Fortis (Canada) Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fortis (Canada) Bundle

Fortis (Canada)'s position within the utility sector is shaped by moderate rivalry, significant capital requirements, and a strong but not insurmountable threat from substitutes. Understanding the interplay of these forces is crucial for assessing its long-term viability and growth potential.

The complete report reveals the real forces shaping Fortis (Canada)’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Fortis Inc. depends on suppliers for essential infrastructure like turbines and advanced grid technologies, impacting its operational costs. The bargaining power of these specialized equipment providers can be significant, particularly when their technology is proprietary or has few substitutes, potentially driving up Fortis's capital expenditures.

In 2024, the demand for advanced grid modernization technologies, crucial for utility resilience and efficiency, remained robust. Suppliers offering cutting-edge solutions in areas like smart metering and grid automation likely commanded higher prices due to the specialized nature of their offerings and the critical need for these upgrades across the utility sector.

Fortis relies on natural gas for a significant portion of its electricity generation and distribution operations. The bargaining power of natural gas suppliers can influence Fortis's operating costs, especially given the volatility in global commodity markets. For instance, in 2024, natural gas prices experienced fluctuations, impacting the cost of fuel for power plants.

However, Fortis's regulated business model often permits the recovery of fuel costs through rate adjustments, effectively passing these expenses onto consumers. This regulatory mechanism mitigates the direct impact of supplier price hikes on Fortis's profit margins. Nevertheless, persistently elevated fuel prices could still invite regulatory review and potential pressure to absorb some of these costs.

The utility sector, including Fortis, relies heavily on a specialized and skilled workforce for everything from daily operations and crucial maintenance to ambitious new infrastructure developments. This need for expertise is a key factor influencing labor dynamics.

Labor unions, especially those representing specific trades within the utility industry, can wield considerable bargaining power. Through collective agreements and the potential threat or execution of strikes, these unions can significantly impact Fortis's operational continuity and labor expenses. For instance, in 2024, the average wage for a utility worker in Canada saw an increase, reflecting ongoing labor market pressures.

Fortis's strategic approach to attracting and retaining top-tier talent is therefore paramount. By offering competitive compensation, robust training programs, and a positive work environment, Fortis can better manage the bargaining power of its skilled workforce and mitigate potential disruptions.

Construction and Engineering Services

Fortis, with its ambitious $26 billion capital plan for 2025-2029, heavily relies on construction and engineering services for its extensive infrastructure projects. This significant investment fuels demand for these specialized firms, potentially increasing their leverage.

The bargaining power of construction and engineering suppliers for Fortis can be considerable, particularly for projects demanding unique expertise and advanced capabilities. The current robust market for utility infrastructure development further amplifies this power.

- High Demand: The booming utility infrastructure sector means many companies are vying for skilled construction and engineering resources, giving suppliers more pricing power.

- Specialized Expertise: Fortis’s complex infrastructure needs often require highly specialized engineering and construction skills, which are not readily available from a large pool of suppliers.

- Project Scale: The sheer size of Fortis's capital plan means suppliers who can handle large-scale, multi-year projects are in a strong negotiating position.

Regulatory Impact on Supplier Costs

Suppliers to regulated utilities like Fortis often find their pricing power constrained by regulatory bodies. These regulators scrutinize costs to ensure fair rates for consumers, which can cap how much suppliers can increase prices. For instance, in 2024, regulatory decisions on capital expenditures for grid modernization projects directly influenced the pricing of components and services supplied to Fortis's various operating utilities.

However, evolving regulations can introduce new cost pressures. Stricter environmental mandates, such as those related to emissions or renewable energy integration, can necessitate higher compliance costs for suppliers. These increased operational expenses may then be passed on to Fortis, potentially impacting the bargaining power of these suppliers.

- Regulatory Oversight: Regulators can limit supplier price hikes to protect consumers.

- Compliance Costs: New environmental or safety rules can increase supplier expenses.

- Cost Pass-Through: Suppliers may pass these higher costs onto Fortis.

- Impact on Bargaining: This dynamic can shift the balance of supplier bargaining power.

The bargaining power of Fortis's suppliers is a critical factor influencing its operational costs and capital expenditures. Specialized equipment providers, particularly those with proprietary technology, can exert significant influence, as seen with the robust demand for grid modernization in 2024. Similarly, natural gas suppliers' pricing power directly impacts Fortis's fuel costs, though regulatory mechanisms often allow for cost recovery.

The utility sector’s reliance on specialized labor means unions can wield considerable power, impacting wages and operational continuity, as evidenced by rising worker wages in 2024. For Fortis’s extensive capital plans, construction and engineering firms with unique expertise are in a strong negotiating position due to high demand. However, regulatory oversight often tempers supplier price increases, although evolving compliance costs can shift this balance.

| Supplier Type | Key Factors Influencing Bargaining Power | 2024 Relevance/Impact |

|---|---|---|

| Specialized Equipment Providers | Proprietary technology, limited substitutes, high demand for grid modernization | Robust demand for smart metering and grid automation drove higher prices for advanced solutions. |

| Natural Gas Suppliers | Commodity market volatility, reliance on gas for generation | Fluctuations in natural gas prices impacted fuel costs; regulatory recovery mechanisms mitigated direct profit margin impact. |

| Labor (Skilled Trades) | Unionization, demand for specialized skills, collective bargaining agreements | Average wages for utility workers increased in 2024, reflecting labor market pressures and union influence. |

| Construction & Engineering Services | Project scale, specialized expertise, overall market demand for infrastructure development | Fortis's $26 billion capital plan (2025-2029) amplified demand, strengthening suppliers' negotiating positions. |

What is included in the product

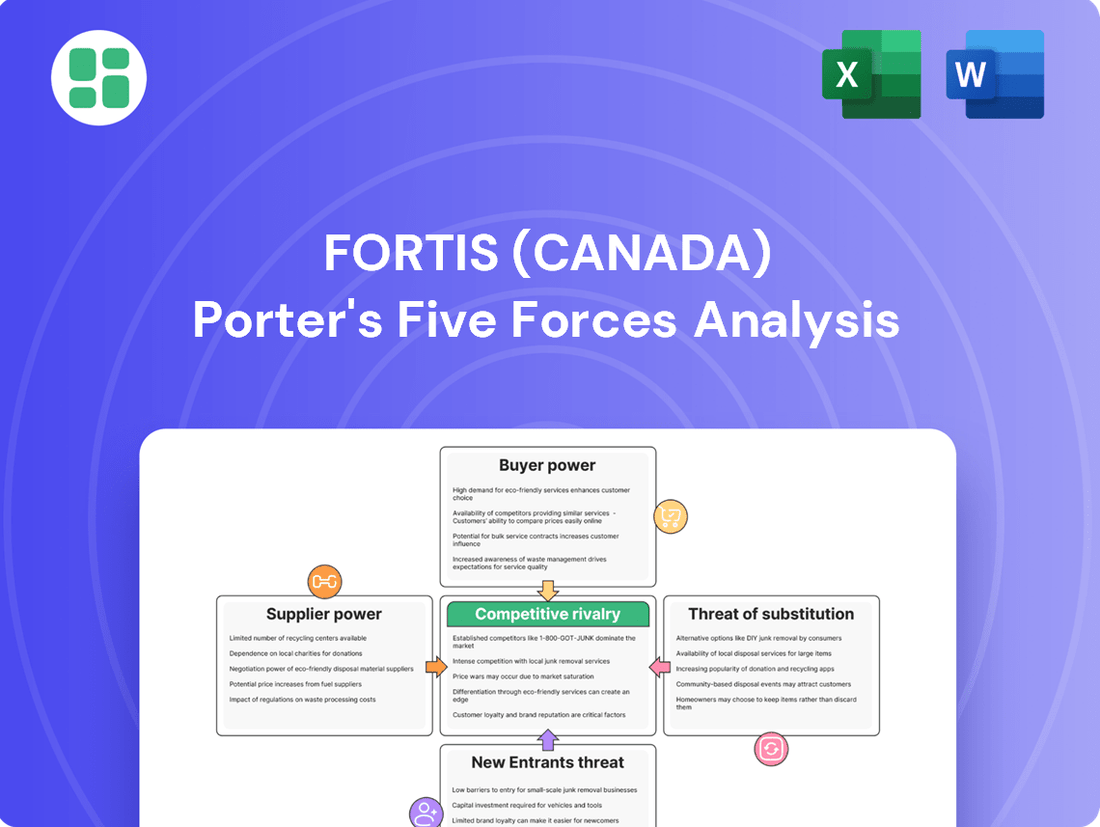

This analysis tailors Porter's Five Forces to Fortis (Canada), examining the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes on its utility and energy infrastructure operations.

Instantly gauge competitive intensity by visualizing Fortis's Porter's Five Forces, highlighting key threats and opportunities.

Customers Bargaining Power

Fortis, as a regulated utility, often enjoys a natural monopoly in its service areas. This means customers in its Canadian, U.S., and Caribbean territories typically have no other choice for essential electricity and natural gas.

This absence of direct alternatives severely limits the bargaining power of Fortis's customers. They cannot easily switch to a competitor if they are unhappy with pricing or service terms, giving Fortis considerable leverage.

Customer rates for Fortis's essential utility services are largely dictated by independent regulatory bodies, such as the Public Utilities Board in Newfoundland and Labrador or the Alberta Utilities Commission. This means customers cannot directly negotiate prices; instead, rates are set through a formal process designed to ensure Fortis can recover its costs and earn a regulated rate of return, typically in the single digits for equity. For instance, in 2024, Fortis continued to navigate rate applications across its various jurisdictions, with approved rate base growth contributing to its revenue stability.

While Fortis (Canada) customers can't directly switch providers, their bargaining power is indirectly shaped by their ability to manage their energy consumption. For instance, widespread adoption of energy-efficient appliances or smart home technology can reduce overall demand. This shift can pressure utilities like Fortis to be more mindful of affordability during rate increase requests, as seen in discussions around the impact of conservation efforts on utility revenue models.

Customer Advocacy Groups

Customer advocacy groups can influence Fortis by collectively voicing concerns during public utility commission hearings. These groups, often representing residential and commercial customers, can challenge proposed rate increases and push for improved service standards or environmental policies. For instance, in 2024, various consumer advocacy organizations actively participated in regulatory proceedings across Fortis's operating territories, scrutinizing proposed capital expenditure plans and their impact on customer bills. Their organized efforts provide a unified front, amplifying the bargaining power that individual customers would otherwise lack.

The collective action of these groups can lead to more favorable outcomes for consumers. They can negotiate for better service level agreements, advocate for the adoption of sustainable energy practices, and scrutinize the necessity and cost-effectiveness of proposed infrastructure upgrades. This organized pressure can sometimes result in modified rate structures or commitments to service improvements that benefit a broad customer base, directly impacting Fortis's operational and financial strategies.

Key impacts of customer advocacy groups on Fortis include:

- Regulatory Scrutiny: Advocacy groups frequently engage with public utility commissions, influencing decisions on rate adjustments and service standards.

- Service Quality Demands: They can lobby for enhanced reliability and responsiveness, pushing Fortis to invest in grid modernization and customer service improvements.

- Sustainability Initiatives: Groups often champion renewable energy integration and environmental stewardship, prompting Fortis to consider more sustainable operational strategies.

Distributed Generation and Energy Efficiency

The increasing adoption of distributed generation, such as rooftop solar, and enhanced energy efficiency measures are empowering customers. This trend allows them to generate their own power and reduce consumption, lessening their dependence on traditional utility providers. For instance, by mid-2024, Canada saw a continued upward trend in residential solar installations, with provinces like Ontario leading the way in adopting these technologies.

This shift in customer behavior directly impacts the bargaining power of customers for utilities like Fortis. As more customers become energy self-sufficient, they have less need for the full suite of services offered by the utility. This can translate into reduced demand for grid-supplied electricity, potentially weakening the utility's pricing power and forcing them to innovate their service offerings to remain competitive.

- Increased Customer Autonomy: Distributed energy resources (DERs) like rooftop solar and energy efficiency improvements grant customers greater control over their energy supply and costs.

- Reduced Reliance on Grid: As customers become more self-sufficient, their reliance on utility-provided electricity diminishes, potentially impacting demand and revenue for traditional utility services.

- Pressure on Business Models: Utilities face pressure to adapt their business models, potentially offering new services or pricing structures to retain customers in an evolving energy landscape.

- Market Adaptation: By mid-2024, the growth in DERs indicated a clear market signal for utilities to explore new strategies beyond traditional power generation and distribution.

Fortis's customers generally have low bargaining power due to the regulated, often monopolistic nature of utility services, limiting direct competition. While individual customers cannot negotiate rates, their collective influence through advocacy groups and changing consumption patterns indirectly impacts Fortis. The trend towards distributed energy resources, like rooftop solar, further empowers consumers by reducing their reliance on traditional utility services. For example, by mid-2024, Canada saw continued growth in residential solar installations, particularly in provinces like Ontario, indicating a shift towards greater customer energy autonomy.

Customer advocacy groups play a crucial role by participating in regulatory proceedings, influencing rate decisions and service standards. These groups, active in 2024 across Fortis's jurisdictions, scrutinize capital expenditures and advocate for consumer interests, impacting Fortis's operational strategies and financial planning.

The increasing adoption of energy efficiency measures and distributed generation empowers customers to reduce their consumption and dependence on utilities. This trend pressures Fortis to adapt its business models and service offerings to remain competitive in an evolving energy landscape.

| Factor | Impact on Fortis Customers | 2024 Context/Data |

|---|---|---|

| Limited Competition | Low bargaining power for individual customers. | Fortis operates as a regulated utility with natural monopolies in many Canadian, US, and Caribbean territories. |

| Regulatory Oversight | Rates set by commissions, not direct negotiation. | Fortis navigated rate applications in 2024, with approved rate base growth supporting revenue. |

| Customer Advocacy Groups | Collective influence on rates and service. | Groups actively participated in 2024 regulatory hearings, challenging rate increases and scrutinizing capital plans. |

| Distributed Energy Resources (DERs) | Increased customer autonomy and reduced utility reliance. | Continued upward trend in residential solar installations in Canada by mid-2024, especially in Ontario. |

What You See Is What You Get

Fortis (Canada) Porter's Five Forces Analysis

This preview shows the exact Fortis (Canada) Porter's Five Forces Analysis you'll receive immediately after purchase—no surprises, no placeholders. It delves into the competitive landscape, examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the industry. This comprehensive document is ready for your immediate use.

Rivalry Among Competitors

Fortis operates within geographically segmented markets, primarily in regulated service territories across North America. This structure inherently limits direct head-to-head competition for the same customer base within specific regions, as regulatory frameworks often grant exclusive franchises. For instance, FortisBC operates as the sole natural gas distributor in British Columbia, and its electricity distribution service is also largely exclusive within its service areas.

The utility sector, including Fortis's operations, is characterized by stringent regulatory oversight that significantly curtails direct competition. These regulations, which dictate everything from pricing to service standards, act as substantial barriers to entry, effectively preventing new players from easily entering the market and engaging in aggressive tactics like price wars.

Regulatory bodies like the Public Utilities Commission in various jurisdictions ensure that utilities can recover their costs and achieve a reasonable return on investment. This focus on cost recovery and fair returns, rather than fostering open market competition, means that utilities are less incentivized to engage in head-to-head battles for market share through aggressive pricing.

For instance, in 2023, Fortis’s regulated utilities, which represent a substantial portion of its business, operated under frameworks that limited the scope for direct competitive actions. The approved rate base for Fortis in 2023 was approximately $34.5 billion, reflecting the capital-intensive nature of the industry and the regulatory approvals required for such investments.

While Fortis doesn't face direct competition for its utility services from other companies, it absolutely competes in the financial markets for capital. Think of it like this: many large utility companies are all looking to fund significant infrastructure upgrades and expansions. Fortis needs to attract investors, and so do its peers.

This competition for investment dollars means Fortis must consistently demonstrate robust financial health and a clear path to stable earnings. For instance, the company's guidance for 4-6% annual dividend growth through 2029 is a key factor in attracting and retaining investors who value predictable income streams. This focus on financial performance is crucial when competing against other utility giants vying for the same investor attention and capital.

Benchmarking and Operational Efficiency

Utilities like Fortis are often benchmarked by regulators and investors against industry peers. This indirect competition pushes Fortis to excel in operational efficiency and reliability. For instance, in 2023, Fortis reported a Return on Equity of 9.1%, a metric closely watched by investors assessing performance relative to other utility companies.

Maintaining high operational efficiency is crucial for Fortis to demonstrate its value proposition. This includes minimizing service disruptions and managing costs effectively. In 2024, Fortis continued its focus on infrastructure upgrades, aiming to improve system reliability and reduce operational expenditures.

- Benchmarking: Regulators and investors use performance metrics to compare utilities, driving Fortis towards higher operational standards.

- Operational Efficiency: Fortis aims to optimize its processes to reduce costs and enhance service delivery, a key factor in its 2024 strategic priorities.

- Reliability: Maintaining a consistent and dependable energy supply is a critical performance indicator that Fortis strives to uphold.

- Customer Satisfaction: High levels of customer satisfaction are a direct reflection of operational effectiveness and are actively monitored.

M&A Activity within the Utility Sector

Mergers and acquisitions (M&A) are a significant driver of competitive rivalry in the utility sector, as companies like Fortis strategically pursue growth. This activity allows utilities to expand their regulated asset base, a key metric for revenue generation, and achieve greater economies of scale. For instance, in 2023, the North American utility sector saw substantial M&A, with deals valued in the tens of billions of dollars, as companies aimed to consolidate operations and enhance efficiency.

Fortis, as a diversified utility leader, actively participates in this M&A landscape. The company's history includes major acquisitions, such as the 2016 purchase of ITC Holdings for approximately $11.3 billion, which significantly expanded its transmission infrastructure. This strategic M&A demonstrates how competitive expansion within the sector directly impacts established players.

- Sector Consolidation: M&A activity is a primary method for utilities to consolidate, aiming for larger regulated asset bases and improved operational efficiencies.

- Economies of Scale: Acquisitions enable companies to spread fixed costs over a larger operational footprint, potentially leading to cost savings and increased profitability.

- Fortis's Strategic Growth: Fortis utilizes M&A as a core strategy to expand its regulated asset base and geographic reach across North America.

- Market Impact: Significant M&A deals, like Fortis's past transactions, reshape the competitive landscape and influence market dynamics for all utility operators.

Competitive rivalry for Fortis is largely indirect, stemming from its regulated market structure which limits direct competition for customers. Instead, rivalry manifests in the financial markets for capital and through benchmarking against peers on operational efficiency and reliability. Mergers and acquisitions also play a significant role, as companies like Fortis strategically consolidate to grow their regulated asset bases and achieve economies of scale.

| Competitive Factor | Fortis's Position/Strategy | 2023/2024 Relevance |

|---|---|---|

| Direct Customer Competition | Limited due to regulated, exclusive service territories. | FortisBC operates as a sole natural gas distributor in BC. |

| Competition for Capital | Fortis competes with other utilities for investor funding. | Guidance for 4-6% annual dividend growth through 2029 aims to attract investors. |

| Operational Benchmarking | Fortis is benchmarked against peers on efficiency and reliability. | Reported Return on Equity of 9.1% in 2023, a key investor metric. |

| Mergers & Acquisitions | Fortis uses M&A for strategic growth and consolidation. | Sector saw billions in M&A in 2023; Fortis aims to expand regulated asset base. |

SSubstitutes Threaten

The increasing affordability and accessibility of distributed renewable energy, particularly rooftop solar, pose a significant threat to Fortis. In 2024, the global installed solar capacity continued its upward trajectory, with significant growth in residential installations in North America. This allows customers to generate their own power, reducing their reliance on traditional grid electricity supplied by Fortis.

While distributed solar and wind often still require grid connection for backup or selling excess power, they represent a growing alternative to complete grid dependency. This trend could lead to lower overall electricity demand from Fortis's customer base, impacting revenue streams for the utility.

Advancements in energy efficiency and conservation present a significant threat of substitutes for Fortis. For instance, in 2024, Canadian households continued to adopt more energy-efficient appliances and improved insulation, directly reducing their reliance on purchased electricity and natural gas. This trend directly impacts Fortis's potential for load growth, as customers consuming less effectively substitute traditional energy use with smarter consumption patterns.

Advancements in battery storage technology present a significant threat of substitutes for traditional utility services like Fortis. Customers can now store energy from the grid during off-peak times or from their own renewable sources, like solar panels, for later use. This capability allows them to reduce reliance on continuous grid supply, especially during peak demand periods or power outages.

This shift directly challenges utility revenue models that depend on consistent energy consumption from the grid. For instance, the global battery energy storage system market was valued at approximately $30 billion in 2023 and is projected to grow substantially. This growth indicates increasing customer adoption of alternative energy solutions, potentially impacting Fortis's traditional customer base and revenue streams.

Alternative Heating/Cooling Technologies

The threat of substitutes for Fortis' natural gas distribution business primarily comes from alternative heating and cooling technologies. As electrification gains momentum, technologies like electric heat pumps and geothermal systems present viable options for customers seeking to move away from natural gas. This shift directly impacts the demand for natural gas, posing a long-term challenge.

These alternative technologies are becoming increasingly competitive. For instance, by the end of 2023, Canada saw a significant increase in heat pump installations, with provincial and federal incentives driving adoption. The efficiency and environmental benefits of these systems are key drivers, making them attractive substitutes for traditional natural gas heating.

- Electric Heat Pumps: These systems are becoming more efficient and cost-effective, especially in milder climates.

- Geothermal Systems: While having a higher upfront cost, geothermal systems offer stable, low operating costs and environmental benefits.

- Other Non-Combustion Solutions: Advancements in solar thermal and biomass heating also provide alternatives, though their market penetration varies.

- Government Policies: Incentives for energy efficiency and carbon reduction are accelerating the adoption of these substitute technologies.

Microgrids and Energy Independence

The rise of microgrids presents a compelling threat of substitutes for traditional utility services, including those provided by Fortis. These localized energy systems can generate and distribute power independently, offering enhanced reliability and control. For instance, in 2024, the global microgrid market was valued at approximately USD 35 billion, with projections indicating substantial growth, driven by demand for energy resilience.

Communities and large industrial users are increasingly exploring microgrids to reduce reliance on the main grid. This trend is particularly pronounced in areas prone to grid instability or extreme weather events. While initial investment can be significant, the long-term benefits of energy independence and potential cost savings make microgrids an attractive alternative, especially for critical infrastructure sectors.

- Microgrid Market Growth: The global microgrid market reached an estimated USD 35 billion in 2024.

- Key Drivers: Energy resilience, grid stability concerns, and the desire for energy independence are primary motivators.

- Substitute Potential: Microgrids offer a direct alternative to centralized utility power supply for end-users.

- Industry Adoption: Critical infrastructure sectors are leading the adoption of microgrid technology.

The threat of substitutes for Fortis is significant, driven by advancements in distributed generation and energy efficiency. Rooftop solar, energy storage systems, and electric heating alternatives like heat pumps directly reduce customer reliance on traditional utility services. The increasing adoption of these technologies, fueled by falling costs and government incentives, creates a clear substitute for Fortis's core offerings.

| Substitute Technology | Impact on Fortis | 2024/2023 Data Point |

|---|---|---|

| Distributed Solar (Rooftop) | Reduced electricity demand from grid | Global installed solar capacity continued strong growth in residential sector. |

| Battery Energy Storage | Decreased reliance on continuous grid supply | Global battery energy storage market valued around $30 billion in 2023. |

| Electric Heat Pumps | Reduced natural gas demand | Significant increase in heat pump installations in Canada by end of 2023. |

| Microgrids | Potential for energy independence from main grid | Global microgrid market estimated at USD 35 billion in 2024. |

Entrants Threaten

The electric and gas utility sector, where Fortis operates, demands massive upfront capital for essential infrastructure like power generation facilities, extensive transmission lines, and robust distribution grids. This inherently creates a very high barrier to entry for any new companies looking to compete.

For instance, Fortis itself has outlined a substantial capital plan of approximately $26 billion for the period of 2025 through 2029. This significant financial commitment underscores the enormous investment required to establish and maintain operations, effectively deterring most potential new entrants due to the sheer scale of the financial resources needed.

New entrants into the utility sector, like the one Fortis operates in, must navigate a maze of complex regulatory approvals and licensing. This process is not only lengthy but also involves securing permits from federal, provincial, and local governing bodies. For instance, in 2024, the average time for obtaining major infrastructure permits in Canada could extend over several years, significantly increasing the upfront investment and risk for potential competitors.

These stringent regulatory frameworks, while intended to ensure service reliability and affordability for consumers, act as a significant barrier to entry. They are meticulously designed to safeguard the stability of existing utility providers, such as Fortis, effectively shielding them from the immediate threat of new market participants. This established regulatory moat means that any new entity would face substantial hurdles in simply gaining the legal right to operate and compete.

Fortis benefits significantly from its vast, established transmission and distribution infrastructure, a network painstakingly built over many years and serving millions of customers across North America. The sheer scale and complexity of this existing system make it incredibly difficult and expensive for newcomers to replicate.

The cost to build a comparable network from scratch would be astronomical, easily running into billions of dollars. Furthermore, navigating the intricate web of regulatory approvals, land acquisition, and environmental permits required for such an undertaking presents substantial legal and logistical hurdles, effectively deterring most potential entrants.

Economies of Scale and Scope

Incumbent utilities like Fortis benefit from substantial economies of scale and scope across power generation, transmission, and distribution. Their established, broad customer base enables cost-effective operations and efficient asset utilization. For instance, Fortis's extensive transmission network, spanning over 57,000 kilometers of U.S. and Canadian electric transmission infrastructure as of 2023, provides a significant cost advantage.

These scale advantages make it challenging for new entrants to compete on price. Entering the market would necessitate enormous initial capital investment and the rapid acquisition of significant market share to achieve comparable cost efficiencies, a hurdle most new players cannot overcome.

- Economies of Scale: Fortis's large operational footprint reduces per-unit costs in power generation and delivery.

- Economies of Scope: Diversified operations across different energy sectors allow for cost sharing and efficiency gains.

- Capital Intensity: The high cost of building new infrastructure acts as a significant barrier to entry.

- Customer Base: Fortis's existing customer relationships and established service areas are difficult for new entrants to replicate.

Public Utility Commissions and Franchises

Public Utility Commissions (PUCs) and the franchise system create a significant barrier to new entrants for companies like Fortis (Canada). In many regions, utilities are granted exclusive rights to operate within specific geographic areas, effectively creating a monopoly. This government-sanctioned structure makes it exceptionally difficult for any new company to establish a competing infrastructure and service the same customer base.

These regulatory bodies oversee the operations of existing utilities, setting rates and service standards. For a new entrant to challenge this established order, they would need to navigate a complex and often lengthy approval process, demonstrating both the need for their service and their ability to meet stringent regulatory requirements. This process is designed to protect existing investments and ensure reliable service, inherently limiting competition.

- Monopoly Protection: Franchises granted by governments to utilities like Fortis often provide exclusive operating rights, severely limiting the threat of new entrants.

- Regulatory Hurdles: Public Utility Commissions impose strict regulations and approval processes, making market entry for competitors extremely challenging and costly.

- Infrastructure Investment: The substantial capital required to build duplicate utility infrastructure, such as power lines or gas pipelines, acts as a further deterrent to potential new competitors.

The threat of new entrants for Fortis is considerably low due to the sector's extreme capital intensity and stringent regulatory environment. Building the necessary infrastructure, like transmission lines and generation facilities, requires billions of dollars in upfront investment, a cost that deters most potential competitors. For instance, Fortis's planned capital expenditures of approximately $26 billion between 2025 and 2029 highlight the scale of investment involved.

Furthermore, obtaining the necessary regulatory approvals and licenses from various government bodies is a complex and lengthy process, often taking years. This regulatory hurdle, combined with the need to replicate Fortis's extensive existing infrastructure, creates a formidable barrier. As of 2023, Fortis operated over 57,000 kilometers of electric transmission infrastructure in North America, a network that is incredibly difficult and costly for new players to match.

| Barrier Type | Description | Impact on New Entrants |

| Capital Requirements | High cost of building infrastructure (e.g., $26 billion Fortis capex 2025-2029) | Very High Deterrent |

| Regulatory Approvals | Lengthy and complex licensing and permitting processes | Significant Deterrent |

| Existing Infrastructure | Fortis's vast network (57,000+ km transmission) is hard to replicate | High Deterrent |

| Economies of Scale | Fortis's size leads to lower per-unit costs | Moderate Deterrent |

Porter's Five Forces Analysis Data Sources

Our Fortis Porter's Five Forces analysis is built upon a foundation of public company filings, including annual reports and investor presentations, supplemented by industry-specific market research and regulatory data from Canadian energy authorities.