Freenet Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Freenet Bundle

Freenet's marketing success hinges on a carefully crafted blend of Product, Price, Place, and Promotion. This analysis delves into how their innovative product offerings, competitive pricing, strategic distribution, and impactful promotional campaigns create a powerful market presence.

Uncover the strategic brilliance behind Freenet's 4Ps. From their product development to pricing strategies, distribution channels, and promotional activities, this comprehensive analysis provides actionable insights for any business looking to optimize its marketing mix.

Ready to elevate your marketing strategy? Get the full, in-depth 4Ps Marketing Mix Analysis for Freenet, complete with editable content and actionable insights. Save time and gain a competitive edge.

Product

Freenet's mobile communication services are the core of its offering, delivered through well-known brands like freenet Mobile, mobilcom-debitel, and klarmobil. These services encompass a wide array of postpaid and prepaid plans, frequently paired with the latest smartphones, to appeal to a broad customer base. The company emphasizes customer choice, enabling users to select plans that align with their specific requirements, with the flexibility to utilize services across various German network providers.

Freenet's internet services extend beyond mobile, offering a diverse range of broadband solutions that are a cornerstone of their digital lifestyle strategy. These offerings, including DSL and fiber optic options, are crafted to provide German households with reliable and high-speed connectivity, complementing their mobile and TV packages.

The company aims to ensure seamless integration across its digital product ecosystem, catering to the increasing consumption of streaming services, online gaming, and smart home technologies. As of early 2024, Freenet reported a significant portion of its customer base utilizing these bundled internet services, highlighting their importance in driving customer retention and average revenue per user.

Freenet's TV entertainment, spearheaded by waipu.tv, stands as a cornerstone product, recognized as Germany's premier OPEN-IPTV platform. It offers a rich selection of channels, encompassing many HD and premium Pay-TV options, complemented by a vast on-demand library, the waiputhek.

This versatile service, accessible across various devices, is a significant contributor to Freenet's expansion. For instance, in the first quarter of 2024, Freenet reported that waipu.tv's subscriber base grew to over 1.5 million customers, highlighting its market penetration and appeal.

Digital Lifestyle s & Services

Freenet's product strategy centers on a comprehensive 'Digital Lifestyle' offering. This integrates telecommunications, internet, and TV entertainment with a suite of applications and smart devices, aiming for a unified customer experience under a single brand. The company actively refines and grows this portfolio to align with shifting consumer needs in the current digital landscape.

Freenet's commitment to its Digital Lifestyle product strategy is evident in its continuous efforts to bundle and enhance its service offerings. For instance, in 2024, Freenet continued to focus on expanding its digital services beyond traditional connectivity, aiming to capture a larger share of the digital entertainment and smart home markets. This strategy is designed to foster customer loyalty and increase average revenue per user (ARPU) by providing a more integrated and valuable digital ecosystem.

- Integrated Offerings: Freenet provides a single point of access for telecommunications, internet, and TV, simplifying the digital experience for consumers.

- Evolving Portfolio: The company consistently updates its range of services, applications, and smart devices to keep pace with technological advancements and consumer preferences.

- Customer-Centric Approach: By bundling diverse digital services, Freenet aims to create a sticky ecosystem that caters to the modern consumer's interconnected lifestyle.

- Market Expansion: Freenet's strategy targets growth in digital entertainment and smart home solutions, reflecting a broader industry trend toward comprehensive digital service integration.

Value-Added Services and Features

Freenet significantly boosts its product value through a suite of integrated services. For mobile customers, this includes essential features like EU-Roaming, ensuring seamless connectivity abroad, alongside advanced capabilities such as VoLTE for clearer calls and WiFi-Call for improved indoor reception. The convenience of eSIM technology further enhances flexibility, allowing for easier plan management and device switching.

For its waipu.tv service, Freenet offers premium features that elevate the viewing experience. Customers can enjoy parallel streaming on multiple devices, catering to households with diverse viewing needs. Additionally, access to on-demand content provides greater control and choice, allowing users to watch what they want, when they want.

These value-added services are strategically implemented to differentiate Freenet's offerings in a competitive market. For instance, as of Q1 2024, Freenet reported a substantial increase in its customer base for waipu.tv, underscoring the appeal of such enhanced features. The company's focus on convenience and advanced functionality aims to foster customer loyalty and drive revenue growth.

- EU-Roaming: Facilitates seamless international communication for mobile users.

- VoLTE and WiFi-Call: Enhances call quality and connectivity indoors.

- eSIM Capabilities: Offers greater convenience and flexibility in mobile plan management.

- waipu.tv Parallel Streaming: Allows simultaneous viewing on multiple devices.

- waipu.tv On-Demand Content: Provides flexible access to a library of entertainment.

Freenet's product strategy revolves around a comprehensive Digital Lifestyle offering, integrating mobile, internet, and TV services. This approach aims to provide a unified and convenient digital experience for consumers, encompassing everything from basic connectivity to advanced entertainment options. The company actively develops and bundles these services to meet evolving customer needs and capture a larger share of the digital market.

What is included in the product

Delivers a comprehensive analysis of Freenet's marketing strategies, examining its Product, Price, Place, and Promotion tactics with real-world examples and strategic implications.

This breakdown is perfect for understanding Freenet's market positioning and can be easily adapted for reports, presentations, or strategic planning.

Simplifies complex marketing strategies by clearly defining Freenet's Product, Price, Place, and Promotion, alleviating the pain of strategic ambiguity.

Provides a clear, actionable framework for Freenet's marketing team, reducing the stress of developing cohesive and effective campaigns.

Place

Freenet AG strategically utilizes its owned digital properties like freenet.de and klarmobil.de, alongside partnerships, to drive direct sales and manage customer relationships. This digital-centric strategy ensures widespread reach across Germany, offering consumers a seamless online experience for acquiring and overseeing their mobile and entertainment services.

In 2023, Freenet reported that approximately 70% of its new customer acquisitions were generated through its online channels, highlighting the critical role of digital platforms in its growth strategy. The company's investment in optimizing these online touchpoints underscores its commitment to enhancing customer engagement and facilitating smooth digital transactions, a trend expected to continue into 2024 and 2025.

Freenet leverages a robust physical retail network, encompassing both its wholly-owned stores and a significant partnership with electronic retailers like MediaMarktSaturn. This dual approach, as of late 2024, allows Freenet to maintain over 500 own stores and access a vast network of partner locations, ensuring broad market coverage.

These physical locations serve as crucial hubs for offering a full spectrum of services, from in-depth customer consultations to direct sales of mobile tariffs and the latest smartphones. For instance, in 2023, Freenet reported that a substantial portion of its new customer acquisitions originated from its retail channels, highlighting their importance in the sales funnel.

This integrated omni-channel strategy is designed to keep Freenet close to its customer base, effectively catering to individuals who value face-to-face interactions and personalized advice when making purchasing decisions about telecommunications services and devices.

Freenet leverages indirect distribution channels, such as specialized dealers and a broad network of retail partners, to significantly expand its market reach. This multi-faceted approach ensures Freenet's mobile and digital lifestyle products are accessible through numerous points of sale, complementing its direct sales efforts.

This strategy is vital for driving customer acquisition and increasing market penetration. For instance, in 2023, Freenet's partner network contributed to a substantial portion of its device sales, enabling the company to connect with a wider customer base than it could through direct channels alone.

B2B and B2C Segments

Freenet AG primarily targets the Business-to-Consumer (B2C) market in Germany, offering mobile and digital lifestyle products and services directly to individual customers. This consumer focus is evident in their broad marketing and distribution efforts aimed at the general public.

While Freenet does engage in Business-to-Business (B2B) activities, notably through Freenet Business, its operational emphasis and revenue generation are predominantly driven by its extensive consumer base. Distribution strategies are therefore heavily weighted towards channels that efficiently serve millions of individual users.

Freenet's recent financial performance highlights this B2C dominance. For the fiscal year 2023, Freenet reported revenues of approximately €2.6 billion, with the vast majority stemming from its consumer-centric mobile services. This underscores the importance of the B2C segment in their overall business model and marketing mix.

- Primary Market Focus: Freenet AG's core business and marketing efforts are concentrated on the German B2C market.

- B2B Engagement: The company does operate in the B2B space through Freenet Business, providing services to corporate clients.

- Distribution Strategy: Tailored channels are employed to reach both individual consumers and business customers effectively.

- Revenue Driver: The B2C segment is the principal contributor to Freenet's overall revenue, as seen in its 2023 financial results.

Strategic Partnerships for Reach

Strategic partnerships are a cornerstone of Freenet's marketing strategy, significantly amplifying its market reach. A prime example is its enduring alliance with Telefónica Deutschland, which underpins the distribution of its services, including the popular waipu.tv. This collaboration not only secures competitive network access but also broadens the availability of Freenet's offerings to a wider customer base.

These strategic alliances are crucial for Freenet in optimizing its logistics and ensuring maximum customer convenience. By leveraging the infrastructure and customer base of partners like Telefónica Deutschland, Freenet can efficiently deliver its products and services. In 2023, Freenet reported a significant increase in its customer base, partly attributed to these distribution agreements, reaching over 14 million mobile customers.

- Telefónica Deutschland Partnership: Essential for network access and service distribution.

- waipu.tv Collaboration: Leverages strategic alliances for expanded reach.

- Customer Convenience: Partnerships aim to streamline access and enhance user experience.

- Market Reach: Freenet's over 14 million mobile customers in 2023 highlight the effectiveness of its distribution network.

Freenet AG's place strategy is a sophisticated blend of owned digital properties, extensive physical retail presence, and strategic indirect distribution. This multi-channel approach ensures broad accessibility for its mobile and digital lifestyle products across Germany.

By leveraging over 500 owned stores and a vast network of retail partners, Freenet effectively reaches consumers seeking both online convenience and in-person service. This dual focus caters to diverse customer preferences, reinforcing its market penetration.

The company's digital platforms, such as freenet.de, are central to customer acquisition, with approximately 70% of new customers in 2023 originating from online channels. This digital-first orientation is complemented by physical touchpoints for a comprehensive customer journey.

| Distribution Channel | Key Features | Customer Reach (approx.) | 2023 Impact |

|---|---|---|---|

| Owned Digital Properties (freenet.de, klarmobil.de) | Direct sales, customer relationship management, seamless online experience | High (primary acquisition channel) | ~70% of new customer acquisitions |

| Owned Physical Stores | In-depth consultations, direct sales, device support | 500+ locations | Significant contributor to new customer acquisition |

| Retail Partnerships (e.g., MediaMarktSaturn) | Extended market access, broad product availability | Vast network | Substantial portion of device sales |

| Indirect Distribution (Specialized Dealers) | Increased market penetration, accessibility | Broad network | Complements direct sales efforts |

Preview the Actual Deliverable

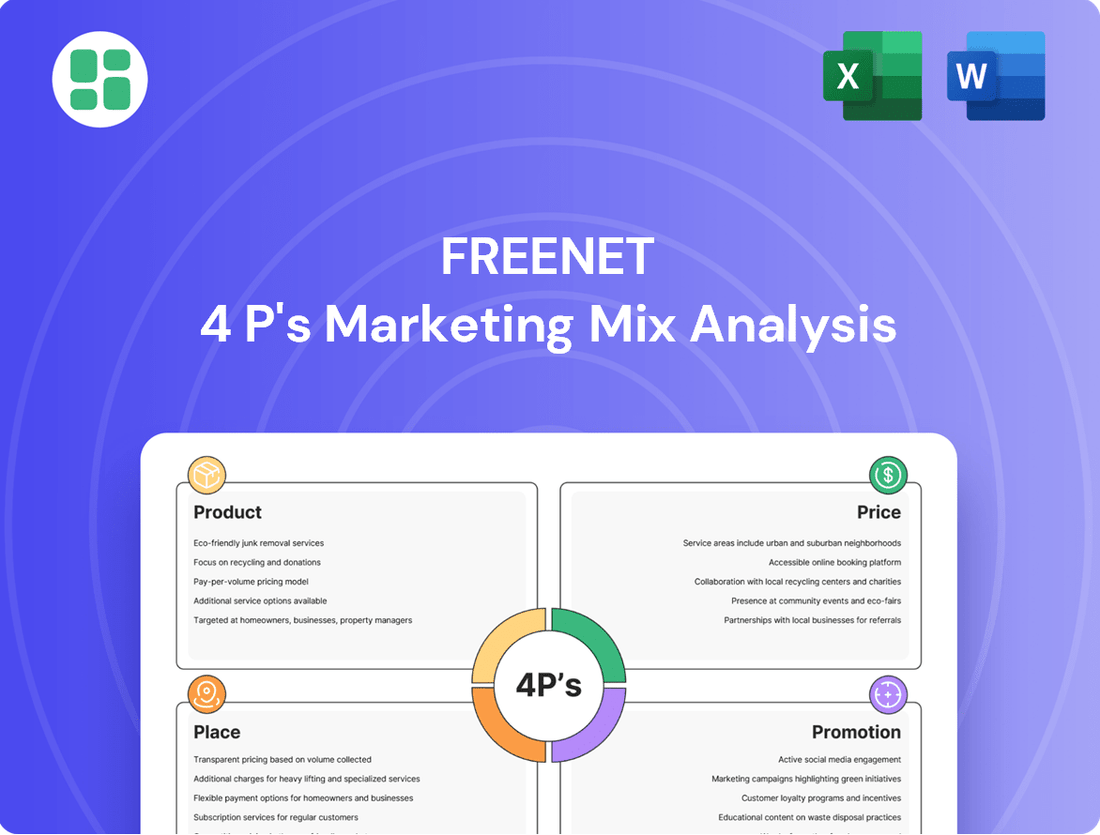

Freenet 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Freenet 4P's Marketing Mix Analysis covers Product, Price, Place, and Promotion in detail. You're viewing the exact version of the analysis you'll receive, fully complete and ready to use for your strategic planning.

Promotion

Freenet's brand campaigns actively position it as a 'smarter Challenger' and a champion of consumer choice, highlighting its independence from specific network operators. This strategy aims to differentiate Freenet in a crowded telecommunications market.

Recent campaigns, such as the 'Läuft' (It's running smoothly) initiative, focus on simplicity and effortless user experience. This messaging is designed to build trust and convey Freenet's reliability and ease of use to potential customers.

These strategic brand efforts are vital for Freenet's growth, contributing to increased brand awareness and fostering customer loyalty. In 2023, Freenet reported a significant increase in its customer base, underscoring the effectiveness of its marketing approach.

Freenet leverages a comprehensive multi-channel advertising strategy, incorporating traditional media like TV spots with a strong digital presence across Facebook, Instagram, YouTube, and TikTok. This broad approach is designed to capture attention across diverse demographics.

The company also utilizes display ads and Digital Out-of-Home (DOOH) advertising, extending its reach into physical spaces and online environments. By presenting high-reach TV formats, Freenet further amplifies its brand visibility and engagement with a wider audience.

Freenet consistently employs sales promotions and special offers as a key driver for customer acquisition and purchase incentives. These often manifest as discounted waipu.tv packages, extended free trial periods, and complimentary data upgrades for their mobile tariffs. For instance, in early 2024, Freenet offered a significant discount on its waipu.tv premium package, aiming to capture market share as the cable TV obligation phased out.

Public Relations and Corporate Communications

Public relations and corporate communications are crucial for shaping Freenet's brand perception and keeping its stakeholders informed. This involves consistent dissemination of financial updates, such as quarterly earnings reports and detailed annual reports, alongside proactive investor relations outreach.

Freenet actively engages with the media to announce significant developments, including new service launches, strategic alliances, and key financial achievements. For instance, in early 2024, Freenet highlighted its expansion into new digital services, aiming to bolster its market position and communicate growth strategies to investors and the public.

The company's commitment to transparency is evident in its communication strategy, fostering trust among its diverse stakeholder groups. Freenet's investor relations portal provides readily accessible information, including:

- Financial Statements: Detailed quarterly and annual financial reports.

- Press Releases: Timely announcements of corporate news and performance.

- Investor Presentations: Updates on strategy, market performance, and future outlook.

- Shareholder Information: Details on stock performance and corporate governance.

Sports Sponsorships and Partnerships

Freenet actively leverages sports sponsorships to boost its brand presence, a key element in its marketing mix. This includes prominent advertising on perimeter boards in both the 1st and 2nd German Football Bundesliga leagues, reaching millions of passionate fans. For instance, during the 2023-2024 Bundesliga season, Freenet's visibility was significantly amplified through these placements.

Further solidifying its connection with sports enthusiasts, Freenet served as an official partner for major events like the Men's Handball European Championship. This strategic move in early 2024 allowed Freenet to engage directly with a large, highly motivated audience, reinforcing its brand association with dynamic and popular sports.

The company also extends its brand-building efforts through partnerships with unique initiatives. Collaborating with organizations such as The Icon League, Freenet aims to enhance its brand presence in innovative ways, tapping into new demographics and strengthening its overall market position.

- Bundesliga Sponsorship: Increased brand visibility in Germany's top two football leagues.

- Handball Partnership: Engaged with a broad audience during the 2024 Men's Handball European Championship.

- The Icon League Collaboration: Expanded brand reach through innovative sports event partnerships.

Freenet's promotional activities are multifaceted, aiming to build brand awareness and drive customer acquisition. Their strategy includes broad media campaigns, targeted digital advertising, and impactful sports sponsorships. For instance, in the 2023-2024 season, Freenet significantly boosted its visibility through advertising in the German Football Bundesliga and by partnering with the Men's Handball European Championship in early 2024.

Sales promotions are a key component, with Freenet frequently offering incentives like discounted waipu.tv packages and extended free trials. These efforts are designed to attract new customers and encourage upgrades, as seen with early 2024 offers on premium waipu.tv subscriptions coinciding with the cable TV obligation phase-out.

Public relations and transparent corporate communications reinforce Freenet's brand image. The company actively shares financial updates and announces new service expansions through press releases and an accessible investor relations portal, fostering trust among stakeholders.

Price

Freenet employs competitive pricing across its mobile, internet, and TV offerings to capture and keep customers in Germany's dynamic market. This strategy includes appealing entry-level plans and cost-effective bundled packages.

Pricing decisions are frequently informed by competitor analysis, aiming to maintain market relevance while aligning with the perceived value of Freenet's services. For instance, in early 2024, Freenet's mobile tariffs often started around €10-€15 per month, directly challenging major players with similar entry-level data allowances.

Freenet's marketing mix prominently features tiered tariff structures across its mobile and TV offerings. For instance, klarmobil's Allnet-Flats cater to diverse data needs, while waipu.tv's Perfect Plus provides various TV package options. This strategy directly addresses varying customer usage habits and budget constraints, offering a spectrum of choices.

These tiered plans are crucial for maximizing market penetration by appealing to a broad customer base with different price sensitivities. By segmenting services, Freenet ensures that customers can find a plan that fits their specific requirements, fostering wider adoption. For example, in Q1 2024, Freenet reported a significant increase in its customer base, partly attributed to the flexibility of its tariff options.

Freenet actively employs promotional discounts and bundling to attract new customers and enhance value. For instance, a common tactic involves offering a waipu.tv 4K-Stick alongside a reduced annual subscription, making the initial investment more appealing.

Bundling also extends to popular streaming services, combining offerings like Netflix and WOW with their core products. This strategy is designed to lower the initial hurdle for new users and boost the perceived worth of their packages, thereby encouraging sign-ups and facilitating cross-selling opportunities.

Value-Based Pricing for Premium Services

Freenet employs value-based pricing for premium services like waipu.tv's Perfect Plus. This strategy centers on the significant benefits offered, such as an extensive channel lineup, superior HD streaming, and a robust on-demand library. The price point directly correlates with the enhanced user experience and the breadth of entertainment provided, differentiating it from more basic subscription tiers.

For instance, as of early 2025, waipu.tv's Perfect Plus package, priced at €14.99 per month, offers over 130 channels, including more than 50 in HD. This contrasts with their Perfect package at €9.99, which provides fewer channels and less HD content. This tiered structure clearly communicates the added value for the higher price.

- Extensive Channel Selection: Over 130 channels, with more than 50 in HD for Perfect Plus.

- On-Demand Content: Access to a vast library of movies and series.

- Enhanced User Experience: Superior streaming quality and features justify premium pricing.

Transparent Pricing and Flexible Terms

Freenet's pricing strategy emphasizes clarity, detailing all one-time setup costs alongside recurring monthly service fees. This transparency is crucial for building customer trust in a competitive market. For instance, in early 2024, Freenet brands continued to offer a mix of contract lengths, with a notable increase in short-term, monthly cancellable options to appeal to budget-conscious and flexible consumers.

The company understands that customer needs vary, and thus provides flexible contract terms. While traditional multi-year contracts are available, brands such as klarmobil have been particularly active in promoting monthly cancellable tariffs. This dual approach allows Freenet to capture a broader customer base, from those seeking long-term value to individuals prioritizing immediate flexibility.

This commitment to transparent and flexible pricing directly impacts customer acquisition and retention. By clearly communicating costs and offering adaptable plans, Freenet aims to reduce perceived risk for consumers. Data from early 2024 indicated that telecommunication providers offering more flexible, month-to-month plans saw higher customer satisfaction scores compared to those solely relying on rigid, long-term contracts.

- Transparent Cost Breakdown: Freenet clearly itemizes all connection fees and monthly charges, ensuring customers understand their financial commitment.

- Flexible Contract Options: Offering both traditional contracts and easily cancellable monthly plans caters to diverse customer preferences for commitment.

- Customer Trust and Acquisition: This approach fosters trust and is a key differentiator in attracting new subscribers seeking straightforward and adaptable mobile services.

- Market Responsiveness: The emphasis on flexibility reflects a broader market trend in 2024, where consumers increasingly value adaptable service agreements.

Freenet's pricing strategy is a cornerstone of its market approach, blending competitive entry points with value-driven premium offerings. This dual focus aims to attract a wide audience while also maximizing revenue from those seeking enhanced services.

By offering a range of tariffs, Freenet effectively caters to different customer segments. For instance, in early 2024, mobile plans often began around €10-€15 monthly, directly competing with established providers. This is further supported by bundled deals, such as a waipu.tv 4K-Stick with a discounted annual subscription, enhancing initial customer value.

| Service Segment | Example Pricing (Early 2024/2025) | Key Features | Target Audience |

|---|---|---|---|

| Mobile (Entry-Level) | €10-€15/month | Basic data allowance, calls, texts | Budget-conscious users |

| TV (Premium) | waipu.tv Perfect Plus: €14.99/month | 130+ channels (50+ HD), extensive on-demand | Entertainment enthusiasts |

| Bundles | Varies (e.g., waipu.tv + Stick) | Promotional discounts, added value | New customer acquisition |

4P's Marketing Mix Analysis Data Sources

Our Freenet 4P's Marketing Mix Analysis is built on a foundation of verified data, including official company reports, pricing structures, distribution network details, and promotional campaign analyses. We leverage credible sources such as public filings, investor relations materials, and industry-specific market research.