Fortis (Canada) Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fortis (Canada) Bundle

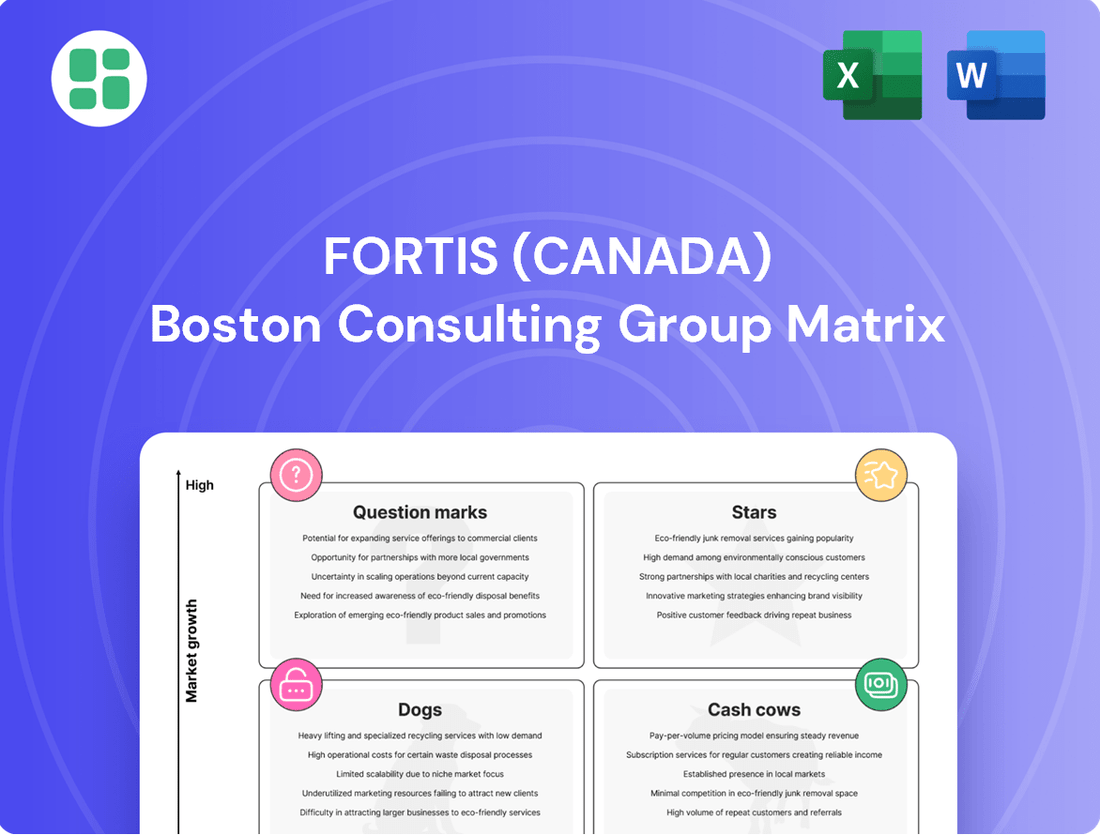

Curious about Fortis (Canada)'s strategic product positioning? Our BCG Matrix preview highlights key areas, but to truly grasp their market dynamics – identifying Stars, Cash Cows, Dogs, and Question Marks – you need the full picture.

Unlock a complete breakdown of Fortis (Canada)'s product portfolio with our comprehensive BCG Matrix. Gain data-backed insights and actionable recommendations to inform your investment and product development strategies.

Don't miss out on the strategic clarity Fortis (Canada)'s full BCG Matrix provides. Understand their competitive edge and where to focus future efforts. Purchase the complete report for a roadmap to informed decision-making.

Stars

Fortis has outlined a significant $26 billion capital plan spanning 2025 through 2029. This ambitious investment strategy is designed to substantially grow its rate base, projecting an increase from $39 billion in 2024 to $53 billion by 2029. This represents a compound annual growth rate of 6.5% for its regulated assets.

These considerable, regulated investments are strategically allocated across Fortis's diverse utility operations in North America and the Caribbean. The focus on infrastructure expansion and modernization is a key factor in ensuring predictable and sustained earnings growth for the company.

This ongoing program of infrastructure development in areas experiencing growth effectively positions these capital projects as high-growth components within the generally stable utility industry. The sustained build-out supports the company's long-term financial objectives.

Fortis's substantial investments in major transmission infrastructure, such as ITC's MISO Long-Range Transmission Plan (Tranche 2.1), position these as Stars within its BCG Matrix. These projects tap into a burgeoning market for grid modernization and interregional transmission, securing high market share in a critical growth area.

These large-scale undertakings are fundamental to bolstering grid reliability and facilitating the integration of new renewable energy sources. They are designed to significantly expand Fortis's rate base, ensuring consistent regulated returns. The MISO LRTP, for instance, anticipates US$3.7 to US$4.2 billion in investments, with the majority slated for deployment after 2029, signaling robust long-term expansion prospects.

Fortis's agreement to supply around 300 MW to an Arizona data center, with possibilities for expansion up to 600-700 MW, underscores a significant opportunity in a high-growth market. This substantial commitment demonstrates Fortis's ability to secure and serve large industrial clients.

Securing these large data center loads indicates a strong market position within this rapidly expanding demand sector. Such connections are crucial for new revenue generation and necessitate considerable infrastructure upgrades, positioning them as vital growth catalysts for the company.

Strategic Renewable Energy Transition Investments

Fortis's strategic renewable energy investments position it favorably for future growth. The conversion of 793 MW of coal-fired generation to natural gas by 2030 is a significant step in decarbonizing its energy mix.

Projects like the Roadrunner Reserve 1 battery storage facility underscore Fortis's commitment to the clean energy transition. These investments are designed to capture substantial market share in the burgeoning renewable energy and storage sectors, operating within supportive regulated frameworks.

- Decarbonization Efforts: Conversion of 793 MW of coal-fired generation to natural gas by 2030.

- Renewable Integration: Investment in battery storage projects like Roadrunner Reserve 1.

- Market Position: Securing high market share in the growing renewable energy and storage market.

- Financial Outlook: Ensuring future revenue streams while meeting environmental targets.

Eagle Mountain Pipeline Project

The Eagle Mountain Pipeline Project represents a significant capital investment for FortisBC Energy, a subsidiary of Fortis Inc. This project is designed to enhance natural gas delivery capacity in British Columbia, directly contributing to the growth of Fortis's regulated asset base and, consequently, its earnings. As of early 2024, FortisBC was actively managing its extensive pipeline network, which serves a substantial portion of the province's energy needs.

- Project Focus: The Eagle Mountain Pipeline is a key infrastructure expansion aimed at meeting increasing demand for natural gas in British Columbia.

- Market Position: This project reinforces FortisBC's strong market share in a critical energy delivery service within the province.

- Financial Impact: The investment contributes directly to rate base growth, a primary driver of earnings for regulated utilities like FortisBC.

- Strategic Execution: It showcases Fortis's capability in successfully executing large-scale, regulated infrastructure development projects.

Fortis's substantial investments in major transmission infrastructure, such as ITC's MISO Long-Range Transmission Plan, position these as Stars. These projects tap into the burgeoning market for grid modernization and interregional transmission, securing high market share in a critical growth area.

The agreement to supply around 300 MW to an Arizona data center, with potential expansion, highlights a significant opportunity in a high-growth market, demonstrating Fortis's ability to secure and serve large industrial clients and necessitating considerable infrastructure upgrades.

Strategic renewable energy investments, including battery storage projects like Roadrunner Reserve 1, position Fortis favorably for future growth and capture substantial market share in the burgeoning renewable energy and storage sectors.

The Eagle Mountain Pipeline Project, aimed at enhancing natural gas delivery capacity in British Columbia, reinforces FortisBC's strong market share and contributes directly to rate base growth, showcasing successful execution of large-scale, regulated infrastructure development.

| Project Area | Estimated Investment (USD Billions) | Growth Potential | Market Share |

|---|---|---|---|

| MISO Long-Range Transmission Plan | $3.7 - $4.2 (post-2029) | High (Grid Modernization) | High (Interregional Transmission) |

| Arizona Data Center Load | Significant (for 300-700 MW) | Very High (High-Growth Market) | High (Large Industrial Clients) |

| Renewable Energy & Storage | Undisclosed (but substantial) | High (Clean Energy Transition) | High (Renewables & Storage Sector) |

| Eagle Mountain Pipeline | Undisclosed (part of capital plan) | High (Natural Gas Demand) | High (BC Energy Delivery) |

What is included in the product

The Fortis (Canada) BCG Matrix offers a tailored analysis of its product portfolio, highlighting which units to invest in, hold, or divest.

The Fortis BCG Matrix offers a clear, one-page overview, alleviating the pain of scattered business unit performance data.

Cash Cows

Fortis's core regulated electric and gas utilities are its undisputed cash cows. These businesses, spanning Canada, the U.S., and the Caribbean, are the backbone of the company's stable earnings, making up a massive 99% of its total assets.

Operating as natural monopolies in mature, low-growth markets, these utility segments offer highly predictable and reliable cash flows. This stability is crucial for Fortis's ability to consistently grow its dividends, a key attraction for investors seeking steady income.

As of the first quarter of 2024, Fortis reported a 5.9% increase in its adjusted net earnings per share year-over-year, largely driven by the performance of its regulated utility operations. This demonstrates the ongoing strength and cash-generating power of these core assets.

Fortis's transmission and distribution networks are its undisputed cash cows. These established infrastructures, representing a massive 93% of the company's assets, are the bedrock of its stable and consistent revenue generation. Think of them as the reliable workhorses of the business, constantly churning out cash.

These networks, like those managed by FortisBC and Newfoundland Power, are mature and hold significant market share within their operational areas. This dominance means they don't need hefty investments to attract new customers or expand into uncharted territories, freeing up capital.

Because they require minimal promotional spending or new market development, these cash cows are excellent generators of free cash flow. This reliable cash inflow is crucial for funding other parts of Fortis's business and providing returns to shareholders.

Fortis benefits significantly from predictable regulatory frameworks, which are crucial for its cash cow status. These stable environments allow for consistent revenue streams, as seen in their operations in British Columbia where formula rate approvals and multi-year rate frameworks minimize revenue volatility. This predictability is key to Fortis's ability to generate reliable returns on its high market share assets.

The regulatory certainty provided by these frameworks directly translates into consistent cash generation for Fortis. For instance, in 2024, Fortis continued to benefit from the stable rate-setting mechanisms in its regulated utility businesses, which underpin its ability to fund dividends and other strategic growth initiatives. This predictable cash flow is a hallmark of a true cash cow.

Mature Renewable and Hydro Generation Assets

Fortis's mature renewable and hydro generation assets, particularly those integrated into its regulated rate base, function as significant cash cows. These established facilities, including hydro power plants and long-term contracted clean energy projects, are pillars of stability within the energy sector. Their predictable output and low operational variability translate into consistent, reliable cash generation for the company.

These assets benefit from secured revenue streams, often through long-term power purchase agreements, insulating them from market volatility. This stability is crucial for Fortis's overall financial health, providing a dependable source of funds that can be reinvested or distributed.

- Stable Cash Flows: Mature renewable and hydro assets provide consistent earnings due to their operational maturity and predictable output.

- Secured Revenue Streams: Long-term contracts and regulated rate base integration ensure reliable income, minimizing market risk.

- Low Operational Variability: These assets exhibit consistent performance, making them dependable cash generators for Fortis.

- Contribution to Financial Stability: Their reliable cash generation supports overall financial stability and investment capacity.

Consistent Dividend Payouts

Fortis's impressive 51-year streak of consecutive dividend increases highlights its status as a cash cow. This sustained growth in payouts directly reflects the company's robust and predictable cash flow, primarily generated from its established utility businesses which hold significant market share.

The company's ability to consistently return value to shareholders is underpinned by a sustainable payout ratio and strong operating cash flow. These factors confirm the maturity and stability of its core revenue-generating assets, characteristic of a cash cow.

- 51-year dividend increase track record

- Strong, predictable cash flow from mature utility operations

- Sustainable payout ratio and robust operating cash flow

- Consistent shareholder value return from high-market-share businesses

Fortis's regulated electric and gas utilities are its primary cash cows, representing a substantial 99% of its assets as of Q1 2024. These operations, characterized by their natural monopoly status in mature, low-growth markets, deliver highly predictable and stable cash flows. This reliability is fundamental to Fortis's consistent dividend growth, a key investor attraction.

The company's transmission and distribution networks, comprising 93% of its assets, are also strong cash cows. These mature, high-market-share infrastructures, like those operated by FortisBC, require minimal new investment for growth, generating substantial free cash flow. This predictable cash generation supports dividend payments and strategic initiatives, as evidenced by Fortis's 51-year dividend increase streak.

| Asset Type | BCG Category | Key Characteristics | Q1 2024 Data/Notes |

| Regulated Utilities (Electric & Gas) | Cash Cow | Mature, low-growth, natural monopolies, predictable revenue, high market share | 99% of total assets; 5.9% YoY adjusted EPS growth driven by these operations |

| Transmission & Distribution Networks | Cash Cow | Established infrastructure, minimal growth investment needed, high free cash flow generation | 93% of total assets; supports consistent dividend growth |

| Mature Renewable & Hydro Generation | Cash Cow | Secured revenue streams (PPAs), low operational variability, stable cash generation | Contributes to overall financial stability and investment capacity |

What You See Is What You Get

Fortis (Canada) BCG Matrix

The Fortis (Canada) BCG Matrix preview you are viewing is the complete, unwatermarked document you will receive upon purchase. This means the strategic analysis and visual representation of Fortis's business units, categorized by market share and growth rate, are precisely what you will download and utilize. You can confidently assess Fortis's portfolio, identifying Stars, Cash Cows, Question Marks, and Dogs, knowing this preview accurately reflects the final, ready-to-use report. This ensures you gain immediate, actionable insights for your strategic planning without any hidden surprises or missing information.

Dogs

Fortis's divestment of Aitken Creek in 2023, a non-core asset, strongly suggests it was categorized as a 'Dog' in their BCG Matrix. This classification points to an asset with limited strategic alignment, poor growth potential, and likely a minor market presence within Fortis's primarily regulated utility operations.

The sale of Aitken Creek allowed Fortis to reallocate capital and resources towards more promising ventures. While the financial impact for the 2024 annual period was neutral, this strategic move is crucial for optimizing the company's portfolio and focusing on higher-return opportunities.

Within Fortis's diverse energy portfolio, certain older or less efficient smaller generation units, though not explicitly categorized by the company, can be viewed as potential 'Dogs' in a BCG-like analysis. These assets might represent a shrinking portion of the overall energy generation landscape, facing higher operational expenses compared to newer, more advanced facilities.

For instance, older fossil fuel-based plants that are not slated for significant upgrades or conversion to cleaner fuels could fall into this classification. Their contribution to Fortis's total generation capacity might be declining, and their profitability could be squeezed by increasing maintenance costs and potentially lower market prices for their output, especially as renewable energy sources become more prevalent and cost-effective.

Underperforming legacy non-regulated ventures within Fortis represent small, historical investments that haven't gained significant market traction or profitability. These ventures often don't align with Fortis's primary focus on regulated utilities and can divert valuable management attention and capital without generating substantial returns. Their overall contribution to Fortis's financial performance is minimal.

Isolated or Stagnant Small Service Areas

Isolated or stagnant small service areas within Fortis's regulated portfolio represent territories with minimal load growth that do not warrant substantial capital expenditure for expansion. These segments often face disproportionately high operational costs per customer, offering limited contributions to the company's overall growth trajectory. Investment in these pockets is typically focused on essential maintenance rather than strategic development.

For instance, in 2024, Fortis's regulated utility operations, which encompass many such smaller service areas, continued to focus on reliability and infrastructure upkeep. While specific data for these isolated segments is not publicly disaggregated, the company's overall capital expenditure plan for 2024 was approximately $2.4 billion, with a significant portion allocated to maintaining and upgrading existing infrastructure across its diverse service territories.

- Low Load Growth: These areas exhibit negligible increases in energy demand, limiting opportunities for revenue expansion.

- High Operational Costs: The cost to serve customers in these dispersed or small territories can be significantly higher than in more densely populated regions.

- Maintenance Focus: Capital investments are primarily directed towards ensuring the safety and reliability of existing infrastructure, not growth initiatives.

- Minimal Growth Contribution: Their limited economic activity and customer base mean they contribute minimally to Fortis's overall revenue and profit growth.

Pilot Projects Lacking Scalability

Fortis has historically encountered challenges with pilot projects that struggled to scale effectively. These ventures, often focused on new technologies or service delivery models, consumed capital without generating substantial returns or widespread adoption within the company's established utility operations. For instance, a past initiative exploring advanced smart grid metering technology, while promising in its initial small-scale deployment, faced significant integration hurdles and cost overruns that prevented a broader rollout.

These projects, initially categorized as potential growth areas, ultimately became cash traps. They failed to transition from experimental phases to profitable, scalable components of Fortis's business. Such ventures represent investments that, despite initial promise, did not demonstrate a clear path to market penetration or profitability, leading to their discontinuation or a reduction in investment to minimal levels.

- Limited Market Adoption: Past pilot projects failed to gain traction beyond initial testing phases, indicating a mismatch with customer needs or market conditions.

- Integration Challenges: Significant technical or operational difficulties arose when attempting to integrate new technologies into Fortis's existing infrastructure, hindering scalability.

- Unclear ROI: The financial viability of these ventures remained uncertain, with projected returns not justifying the substantial investments required for expansion.

- Resource Drain: These underperforming projects diverted capital and management attention from more promising core business activities.

Fortis's divestment of non-core assets like Aitken Creek in 2023, likely classified as 'Dogs' due to limited growth and strategic alignment, exemplifies a move to optimize its portfolio. These assets, often older or less efficient, face higher operational costs and declining market presence compared to newer, more advanced operations.

Potential 'Dogs' within Fortis could include older fossil fuel plants not slated for upgrades, or underperforming legacy non-regulated ventures that divert capital and attention. Isolated service areas with minimal load growth also fit this description, requiring maintenance focus over expansion due to high per-customer operational costs.

For instance, Fortis's 2024 capital expenditure of approximately $2.4 billion prioritized infrastructure maintenance across its diverse territories, including these smaller, stagnant segments. Past pilot projects that failed to scale, like a smart grid metering initiative, also represent 'Dogs' due to integration challenges and uncertain returns.

| Asset Category | Characteristics | Fortis Example/Potential | BCG Matrix Classification | Strategic Implication |

| Divested Non-Core Assets | Low Market Share, Low Growth | Aitken Creek (divested 2023) | Dog | Capital reallocation, portfolio optimization |

| Older Generation Units | Declining Efficiency, High OpEx | Certain older fossil fuel plants | Potential Dog | Focus on maintenance, potential phase-out |

| Underperforming Ventures | Low Profitability, Limited Traction | Legacy non-regulated projects | Potential Dog | Resource drain, management attention diversion |

| Isolated Service Areas | Negligible Load Growth, High Cost-to-Serve | Small, dispersed regulated territories | Potential Dog | Maintenance focus, minimal growth contribution |

Question Marks

Fortis is actively evaluating advanced grid modernization technologies beyond its current, more widespread plans. These include exploring the large-scale implementation of microgrids and sophisticated distributed energy resource management systems (DERMS). While these represent significant growth potential within the utility sector, Fortis's current market penetration in these highly innovative sub-segments is likely limited, necessitating substantial future investment.

Fortis sees significant growth potential in early-stage renewable natural gas (RNG) and liquefied natural gas (LNG) infrastructure in British Columbia, viewing these as opportunities beyond its current five-year strategic horizon. This burgeoning market is fueled by strong decarbonization mandates, yet Fortis's current penetration in these large-scale, developing projects remains modest.

These initiatives represent a high-growth area, but they necessitate considerable future capital commitments to evolve into substantial revenue streams for Fortis. For instance, the Canadian government's 2024 budget included provisions for clean fuel production, potentially accelerating RNG development, a sector where Fortis is still building its footprint.

Fortis's exploration of new geographic markets for regulated utility expansion, whether through acquisitions or greenfield projects in North America or the Caribbean, falls squarely into the Stars category of the BCG Matrix. These are markets with high growth potential where Fortis currently has no presence.

These ventures are inherently cash-intensive initially, requiring significant investment in due diligence and regulatory applications. For instance, the substantial capital required for a major acquisition or a large-scale greenfield project, like building new transmission infrastructure, exemplifies this cash drain. The successful integration of a new utility in a region like the US Southeast, a market Fortis has actively pursued, would secure a strong market position and generate future cash flows, characteristic of a Star.

Long-Term Clean Energy Technologies Exploration

Fortis's exploration into long-term clean energy technologies, such as advanced nuclear (Small Modular Reactors or SMRs) and specific hydrogen applications, positions them in potential high-growth future markets. These ventures represent a strategic bet on nascent technologies that are not yet widely commercialized within the utility sector. For instance, the global SMR market is projected to reach $12.4 billion by 2030, indicating significant future potential that Fortis is beginning to explore.

While these initiatives are crucial for future revenue streams, Fortis's current market share in these specific areas is likely minimal, reflecting their early-stage development. Significant research, development, and capital investment are required to bring these technologies to maturity and widespread adoption. In 2023, Fortis allocated approximately $1.1 billion towards capital expenditures, with a portion directed towards future growth initiatives and emerging technologies.

- Early-stage investment: Focus on technologies like SMRs and hydrogen, which are not yet mainstream utility solutions.

- High future growth potential: These markets are anticipated to expand significantly in the coming decades.

- Low current market share: Fortis's involvement is in the exploratory phase, meaning minimal current market penetration.

- Significant R&D and capital needs: Maturing these technologies requires substantial investment and research efforts.

Future Data Center Load Beyond Committed Projects

Fortis's current data center load commitments, particularly the Arizona project, are considered Stars in the BCG matrix, indicating high growth and market share. However, the company is actively pursuing additional, uncommitted large data center loads, which fall into the Question Mark category. This means these future opportunities have high growth potential but Fortis's market share is not yet established.

The utility services market for data centers is experiencing robust growth, with projections showing continued expansion. For instance, global data center colocation revenue was estimated to reach over $250 billion in 2024, highlighting the significant demand. Yet, securing these massive new connections is intensely competitive, with other utilities vying for these lucrative contracts.

Fortis's success in capturing these future, uncommitted data center loads depends on its ability to proactively engage with potential clients and strategically plan for the necessary infrastructure upgrades. This involves significant capital investment and a keen understanding of the evolving needs of hyperscale data center operators.

- High-Growth Market: The global data center market is a significant growth area for utilities.

- Uncertain Market Share: Fortis's position in securing future, uncommitted data center loads is not yet defined.

- Competitive Landscape: Other utilities are also actively seeking to connect large data center projects.

- Proactive Engagement Required: Continued investment in infrastructure and client relations is crucial for success.

Fortis is exploring new, uncommitted large data center loads beyond its existing Arizona project. These represent potential high-growth opportunities, but Fortis's market share in these specific future projects is currently undefined, placing them in the Question Mark category.

The demand for utility services from data centers is substantial, with global colocation revenue projected to exceed $250 billion in 2024. However, securing these new connections is highly competitive, as other utilities are also targeting these lucrative opportunities.

Fortis must proactively engage with potential clients and invest in infrastructure to secure these future data center loads. Success hinges on strategic planning and meeting the evolving needs of hyperscale operators.

These uncommitted data center loads are characterized by high market growth potential but an uncertain market share for Fortis, requiring significant proactive effort and investment to capture.

BCG Matrix Data Sources

Our Fortis BCG Matrix is built on verified market intelligence, combining financial data, industry research, and official reports from regulatory bodies to ensure reliable, high-impact insights.