Fortis (Canada) Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fortis (Canada) Bundle

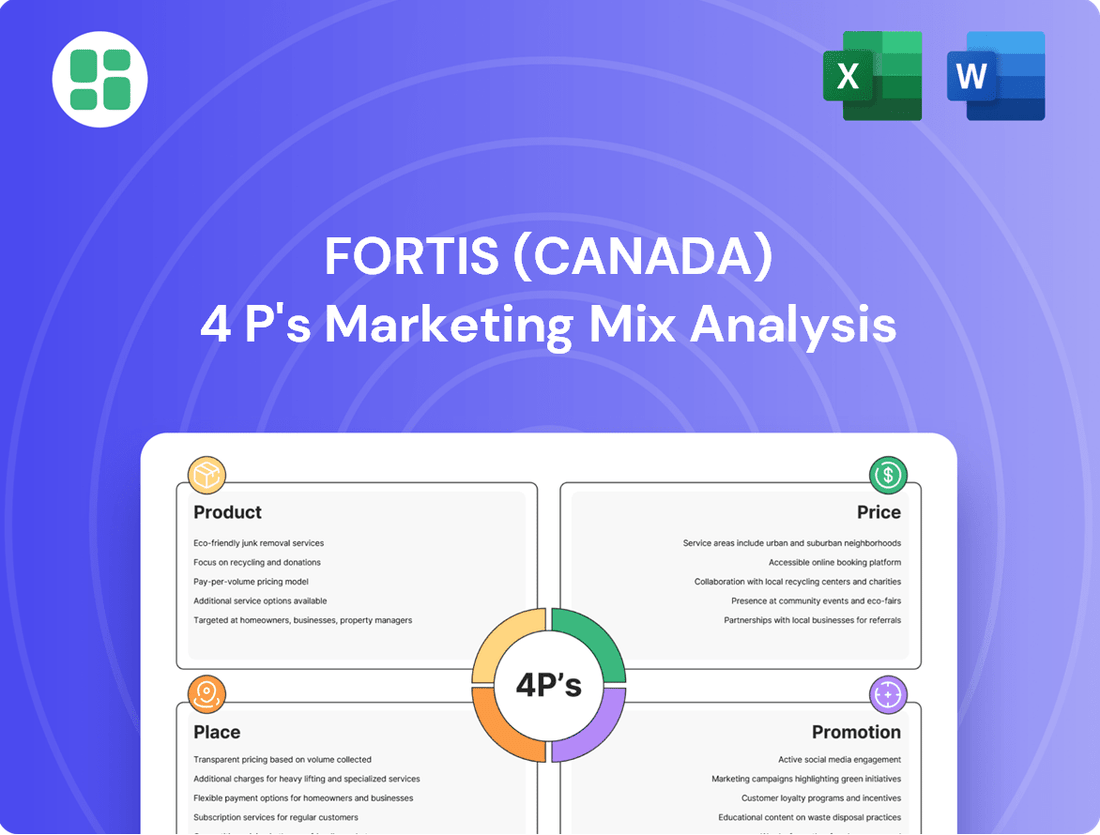

Fortis (Canada)'s marketing strategy is a masterclass in aligning product, price, place, and promotion for sustained growth. This analysis delves into how their diversified energy services and infrastructure offerings are positioned, priced competitively, distributed effectively, and promoted to stakeholders.

Go beyond the basics—get access to an in-depth, ready-made Marketing Mix Analysis covering Fortis (Canada)'s Product, Price, Place, and Promotion strategies. Ideal for business professionals, students, and consultants looking for strategic insights into the energy sector.

Product

Fortis Inc.'s regulated utility services, forming the core of its product offering, include electricity generation, transmission, and distribution, alongside natural gas distribution. These essential services cater to residential, commercial, and industrial clients across its North American and Caribbean footprint.

The regulated structure of these utilities provides a stable revenue stream and predictable cash flows, a key attraction for investors. For instance, as of the first quarter of 2024, Fortis reported that approximately 97% of its earnings were derived from regulated operations, highlighting the stability of its product.

Fortis's product offering is deeply rooted in its extensive energy infrastructure development. This includes substantial investments in modernizing existing electricity grids and expanding the capacity of its natural gas systems, ensuring a robust and reliable energy supply for millions.

The company is actively executing a significant capital plan, projecting approximately $24 billion in investments through 2028. This focus on infrastructure enhancement is designed to improve the reliability and resilience of its operations, directly benefiting its customer base.

These development initiatives not only secure Fortis's future growth trajectory but also directly contribute to improved service quality and operational efficiency across its diverse utility assets.

Fortis's clean energy transition solutions are a core part of its product offering, focusing on integrating renewable energy sources like wind and solar. This includes significant investments in battery storage to enhance grid reliability as more renewables come online. For instance, the company is advancing its Waterton Phase 2 wind project in Montana, expected to add 203 MW of capacity by late 2024.

The company is also exploring renewable natural gas (RNG) initiatives, aiming to diversify its fuel sources and reduce emissions. These solutions are designed to support Fortis's ambitious environmental goals, such as becoming coal-free by 2032 and achieving net-zero direct greenhouse gas emissions by 2050.

Reliability and Safety

Reliability and safety are foundational to Fortis's product offering, ensuring customers receive consistent energy. This commitment is demonstrated through substantial capital investments in infrastructure. For instance, in 2023, Fortis invested approximately $4.7 billion in its regulated utilities, with a significant portion allocated to system modernization and reliability improvements.

Fortis prioritizes operational excellence by continually enhancing its energy delivery networks. This includes proactive maintenance, advanced grid technologies, and robust safety protocols. These efforts are crucial for protecting both employees and the communities it serves from potential disruptions.

- System Hardening: Fortis invests heavily in making its infrastructure more resilient to extreme weather events and other potential threats.

- Modernization Efforts: The company upgrades aging infrastructure with newer, more efficient, and reliable technologies.

- Safety Protocols: Stringent safety measures are in place to protect workers and the public during operations and maintenance.

Customer-Centric Energy Solutions

Fortis's customer-centric energy solutions are a key part of its Product strategy, moving beyond basic utility services. This includes developing specialized offerings to address growing demands, such as the significant electricity needs of data centers and the infrastructure required for electric vehicles. For instance, FortisBC is actively involved in projects supporting the transition to cleaner energy, including natural gas for transportation and renewable natural gas initiatives, reflecting a direct response to customer and societal shifts.

The company leverages its diverse subsidiaries to deliver these tailored solutions, ensuring a localized and responsive approach. This means working closely with communities and regulatory bodies to adapt services to specific regional demands and customer expectations. In 2024, Fortis continued to invest heavily in infrastructure upgrades across its various operating regions, aiming to enhance reliability and capacity to meet these evolving customer needs, with capital expenditures projected to remain robust through 2025.

- Data Center Support: Fortis is actively enabling the growth of data centers by ensuring reliable and scalable power supply, a critical factor for these energy-intensive operations.

- EV Infrastructure: The company is investing in grid modernization and charging infrastructure to support the increasing adoption of electric vehicles by its residential and commercial customers.

- Renewable Energy Integration: Fortis subsidiaries are integrating renewable energy sources into their portfolios, offering customers cleaner energy options and aligning with sustainability goals.

- Community Engagement: Through local subsidiaries, Fortis maintains strong relationships with communities, ensuring energy solutions are practical and well-received, fostering trust and collaboration.

Fortis's product encompasses essential regulated utility services like electricity and natural gas delivery, forming the bedrock of its operations. These services are designed for reliability and safety, backed by substantial capital investments in infrastructure modernization. For example, the company projected around $24 billion in investments through 2028 to enhance system resilience and efficiency.

The company is also expanding its product into clean energy solutions, including wind power and battery storage, as seen with its Waterton Phase 2 wind project. Furthermore, Fortis is developing customer-centric offerings such as support for data centers and electric vehicle charging infrastructure, demonstrating an adaptive product strategy to meet evolving market demands.

| Product Aspect | Description | Key Data/Initiative |

|---|---|---|

| Core Utility Services | Electricity and natural gas generation, transmission, and distribution. | Approximately 97% of earnings from regulated operations (Q1 2024). |

| Infrastructure Investment | Modernization and expansion of energy grids and natural gas systems. | Projected $24 billion in investments through 2028. |

| Clean Energy Solutions | Integration of renewable energy sources and battery storage. | Waterton Phase 2 wind project (203 MW) expected by late 2024. |

| Customer-Centric Offerings | Tailored solutions for data centers and EV charging. | Ongoing investment in grid upgrades to support EV adoption. |

What is included in the product

This analysis provides a comprehensive breakdown of Fortis (Canada)'s marketing strategies, examining its Product offerings, Price structures, Place (distribution) strategies, and Promotion activities to understand its market positioning.

It offers actionable insights into Fortis (Canada)'s marketing mix, suitable for stakeholders seeking to understand or benchmark the company's approach in the energy sector.

Simplifies Fortis Canada's complex marketing strategy by clearly outlining how their 4Ps address customer pain points, making strategic alignment effortless.

Place

Fortis boasts an expansive network covering five Canadian provinces and ten U.S. states, alongside operations in three Caribbean nations. This extensive reach allows them to serve approximately 3.5 million electricity and natural gas customers, demonstrating a significant market presence.

Regulated transmission and distribution assets are the core of Fortis's business, representing approximately 93% of its total asset base. This significant concentration highlights the company's focus on essential energy infrastructure, ensuring reliable delivery of electricity and natural gas to millions of customers. The stable, regulated environment these assets operate within provides a predictable revenue stream, crucial for long-term financial planning and investment.

Fortis's local operating subsidiaries, such as FortisBC and FortisAlberta, are crucial to its place strategy. These entities, with local leadership, manage direct customer connections and distribution channels, ensuring responsiveness to regional demands and regulatory environments. As of the first quarter of 2024, Fortis reported approximately 3.7 million customers across its North American utilities, highlighting the broad reach of these localized operations.

Strategic Infrastructure Investments

Fortis strategically invests in its distribution channels, evident in its ambitious $26 billion five-year capital plan extending through 2029. This significant allocation is designed to bolster grid capacity and enhance reliability across its service territories.

These infrastructure upgrades are crucial for integrating cleaner energy sources, positioning Fortis for future growth and market leadership. The company's commitment to these capital programs underscores its dedication to long-term value creation and operational excellence.

- Capital Plan: $26 billion over five years through 2029.

- Objective: Enhance grid capacity and reliability.

- Strategic Focus: Support integration of cleaner energy sources.

- Market Impact: Solidifies market presence and future growth prospects.

Integrated Supply Chain & Logistics

Fortis manages an intricate supply chain crucial for uninterrupted energy delivery, spanning natural gas pipelines and electricity transmission networks. This involves meticulous oversight of assets across its extensive service areas, ensuring reliability and efficiency. For instance, in 2023, Fortis invested significantly in its transmission and distribution infrastructure, with capital expenditures of approximately $4.2 billion, underscoring the importance of maintaining and expanding these vital logistics networks.

Effective logistics are paramount for Fortis to guarantee service accessibility and operational excellence. This includes managing the flow of energy resources, maintaining infrastructure, and responding to demand across diverse geographical regions. The company's commitment to infrastructure upgrades directly supports its logistics capabilities, ensuring that energy reaches customers reliably.

- Infrastructure Investment: Fortis's 2023 capital expenditures of roughly $4.2 billion highlight a strong focus on enhancing its integrated supply chain and logistics capabilities.

- Service Territory Reach: Managing energy flow across vast territories, including British Columbia, Alberta, and the eastern United States, necessitates robust logistical planning and execution.

- Operational Efficiency: The continuous operation of its extensive pipeline and transmission line networks relies heavily on efficient logistics for maintenance, repair, and expansion projects.

- Energy Flow Management: Ensuring a consistent supply of natural gas and electricity from generation sources to end-users is a core function dependent on seamless supply chain integration.

Fortis's place in the market is defined by its extensive, geographically diverse utility operations and a strategic focus on regulated infrastructure. Its significant capital investments, like the $26 billion planned through 2029, directly enhance its distribution networks and grid capacity, ensuring reliable energy delivery to its millions of customers across Canada, the U.S., and the Caribbean.

| Metric | 2023 Data | 2024 (Q1) Data | 2025 Projection/Plan |

|---|---|---|---|

| Customer Base (Approx.) | ~3.5 million | ~3.7 million | Continued growth expected |

| Capital Expenditures (Annual) | ~$4.2 billion (2023) | On track with five-year plan | Part of $26 billion five-year plan (through 2029) |

| Asset Focus | ~93% regulated transmission & distribution | ~93% regulated transmission & distribution | Continued focus on regulated assets |

Full Version Awaits

Fortis (Canada) 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Fortis (Canada) 4P's Marketing Mix Analysis is complete and ready for your immediate use.

Promotion

Fortis (FTS) actively manages its investor relations, aiming for transparency with its broad shareholder base, which includes both individual investors and financial professionals. This commitment is demonstrated through consistent financial reporting, including annual and quarterly reports, timely news releases, and in-depth investor presentations. For instance, as of Q1 2024, Fortis reported a strong financial performance, with adjusted earnings per share of $0.79, reflecting the effectiveness of their strategic communications in conveying business progress and financial objectives.

Fortis actively manages its public perception through proactive communications, aiming to build trust with investors, customers, and communities. This strategy includes transparently sharing updates on their renewable energy projects and infrastructure investments, such as their significant capital expenditure plans for 2024, which are projected to reach billions of dollars, demonstrating their commitment to sustainable growth.

Their corporate communications team focuses on strategic messaging across various channels, including press releases and investor relations presentations, to highlight Fortis's financial performance and its role in the energy transition. For instance, in early 2024, Fortis reported strong earnings, driven by regulated utility operations and growth in renewable energy assets, reinforcing their stable business model.

By maintaining open dialogue and providing clear information about their operations and future plans, Fortis fosters positive stakeholder relationships. This approach is crucial for securing continued support for their long-term infrastructure development, which is vital for meeting energy demands and environmental goals.

Fortis actively engages with government, regulators, and communities to advocate for policies supporting its regulated utility operations. This proactive approach fosters a favorable regulatory climate and ensures community buy-in for infrastructure development, crucial for its business model.

Sustainability Reporting & ESG Communication

Fortis emphasizes its dedication to ESG through detailed annual sustainability reports. These reports showcase advancements in areas like decarbonization and clean energy, with Fortis aiming for a 35% reduction in absolute Scope 1 and Scope 2 greenhouse gas emissions by 2030 compared to a 2019 baseline.

The company's communication strategy highlights investments in renewable energy projects, such as its wind and solar portfolio, and its contributions to local communities. This transparency builds trust and meets the growing demand from investors for sustainable and responsible business operations.

- ESG Reporting: Fortis publishes annual sustainability reports detailing ESG performance.

- Decarbonization Goals: Aims for a 35% reduction in Scope 1 & 2 GHG emissions by 2030 (vs. 2019).

- Clean Energy Investments: Highlights progress in renewable energy projects, including wind and solar.

- Community Engagement: Communicates contributions to local communities, fostering positive stakeholder relations.

Digital Presence & Information Accessibility

Fortis, Inc. prioritizes a robust digital presence, utilizing its official website as a comprehensive portal for stakeholders. This platform serves as the primary conduit for disseminating crucial company information, including news releases, detailed financial reports, and investor presentations. By ensuring broad accessibility, Fortis enhances transparency and facilitates informed decision-making for investors and the public alike.

The company's digital strategy focuses on making key data readily available, streamlining access to essential information. For instance, as of their Q1 2024 earnings report, Fortis highlighted continued investment in digital infrastructure to improve customer and investor engagement. This commitment underpins their approach to information accessibility.

- Website as Central Information Hub: Fortis's official website provides a consolidated source for news, financial statements, and investor materials.

- Enhanced Transparency: The digital platform is key to Fortis's strategy of maintaining open communication and transparency with all stakeholders.

- Data Accessibility for Decision-Making: Easy access to financial reports and company updates empowers investors and analysts to make well-informed choices.

- Digital Engagement: Fortis's investment in its digital presence reflects a broader trend in the utility sector towards improved online accessibility and communication.

Fortis's promotional efforts center on transparent communication, highlighting its stable regulated utility base and growth in renewable assets. Their investor relations strategy emphasizes consistent financial reporting and timely updates, as evidenced by their Q1 2024 adjusted EPS of $0.79. The company actively shares progress on significant capital expenditures, projected to be billions in 2024, to signal commitment to sustainable expansion.

Fortis utilizes its website as a primary channel for information dissemination, ensuring broad accessibility to news, financial reports, and investor materials. This digital focus enhances transparency and supports informed decision-making for a diverse stakeholder base.

The company's commitment to ESG is a key promotional pillar, detailed in annual sustainability reports that showcase progress on decarbonization goals, such as a 35% reduction target for Scope 1 & 2 GHG emissions by 2030. They also highlight investments in clean energy, like their wind and solar portfolios, and community contributions.

| Communication Focus | Key Initiatives | Supporting Data (as of Q1 2024 or recent reports) |

|---|---|---|

| Financial Performance & Stability | Investor Relations, Financial Reporting, News Releases | Adjusted EPS: $0.79 (Q1 2024) |

| Growth & Future Investments | Capital Expenditure Updates, Project Highlights | Projected Capital Expenditures: Billions for 2024 |

| Sustainability & ESG | Sustainability Reports, ESG Metrics | GHG Emission Reduction Goal: 35% by 2030 (Scope 1 & 2 vs. 2019) |

| Digital Presence & Transparency | Website Information Hub, Data Accessibility | Continuous investment in digital infrastructure for engagement |

Price

Fortis's pricing is governed by a regulated framework, meaning utility rates are set and approved by independent commissions in each operating region. This structure provides earnings stability, allowing Fortis to cover costs and earn a reasonable return on its capital investments. For instance, in 2023, Fortis reported capital expenditures of $4.4 billion, which are crucial for maintaining and upgrading infrastructure, and these investments are factored into rate base growth, which directly influences regulated pricing.

Fortis's pricing strategy is directly tied to its rate base, the regulated value of its utility assets used to determine allowed returns. The company's significant capital investment, including a $26 billion five-year plan extending through 2029, aims to expand this rate base. This expansion is crucial as it forms the foundation for future revenue and profit generation.

Fortis, like other regulated utilities, navigates rate adjustments through formal general rate applications filed with provincial and federal regulators. These filings are crucial for recovering costs associated with significant capital investments, such as the $23.6 billion capital plan for 2024-2028. The process is designed to ensure rates cover operational expenses, inflation, and the cost of maintaining and upgrading essential infrastructure, like the $1.3 billion invested in grid modernization in 2023.

These applications are meticulously reviewed by regulatory bodies, such as the Nova Scotia Utility and Review Board or the Alberta Utilities Commission, to ensure a fair balance between the utility's need to earn a reasonable return on investment and the affordability for its customers. For instance, in 2024, Fortis Alberta's general rate application proposed an average increase of 5.2% for electricity distribution rates, reflecting increased operating costs and infrastructure investments.

Cost Recovery & Efficiency Incentives

Fortis's regulated pricing model is designed to ensure that the company can recover its necessary operating and capital expenses, which is crucial for funding extensive infrastructure upgrades. This stability underpins their ability to undertake significant, long-term projects essential for reliable energy delivery.

In 2023, Fortis reported capital expenditures of approximately $4.3 billion, demonstrating the scale of investment required for maintaining and expanding its utility assets. These costs are factored into the rates approved by regulatory bodies, allowing for a predictable revenue stream.

Regulatory frameworks often incorporate incentives for efficiency. For instance, performance-based ratemaking can reward Fortis for achieving specific operational targets, such as reducing system losses or improving customer service response times, thereby encouraging cost-effectiveness. This approach aims to strike a balance, ensuring adequate returns for investors while safeguarding consumer interests through controlled pricing.

- Cost Recovery: Prudent operating and capital costs are recoverable through regulated rates, ensuring financial stability for infrastructure investments.

- Efficiency Incentives: Regulatory mechanisms encourage Fortis to operate cost-effectively and improve performance, potentially leading to lower costs for consumers.

- Financial Stability: The regulated model provides a predictable revenue stream, supporting Fortis's substantial capital expenditure programs, which reached $4.3 billion in 2023.

- Consumer Protection: The balance between cost recovery and efficiency incentives aims to ensure fair returns for the company while protecting customers from excessive pricing.

Dividend Growth Supported by Stable Earnings

Fortis's pricing strategy is fundamentally tied to its regulated utility operations, which generate predictable and stable earnings. This stability directly underpins its commitment to a growing dividend, making it a cornerstone of its shareholder return policy. For instance, Fortis has a history of increasing its dividend annually, a testament to the reliable cash flows generated by its essential services.

The predictable nature of earnings from regulated assets allows Fortis to forecast cash flows with a high degree of certainty. This financial visibility is crucial for maintaining a consistent dividend growth trajectory, appealing to investors who prioritize stability and dependable income streams. The company's financial health, bolstered by these regulated revenues, supports its ability to reinvest in infrastructure while also rewarding shareholders.

- Dividend Growth: Fortis has a strong track record of increasing its dividend, aiming for 6% annual growth through 2028.

- Stable Earnings: Regulated utility operations provide predictable revenue streams, ensuring financial stability.

- Shareholder Returns: The company's pricing model supports consistent dividend payments, attracting income-focused investors.

- Investment Appeal: Fortis is considered an attractive option for those seeking reliable income and long-term stability in their portfolios.

Fortis's pricing is dictated by regulatory bodies, ensuring rates cover operational costs and capital investments, which is fundamental to its business model. This regulated approach provides a stable revenue stream, allowing for consistent capital deployment, such as the $23.6 billion capital plan for 2024-2028, which directly influences rate base growth and thus pricing.

| Metric | 2023 Value | 2024-2028 Plan |

|---|---|---|

| Capital Expenditures | ~$4.3 billion | $23.6 billion |

| Dividend Growth Target | N/A | 6% annually through 2028 |

| Example Rate Adjustment | Fortis Alberta: 5.2% increase (proposed 2024) | N/A |

4P's Marketing Mix Analysis Data Sources

Our Fortis 4P's Marketing Mix analysis is grounded in official company reports, regulatory filings, and investor communications. We also incorporate data from industry publications and credible news sources to capture their product offerings, pricing strategies, distribution networks, and promotional activities.