Fuyo General Lease SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fuyo General Lease Bundle

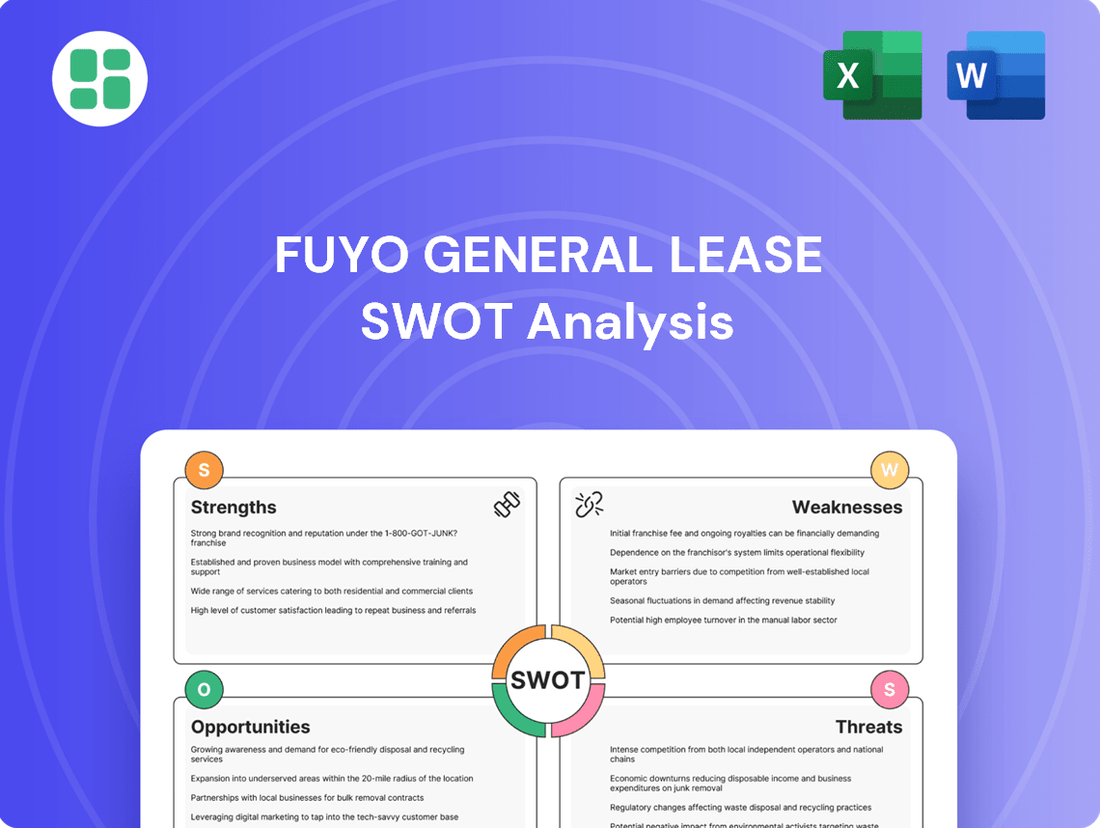

Fuyo General Lease leverages strong financial backing and a diversified leasing portfolio, but faces potential headwinds from evolving market demands and competitive pressures. Understanding these dynamics is crucial for strategic planning.

Want the full story behind Fuyo General Lease's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Fuyo General Lease boasts a robust and diversified financial services portfolio that extends well beyond traditional leasing. This includes offerings like installment sales, credit card services, real estate financing, and specialized asset finance. This broad spectrum of services significantly de-risks the company by reducing its dependence on any single market segment, creating multiple avenues for sustained revenue generation and growth.

The company strategically targets growth in key sectors such as mobility, energy and environment, and healthcare. For instance, in fiscal year 2024, Fuyo General Lease reported a substantial increase in its leasing and installment sales segment, indicating strong demand across its diverse service offerings. This strategic focus allows Fuyo to capture opportunities in rapidly evolving industries, further solidifying its market presence.

Fuyo General Lease, a prominent Japanese diversified leasing company since its founding in 1969, leverages a deep-rooted market presence and robust relationships. Its affiliation with Mizuho Bank is a key asset, fostering a stable customer base primarily composed of large enterprises. This strong foundation underpins the company's sound financial standing and its commitment to conservative financial management.

Fuyo General Lease's 'Fuyo Shared Value 2026' medium-term plan clearly outlines a commitment to sustainable growth, balancing societal contributions with economic gains. This strategic direction is supported by substantial investments in burgeoning sectors, demonstrating a forward-looking approach to market opportunities.

The company is actively channeling resources into high-growth segments such as mobility, energy and environment, BPO/ICT, and healthcare. These investments, totaling significant capital allocations in the 2024 fiscal year, position Fuyo General Lease to capitalize on evolving market demands and technological advancements, enhancing its competitive edge.

Furthermore, Fuyo General Lease is prioritizing differentiation within its real estate and aircraft leasing businesses. This dual focus on innovation in growth areas and strengthening core segments, aligned with ESG principles, bolsters the company's long-term resilience and attractiveness to stakeholders.

Robust Asset Quality and Profitability

Fuyo General Lease showcases strong asset quality, notably in its real estate finance and aircraft leasing segments. This strength is underpinned by a commitment to conservative credit management practices, ensuring the stability of its portfolio.

The company has achieved enhanced operational efficiency, which has translated into a rise in operating profit, even with a recent dip in net sales. This indicates effective cost management and a focus on core business performance.

Fuyo General Lease’s strategic emphasis on high-margin asset finance sectors, coupled with diligent asset control, supports a favorable Return on Assets (ROA). For instance, in fiscal year 2023, the company reported an ROA of 1.06%, demonstrating its ability to generate returns from its asset base.

- Robust Asset Quality: Particularly strong in real estate finance and aircraft leasing, bolstered by conservative credit management.

- Improved Operational Efficiency: Led to an increase in operating profit, highlighting effective internal management.

- Focus on Profitability: Concentration on high-margin asset finance businesses contributes to a solid ROA.

- Favorable ROA: Achieved a 1.06% ROA in fiscal year 2023, reflecting efficient asset utilization.

Strong Financial Performance and Ratings

Fuyo General Lease demonstrates robust financial health, evidenced by its consistent profit growth. The company achieved a record-high ordinary profit for eight consecutive periods, underscoring its operational efficiency and market positioning. This strong performance extends into the latest reporting periods, with Q1 FY2025 results showing a notable increase in profit attributable to owners of the parent.

Furthermore, Fuyo General Lease's financial stability is recognized through its strong credit ratings. It holds an AA- rating from Japan Credit Rating Agency (JCR) and an A+ rating from Rating and Investment Information, Inc. (R&I), both with stable outlooks. These ratings reflect a sound management approach and a reliable financial foundation.

- Record Profit Growth: Achieved a record-high ordinary profit for eight consecutive periods.

- Q1 FY2025 Performance: Significant increase in profit attributable to owners of the parent.

- Strong Credit Ratings: AA- (JCR) and A+ (R&I) with stable outlooks.

Fuyo General Lease's strengths lie in its diversified financial services, offering leasing, installment sales, credit cards, and real estate financing, which reduces reliance on any single market. The company's strategic focus on growth sectors like mobility and healthcare, supported by significant investments in fiscal year 2024, positions it well for future expansion. Its affiliation with Mizuho Bank provides a stable customer base and a solid financial foundation, further enhanced by a commitment to conservative financial management.

| Key Strength | Description | Supporting Data/Fact |

|---|---|---|

| Diversified Portfolio | Offers a broad range of financial services beyond traditional leasing. | Includes installment sales, credit cards, real estate finance, and specialized asset finance. |

| Strategic Sector Focus | Targets growth in key industries like mobility, energy, and healthcare. | Substantial capital allocations in FY2024 to these high-growth segments. |

| Strong Market Position & Affiliation | Leverages deep-rooted market presence and a stable customer base through Mizuho Bank affiliation. | Maintains strong relationships with large enterprises, ensuring a stable client foundation. |

| Financial Health & Profitability | Demonstrates consistent profit growth and strong credit ratings. | Achieved record ordinary profit for eight consecutive periods; Q1 FY2025 saw increased profit attributable to owners. Holds AA- (JCR) and A+ (R&I) ratings. |

What is included in the product

Analyzes Fuyo General Lease’s competitive position through key internal and external factors, highlighting its strengths in established markets and potential weaknesses in emerging technologies, while also identifying opportunities for diversification and threats from increased competition.

Fuyo General Lease's SWOT analysis acts as a pain point reliever by offering a clear, actionable framework to identify and address weaknesses and threats, thereby mitigating potential business disruptions.

Weaknesses

Fuyo General Lease's financial performance is vulnerable to interest rate shifts, as seen in their reported increase in funding costs due to rising domestic rates. As a company that finances its leasing operations through borrowing, higher interest rates directly inflate its cost of capital, potentially squeezing profit margins.

This inherent sensitivity to interest rate movements represents a persistent challenge for the company's profitability. For instance, during fiscal year 2023, the Bank of Japan's policy adjustments led to a noticeable uptick in borrowing expenses for financial institutions, a trend that would have directly impacted Fuyo General Lease's bottom line.

Fuyo General Lease's significant reliance on the Japanese economy is a notable weakness. While the company has some overseas presence, its core business is deeply intertwined with Japan's economic health and regulatory landscape. This makes it vulnerable to domestic slowdowns or policy shifts.

The demographic challenges facing Japan, particularly the '2025 Problem' concerning its aging population, could directly affect consumer spending and business investment, consequently impacting demand for Fuyo's leasing and financial services. Economic stagnation in key Japanese sectors further amplifies this risk.

This concentration in a single geographic market creates a systemic risk for Fuyo General Lease. For instance, if Japan's GDP growth, which was projected to be around 1.0% for 2024 and 0.9% for 2025, falters, the company's revenue streams could be disproportionately affected.

Fuyo General Lease faces a challenging environment in the diversified financial services and leasing sector, characterized by a multitude of active competitors. This intense competition, stemming from both established domestic and international players as well as emerging entrants, can exert significant pressure on the company's pricing strategies, its ability to maintain market share, and overall profitability. For instance, in the fiscal year ending March 2024, the leasing industry saw increased activity from non-bank financial institutions, intensifying the competitive dynamic.

Potential for Declining Lease Volumes in Certain Segments

While Fuyo General Lease has seen positive growth in overall newly executed contract volumes, a notable weakness lies in the declining lease execution volumes within specific segments. For instance, the Real Estate sector experienced a downturn, attributed to stricter asset control measures and an increasingly competitive market in metropolitan areas.

This trend highlights a vulnerability that could impact overall financial performance if not proactively managed. The company needs to carefully assess and adapt its strategies within these challenged segments to mitigate potential revenue shortfalls and ensure a balanced leasing portfolio.

The competitive landscape in key urban markets is intensifying, putting pressure on lease execution volumes in sectors like Real Estate.

- Decreased Real Estate Lease Volumes: Asset control measures and market saturation in metropolitan areas have led to a reduction in lease execution within this segment.

- Competitive Pressures: An overheating competitive environment in key urban centers poses a risk to sustained leasing activity.

- Portfolio Management Challenges: The need for careful management of the leasing portfolio is underscored by these segment-specific declines.

Asset Quality Risks in Specific Business Areas

While Fuyo General Lease maintains a generally conservative approach to credit management, its risk profile is notably influenced by potential property price fluctuations and inherent credit risks. The real estate sector, a substantial component of its operations, presents a comparatively elevated risk exposure.

A significant downturn or unforeseen shock within the real estate market could directly diminish asset values and consequently strain the company's financial stability. For instance, as of the first half of fiscal year 2024, the company's real estate segment accounted for approximately 30% of its total assets, highlighting its material impact on the overall risk landscape.

- Property Price Volatility: Exposure to real estate market downturns can devalue significant portions of the company's asset base.

- Concentrated Sector Risk: The substantial weight of the real estate business amplifies the impact of sector-specific challenges.

- Credit Risk in Real Estate: Potential defaults or payment delays from real estate-related financing can lead to direct financial losses.

Fuyo General Lease's reliance on the Japanese economy is a significant weakness. The company's operations are deeply tied to domestic economic health and policy, making it susceptible to national slowdowns or regulatory changes. For example, Japan's projected GDP growth of around 1.0% for 2024 and 0.9% for 2025 means any faltering in these modest forecasts could disproportionately impact Fuyo's revenue.

Same Document Delivered

Fuyo General Lease SWOT Analysis

You’re previewing the actual Fuyo General Lease SWOT analysis document. The complete, in-depth report you see here is exactly what you'll receive upon purchase, ensuring full transparency and professional quality.

Opportunities

Fuyo General Lease is actively pursuing growth by channeling investments into high-demand areas like mobility, energy and environment, BPO/ICT, and healthcare. This strategic focus aligns with major market trends, positioning the company to capitalize on emerging needs.

The mobility sector, for instance, is experiencing a surge in demand for flexible and on-demand solutions, a trend Fuyo is well-placed to address. Furthermore, the global commitment to decarbonization and renewable energy creates substantial opportunities in the energy & environment segment.

Japan's demographic shifts, particularly its aging population, are driving innovation and demand in the healthcare sector, offering another avenue for Fuyo's expansion and diversification beyond its core leasing business.

Fuyo General Lease's commitment to digital transformation, evidenced by its DX Personnel Development Program and trials of generative AI for internal processes, positions it to significantly boost operational efficiency. This strategic embrace of technology is crucial for developing cutting-edge financial products and enhancing customer interactions.

By actively integrating new technologies, Fuyo General Lease can unlock new revenue streams and maintain a competitive edge. For instance, in 2024, the financial services sector saw a significant uptick in AI adoption for customer service, with companies reporting an average 15% increase in customer satisfaction through AI-powered chatbots.

Fuyo General Lease's commitment to sustainable finance, evidenced by its selection as an 'Asia Climate Change Leader Company,' positions it favorably within a rapidly growing global market. This focus allows the company to tap into increasing investor demand for environmentally responsible investments. For instance, the global sustainable finance market reached an estimated $3.9 trillion in 2024, a figure projected to continue its upward trajectory through 2025.

Expanding its involvement in green and sustainable financing projects, both in Japan and abroad, offers a significant opportunity. This aligns perfectly with the increasing global emphasis on ESG (Environmental, Social, and Governance) criteria, attracting a wider pool of environmentally conscious investors and clients seeking to align their portfolios with sustainability goals.

Strategic Acquisitions and Partnerships

Fuyo General Lease has a history of growth through mergers and acquisitions, notably by making YAMATO LEASE CO., LTD. a consolidated subsidiary. They've also invested in companies such as MATEHAN SIAM LAMBDA CO.,LTD. and Japan Pallet Rental Corporation, demonstrating a clear strategy for expansion. This approach can open doors to new markets and bolster their service portfolio.

Further strategic acquisitions and partnerships offer significant opportunities for Fuyo General Lease. These moves can accelerate entry into new geographical regions and specialized market niches, allowing the company to quickly gain market share and expertise. By integrating new capabilities, Fuyo General Lease can also broaden its existing service offerings and enhance its competitive edge.

- Acquisition of YAMATO LEASE CO., LTD.: This move integrated a significant leasing operation, likely boosting Fuyo's asset base and market presence.

- Investment in MATEHAN SIAM LAMBDA CO.,LTD.: This suggests an interest in expanding into Southeast Asian markets and potentially leveraging specialized technology or services.

- Acquisition of Japan Pallet Rental Corporation: This likely strengthens Fuyo's position in the logistics and supply chain sector, offering synergies with its existing leasing business.

- Future Expansion Opportunities: Pursuing similar strategic moves can unlock new revenue streams and diversify the company's operational footprint.

Increased Demand for Leasing in a Shifting Economic Landscape

The equipment leasing and automotive leasing sectors are poised for expansion, fueled by escalating ownership costs and a growing preference for flexible mobility. Fuyo General Lease is well-positioned to benefit from this trend as businesses and consumers increasingly opt for leasing over outright purchases.

For instance, the global equipment leasing market was valued at approximately $1.1 trillion in 2023 and is projected to reach $1.6 trillion by 2030, indicating a significant growth trajectory. Similarly, the automotive leasing market is also experiencing robust growth, with projections suggesting continued upward momentum through 2025 and beyond.

- Rising Cost of Ownership: High inflation and increased interest rates make purchasing new equipment and vehicles less attractive for many businesses and individuals.

- Shift to Flexible Mobility: Consumers and businesses are increasingly valuing flexibility and avoiding long-term commitments associated with ownership.

- Environmental Considerations: The drive towards cleaner transportation aligns with leasing models that can more easily incorporate newer, more fuel-efficient, or electric vehicles.

- Capital Preservation: Leasing allows companies to preserve capital for core operations and investments rather than tying it up in depreciating assets.

Fuyo General Lease can leverage the increasing demand for flexible and cost-effective solutions in equipment and automotive leasing. The global equipment leasing market was valued at approximately $1.1 trillion in 2023, with projections indicating continued growth through 2030. This trend, coupled with rising ownership costs, presents a significant opportunity for Fuyo to expand its leasing services and capture market share.

The company's strategic investments in areas like mobility and healthcare, alongside its commitment to digital transformation and sustainable finance, position it to capitalize on evolving market needs. For instance, the sustainable finance market reached an estimated $3.9 trillion in 2024, highlighting a strong investor appetite for ESG-aligned ventures.

Furthermore, Fuyo's proven track record of growth through strategic acquisitions, such as that of YAMATO LEASE CO., LTD., demonstrates its capacity to expand its operational footprint and service portfolio. These strategic moves can unlock new revenue streams and enhance its competitive advantage in a dynamic market environment.

| Opportunity Area | Market Trend | Fuyo's Position/Action | Data Point (2023-2025) |

|---|---|---|---|

| Equipment & Automotive Leasing | Rising ownership costs, preference for flexibility | Well-positioned to benefit from shift to leasing | Global equipment leasing market ~$1.1T (2023), projected growth |

| Sustainable Finance | Growing investor demand for ESG | Selected as 'Asia Climate Change Leader Company' | Sustainable finance market ~$3.9T (2024), continued growth |

| Digital Transformation | Need for operational efficiency & innovation | Investing in DX, AI trials | AI adoption in financial services increasing customer satisfaction |

| Strategic Expansion | Market consolidation and diversification | Acquisitions (e.g., YAMATO LEASE), investments (e.g., MATEHAN SIAM LAMBDA) | Demonstrated history of successful M&A and investments |

Threats

A significant economic slowdown or recession, both in Japan and globally, poses a substantial threat to Fuyo General Lease. Such downturns typically curb business investment, leading to decreased demand for leasing services. For instance, if Japan's GDP growth falters in 2024 or 2025, as some forecasts suggest, this could directly translate to fewer companies seeking equipment or asset leases.

Recessionary environments also heighten the risk of credit defaults among lessees, impacting Fuyo General Lease's financial health. Increased unemployment and business failures during economic contractions mean a higher likelihood of clients being unable to meet their lease obligations, potentially leading to write-offs and reduced profitability.

Furthermore, a global economic downturn could affect Fuyo General Lease's international operations or its ability to secure favorable financing. For example, if major trading partners experience recessions, it could indirectly reduce the demand for Japanese exports and, consequently, the leasing of related capital goods.

The financial services and leasing sectors are heavily regulated, and Fuyo General Lease is no exception. Changes in Japanese financial regulations, accounting standards, or tax policies, especially those impacting leasing operations, could significantly increase compliance costs and potentially restrict certain business activities, directly affecting profitability. For instance, the Financial Services Agency (FSA) in Japan continuously updates its guidelines, and any new requirements for capital adequacy or risk management in 2024 or 2025 could necessitate substantial operational adjustments.

Fuyo General Lease operates in a highly competitive landscape within diversified financial services and leasing, facing numerous domestic and international rivals. This intense rivalry directly translates into significant pricing pressure, potentially squeezing profit margins. For instance, in the broader Japanese leasing market, average profit margins for key players hovered around 5-7% in recent years, a figure Fuyo General Lease must contend with.

Disruptive Technologies and New Business Models

The financial sector is experiencing a significant shift driven by FinTech advancements and novel business models. These innovations pose a direct threat to established leasing and financial service providers like Fuyo General Lease. For instance, the rise of digital lending platforms and peer-to-peer financing could erode market share for traditional leasing companies by offering more agile and potentially lower-cost alternatives.

While Fuyo General Lease is actively pursuing digital transformation (DX) initiatives, a lag in adopting or effectively countering these emerging solutions could prove detrimental. Competitors, especially agile startups, are rapidly introducing user-friendly digital interfaces and data-driven risk assessment tools. A failure to keep pace could result in Fuyo General Lease losing its competitive edge and relevance in a rapidly evolving market.

Consider the impact of embedded finance, where financial services are integrated directly into non-financial platforms. This trend, gaining momentum throughout 2024 and projected to continue into 2025, allows companies to offer leasing or financing solutions seamlessly at the point of sale, bypassing traditional financial intermediaries. Fuyo General Lease must innovate to integrate its services into such ecosystems or risk being sidelined.

- FinTech Disruption: The global FinTech market was valued at over $2.4 trillion in 2023 and is expected to see continued growth, impacting traditional financial services significantly.

- Digital Adoption Gap: A significant portion of the financial services industry still lags in fully embracing digital transformation, creating opportunities for nimble FinTech players.

- Embedded Finance Growth: Projections indicate embedded finance could account for a substantial portion of new loan originations by 2025, challenging traditional financing models.

- New Entrant Agility: Startups can often deploy new technologies and business models much faster than established institutions, creating a competitive disadvantage if not addressed proactively.

Credit Risk and Asset Impairment

Fuyo General Lease faces significant credit risk, as clients might fail to meet their lease or loan obligations. This is a constant concern for any financial services firm, especially during economic downturns. For instance, in the fiscal year ending March 2024, Fuyo General Lease reported a slight increase in non-performing loans, underscoring the ongoing need for robust credit assessment and management.

Furthermore, the company's exposure to asset impairment is a critical threat. The value of leased assets, particularly those in volatile sectors like real estate and aviation, can decline. If market values drop substantially, Fuyo General Lease may need to record impairment charges, directly impacting its profitability and balance sheet strength. For example, a slowdown in the commercial real estate market in 2024 could pressure the valuation of Fuyo's real estate-backed leases.

- Credit Risk Exposure: Fuyo General Lease's core business involves extending credit through leases and loans, making it susceptible to client defaults.

- Asset Value Volatility: Fluctuations in market prices for leased assets, such as vehicles, machinery, and real estate, can lead to potential write-downs.

- Economic Sensitivity: Economic downturns or sector-specific challenges can heighten the risk of both credit defaults and asset value depreciation.

- Impact on Financials: Defaults and asset impairments directly reduce the company's earnings and can necessitate increased provisioning, affecting capital adequacy.

The increasing sophistication and rapid adoption of FinTech pose a significant threat, as new digital platforms offer more agile and potentially cost-effective alternatives to traditional leasing. For example, embedded finance, projected to grow substantially by 2025, could bypass intermediaries like Fuyo General Lease. This rapid innovation means a failure to adapt quickly could lead to market share erosion.

Intensifying competition within the leasing sector creates considerable pricing pressure, potentially squeezing profit margins. With average profit margins in the Japanese leasing market hovering around 5-7% in recent years, Fuyo General Lease must navigate this environment carefully. The agility of new entrants, often able to deploy technology faster, further exacerbates this competitive challenge.

Regulatory changes in Japan's financial services sector represent another key threat. New guidelines from bodies like the Financial Services Agency (FSA) could increase compliance costs or restrict business activities. For instance, any updates to capital adequacy or risk management requirements in 2024 or 2025 might necessitate significant operational adjustments for Fuyo General Lease.

Economic downturns, both domestically and globally, directly impact demand for leasing services and increase credit risk. A recessionary environment in Japan, potentially affecting GDP growth in 2024-2025, could curb business investment and lead to higher client defaults. This dual impact of reduced demand and increased default risk presents a substantial challenge.

SWOT Analysis Data Sources

This Fuyo General Lease SWOT analysis is built upon robust data from financial reports, comprehensive market research, and expert industry insights, ensuring a well-rounded and accurate assessment.