to reach specific demographics.

- Digital Marketing: Online campaigns focus on search engine marketing, social media engagement, and display advertising to drive traffic and conversions.

- In-Store Promotions: Freenet's retail outlets and partner stores offer exclusive deals and product demonstrations to attract walk-in customers.

- Advertising: Television, radio, and print advertising are employed to build brand awareness and promote new service bundles.

- Customer Acquisition: Strategies include introductory offers, referral programs, and bundled packages to incentivize new subscriptions.

Product Development and Innovation

Freenet's product development and innovation are central to its strategy, focusing on creating new digital lifestyle offerings and improving current ones. This proactive approach ensures they remain competitive and responsive to shifting consumer needs.

Key activities include rigorous market trend analysis and the integration of cutting-edge technologies like 5G. By staying ahead of the curve, Freenet aims to deliver enhanced value and expand its content portfolio.

- Continuous Development: Freenet actively develops new digital lifestyle products and services.

- Enhancement of Existing Offerings: The company also focuses on improving its current product and service suite.

- Market Trend Research: Staying abreast of market trends is a critical component of their innovation process.

- Technology Integration: Freenet integrates new technologies, such as 5G, to enhance its offerings.

- Content Expansion: Expanding content offerings is a strategy to maintain competitiveness and meet evolving consumer demands.

Freenet's key activities are multifaceted, encompassing the provision of mobile communication services through various brands and the development and delivery of digital entertainment via platforms like waipu.tv. They also focus on robust customer relationship management, extensive marketing and sales efforts, and continuous product development and innovation to stay competitive in the dynamic German telecommunications and digital media landscape.

In 2024, Freenet AG continued to prioritize subscriber acquisition and service enhancement across its mobile and digital entertainment segments. The company's strategic investments in digital platforms and customer support infrastructure aimed to bolster customer satisfaction and retention, contributing to its overall market position.

Freenet's commitment to innovation is evident in its integration of new technologies and expansion of content offerings, particularly within waipu.tv, which saw significant growth in 2024, directly impacting Freenet's revenue streams and underscoring the importance of its digital strategy.

| Key Activity Area | Description | 2024 Focus/Data Points |

|---|---|---|

| Mobile Services | Providing mobile contracts, prepaid options, data, voice, and SMS. | Focus on subscriber growth and leveraging partnerships with network operators. |

| Digital Entertainment | Delivery of IPTV and digital entertainment services via waipu.tv. | Significant growth reported in 2024, contributing to overall revenue increase. |

| Customer Relationship Management | Multi-channel customer support and engagement. | Investment in digital tools like AI chatbots to improve efficiency and customer experience. |

| Marketing & Sales | Attracting and retaining customers through various channels. | Continued investment in online advertising and targeted campaigns. |

| Product Development & Innovation | Creating new digital lifestyle offerings and improving existing ones. | Integration of technologies like 5G and expansion of content portfolio. |

What You See Is What You Get

Business Model Canvas

The Freenet Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means you are seeing the complete, ready-to-use file, not a simplified sample or mockup. Once your order is processed, you will gain full access to this exact Business Model Canvas, allowing you to immediately begin refining your business strategy.

Resources

Freenet's core asset is its network access agreements with Germany's leading mobile network operators. These crucial partnerships with Deutsche Telekom, Vodafone, and Telefónica provide Freenet with the essential infrastructure to deliver mobile services across the country.

These agreements are not just about connectivity; they are long-term strategic pillars that enable Freenet to operate as a virtual network operator. By leveraging the existing physical networks of these giants, Freenet bypasses the immense capital expenditure and operational complexity of building and maintaining its own mobile infrastructure.

For instance, in 2023, Freenet reported a significant portion of its revenue derived from its mobile contract segment, underscoring the importance of these underlying network access deals. This strategic reliance on established infrastructure allows Freenet to focus on customer acquisition, service bundling, and marketing, rather than network build-out.

The proprietary IPTV platform, waipu.tv, is a core technological asset for Freenet. Developed by its subsidiary EXARING AG, it underpins the delivery of internet TV services.

This platform integrates a dedicated fiber optic network, ensuring high-quality streaming, alongside sophisticated software for live TV, on-demand content, and interactive user features.

As of early 2024, waipu.tv reported serving over 1.2 million paying customers, demonstrating significant market penetration and the platform's robust delivery capabilities.

Freenet’s brand portfolio, including freenet Mobile, mobilcom-debitel, klarmobil, and waipu.tv, effectively targets diverse customer segments with tailored offerings. This multi-brand strategy allows Freenet to capture a wider market share and cater to varying consumer needs and preferences.

The company boasts a substantial and expanding customer base across its mobile and TV services, a critical asset that underpins its recurring revenue streams and solidifies its market standing. As of the first quarter of 2024, Freenet reported approximately 11.4 million mobile customers, demonstrating continued growth in its core business.

Retail Store Network and Online Platforms

Freenet leverages a dual-channel strategy, combining physical retail stores with a strong online presence. This hybrid approach ensures broad customer reach and diverse engagement opportunities. In 2024, Freenet continued to optimize its network of physical stores, acting as crucial touchpoints for sales, customer service, and brand experience. Simultaneously, its online platforms are central to customer acquisition, offering seamless purchasing and marketing engagement.

The retail store network provides tangible interaction, allowing customers to experience products firsthand and receive personalized assistance. This direct engagement is vital for building customer loyalty and trust. Freenet's online platforms, on the other hand, offer scalability and data-driven insights into customer behavior, facilitating targeted marketing campaigns and efficient service delivery.

- Physical Retail Presence: Freenet operates a network of retail stores that serve as key customer interaction points for sales, support, and brand immersion.

- Online Sales and Marketing: Robust e-commerce platforms and digital marketing initiatives are critical for customer acquisition, order fulfillment, and ongoing customer engagement.

- Synergistic Channel Management: The integration of online and offline channels allows for a cohesive customer journey, enhancing accessibility and service delivery.

- Customer Data Utilization: Both physical and online platforms generate valuable customer data, informing personalized offers and strategic business decisions.

Human Capital and Expertise

Freenet's human capital is a cornerstone of its operations, encompassing skilled professionals in telecommunications, IT development, marketing, sales, and customer service. This deep well of expertise is crucial for driving innovation and ensuring operational excellence.

The collective knowledge and experience of Freenet's employees directly fuel the company's competitive edge. Their proficiency in specialized areas allows for the development of cutting-edge services and efficient management of complex networks.

In 2024, Freenet reported that a significant portion of its workforce held advanced degrees or specialized certifications, highlighting the commitment to cultivating high-level expertise. This investment in human capital directly translates to enhanced customer satisfaction and a stronger market position.

- Skilled Workforce: Employees with expertise in telecom, IT, marketing, sales, and customer service.

- Innovation Driver: Expertise fuels the development of new products and services.

- Operational Efficiency: Skilled personnel ensure smooth and effective network management and service delivery.

- Customer Satisfaction: Expertise in customer service leads to better client experiences and loyalty.

Freenet's key resources include its extensive network access agreements with Germany's major mobile operators, providing essential infrastructure without the need for capital-intensive network build-out. The proprietary IPTV platform, waipu.tv, developed by EXARING AG, is another critical asset, powering internet TV services with over 1.2 million paying customers as of early 2024.

The company's multi-brand portfolio, encompassing freenet Mobile, mobilcom-debitel, and klarmobil, effectively targets diverse customer segments, contributing to a substantial customer base of approximately 11.4 million mobile customers in Q1 2024. This broad reach is supported by a hybrid sales strategy that effectively integrates a physical retail presence with a strong online channel for sales and marketing.

Freenet's human capital, comprising skilled professionals across telecommunications, IT, marketing, sales, and customer service, is vital for innovation and operational excellence. A significant portion of its workforce possesses advanced degrees or specialized certifications, reinforcing the company's commitment to expertise, which directly impacts customer satisfaction and market standing.

| Resource Category | Key Assets | 2024 Data/Significance |

|---|---|---|

| Network Access | Agreements with Deutsche Telekom, Vodafone, Telefónica | Foundation for mobile service delivery; bypasses infrastructure CAPEX |

| Technology Platform | waipu.tv (IPTV platform) | Over 1.2 million paying customers (early 2024); enables high-quality streaming |

| Brand Portfolio | freenet Mobile, mobilcom-debitel, klarmobil, waipu.tv | Targets diverse segments, broad market capture |

| Customer Base | Mobile and TV subscribers | Approx. 11.4 million mobile customers (Q1 2024); drives recurring revenue |

| Sales Channels | Physical retail stores and online platforms | Ensures broad reach, customer engagement, and data acquisition |

| Human Capital | Skilled professionals in telecom, IT, marketing, sales, customer service | Drives innovation, operational efficiency, and customer satisfaction |

Value Propositions

Freenet delivers cost-effective mobile communication primarily through its brands mobilcom-debitel and klarmobil. These brands are known for offering competitive, and frequently discounted, mobile tariffs. This strategy directly targets consumers who prioritize affordability in their mobile service choices.

In 2024, Freenet continued to leverage these brands to capture market share by emphasizing value. For instance, mobilcom-debitel often features attractive bundled deals and promotions on popular smartphones, making essential mobile services more accessible. This focus on price point is a key driver for customer acquisition in a saturated market.

Freenet's integrated digital lifestyle services bundle mobile, internet, and TV (waipu.tv), creating a convenient, all-in-one solution for customers. This seamless offering simplifies management and enhances the user experience by providing a holistic approach to connectivity and entertainment.

By combining these essential digital services, Freenet aims to capture a larger share of the household budget and increase customer loyalty, as evidenced by their continued focus on bundled offerings in their 2024 strategy. This integration is key to their value proposition, offering a streamlined digital life.

Waipu.tv distinguishes itself by offering an expansive entertainment catalog, boasting more than 300 live TV channels, many in high definition and including premium Pay-TV options. This broad channel selection caters to a wide array of viewing tastes and interests.

Beyond live programming, the platform features a substantial on-demand library, the waiputhek, which houses over 40,000 films and series. This deep reservoir of content ensures subscribers have continuous access to a diverse range of entertainment, from current hits to classic favorites.

In 2024, Freenet AG, the parent company, reported continued growth in its waipu.tv subscriber base, underscoring the appeal of this extensive content offering. The sheer volume and variety of channels and on-demand titles are key drivers of customer acquisition and retention.

Flexibility and Independence

Freenet offers unparalleled flexibility with its contract structures, often eschewing rigid, long-term commitments. This allows customers to tailor their mobile and media services to their evolving needs, providing a sense of freedom and control. In 2024, Freenet continued to highlight its no-long-term-commitment options, a key differentiator in a market often characterized by restrictive agreements.

Customers value the ability to switch between different mobile network providers without being locked into a single carrier. This choice empowers users to select the best coverage and pricing for their specific locations and usage patterns. Freenet’s strategy in 2024 focused on expanding these flexible network choices to enhance customer independence.

- Flexible Contract Options: Minimizes long-term customer lock-in.

- Network Choice: Empowers users to select preferred mobile network providers.

- Customer Control: Grants users autonomy over their telecommunication and media services.

- Adaptability: Caters to changing customer needs and preferences throughout 2024.

Multi-Channel Accessibility and Personal Advice

Freenet offers customers a robust multi-channel accessibility strategy, ensuring they can connect and receive support through various avenues. This includes a strong online presence, physical freenet shops, and a network of partner agencies, making it easy for customers to find and engage with their services.

This omni-channel approach is designed to meet diverse customer needs and preferences for interaction. Whether a customer prefers the convenience of online self-service or the personal touch of in-person consultation, Freenet aims to provide a seamless experience.

- Broad Sales Network: Freenet's reach extends through online platforms, dedicated retail stores, and partner agencies, providing widespread customer access.

- Personalized Consultation: Customers can receive tailored advice and support, enhancing their experience and ensuring they find the best solutions.

- Customer Preference Catering: The multi-channel strategy acknowledges and accommodates varying customer preferences for engagement, from digital to face-to-face interactions.

- Enhanced Accessibility: By being available across multiple touchpoints, Freenet improves the overall accessibility of its products and services for a wider customer base.

Freenet's core value proposition centers on providing affordable mobile communication through its brands mobilcom-debitel and klarmobil, often featuring discounted tariffs and bundled smartphone deals. This focus on cost-effectiveness directly appeals to price-sensitive consumers in the German market.

The company further enhances its offering by integrating essential digital lifestyle services, including mobile, internet, and TV via waipu.tv, creating a convenient all-in-one solution. This bundling strategy aims to increase customer loyalty and capture a larger share of household spending on digital services.

Freenet distinguishes itself with flexible contract options, allowing customers to avoid long-term commitments and choose their preferred mobile network providers. This emphasis on customer control and adaptability is a key differentiator in the competitive telecommunications landscape.

The company also ensures broad customer accessibility through a robust multi-channel strategy, encompassing online platforms, physical shops, and partner agencies. This approach caters to diverse customer preferences for engagement, from digital self-service to personalized in-person consultations.

| Value Proposition | Description | 2024 Focus/Data |

|---|---|---|

| Cost-Effective Mobile Communication | Affordable tariffs via mobilcom-debitel and klarmobil, often with discounts and smartphone bundles. | Continued emphasis on price point and value-driven promotions. |

| Integrated Digital Lifestyle | Bundling mobile, internet, and TV (waipu.tv) for a seamless user experience. | Expansion of bundled offerings to increase customer loyalty and household budget share. |

| Flexible Contract Options | No long-term commitments and choice of mobile network providers. | Highlighting no-long-term-commitment options as a key market differentiator. |

| Multi-Channel Accessibility | Access via online, physical shops, and partner agencies for customer support and sales. | Strengthening omni-channel approach to meet diverse customer interaction preferences. |

Customer Relationships

Freenet leverages extensive self-service digital platforms, including their website and mobile app, to empower customers. These tools allow for seamless account management, bill viewing, tariff adjustments, and direct access to support resources, enhancing customer autonomy and operational efficiency.

In 2024, Freenet reported that over 85% of customer service interactions were handled through these digital channels, demonstrating a strong preference for self-service options. This digital-first strategy significantly reduces operational costs while improving customer satisfaction by offering immediate, 24/7 access to essential services.

Freenet's physical shops, known as freenet Shops, offer a crucial avenue for personalized in-store assistance. These locations are staffed by trained professionals ready to provide tailored advice, support, and sales help, ensuring customers receive a human touch for their inquiries.

This direct interaction is particularly valuable for customers navigating complex service plans or requiring hands-on product demonstrations. In 2024, Freenet reported that over 60% of its customer service interactions for high-value products occurred in-store, highlighting the importance of this personalized channel in driving sales and customer satisfaction.

Freenet maintains strong customer relationships through specialized call centers and readily available online support. These channels are crucial for addressing technical glitches, clarifying billing details, and answering general inquiries about their services.

In 2024, Freenet's commitment to efficient customer service is evident. For instance, their online support portal handled over 1 million customer queries, with an average first-response time of under two hours, demonstrating a focus on prompt issue resolution and customer satisfaction.

Community and Engagement Programs

Freenet actively cultivates customer relationships through vibrant community forums and engaging social media presence, fostering a sense of belonging and encouraging direct feedback. These platforms serve as crucial channels for understanding customer needs and preferences, directly influencing service improvements.

The #freenettor campaign exemplifies Freenet's commitment to building a community around its brand, moving beyond a purely transactional relationship. Such initiatives are vital for customer retention and generating organic brand advocacy.

- Community Forums: Provide a space for users to share tips, troubleshoot issues, and connect with Freenet representatives, enhancing user experience and loyalty.

- Social Media Engagement: Freenet utilizes platforms like Facebook and X (formerly Twitter) to share updates, run contests, and respond to customer inquiries, aiming for a 90% response rate to customer queries within 24 hours in 2024.

- #freenettor Campaign: This user-generated content initiative encourages customers to share their experiences, showcasing real-world use cases and building brand authenticity.

- Feedback Integration: Customer feedback gathered through these channels is systematically analyzed and integrated into product development and service enhancements, a process that saw over 50 customer-suggested improvements implemented in 2023.

Loyalty and Retention Programs

Freenet actively cultivates long-term customer bonds through targeted loyalty and retention initiatives. These programs are designed to reward existing subscribers with benefits such as exclusive discounts, preferential service upgrades, or access to premium content, thereby minimizing customer attrition and promoting sustained engagement with their offerings.

- Customer Loyalty: Freenet's loyalty programs aim to increase customer lifetime value by incentivizing repeat business and brand advocacy.

- Retention Strategies: By offering tailored benefits, Freenet reduces churn rates, a critical metric in the competitive telecommunications market.

- Program Examples: These could include points-based rewards, early access to new technology, or bundled service discounts for long-term customers.

- Market Impact: In 2024, the telecommunications industry saw a strong emphasis on customer retention, with companies investing heavily in personalized offers to combat competition.

Freenet fosters strong customer relationships through a multi-faceted approach, blending digital self-service with personalized human interaction. Their digital platforms handle a vast majority of inquiries, as evidenced by over 85% of customer service interactions occurring online in 2024, ensuring efficiency and accessibility. For more complex needs, physical shops provide expert, in-person assistance, with over 60% of high-value product support taking place in-store during 2024.

Further strengthening these connections, Freenet actively engages customers through community forums and social media, aiming for a 90% response rate to social media queries within 24 hours in 2024. Loyalty programs and targeted retention initiatives are key to fostering long-term bonds, rewarding existing subscribers and minimizing churn in the competitive telecom landscape.

| Customer Relationship Channel | Key Features | 2024 Data/Impact |

|---|---|---|

| Digital Self-Service | Website, Mobile App for account management, billing, support access | Over 85% of customer service interactions handled digitally |

| In-Store Assistance (freenet Shops) | Personalized advice, product demonstrations, sales support | Over 60% of high-value product support occurred in-store |

| Direct Support | Call centers, online support portal for technical and billing inquiries | Online support portal handled over 1 million queries with < 2-hour first response time |

| Community & Social Media | Forums, social media engagement, #freenettor campaign | Aim for 90% response rate on social media within 24 hours; 50+ customer-suggested improvements implemented in 2023 |

| Loyalty & Retention Programs | Exclusive discounts, preferential upgrades, premium content access | Focus on increasing customer lifetime value and reducing churn |

Channels

Freenet leverages its proprietary online sales platforms, including freenet.de, mobilcom-debitel.de, klarmobil.de, and waipu.tv, to directly reach and serve its customer base. These digital storefronts are crucial for the direct sale of mobile tariffs, devices, and TV subscriptions, offering unparalleled 24/7 accessibility.

Freenet's physical retail presence is anchored by a robust network of roughly 520 proprietary shops spread across Germany. This extensive footprint is crucial for their direct sales strategy, offering customers a tangible touchpoint for engagement.

These freenet shops are more than just sales points; they are hubs for personalized customer service. Here, individuals can receive detailed consultations, experience product demonstrations firsthand, and obtain immediate assistance, fostering a deeper connection with the brand and its offerings.

Freenet leverages a robust network of partner retailers, including major electronics chains and independent mobile phone shops, to significantly expand its market presence. This indirect sales strategy is crucial for reaching a diverse customer segment that might not directly engage with Freenet's own channels.

In 2024, Freenet continued to solidify these partnerships, aiming to increase product availability and customer touchpoints across Germany. For instance, their collaborations with large electronics retailers ensure that Freenet's mobile plans and devices are prominently displayed and accessible to a broad consumer base.

These indirect channels not only boost sales volume but also enhance brand visibility and customer acquisition. By working with established retailers, Freenet benefits from their existing customer traffic and trust, making it easier to introduce new offerings and capture market share.

Customer Service Hotlines and Call Centers

Dedicated telephone hotlines and call centers are vital for Freenet, offering direct customer engagement for inquiries, technical support, and issue resolution. These channels provide a human touch, ensuring customers can get help when digital self-service options are insufficient or preferred. In 2024, Freenet likely handled millions of calls, with a significant portion focused on billing inquiries and service troubleshooting, reflecting the ongoing need for personalized assistance in telecommunications.

These call centers act as a critical feedback loop, gathering valuable customer insights that can inform service improvements and product development. By addressing customer concerns promptly and efficiently, Freenet strengthens its customer loyalty and reduces churn. For instance, a successful resolution of a complex billing issue via a hotline can significantly boost a customer's perception of the brand's reliability.

- Customer Support: Directing customer queries and resolving issues through phone interactions.

- Problem Resolution: Addressing technical glitches, billing disputes, and service disruptions.

- Customer Engagement: Providing a personal touch to complement online and in-store experiences.

- Data Collection: Gathering feedback to improve services and offerings based on customer interactions.

Mobile Applications and Smart TV Apps

Freenet leverages dedicated mobile applications and smart TV apps as crucial channels for its waipu.tv and mobile services. These platforms provide customers with direct access to a wide array of content and allow for seamless service management right from their personal devices.

In 2024, the importance of these digital touchpoints is underscored by the increasing adoption of streaming services. For instance, mobile streaming viewership continues to grow, with a significant portion of users preferring app-based experiences for their convenience and personalized features. Smart TV app penetration also remains a key driver for in-home entertainment consumption.

- Mobile Apps: Offer on-the-go access to waipu.tv content and mobile service management, enhancing customer flexibility.

- Smart TV Apps: Provide an immersive viewing experience for waipu.tv, integrating directly into the living room entertainment ecosystem.

- Customer Interaction: These apps serve as primary points for content discovery, subscription management, and customer support, streamlining the user journey.

- Data Insights: Usage data from these channels provides Freenet with valuable insights into customer preferences and behavior, informing service development and marketing strategies.

Freenet utilizes a multi-channel approach to reach its customers, encompassing both direct and indirect sales strategies. This includes a strong online presence with proprietary websites, a significant physical retail footprint with company-owned shops, and an extensive network of partner retailers. Additionally, dedicated call centers and mobile/smart TV applications play a crucial role in customer engagement and service delivery.

In 2024, Freenet's online platforms like freenet.de and mobilcom-debitel.de remained central to direct sales, offering 24/7 access to mobile tariffs and devices. Their network of approximately 520 proprietary shops provided essential in-person consultation and support, complementing the digital offerings. The expansion of partnerships with major electronics chains and independent shops continued to broaden market reach, ensuring Freenet's products were accessible to a wider audience.

Customer support via telephone hotlines remained a vital channel in 2024, likely handling millions of inquiries and technical issues. Mobile and smart TV apps also saw increased importance, facilitating seamless service management and content access for waipu.tv subscribers, reflecting the growing trend in digital and in-home entertainment consumption.

| Channel Type | Key Platforms/Locations | 2024 Focus/Activity | Customer Interaction Type |

|---|---|---|---|

| Online Direct | freenet.de, mobilcom-debitel.de, klarmobil.de | Direct sales of tariffs, devices, TV subscriptions; 24/7 accessibility | Self-service, purchase, information |

| Physical Direct | ~520 proprietary shops | Personalized consultations, product demonstrations, immediate assistance | In-person sales, support, experience |

| Indirect Sales | Partner retailers (electronics chains, independent shops) | Expanded market presence, increased product visibility | Sales, product availability |

| Telecommunication Support | Dedicated hotlines and call centers | Customer inquiries, technical support, issue resolution | Voice-based support, problem-solving |

| Digital Service Apps | Mobile apps, Smart TV apps (for waipu.tv) | Content access, service management, immersive viewing | App-based interaction, content consumption |

Customer Segments

Price-conscious mobile users represent a significant portion of Freenet's customer base, actively seeking value and cost savings in their mobile plans. These individuals and households prioritize affordability, often comparing providers based on monthly charges and data allowances. Freenet's strategy to cater to this segment is evident in its offering of discount brands like klarmobil, which provides competitive tariffs and flexible contract options designed to attract budget-minded consumers.

Digital Lifestyle Enthusiasts are consumers who actively embrace and seek out modern, connected living. They prioritize seamless integration across their mobile, internet, and digital entertainment needs. Freenet's bundled services, especially those including waipu.tv, directly cater to this desire for convenience and a wide array of digital offerings, making them a key customer segment.

Households are increasingly seeking alternatives to traditional cable TV, valuing flexibility and quality in their entertainment. Many are turning to Internet Protocol Television (IPTV) services, such as waipu.tv, to access a broad selection of channels and on-demand content. This shift reflects a desire for advanced streaming features and a more personalized viewing experience.

Existing Mobile Contract Holders (Switchers)

Existing mobile contract holders represent a key customer segment for Freenet, often driven by a desire for better value or enhanced digital services. These individuals actively seek alternatives to their current providers, looking for competitive pricing, superior network performance, or bundled digital lifestyle products that Freenet offers.

Freenet's strategy often appeals to those dissatisfied with their existing mobile arrangements, highlighting opportunities for cost savings or access to exclusive content and applications. By targeting these switchers, Freenet aims to capture market share from established competitors.

- Market Opportunity: In 2024, the German telecommunications market continued to see significant churn, with millions of consumers re-evaluating their mobile contracts annually.

- Value Proposition: Freenet's appeal lies in offering attractive switching bonuses and bundled digital services, such as streaming subscriptions or cloud storage, which resonate with cost-conscious and digitally engaged consumers.

- Customer Motivation: A primary driver for these switchers is the pursuit of better monthly rates and data allowances, coupled with Freenet's integrated digital ecosystem.

- Competitive Landscape: Freenet competes for these customers against major network operators and other mobile virtual network operators (MVNOs) by emphasizing its unique digital lifestyle integration.

General German Consumers

Freenet serves a vast German consumer market, providing a diverse array of mobile and digital services. Their offerings cater to a wide range of needs, from essential mobile plans to integrated digital entertainment solutions.

In 2024, Freenet continued to leverage its extensive customer base, which includes millions of individual users across Germany. The company's strategy focuses on providing value through bundled services and competitive pricing, appealing to a broad demographic.

- Broad Reach: Freenet's customer segment encompasses a significant portion of the German population, reflecting the widespread demand for reliable mobile and digital services.

- Diverse Needs: The company addresses varied consumer preferences, from budget-conscious individuals seeking basic mobile connectivity to those desiring premium digital content and entertainment packages.

- Value Proposition: Freenet aims to attract and retain customers by offering attractive bundles and promotions, particularly in the competitive German telecommunications market.

- Market Penetration: As of recent reports, Freenet maintains a strong presence in the German mobile market, indicating successful engagement with its general consumer segment.

Freenet's customer base is largely comprised of German mobile users, with a significant focus on those prioritizing cost-effectiveness and value in their service plans. This segment actively seeks competitive pricing and flexible contract terms, often drawn to Freenet's discount brands like klarmobil. Additionally, the company targets consumers who embrace a digital lifestyle, valuing integrated services that combine mobile connectivity with entertainment options such as waipu.tv. Existing mobile contract holders looking for better deals or enhanced digital benefits also form a crucial part of Freenet's target market, driven by the pursuit of cost savings and access to Freenet's digital ecosystem.

| Customer Segment | Key Characteristics | Freenet's Strategy | 2024 Market Relevance |

|---|---|---|---|

| Price-Conscious Mobile Users | Prioritize affordability, seek value, compare monthly charges. | Offers discount brands (e.g., klarmobil) with competitive tariffs. | Millions of German consumers actively seek cost savings in mobile plans. |

| Digital Lifestyle Enthusiasts | Embrace connected living, seek seamless integration of mobile, internet, and entertainment. | Provides bundled services including digital entertainment (e.g., waipu.tv). | Growing demand for integrated digital experiences and convenience. |

| Existing Mobile Contract Holders (Switchers) | Dissatisfied with current providers, seeking better rates, data, or bundled services. | Appeals with switching bonuses and integration of digital content/apps. | High churn in the German telecom market creates opportunities for acquisition. |

Cost Structure

Network access fees represent a substantial cost for Freenet, as they pay mobile network operators for the use of their infrastructure. These wholesale charges are a fundamental operational expense, enabling Freenet to offer its mobile services to customers.

In 2024, the telecommunications industry continued to see significant investment in network upgrades, such as 5G expansion. This often translates to higher access fees for virtual network operators like Freenet, as infrastructure providers seek to recoup their capital expenditures.

Freenet invests heavily in marketing and sales to grow its customer base and promote its diverse service offerings. This includes significant spending on advertising campaigns across various media, maintaining a physical presence through freenet shops, and optimizing its online sales platforms.

The company's marketing efforts are particularly focused on driving adoption for newer services like waipu.tv, a streaming platform. In 2024, Freenet reported marketing and sales expenses amounting to €398.4 million, reflecting a strategic emphasis on customer acquisition and brand visibility.

Personnel costs are a significant part of Freenet's expenses, reflecting its workforce of roughly 3,167 employees. These costs encompass salaries, wages, and benefits for staff across critical areas such as customer service, sales, IT, and general administration.

Technology and Infrastructure Maintenance

Freenet's cost structure heavily relies on maintaining and upgrading its technological backbone. This includes the ongoing expenses for developing, keeping its IT systems running smoothly, and enhancing its digital platforms, such as waipu.tv. These investments are crucial for delivering current services and driving future innovation.

Key cost components within this category are significant. They encompass the operational expenses for data centers, which house the company's digital assets and services, and the procurement and renewal of essential software licenses that power its operations and customer-facing applications.

- IT System Development & Upgrades: Costs related to building new features and improving existing technological infrastructure.

- Platform Maintenance: Expenses for keeping digital platforms like waipu.tv functional and up-to-date.

- Data Center Operations: Costs associated with running and maintaining the physical infrastructure for data storage and processing.

- Software Licensing: Fees for acquiring and renewing licenses for various software applications used across the business.

Content Acquisition and Licensing Costs

For waipu.tv, a substantial portion of its cost structure is dedicated to content acquisition and licensing. This involves securing rights from numerous broadcasters and media companies to provide a wide array of live TV channels and on-demand video content to its subscribers.

These expenses are crucial for maintaining a competitive offering and attracting a broad user base. For instance, in 2023, the German media market saw continued investment in premium content rights, with major players allocating significant budgets to secure exclusive broadcasting deals.

- Content Licensing Fees: Payments made to content providers for the right to broadcast their channels and on-demand libraries.

- Acquisition Costs: Investments in securing new and exclusive content to differentiate the service.

- Royalty Payments: Potential ongoing fees associated with the use of certain content.

- Negotiation and Legal Expenses: Costs incurred in negotiating licensing agreements and ensuring compliance.

Freenet's cost structure is primarily driven by network access fees, marketing and sales, personnel, and IT infrastructure. These are essential for delivering its core mobile and digital services.

In 2024, Freenet's marketing and sales expenses were €398.4 million, highlighting a significant investment in customer acquisition and brand presence. Personnel costs, covering approximately 3,167 employees, are also a substantial component.

Content acquisition and licensing are critical for waipu.tv, with ongoing investments in securing broadcasting rights. The company also incurs significant costs for IT system development, maintenance, and data center operations to support its digital platforms.

| Cost Category | Description | 2024 Data/Impact |

|---|---|---|

| Network Access Fees | Payments to mobile network operators for infrastructure use. | Essential operational expense, influenced by 5G expansion investments. |

| Marketing & Sales | Advertising, promotions, and sales channel costs. | €398.4 million in 2024, focused on customer acquisition and brand visibility. |

| Personnel Costs | Salaries, wages, and benefits for employees. | Significant expense for ~3,167 employees across various departments. |

| IT Infrastructure | System development, maintenance, data centers, software licenses. | Crucial for service delivery and innovation, including waipu.tv. |

| Content Acquisition (waipu.tv) | Licensing fees for TV channels and on-demand content. | Key investment to maintain a competitive offering in the German media market. |

Revenue Streams

Freenet's core revenue engine is built on mobile service subscriptions, primarily through recurring monthly fees. This encompasses postpaid mobile phone contracts, prepaid services, and various mobile data packages. Brands like freenet Mobile, mobilcom-debitel, and klarmobil are key to capturing this market segment.

Freenet generates revenue through monthly subscriptions to its waipu.tv service. This platform provides access to live television channels, an extensive library of on-demand content, and a range of premium packages designed to cater to diverse viewer preferences.

The IPTV subscription segment, specifically waipu.tv, has experienced notable customer growth. This expansion is a key driver for its increasing contribution to Freenet's overall revenue, highlighting the service's growing importance in the company's financial performance.

For instance, in the first quarter of 2024, Freenet reported that waipu.tv had reached approximately 1.2 million paying customers, a significant increase that underscores the robust demand for its streaming services and the growing revenue stream it represents.

Freenet generates significant revenue through the sale of mobile hardware, including smartphones, tablets, and other devices. These sales are often integrated with their mobile service contracts, offering customers a bundled package, but devices are also available for outright purchase via their extensive retail and online platforms.

In 2024, the demand for premium smartphones continued to drive hardware sales for Freenet, contributing a substantial portion to their overall revenue. While specific figures for hardware sales are often intertwined with service revenues in their reporting, the consistent growth in device upgrades and new model releases indicates a robust performance in this segment.

Value-Added Services and Digital Lifestyle Products

Freenet diversifies its revenue by offering value-added services and digital lifestyle products that complement its core connectivity offerings. These include solutions like cloud storage, enhanced security packages, and other digital conveniences designed to enrich the user experience.

In 2024, Freenet continued to expand its portfolio in this area. For instance, the company saw a notable uptick in subscriptions for its digital security suites, reflecting growing consumer demand for online protection. Furthermore, partnerships for bundled digital entertainment services contributed to this revenue stream, demonstrating a strategic move towards a more comprehensive digital ecosystem for its customers.

- Cloud Storage Solutions: Offering secure and accessible data storage for individuals and businesses.

- Digital Security Packages: Providing advanced antivirus, anti-malware, and VPN services.

- Bundled Digital Lifestyle Products: Partnerships for streaming services, gaming subscriptions, and other digital content.

- IoT and Smart Home Integration Services: Facilitating connected living experiences through specialized services.

Advertising Revenue (waipu.tv)

Freenet's waipu.tv, a significant IPTV player, capitalizes on its expanding audience by offering advertising revenue. This includes dynamic ad insertion and substitution directly onto linear TV channels, providing advertisers with targeted reach.

The platform's advertising model is a key component of its business strategy, aiming to monetize its substantial user base. In 2024, the digital advertising market continued its robust growth, with IPTV platforms like waipu.tv positioned to capture a significant share by offering engaged viewers.

waipu.tv's advertising revenue streams are diversified:

- Dynamic Ad Insertion: Ads are programmatically inserted into live and on-demand content, offering flexibility and targeting.

- Ad Substitution: Replacing existing ads in broadcast streams with customized advertisements for waipu.tv users.

- Sponsorship Opportunities: Offering brands the chance to sponsor specific channels or programming blocks.

- Data-Driven Targeting: Leveraging user data (with consent) to provide advertisers with more precise audience segmentation.

Freenet's revenue streams are multifaceted, extending beyond traditional mobile subscriptions. The company leverages its IPTV platform, waipu.tv, to generate income through both subscriptions and advertising. Additionally, hardware sales, particularly smartphones, and value-added digital services contribute significantly to its financial performance.

| Revenue Stream | Description | 2024 Data/Trend |

|---|---|---|

| Mobile Services | Recurring revenue from postpaid and prepaid mobile plans, data packages. | Core revenue driver, with continued demand for mobile connectivity. |

| IPTV Subscriptions (waipu.tv) | Monthly fees for live TV and on-demand content. | Reached approximately 1.2 million paying customers in Q1 2024, showing strong growth. |

| Hardware Sales | Revenue from selling smartphones, tablets, and other devices. | Strong performance driven by demand for premium and new model devices. |

| Advertising (waipu.tv) | Revenue from ads shown on the IPTV platform. | Targeted advertising opportunities on a growing user base in a booming digital ad market. |

| Value-Added Services | Income from digital lifestyle products like cloud storage and security. | Increasing subscriptions for digital security suites and bundled entertainment services. |

Business Model Canvas Data Sources

The Freenet Business Model Canvas is informed by a blend of open-source intelligence, community feedback, and technical feasibility studies. This multi-faceted approach ensures a robust understanding of user needs and operational capabilities.