Fortis (Canada) PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fortis (Canada) Bundle

Fortis (Canada) operates within a dynamic environment shaped by evolving political landscapes, economic fluctuations, and technological advancements. Understanding these external forces is crucial for strategic planning and identifying potential opportunities or threats. Our comprehensive PESTLE analysis delves into these critical factors, offering actionable insights tailored to Fortis. Gain a competitive edge and make informed decisions by downloading the full report now.

Political factors

Fortis operates within a heavily regulated landscape across its diverse service territories in Canada, the United States, and the Caribbean. Government agencies and commissions are instrumental in setting utility rates, defining service quality benchmarks, and approving significant infrastructure development projects. This oversight directly shapes the company's operational parameters and financial performance.

Regulatory shifts can significantly influence Fortis's strategic direction and profitability. For instance, the Arizona Corporation Commission's approval of a formula rate plan in October 2024 offers Fortis Arizona enhanced operational flexibility and greater predictability in its earnings, a crucial factor for managing capital-intensive investments.

The continuous evolution of utility regulations in these various jurisdictions presents both challenges and opportunities. These ongoing discussions and potential policy updates are critical for Fortis, impacting its capacity to recover costs associated with its substantial capital expenditure programs and ultimately affecting its overall financial health.

Government policies focused on decarbonization and achieving net-zero emissions are fundamentally shaping Fortis's strategic path. Canada's finalized Clean Electricity Regulations, effective January 1, 2025, mandate a net-zero electricity grid by 2050. This regulation compels utilities like Fortis to accelerate investments in cleaner energy sources and upgrade their grid infrastructure to meet these ambitious targets.

The Inflation Reduction Act of 2022 in the United States provides significant tailwinds for Fortis's strategic initiatives. This legislation specifically supports investments in regional transmission projects and facilitates the transition away from coal-fired power generation, aligning with Fortis's broader goals for a cleaner energy future.

The ongoing debate between federal and provincial governments over energy policy significantly impacts Fortis. Federal efforts, such as the proposed Clean Electricity Regulations aiming for net-zero emissions by 2035, can create investment opportunities in renewable infrastructure. However, provincial pushback, particularly from resource-rich provinces like Alberta, which views these regulations as overreach into their jurisdiction, introduces considerable regulatory uncertainty for major capital projects.

Government Incentives and Subsidies

Government support, including tax incentives and funding stimulus for clean energy projects, significantly influences Fortis's investment decisions. These programs are vital for accelerating infrastructure modernization and the integration of renewable energy sources.

The Inflation Reduction Act (IRA) in the U.S. has been a substantial tailwind for Fortis's capital plan, particularly supporting transmission projects and the company's strategic move away from coal-fired generation. This legislation is projected to drive significant investment in clean energy infrastructure across the United States.

- IRA Impact: The IRA is expected to unlock billions in clean energy investments, directly benefiting utilities like Fortis with projects in renewable generation and grid modernization.

- Accelerated Transition: Such incentives are crucial for speeding up the transition to cleaner energy sources, making previously marginal projects economically viable.

- Capital Allocation: Fortis has highlighted the IRA's role in supporting its substantial capital expenditure plans, which are focused on regulated utility investments and clean energy development through 2027.

Geopolitical Stability and Trade Policies

Fortis's operations span Canada, the United States, and the Caribbean, exposing it to diverse geopolitical landscapes. While its primary markets in Canada and the U.S. offer high stability, shifts in regional politics or international relations could indirectly affect supply chains for essential infrastructure components. For instance, disruptions in global trade routes, potentially exacerbated by geopolitical tensions, could increase the cost of specialized equipment needed for Fortis's capital expenditure programs, which are projected to reach $24.3 billion between 2024 and 2028.

Changes in trade agreements or tariffs between North American countries could also influence the cost-effectiveness of cross-border operations and material sourcing. Furthermore, geopolitical events impacting global energy markets can directly affect commodity prices, influencing both the cost of energy generation and the demand for Fortis's utility services. For example, the volatility in natural gas prices in 2024, driven by international supply concerns, underscores this dependency.

- Geopolitical Risk Exposure: Fortis operates in jurisdictions with varying levels of geopolitical stability, requiring continuous monitoring of political developments in each region.

- Trade Policy Impact: Evolving trade policies, particularly between Canada and the U.S., can affect the cost and availability of critical equipment and materials for infrastructure projects.

- Energy Market Volatility: Geopolitical events influencing global energy supply and demand can lead to fluctuations in energy prices, impacting Fortis's operational costs and revenue streams.

- Supply Chain Resilience: Fortis must ensure its supply chains for infrastructure investments are robust enough to withstand potential disruptions stemming from geopolitical instability or trade disputes.

Government regulations are a primary driver for Fortis, with policies on decarbonization and grid modernization directly influencing its capital investments. The finalized Clean Electricity Regulations in Canada, effective January 1, 2025, mandate a net-zero grid by 2050, compelling Fortis to invest in cleaner energy and infrastructure upgrades. The U.S. Inflation Reduction Act of 2022 provides significant incentives for regional transmission projects and the transition away from coal, aligning with Fortis's clean energy goals. Federal energy policies, while creating opportunities, also introduce uncertainty due to provincial disagreements, impacting large-scale projects.

| Policy/Regulation | Effective Date | Impact on Fortis |

|---|---|---|

| Canada Clean Electricity Regulations | January 1, 2025 | Mandates net-zero grid by 2050; requires accelerated investment in renewables and grid upgrades. |

| U.S. Inflation Reduction Act (IRA) | 2022 | Supports transmission projects and coal phase-out; drives clean energy investment. |

| Arizona Formula Rate Plan | October 2024 | Enhances operational flexibility and earnings predictability for Fortis Arizona. |

What is included in the product

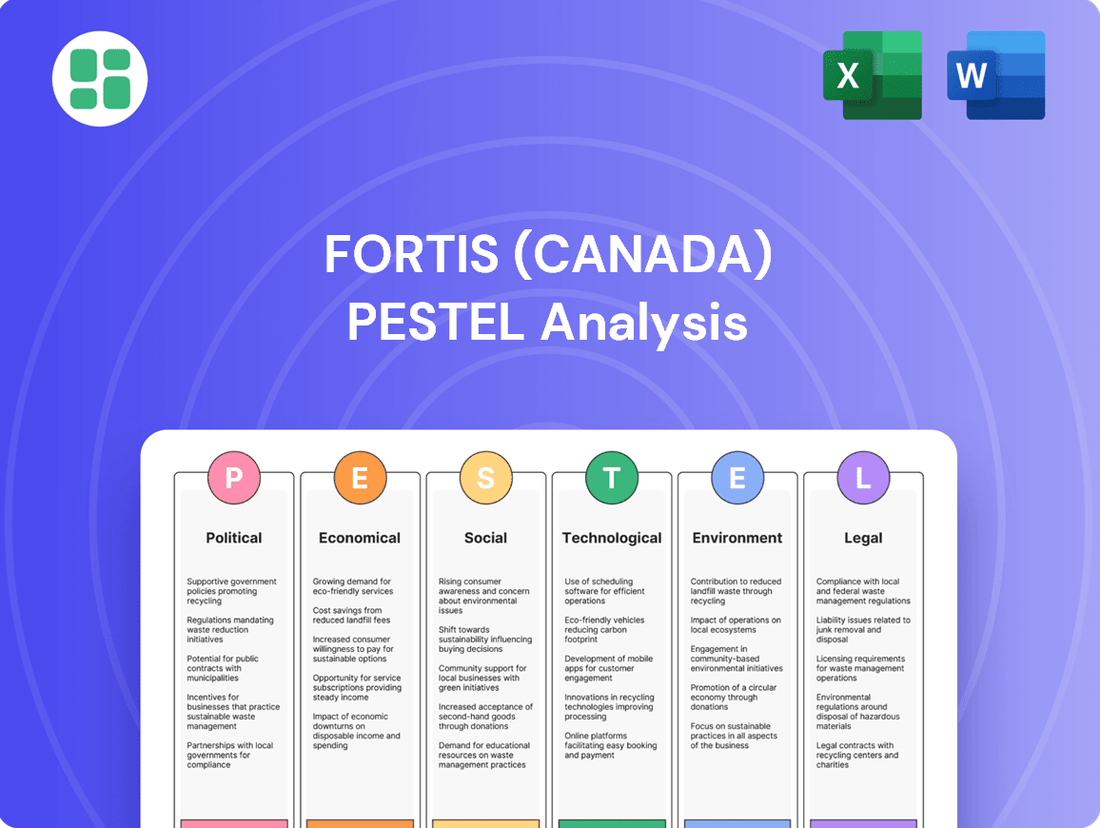

This PESTLE analysis examines the external macro-environmental factors influencing Fortis (Canada) across political, economic, social, technological, environmental, and legal dimensions.

It provides a comprehensive understanding of how these forces create both challenges and strategic advantages for the company.

A clean, summarized version of the Fortis (Canada) PESTLE Analysis, presented in an easily digestible format, alleviates the pain point of information overload, allowing teams to quickly grasp key external factors influencing the company.

Economic factors

Interest rate fluctuations are a significant economic factor for Fortis, a capital-intensive utility. As the company relies heavily on debt financing for its substantial infrastructure investments, rising interest rates directly increase borrowing costs. This can negatively affect the profitability of new projects and elevate Fortis's overall cost of capital.

Fortis's ambitious $26 billion five-year capital plan, spanning from 2025 to 2029, is slated for funding primarily through operational cash flow and regulated debt. Consequently, maintaining stability in interest rates is crucial for the successful execution and financial viability of these planned investments.

Inflationary pressures can significantly impact Fortis's operating costs. For instance, rising material costs, such as steel and copper used in infrastructure projects, directly increase capital expenditure. In 2024, global inflation rates, while moderating from 2023 peaks, remained a concern for many economies where Fortis operates, potentially pushing up expenses for labor and supplies.

While Fortis operates in regulated markets, allowing for rate adjustments to offset inflation, there's often a time lag. This delay means that increased costs might not be immediately passed on to customers, potentially squeezing profit margins in the interim. For example, a typical rate case process can take 12-18 months, during which Fortis absorbs higher expenses.

Effectively managing these inflationary impacts is crucial for Fortis to maintain both customer affordability and its own financial stability. Balancing the need to recover costs with keeping rates reasonable is a constant challenge for regulated utilities, especially as the cost of capital also tends to rise with inflation.

Fortis's service territories, which include regions in Canada, the U.S., and the Caribbean, are directly impacted by the economic health and growth within these areas. Strong economic expansion typically fuels higher energy consumption from homes, businesses, and industries, which in turn supports Fortis's revenue streams.

For instance, Canada's GDP growth was estimated to be around 1.7% in 2024, and the U.S. economy projected a similar growth rate. This sustained economic activity generally translates to increased demand for electricity and natural gas, benefiting utilities like Fortis.

Conversely, any economic downturns or recessions in these key markets can lead to reduced energy usage, potentially impacting Fortis's earnings and investment plans. A slowdown in industrial output or consumer spending directly correlates with lower energy demand.

Capital Expenditure Programs and Rate Base Growth

Fortis's strategy hinges on expanding its regulated asset base through substantial capital expenditure programs. This approach is designed to generate predictable, long-term earnings growth.

The company has outlined an ambitious five-year capital plan, totaling $26 billion for the period 2025-2029. This significant investment is projected to boost its rate base considerably.

Specifically, Fortis anticipates its midyear rate base to grow from $39.0 billion in 2024 to $53.0 billion by 2029. This represents a compound annual growth rate of 6.5%.

- Capital Plan: $26 billion over five years (2025-2029).

- Rate Base Growth: Expected to increase from $39.0 billion (2024) to $53.0 billion (2029).

- CAGR: 6.5% compound annual growth rate for the rate base.

- Investment Rationale: Enhancing reliability, grid modernization, and clean energy integration.

Foreign Exchange Rate Volatility

Fortis's operations across Canada, the U.S., and the Caribbean mean that fluctuations in foreign exchange rates, especially between the U.S. dollar (USD) and the Canadian dollar (CAD), directly impact its financial results. For instance, a stronger USD relative to the CAD can boost the reported earnings from its U.S. subsidiaries when converted back to Canadian dollars. Conversely, a weaker USD can diminish these reported earnings.

Exchange rate volatility also affects Fortis's capital expenditures. If the company needs to purchase equipment or services priced in USD for its Canadian operations, a stronger USD would increase the cost in CAD. This dynamic requires careful financial planning and hedging strategies to mitigate potential negative impacts on profitability and project budgets.

- USD/CAD Exchange Rate Impact: In 2024, the USD/CAD exchange rate has seen fluctuations, with the USD generally trading in a range that can influence Fortis's reported earnings. For example, if the USD strengthens against the CAD, it enhances the value of U.S. dollar-denominated revenues when translated into Canadian dollars for reporting purposes.

- Capital Expenditure Costs: Fortis's significant capital investments, such as those in its U.S. utility assets, can become more expensive in CAD terms if the USD strengthens. This necessitates careful budgeting and potentially utilizing currency hedging instruments to lock in costs.

- Caribbean Operations: While less significant than its North American exposure, Fortis's Caribbean operations may also be subject to currency fluctuations with local currencies against the USD and CAD, adding another layer of complexity to its financial management.

Economic growth directly influences Fortis's revenue through increased energy consumption. Canada's projected GDP growth of 1.7% for 2024 and similar U.S. forecasts suggest continued demand for Fortis's services. However, economic downturns could reduce energy usage and impact earnings.

Interest rate stability is critical for Fortis's $26 billion capital plan (2025-2029), which relies on debt financing. Rising rates increase borrowing costs, potentially affecting project profitability and the cost of capital. The company aims for a 6.5% compound annual growth rate in its rate base, reaching $53.0 billion by 2029 from $39.0 billion in 2024.

Inflation impacts operating costs, particularly for materials and labor, though regulated rate adjustments can offset these. A time lag in rate cases means Fortis may absorb higher costs temporarily. Managing these cost pressures while maintaining customer affordability is a key challenge.

Foreign exchange rates, especially USD/CAD, affect Fortis's financial reporting and capital expenditures. A stronger USD can increase the reported value of U.S. earnings but also raise the cost of USD-denominated equipment for Canadian projects.

| Economic Factor | Impact on Fortis | Key Data/Considerations (2024-2025) |

| Economic Growth | Drives energy demand and revenue. | Canada GDP ~1.7% (2024 est.); U.S. GDP similar. Economic slowdowns reduce demand. |

| Interest Rates | Affects cost of debt financing for capital investments. | Crucial for $26B capital plan (2025-2029). Rising rates increase borrowing costs. |

| Inflation | Increases operating and capital costs. | Moderating but still a concern for materials/labor. Rate lag can squeeze margins. |

| Foreign Exchange Rates (USD/CAD) | Impacts reported earnings and capital expenditure costs. | Fluctuations affect translation of U.S. subsidiary earnings and USD-denominated purchases. |

What You See Is What You Get

Fortis (Canada) PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, offering a comprehensive PESTLE analysis of Fortis (Canada).

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, detailing the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Fortis.

The content and structure shown in the preview is the same document you’ll download after payment, providing actionable insights for strategic planning regarding Fortis.

Sociological factors

Customers increasingly expect Fortis to provide reliable and affordable energy, a demand that is amplified by a growing awareness of climate change impacts. In 2024, for instance, extreme weather events across North America, including severe storms and heatwaves, placed significant strain on energy infrastructure, highlighting the need for robust and resilient systems.

Fortis's investments in grid hardening and system adaptation are direct responses to these evolving customer expectations and the increasing frequency of disruptive weather. For example, their capital expenditure plans for 2024-2028 include billions dedicated to modernizing and strengthening their networks to ensure continuity of service, even under challenging conditions.

The company's commitment to safety and reliability is a cornerstone of customer satisfaction. In 2023, Fortis reported high levels of service reliability across its operations, with metrics such as System Average Interruption Duration Index (SAIDI) demonstrating consistent performance, which is crucial for maintaining customer trust and loyalty.

Demographic shifts significantly impact Fortis's operations. For instance, in its Canadian utilities, population growth in regions like Alberta and British Columbia directly translates to increased demand for electricity and natural gas. Fortis's 2024 capital plan, totaling $4.7 billion, includes substantial investments aimed at supporting this customer growth and ensuring reliable service delivery.

Urbanization trends also play a crucial role. As more people move into urban centers within Fortis's service territories, the demand for energy infrastructure intensifies. This can necessitate upgrades to existing networks and the development of new connections to accommodate higher population densities, supporting economic development in these growing areas.

Fortis recognizes that a strong public image and a social license to operate are paramount, particularly as it navigates environmental responsibilities and community relations. Demonstrating commitment to sustainability, such as its goal to reduce greenhouse gas emissions by 35% from 2019 levels by 2035, directly influences how the public views the company.

Investing in cleaner energy sources and actively engaging with communities where it operates are key strategies. For instance, Fortis's significant investments in renewable energy projects, like the recently completed $1.3 billion Blue Sky Green Field renewable energy portfolio in the US, bolster its reputation as an environmentally conscious entity.

Furthermore, Fortis's proactive approach to partnerships with Indigenous communities, exemplified by its involvement in the Wataynikaneyap Power Project which aims to connect 17 remote First Nations communities to the electricity grid, significantly enhances social acceptance and underscores a dedication to positive social impact.

Workforce Availability and Labor Relations

Fortis relies heavily on a skilled workforce for its diverse operations, from construction and maintenance to the integration of new technologies. The energy transition is a key driver here, demanding employees proficient in areas like renewable energy systems, grid modernization, and advanced analytics. For instance, as of late 2024, the Canadian construction industry faced a notable shortage of skilled trades, impacting project timelines and costs, a challenge Fortis actively addresses through training and recruitment initiatives.

Attracting and retaining this specialized talent is paramount for Fortis’s continued success and its ability to innovate. The company's investment in employee development programs and competitive compensation packages are crucial in this regard. In 2024, reports indicated a growing demand for engineers with expertise in smart grid technology, with salaries for these roles seeing a significant uptick, underscoring the competitive landscape for talent.

Maintaining positive labor relations is also fundamental to Fortis's operational stability and project execution. Strong relationships with unions and employees ensure smoother negotiations, fewer disruptions, and a more productive work environment. In 2025, Fortis continued its commitment to collaborative bargaining, aiming to secure labor agreements that support both employee well-being and the company's strategic objectives, thereby minimizing the risk of work stoppages.

- Skilled Labor Demand: The energy sector, particularly with the transition to renewables, requires specialized skills in areas like advanced grid management and renewable energy installation.

- Talent Attraction & Retention: Fortis faces competition for talent, making employee development, competitive wages, and a positive work environment critical for securing and keeping skilled workers.

- Labor Relations: Maintaining constructive relationships with unions and employees is vital for operational continuity and efficient project delivery, reducing the likelihood of disruptions.

- 2024/2025 Context: The Canadian labor market in 2024 and 2025 shows persistent shortages in skilled trades and growing demand for tech-focused energy roles, impacting recruitment and operational costs for companies like Fortis.

Affordability of Energy Services

Customer affordability remains a paramount concern for Fortis, particularly within its regulated utility operations where any adjustments to energy rates require stringent approval from governing bodies. This dynamic necessitates a careful balancing act, ensuring substantial investments in infrastructure upgrades and modernization are made while simultaneously striving to maintain accessible energy costs for its vast customer base.

Fortis is actively working towards a cleaner energy future, but the commitment to affordability and reliability is non-negotiable. For instance, in 2023, Fortis invested approximately $4.5 billion in capital projects, a significant portion of which is aimed at enhancing the safety and efficiency of its existing infrastructure, ultimately supporting long-term affordability.

- Balancing Investment and Affordability: Fortis navigates the challenge of funding essential infrastructure upgrades while keeping energy prices manageable for consumers.

- Regulatory Scrutiny: Rate increases are subject to approval, making customer affordability a key consideration in all financial planning.

- Clean Energy Transition: The company aims to provide cleaner energy solutions without compromising affordability or service reliability.

- Capital Investment Focus: In 2023, Fortis allocated roughly $4.5 billion to capital projects, underscoring its commitment to infrastructure improvements that support stable pricing.

Societal expectations for Fortis are evolving, with a growing emphasis on corporate social responsibility and environmental stewardship. Customers and communities increasingly demand that energy providers operate sustainably and contribute positively to society. Fortis's proactive engagement with Indigenous communities, such as its role in the Wataynikaneyap Power Project, demonstrates a commitment to social inclusion and equitable development, fostering goodwill and strengthening its social license to operate.

The company's dedication to safety and reliability is a critical component of its social contract with customers. In 2023, Fortis maintained high service reliability across its operations, with key performance indicators like SAIDI reflecting a commitment to minimizing disruptions. This focus on dependable service builds customer trust, which is essential for maintaining its reputation and market position.

Demographic shifts and urbanization are also shaping societal demands on Fortis. Population growth in key service territories, like Alberta and British Columbia, drives increased energy demand, necessitating significant infrastructure investment. Fortis's 2024 capital plan, totaling $4.7 billion, directly addresses this by focusing on expanding and modernizing its networks to meet growing customer needs and support economic development.

| Sociological Factor | Description | Fortis's Response/Data |

| Corporate Social Responsibility | Increasing demand for ethical operations and community contribution. | Engagement with Indigenous communities via Wataynikaneyap Power Project; commitment to sustainability goals. |

| Customer Expectations | Emphasis on reliability, affordability, and environmental consciousness. | High service reliability metrics (e.g., SAIDI) in 2023; balancing infrastructure investment with rate management. |

| Demographic & Urbanization Trends | Growing energy demand due to population increases and urban concentration. | $4.7 billion capital plan for 2024 to support customer growth and infrastructure modernization in key Canadian territories. |

Technological factors

Fortis is actively investing in grid modernization, with a significant focus on smart grid technologies. In 2023, the company continued its substantial capital expenditures aimed at enhancing its transmission and distribution infrastructure. These investments are key to improving operational efficiency and ensuring a more reliable power supply for its customers.

The deployment of smart grid technologies allows Fortis to better integrate distributed energy resources, such as solar and wind power, into its existing network. This is crucial for meeting evolving energy demands and supporting the transition to cleaner energy sources. By 2024, Fortis anticipates further progress in these areas, bolstering grid resilience.

Furthermore, Fortis's grid hardening initiatives are a critical technological factor, increasing the network's ability to withstand disruptions. These efforts are designed to protect against both physical threats, like severe weather events, and increasingly sophisticated cyber threats, ensuring the continuity of essential services.

The global shift towards a low-carbon economy is driving substantial investments in renewable energy sources and advanced battery storage systems. Fortis is actively participating in this transition, earmarking about 27% of its capital expenditure over the next five years for cleaner energy initiatives. This strategic allocation is geared towards enhancing the grid's capacity to integrate renewable power and building out essential storage infrastructure.

A prime illustration of Fortis's commitment is the Roadrunner Reserve battery storage project in Arizona. This initiative is crucial for enabling the seamless incorporation of intermittent renewable energy, such as solar and wind, into the existing power grid. Such projects are vital for ensuring grid stability and reliability as the energy landscape evolves.

As utility infrastructure becomes more interconnected and digitized, cybersecurity threats pose a significant risk to operational integrity and data privacy. Fortis must continually invest in robust cybersecurity measures to protect its critical infrastructure and customer information from potential breaches.

The increasing reliance on digital systems means Fortis faces evolving threats, from ransomware to sophisticated state-sponsored attacks. For instance, the energy sector globally saw a significant increase in cyber incidents reported in 2023 and early 2024, with attacks often targeting operational technology (OT) systems. Fortis's commitment to cybersecurity is crucial for maintaining reliable service delivery and safeguarding sensitive customer data, a challenge that requires ongoing adaptation and significant capital allocation.

Digitalization of Operations and Analytics

Fortis is actively embracing digitalization to enhance its operations. By integrating artificial intelligence, advanced data analytics, and automation, the company aims to boost efficiency, particularly in areas like predictive maintenance for its extensive infrastructure. This focus on digital transformation is crucial for optimizing energy delivery and improving asset management across its diverse utility portfolio.

The company's commitment to leveraging digital technologies is evident in its ongoing investments. For instance, in 2023, Fortis reported capital expenditures of approximately $4.5 billion, a significant portion of which is directed towards modernization and technology upgrades, including digitalization initiatives. These investments are designed to streamline processes and enhance the customer experience through more responsive and data-driven services.

Key technological advancements impacting Fortis include:

- AI-powered predictive maintenance: Reducing downtime and operational costs by anticipating equipment failures.

- Advanced data analytics: Optimizing energy grid performance and load balancing in real-time.

- Automation of customer service: Improving response times and personalization for customer interactions.

- Digital twin technology: Creating virtual replicas of assets for simulation and improved management.

Electric Vehicle (EV) Infrastructure Growth

The accelerating adoption of electric vehicles (EVs) is a significant technological factor influencing Fortis. This trend creates both opportunities for increased electricity sales and challenges related to managing higher demand and investing in necessary charging infrastructure. For instance, by the end of 2024, it's projected that over 3 million EVs will be on Canadian roads, a substantial increase from previous years.

Fortis's strategy likely involves actively supporting the expansion of EV charging networks and ensuring its distribution systems can handle the anticipated surge in electricity consumption. This includes grid modernization efforts to accommodate the growing EV load. By 2030, forecasts suggest that EVs could represent up to 30% of new vehicle sales in Canada, underscoring the scale of this transformation.

- Increased Electricity Demand: The growing number of EVs directly translates to higher electricity consumption, presenting a revenue opportunity for Fortis.

- Infrastructure Investment: Fortis will need to invest in upgrading and expanding its grid infrastructure to support widespread EV charging.

- Grid Modernization: Technological advancements in grid management are crucial for efficiently integrating and managing EV charging loads.

Technological advancements are reshaping Fortis's operational landscape, driving investments in smart grid technologies and grid modernization to enhance efficiency and reliability. The company is also focusing on integrating distributed energy resources and improving grid resilience against cyber threats.

Fortis is allocating significant capital towards cleaner energy initiatives, including battery storage projects like Roadrunner Reserve, to support the integration of renewable energy sources and ensure grid stability. Digitalization efforts, utilizing AI and data analytics, are also underway to optimize operations and asset management.

The accelerating adoption of electric vehicles (EVs) presents both opportunities for increased electricity sales and the challenge of managing higher demand and investing in charging infrastructure. By 2030, EVs could account for up to 30% of new vehicle sales in Canada, necessitating grid upgrades.

| Technological Factor | Impact on Fortis | Key Data/Trend (2024/2025) |

| Smart Grid & Modernization | Improved efficiency, reliability, integration of renewables | Continued substantial capital expenditures in 2023 for infrastructure enhancement. |

| Cybersecurity | Protection of critical infrastructure and data | Energy sector saw increased cyber incidents in late 2023/early 2024, targeting OT systems. |

| Electric Vehicle (EV) Adoption | Increased electricity demand, infrastructure investment needs | Projected over 3 million EVs on Canadian roads by end of 2024. |

Legal factors

Fortis's financial health hinges on securing regulatory approvals for rate adjustments and significant infrastructure investments across its operating regions. These approvals directly impact the company's ability to recover capital expenditures and maintain profitability.

In 2024, Fortis experienced positive developments, such as the approval of FortisBC's multi-year rate plan, which provides a predictable revenue stream. Similarly, Central Hudson's general rate application in New York was approved, allowing for necessary investments in its transmission and distribution systems.

These regulatory outcomes are vital, as they enable Fortis to earn a fair return on its substantial capital investments, estimated at $24.5 billion through 2028, supporting long-term growth and operational reliability.

Fortis faces stringent environmental regulations, particularly concerning greenhouse gas emissions, air quality, and water management. These rules directly shape its operational choices and future investment plans, compelling the company to adapt its strategies. For instance, Canada's proposed Clean Electricity Regulations aim for a net-zero grid by 2035, impacting Fortis's generation portfolio.

Compliance with these evolving standards is not optional; it's a mandatory aspect of doing business. This necessitates significant capital allocation towards decarbonization efforts, including investments in renewable energy sources and advanced emission reduction technologies. By 2024, Fortis had already committed billions to its capital plan, with a substantial portion earmarked for cleaner energy infrastructure to meet these regulatory demands.

Fortis operates under rigorous health and safety regulations, essential for safeguarding its workforce and the communities it serves. Adherence to occupational safety standards and operational procedures is paramount to preventing incidents and ensuring a secure operating environment.

In 2023, Fortis reported a Total Recordable Injury Frequency Rate (TRIFR) of 0.69, significantly below the industry average, demonstrating a strong commitment to safety excellence.

Land Use and Permitting Laws

Fortis's large-scale infrastructure projects, like transmission lines and power plants, are significantly shaped by intricate land use and permitting regulations. Navigating these legal landscapes, which often include rigorous environmental assessments and public consultations, can be a lengthy and costly endeavor, directly influencing project schedules and overall expenditures.

The complexities of these laws are highlighted by projects such as the Wataynikaneyap Power Project. This initiative required extensive and meaningful engagement with numerous First Nations communities, underscoring the critical need for thorough stakeholder consultation within the permitting process.

- Regulatory Hurdles: Land use and permitting laws present significant hurdles for infrastructure development, demanding meticulous adherence to environmental standards and community engagement protocols.

- Project Delays and Costs: The time-consuming nature of these legal frameworks can lead to substantial project delays and increased capital costs for companies like Fortis.

- First Nations Engagement: Projects involving Indigenous territories, such as the Wataynikaneyap Power Project, necessitate deep and ongoing consultation with First Nations communities, impacting project planning and execution.

Data Privacy and Consumer Protection Laws

Fortis must navigate a complex web of data privacy and consumer protection laws as it leverages customer information for smart grid initiatives and tailored offerings. Compliance with regulations like Canada's Personal Information Protection and Electronic Documents Act (PIPEDA) and various U.S. state-level data protection statutes, such as California's Consumer Privacy Act (CCPA), is paramount.

These laws govern the collection, storage, and utilization of customer data, imposing strict requirements on consent, transparency, and security. Failure to comply can result in significant fines and reputational damage, impacting Fortis's ability to operate and innovate.

- PIPEDA sets national standards for privacy in the private sector in Canada.

- CCPA grants California consumers specific rights regarding their personal information.

- Fortis's data handling practices must align with evolving privacy expectations and regulatory enforcement trends observed in both Canada and the U.S.

Fortis's operational and investment strategies are profoundly influenced by a dynamic legal and regulatory environment. Key legal factors include the necessity for regulatory approvals for rate adjustments and capital investments, ensuring a fair return on its $24.5 billion capital plan through 2028. Environmental regulations, particularly those targeting greenhouse gas emissions, mandate significant capital allocation towards decarbonization, impacting generation portfolios in line with goals like Canada's net-zero grid by 2035.

Furthermore, stringent health and safety regulations are paramount, with Fortis reporting a strong safety record in 2023. Navigating complex land use and permitting laws, especially for large infrastructure projects requiring extensive stakeholder and First Nations engagement, can lead to project delays and increased costs. Data privacy laws, such as PIPEDA and CCPA, govern customer information use, demanding strict adherence to consent, transparency, and security protocols.

| Legal Factor | Impact on Fortis | Example/Data Point |

|---|---|---|

| Regulatory Approvals | Enables revenue recovery and investment returns | FortisBC's multi-year rate plan approved in 2024 |

| Environmental Regulations | Drives investment in decarbonization | Canada's proposed Clean Electricity Regulations (net-zero by 2035) |

| Health & Safety | Ensures worker and community protection | TRIFR of 0.69 in 2023 |

| Land Use & Permitting | Affects project timelines and costs | Wataynikaneyap Power Project requiring extensive First Nations consultation |

| Data Privacy | Governs customer information use | Compliance with PIPEDA and CCPA |

Environmental factors

Fortis's extensive infrastructure, including power lines and pipelines, faces significant threats from climate change. The increasing frequency and intensity of events like hurricanes, ice storms, and wildfires, amplified by global warming, can lead to widespread service disruptions and costly damage to its assets. For instance, the company's 2024 Climate Report outlines its ongoing assessment of these physical risks.

These extreme weather events necessitate substantial investments in infrastructure resilience and adaptation. Fortis is actively analyzing these impacts to develop strategies that protect its operations and ensure reliable service delivery to its customers across its diverse service territories. The company's commitment to understanding and mitigating these climate-related challenges is a key aspect of its long-term operational planning.

The global imperative to decarbonize and transition to clean energy presents a significant environmental factor for Fortis. Governments worldwide are implementing policies to reduce greenhouse gas (GHG) emissions, directly influencing the energy sector. This trend necessitates substantial investment in sustainable infrastructure and cleaner energy sources.

Fortis is actively responding to this environmental shift with its own ambitious targets. The company aims to slash Scope 1 GHG emissions by 50% by 2030 and 75% by 2035, with a long-term goal of achieving net-zero emissions by 2050. This strategic direction compels Fortis to allocate considerable capital towards renewable energy projects, the development of cleaner fuel alternatives, and the essential modernization of its existing energy grids.

Fortis, with its significant hydroelectric assets, faces critical environmental considerations in water resource management. The company must actively manage its water footprint, particularly as regions like Western Canada experience increasing water scarcity and stricter regulations on water usage. Climate change impacts on precipitation patterns and glacial melt directly affect water availability for hydro generation, a key operational factor for Fortis.

Biodiversity and Land Use Conservation

Fortis's infrastructure expansion, especially for transmission lines and substations, necessitates stringent land use planning to safeguard biodiversity. Navigating environmental regulations and stakeholder expectations around habitat preservation and protected areas is crucial. For instance, in 2024, FortisBC reported investing $400 million in capital projects, many of which involve land access and potential environmental considerations.

The company must adhere to various environmental impact assessment processes and mitigation strategies to ensure sustainable development. These efforts are vital for maintaining ecological balance and public trust. Fortis's commitment to environmental stewardship is reflected in its ongoing efforts to minimize its footprint during construction and operations.

- Regulatory Compliance: Fortis must comply with federal and provincial regulations concerning endangered species and critical habitats, impacting project timelines and costs.

- Stakeholder Engagement: Proactive engagement with environmental groups and Indigenous communities is essential for addressing concerns related to land use and biodiversity.

- Mitigation Measures: Implementing measures like wildlife crossings and habitat restoration projects are key to offsetting development impacts.

- Sustainable Land Management: Fortis aims to integrate sustainable land management practices across its operations to protect natural resources.

Waste Management and Pollution Control

Fortis, like any utility operator, faces environmental scrutiny regarding its waste streams and potential pollution. In 2023, the company reported managing various operational wastes, with a focus on reducing landfill contributions and increasing recycling rates across its diverse utility operations. This includes adhering to stringent provincial and federal regulations on everything from wastewater discharge to the safe disposal of retired equipment.

The company's commitment to pollution control extends beyond greenhouse gas emissions, encompassing air pollutants and potential soil or water contaminants. Fortis invested significantly in advanced emission control technologies at its power generation facilities and implemented robust spill prevention and response plans for its extensive pipeline networks. For instance, in 2024, Fortis continued its program of upgrading infrastructure to minimize leaks and fugitive emissions, a key aspect of its environmental stewardship.

- Waste Reduction Targets: Fortis is actively working towards specific waste reduction and diversion targets, aiming to increase the percentage of waste recycled or reused by 2025.

- Air Quality Monitoring: Continuous monitoring of air emissions at its facilities ensures compliance with stringent air quality standards, a critical factor for public health and environmental protection.

- Contaminant Management: The company employs rigorous protocols for identifying, assessing, and remediating any potential soil or groundwater contamination resulting from historical or current operations.

- Pollution Prevention Investment: Fortis allocates capital to pollution prevention initiatives, such as modernizing equipment and implementing best practices in operational management to minimize environmental impact.

Fortis faces significant environmental pressures, including the increasing impact of extreme weather events due to climate change, necessitating substantial investments in infrastructure resilience. The global push for decarbonization and the transition to clean energy also demands considerable capital allocation towards sustainable infrastructure and cleaner energy sources.

Water resource management is critical, especially in regions experiencing scarcity, directly impacting Fortis's hydroelectric generation capabilities. Furthermore, land use planning for infrastructure expansion requires careful navigation of environmental regulations and stakeholder expectations regarding biodiversity and habitat preservation.

Waste management and pollution control are ongoing concerns, with Fortis adhering to stringent regulations and investing in technologies to minimize emissions and prevent contamination. The company has set ambitious targets for GHG emission reductions, aiming for net-zero by 2050, and is actively working towards waste reduction and increased recycling rates.

| Environmental Factor | Impact on Fortis | Fortis's Response/Data |

|---|---|---|

| Climate Change & Extreme Weather | Damage to infrastructure, service disruptions | Ongoing assessment of physical risks (2024 Climate Report); investments in resilience |

| Decarbonization & Clean Energy Transition | Need for investment in renewables and cleaner fuels | Aim to cut Scope 1 GHG emissions by 50% by 2030, net-zero by 2050 |

| Water Resource Management | Impacts hydroelectric generation | Active management of water footprint; climate change effects on precipitation |

| Biodiversity & Land Use | Regulatory compliance, stakeholder engagement | $400 million in capital projects (2024) with environmental considerations; habitat preservation efforts |

| Waste Management & Pollution Control | Adherence to regulations, operational impact | Focus on waste reduction and recycling; investment in emission control and spill prevention (2024 infrastructure upgrades) |

PESTLE Analysis Data Sources

Our Fortis PESTLE Analysis is built on a robust foundation of data from Statistics Canada, Environment and Climate Change Canada, and industry-specific reports. We also incorporate insights from financial news outlets and market research firms to ensure comprehensive coverage of political, economic, social, technological, environmental, and legal factors.