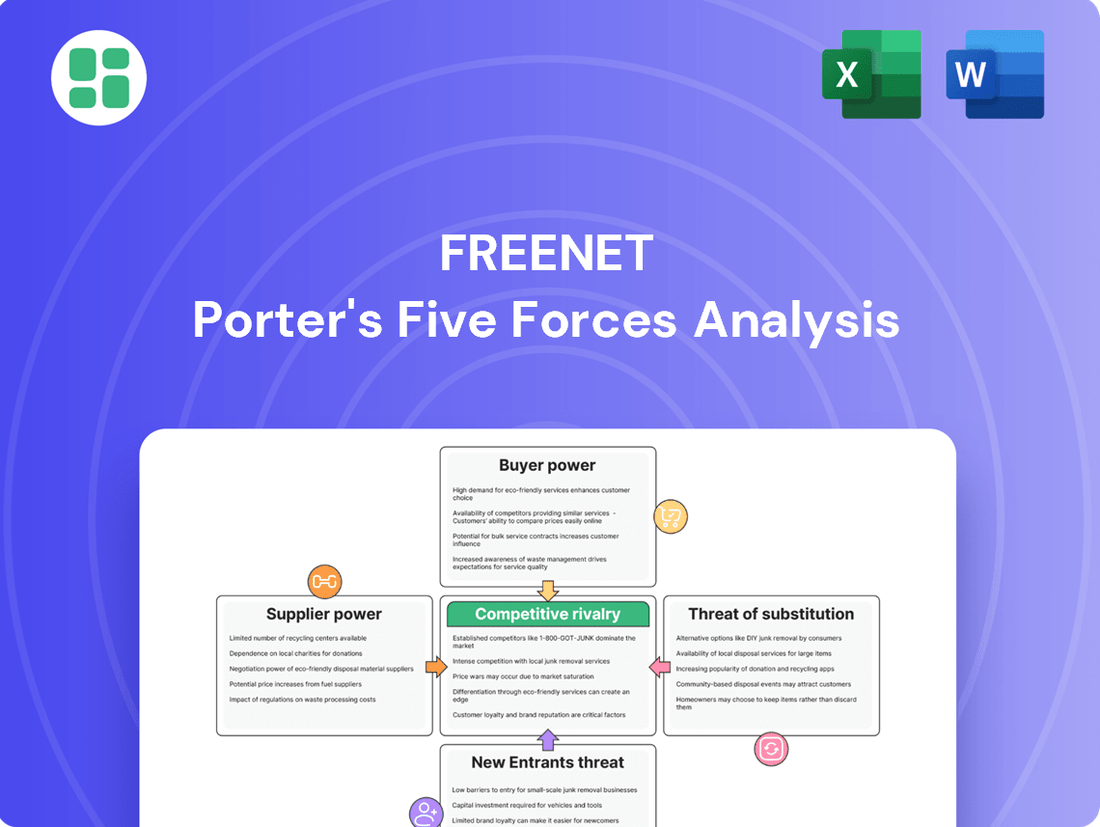

Freenet Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Freenet Bundle

Freenet navigates a competitive landscape shaped by the bargaining power of its buyers and the intensity of rivalry within the telecommunications sector. Understanding these forces is crucial for strategic planning.

The full report reveals the real forces shaping Freenet’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Freenet AG, operating as a Mobile Virtual Network Operator (MVNO), faces substantial supplier bargaining power due to its reliance on major German network infrastructure providers. Companies like Deutsche Telekom, Vodafone, and Telefónica Germany are essential for Freenet's core mobile and fixed-line services.

These dominant players, controlling the vital network inputs, possess significant leverage over Freenet. Their ongoing, substantial investments in advanced technologies such as 5G and fiber-optic networks only serve to strengthen their critical supplier status, limiting Freenet's alternatives.

Freenet has strategically entered into multi-year contracts with network operators, a move that shores up its operational stability and offers a clearer picture for long-term planning. These agreements, while providing a degree of certainty, are still shaped by the significant leverage wielded by the underlying network owners.

The German regulatory environment, specifically the oversight by the Bundesnetzagentur, plays a crucial role. By aiming to ensure equitable wholesale access terms, the regulator provides a protective buffer for Mobile Virtual Network Operators (MVNOs) like Freenet, somewhat leveling the playing field against dominant network infrastructure providers.

Freenet's waipu.tv relies heavily on content providers, and their bargaining power is significant, particularly for exclusive or highly sought-after programming. This access is vital for waipu.tv to attract and keep subscribers in the crowded streaming landscape. For instance, in 2024, the ongoing demand for live sports and premium series means content providers can command higher licensing fees, directly impacting waipu.tv's cost structure and profitability.

Limited Number of Key Suppliers

The telecommunications sector, especially for essential network infrastructure, is dominated by a small group of key suppliers. This oligopolistic environment means Freenet has limited options for sourcing its core services, giving these suppliers significant bargaining power. For instance, in 2024, the global market for 5G network equipment saw major players like Ericsson, Nokia, and Huawei holding substantial market share, often exceeding 70% combined in many regions. This concentration directly impacts Freenet's ability to negotiate favorable terms.

This limited supplier base presents a persistent challenge for Freenet. When few companies control the supply of critical components or services, they can dictate terms, potentially leading to higher costs and reduced flexibility for Freenet. This situation requires Freenet to carefully manage its relationships with these dominant providers to mitigate potential risks.

- Concentrated Market: The telecommunications infrastructure market is characterized by a few dominant suppliers of core network services.

- Reduced Alternatives: Freenet faces a limited number of viable alternatives for its primary supply needs.

- Supplier Leverage: The oligopolistic nature of the supplier market grants significant bargaining power to these essential partners.

- Ongoing Challenge: This supplier concentration represents a continuous hurdle for Freenet in managing costs and securing favorable supply agreements.

Technological Dependencies

Freenet's reliance on technology and software providers for critical functions like network management, billing, and digital platforms significantly impacts supplier bargaining power. Even with a larger number of vendors compared to infrastructure partners, those offering specialized or proprietary technologies can exert considerable influence.

The necessity for smooth integration and continuous technical support creates substantial switching costs for Freenet. This dependency increases the leverage of these technology suppliers, as changing providers can be disruptive and expensive.

- High Switching Costs: Freenet faces significant costs and operational disruption when switching technology vendors, particularly for core systems like billing and network management.

- Proprietary Technology: Suppliers offering unique or patented software solutions often hold greater power due to the limited availability of alternatives.

- Vendor Lock-in: Deep integration of a vendor's technology can lead to a form of lock-in, reducing Freenet's flexibility and increasing supplier leverage.

- Support Dependency: Ongoing technical support and maintenance agreements are crucial for network stability, giving suppliers ongoing bargaining power.

The bargaining power of suppliers for Freenet AG is notably high, primarily stemming from its dependence on a limited number of network infrastructure providers in Germany. These key suppliers, including Deutsche Telekom, Vodafone, and Telefónica Germany, control essential network access, granting them significant leverage. Their substantial investments in advanced technologies like 5G in 2024 further solidify their critical position and limit Freenet's alternatives.

Freenet's reliance on content providers for its waipu.tv service also presents a strong supplier bargaining power. The demand for exclusive content, especially live sports and premium series in 2024, allows content providers to negotiate higher licensing fees, directly impacting Freenet's cost structure.

Furthermore, technology and software providers for critical functions like network management and billing can exert considerable influence due to high switching costs and potential vendor lock-in. This dependency means suppliers offering specialized or proprietary technologies hold significant leverage.

| Factor | Impact on Freenet | Key Suppliers/Examples | 2024 Context |

| Network Infrastructure Access | High dependence, limited alternatives | Deutsche Telekom, Vodafone, Telefónica Germany | Continued 5G rollout and investment |

| Content Licensing | Essential for waipu.tv subscriber acquisition | Major broadcasters, sports rights holders | Increased demand for premium content |

| Specialized Software/Technology | High switching costs, potential vendor lock-in | Network management software providers, billing system vendors | Ongoing need for advanced digital platform integration |

What is included in the product

This analysis meticulously examines the five forces impacting Freenet's competitive environment, offering strategic insights into its market position and potential vulnerabilities.

Effortlessly identify and mitigate competitive threats with a visually intuitive breakdown of each force, making strategic planning a breeze.

Customers Bargaining Power

In Germany's telecom sector, especially for mobile services, customers are very sensitive to price. This means they'll readily switch providers if they find a cheaper option. For instance, in 2023, the average monthly revenue per user (ARPU) for German mobile subscribers hovered around €10-€12, a figure that can fluctuate significantly based on promotional offers, highlighting this price sensitivity.

The ease with which customers can switch is a major factor. With mobile number portability widely available, moving from one network to another is straightforward, with minimal hassle. This lack of significant barriers to switching directly amplifies the bargaining power customers wield, as providers must constantly compete on price and service to retain their subscriber base.

Freenet operates in a market flooded with diverse tariff models and offers, spanning nearly all price points. This abundance of choice directly fuels the bargaining power of customers, as they can readily compare and select the most advantageous deals. For instance, in 2024, the German mobile market continued to see aggressive pricing strategies from major players, with new customer acquisition offers frequently featuring significant discounts or bundled services, giving consumers considerable leverage.

The rise of online comparison platforms has dramatically shifted power towards customers. For Freenet, this means consumers can effortlessly compare mobile and TV service plans, pricing, and features from various providers. This easy access to information, a trend amplified in 2024, significantly boosts transparency in the market.

With readily available data on competitors, customers are better equipped to negotiate or switch to more favorable offerings. Freenet, like many in the telecommunications sector, faces increased pressure to maintain competitive pricing and service quality due to this heightened customer awareness and the ease with which they can switch providers.

Growing Demand for Bundled Services

Customers are increasingly looking for bundled services, combining mobile, internet, and TV. This trend pushes companies like Freenet to create all-encompassing digital lifestyle packages to meet this demand.

While bundling can strengthen customer loyalty, it also gives customers more leverage. They can use their desire for multiple services to negotiate better overall deals with providers.

- Bundled Service Demand: Customers prefer integrated packages for mobile, internet, and TV.

- Negotiating Power: Bundling allows customers to bargain for improved terms across multiple services.

- Convergent Customer Base: The increasing number of customers utilizing multiple services amplifies this bargaining power.

Impact of Digital Transformation and Data Consumption

The increasing digitalization and the insatiable demand for high-speed internet and mobile data significantly boost customer bargaining power. Customers now expect seamless connectivity and efficient services, making reliability a key factor in their choices. For instance, in 2024, global mobile data traffic continued its upward trajectory, with projections indicating a substantial increase driven by video streaming and connected devices.

Freenet faces pressure to continuously enhance its service quality and introduce innovative solutions to keep pace with these evolving customer expectations. The widespread adoption of mobile video applications and the proliferation of connected devices are particularly influential, shaping consumer demands for robust and high-performance data services.

- Digitalization drives demand: Increased reliance on digital services necessitates reliable internet.

- Customer expectations rise: Consumers demand high-speed, efficient, and innovative data offerings.

- Video and connected devices are key: These trends amplify the need for superior data capabilities.

- Investment is crucial: Freenet must invest in infrastructure and services to meet these demands.

Customers in Germany's telecom market possess significant bargaining power, primarily driven by price sensitivity and the ease of switching providers. The availability of numerous tariff options and the transparency facilitated by online comparison platforms empower consumers to demand competitive pricing and superior service. This dynamic forces companies like Freenet to continuously innovate and offer attractive deals to retain their customer base.

| Factor | Impact on Freenet | 2024 Market Trend |

|---|---|---|

| Price Sensitivity | High pressure on ARPU | Continued aggressive pricing by competitors |

| Ease of Switching | Low customer retention barriers | Number portability remains a key factor |

| Information Transparency | Increased customer awareness | Growth of comparison websites |

| Bundled Services Demand | Opportunity for value-added packages | Customers leverage bundling for better deals |

Full Version Awaits

Freenet Porter's Five Forces Analysis

This preview shows the exact Freenet Porter's Five Forces Analysis you'll receive immediately after purchase—no surprises, no placeholders. It provides a comprehensive breakdown of the competitive landscape, including the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitute products, and the intensity of rivalry among existing competitors. This professionally formatted document is ready for your immediate use and strategic decision-making.

Rivalry Among Competitors

The German telecommunications market is a prime example of a mature and saturated landscape, especially within the mobile sector. This intense saturation means Freenet primarily competes by attracting customers away from rivals, rather than tapping into new growth areas. In 2023, Germany's mobile penetration rate stood at an impressive 129%, indicating more SIM cards than people, underscoring the highly competitive nature of the market.

The German telecommunications market is characterized by intense competition, primarily driven by the presence of major incumbents like Deutsche Telekom, Vodafone, and Telefónica Germany. These established players command significant market share and benefit from substantial investments in extensive network infrastructure, giving them a considerable advantage.

Freenet, operating as the largest network-independent supplier, directly confronts these telecommunication giants. This positioning means Freenet must navigate a competitive landscape where scale, brand loyalty, and existing infrastructure are key differentiators, presenting a substantial challenge for market growth and customer acquisition.

Competitive rivalry within the telecommunications sector, impacting companies like Freenet, is intense, driven by aggressive pricing and bundled service offerings. Freenet and its competitors frequently adjust tariffs and package deals to capture market share in a highly price-sensitive environment.

This dynamic leads to continuous innovation in service packages and promotional activities as companies strive to attract and retain customers. For instance, in 2024, many providers continued to offer attractive bundles combining mobile, broadband, and streaming services, often with introductory discounts to gain new subscribers.

Investments in Network Infrastructure

Competitive rivalry in the telecommunications sector is intensified by significant ongoing investments in advanced network infrastructure, including 5G and fiber-to-the-home (FTTH) technologies. Major established operators are continuously enhancing their network coverage and capacity, compelling all market players to provide increasingly high-speed connectivity to remain competitive.

As a Mobile Virtual Network Operator (MVNO), Freenet's competitive standing is directly linked to the quality of the underlying network infrastructure provided by its wholesale partners. For instance, in 2024, Germany's major network operators continued their 5G rollout; Deutsche Telekom reported over 90% of the population covered by its 5G network, while Vodafone and O2 also made substantial progress in expanding their 5G footprints.

- Network Investment Pressure: Operators are spending billions on 5G and fiber upgrades, creating a baseline expectation for high-speed services.

- MVNO Dependence: Freenet's service competitiveness hinges on the quality and reach of the networks it leases capacity from.

- Speed and Capacity Wars: The drive for faster speeds and greater capacity means Freenet must ensure its wholesale agreements can support these demands to avoid customer churn.

Competition in the TV and Media Segment

Freenet's waipu.tv operates in a highly competitive TV and media segment, facing intense rivalry from established IPTV providers and a burgeoning array of over-the-top (OTT) streaming services. This dynamic landscape necessitates continuous innovation and strategic investment to capture and retain subscribers.

Companies in this space actively differentiate themselves through exclusive content offerings and aggressive pricing strategies. For instance, in 2024, the streaming market saw significant content rights battles, with major players investing billions to secure popular shows and movies, directly impacting subscriber acquisition costs and retention efforts.

- Intense Competition: Freenet's waipu.tv competes with numerous IPTV and OTT providers, including major global players and local broadcasters.

- Content Differentiation: Success hinges on securing exclusive or compelling content libraries to attract and retain customers.

- Pricing Wars: The market is characterized by competitive pricing, with providers frequently adjusting subscription fees and offering promotional bundles.

- Market Dynamics: The rapid growth of OTT services and evolving consumer viewing habits create a challenging but opportunity-rich environment.

The competitive rivalry for Freenet is exceptionally high, particularly in the saturated German telecommunications market. Major incumbents like Deutsche Telekom, Vodafone, and Telefónica Germany possess significant infrastructure advantages and brand loyalty, forcing Freenet, as a network-independent supplier, into aggressive pricing and service bundling strategies to gain market share.

This intense competition is further fueled by continuous network investment, especially in 5G and fiber optics, compelling all players to offer high-speed connectivity. For example, in 2024, Deutsche Telekom reported over 90% 5G population coverage, setting a high bar for service quality that Freenet must meet through its wholesale partners.

Freenet's TV and media segment, waipu.tv, also faces fierce competition from IPTV and OTT providers, with companies investing heavily in exclusive content and employing aggressive pricing. The market dynamics in 2024 saw significant content rights battles, directly impacting subscriber acquisition costs and retention efforts for all participants.

| Competitor | Market Share (Mobile, Approx. 2023) | Key Strategy |

|---|---|---|

| Deutsche Telekom | ~37% | Extensive network infrastructure, bundled services |

| Vodafone | ~30% | Network upgrades, convergent offerings |

| Telefónica Germany (O2) | ~25% | Aggressive pricing, network expansion |

| Freenet | Indirect via MVNO agreements | Service aggregation, competitive tariffs, waipu.tv |

SSubstitutes Threaten

The threat of substitutes for mobile communication services, particularly for operators like Freenet, is significant due to over-the-top (OTT) applications. Services such as WhatsApp, Signal, and Telegram enable users to communicate via the internet, effectively bypassing traditional SMS and voice call minutes. This shift directly impacts revenue streams for telecom providers by cannibalizing their core services.

In 2024, the widespread adoption of these OTT apps continues to erode the traditional revenue models of mobile operators. For instance, while specific data for Freenet's direct revenue loss from OTT substitution isn't publicly detailed, the broader industry trend shows a consistent decline in voice and SMS revenue. Global mobile data traffic, largely driven by these communication apps, is projected to grow substantially, further highlighting the shift away from traditional services.

Freenet's waipu.tv faces a substantial threat from streaming services like Netflix, Amazon Prime Video, and Disney+. These platforms provide extensive on-demand libraries, directly competing for viewer attention and time. By 2024, the global streaming market was valued at over $200 billion, highlighting the massive appeal of non-linear viewing.

Public Wi-Fi and alternative internet access methods like satellite internet represent a significant threat of substitutes for traditional broadband providers. The widespread availability of free or low-cost Wi-Fi in public spaces, cafes, and even some businesses can reduce consumer demand for dedicated home internet plans, especially for casual use or when on the go. This is particularly relevant as many users might opt for public Wi-Fi over their mobile data plans, impacting revenue streams for cellular providers.

Self-Provisioned Entertainment and Information

The rise of self-provisioned entertainment and information presents a significant threat of substitutes for traditional media companies. Consumers increasingly turn to readily available digital platforms for news, music, and video, bypassing conventional subscription models. For instance, by July 2024, platforms like TikTok and YouTube continued to capture substantial viewer attention, with YouTube reporting over 2 billion logged-in monthly users, many accessing content without direct payment.

This shift is fueled by the accessibility and cost-effectiveness of these alternatives. User-generated content and free, ad-supported streaming services offer a vast library of entertainment that directly competes with bundled cable packages and paid digital subscriptions. In 2024, the global digital advertising market was projected to exceed $600 billion, a significant portion of which funded the free content consumers now expect.

- Growing popularity of streaming services: Platforms like Netflix, Disney+, and Amazon Prime Video, alongside free ad-supported services such as Pluto TV and Tubi, offer vast libraries of content, directly competing with traditional broadcast and cable television.

- Rise of user-generated content: Social media platforms and video-sharing sites like YouTube and TikTok provide an endless stream of entertainment and information, often created by individuals rather than professional studios, and are frequently free to access.

- Podcast and audio content boom: Podcasts have become a major substitute for radio and even some forms of television, offering specialized content on demand, with millions of active podcasts available globally by 2024.

- News aggregation and social media: Consumers increasingly get their news from social media feeds and news aggregators rather than dedicated news channels or print publications, fragmenting the audience for traditional news providers.

Device-Based Functionality and Wearables

The rising adoption of connected devices, particularly smartwatches and fitness trackers, poses a threat of substitution to traditional mobile services. These wearables, with their increasingly sophisticated communication features, can fulfill certain communication needs independently, thereby diverting usage from primary mobile devices.

For instance, the ability of many smartwatches to make calls, send messages, and access notifications without a paired smartphone represents a direct, albeit partial, substitute for core mobile functionalities. This trend is significant, with the global smartwatch market projected to reach over $130 billion by 2028, indicating a substantial user base engaging with these alternative communication platforms.

- Wearable device sales are growing rapidly, with shipments expected to exceed 200 million units annually by 2024.

- Many smartwatches now offer standalone cellular connectivity, reducing reliance on a paired smartphone for communication.

- This shift can impact mobile service providers by potentially reducing data and voice plan usage on primary devices.

- The convenience and integrated nature of wearables offer a compelling alternative for specific communication tasks.

The threat of substitutes for Freenet's core mobile services is substantial, primarily from over-the-top (OTT) applications like WhatsApp and Telegram. These internet-based communication tools directly chip away at traditional revenue streams from voice calls and SMS. By 2024, the pervasive use of these apps continues this trend, impacting the overall value proposition of standard mobile plans.

Freenet's streaming service, waipu.tv, faces intense competition from global giants like Netflix and Disney+. The sheer volume of content available on these platforms, coupled with their established user bases, presents a significant challenge. The global streaming market’s valuation exceeding $200 billion in 2024 underscores the strength of these substitutes.

| Substitute Category | Examples | Impact on Freenet | 2024 Market Data/Trend |

|---|---|---|---|

| OTT Communication Apps | WhatsApp, Signal, Telegram | Cannibalizes voice and SMS revenue | Continued growth in data traffic driven by these apps |

| Streaming Services | Netflix, Amazon Prime Video, Disney+ | Competes for entertainment spending and viewer time | Global streaming market valued over $200 billion |

| User-Generated Content Platforms | YouTube, TikTok | Diverts attention from traditional media and paid subscriptions | YouTube has over 2 billion monthly logged-in users; TikTok continues rapid growth |

Entrants Threaten

The telecommunications sector, especially for mobile and fixed-line services, demands colossal upfront capital. Think about the costs for spectrum licenses, building cell towers, and laying fiber optic cables – these are substantial financial hurdles. For instance, in 2024, major telecom companies continue to invest billions in 5G network expansion, making it incredibly difficult for a new entrant to match this scale without immense financial backing.

New entrants in the telecommunications sector, like Freenet, encounter significant barriers due to stringent regulatory frameworks and the necessity of obtaining costly licenses. For instance, securing spectrum licenses from national bodies such as Germany's Bundesnetzagentur involves complex application processes and substantial financial outlays, often running into millions of euros.

These regulatory requirements are not only demanding but also protracted, creating a challenging environment for new companies aiming to enter the market. The need for compliance with data protection laws, consumer rights regulations, and technical standards further adds to the complexity, deterring potential new players.

Established brand loyalty and significant economies of scale act as substantial barriers to entry in the German mobile telecommunications market. Incumbent operators, including Deutsche Telekom, Vodafone, and Telefónica Germany, have cultivated strong brand recognition and loyal customer bases over many years. For instance, in Q1 2024, Deutsche Telekom reported over 43 million mobile customers in Germany, showcasing its vast reach.

These established players benefit from considerable economies of scale, allowing them to negotiate better terms with suppliers and spread fixed costs over a larger customer base. This cost advantage makes it difficult for newcomers to match pricing or service levels, as they would need to invest heavily to achieve comparable operational efficiencies. The sheer size of these incumbents means they can absorb market shocks and invest more in network infrastructure and marketing, further solidifying their competitive positions.

Market Saturation and Intense Competition

The German telecom market is a prime example of saturation, making the threat of new entrants quite low. Existing players like Deutsche Telekom, Vodafone, and O2 (Telefónica) have already captured substantial market share, leading to intense competition. This rivalry often forces new companies to adopt aggressive pricing, which can be difficult to sustain in such a mature environment.

For instance, as of early 2024, the German mobile market penetration rate hovers around 120%, indicating more SIM cards than people, a clear sign of saturation. New entrants would need significant capital to challenge established networks and customer loyalty programs, making it a formidable barrier.

- Market Saturation: Germany's mobile penetration rate exceeding 120% in early 2024 highlights an oversaturated market.

- Intense Competition: Dominant players like Deutsche Telekom, Vodafone, and O2 have established strong market positions and customer bases.

- High Entry Costs: Significant investment in network infrastructure and marketing is required to compete effectively.

- Price Wars: New entrants would likely need to engage in aggressive pricing, potentially impacting profitability.

Niche Entry vs. Full-Scale Operation

While establishing a full-scale mobile network presents formidable barriers, including extensive infrastructure investment and regulatory hurdles, the threat of new entrants isn't entirely absent. Niche segments, such as specialized IoT connectivity providers or smaller Mobile Virtual Network Operators (MVNOs), could emerge. However, these entrants would likely face significant challenges in achieving scale and offering the comprehensive services provided by established players like Freenet.

For instance, in 2024, the average cost to deploy a new 5G base station can range from €50,000 to €100,000, making widespread network build-out prohibitively expensive for newcomers. Furthermore, securing spectrum licenses, a critical component for network operation, involves substantial financial outlay and often lengthy regulatory processes. This high capital requirement acts as a significant deterrent for any entity considering a direct challenge to incumbent operators.

- High Capital Requirements: Building a new mobile network necessitates massive upfront investment in infrastructure, spectrum, and technology.

- Regulatory Hurdles: Obtaining necessary licenses and adhering to telecommunications regulations are complex and time-consuming processes.

- Economies of Scale: Established operators benefit from existing infrastructure and a large customer base, allowing for lower per-unit costs.

- Brand Loyalty and Switching Costs: Customers may be reluctant to switch from established providers due to brand recognition and the hassle of changing providers.

The threat of new entrants in the telecommunications sector is significantly low due to immense capital requirements for network infrastructure and spectrum licenses. For example, deploying new 5G infrastructure in 2024 can cost upwards of €50,000 per base station, a substantial barrier. Furthermore, established players benefit from strong brand loyalty and economies of scale, making it difficult for newcomers to compete on price or service.

| Barrier Type | Description | 2024 Relevance |

|---|---|---|

| Capital Requirements | Massive investment needed for network build-out and technology upgrades. | 5G expansion continues to demand billions, making it prohibitive for new entrants. |

| Regulatory Hurdles | Complex licensing processes and compliance with data protection laws. | Spectrum auctions remain costly and lengthy, exemplified by recent German auctions. |

| Economies of Scale | Established operators have lower per-unit costs due to large customer bases. | Incumbents like Deutsche Telekom leverage vast networks, impacting pricing strategies. |

| Brand Loyalty | Customer retention due to trust and established service relationships. | High customer bases, such as Vodafone's millions of German subscribers, indicate strong loyalty. |

Porter's Five Forces Analysis Data Sources

Our Freenet Porter's Five Forces analysis is built upon a foundation of diverse data sources, including publicly available financial reports from Freenet AG and its competitors, as well as industry-specific market research reports and telecommunications regulatory filings.