Fortis (Canada) SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fortis (Canada) Bundle

Fortis (Canada) boasts strong brand recognition and a stable, regulated utility base, providing a solid foundation for growth. However, navigating evolving energy landscapes and potential regulatory shifts presents key challenges that demand a deeper understanding.

Want the full story behind Fortis's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Fortis Inc.'s core strength lies in its stable and predictable earnings, largely due to its regulated utility business model. This structure ensures consistent cash flow, as nearly 99% of its assets operate under regulatory frameworks. For instance, in the first quarter of 2024, Fortis reported adjusted net earnings of $642 million, demonstrating the reliability of its revenue streams.

Fortis's ambitious $26 billion capital investment plan for 2025-2029 represents its largest ever, targeting a 6.5% compound annual growth rate in its rate base. This substantial commitment to infrastructure, covering transmission, generation, and distribution, is characterized by its low-risk nature and high executability.

This robust capital deployment is a key strength, directly supporting Fortis's future earnings and dividend growth trajectory. The company's proven track record in executing large-scale infrastructure projects instills confidence in its ability to deliver on this significant five-year plan.

Fortis has a remarkable 51-year history of consistently increasing its dividends year after year. This sustained growth is a standout feature in the utility industry, signaling financial stability and a strong commitment to shareholder returns.

Looking ahead, Fortis plans to continue this trend, targeting annual dividend growth between 4% and 6% up to 2029. This forward-looking projection is underpinned by robust operating cash flows and a disciplined approach to managing its capital, offering a dependable income stream for investors.

Geographic and Operational Diversification

Fortis's geographic and operational diversification is a significant strength. Operating across Canada, the United States, and the Caribbean, the company manages a portfolio of 10 regulated electric and gas utilities. This wide reach across different economic and regulatory environments helps cushion the impact of any single region's downturns.

This diversification enhances Fortis's overall business resilience. For instance, as of the first quarter of 2024, the company reported a stable performance, with its regulated utility operations providing a predictable revenue stream. This spread of assets across various jurisdictions reduces reliance on any one market, contributing to financial stability and mitigating specific regulatory risks.

- Diversified Operations: 10 regulated electric and gas utilities across North America and the Caribbean.

- Risk Mitigation: Reduced exposure to regional economic downturns and regulatory changes.

- Revenue Stability: Predictable cash flows from regulated utility assets.

- Enhanced Resilience: Stronger overall business stability due to broad geographic presence.

Commitment to Cleaner Energy and ESG Initiatives

Fortis demonstrates a strong commitment to the clean energy transition, a significant strength in today's market. The company has set ambitious targets, aiming to reduce its Scope 1 greenhouse gas emissions by 50% by 2030 and 75% by 2035, with a net-zero goal by 2050. Furthermore, Fortis plans to achieve a coal-free generation mix by 2032.

These environmental, social, and governance (ESG) initiatives are backed by substantial investments in renewable energy projects, battery storage solutions, and crucial grid modernization efforts. This strategic focus not only aligns Fortis with prevailing global sustainability trends but also enhances its attractiveness to a growing segment of environmentally conscious investors and stakeholders, potentially leading to improved access to capital and a stronger market position.

The company's proactive approach to decarbonization and sustainable infrastructure development positions it favorably for long-term growth and resilience in an evolving energy landscape.

Fortis's extensive capital investment plan, totaling $26 billion for 2025-2029, is a key strength, aiming for a 6.5% compound annual growth rate in its rate base. This significant investment in infrastructure, including transmission, generation, and distribution, is characterized by its low-risk profile and high likelihood of successful execution.

The company's financial discipline is evident in its 51-year history of consistent dividend increases, with a target of 4-6% annual dividend growth through 2029. This sustained commitment to shareholder returns is supported by robust operating cash flows and strategic capital management.

Fortis benefits from significant geographic and operational diversification, managing 10 regulated utilities across North America and the Caribbean. This broad presence across different regulatory and economic environments enhances business resilience and revenue stability, as demonstrated by its stable performance in Q1 2024.

The company's commitment to the clean energy transition is a notable strength, with targets to reduce Scope 1 greenhouse gas emissions by 50% by 2030 and achieve net-zero by 2050. Investments in renewable energy and grid modernization position Fortis favorably for long-term growth and sustainability.

| Metric | 2024 (Q1) | 2025-2029 Plan |

|---|---|---|

| Adjusted Net Earnings | $642 million | N/A |

| Capital Investment | N/A | $26 billion |

| Rate Base CAGR Target | N/A | 6.5% |

| Dividend Growth Target | N/A | 4-6% annually |

| Scope 1 GHG Emission Reduction Target | N/A | 50% by 2030 |

What is included in the product

Delivers a strategic overview of Fortis (Canada)’s internal and external business factors, highlighting its stable utility operations and growth potential in regulated markets, while also considering regulatory risks and capital intensity.

Provides a clear, actionable SWOT analysis for Fortis (Canada) to identify and address strategic challenges, relieving the pain of uncertainty.

Weaknesses

Fortis's earnings are susceptible to regulatory lag, meaning that increases in costs might not be immediately passed on to customers through higher rates, a situation observed in some of its Western Canadian operations. This lag can compress margins until rate adjustments are approved.

Changes in the allowed rate of return on equity (ROE) or the phasing out of existing regulatory incentives can also act as a brake on growth and impact profitability. For instance, a reduction in the authorized ROE from 9.0% to 8.5% in a key jurisdiction could directly affect future earnings potential.

The company must therefore maintain ongoing, proactive engagement with various regulatory bodies to navigate these complexities and advocate for timely rate adjustments that reflect operational costs and ensure a fair return on investment.

Fortis's capital-intensive operations, requiring significant debt financing for ongoing investments, make it particularly vulnerable to shifts in interest rates. For instance, if interest rates were to rise significantly in 2024-2025, the company’s borrowing costs would increase, directly impacting its finance expenses.

This rise in finance expenses could potentially squeeze profit margins, reducing the net income available to shareholders and potentially affecting the company's ability to fund future growth or maintain its dividend payouts. This sensitivity is a notable financial headwind.

Fortis's substantial $26 billion capital plan, while geared for growth, demands significant and continuous capital outlay. This extensive investment program inherently strains the company's financial capacity. The need for ongoing financing, potentially including equity issuance, could dilute existing shareholder value.

Currency Exchange Rate Volatility

Fortis, with its substantial U.S. operations, faces a significant vulnerability due to the fluctuating exchange rate between the U.S. and Canadian dollars. This currency volatility can directly impact its reported earnings and the cost of its capital projects.

While a weaker Canadian dollar can enhance the value of its U.S. earnings when converted back to Canadian dollars, unfavorable shifts, such as a stronger Canadian dollar, could diminish these reported figures. For instance, in 2023, Fortis reported that a 1 cent change in the USD/CAD exchange rate could impact its net earnings by approximately $20 million. This sensitivity highlights the risk associated with its cross-border business model.

- Exposure to USD/CAD Fluctuations: Fortis's significant U.S. asset base makes it susceptible to currency swings.

- Impact on Earnings: A stronger Canadian dollar can reduce the translated value of U.S. profits.

- Capital Expenditure Risk: Exchange rate changes can alter the Canadian dollar cost of U.S.-based capital investments.

- 2023 Sensitivity: A 1 cent USD/CAD movement was estimated to affect net earnings by around $20 million in 2023.

Challenges in Achieving Interim GHG Reduction Targets

Fortis faces challenges in meeting its interim greenhouse gas (GHG) reduction targets, specifically a 50% reduction by 2030 and 75% by 2035. These targets, while ambitious, are subject to potential delays due to several key factors.

Significant load growth, meaning increased demand for energy, can complicate efforts to transition to lower-emission sources. Additionally, ensuring customer affordability during this transition is a critical consideration that may influence the speed of decarbonization initiatives. The pace at which clean energy technologies develop and become readily deployable also plays a crucial role in the feasibility of hitting these interim milestones. For instance, while Fortis has a robust capital plan, the actual deployment of new renewable capacity is subject to supply chain and regulatory timelines.

- Load Growth: Increased energy demand can strain existing infrastructure and slow the pace of replacing high-emission sources.

- Customer Affordability: Balancing emission reduction costs with customer budgets is a significant constraint.

- Technology Pace: The speed of innovation and deployment of clean energy solutions directly impacts decarbonization timelines.

Fortis's profitability is subject to regulatory approvals, which can lead to delays in passing on increased operating costs to customers, potentially impacting margins. Changes to the authorized rate of return on equity (ROE) directly influence earnings potential, as seen with a reduction in ROE from 9.0% to 8.5% in a key market.

The company's substantial capital expenditure plans, estimated at $26 billion, necessitate significant debt financing, increasing its sensitivity to interest rate fluctuations. Rising borrowing costs in 2024-2025 could compress profit margins and affect the company's ability to fund growth or maintain dividends.

Currency exchange rate volatility, particularly between the USD and CAD, poses a risk to Fortis's reported earnings and capital project costs. A 1-cent shift in the USD/CAD exchange rate was estimated to impact net earnings by approximately $20 million in 2023.

Meeting ambitious interim greenhouse gas reduction targets by 2030 and 2035 faces challenges from increasing energy demand (load growth), ensuring customer affordability during the transition, and the pace of clean energy technology deployment.

What You See Is What You Get

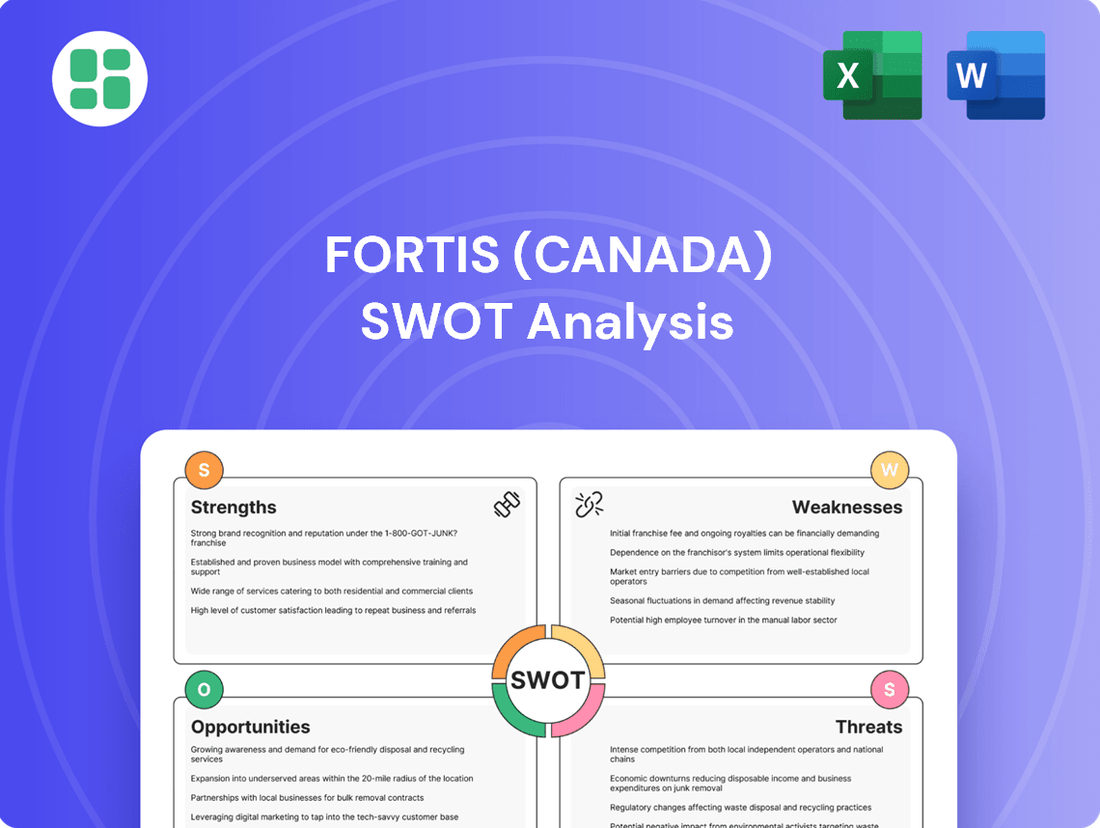

Fortis (Canada) SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It provides a comprehensive overview of Fortis (Canada)'s Strengths, Weaknesses, Opportunities, and Threats. You'll gain valuable insights into the company's strategic position.

Opportunities

The global push towards electrification, driven by climate initiatives and technological advancements, is creating a significant surge in electricity demand. Sectors like transportation, industry, and residential buildings are increasingly adopting electric solutions, directly benefiting utility providers.

Data centers, in particular, are massive electricity consumers, and their rapid expansion is a key driver of load growth. For instance, in 2024, the demand from data centers is projected to account for a substantial portion of new electricity needs, with estimates suggesting they could consume up to 10-15% of global electricity by 2026. This trend is amplified by the growth in artificial intelligence and cloud computing.

Fortis, with its extensive transmission and distribution networks across North America, is strategically positioned to benefit from this burgeoning demand. The company's existing infrastructure provides a robust platform to connect new, high-demand facilities, including large manufacturing plants and the aforementioned data centers, thereby securing future revenue streams.

Significant opportunities exist for Fortis to further invest in expanding the U.S. electric transmission grid, particularly to integrate more clean energy sources. This aligns with the growing demand for renewable energy and the need for a more robust and resilient grid.

Projects such as ITC's MISO Long-Range Transmission Plan (LRTP) Tranche 2.1 represent substantial capital investment prospects extending beyond Fortis's current five-year capital plan. These initiatives are crucial for supporting the broader energy transition and enhancing overall grid reliability.

Fortis has a proven track record of successful strategic acquisitions, a capability that becomes even more potent in a consolidating market. With potential interest rate drops anticipated in 2024 and 2025, the utility sector is ripe for a wave of mergers and acquisitions.

This market dynamic presents Fortis with a prime opportunity to acquire new, well-positioned assets or entire companies. Such moves would directly contribute to expanding its regulated rate base, a key driver of predictable earnings growth, and solidify its already strong market standing.

Investments in Grid Modernization and Climate Adaptation

Fortis is well-positioned to capitalize on the increasing demand for grid modernization and climate adaptation. With rising energy needs and more frequent extreme weather events, there's a significant push for resilient infrastructure. Fortis's ongoing investments in upgrading its systems directly address these challenges, creating substantial opportunities for growth and enhanced service reliability.

The company's proactive approach to climate adaptation is a key strength. By enhancing its infrastructure to withstand climate impacts, Fortis is not only ensuring uninterrupted energy delivery but also unlocking new avenues for investment. For instance, Fortis announced capital expenditures of approximately $24.6 billion between 2024 and 2028, with a significant portion allocated to regulated capital investments aimed at enhancing reliability and sustainability.

- Grid Modernization: Fortis is investing in advanced technologies to improve grid efficiency and reliability, crucial for meeting growing energy demand.

- Climate Resilience: Upgrades are focused on protecting infrastructure from extreme weather, ensuring consistent service delivery.

- Investment Opportunities: These infrastructure enhancements create new avenues for capital deployment and long-term value creation.

- Regulatory Support: Investments in modernization and resilience often receive favorable regulatory treatment, supporting financial returns.

Development of Renewable Natural Gas and LNG Infrastructure

Fortis has a significant opportunity to expand its involvement in renewable natural gas (RNG) and liquefied natural gas (LNG) infrastructure, especially in British Columbia. This strategic move supports Canada's broader decarbonization efforts and addresses the growing need for diverse energy sources. By investing in these areas, Fortis can tap into new revenue streams and solidify its position as a key energy provider in a changing market.

The development of RNG, often produced from organic waste, offers a pathway to reduce greenhouse gas emissions from the natural gas sector. Simultaneously, expanding LNG infrastructure is crucial for meeting both domestic and international energy demands, particularly as countries transition away from higher-carbon fuels. Fortis's existing natural gas distribution network provides a strong foundation for these growth initiatives.

For instance, in 2023, FortisBC, a subsidiary of Fortis, announced plans to invest approximately $400 million in its natural gas distribution system, which includes projects that could support RNG integration. The global LNG market is projected to continue its growth trajectory, driven by energy security concerns and the need for cleaner-burning fuels, presenting a compelling case for Fortis to bolster its LNG capabilities.

- Renewable Natural Gas (RNG) Development: Focus on capturing methane from sources like landfills and agricultural waste, converting it into a usable energy source.

- LNG Infrastructure Expansion: Investing in facilities and transportation for liquefied natural gas to meet increasing demand and support export markets.

- Decarbonization Alignment: These ventures directly contribute to reducing carbon intensity in the energy sector, aligning with national and international climate goals.

- Energy Diversification: Broadening Fortis's energy portfolio beyond traditional natural gas and electricity, creating a more resilient business model.

Fortis is poised to benefit from increasing electricity demand driven by electrification and data center growth, with data centers potentially consuming 10-15% of global electricity by 2026. The company's extensive infrastructure allows for connection of new high-demand facilities, securing future revenue. Furthermore, opportunities exist to invest in expanding the U.S. electric transmission grid to integrate more clean energy, as highlighted by projects like ITC's MISO LRTP Tranche 2.1.

Strategic acquisitions are a significant opportunity for Fortis, especially with anticipated interest rate drops in 2024-2025 stimulating utility sector M&A. This allows for expansion of its regulated rate base, driving predictable earnings. Fortis's proactive investments in grid modernization and climate resilience, totaling approximately $24.6 billion between 2024-2028, address rising energy needs and extreme weather, creating growth avenues and enhancing service reliability. Investments in grid modernization and resilience often receive favorable regulatory treatment, supporting financial returns.

Fortis can expand into renewable natural gas (RNG) and liquefied natural gas (LNG) infrastructure, particularly in British Columbia, supporting decarbonization and energy diversification. FortisBC's planned $400 million investment in its natural gas system in 2023 includes RNG integration projects. The global LNG market's growth, driven by energy security, presents a compelling case for Fortis to bolster its LNG capabilities.

| Opportunity Area | Description | 2024-2028 Capital Plan Allocation (Approx.) | Key Driver |

|---|---|---|---|

| Electrification & Data Centers | Increased electricity demand from EVs, industry, and AI-driven data centers. | Significant portion of $24.6 billion | Global climate initiatives, AI growth |

| Transmission Grid Expansion | Integrating clean energy sources and enhancing grid reliability. | Included in $24.6 billion | Energy transition, grid resilience needs |

| Strategic Acquisitions | Acquiring new assets or companies to expand regulated rate base. | N/A (opportunistic) | Market consolidation, anticipated rate drops |

| RNG & LNG Infrastructure | Developing RNG from waste and expanding LNG capacity. | $400 million (FortisBC 2023 plans) | Decarbonization, energy security |

Threats

Changes in regulatory frameworks pose a significant threat to Fortis. Unfavorable rate case outcomes, stricter environmental regulations, or new government tariffs could directly impact profitability and the ability to recover capital investments. For instance, a shift towards more aggressive climate policies might necessitate substantial, unplanned capital expenditures for Fortis's utility operations.

While regulatory processes are in place to manage these changes, unexpected policy shifts can introduce uncertainty. Such shifts could lead to increased operating costs or a reduction in the allowed rate of return on equity, directly affecting Fortis's financial performance and investor returns, as seen in past regulatory reviews where allowed returns were adjusted.

Persistent inflation and anticipated further interest rate hikes by the Bank of Canada, projected to remain elevated through 2024 and potentially into 2025, pose a significant threat to Fortis. These economic conditions will likely increase the cost of borrowing, impacting Fortis's ability to finance its considerable capital expenditure plans, which are crucial for infrastructure upgrades and expansion.

Higher borrowing costs could directly compress Fortis's profit margins. For instance, if interest rates on new debt rise by 1% or more, it could add tens of millions to annual interest expenses, potentially reducing the cash available for dividend payouts, a key attraction for utility investors.

This scenario may also lead to a reassessment of the investment attractiveness of utility stocks like Fortis. Investors might seek higher yields elsewhere, or demand a greater risk premium, potentially impacting Fortis's stock valuation and its cost of equity capital.

Fortis's vast network of utility infrastructure, including power lines and pipelines, faces increasing threats from climate change. More frequent and severe weather events, such as hurricanes and wildfires, can cause substantial damage to these physical assets, leading to costly repairs and extended service outages. For instance, in 2023, extreme weather events across North America resulted in billions of dollars in infrastructure damage for utility companies, a trend expected to continue and potentially worsen.

These physical disruptions directly impact Fortis's operational reliability and financial health. Significant capital expenditures will be required for climate resilience and adaptation measures, potentially straining earnings and impacting dividend growth. The company's ability to maintain consistent service delivery and manage these escalating repair costs will be critical in navigating these climate-related challenges.

Competitive Pressure on Returns

Fortis, operating within a regulated utility sector, still encounters significant competitive pressure impacting its return on assets (ROA). This pressure stems from other utility companies that may achieve superior financial performance, potentially influencing investor perception and the company's market valuation.

The competitive environment can make it difficult for Fortis to consistently enhance its profitability. For instance, if peer utilities demonstrate higher ROA figures, it could signal to investors that Fortis is less efficient or offers a lower return on their investment, thereby impacting its stock price and ability to attract capital.

- Competitive ROA Pressure: Fortis faces pressure on its ROA from other utilities, even in a regulated market.

- Impact on Profitability: A competitive landscape can hinder the maintenance or improvement of profitability if rivals outperform on key financial metrics.

- Investor Sentiment: Underperformance relative to peers can negatively affect investor sentiment and the company's overall valuation.

Cybersecurity Risks and Infrastructure Security

Fortis, as a critical infrastructure operator, faces escalating cybersecurity risks. The utility sector is a prime target for sophisticated cyberattacks, which could lead to operational disruptions, data breaches, and equipment damage. For instance, the Canadian Centre for Cyber Security reported a rise in state-sponsored cyber threats targeting critical infrastructure in 2024.

A successful cyberattack on Fortis could result in substantial financial losses due to service interruptions and recovery costs. Beyond direct financial impact, the reputational damage and potential regulatory penalties, such as those under Canada's Critical Infrastructure Protection Act, could be severe. Fortis's capital plan acknowledges ongoing investments in cybersecurity and infrastructure resilience to mitigate these threats.

The continuous evolution of cyber threats necessitates ongoing, significant investment in cybersecurity measures. This is a persistent operational cost, not a one-time fix. For example, industry reports from 2024 indicate that utility companies are allocating an increasing portion of their IT budgets to cybersecurity solutions to stay ahead of emerging threats.

- Increased Sophistication of Cyber Threats: Utility companies like Fortis are increasingly targeted by advanced persistent threats (APTs) and ransomware attacks.

- Potential for Widespread Disruption: A successful attack could cripple essential services, impacting millions of customers and the broader economy.

- Significant Financial and Reputational Costs: Breaches can lead to substantial fines, legal liabilities, and long-term damage to public trust.

- Ongoing Investment Requirements: Fortis must continually invest in advanced security technologies and skilled personnel to defend against evolving cyber risks.

The ongoing threat of interest rate hikes, with the Bank of Canada expected to maintain a higher rate environment through 2024 and into 2025, directly impacts Fortis's financing costs for its substantial capital expenditures. This increased cost of borrowing could compress profit margins, potentially affecting the company's ability to fund growth initiatives and maintain its dividend appeal.

Fortis's extensive infrastructure is vulnerable to more frequent and severe weather events, driven by climate change. Damage from storms, wildfires, or floods can lead to costly repairs, service disruptions, and necessitate significant capital investment in resilience measures, impacting operational reliability and financial performance.

Escalating cybersecurity risks pose a significant threat, as utility sectors are prime targets for sophisticated cyberattacks. A successful breach could result in operational disruptions, data loss, and substantial financial and reputational damage, requiring continuous investment in advanced security defenses.

Changes in regulatory frameworks, including potential shifts in environmental policies or adjustments to allowed rates of return, introduce uncertainty. Unfavorable outcomes in rate cases or new government regulations could directly impact Fortis's profitability and its capacity to recover capital investments.

SWOT Analysis Data Sources

This Fortis SWOT analysis is built upon a foundation of credible data, including their official financial statements, comprehensive market research reports, and expert industry analysis to provide a robust understanding of their strategic position.