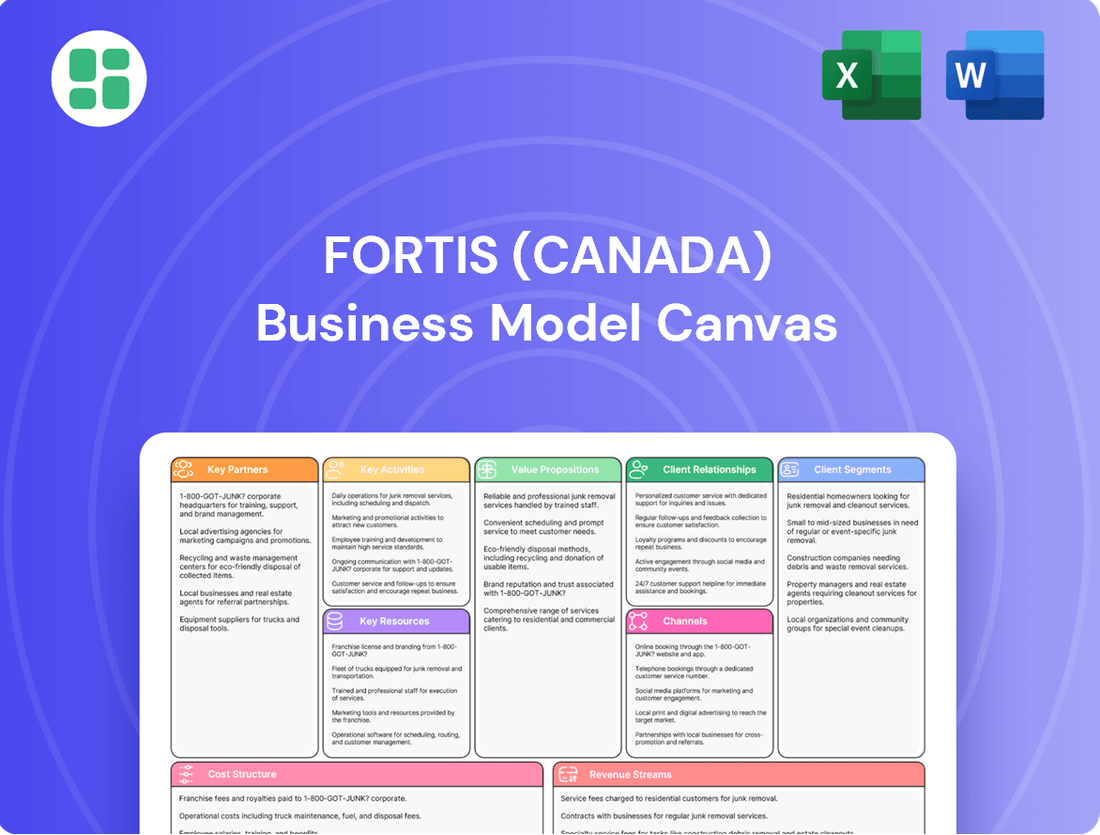

Fortis (Canada) Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fortis (Canada) Bundle

Curious about how Fortis (Canada) built its robust infrastructure and customer base? This comprehensive Business Model Canvas breaks down their customer relationships, revenue streams, and key resources, offering a strategic roadmap for success.

Partnerships

Fortis Inc. maintains vital relationships with government and regulatory bodies across Canada, the U.S., and the Caribbean. These partnerships are fundamental for obtaining approvals on rate adjustments and significant capital investments, directly impacting the company's ability to generate predictable earnings. For instance, in 2024, Fortis continued its engagement with various public utility commissions, such as the New York Public Service Commission and the Alberta Utilities Commission, to secure necessary approvals for its infrastructure projects, which are critical for its long-term growth.

Fortis relies on equipment and technology suppliers to maintain its infrastructure. In 2024, the company continued to invest in grid modernization, which includes sourcing advanced smart grid technologies and components for renewable energy projects. These partnerships are crucial for ensuring the reliability of its electricity transmission and natural gas distribution systems.

Fortis relies heavily on construction and engineering firms to execute its substantial infrastructure development plans. These specialized partners are crucial for building, expanding, and maintaining Fortis's extensive electricity generation, transmission, and natural gas distribution networks.

Their expertise is vital for the safe and efficient completion of major projects, directly contributing to the growth of Fortis's rate base. For instance, in 2023, Fortis continued to advance projects like the Waterton Phase 3 expansion in Alberta, a significant undertaking that relies on these skilled partnerships.

Indigenous Communities and Local Partners

Fortis actively cultivates partnerships with Indigenous communities and local stakeholders across its operating regions. These relationships are crucial for the successful development and operation of new energy infrastructure, ensuring that projects align with community needs and provide tangible local benefits. For instance, Fortis’s involvement in the Wataynikaneyap Power project exemplifies this, a significant transmission line initiative in Northwestern Ontario that is majority-owned by 24 Anishinaabe and Treaty 3 First Nations. This collaboration, which saw substantial progress in 2024 with ongoing construction phases, aims to connect remote communities to the provincial grid, enhancing reliability and fostering economic development opportunities for Indigenous partners.

These collaborations are not just about project execution; they are foundational to Fortis's social license to operate and its commitment to reconciliation. By engaging early and often, Fortis ensures that traditional land use, environmental stewardship, and economic participation are integrated into project planning. The company's 2024 sustainability reports highlighted increased investment in community benefit agreements and local employment programs stemming from these partnerships, underscoring their growing importance in the utility sector's strategic approach.

- Indigenous Ownership and Collaboration: Fortis prioritizes partnerships where Indigenous communities have equity stakes, such as the Wataynikaneyap Power project, where First Nations hold majority ownership.

- Local Economic Benefits: Agreements often include provisions for local hiring, training, and procurement, directly contributing to economic development in partnership territories.

- Community Engagement: Ongoing dialogue and consultation are key to respecting traditional lands and ensuring projects meet community expectations and needs.

- Reconciliation Efforts: These partnerships are viewed as vital components of broader reconciliation efforts, fostering mutual respect and shared prosperity.

Financial Institutions and Investors

Fortis's ability to execute its substantial capital expenditure plans, projected to be around $24.0 billion through 2028, hinges on strong relationships with financial institutions and investors. These partnerships are essential for securing the necessary debt and equity financing to fund its regulated utility investments and renewable energy projects.

Key financial partners include a diverse group of banks, institutional investors, and individual shareholders. Fortis actively manages its relationships with bondholders to ensure favorable terms on its debt issuances, supporting its ongoing capital needs and dividend growth strategy.

- Banks: Provide credit facilities and underwrite debt offerings, crucial for Fortis's $24.0 billion capital plan through 2028.

- Bondholders: Essential for securing long-term debt financing, supporting infrastructure investments and dividend stability.

- Equity Investors: Provide capital through stock issuance and reinvestment, vital for funding growth initiatives and maintaining an investment-grade credit rating.

Fortis's strategic approach to growth and operations is significantly bolstered by its key partnerships, spanning government, suppliers, construction firms, Indigenous communities, and financial institutions.

These collaborations are critical for regulatory approvals, infrastructure development, community integration, and financial stability, directly supporting Fortis's substantial capital expenditure plans and its commitment to sustainable energy solutions.

For instance, the company's 2024 capital plan of approximately $24.0 billion through 2028 relies heavily on securing financing from banks and bondholders, while its commitment to Indigenous partnerships, like the Wataynikaneyap Power project, underscores a dedication to shared value and social license.

| Partnership Type | Key Role | 2024/Recent Relevance | Impact on Fortis |

|---|---|---|---|

| Government & Regulators | Approvals for rates & investments | Ongoing engagement with NYPSC, AUC | Predictable earnings, project execution |

| Suppliers & Tech Providers | Infrastructure maintenance & upgrades | Smart grid tech, renewable components | System reliability, modernization |

| Construction & Engineering | Infrastructure development & expansion | Waterton Phase 3 expansion (2023) | Rate base growth, project completion |

| Indigenous Communities | Project development & local benefits | Wataynikaneyap Power majority ownership | Social license, community development |

| Financial Institutions | Financing for capital expenditures | Supporting $24.0B capex through 2028 | Capital access, growth funding |

What is included in the product

A detailed Business Model Canvas for Fortis (Canada) outlining its core customer segments, value propositions, and revenue streams, providing a clear roadmap for strategic planning and investor communication.

This canvas offers a comprehensive view of Fortis's operational structure, key resources, and cost drivers, enabling informed decision-making and strategic alignment across the organization.

Fortis (Canada)'s Business Model Canvas acts as a pain point reliever by providing a clear, one-page snapshot of their core business components, enabling rapid identification of potential inefficiencies and strategic alignment.

Activities

Fortis's primary activities revolve around generating electricity, moving it through transmission lines, and delivering it to end-users. This integrated approach ensures a steady supply of power.

In 2024, Fortis managed a significant portfolio of regulated and non-regulated utility operations, serving over 3.4 million customers across North America and the Caribbean. Their diverse generation fleet includes renewable sources like hydropower and wind, alongside natural gas and other conventional power sources.

The company consistently invests in its infrastructure, with capital expenditures in 2024 projected to be around $23.6 billion through 2028, focusing on grid modernization and reliability to meet evolving energy needs. This commitment underpins their ability to provide essential services.

Fortis's natural gas distribution is a core activity, focusing on the safe and reliable delivery of gas to over 1.3 million customers in British Columbia through FortisBC Energy. This involves operating and maintaining a vast network of pipelines, ensuring efficient energy flow for homes and businesses.

Key investments are made in modernizing and expanding this infrastructure, including advancements in liquefied natural gas (LNG) capabilities. In 2023, Fortis invested approximately $1.1 billion in its regulated gas distribution business, underscoring its commitment to this essential service and its future growth.

Fortis invests heavily in upgrading and expanding its utility infrastructure, a core activity driving future growth. This includes modernizing its electric transmission and distribution networks across North America, ensuring greater reliability and capacity. For instance, their 2024 capital plan projects approximately $4.0 billion in investments, with a significant portion dedicated to infrastructure enhancements.

A key focus is the development of new generation and energy storage solutions to support the transition to cleaner energy sources. This involves building advanced grid infrastructure and integrating renewable energy projects. Fortis aims to grow its rate base significantly through these strategic capital expenditures, projecting a compound annual growth rate in its rate base of 5-7% through 2028.

Regulatory Compliance and Rate Case Management

Fortis's operations as a regulated utility necessitate significant investment in regulatory compliance and rate case management. This involves extensive preparation and submission of detailed financial and operational data to various provincial, state, and federal regulatory bodies across North America and the Caribbean. For instance, in 2024, Fortis continued its proactive engagement with regulators to ensure timely approvals for capital investments and to reflect updated operating costs in customer rates, a critical step for maintaining financial stability.

The company's success hinges on its ability to navigate these complex regulatory landscapes, which often involve multi-year rate plans and public consultations. Fortis's teams are dedicated to presenting compelling cases that support the need for rate adjustments, thereby enabling cost recovery and a reasonable return on the substantial infrastructure investments made to serve its customers. This strategic focus on regulatory outcomes directly underpins the predictability of Fortis's earnings stream.

- Regulatory Filings: Fortis regularly submits detailed rate applications and supporting evidence to commissions like the Alberta Utilities Commission and the New York Public Service Commission.

- Engagement with Commissions: The company actively participates in hearings and workshops, presenting testimony from company experts and responding to stakeholder inquiries.

- Rate Case Outcomes: Successful rate case management in 2024 allowed Fortis to secure necessary revenue adjustments to support its ongoing capital expenditure programs, which are vital for system reliability and modernization.

- Earnings Predictability: The regulated nature of its business, managed through effective rate case execution, provides a stable and predictable earnings profile for investors.

Customer Service and Operations Management

Fortis's commitment to customer service and operations management is central to its business model, ensuring the delivery of safe, reliable, and affordable energy. This involves meticulous oversight of utility systems and a proactive approach to customer needs.

The company prioritizes maintaining top-quartile reliability performance, a critical factor for its customers. In 2023, Fortis reported a significant focus on operational excellence, with investments aimed at system upgrades and resilience. For instance, their regulated utilities consistently aim to minimize service interruptions, a key performance indicator for customer satisfaction.

- Reliability Focus: Fortis strives for industry-leading reliability metrics across its operations, directly impacting customer experience and trust.

- Customer Responsiveness: Efficiently addressing customer inquiries and service requests is a core operational activity, supported by investments in technology and personnel.

- Safety Culture: Continuous improvement in safety practices for employees, contractors, and the public is paramount, underpinning all operational activities and reflecting responsible utility management.

- Operational Efficiency: Managing the day-to-day operations of diverse utility assets requires robust systems and ongoing investment to ensure cost-effectiveness and service quality.

Fortis's key activities encompass the generation, transmission, and distribution of electricity and natural gas, ensuring reliable energy delivery to millions of customers. They actively manage a diverse portfolio of regulated and non-regulated utility assets across North America and the Caribbean, a strategy that saw them serve over 3.4 million customers in 2024.

Significant capital investments are a cornerstone of their operations, with a 2024 projected capital plan of approximately $23.6 billion through 2028, focused on infrastructure modernization and expansion. This includes substantial spending on natural gas distribution, with $1.1 billion invested in 2023 alone in this segment.

Navigating complex regulatory environments and managing rate cases are critical activities, enabling cost recovery and supporting their extensive capital expenditure programs. Fortis's focus on operational excellence and customer service, including maintaining top-quartile reliability, further defines their core activities.

| Key Activity | Description | 2024 Data/Focus |

| Energy Generation & Delivery | Producing and distributing electricity and natural gas. | Serving over 3.4 million customers across North America and Caribbean. |

| Infrastructure Investment | Modernizing and expanding utility networks. | Projected $23.6 billion capital expenditure (2024-2028); $4.0 billion in 2024 for infrastructure. |

| Regulatory Management | Engaging with regulatory bodies for rate approvals. | Proactive engagement in 2024 for capital investment approvals and cost recovery. |

| Operational Excellence | Ensuring reliability, safety, and customer service. | Focus on top-quartile reliability performance and safety culture. |

Delivered as Displayed

Business Model Canvas

The Fortis (Canada) Business Model Canvas you are previewing is the actual, complete document you will receive upon purchase. This isn't a sample or a mockup; it's a direct representation of the professional, ready-to-use file you'll gain access to. You can be confident that the structure, content, and formatting you see here are precisely what you'll download, enabling immediate application for your strategic planning needs.

Resources

Fortis's primary key resource is its extensive portfolio of regulated utility infrastructure, encompassing electricity generation, transmission, distribution, and natural gas pipelines. These physical assets are fundamental to its business, allowing for the reliable delivery of essential energy services to millions of customers across North America and the Caribbean. The company's significant investment in these assets, reflected in its substantial rate base, directly underpins its revenue generation and earnings capacity.

As of the first quarter of 2024, Fortis reported a regulated asset base of approximately $47 billion. This robust infrastructure base is crucial for its long-term growth and stability, as it allows Fortis to earn a regulated rate of return on its investments, providing predictable cash flows. The company's ongoing capital expenditure program, projected to be around $24.3 billion through 2028, will further enhance and expand this vital key resource.

Fortis's approximately 9,800 employees, including engineers, technicians, customer service representatives, and management, are a core asset. Their collective knowledge in operating intricate utility systems, navigating regulatory frameworks, and successfully completing major capital projects is indispensable to the company's operations.

The company places a significant emphasis on fostering a robust safety culture and investing in the ongoing professional development of its workforce. This commitment ensures that employees possess the skills and expertise necessary to manage complex utility operations effectively and safely.

Fortis relies on substantial financial capital to support its vast operations and ambitious multi-billion dollar capital expenditure programs. This funding is a mix of internally generated cash flow, which was robust in 2024, and access to diverse debt and equity markets.

The company's ability to secure necessary financing is significantly bolstered by its strong credit ratings, which provide favorable terms on debt issuances. Furthermore, Fortis's track record of consistent dividend growth, a key indicator of financial health, makes it an attractive proposition for equity investors.

Regulatory Licenses and Approvals

Fortis's ability to operate as a regulated utility hinges on a portfolio of regulatory licenses and approvals, which are crucial intangible assets. These permissions grant the company exclusive rights to provide essential services within defined geographic territories, forming the bedrock of its stable earnings model.

In 2024, Fortis continued to navigate a complex regulatory landscape across its diverse operations in Canada, the United States, and the Caribbean. The company's success is directly tied to its ongoing engagement with regulatory bodies, ensuring the preservation and renewal of these vital operating authorities.

- Exclusive Service Territories: Licenses grant Fortis the right to operate in specific regions, preventing direct competition and ensuring a predictable customer base.

- Stable Earnings Framework: Regulatory approvals often include provisions for cost recovery and a fair rate of return, contributing to Fortis's consistent financial performance.

- Ongoing Regulatory Engagement: Maintaining strong relationships with regulators is paramount for license renewals, rate case approvals, and the successful integration of new infrastructure projects.

- Compliance and Transparency: Adherence to regulatory standards and transparent reporting are essential for upholding the trust and confidence of regulatory bodies.

Intellectual Property and Data Systems

Fortis leverages intellectual property through its operational best practices and proprietary technologies designed for sophisticated grid management. These assets are crucial for maintaining system efficiency and enabling predictive maintenance, ensuring reliable energy delivery. For instance, in 2024, Fortis continued to invest in advanced analytics to optimize its extensive network operations.

The company’s robust data systems are indispensable for effective customer management and accurate billing processes. These systems also play a critical role in meeting stringent regulatory reporting requirements across its diverse utility operations. By mid-2024, Fortis reported significant progress in upgrading its customer data platforms to enhance service delivery and data security.

- Operational Best Practices: Fortis’s accumulated knowledge in utility operations drives efficiency.

- Proprietary Technologies: Advanced systems for grid management and data analytics are key differentiators.

- Data Systems: Essential for customer relations, billing, and regulatory compliance.

- 2024 Focus: Continued investment in data analytics and customer platform upgrades.

Fortis's key resources are its extensive regulated utility infrastructure, its skilled workforce, and its access to financial capital. These elements collectively enable the company to deliver essential energy services reliably and pursue growth opportunities.

The company's substantial regulated asset base, which stood at approximately $47 billion in Q1 2024, is the cornerstone of its operations. This infrastructure, combined with a projected $24.3 billion in capital expenditures through 2028, ensures continued service delivery and expansion.

Fortis's approximately 9,800 employees are vital for operating complex systems and managing capital projects, supported by a strong safety culture and ongoing professional development initiatives.

Financial capital, secured through internally generated cash flow and access to debt and equity markets, is critical for funding operations and growth. Strong credit ratings and a history of dividend growth enhance its financial flexibility.

| Key Resource | Description | 2024 Relevance/Data |

| Regulated Infrastructure | Electricity generation, transmission, distribution, and natural gas pipelines. | Approx. $47 billion regulated asset base (Q1 2024). Projected $24.3 billion capital expenditures through 2028. |

| Human Capital | Approx. 9,800 employees with expertise in utility operations and project management. | Emphasis on safety culture and professional development. |

| Financial Capital | Access to debt and equity markets, supported by strong credit ratings. | Robust internally generated cash flow in 2024. Consistent dividend growth history. |

Value Propositions

Fortis's core value proposition centers on the dependable and secure provision of electricity and natural gas. This commitment ensures that homes, businesses, and industries have the energy they need, precisely when they need it.

The company consistently demonstrates top-quartile reliability in its operations, a crucial factor for its diverse customer base. For instance, in 2023, Fortis reported an average customer outage duration of just over 100 minutes across its regulated utilities, significantly better than many industry benchmarks.

This unwavering focus on operational excellence and safety is fundamental. It underpins the trust that residential, commercial, and industrial clients place in Fortis for their essential energy needs, contributing to stable economic activity and daily life.

Fortis's operation within Canada's robust regulatory environment ensures that its energy rates remain notably stable, offering a stark contrast to the unpredictable fluctuations often seen in unregulated markets. This predictability is a significant advantage for both residential customers and commercial enterprises, fostering a sense of financial security and contributing to the overall economic steadiness of the communities it serves.

These regulated rates are a core value proposition, shielding customers from market volatility. For instance, in 2024, Fortis's regulated utilities provided essential services with rate structures approved by provincial regulators, ensuring affordability and reliability for millions of Canadians. This stability allows businesses to budget effectively and consumers to manage their household expenses with greater confidence.

Furthermore, the regulatory framework is designed to allow Fortis to recover its operational costs and earn a reasonable return on its substantial investments in infrastructure. This mechanism is crucial for maintaining and upgrading its energy networks, ensuring continued service reliability and supporting long-term growth, which ultimately benefits customers through dependable energy delivery.

Fortis delivers value by consistently investing in upgrading its energy infrastructure, ensuring it's modern and robust. This focus on modernization means replacing older equipment and expanding capacity to handle increasing energy needs.

These capital expenditures, which reached approximately $4.1 billion in 2023, directly enhance the reliability and quality of service for Fortis's customers. Investments in grid modernization are crucial for meeting future energy demands and improving operational efficiency.

Furthermore, Fortis prioritizes hardening its infrastructure against the impacts of climate change and extreme weather. By strengthening assets, the company aims to minimize service disruptions and maintain dependable energy delivery, a critical factor for its customer base.

Commitment to Cleaner Energy and Sustainability

Fortis is committed to a cleaner energy future, a core value proposition that resonates with environmentally conscious stakeholders and aligns with long-term sustainability goals. This commitment translates into tangible benefits for customers and investors alike by reducing the environmental footprint associated with energy generation and distribution.

The company is actively investing in renewable energy sources and energy storage solutions, moving away from traditional fossil fuels. For instance, Fortis has been a significant investor in wind and solar projects, contributing to a diversified and cleaner energy portfolio. This strategic shift is crucial for meeting evolving regulatory requirements and customer preferences.

Fortis has established ambitious greenhouse gas reduction targets, demonstrating a clear dedication to environmental stewardship. By 2030, the company aims to reduce its absolute greenhouse gas emissions by 35% from its 2019 levels. This proactive approach positions Fortis as a leader in the energy transition.

- Reduced Environmental Impact: Fortis's transition to cleaner energy directly lowers its carbon emissions, benefiting the environment.

- Investment in Renewables: The company is actively integrating wind and solar power into its energy mix.

- Energy Storage Solutions: Fortis is investing in technologies that support the reliability of renewable energy sources.

- Greenhouse Gas Reduction Targets: Fortis has set a goal to reduce its greenhouse gas emissions by 35% by 2030 compared to 2019 levels.

Community Development and Economic Growth Support

Fortis actively fuels community development and economic growth by making substantial infrastructure investments, which directly translate into job creation. In 2024, Fortis continued its commitment to enhancing energy infrastructure, a critical component for attracting and sustaining businesses. This focus on reliability empowers existing industries and fosters an environment conducive to new enterprise, including the burgeoning data center sector.

The company’s dedication extends beyond infrastructure, encompassing direct community support. Fortis's investments in local initiatives and programs in 2024 aimed to bolster social well-being and economic opportunity within its operational areas. This dual approach ensures that Fortis is not just a utility provider but a partner in the prosperity of the communities it serves.

- Infrastructure Investment: Fortis's capital expenditure programs in 2024, totaling billions of dollars, are designed to modernize and expand energy grids, directly supporting economic activity.

- Job Creation: These investments lead to significant direct and indirect employment opportunities across various sectors within the communities Fortis operates.

- Business Enablement: A reliable and robust energy supply is fundamental for business operations, facilitating industrial expansion and attracting new commercial ventures.

- Community Engagement: Fortis's corporate social responsibility efforts in 2024 included sponsorships and partnerships that contribute to local economic and social development.

Fortis's value proposition is built on providing reliable, safe, and affordable energy through its regulated utility operations. This stability is crucial for consumers and businesses alike, offering a predictable cost structure that aids financial planning.

The company's commitment to infrastructure upgrades, exemplified by its significant capital expenditures, directly enhances service quality and reliability. These investments ensure Fortis can meet current and future energy demands effectively.

Furthermore, Fortis is dedicated to a sustainable energy future, actively investing in renewable energy sources and setting ambitious greenhouse gas reduction targets. This forward-looking approach appeals to environmentally conscious customers and investors.

Fortis also plays a vital role in community development through its infrastructure investments, which stimulate job creation and support economic growth. By ensuring a dependable energy supply, Fortis empowers existing businesses and attracts new ones, fostering local prosperity.

| Value Proposition Area | Key Aspect | Supporting Data/Fact (2023/2024) |

|---|---|---|

| Reliable Energy Delivery | Operational Excellence | Average customer outage duration of just over 100 minutes in 2023 across regulated utilities. |

| Stable and Affordable Rates | Regulatory Framework | Regulated rates in 2024 ensured affordability and reliability for millions of Canadians. |

| Infrastructure Modernization | Capital Investments | Approximately $4.1 billion in capital expenditures in 2023 to upgrade and harden infrastructure. |

| Commitment to Sustainability | Renewable Energy & GHG Reduction | Target to reduce absolute greenhouse gas emissions by 35% by 2030 from 2019 levels. |

| Community Development | Economic Support & Job Creation | Continued infrastructure investments in 2024 supporting job creation and business attraction. |

Customer Relationships

Fortis significantly enhances customer relationships through its automated and self-service portals. These digital platforms offer 24/7 access to crucial account information, including billing history and detailed consumption data, allowing customers to manage their energy usage effectively. This digital-first approach not only boosts convenience but also streamlines routine inquiries, reducing the need for direct contact for common tasks.

Fortis operates dedicated customer contact centers, ensuring customers have access to trained professionals for complex inquiries, service issues, and billing questions. These centers are crucial for addressing outages and safety concerns promptly.

Emergency services are available around the clock, 24/7, to provide rapid response to critical incidents impacting energy supply, demonstrating Fortis's commitment to reliability. In 2023, Fortis reported over 2.5 million customer interactions across its various utilities, highlighting the significant volume handled by these support channels.

Fortis actively cultivates community relationships by maintaining a robust local presence through its diverse utility operations. This direct engagement, exemplified by community giving days and sponsorships, reinforces trust and addresses specific local needs.

In 2023, Fortis contributed over $10 million to community initiatives across its service territories, underscoring its commitment to local development and well-being. These efforts span vital areas like safety, education, and environmental stewardship.

Regulatory Communication and Public Hearings

As a regulated utility, Fortis's customer relationships are significantly shaped by interactions with regulatory bodies and participation in public hearings. This involves presenting capital expenditure plans, rate adjustments, and service improvement strategies to customer representatives and the broader public.

Transparency during these public forums is paramount for fostering trust and securing ongoing regulatory approval. For instance, in 2023, Fortis Inc. reported capital expenditures of $4.4 billion, a substantial portion of which requires regulatory review and public justification to ensure customer interests are met.

- Regulatory Engagement: Fortis actively engages with regulatory commissions and intervenors to gain approval for its business plans and rate structures.

- Public Hearings: The company presents its capital investment proposals and operational performance in public hearings, allowing for scrutiny and feedback from customer advocates.

- Transparency and Trust: Open communication in these settings is vital for maintaining public confidence and demonstrating commitment to service quality and affordability.

- 2023 Capital Investments: Fortis invested $4.4 billion in capital projects in 2023, underscoring the scale of operations requiring regulatory and public oversight.

Stakeholder Consultation for Major Projects

Fortis prioritizes stakeholder engagement for its major infrastructure projects, actively consulting with landowners, businesses, and Indigenous communities. This collaborative process is crucial for addressing potential impacts and fostering community buy-in. For instance, in 2024, Fortis continued its engagement for projects like the Coastal GasLink pipeline, which involves extensive dialogue with numerous stakeholders to ensure responsible development.

This proactive consultation strategy is designed to minimize disruptions and build consensus, ultimately contributing to project success. By understanding and addressing community concerns early on, Fortis aims to secure social license and ensure long-term acceptance of its essential infrastructure. In 2023, Fortis reported significant progress on its capital expenditure programs, underscoring the importance of these relationships in project execution.

- Stakeholder Consultation: Fortis engages landowners, businesses, and Indigenous communities for major infrastructure projects.

- Impact Mitigation: Proactive dialogue aims to address concerns and minimize project impacts.

- Community Acceptance: Consensus-building fosters project success and local support.

- 2024 Focus: Continued engagement on projects like Coastal GasLink, building on 2023 capital expenditure progress.

Fortis leverages digital self-service portals and dedicated contact centers to manage customer interactions, offering 24/7 access to account information and support for complex issues. The company's commitment to reliability is underscored by its 24/7 emergency services, which handled a significant volume of customer interactions in 2023. Fortis also actively builds community trust through local presence, sponsorships, and substantial community contributions, investing over $10 million in 2023 across various initiatives.

| Customer Relationship Aspect | Description | Key Data/Initiatives |

| Digital Engagement | Automated and self-service portals for 24/7 account access and management. | Streamlines routine inquiries, enhances convenience. |

| Direct Support | Dedicated customer contact centers for complex inquiries and issue resolution. | Handles outages, safety concerns, and billing questions. |

| Emergency Services | Around-the-clock availability for critical incidents. | Ensures rapid response to energy supply disruptions. |

| Community Investment | Local presence, sponsorships, and community giving days. | Over $10 million contributed to community initiatives in 2023. |

| Regulatory Interaction | Engagement with regulatory bodies and public hearings. | Transparency in capital expenditure plans and rate adjustments. |

| Stakeholder Consultation | Proactive engagement with landowners, businesses, and Indigenous communities for infrastructure projects. | Ongoing dialogue for projects like Coastal GasLink in 2024. |

Channels

Fortis's physical infrastructure, encompassing vast electricity grids and natural gas pipelines, forms the backbone of its operations. These networks are crucial for delivering energy reliably to millions of customers across North America and the Caribbean. For instance, in 2024, Fortis continued to invest heavily in maintaining and upgrading its transmission and distribution systems, ensuring the flow of electricity and gas remains uninterrupted.

The company's power generation facilities, including renewable sources like wind and hydro, are also integral to its physical infrastructure. These assets generate the energy that traverses its extensive network. By operating a diverse portfolio of power plants, Fortis can meet varied energy demands and contribute to a more sustainable energy future, a key aspect of its value proposition in 2024.

Fortis's direct customer service, encompassing call centers and field crews, is a critical component of its operations. In 2024, Fortis continued to invest in its customer service infrastructure, aiming to enhance response times and resolution efficiency. These teams handle a vast volume of customer interactions daily, from routine inquiries to urgent service needs, ensuring the reliable delivery of energy services across its diverse utility operations.

Fortis leverages its website, online customer portals, and mobile applications as key digital channels. These platforms offer customers easy access to account management, billing inquiries, and various self-service options, significantly boosting convenience and operational efficiency. For instance, in 2024, Fortis reported that over 70% of its customer interactions occurred through digital channels, highlighting their importance.

These digital tools are instrumental in enhancing the customer experience by providing 24/7 access to information and support. Furthermore, they serve as a crucial avenue for Fortis to communicate important company updates, service alerts, and its ongoing commitment to sustainability initiatives, fostering transparency and engagement with its stakeholders.

Regulatory Filings and Public Reports

Fortis relies heavily on formal regulatory filings, including annual reports (Form 10-K), quarterly reports (Form 10-Q), and specific sustainability reports, to communicate its operational performance, strategic initiatives, and financial standing. These documents are crucial for maintaining transparency and accountability, especially within its regulated utility business model. For instance, in 2023, Fortis reported total revenues of CAD 10.9 billion, showcasing its substantial operational scale through these official disclosures.

These official reports are readily available to investors, regulators, and the general public. They can be accessed through the company's investor relations website and various regulatory bodies' online portals, ensuring broad accessibility. For example, filings with the U.S. Securities and Exchange Commission (SEC) and Canadian securities regulators provide detailed financial statements and management discussions.

The information contained within these filings is vital for stakeholders to assess Fortis's financial health and future prospects. They offer insights into capital expenditures, earnings, debt levels, and progress on sustainability goals. As of the first quarter of 2024, Fortis confirmed its capital expenditure plan of approximately CAD 24 billion through 2028, a key detail typically found in these public reports.

Key aspects of regulatory filings and public reports for Fortis include:

- Financial Performance: Detailed financial statements, including income statements, balance sheets, and cash flow statements, providing a clear picture of profitability and financial stability. For 2023, Fortis reported net earnings of CAD 2.2 billion.

- Operational Updates: Information on the performance of its various utility operations across North America and the Caribbean, including regulatory proceedings and rate adjustments.

- Strategic Outlook: Management's discussion and analysis of the company's strategy, growth opportunities, and risk factors, guiding investor expectations.

- Sustainability Initiatives: Reports on environmental, social, and governance (ESG) performance, detailing progress on emissions reduction targets and community engagement efforts.

Community Outreach and Public Relations

Fortis actively engages in community outreach and public relations to reinforce its dedication to safety, sustainability, and local well-being. These initiatives are crucial for building a strong brand reputation and cultivating positive relationships with the public and stakeholders. For instance, in 2024, Fortis continued its investment in local communities through various sponsorships and outreach programs, aiming to enhance its social license to operate.

Through strategic public relations, including timely news releases and proactive media engagement, Fortis ensures transparent communication about its operations and community impact. This approach helps manage public perception and address concerns effectively. The company's commitment to corporate social responsibility is a key theme in its public messaging, highlighting its role as a responsible corporate citizen.

- Community Investment: Fortis's community outreach programs in 2024 focused on areas like education and environmental stewardship, reflecting a deep commitment to local development.

- Brand Reputation: Public relations efforts in 2024 aimed to bolster Fortis's image as a reliable and community-focused utility provider.

- Stakeholder Relations: Engaging with local media and the public helps foster trust and understanding, essential for long-term operational success.

Fortis utilizes its extensive physical infrastructure, including electricity grids and natural gas pipelines, as a primary channel for delivering energy services. These networks are essential for reaching millions of customers, with ongoing investments in 2024 focused on maintenance and upgrades to ensure reliability. The company also operates diverse power generation facilities, including renewables, to meet varying energy demands.

Digital channels, such as the Fortis website, customer portals, and mobile apps, are key for customer interaction and account management. In 2024, over 70% of customer interactions occurred through these digital platforms, highlighting their efficiency and importance for providing 24/7 access to information and support.

Formal regulatory filings and public reports, including annual and quarterly disclosures, serve as critical communication channels for financial performance, operational updates, and strategic outlook. For instance, in 2023, Fortis reported total revenues of CAD 10.9 billion, demonstrating transparency through these official documents.

Community outreach and public relations initiatives are also vital channels for Fortis, reinforcing its commitment to safety, sustainability, and local well-being. These efforts in 2024 focused on community investment and bolstering the company's reputation as a reliable, community-focused utility provider.

Customer Segments

Residential customers are the backbone of Fortis's operations, comprising millions of individual households across North America and the Caribbean that depend on the company for essential electricity and natural gas. In 2023, Fortis reported serving approximately 3.5 million electricity customers and 1.3 million natural gas customers, highlighting the sheer scale of this segment. These customers primarily value dependable service, competitive pricing, and accessible support, making reliability and affordability key drivers for their continued patronage.

Fortis's commercial customer base includes a wide array of entities, from small shops to larger office complexes. These businesses rely on dependable energy to power their operations, with demand often fluctuating according to their specific operating schedules and industry needs. In 2024, Fortis continued to focus on meeting these diverse energy requirements with reliable service.

For these commercial clients, consistent energy supply and predictable, competitive pricing are paramount. Fortis offers specialized services and dedicated support designed to address the unique energy consumption patterns and service expectations of this vital segment of their customer network.

Fortis's industrial customers are the backbone of its energy supply, encompassing large-scale facilities like manufacturing plants and resource extraction operations. These clients have significant and often intricate energy needs, demanding a consistent and high-capacity power flow tailored to their specific technical requirements.

In 2024, Fortis continued to focus on serving these vital sectors, recognizing their substantial load growth potential. The company's infrastructure is designed to support the immense power demands of industries such as mining, oil and gas, and heavy manufacturing, which are critical drivers of economic activity.

Wholesale and Institutional Customers

Fortis serves wholesale customers, including other utilities and large institutional clients, by providing energy for resale or their own extensive operations. These transactions typically involve bulk energy sales and are often secured by long-term contracts, ensuring stable revenue streams. In 2024, Fortis continued to see significant interest from these segments, particularly with the growing demand from new large-scale opportunities like data centers, which require substantial and reliable power supply.

This segment is crucial for Fortis's growth strategy, as it allows for the efficient utilization of its infrastructure and the expansion of its customer base beyond direct residential and commercial users. The company's ability to secure multi-year agreements with these wholesale partners provides a predictable revenue profile, which is attractive to investors and supports ongoing capital investments in its regulated utility businesses.

Key aspects of this customer segment include:

- Bulk Energy Sales: Supplying large volumes of electricity and natural gas to other energy providers or industrial consumers.

- Long-Term Contracts: Establishing agreements that provide revenue certainty and support long-term infrastructure planning.

- New Market Opportunities: Targeting emerging high-demand sectors such as data centers, which represent significant growth potential for wholesale energy services.

Government and Public Sector Entities

Government and public sector entities, encompassing municipal, provincial/state, and federal agencies, represent a significant customer segment for Fortis. These organizations require reliable energy services to maintain critical public infrastructure and deliver essential services. For instance, in 2024, government spending on infrastructure projects across Canada remained robust, creating sustained demand for energy solutions.

Fortis's engagement with this segment is characterized by adherence to public procurement processes, which can be extensive and require detailed proposals. Service level agreements (SLAs) are also crucial, outlining specific performance expectations and reporting requirements. The company's regulated operational framework is a strong asset, aligning with the predictable and stable energy needs of public sector operations.

Key aspects of serving this segment include:

- Public Procurement Compliance: Navigating and meeting the requirements of government tenders and bidding processes.

- Service Level Agreements (SLAs): Establishing and consistently meeting agreed-upon performance standards for energy delivery and reliability.

- Regulatory Alignment: Leveraging Fortis's regulated status to provide stable, predictable, and compliant energy services to public entities.

- Infrastructure Support: Providing energy solutions for a wide range of public facilities, from administrative buildings to critical services like water treatment plants.

Fortis serves a diverse customer base, including millions of residential customers who value reliability and affordability. The company also caters to commercial clients, from small businesses to larger complexes, requiring consistent energy supply. Additionally, industrial customers with significant, high-capacity energy demands are a key focus, alongside wholesale clients like other utilities and large institutions. Government and public sector entities also rely on Fortis for essential energy services.

| Customer Segment | Description | Key Needs | 2023/2024 Focus |

|---|---|---|---|

| Residential | Millions of households across North America and Caribbean. | Dependable service, competitive pricing, accessible support. | Maintaining reliability and affordability for 3.5M electricity and 1.3M natural gas customers. |

| Commercial | Small shops to larger office complexes. | Consistent energy supply, predictable and competitive pricing. | Meeting diverse energy requirements with reliable service. |

| Industrial | Manufacturing plants, resource extraction operations. | Consistent, high-capacity power flow tailored to technical requirements. | Supporting significant load growth potential in sectors like mining and manufacturing. |

| Wholesale | Other utilities, large institutional clients. | Bulk energy sales, long-term contracts, new market opportunities (e.g., data centers). | Securing multi-year agreements and targeting high-demand sectors. |

| Government/Public Sector | Municipal, provincial/state, federal agencies. | Reliable energy for critical public infrastructure, compliance with SLAs. | Providing stable, compliant energy services aligned with public sector operations. |

Cost Structure

Capital expenditures are the largest part of Fortis's expenses, focusing on building and improving their utility infrastructure. This includes significant investments in new power generation facilities, extensive transmission lines, and modern distribution networks to ensure reliable service.

Fortis has a substantial capital investment plan, projecting $26 billion in capital expenditures between 2025 and 2029. This considerable outlay underscores their commitment to long-term growth and infrastructure development across their diverse utility operations.

Operating and Maintenance (O&M) costs for Fortis are the essential day-to-day expenses of keeping their extensive utility infrastructure running smoothly. This includes everything from paying the skilled workforce that keeps the lights on and water flowing, to maintaining and repairing critical equipment like pipelines, power lines, and treatment plants.

Fortis is committed to managing these operational expenses efficiently, aiming to keep controllable O&M cost increases stable. For instance, in 2023, Fortis reported that its total operating expenses were $5.4 billion, with O&M being a significant portion of that. Maintaining cost discipline here is vital for profitability, especially within the regulated utility sector where cost recovery is carefully monitored.

Fuel and purchased power are significant expenses for Fortis, particularly for its electricity generation segment. In 2023, Fortis's total operating expenses were $10.5 billion, with fuel and purchased power making up a substantial portion of this. For instance, at its regulated utilities, these costs are often subject to regulatory review and can be recovered from customers through approved rates, mitigating direct impact on the company's profitability.

Regulatory and Compliance Costs

Fortis's cost structure is significantly impacted by regulatory and compliance expenses. These are inherent to operating as a regulated utility, encompassing legal fees for navigating complex regulations, administrative costs associated with rate case filings, and expenditures on environmental compliance. For instance, in 2023, Fortis reported significant investments in regulatory proceedings and compliance initiatives, reflecting the ongoing nature of these requirements.

These costs are generally recoverable through approved customer rates, ensuring that Fortis can maintain its operations and infrastructure while adhering to all legal and environmental standards. The company actively manages these costs through efficient processes and strategic planning.

- Legal fees for regulatory approvals and ongoing compliance.

- Administrative expenses for rate case filings and reporting.

- Environmental compliance measures to meet sustainability standards.

- Ongoing investments in systems and personnel to ensure adherence to regulations.

Financing Costs and Debt Servicing

Fortis's capital-intensive operations necessitate significant debt financing for infrastructure projects, directly impacting its cost structure through interest expenses. For instance, in 2023, Fortis reported interest expenses of approximately $1.2 billion CAD, reflecting the substantial debt load required to fund its extensive utility assets.

The company's robust financial health, evidenced by its investment-grade credit ratings, allows it to secure favorable borrowing terms. This strategic advantage helps mitigate the overall cost of debt servicing, making it a manageable component of its overall expenses.

- Substantial Debt Load: Fortis utilizes significant debt to finance its capital-intensive infrastructure, a common practice in the utility sector.

- Interest Expense Impact: Interest payments on this debt represent a material cost within the company's overall financial obligations.

- Favorable Financing Terms: Strong credit ratings enable Fortis to access debt at competitive rates, thereby managing servicing costs effectively.

Fortis's cost structure is heavily influenced by its capital expenditures, which are essential for maintaining and expanding its utility infrastructure. These investments are substantial, with the company projecting $26 billion in capital expenditures between 2025 and 2029, highlighting the significant upfront investment required for new power generation, transmission lines, and distribution networks.

Operating and maintenance (O&M) costs represent the ongoing expenses for keeping Fortis's vast utility operations running, encompassing labor, repairs, and upkeep of critical assets. In 2023, total operating expenses were $5.4 billion, with O&M being a key component, and the company aims to maintain stable, controllable O&M cost increases.

Fuel and purchased power are significant variable costs, particularly for electricity generation, and these were a substantial part of Fortis's $10.5 billion in total operating expenses in 2023. These costs are often recoverable from customers through regulated rates.

Interest expenses are a material cost due to Fortis's reliance on debt financing for its capital-intensive projects. In 2023, interest expenses were approximately $1.2 billion CAD, a direct consequence of the significant debt required to fund its utility assets.

| Cost Category | 2023 Expense (CAD billions) | Key Drivers | Impact on Business Model |

|---|---|---|---|

| Capital Expenditures | (Projected $26B, 2025-2029) | Infrastructure development, new generation, network upgrades | Long-term asset growth, service reliability, future revenue generation |

| Operating & Maintenance (O&M) | Significant portion of $5.4B total operating expenses | Labor, repairs, asset upkeep, skilled workforce | Ensuring service continuity, operational efficiency, profitability |

| Fuel & Purchased Power | Substantial portion of $10.5B total operating expenses | Electricity generation, energy market fluctuations | Direct operating cost, recoverable through regulated rates |

| Interest Expense | ~$1.2B | Debt financing for capital projects, borrowing costs | Financing cost, managed through credit ratings and favorable terms |

Revenue Streams

Fortis's core revenue generation stems from selling electricity to a diverse customer base, including homes, businesses, and industries across its regulated territories. This is a highly dependable income source because the prices are set by regulatory authorities, ensuring they cover operational expenses and allow for a fair return on the company's investments.

In 2024, Fortis's regulated electricity sales are projected to remain the dominant revenue driver, reflecting the essential nature of utility services. The company's substantial rate base, which represents its invested capital in infrastructure, directly underpins these predictable sales revenues.

Fortis generates revenue from selling and distributing natural gas to customers within its regulated service territories. These sales, like electricity, are overseen by regulators, which helps ensure stable revenue and the ability to recover costs. FortisBC Energy, a significant part of the company, is a major player in this segment.

Fortis generates substantial revenue from transmission and distribution charges, which are separate from the actual cost of electricity and natural gas. These charges essentially act as a toll for using their vast network of pipes and power lines, covering the costs and risks associated with maintaining and operating this critical infrastructure.

The company's extensive investments in its transmission systems, particularly through subsidiaries like ITC, are a key driver of its earnings. These investments increase the company's rate base, which is the value of assets upon which regulators allow Fortis to earn a return, directly boosting profitability.

For instance, in 2023, Fortis reported that its regulated businesses, heavily reliant on transmission and distribution infrastructure, formed the backbone of its stable earnings. This segment continues to be a primary focus for capital deployment, aiming to further expand the rate base and ensure predictable revenue streams.

Rate Base Growth and Capital Investment Returns

Fortis's strategy centers on expanding its regulated asset base, known as the rate base, through consistent capital investments. This growth directly translates into higher earnings as new infrastructure projects are approved and begin generating revenue under regulatory oversight. For instance, Fortis's 2024 capital plan targets significant investments, aiming to further bolster its rate base and secure predictable returns.

The company's ability to earn a regulated return on these invested capital assets is a cornerstone of its financial model. This allows Fortis to generate stable cash flows, which are crucial for funding ongoing operations, reinvestment, and importantly, supporting its commitment to dividend growth for shareholders. The regulated nature of these returns provides a degree of insulation from market volatility.

- Rate Base Expansion: Fortis aims to grow its rate base through planned capital expenditures, adding new regulated assets to its portfolio.

- Regulated Returns: The company earns a predetermined rate of return on its invested capital within the rate base, ensuring predictable earnings.

- Earnings Growth Driver: Successful integration of new assets into the rate base directly contributes to increased earnings per share.

- Dividend Support: Stable, regulated returns provide the financial foundation to support and grow dividend payments to investors.

Ancillary Services and Other Regulated Fees

Beyond direct energy sales, Fortis generates significant revenue from ancillary services and regulated fees. These include charges for new customer connections, meter services, and specific tariffs for specialized offerings, all approved by regulatory bodies. In 2023, Fortis reported approximately $1.1 billion in revenue from its regulated utilities' non-energy related services, highlighting their importance to the overall regulated earnings profile.

- Connection fees for new residential and commercial customers.

- Service charges for meter reading and maintenance.

- Tariffs for specialized services like voltage regulation or power quality monitoring.

- Late payment fees and other administrative charges.

Fortis's revenue streams are primarily anchored in the regulated sale of electricity and natural gas across its diverse utility operations. These sales are bolstered by transmission and distribution charges, essentially tolls for utilizing its extensive infrastructure network. The company's strategy focuses on expanding its regulated asset base, or rate base, through consistent capital investments, which directly translates into predictable earnings and supports dividend growth.

| Revenue Stream | Description | 2023 Contribution (Approximate) |

| Regulated Electricity Sales | Sale of electricity to residential, commercial, and industrial customers. | Dominant revenue source, driven by rate base. |

| Regulated Natural Gas Sales | Sale and distribution of natural gas to customers. | Significant contributor, with FortisBC Energy being a key entity. |

| Transmission & Distribution Charges | Fees for using Fortis's power lines and natural gas pipelines. | Crucial for covering infrastructure costs and risks. |

| Ancillary Services & Fees | Revenue from new customer connections, meter services, and specialized tariffs. | Approximately $1.1 billion in 2023 from regulated utilities' non-energy services. |

Business Model Canvas Data Sources

The Fortis Business Model Canvas is built using a combination of internal financial data, extensive market research on energy infrastructure and customer needs, and strategic insights derived from industry analysis. These sources ensure each block is filled with accurate, up-to-date information reflecting Fortis's operations and market position.