Fuyo General Lease PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fuyo General Lease Bundle

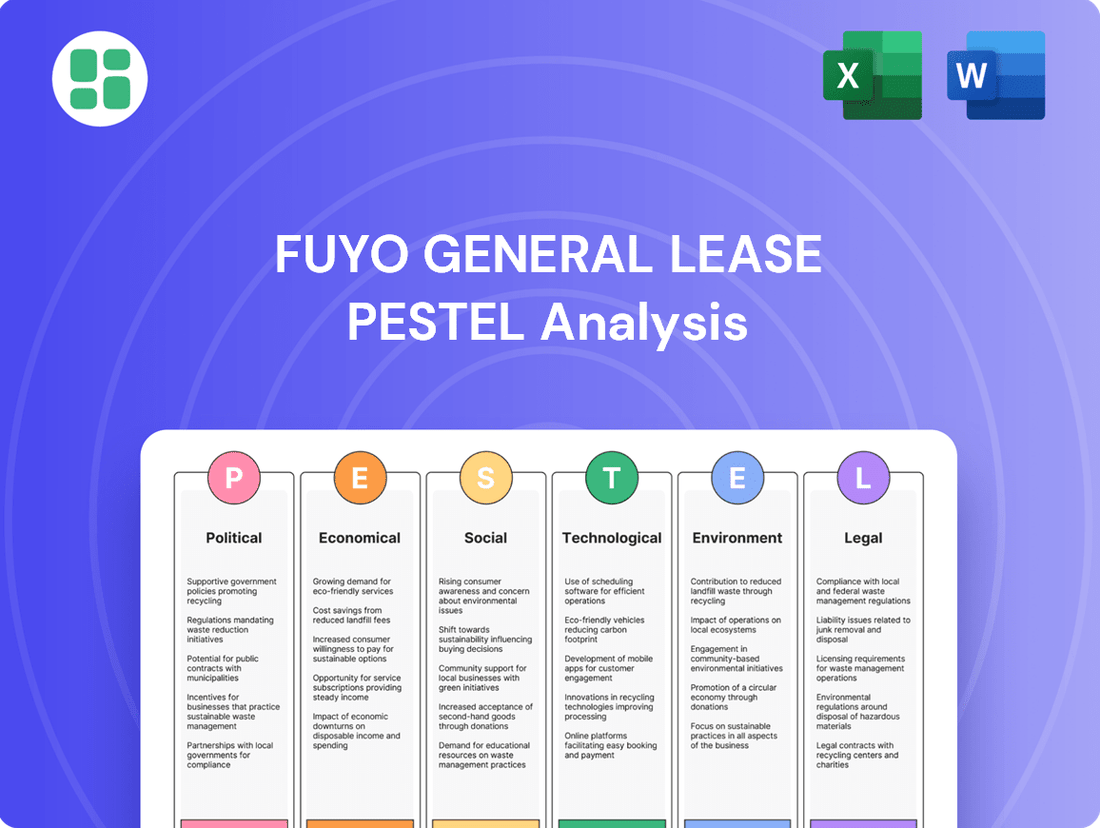

Uncover the critical political, economic, social, technological, environmental, and legal factors shaping Fuyo General Lease's trajectory. This comprehensive PESTLE analysis provides actionable intelligence to navigate market complexities and identify strategic opportunities. Download the full report to gain a deeper understanding and sharpen your competitive edge.

Political factors

The Japanese government's commitment to economic expansion is evident in its strategic push for consistent wage hikes and incentives for private sector investment. This approach is designed to cultivate a self-reinforcing economic environment, where heightened corporate profits fuel increased capital expenditure, ultimately bolstering economic stability and the demand for leasing services.

In 2024, Japan's government continued to prioritize these growth-oriented policies. For instance, the "New Plan for a New Capitalism" emphasizes increased corporate investment and wage growth, with preliminary data suggesting a 3.1% rise in nominal wages in early 2024, a key indicator of the government's success in stimulating domestic demand and business activity.

The Financial Services Agency (FSA) in Japan is actively pursuing reforms aimed at digitizing financial services and championing sustainable finance. This proactive approach includes a thorough review of existing regulations governing payment and credit services, creating a more conducive environment for innovation.

These regulatory shifts are designed to foster the growth of FinTech companies, which in turn can unlock significant new business avenues for Fuyo General Lease. For instance, the FSA's focus on digital transformation aligns with the increasing demand for technology-driven leasing solutions and digital payment integration within the leasing sector.

Japan's commitment to sustainability is accelerating, with the government actively promoting green finance. The issuance of Green Transformation (GX) bonds, totaling ¥20 trillion (approximately $130 billion USD as of early 2025) over the next decade, is a key initiative to fund decarbonization efforts across various sectors.

This strong governmental backing creates a robust and encouraging landscape for companies like Fuyo General Lease to deepen their involvement in green leasing and sustainable investments. The clear policy direction supports Fuyo's strategic expansion in eco-friendly financial solutions.

Geopolitical Stability and Foreign Investment Policies

Japan's consistent geopolitical stability and transparent foreign investment policies remain a significant advantage for Fuyo General Lease. This predictable environment fosters confidence among international investors, encouraging capital inflows that directly benefit sectors reliant on leasing and financing. For instance, in 2024, Japan's commitment to open markets was underscored by continued efforts to streamline foreign direct investment processes, aiming to attract more overseas capital.

Fuyo General Lease benefits from this stability as it translates into a more robust demand for its diverse leasing and financing services. Businesses, both domestic and international, are more inclined to invest in new equipment and expand operations when the political and economic landscape is secure. This confidence is crucial for Fuyo's growth, as it underpins capital expenditure decisions across various industries.

Key aspects of Japan's approach include:

- Stable political framework: Minimizing risks for foreign investors.

- Transparent regulations: Facilitating easier market entry and operations.

- Pro-investment policies: Encouraging capital expenditure and business expansion.

- Strong rule of law: Ensuring contract enforceability and investor protection.

Policies Addressing Labor Shortages and Productivity

Governments worldwide are actively implementing policies to combat labor shortages and boost productivity. In Japan, for instance, initiatives focusing on raising the minimum wage and ensuring fair labor practices are underway. These measures aim to make employment more attractive, potentially easing some of the pressure on businesses to find workers.

Furthermore, a significant push is being made to encourage investments in labor-saving technologies and digitalization. This strategic direction directly benefits companies like Fuyo General Lease, which can capitalize on increased demand for leasing advanced equipment and IT solutions. For example, a 2024 report indicated a 15% year-over-year increase in corporate investment in automation across key Japanese industries.

- Minimum Wage Increases: Policies aimed at raising minimum wages to improve worker compensation and attract talent.

- Fair Transaction Promotion: Government efforts to ensure equitable dealings between businesses, particularly in labor contracts.

- Labor-Saving Investments: Incentives for companies to adopt automation and robotics to offset labor deficits.

- Digitalization Drive: Encouragement of IT infrastructure and digital solutions to enhance operational efficiency and productivity.

Japan's political landscape offers a stable foundation for Fuyo General Lease, characterized by consistent pro-investment policies and a strong rule of law that protects investors. The government's ongoing commitment to economic growth, exemplified by initiatives like the "New Plan for a New Capitalism," directly stimulates demand for leasing services by encouraging corporate investment and wage increases.

The government's proactive stance on financial sector reforms, particularly in digitizing services and promoting sustainable finance, opens new avenues for Fuyo. For instance, the FSA's regulatory adjustments in 2024 aimed to foster FinTech growth, which can integrate with leasing solutions. Furthermore, Japan's significant push for green finance, with ¥20 trillion in GX bonds planned by early 2025, directly supports Fuyo's expansion into eco-friendly leasing.

| Government Initiative | Description | Impact on Fuyo General Lease | 2024/2025 Data/Target |

| New Plan for a New Capitalism | Focus on corporate investment and wage growth | Increased demand for leasing due to higher business activity | Nominal wage rise of 3.1% (early 2024) |

| Financial Services Agency Reforms | Digitization of financial services, FinTech support | Opportunities for tech-driven leasing solutions and digital payments | Ongoing regulatory review of payment/credit services |

| Green Finance Promotion | Funding decarbonization efforts | Growth in green leasing and sustainable investment demand | ¥20 trillion in GX bonds planned over the next decade |

What is included in the product

This Fuyo General Lease PESTLE analysis provides a comprehensive examination of external macro-environmental factors, offering forward-looking insights to support scenario planning and proactive strategy design.

It delves into the Political, Economic, Social, Technological, Environmental, and Legal dimensions, highlighting how these elements shape competitive dynamics and present opportunities for Fuyo General Lease.

A concise, PESTLE-driven overview of Fuyo General Lease's external environment, serving as a readily accessible tool to identify and mitigate potential market challenges, thus alleviating strategic uncertainty.

Economic factors

The Bank of Japan's anticipated gradual interest rate increases through 2026, aiming to solidify the economy's exit from deflation, will directly impact Fuyo General Lease. With core CPI projected to stabilize around 2%, these policy shifts will likely lead to higher borrowing costs for the company, potentially affecting the competitiveness and pricing of its leasing and financial services.

Japan's economy is anticipated to see a steady recovery in fiscal year 2025. This growth is largely fueled by increased private consumption, which is expected to benefit from rising real wages. Strong corporate profits are also a key factor, providing the financial backing for continued capital expenditure.

This positive economic environment is a direct tailwind for Fuyo General Lease. As businesses invest more in their operations and expansion, the demand for leasing services, which facilitate capital investment without upfront ownership costs, naturally rises. For instance, in fiscal year 2024, Japanese companies reported record profits, with many signaling intentions to boost capital spending in FY2025, particularly in areas like digital transformation and green initiatives.

Japan is navigating a period of persistent inflation, a key economic factor influencing business operations. However, the outlook for 2025 signals robust wage growth, which is anticipated to outpace inflation, leading to a recovery in real wages. This is crucial for maintaining household purchasing power and bolstering consumer confidence.

This projected increase in real wages is expected to positively impact Fuyo General Lease's diverse customer base. As households have more disposable income, consumer spending is likely to rise, potentially driving demand for leasing services across various sectors. Furthermore, this supportive economic environment could encourage businesses to increase their own investments, further benefiting Fuyo General Lease.

Real Estate Market Resilience and Investment

Japan's real estate market, especially in major cities like Tokyo, is demonstrating remarkable resilience. Land prices in central Tokyo, for instance, saw a notable increase of 8.5% in 2024, signaling continued investor confidence. This upward trend is attracting substantial foreign investment, with overseas entities showing keen interest in both residential and commercial properties, particularly in prime locations.

Fuyo General Lease is well-positioned to leverage this dynamic environment. Its real estate financing operations can directly benefit from the rising demand and increased transaction volumes. The company's ability to provide financing solutions for property acquisitions and development aligns perfectly with the current market momentum.

Key indicators supporting this outlook include:

- Rising Land Prices: Central Tokyo land prices increased by 8.5% in 2024.

- Increased Foreign Investment: Significant capital inflows from overseas investors are being observed.

- Robust Transaction Volumes: The market is experiencing a healthy number of property sales and leases.

- Demand for Quality Assets: Strong demand persists for well-located residential and commercial properties.

Trends in Automotive Leasing Market

The domestic automotive leasing market in Japan is showing consistent expansion, fueled by rising urbanization and a clear move towards more adaptable mobility options. This shift means more people are opting for leasing over outright ownership, presenting a growing opportunity for companies like Fuyo General Lease.

A significant development is the increasing preference for electric and hybrid vehicles. This trend opens up new avenues for leasing, as consumers and businesses alike seek to embrace more sustainable transportation. Fuyo General Lease is well-positioned to capitalize on this by offering specialized leasing packages for these eco-friendly models.

- Market Growth: Japan's automotive leasing market is projected to grow steadily, with an estimated compound annual growth rate (CAGR) of 4.5% between 2023 and 2028, according to industry reports from early 2024.

- EV/Hybrid Adoption: The adoption rate of electric and hybrid vehicles in Japan saw a notable increase in 2023, with these alternative powertrains accounting for approximately 15% of new vehicle sales, up from 10% in 2022.

- Urbanization Impact: Urban centers are driving demand, with leasing penetration rates in major metropolitan areas like Tokyo and Osaka exceeding national averages by a considerable margin.

Japan's economic forecast for fiscal year 2025 indicates a steady recovery, driven by increased private consumption and robust corporate profits. This positive trend is expected to boost demand for leasing services as businesses expand their capital expenditures, particularly in technology and sustainability. Fuyo General Lease is poised to benefit from this environment, as evidenced by record corporate profits in FY2024 and planned investments for FY2025.

Persistent inflation is a factor, but projected wage growth outpacing inflation in 2025 should support consumer spending and business investment. This rise in real wages will likely enhance demand for Fuyo General Lease's diverse customer base and encourage corporate expansion.

The real estate market, especially in Tokyo, shows resilience with an 8.5% land price increase in 2024 and strong foreign investment, directly benefiting Fuyo General Lease's real estate financing operations. The automotive leasing sector is also expanding, with a projected 4.5% CAGR and increasing adoption of EVs, creating new leasing opportunities for the company.

| Economic Factor | 2024 Data/Projection | 2025 Projection | Impact on Fuyo General Lease |

|---|---|---|---|

| Economic Growth | Steady recovery | Continued recovery | Increased demand for leasing |

| Inflation | Persistent | Expected to moderate | Potential for higher costs, but offset by wage growth |

| Wage Growth | Robust | Outpacing inflation | Boosted consumer spending and business investment |

| Interest Rates (BoJ) | Gradual increases anticipated | Continued gradual increases | Higher borrowing costs |

| Real Estate Prices (Tokyo) | +8.5% (2024) | Continued upward trend | Beneficial for real estate financing |

| Automotive Leasing Market | Consistent expansion | Continued steady growth (4.5% CAGR projected) | Growing opportunities in auto leasing |

| EV/Hybrid Adoption | ~15% of new sales (2023) | Expected to increase | New leasing segments for eco-friendly vehicles |

Full Version Awaits

Fuyo General Lease PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, offering a comprehensive PESTLE analysis for Fuyo General Lease.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, detailing the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Fuyo General Lease.

The content and structure shown in the preview is the same document you’ll download after payment, providing actionable insights for strategic planning regarding Fuyo General Lease.

Sociological factors

Japan's demographic landscape is rapidly changing, with its aging population presenting unique challenges and opportunities. By 2025, a significant portion of the baby boomer generation will reach the age of 75 or older, a milestone often referred to as the '2025 Problem'. This demographic shift is a key sociological factor impacting various industries.

This aging trend directly contributes to labor shortages across Japan, as fewer people are available to work. Simultaneously, it's leading to an increase in vacant homes, particularly in rural areas, as older residents may downsize or pass away. In 2023, Japan's vacancy rate for residential properties reached 13.1%, highlighting this growing issue.

The demand for specific goods and services is also being reshaped by this demographic evolution. Fuyo General Lease, for instance, can leverage this by focusing on sectors that cater to an aging society, such as healthcare facilities, elder care services, and labor-saving technologies that can help offset workforce deficits. The market for assistive technologies and services for the elderly is projected to grow substantially in the coming years.

The shift towards hybrid work models is significantly reshaping the commercial real estate landscape, driving demand for adaptable lease structures. Businesses are increasingly seeking flexible lease agreements and multi-purpose spaces that can accommodate fluctuating team sizes and evolving operational needs.

Fuyo General Lease can strategically position itself by offering tailored asset solutions that support these modern work environments. For example, the continued growth of co-working spaces, which saw a global market size of approximately $26.7 billion in 2023 and is projected to grow, highlights this trend.

Societal expectations are increasingly pushing companies to prioritize Corporate Social Responsibility (CSR) and integrate Environmental, Social, and Governance (ESG) principles. This trend is evident in the growing demand for transparency and ethical business practices across industries. For Fuyo General Lease, aligning with these expectations through initiatives like Creating Shared Value (CSV) is crucial for maintaining a positive reputation and attracting environmentally and socially conscious investors and customers.

Shifting Preferences for Asset Ownership

A significant societal shift is underway, with consumers and businesses increasingly favoring leasing and renting over outright asset ownership. This is particularly evident in densely populated urban centers where the financial burden of ownership, including maintenance and depreciation, can be substantial. This trend directly aligns with and bolsters the fundamental business model of companies like Fuyo General Lease.

This preference for access over ownership is reshaping markets. For instance, the global car rental and leasing market was valued at approximately $70 billion in 2023 and is projected to grow steadily, indicating a strong consumer and corporate embrace of flexible mobility solutions. This growth trajectory underscores the expanding opportunity for leasing companies.

- Growing preference for leasing: Consumers and businesses are opting for leasing due to lower upfront costs and predictable monthly expenses.

- Urbanization impact: High living costs and parking challenges in cities further drive the shift away from vehicle ownership.

- Market validation: The expanding car rental and leasing market, projected for continued growth, demonstrates the societal acceptance of this model.

- Alignment with Fuyo General Lease: This societal trend directly supports and validates Fuyo General Lease's core business operations and strategic direction.

Talent and Diversity in the Workforce

Japan's demographic shifts, with a declining birthrate and aging population, are driving a heightened focus on talent and diversity. Companies like Fuyo General Lease are recognizing that a diverse workforce is crucial for innovation and global competitiveness. This recognition is translating into strategies aimed at attracting and retaining a broader range of talent.

Embracing diversity in leadership and the broader workforce is becoming a strategic imperative for Japanese firms. By doing so, they can better tap into varied perspectives and skills, which is essential for navigating a complex global market. This focus is particularly important as Japan seeks to offset the impacts of its shrinking native workforce.

- Talent Acquisition: Fuyo General Lease needs to broaden its recruitment pools beyond traditional sources to attract a more diverse candidate base.

- Leadership Diversity: Increasing the representation of women and foreign nationals in management roles is a key objective for enhancing decision-making.

- Retention Strategies: Implementing inclusive workplace policies and flexible working arrangements can improve the retention of diverse employees.

- Innovation Driver: A diverse workforce is linked to higher levels of creativity and problem-solving, directly benefiting Fuyo General Lease's competitive edge.

Japan's aging population, with the '2025 Problem' highlighting a significant increase in those aged 75 and over, is a major sociological driver. This demographic shift fuels demand for elder care services and labor-saving technologies, directly impacting sectors like asset leasing. The trend of vacant homes, reaching 13.1% in 2023, also presents leasing opportunities for underutilized properties.

Societal preferences are increasingly leaning towards leasing over ownership, a trend validated by the global car rental and leasing market's 2023 valuation of approximately $70 billion. This shift aligns perfectly with Fuyo General Lease's business model, offering flexibility and reducing upfront costs for consumers and businesses alike, particularly in urban areas facing high living expenses.

The growing emphasis on Corporate Social Responsibility (CSR) and ESG principles is reshaping business strategies. Companies are expected to demonstrate transparency and ethical practices, making initiatives like Creating Shared Value (CSV) crucial for maintaining a positive reputation and attracting socially conscious stakeholders.

Furthermore, a focus on workforce diversity and inclusion is becoming a strategic imperative for Japanese firms aiming for innovation and global competitiveness. Fuyo General Lease can leverage this by fostering an inclusive environment to attract and retain a broader talent pool, essential for navigating a shrinking native workforce.

Technological factors

Technological factors are significantly reshaping Fuyo General Lease's operating environment. Japan's financial services sector is embracing digital transformation, with AI, machine learning, and blockchain technologies at the forefront. For instance, in 2024, financial institutions globally are investing heavily in AI, with projections indicating a market size of over $100 billion by 2025.

Fuyo General Lease must strategically integrate these advancements to boost efficiency and customer satisfaction. Leveraging AI for credit scoring or blockchain for secure transaction processing can streamline operations and reduce costs. The company's ability to adapt to these technological shifts will be crucial for developing innovative financial products and maintaining a competitive edge in the evolving market.

Japanese businesses are confronting a critical juncture, often termed the '2025 digital cliff.' This refers to the substantial economic risks, potentially in the billions of yen, that companies face if they delay or fail to integrate digital technologies into their operations. This impending deadline is a powerful catalyst, compelling a broad spectrum of Japanese enterprises to accelerate their digital transformation initiatives.

This heightened urgency directly fuels a robust demand for services like those provided by Fuyo General Lease. As companies scramble to modernize, there's a significant uptick in the need for leasing ICT equipment, cloud services, and other digital infrastructure. For instance, in fiscal year 2023, the Japanese government allocated ¥1 trillion (approximately $6.7 billion USD at current exchange rates) towards digital transformation support for SMEs, underscoring the national priority and market opportunity.

Technological advancements are revolutionizing leasing operations, automating everything from initial credit checks to the final contract management. This shift allows companies like Fuyo General Lease to streamline workflows significantly.

By embracing automation, Fuyo General Lease can expect a substantial boost in operational efficiency. For instance, a 2024 report by McKinsey highlighted that automation in financial services can reduce processing times by up to 70%, directly impacting cost savings and service speed.

The integration of AI and machine learning in credit assessment, for example, can lead to faster, more accurate risk evaluations. Similarly, digital contract management systems reduce manual errors and expedite the entire leasing lifecycle, enhancing customer satisfaction and Fuyo General Lease's competitive edge in the 2024-2025 market.

Emergence of New Asset Classes for Financing

Technological advancements are continually creating new types of assets that need unique financing. Think about the rise of the Internet of Things (IoT) devices, sophisticated robotics, and crucial renewable energy projects. These innovations demand specialized financial products and services, moving beyond traditional asset financing models.

Fuyo General Lease is strategically focusing on growth areas like energy and environmental sectors. This foresight allows the company to be well-positioned to offer financing for these emerging asset classes. For instance, the global renewable energy market, projected to reach over $2 trillion by 2030, presents significant opportunities for specialized leasing and financing solutions.

- IoT Device Financing: The expanding IoT market, with billions of connected devices, requires flexible financing for hardware and data management.

- Robotics and Automation Leasing: As industries embrace automation, leasing models for advanced robotics are becoming essential for capital expenditure management.

- Renewable Energy Infrastructure: Financing solar farms, wind turbines, and battery storage systems is a key growth area, driven by global decarbonization efforts.

- Digital Asset Securitization: Emerging technologies may lead to the securitization of new digital assets, creating novel financing avenues.

Cybersecurity and Data Privacy

With the ongoing digital transformation across industries, cybersecurity threats and data privacy concerns are increasingly critical for financial service providers like Fuyo General Lease. The company must proactively enhance its data security infrastructure to safeguard sensitive client information and maintain operational integrity.

Adherence to evolving global and regional data privacy regulations, such as GDPR and similar frameworks, is essential. Fuyo General Lease needs to ensure its practices align with these mandates to avoid penalties and build customer confidence. For instance, the global cybersecurity market was valued at approximately $217.2 billion in 2023 and is projected to grow significantly, highlighting the increasing investment and focus on this area.

Key considerations for Fuyo General Lease include:

- Implementing advanced threat detection and response systems.

- Conducting regular data privacy audits and employee training.

- Ensuring compliance with international data transfer regulations.

- Developing robust incident response plans for data breaches.

Technological advancements are driving significant operational efficiencies for Fuyo General Lease, with automation expected to reduce processing times by up to 70% in financial services, according to a 2024 McKinsey report. AI and machine learning are enhancing credit assessment accuracy and speed, while digital contract management systems minimize errors, ultimately improving customer satisfaction and Fuyo General Lease's competitive standing in the 2024-2025 market.

The company must also navigate the critical '2025 digital cliff' faced by Japanese businesses, which compels accelerated digital transformation and creates a strong demand for leasing ICT equipment and cloud services, supported by government initiatives like the ¥1 trillion digital transformation support for SMEs in fiscal year 2023.

Emerging technologies are creating new asset classes requiring specialized financing, such as IoT devices and robotics, with the global renewable energy market alone projected to exceed $2 trillion by 2030, presenting substantial growth opportunities for Fuyo General Lease's financing solutions.

Cybersecurity and data privacy are paramount concerns, with the global cybersecurity market valued at approximately $217.2 billion in 2023. Fuyo General Lease must bolster its defenses and ensure compliance with evolving data privacy regulations to protect client information and maintain trust.

Legal factors

Recent amendments to Japan's Banking Act, effective from early 2024, are notably broadening the permissible ancillary business activities for financial institutions. This regulatory shift, coupled with relaxed criteria for venture business investments, directly impacts Fuyo General Lease by potentially opening new avenues for partnerships and diversified service offerings. For instance, the revised regulations might allow leasing companies to engage more deeply in financial advisory services or to invest in a wider range of technology startups, enhancing their competitive edge.

Japanese regulations, such as the amended Cabinet Office Order on Disclosure of Corporate Affairs and the Corporate Governance Code, are increasingly mandating or strongly encouraging comprehensive ESG disclosures. Fuyo General Lease must ensure its reporting on sustainability initiatives is compliant and transparent to meet these evolving legal expectations.

Japan's commitment to combating financial crime has led to increasingly strict Anti-Money Laundering (AML) and Counter-Terrorism Financing (CFT) regulations. Financial institutions, including leasing companies like Fuyo General Lease, were mandated to implement enhanced compliance measures by March 2024. This regulatory shift necessitates a proactive approach to risk management.

Fuyo General Lease must therefore ensure its internal systems and operational procedures are robust enough to satisfy these heightened requirements. Adherence to these stringent guidelines is crucial for mitigating the risks associated with financial crime and maintaining regulatory compliance in the evolving Japanese financial landscape.

New Legislation for Cash Flow-Based Lending

The Act on the Promotion of Cash Flow-Based Lending, effective from June 2024, introduces a novel 'enterprise value security interest'. This legal framework is designed to bolster financing options for startups and businesses that may not possess substantial tangible assets, thereby broadening the scope for financial institutions like Fuyo General Lease to engage with emerging enterprises.

This legislative shift is particularly impactful as it aims to unlock capital for innovative ventures by recognizing their potential enterprise value rather than solely relying on traditional collateral. For Fuyo General Lease, this presents a significant opportunity to expand its client base and product offerings within the dynamic startup ecosystem.

- New Security Interest: The 'enterprise value security interest' allows lenders to secure loans against the overall value of a business, not just its physical assets.

- Startup Support: This legislation directly addresses a key challenge for startups: accessing finance without a long history of tangible asset accumulation.

- Market Potential: By facilitating cash flow-based lending, the act is expected to stimulate growth in sectors heavily reliant on intangible assets and future earnings potential.

- Fuyo General Lease Opportunity: Fuyo General Lease can leverage this new legal instrument to offer tailored financing solutions to a wider range of growing businesses.

Regulatory Framework for Digital Assets and Payments

Japan's Financial Services Agency (FSA) is actively refining the legal landscape for digital assets and electronic payments. Recent updates in 2024 have clarified rules for credit transactions involving these instruments, impacting how companies like Fuyo General Lease can structure their financial offerings. Staying abreast of these evolving regulations is crucial for Fuyo General Lease to ensure compliance and to strategically adapt its services in the burgeoning digital finance sector.

The continuous evolution of digital asset regulations presents both challenges and opportunities for Fuyo General Lease. For instance, the FSA's focus on consumer protection in digital transactions, as seen in guidelines issued in late 2024, necessitates robust risk management frameworks. Fuyo General Lease must integrate these compliance measures to maintain trust and operational integrity in its digital payment solutions.

- FSA's ongoing updates to digital asset regulations in Japan.

- Specific rules for credit transactions involving digital assets and electronic payments.

- Need for Fuyo General Lease to monitor and adapt financial services.

- Impact of consumer protection guidelines on digital payment operations.

Recent Japanese legal reforms, particularly those impacting financial services and corporate governance, directly influence Fuyo General Lease's operational landscape. Amendments to the Banking Act from early 2024, for example, expand permissible ancillary business activities for financial institutions, potentially opening new partnership and service diversification avenues for leasing companies.

Further, the Act on the Promotion of Cash Flow-Based Lending, effective June 2024, introduces an 'enterprise value security interest.' This allows financing against a business's overall value, not just tangible assets, creating significant opportunities for Fuyo General Lease to support startups and emerging enterprises by broadening its client base and product offerings.

Compliance with increasingly stringent Anti-Money Laundering (AML) and Counter-Terrorism Financing (CFT) regulations, with enhanced measures mandated by March 2024, is crucial. Fuyo General Lease must ensure its internal systems are robust to satisfy these heightened requirements, mitigating financial crime risks.

The evolving legal framework for digital assets and electronic payments, with FSA updates in 2024 clarifying credit transaction rules, necessitates Fuyo General Lease's adaptation to ensure compliance and strategic service adjustments in the digital finance sector.

Environmental factors

Japan's ambitious goal of achieving carbon neutrality by 2050 is driving significant policy support for electrification and green energy adoption. This national commitment directly translates into a burgeoning market for financing and leasing renewable energy infrastructure and other decarbonization technologies.

Fuyo General Lease is strategically positioned to capitalize on this trend, as evidenced by its increasing involvement in financing green projects. For instance, in fiscal year 2023, the company significantly expanded its leasing of electric vehicles, with EV leases growing by 18% compared to the previous year, reflecting a direct response to the decarbonization imperative.

The global market for ESG bonds is experiencing significant growth, with issuance projected to reach $1.5 trillion in 2024, up from $1.2 trillion in 2023. Japan, in particular, is a frontrunner in climate transition finance, having issued its first sovereign transition bond in 2024. This burgeoning demand for sustainable finance presents Fuyo General Lease with increased opportunities to secure capital for environmentally conscious projects and bolster its commitment to green initiatives.

Fuyo General Lease is actively pursuing environmental sustainability, targeting carbon neutrality for its Scope 1 and Scope 2 emissions by 2030. This ambitious goal includes a 30% reduction in these emissions compared to its 2020 baseline.

The company is also making tangible contributions to a circular economy through initiatives like waste plastic recycling and investments in renewable energy projects, showcasing a practical approach to environmental stewardship.

Climate Change Risks and Resilience

Japan's vulnerability to natural disasters, including earthquakes and floods, necessitates robust adaptation strategies. These physical risks are projected to intensify due to climate change, impacting property values and operational continuity. For instance, the estimated annual economic losses from floods in Japan could reach ¥1.9 trillion by 2050 under a high-emission scenario.

Fuyo General Lease must integrate climate resilience into its financing decisions, particularly for real estate and infrastructure projects. This involves assessing the physical risks associated with specific locations and ensuring that financed assets can withstand or recover from climate-related events. Failure to do so could lead to increased insurance costs, asset depreciation, and potential loan defaults.

- Climate-related physical risks in Japan: Earthquakes, floods, typhoons, and sea-level rise pose significant threats.

- Economic impact: Annual flood losses in Japan could reach ¥1.9 trillion by 2050 (high-emission scenario).

- Fuyo General Lease's role: Financing projects requires evaluating and mitigating climate change impacts on real estate and infrastructure.

- Resilience measures: Investing in climate-resilient infrastructure and property development is crucial for long-term asset value.

Promotion of Eco-Friendly Vehicles in Leasing

The Japanese automotive leasing sector is witnessing a significant shift towards electric and hybrid vehicles, fueled by heightened environmental consciousness and supportive government policies. This trend presents a clear opportunity for Fuyo General Lease to bolster its fleet with a wider array of eco-friendly options, directly addressing growing consumer and corporate demand for sustainable transportation solutions.

For instance, in fiscal year 2023, the adoption rate of eco-friendly vehicles, including EVs and hybrids, in Japan's overall automotive market saw a notable increase. Fuyo General Lease can capitalize on this by strategically expanding its leasing portfolio to include more models that align with these environmental preferences. This proactive approach not only meets market demand but also positions the company as a leader in sustainable mobility services.

- Growing Demand: Consumer and corporate interest in EVs and hybrids is on the rise in Japan.

- Government Support: Policies encouraging eco-friendly vehicle adoption are creating a favorable market environment.

- Fleet Expansion: Fuyo General Lease can benefit by increasing its offering of electric and hybrid lease options.

- Market Positioning: Expanding into eco-friendly vehicles enhances Fuyo's image as a forward-thinking, sustainable leasing provider.

Japan's commitment to carbon neutrality by 2050 is a significant environmental driver, creating a robust market for green financing and leasing. Fuyo General Lease is actively participating, with its EV leases growing 18% in fiscal year 2023, aligning with national decarbonization goals.

The company targets carbon neutrality for its Scope 1 and 2 emissions by 2030, aiming for a 30% reduction from its 2020 baseline, demonstrating a clear internal environmental strategy.

Fuyo General Lease is also addressing physical climate risks, such as the potential ¥1.9 trillion annual flood losses in Japan by 2050 under a high-emission scenario, by integrating climate resilience into its financing decisions for real estate and infrastructure.

| Environmental Factor | Impact on Fuyo General Lease | Fuyo General Lease's Response/Opportunity |

| Carbon Neutrality Goals (Japan) | Drives demand for green financing and leasing. | Increased leasing of EVs (18% growth FY2023) and renewable energy infrastructure. |

| Climate Change Physical Risks | Potential asset depreciation and increased insurance costs from events like floods. | Integrating climate resilience into financing decisions for real estate and infrastructure. |

| Circular Economy Initiatives | Growing consumer and corporate focus on sustainability. | Investments in waste plastic recycling and renewable energy projects. |

PESTLE Analysis Data Sources

Our Fuyo General Lease PESTLE Analysis is constructed using a robust blend of official government publications, reputable financial news outlets, and industry-specific market research reports. This ensures that our insights into political, economic, social, technological, legal, and environmental factors are grounded in accurate and current information.