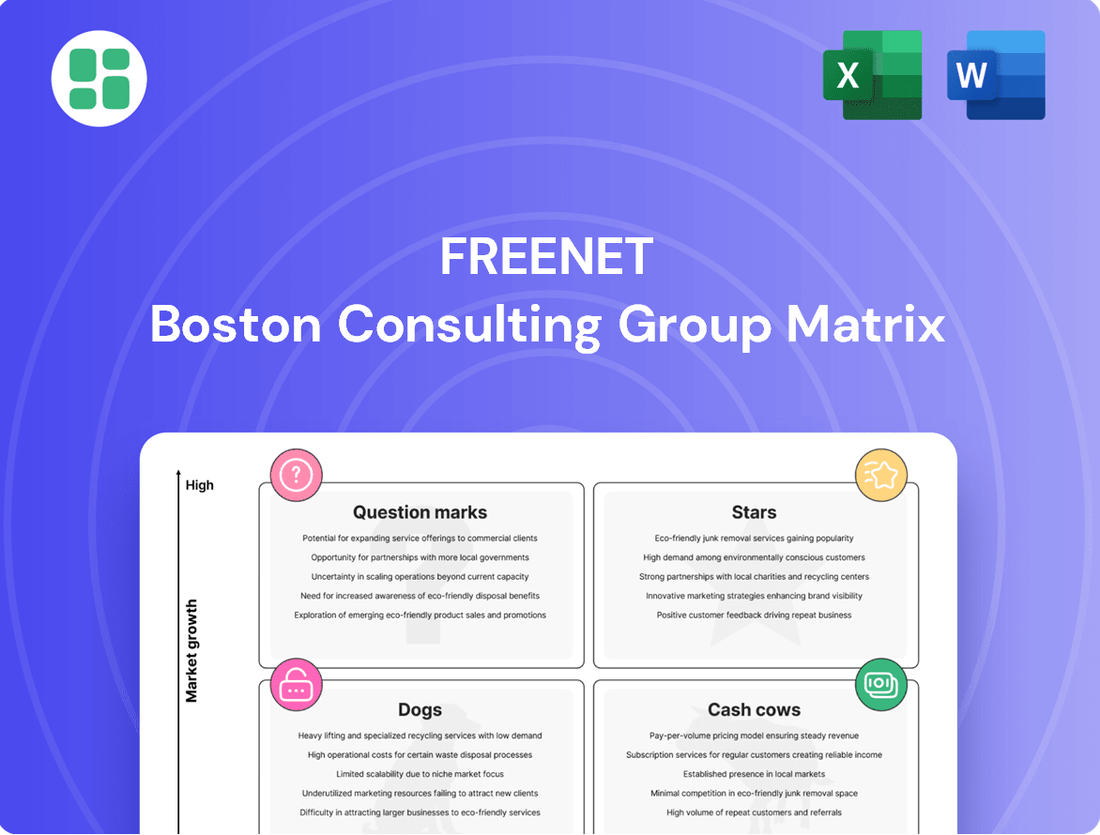

Freenet Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Freenet Bundle

Curious about Freenet's product portfolio? Our preview offers a glimpse into how their offerings might fit into the BCG Matrix, categorizing them as potential Stars, Cash Cows, Dogs, or Question Marks. Understand the strategic implications of these placements and unlock the full potential of your own product strategy.

Don't settle for a partial view. Purchase the full Freenet BCG Matrix report to gain a comprehensive understanding of each product's market position and growth potential. This detailed analysis will equip you with the insights needed to make informed decisions about resource allocation and future investments.

Ready to transform your strategic planning? The complete Freenet BCG Matrix provides actionable recommendations and clear visual mapping, empowering you to identify growth opportunities and mitigate risks effectively. Invest in clarity and drive your business forward.

Stars

waipu.tv stands out as a Star for Freenet, fueled by its impressive growth in the expanding IPTV market. In 2024, the service welcomed over 571,000 net new customers, a testament to its strong market appeal. This upward trajectory continued into the first quarter of 2025, with an additional 59.8 thousand subscribers joining the platform.

This robust customer acquisition, coupled with a 15.8% revenue increase in Freenet's TV/Media segment during 2024, firmly establishes waipu.tv as a leader in a high-growth sector. The German IPTV market is anticipated to expand at a compound annual growth rate of approximately 6.75% between 2025 and 2035, creating a fertile ground for waipu.tv's continued success and market dominance.

Freenet's postpaid mobile customer growth is a clear Star in its portfolio. The company demonstrated strong performance by adding over 180,000 net new postpaid customers in 2024.

This momentum continued into 2025, with Freenet nearly tripling its Q1 postpaid growth by securing 53.4 thousand new contracts. Such expansion in the competitive German market highlights Freenet's effective customer acquisition strategies and strengthens its revenue streams.

Freenet's commitment to its digital lifestyle product innovation is a key driver for future growth, aiming to go beyond traditional mobile and TV services. This strategic direction leverages the increasing consumer demand for integrated digital experiences, positioning Freenet to capture emerging market trends. For instance, in 2023, Freenet reported a significant increase in its digital services segment, reflecting the success of this expansion strategy.

Strategic Bundled Offerings

Freenet's strategic bundled offerings, combining mobile, TV, internet, and emerging digital lifestyle services, position themselves as a Star in the BCG matrix. These integrated solutions are designed to capture new customer segments and enhance customer lifetime value within a highly competitive telecommunications landscape.

By presenting a unified solution under a single brand, Freenet can effectively tap into its existing customer base and distribution networks. This strategy is particularly potent in high-growth market areas, driving greater adoption of these comprehensive service packages.

- Bundled Offerings: Freenet's strategy involves integrating mobile, internet, and TV services, alongside new digital lifestyle add-ons.

- Market Positioning: These bundles are classified as Stars due to their potential to attract new customers and increase overall customer value.

- Competitive Advantage: The 'coordinated solution under one umbrella brand' leverages Freenet's existing infrastructure and customer relationships.

- Growth Potential: This approach targets high-growth segments, aiming for increased market share and revenue streams.

High-Value Mobile Data Services

High-value mobile data services, particularly 5G, represent a significant growth avenue for Freenet within the German telecommunications landscape. The insatiable demand for faster speeds and increased data consumption by users fuels this potential. Freenet's strategic focus on optimizing its tariff structures to align with these evolving consumer needs positions it to capture a larger share of this expanding market segment.

Germany's mobile data market, while mature overall, shows robust growth in specific areas. As of early 2024, 5G network coverage continues to expand, with a growing number of consumers actively seeking and utilizing 5G-enabled plans. This trend is directly supported by increasing average data consumption per user, which has seen consistent year-over-year increases, driven by video streaming and cloud-based applications.

- Growing 5G Adoption: Freenet can capitalize on the increasing German consumer adoption of 5G technology, which is projected to continue its upward trajectory throughout 2024 and beyond.

- Increased Data Usage: The persistent rise in average mobile data consumption per subscriber presents a direct opportunity for Freenet to offer and monetize higher-tier data plans.

- Tariff Optimization: By tailoring its mobile tariff portfolio to specifically address the demand for high-speed data and 5G capabilities, Freenet can effectively attract and retain customers in this lucrative sub-segment.

Freenet's bundled offerings, integrating mobile, TV, and digital lifestyle services, are key Stars. These packages are designed to attract new customers and boost lifetime value in a competitive market. By offering a unified solution, Freenet leverages its existing infrastructure to drive adoption of these comprehensive service packages in high-growth areas.

| Business Unit | BCG Category | Key Performance Indicator (2024/Q1 2025) | Growth Driver |

| waipu.tv | Star | 571,000 net new customers (2024); 59.8k net new subscribers (Q1 2025) | Expanding IPTV market, 15.8% revenue increase in TV/Media segment (2024) |

| Postpaid Mobile | Star | 180,000+ net new postpaid customers (2024); 53.4k new contracts (Q1 2025) | Effective customer acquisition, strong revenue streams |

| Bundled Offerings | Star | N/A (Strategic focus) | Integrated solutions, enhanced customer lifetime value, high-growth segments |

| High-Value Mobile Data (5G) | Star | N/A (Market trend) | Increasing demand for faster speeds and data, tariff optimization for 5G |

What is included in the product

The Freenet BCG Matrix offers a tailored analysis of the company's product portfolio, categorizing each unit into Stars, Cash Cows, Question Marks, and Dogs.

It provides clear descriptions and strategic insights, highlighting which units to invest in, hold, or divest for optimal resource allocation.

Freenet BCG Matrix provides a clear, one-page overview of your business units, relieving the pain of complex data analysis.

Cash Cows

As a cornerstone of Freenet's portfolio, mobilcom-debitel, now fully integrated, represents a classic Cash Cow. Its deep roots and established presence in the German mobile market have secured a commanding market share within a mature industry.

This strong market position translates into significant and predictable recurring service revenues, primarily derived from its extensive and loyal customer base. These consistent cash inflows are a vital component of Freenet's financial stability.

The brand's inherent recognition and customer loyalty mean that the investment needed to maintain these revenues is relatively low. This efficiency directly contributes to Freenet's robust and dependable cash flow generation.

klarmobil, much like mobilcom-debitel, is a cornerstone brand for Freenet in the German mobile landscape. It consistently generates reliable revenue, solidifying its position as a cash cow.

This brand benefits from a mature customer base, which translates into predictable income for Freenet. The focus here is on maintaining efficiency and extracting value rather than significant growth investment.

In 2024, Freenet's mobile communications segment, where klarmobil plays a vital role, continued to be a primary driver of profitability. While specific segment breakdowns for klarmobil alone aren't publicly detailed, the overall segment's performance underscores the stability these established brands provide.

Freenet's overall mobile communications service revenues represent a classic cash cow. This segment consistently commands a high market share, a testament to its established position and customer loyalty.

Even in a mature market, Freenet's robust postpaid customer base, which surpassed 7.6 million subscribers by the first quarter of 2025, guarantees a steady and predictable income stream. This stability is crucial for funding other business ventures.

The segment's significant and consistent EBITDA contribution, coupled with a high cash conversion rate, firmly establishes it as a primary generator of cash for the Freenet group, enabling strategic investments and growth.

CECONOMY AG Investment

Freenet AG's investment in CECONOMY AG positions it as a Cash Cow within the Freenet BCG Matrix. This equity holding contributes to Freenet's overall financial health by generating profits and other comprehensive income.

CECONOMY AG operates in the retail electronics sector, a market characterized by a high market share for CECONOMY but in a relatively stable, mature environment. This maturity signifies consistent, albeit not explosive, growth potential.

This investment serves as a valuable, non-operational source of cash for Freenet. It allows Freenet to benefit from CECONOMY's earnings passively, effectively milking gains without requiring extensive direct operational management.

- CECONOMY AG's Market Position: Holds a significant market share in the mature German electronics retail market.

- Financial Contribution: Generates profits and other comprehensive income for Freenet.

- Cash Generation: Provides a stable, non-operational source of cash flow for Freenet.

- Strategic Role: Allows Freenet to leverage CECONOMY's established presence for passive financial returns.

Existing Customer Base Management

Freenet's commitment to its existing customer base is a cornerstone of its cash cow strategy. By focusing on retention and satisfaction across its mobile and TV services, the company cultivates a stable revenue stream.

This approach is evident in Freenet's substantial subscriber numbers, exceeding 10 million customers. These loyal customers provide predictable, recurring revenue, which is essential for a cash cow business.

The company effectively leverages this secure base through up-selling and cross-selling initiatives. This maximizes the value derived from existing relationships, a hallmark of successful cash cow management.

- Customer Retention Focus: Freenet prioritizes managing and keeping its existing customers in both mobile and TV sectors.

- Subscriber Base: The company boasts over 10 million subscribers, ensuring a significant and stable revenue foundation.

- Revenue Predictability: Effective customer experience management leads to long-term contracts and predictable income.

- Value Maximization: Freenet emphasizes up-selling and cross-selling to its established customer base to enhance profitability.

Cash Cows within Freenet's portfolio, like mobilcom-debitel and klarmobil, are established brands in mature markets. They generate consistent, predictable revenue streams with minimal investment required for maintenance.

These brands benefit from high customer loyalty and significant market share, ensuring a stable income for Freenet. The focus is on maximizing existing value rather than aggressive expansion.

Freenet's overall mobile communications segment, underpinned by these strong brands, is a prime example of a cash cow. It consistently delivers substantial EBITDA and a high cash conversion rate.

The equity holding in CECONOMY AG also functions as a cash cow, providing passive income from a mature market presence without requiring active operational management.

| Freenet Cash Cow Segments/Holdings | Market Position | Revenue Generation | Investment Needs | Financial Contribution (2024/Early 2025) |

|---|---|---|---|---|

| Mobile Communications (mobilcom-debitel, klarmobil) | High Market Share in Mature German Market | Predictable Recurring Service Revenues | Low Maintenance Investment | Primary Profitability Driver; Over 7.6M Postpaid Subscribers (Q1 2025); High EBITDA |

| CECONOMY AG (Equity Holding) | Significant Market Share in German Electronics Retail | Profits and Other Comprehensive Income | Passive Investment | Stable, Non-Operational Cash Flow Source |

| Overall Customer Base Management | Over 10 Million Subscribers | Stable, Recurring Revenue from Mobile & TV | Focus on Retention & Value Maximization | Ensures Predictable Income Streams |

Full Transparency, Always

Freenet BCG Matrix

The Freenet BCG Matrix preview you're viewing is the identical, complete document you'll receive immediately after purchase. This means you're seeing the final, unwatermarked analysis, ready for immediate strategic application without any alterations or missing sections. It's designed to provide a clear, actionable framework for evaluating Freenet's product portfolio and making informed business decisions.

Dogs

freenet TV, utilizing the DVB-T2 HD standard, is positioned as a Dog within Freenet's portfolio. The market for terrestrial digital television is contracting, evidenced by a decline of 40.3 thousand subscribers in the first half of 2024 and an additional 20.0 thousand in the first quarter of 2025.

Despite attempts to offset subscriber losses through price increases, the persistent migration of consumers towards IPTV and various streaming platforms underscores freenet TV's low market share and limited growth potential. This strategic placement as a Dog indicates Freenet's intention to manage this segment for minimal resource allocation.

Freenet's app-based mobile tariffs, like freenet FUNK and FLEX, are a niche offering. As of Q1 2025, these tariffs served approximately 110,000 customers, representing a small fraction of Freenet's overall mobile subscriber base.

Despite their initial appeal as innovative digital-first options, these app-based tariffs experienced a slight contraction in Q1 2025. This trend suggests a low growth trajectory and a relatively minor market presence when compared to Freenet's more established mobile services.

These segments are likely operating at or near breakeven, generating minimal profits. The limited growth prospects indicate that they may not be a significant driver of Freenet's future revenue, potentially tying up resources without substantial expansion potential.

Freenet's pure hardware business, primarily focused on device sales, has been a challenging segment. Intense competition and weaker consumer spending in Germany have led to declining, low-margin revenue. This has negatively impacted the company's overall revenue and EBITDA.

This part of Freenet's operations is characterized by low growth and low profitability. The company is actively working to reduce its exposure to this area. A clear example of this strategy is the discontinuation of its Gravis operations.

Gravis (Discontinued Operations)

Gravis, Freenet's former subsidiary specializing in Apple products, ceased all operations at the close of June 2024. This strategic divestiture firmly places it in the 'Dog' category of the BCG matrix, signifying a business unit with minimal market share and bleak growth prospects, effectively acting as a drain on resources.

The discontinuation of Gravis is a clear indicator of Freenet's strategic pivot. By eliminating this underperforming segment, Freenet can now redirect capital and management attention toward its more robust and growth-oriented digital lifestyle businesses. This move is expected to improve overall portfolio efficiency.

- Gravis Discontinuation Date: June 30, 2024

- BCG Matrix Classification: Dog

- Reason for Classification: Low market share and negative growth prospects

- Strategic Impact: Resource reallocation to promising digital lifestyle segments

Legacy Prepaid Mobile Services

Legacy prepaid mobile services, while not a distinct segment in recent Freenet reports, typically fall into the low-growth, low-margin category in mature markets like Germany. This is largely due to a customer shift towards postpaid plans, which offer greater predictability and often better value for frequent users.

Freenet's strategic emphasis on expanding its postpaid customer base further suggests a reduced focus on prepaid offerings. This makes legacy prepaid services a 'Dog' within the BCG matrix, characterized by its declining market share and profitability.

- Diminishing Market Relevance: As consumers opt for contract-based services, the appeal and size of the prepaid market segment shrink.

- Low Profitability: The competitive nature and typically lower average revenue per user (ARPU) in prepaid services limit profit margins.

- Strategic De-emphasis: Freenet's focus on postpaid growth indicates a deliberate strategy to move away from less lucrative prepaid segments.

- 2024 Market Trends: While specific prepaid numbers for Freenet are not segregated, the broader German mobile market in 2024 continued to show a strong preference for postpaid subscriptions, with prepaid market share remaining relatively stable or slightly declining.

Freenet TV, operating on the DVB-T2 HD standard, is classified as a Dog due to the shrinking terrestrial digital television market. This segment saw a decline of 40.3 thousand subscribers in the first half of 2024 and another 20.0 thousand in Q1 2025, indicating low market share and growth potential.

Freenet's pure hardware business, facing intense competition and weaker consumer spending in Germany, also exhibits low growth and low profitability. The discontinuation of its Gravis subsidiary on June 30, 2024, exemplifies the company's strategy to reduce exposure to such underperforming segments.

Legacy prepaid mobile services are also considered Dogs, reflecting a declining market share and profitability as customers shift to postpaid plans. Freenet's strategic emphasis on expanding its postpaid base further reinforces the de-emphasis on these less lucrative prepaid segments.

| Business Unit | BCG Classification | Key Data Points |

| Freenet TV (DVB-T2 HD) | Dog | Subscriber decline: 40.3k (H1 2024), 20.0k (Q1 2025) |

| Hardware Business (e.g., Gravis) | Dog | Gravis ceased operations June 30, 2024; low margins, declining revenue |

| Legacy Prepaid Mobile Services | Dog | Shift to postpaid; low ARPU, declining market relevance |

Question Marks

Freenet's electric charging infrastructure services represent a classic "Question Mark" in the BCG matrix. The company secured its first customers in Q1 2025, signaling a very early stage of market penetration.

The German market for charging boxes is poised for substantial growth, expected to expand from approximately 150,000 units to over 1 million by 2030, presenting a high-growth environment. This rapid expansion offers significant potential for Freenet to capture market share.

Despite the promising market outlook, Freenet's current market share is negligible, reflecting the nascent nature of this business segment. Future investment decisions will be crucial to determine if this venture can evolve into a "Star" or if it will remain a "Question Mark" or eventually decline.

Freenet is looking to broaden its integrated services by adding Internet and Energy to its digital lifestyle offerings. This move targets high-growth sectors fueled by increasing digitalization and a growing emphasis on sustainability.

While Freenet has a strong presence in mobile and TV, its Internet and Energy segments are relatively new or require substantial scaling. These markets are attractive due to strong demand, but Freenet currently has a modest market share, necessitating significant investment to compete effectively.

For instance, the global smart grid market, a key component of energy innovation, was valued at approximately $25 billion in 2023 and is projected to grow significantly. Similarly, the broadband internet market continues to expand, with global internet penetration reaching over 66% by early 2024, indicating ongoing demand for enhanced connectivity solutions.

Freenet's foray into advanced smart home and IoT services positions it within a burgeoning sector. These markets, characterized by rapid innovation and increasing consumer adoption, offer substantial growth potential. For instance, the global smart home market was projected to reach over $150 billion by 2024, with IoT services forming a significant component of this expansion.

However, Freenet's current standing in these nascent segments is likely modest, reflecting the early stages of its engagement. Building a strong market presence necessitates considerable investment in research and development to create compelling offerings, strategic alliances with technology providers, and robust marketing campaigns to capture consumer attention and build brand loyalty.

Targeted Youth/Digital-Native Mobile Brands

Targeted youth and digital-native mobile brands represent a crucial area for Freenet's portfolio optimization. These brands, designed for specific demographics like Gen Z or mobile-first users, tap into a high-growth market. For instance, by mid-2024, the 18-24 age group's mobile data consumption was projected to increase by 15% year-over-year, highlighting the potential.

However, these new ventures typically start with a low market share. Significant investment in marketing and unique value propositions is essential to capture this segment effectively. Without rapid scaling and differentiation, they risk becoming Stars that fail to achieve their potential or even Dogs if they don't gain traction.

- High Growth Potential: Targeting digital-native demographics aligns with increasing data usage, especially among younger consumers. In 2023, mobile gaming revenue alone reached over $90 billion globally, indicating a strong appetite for digital services.

- Low Initial Market Share: New brands in this space often begin with a small customer base, necessitating aggressive customer acquisition strategies.

- Investment Required: Substantial marketing spend and innovative product development are critical to gain visibility and market penetration.

- Risk of Becoming a Dog: Failure to differentiate or scale quickly can lead to these brands underperforming and becoming a drain on resources.

Premium Content & Streaming Partnerships (beyond basic waipu.tv)

Freenet's foray into premium content partnerships beyond its core waipu.tv offering positions these ventures as Question Marks. While waipu.tv is a strong performer, expanding into niche streaming or advanced interactive features demands substantial investment in a highly competitive German streaming market. The potential for high market share is present, but success hinges on strategic execution and differentiation.

The German streaming market is dynamic, with significant growth anticipated. For instance, projections indicated the German video-on-demand market revenue to reach approximately €2.2 billion in 2024. This competitive landscape means that new premium content initiatives need to offer unique value propositions to attract and retain subscribers.

- Market Potential: The German streaming market's continued expansion presents an opportunity for specialized premium content.

- Investment Needs: Developing exclusive content or advanced features requires significant capital outlay.

- Competitive Landscape: Established players and emerging platforms create a challenging environment for new entrants.

- Risk vs. Reward: While high market share is achievable, the investment carries inherent risks due to market saturation and evolving consumer preferences.

Freenet's electric charging infrastructure services, along with its expanding Internet and Energy segments, and new premium content partnerships, all represent "Question Marks" within the BCG matrix. These ventures are characterized by operating in high-growth markets, such as the expanding German charging box market, projected to grow from 150,000 units to over 1 million by 2030, or the global smart grid market valued at $25 billion in 2023. However, Freenet currently holds a negligible or modest market share in these areas, demanding substantial investment in R&D, marketing, and strategic alliances to gain traction and potentially evolve into market leaders. The success of these "Question Marks" hinges on Freenet's ability to effectively differentiate its offerings and scale rapidly in these competitive, yet promising, sectors.

| Business Area | Market Growth | Freenet Market Share | Investment Needs | Outlook |

|---|---|---|---|---|

| Electric Charging Infrastructure | High (German charging boxes: 150k to 1M by 2030) | Negligible | High (R&D, infrastructure build-out) | Potential Star if scaled |

| Internet & Energy Services | High (Smart Grid: $25B in 2023, Broadband penetration >66% in early 2024) | Modest | High (Scaling, competitive positioning) | Potential Star with strategic investment |

| Premium Content Partnerships | High (German VOD market: €2.2B in 2024) | Low (for new ventures) | High (Content acquisition, marketing) | Potential Star, high competition |

| Targeted Youth/Digital Brands | High (Mobile data consumption increase) | Low (New ventures) | High (Marketing, differentiation) | Risk of becoming Dog if not scaled |

BCG Matrix Data Sources

Our Freenet BCG Matrix is built upon comprehensive market data, encompassing subscriber growth figures, revenue streams, and competitive landscape analysis from industry reports and public filings.