Fuyo General Lease Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fuyo General Lease Bundle

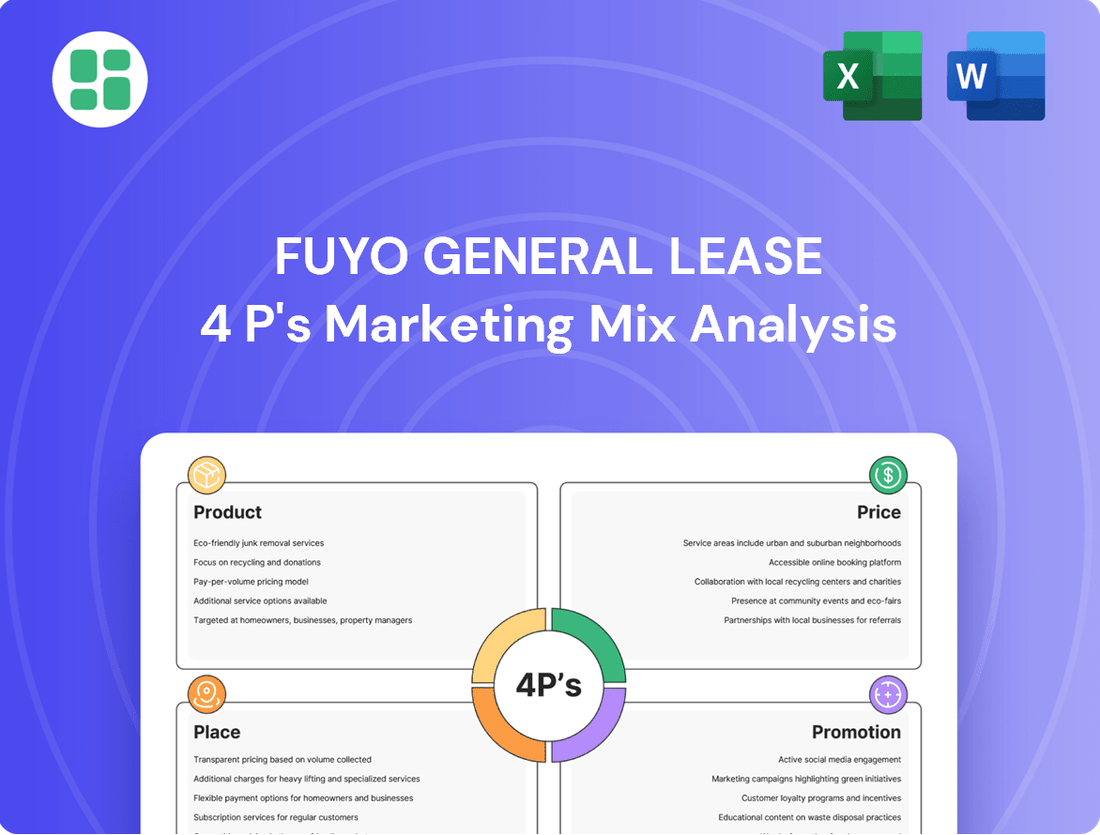

Fuyo General Lease's marketing mix is a carefully orchestrated symphony of Product, Price, Place, and Promotion, designed to resonate with a diverse clientele seeking flexible leasing solutions. Understanding their product offerings, competitive pricing, strategic distribution channels, and targeted promotional efforts is key to grasping their market dominance.

Go beyond the basics—get access to an in-depth, ready-made Marketing Mix Analysis covering Fuyo General Lease's Product, Price, Place, and Promotion strategies. Ideal for business professionals, students, and consultants looking for strategic insights into the leasing industry.

Product

Fuyo General Lease's product strategy is defined by its extensive and diversified financial leasing solutions. This encompasses a wide array of leasing and installment sales options, covering essential business assets like IT and office equipment, heavy industrial machinery, and even real estate.

The company's offering extends to installment sales for critical operational assets, including commercial and production facilities, as well as specialized hospital equipment. This broad product portfolio demonstrates Fuyo's commitment to supporting capital investments across a vast spectrum of industries.

For instance, in fiscal year 2023, Fuyo General Lease reported total assets of ¥2,853.1 billion, underscoring the scale of its leasing operations and the diverse range of equipment and facilities it finances.

Specialized Asset Finance is a key component of Fuyo General Lease's strategy, moving beyond standard leasing to focus on high-value assets like real estate, aircraft, and mobility/logistics equipment. This specialization is a deliberate move, identified in their medium-term management plan as a significant growth driver.

The company is actively targeting these specialized sectors to enhance profitability and solidify its market position. For instance, Fuyo General Lease reported a significant increase in its operating income for the fiscal year ending March 2024, reaching ¥121.4 billion, partly fueled by its strategic expansion in these higher-margin asset finance areas.

Fuyo General Lease enhances its offering by providing credit card and lending services, broadening its financial solutions beyond traditional leasing. This diversification aims to meet a wider range of client financial requirements, from capital investments to day-to-day operational funding.

In 2024, the global credit card market was valued at over $3.1 trillion, indicating a significant opportunity for Fuyo General Lease to capture market share. By integrating these services, the company can offer a more comprehensive financial ecosystem, fostering deeper client relationships and increasing revenue streams.

Sustainable and Circular Economy Offerings

Fuyo General Lease is making significant strides in promoting services centered around sustainability and the circular economy. A prime example is their 'Fuyo Circular Economy Lease®' offering, which is designed to maximize the value of leased assets through reuse and recycling. This program directly addresses environmental concerns by extending product lifecycles and enhancing resource efficiency.

The 'Fuyo Circular Economy Lease®' is more than just a leasing service; it's a commitment to a more sustainable business model. By focusing on the refurbishment and redeployment of returned equipment, Fuyo General Lease is actively contributing to a reduced environmental footprint. This aligns with growing global demand for eco-conscious business practices and resource management.

In 2023, the global circular economy market was valued at approximately $2.4 trillion, with projections indicating substantial growth. Fuyo General Lease's proactive approach positions them to capitalize on this trend. Their initiatives directly support the United Nations Sustainable Development Goals, particularly SDG 12: Responsible Consumption and Production.

- Fuyo Circular Economy Lease® Facilitates the reuse and recycling of returned lease assets.

- Environmental Commitment Focuses on extending product life and improving resource recycling rates.

- Market Alignment Responds to increasing global demand for sustainable and circular economy solutions.

- Economic Impact Contributes to the growing global circular economy, valued at trillions of dollars.

Business Process Outsourcing (BPO) and ICT Solutions

Fuyo General Lease's expansion into Business Process Outsourcing (BPO) and Information and Communication Technology (ICT) solutions significantly enhances its product offering beyond traditional financing. These services are designed to directly support clients in improving their operational efficiency and streamlining business processes.

The company provides integrated billing services and comprehensive back-office support, demonstrating a commitment to offering clients not just financial tools but also practical solutions for operational enhancement. This strategic move positions Fuyo General Lease as a holistic partner, contributing to clients' overall business performance.

By offering these value-added services, Fuyo General Lease aims to deepen client relationships and create a more robust ecosystem of support. This diversification is crucial in a competitive market where clients increasingly seek integrated solutions for both financial and operational needs.

- BPO & ICT Solutions: Fuyo General Lease now offers integrated billing and back-office support, enhancing client operations.

- Operational Enhancement: Services focus on improving efficiency and streamlining business processes for clients.

- Holistic Partnership: The company moves beyond financing to provide tools for tangible business improvement.

- Market Competitiveness: This expansion addresses the growing demand for integrated financial and operational solutions.

Fuyo General Lease's product strategy is a multifaceted approach, offering a broad spectrum of financial leasing and installment sales for diverse assets, from IT equipment to real estate. This is complemented by specialized asset finance in areas like aircraft and mobility, alongside credit card and lending services to create a comprehensive financial ecosystem.

The company is also heavily invested in sustainability through its 'Fuyo Circular Economy Lease®', promoting asset reuse and recycling to meet growing global demand for eco-conscious solutions. Furthermore, Fuyo General Lease expands its value proposition with Business Process Outsourcing (BPO) and Information and Communication Technology (ICT) solutions, including integrated billing and back-office support, to enhance client operational efficiency.

| Product Offering | Key Features | Fiscal Year 2023/2024 Data |

|---|---|---|

| Diversified Leasing & Installment Sales | IT, office equipment, heavy machinery, real estate, facilities, hospital equipment | Total Assets: ¥2,853.1 billion |

| Specialized Asset Finance | Real estate, aircraft, mobility/logistics equipment | Operating Income: ¥121.4 billion (driven by expansion in these areas) |

| Credit Card & Lending Services | Broader financial solutions beyond leasing | Global Credit Card Market Value: >$3.1 trillion (2024) |

| Sustainability Initiatives | Fuyo Circular Economy Lease®, asset reuse and recycling | Global Circular Economy Market Value: ~$2.4 trillion (2023) |

| BPO & ICT Solutions | Integrated billing, back-office support, operational efficiency enhancement | Focus on deepening client relationships and providing integrated solutions |

What is included in the product

This analysis provides a comprehensive breakdown of Fuyo General Lease's marketing strategies across Product, Price, Place, and Promotion, offering actionable insights for competitive positioning and strategic planning.

The Fuyo General Lease 4P's Marketing Mix Analysis provides a clear, actionable framework to address common marketing challenges, simplifying complex strategies into a digestible format.

This analysis serves as a vital tool for overcoming market uncertainties by clearly outlining product, price, place, and promotion strategies, enabling confident decision-making.

Place

Fuyo General Lease heavily relies on direct sales and client engagement as its primary distribution channels, fostering strong, long-term relationships. This approach is particularly effective with its stable customer base, which includes many large enterprises that benefit from customized leasing solutions and a deep understanding of their unique operational requirements.

Fuyo General Lease strategically leverages its global network, featuring key subsidiaries such as Fuyo General Lease (USA), Fuyo General Lease (China), and Fuyo General Lease (HK). This international footprint is crucial for its market penetration and international business expansion efforts.

These overseas operations enable Fuyo General Lease to effectively serve diverse markets, including North America, Latin America, and East Asia. This strategic positioning facilitates robust international business growth and strengthens its competitive advantage in global leasing markets.

Fuyo General Lease's strategic partnerships with major financial institutions are a cornerstone of its marketing mix. A prime example is its close relationship with Mizuho Bank, its primary financing partner, which is crucial for securing the substantial capital needed for its leasing operations.

These collaborations, like the one with Mizuho Bank, are vital for expanding Fuyo General Lease's reach into new markets and reinforcing its financial stability. By leveraging these relationships, the company gains access to diverse funding sources, enabling it to offer competitive leasing solutions and manage its asset procurement effectively.

Digital Platforms for Operational Efficiency

Fuyo General Lease is enhancing its operational efficiency through digital platforms, even as its primary sales channels remain direct. The company is undertaking significant IT system reengineering and actively promoting Business Process Outsourcing (BPO) and Information and Communication Technology (ICT) services. This strategic shift indicates a commitment to leveraging digital tools to streamline operations and improve client service delivery.

While direct client interaction is key, Fuyo General Lease's investment in IT reengineering and BPO/ICT promotion points to a future where digital platforms play a more central role in its marketing mix. This evolution aims to create smoother, more efficient service experiences for their clientele, even if dedicated public-facing digital sales platforms are not yet a primary focus.

- IT System Reengineering: Focused on modernizing internal systems to support greater efficiency.

- BPO/ICT Promotion: Highlighting services that leverage technology for client operational improvements.

- Client Service Enhancement: Digital platforms are seen as a means to deliver better, faster services.

- Evolving Digital Footprint: A gradual expansion of digital capabilities to complement direct sales efforts.

Industry-Specific Ecosystems and Alliances

Fuyo General Lease actively cultivates industry-specific ecosystems, recognizing that tailored solutions drive deeper market penetration. By embedding its leasing services within sectors like healthcare, mobility, and renewable energy, Fuyo provides specialized financial tools that address unique operational needs.

Strategic alliances are crucial to this approach. For instance, Fuyo's collaboration with the Yamato Group in the mobility sector exemplifies how partnerships unlock access to established logistics networks. This allows Fuyo to offer integrated leasing packages that include vehicles, maintenance, and telematics, thereby enhancing efficiency for clients.

These ecosystem-centric strategies are supported by Fuyo's financial performance. For the fiscal year ending March 2024, Fuyo General Lease reported total revenue of ¥532.5 billion, demonstrating the scale and success of its diversified leasing operations. This financial strength underpins their ability to forge and sustain these vital industry alliances.

- Healthcare Ecosystem: Fuyo offers specialized medical equipment leasing, supporting hospitals and clinics in acquiring advanced technology without significant upfront capital expenditure.

- Mobility & Logistics Alliances: Partnerships, such as the one with Yamato Group, enable Fuyo to provide comprehensive fleet management and leasing solutions, optimizing supply chains.

- Renewable Energy Integration: Fuyo facilitates the adoption of solar power and other green technologies through leasing, contributing to sustainability goals and providing clients with predictable energy costs.

Place, as a component of Fuyo General Lease's marketing mix, is defined by its strategic presence in key global markets and its cultivation of industry-specific ecosystems. The company's international subsidiaries, including Fuyo General Lease (USA) and Fuyo General Lease (China), facilitate market penetration and global expansion, serving diverse regions like North America and East Asia.

Fuyo General Lease's commitment to building industry-specific ecosystems, such as in healthcare and mobility, allows it to offer tailored leasing solutions that meet unique operational needs. These localized strategies are supported by a strong financial foundation, with total revenue reaching ¥532.5 billion for the fiscal year ending March 2024.

The company's place strategy also involves strategic alliances, like its collaboration with the Yamato Group in the mobility sector, which enhances its offering of integrated fleet management and leasing solutions.

Fuyo General Lease's operational presence is further strengthened by its investment in digital platforms and IT system reengineering, aiming to improve client service delivery and operational efficiency across its global locations.

What You Preview Is What You Download

Fuyo General Lease 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Fuyo General Lease 4P's Marketing Mix Analysis is fully complete and ready for your immediate use. You can confidently review its contents knowing it reflects exactly what you'll get.

Promotion

Fuyo General Lease prioritizes transparent investor relations, regularly publishing detailed financial results and integrated reports. For fiscal year 2024 (ending March 2024), the company reported a net sales of ¥530.5 billion, demonstrating its consistent financial performance. This commitment to clear communication underscores their dedication to corporate value and shareholder confidence.

Fuyo General Lease actively communicates its dedication to sustainability and social problem-solving via its Creating Shared Value (CSV) management approach. This is evident in their comprehensive environmental and social reports, often featured within their Integrated Report and dedicated sustainability website.

These communications specifically target stakeholders who prioritize environmental and social consciousness, showcasing Fuyo General Lease's commitment to responsible business practices. For instance, their 2023 Integrated Report detailed a 15% reduction in CO2 emissions compared to 2019 levels, underscoring tangible progress in their environmental stewardship.

Fuyo General Lease actively uses public relations and news announcements to communicate significant business milestones. This includes detailing strategic acquisitions and the launch of new projects, ensuring stakeholders are kept informed.

Recent news highlights Fuyo General Lease's expansion into logistics and real estate sectors through strategic acquisitions. Furthermore, their involvement in sustainable energy projects demonstrates a commitment to environmental initiatives, boosting their public profile.

Credit Rating Agency Engagements

Fuyo General Lease actively cultivates relationships with key credit rating agencies, notably Japan Credit Rating Agency (JCR) and Rating and Investment Information, Inc. (R&I). The company regularly issues news releases that highlight their affirmed ratings and outlooks, demonstrating a commitment to transparency and investor confidence. For example, in early 2024, Fuyo General Lease maintained a strong A+ rating from R&I, reflecting its robust financial health and stable business operations.

These high credit ratings are a powerful promotional asset, serving as a clear signal of financial stability and reliability. This is crucial for attracting both new clients seeking dependable leasing partners and investors looking for secure opportunities. A strong credit profile directly translates into a more favorable perception in the market, enhancing Fuyo General Lease's competitive edge.

The consistent engagement and positive ratings from agencies like JCR and R&I underscore Fuyo General Lease's financial discipline and strategic management. This proactive approach to credit assessment reinforces the company's image as a trustworthy and well-managed entity within the leasing industry.

- JCR Rating: Fuyo General Lease has consistently received an A+ rating from JCR, affirming its sound financial standing.

- R&I Rating: The company also holds an A+ rating from R&I, further solidifying its reputation for stability.

- Promotional Impact: High credit ratings act as a significant promotional tool, boosting market confidence.

- Investor Confidence: These ratings are vital for attracting investment and demonstrating long-term viability.

Targeted Business-to-Business (B2B) Marketing

Fuyo General Lease's commitment to facilitating capital investments for a diverse business clientele naturally leads to a strong emphasis on targeted B2B marketing. This approach is crucial for connecting with companies seeking tailored leasing solutions to fuel their growth and operational needs.

Direct sales teams are paramount in this strategy, acting as the frontline for engaging potential corporate clients. These teams are equipped to understand specific industry challenges and present Fuyo General Lease's offerings as solutions. For instance, in 2023, Fuyo General Lease reported a significant portion of its revenue derived from corporate clients, underscoring the effectiveness of these direct engagement efforts.

Participation in industry-specific events and trade shows is another key tactic. These platforms allow Fuyo General Lease to showcase its expertise and leasing options directly to decision-makers within target sectors. Customized proposals are then developed, demonstrating a deep understanding of each business's unique investment requirements and financial objectives. This personalized touch is vital in a competitive market where bespoke financial products are highly valued.

- Direct Sales Engagement: Fuyo General Lease likely utilizes specialized sales forces to build relationships with corporate decision-makers, focusing on understanding their capital expenditure requirements.

- Industry-Specific Outreach: The company probably targets key industries through tailored marketing campaigns and participation in sector-specific conferences and exhibitions to reach relevant businesses.

- Customized Solution Development: Fuyo General Lease's B2B marketing would heavily feature the creation of bespoke leasing proposals that directly address the unique financial and operational needs of each corporate client.

- Client Retention Focus: Given the long-term nature of leasing agreements, marketing efforts also likely extend to client relationship management and upselling opportunities within the existing business customer base.

Fuyo General Lease leverages its strong financial standing, evidenced by consistent A+ ratings from JCR and R&I, as a key promotional tool. These affirmations signal stability and reliability, attracting both clients and investors. The company actively communicates these ratings through news releases, reinforcing its image as a dependable partner in the leasing sector.

The company's promotional efforts are heavily geared towards B2B marketing, utilizing direct sales teams to engage corporate clients. These teams focus on understanding specific industry needs and offering tailored leasing solutions. For fiscal year 2024, Fuyo General Lease reported net sales of ¥530.5 billion, with a significant portion attributed to its corporate clientele, highlighting the effectiveness of this direct approach.

Participation in industry events and the development of customized proposals are central to Fuyo General Lease's B2B strategy. This allows them to showcase expertise and build relationships within target sectors. Their commitment to sustainability, demonstrated by a 15% reduction in CO2 emissions by 2023 compared to 2019, is also a significant promotional aspect, appealing to environmentally conscious stakeholders.

Price

Fuyo General Lease crafts its pricing for core leasing and installment sales with a personalized touch. They meticulously factor in the asset's nature, the desired lease duration, the client's financial standing, and prevailing market dynamics. This granular approach ensures financing structures are flexible and precisely match a client's capital expenditure plans and day-to-day cash flow needs.

Fuyo General Lease provides a range of financing solutions, including loans and factoring, with pricing that stands up well against competitors in the financial services sector. For instance, as of early 2024, average business loan interest rates from similar institutions hovered around 7-10%, and Fuyo's offerings aim to be within this competitive band, adjusted for risk and product value.

These financing options are structured to be both accessible and appealing, carefully considering factors like interest rates, the creditworthiness of the applicant, and the overall perceived value of the financial product being offered. This strategic pricing ensures that Fuyo General Lease remains a viable and attractive partner for businesses seeking capital.

Fuyo General Lease employs value-based pricing for its specialized solutions in real estate, aircraft, and energy & environment sectors. This strategy acknowledges the inherent value, intricate nature, and extended commitment associated with these asset classes.

The company targets enhanced profitability within these segments, underscoring a pricing approach that factors in the significant expertise and substantial capital investment required. For instance, in FY2024, Fuyo General Lease reported a notable increase in operating income from its specialized leasing operations, reflecting the success of this value-driven approach.

Strategic Use of Discounts and Incentives

Fuyo General Lease likely leverages discounts and incentives as a key part of its marketing mix, particularly for substantial volume agreements or extended contract durations. This strategy is crucial for attracting and retaining significant clients, ensuring a stable revenue stream and building enduring business partnerships.

Such incentives can take various forms, tailored to meet the specific needs of different customer segments. For instance, a large corporation requiring a fleet of vehicles for its operations might negotiate preferential rates based on the sheer volume of the lease agreement. Similarly, a business committing to a multi-year lease for essential equipment could be offered a reduced monthly payment or bundled service packages.

The company's approach to discounts would aim to balance customer acquisition and retention with profitability. For example, offering a 5% discount on leases exceeding ¥50 million in value or for contracts of over three years would incentivize larger, more committed business. This proactive approach to pricing can significantly influence customer choice and solidify Fuyo General Lease's market position.

- Volume-Based Discounts: Offering tiered pricing reductions for larger lease volumes, potentially starting at 3% for contracts over ¥20 million.

- Long-Term Contract Incentives: Providing a 5% reduction on monthly payments for leases exceeding a five-year term.

- Customer Loyalty Programs: Implementing a reward system for repeat clients, perhaps offering a 2% discount on their next lease agreement.

- Bundled Service Packages: Including maintenance or insurance at a reduced rate for clients who opt for comprehensive leasing solutions.

Risk-Adjusted Pricing Models

Fuyo General Lease employs risk-adjusted pricing models, a cornerstone of its conservative credit management, especially in real estate and aircraft financing. This approach ensures that the cost of capital directly correlates with the perceived risk of each transaction and client, safeguarding asset quality and maintaining profitability.

This strategy is crucial for navigating the complexities of the financial landscape. For instance, in 2024, the global aviation leasing market, while recovering, still faces headwinds from geopolitical instability and fluctuating fuel prices, necessitating careful risk assessment in pricing aircraft leases.

- Conservative Credit Management: Fuyo General Lease prioritizes a cautious approach to credit risk, particularly in sectors with inherent volatility.

- Risk-Reflecting Pricing: Financing costs are meticulously calibrated to mirror the specific risks tied to assets and borrower profiles.

- Asset Quality Focus: This pricing strategy directly supports the maintenance of high asset quality across the lease portfolio.

- Profitability Assurance: By accounting for risk, the models aim to secure consistent and sustainable profitability.

Fuyo General Lease's pricing strategy is multifaceted, incorporating value-based approaches for specialized assets and risk-adjusted models for conservative credit management. They also utilize volume-based discounts and long-term contract incentives to attract and retain clients, balancing customer acquisition with profitability. For example, in FY2024, their specialized leasing operations showed increased operating income, indicating the success of their value-driven pricing.

| Pricing Strategy Element | Description | Example Incentive (2024/2025) | Impact |

|---|---|---|---|

| Value-Based Pricing | For specialized assets like real estate, aircraft, energy. | Pricing reflects inherent value and extended commitment. | Enhanced profitability in niche sectors. |

| Risk-Adjusted Pricing | Correlates cost of capital with transaction/client risk. | Fuyo's conservative credit management in volatile markets. | Maintains asset quality and profitability. |

| Volume/Term Discounts | Incentives for larger agreements or longer durations. | 5% reduction for leases over five years; 3% for contracts > ¥20 million. | Attracts significant clients and secures stable revenue. |

4P's Marketing Mix Analysis Data Sources

Our Fuyo General Lease 4P's Marketing Mix Analysis is built upon a foundation of official company disclosures, including annual reports and investor relations materials. We also incorporate insights from industry-specific publications and competitive intelligence to provide a comprehensive view of their market strategy.