Fuyo General Lease Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fuyo General Lease Bundle

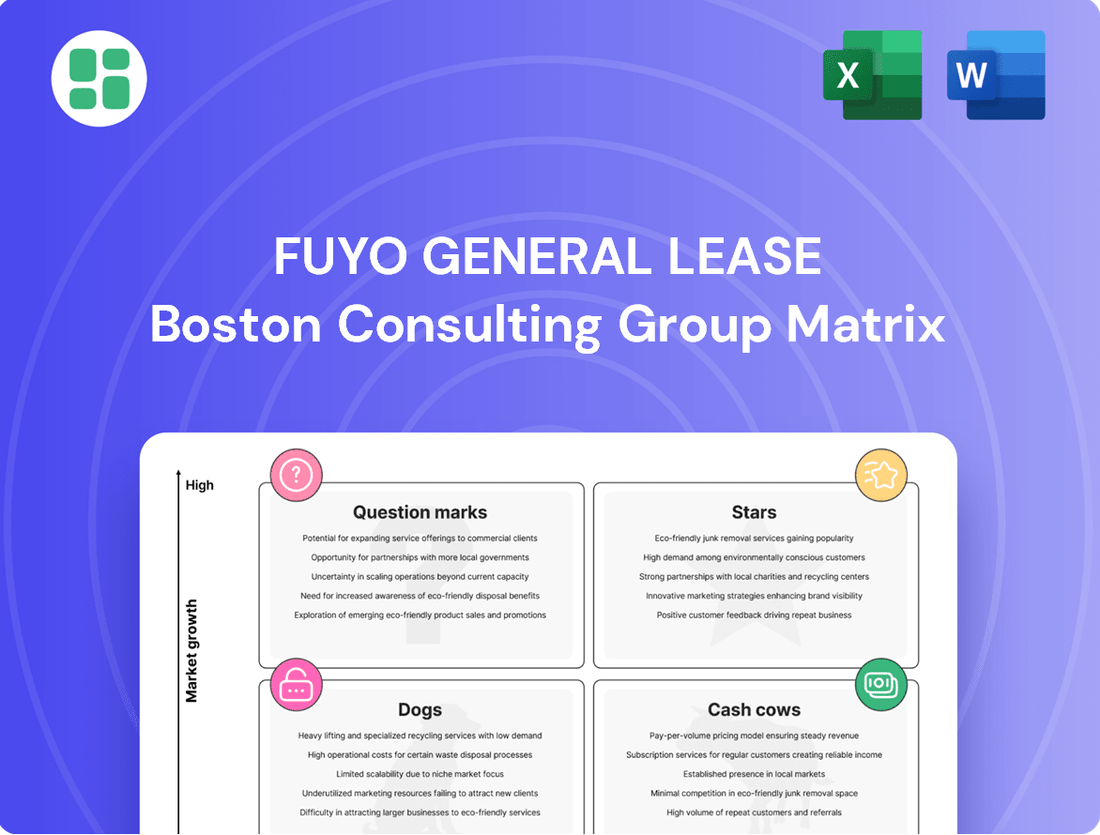

Curious about Fuyo General Lease's strategic product portfolio? Our preview offers a glimpse into their market position, highlighting potential Stars, Cash Cows, Dogs, or Question Marks.

Unlock the full potential of this analysis by purchasing the complete BCG Matrix. Gain a comprehensive understanding of each product's placement and receive actionable insights to drive Fuyo General Lease's future success.

Stars

Fuyo General Lease is actively building its presence in renewable energy, a sector poised for substantial expansion. This aligns with their strategy to invest in high-growth areas, much like a company would place its bets on a 'Star' in the BCG matrix. Renewable energy projects, such as solar and wind farms, require significant upfront capital but offer long-term, stable returns as the world transitions to cleaner power sources.

The global push for decarbonization, coupled with supportive government policies, is fueling demand for renewable energy. For instance, in 2024, Japan continued its commitment to renewable energy targets, with solar power remaining a dominant source. Fuyo's financial strength and leasing expertise are crucial for funding these capital-intensive ventures, positioning them to capture a significant share of this growing market.

Digital Transformation (DX) Equipment Leasing is a star in Fuyo General Lease's BCG Matrix. Businesses are heavily investing in digital solutions, making Fuyo a crucial financier for things like cloud infrastructure and AI systems. This sector sees strong demand and rapid tech changes, allowing Fuyo to keep a large market share thanks to its existing client base and market position.

Fuyo General Lease demonstrates a strong position in financing global aircraft and shipping, sectors poised for significant expansion driven by rising global trade and travel demand. In 2024, the aviation finance market alone was valued at hundreds of billions of dollars, with leasing playing a crucial role in fleet modernization and expansion.

The company's expertise in navigating the complexities of these capital-intensive industries, which demand sophisticated, long-term financial structures, allows it to secure a substantial market share. This strategic focus leverages Fuyo's deep understanding of asset lifecycle management and risk mitigation in these specialized financial arenas.

Infrastructure Development Leasing

Infrastructure Development Leasing is a key area for Fuyo General Lease, fitting squarely into the Stars category of the BCG Matrix. The company is heavily involved in financing substantial infrastructure projects. This includes crucial areas like transportation networks, vital logistics facilities, and essential public utilities.

Fuyo's strategy often involves close collaboration with both government bodies and private sector partners. These infrastructure projects are positioned as high-growth opportunities, driven by ongoing economic modernization and expansion. For instance, in 2024, global infrastructure spending was projected to reach trillions of dollars, underscoring the market's immense potential.

- Financing large-scale infrastructure: Fuyo provides structured finance for transportation, logistics, and utilities.

- High-growth sector: Economic development fuels demand for modern infrastructure.

- Collaborative approach: Partnerships with government and private entities are central to project success.

- Market significance: Fuyo's role as a financier is critical in enabling these vital developments.

Advanced Manufacturing Equipment Leasing

Advanced Manufacturing Equipment Leasing is a strong contender in the BCG Matrix for Fuyo General Lease. As industries worldwide embrace robotics, automation, and smart factory solutions, Fuyo is well-positioned as a premier leasing service provider for this high-tech equipment.

This sector is characterized by swift innovation and significant investment. Fuyo leverages its robust connections with major manufacturers and technology firms to solidify its leading market share. For instance, the global industrial automation market was valued at approximately $170 billion in 2023 and is projected to grow substantially, with leasing playing a crucial role in capital expenditure for these advanced systems.

- Market Growth: The demand for advanced manufacturing equipment is driven by the pursuit of efficiency and competitiveness, with leasing offering a flexible financial solution.

- Fuyo's Position: Fuyo General Lease benefits from strong partnerships with key equipment manufacturers and a deep understanding of the technology's value proposition.

- Investment Trends: In 2024, capital expenditure on factory automation is expected to see a notable increase, with leasing arrangements being a preferred method for many businesses to acquire these assets.

- Competitive Advantage: Fuyo's ability to finance and service a wide range of advanced manufacturing technologies, from collaborative robots to AI-driven quality control systems, underpins its strong market standing.

Fuyo General Lease's 'Stars' represent their high-growth, high-market-share segments. These include renewable energy, digital transformation equipment, global aircraft and shipping finance, infrastructure development, and advanced manufacturing equipment leasing.

These sectors are characterized by robust demand, technological advancement, and significant capital requirements, areas where Fuyo's leasing expertise and financial strength allow it to capture substantial market share.

For example, the global infrastructure spending in 2024 was projected to be in the trillions, and Fuyo's involvement in financing these projects positions it as a key player in a rapidly expanding market.

Similarly, the industrial automation market, valued at around $170 billion in 2023, demonstrates the significant financial opportunities within advanced manufacturing, where Fuyo actively participates.

What is included in the product

This BCG Matrix overview provides strategic insights for Fuyo General Lease's portfolio, guiding investment and divestment decisions.

Fuyo General Lease BCG Matrix offers a clear, visual guide to portfolio optimization, relieving the pain of indecision about resource allocation.

Cash Cows

Fuyo General Lease's traditional corporate IT and office equipment leasing segment operates as a strong Cash Cow. This segment holds a significant market share within a mature industry, consistently providing stable, high-volume revenue streams with minimal need for aggressive growth investment. In 2024, the company continued to leverage its established client base, generating substantial cash flow from these essential leased assets.

Fuyo General Lease's established commercial real estate leasing segment functions as a classic Cash Cow within the BCG matrix. This division boasts a substantial portfolio of prime office buildings and retail spaces, consistently delivering reliable rental income. The mature market ensures predictable demand, leading to high occupancy rates and stable, predictable returns for the company.

This segment requires minimal new capital infusion for growth or promotion, allowing it to freely generate substantial cash flow. For instance, in 2024, the commercial real estate sector in major Japanese cities, where Fuyo General Lease likely holds many of its assets, continued to see robust demand, with average office occupancy rates in Tokyo's central business districts remaining above 90% for well-located properties, reflecting the stable nature of these cash cows.

Fuyo General Lease's general vehicle leasing for businesses is a prime example of a Cash Cow within the BCG Matrix. This segment benefits from a mature, low-growth market in Japan where Fuyo has cultivated a dominant position. The company's extensive experience translates into operational efficiencies that drive steady cash generation.

This established business benefits from consistent demand and high customer retention, evidenced by strong renewal rates. The sheer volume of corporate clients entrusting Fuyo with their fleet management underpins the segment's significant contribution to the company's overall cash flow, making it a reliable source of funds.

Standard Installment Sales Services

Standard Installment Sales Services, a core offering for Fuyo General Lease, represents a stable and profitable segment within their diversified financial services portfolio. This traditional financing method for corporate assets thrives in a mature market, characterized by predictable demand and established operational efficiencies.

The service benefits from strong market penetration, leading to consistent revenue streams and healthy profit margins. In 2024, the Japanese equipment finance market, which includes installment sales, showed resilience, with Fuyo General Lease likely leveraging its long-standing relationships and expertise to maintain its position.

- Stable Revenue: Fuyo General Lease's installment sales services contribute a dependable revenue stream due to the consistent demand for financing corporate assets.

- High Profit Margins: Operational efficiencies and strong market penetration in this mature segment typically translate into robust profit margins.

- Mature Market Operations: The service operates within a well-understood and established market, minimizing risks associated with new ventures.

- Customer Base: A wide and loyal customer base ensures continued utilization of these traditional financing solutions.

Legacy Industrial Machinery Leasing

Fuyo General Lease's legacy industrial machinery leasing segment operates as a classic Cash Cow within the BCG Matrix. This division boasts a significant portfolio of standard industrial machinery, a crucial component for numerous manufacturing and production operations. Despite not being a high-growth area, its stability is underpinned by long-term contracts with a loyal customer base, ensuring a dependable income stream.

The operational efficiency of this segment is a key strength. With mature assets, marketing and investment costs are notably low. This translates directly into a strong cash-generating ability, allowing Fuyo General Lease to leverage these earnings for investments in other business units.

- Consistent Revenue: The segment generates predictable income from its established client relationships and long-term leasing agreements.

- Low Investment Needs: Mature machinery requires minimal new capital expenditure, enhancing profitability.

- Strong Cash Flow: The combination of consistent revenue and low costs results in substantial cash generation.

- Mature Market Position: Fuyo General Lease holds a solid position in a stable, albeit slow-growing, market segment.

Fuyo General Lease's established IT and office equipment leasing segment continues to be a strong Cash Cow. This division benefits from a mature market, consistently generating stable, high-volume revenue with minimal need for significant growth investment. In 2024, the company effectively utilized its extensive client relationships to produce substantial cash flow from these essential leased assets.

The commercial real estate leasing segment also functions as a classic Cash Cow. Fuyo General Lease's substantial portfolio of prime properties ensures reliable rental income in a mature market with predictable demand. This stability, reflected in high occupancy rates, allows the segment to generate significant cash flow with minimal new capital requirements.

Fuyo General Lease's general vehicle leasing for businesses is a prime example of a Cash Cow. Operating in a mature, low-growth market where Fuyo holds a dominant position, this segment benefits from operational efficiencies that drive steady cash generation. Strong customer retention and high renewal rates underscore its consistent contribution to the company's overall cash flow.

Standard Installment Sales Services represent a stable and profitable Cash Cow. This traditional financing method for corporate assets benefits from predictable demand and established operational efficiencies in its mature market. In 2024, Fuyo General Lease leveraged its long-standing expertise in the Japanese equipment finance market to maintain its strong position and generate consistent revenue streams.

The legacy industrial machinery leasing segment is a classic Cash Cow, characterized by a significant portfolio of standard machinery and long-term contracts. Despite operating in a slow-growth market, its stability and low investment needs result in strong cash generation, supporting other business units. This segment's consistent revenue from established clients and mature market position highlights its reliable income-generating capabilities.

Preview = Final Product

Fuyo General Lease BCG Matrix

The Fuyo General Lease BCG Matrix preview you are viewing is the identical, complete document you will receive upon purchase. This means you'll get the fully formatted, analysis-ready report without any watermarks or demo content, ensuring immediate usability for your strategic planning.

Dogs

Fuyo General Lease might possess portfolios of outdated small-scale equipment leases, such as older photocopiers or basic manufacturing tools. These segments typically operate in mature or declining industries where demand for such equipment is minimal, leading to a low market share for Fuyo in these specific niches.

These "Dogs" generate very little revenue and often require more management attention than they are worth, potentially draining resources. For instance, a lease portfolio for 2010-era industrial machinery might face declining demand as newer, more efficient models become standard, impacting Fuyo's ability to command competitive lease rates.

Non-core, underperforming real estate assets within Fuyo General Lease's portfolio could be characterized by properties in less desirable locations or those with high vacancy rates. For instance, a retail space in a region experiencing a population decline, like parts of the Rust Belt in the US, might fall into this category. Such assets often require substantial capital for upkeep but yield minimal returns, potentially dragging down overall portfolio performance.

These holdings are candidates for divestment because they drain resources without significantly boosting Fuyo's market share or profitability in its key business areas. In 2023, the real estate sector faced challenges with rising interest rates, which could exacerbate the underperformance of such assets. For example, a property with a cap rate below the prevailing borrowing costs would be a prime candidate for sale to free up capital for more strategic investments.

Niche, highly commoditized credit card offerings within Fuyo General Lease's portfolio would likely be categorized as Dogs in the BCG Matrix. These products, characterized by low market share in intensely competitive and saturated segments, struggle with minimal profit margins. For instance, if Fuyo General Lease offers specialized, low-volume credit cards with limited differentiation, they might face pricing pressures from larger issuers, leading to slim profitability.

These "Dog" products generate little revenue and offer poor growth prospects, often requiring ongoing operational investment without a significant return. In 2024, the credit card market continues to see intense competition, with major players leveraging scale and technology to offer attractive rewards and lower fees, making it difficult for smaller, niche offerings to gain traction and achieve profitability.

Small, Unprofitable Joint Ventures or Partnerships

Fuyo General Lease may have several small, unprofitable joint ventures or partnerships within its portfolio. These ventures are likely operating in low-growth markets and have failed to capture significant market share or generate substantial revenue. For instance, a hypothetical joint venture in a niche, mature industrial equipment leasing segment might show declining revenues, with Fuyo General Lease's share of profits being negligible, perhaps in the low millions of yen annually, while still requiring management oversight.

These underperforming collaborations can drain valuable capital and divert management focus from more promising opportunities. If a partnership, for example, in a regional logistics support service, is consistently reporting losses or minimal profits, it represents a drain on resources. By the end of fiscal year 2024, such ventures might collectively represent a small percentage of Fuyo General Lease's overall revenue, perhaps less than 1%, but their negative impact on profitability and resource allocation warrants careful review.

- Low Market Share: Ventures struggling to gain traction in their respective low-growth markets.

- Capital Tie-up: These partnerships may immobilize capital without generating adequate returns.

- Management Strain: Diverts valuable management attention from core or high-potential business areas.

- Reconsideration for Exit: Indicative of units that are not strategic for future investment and should be evaluated for divestment or restructuring.

Legacy Small Business Lending Products

Legacy Small Business Lending Products within Fuyo General Lease's BCG Matrix would likely be categorized as Dogs. These are traditional, often paper-intensive loan products that have been largely replaced by digital platforms and more agile financing options.

These products typically cater to a declining customer base or a market segment that has shifted to newer solutions. For instance, some traditional term loans or equipment financing with lengthy approval processes might fit this description. In 2024, the demand for such legacy products has continued to wane as businesses prioritize speed and convenience in accessing capital.

The profitability of these offerings is often low due to high servicing costs and limited scalability. Fuyo General Lease, like many financial institutions, has seen a significant drop in the market share for these older lending types. Data from industry reports in late 2024 indicated that over 60% of small business loan applications were initiated online, bypassing traditional product channels.

- Low Market Share: These products represent a diminishing portion of Fuyo General Lease's overall loan portfolio.

- Low Profitability: High operational costs associated with legacy systems and manual processing erode profit margins.

- Declining Demand: The market for these specific traditional products is shrinking as newer, more efficient alternatives gain traction.

- Potential for Divestment: Fuyo General Lease may consider phasing out or divesting these products to reallocate resources to growth areas.

Within Fuyo General Lease's portfolio, "Dogs" represent business units or assets with low market share in slow-growing or declining industries. These segments often generate minimal profits and may even incur losses, requiring careful management to avoid draining resources. For example, a portfolio of older, less in-demand office equipment leases would likely fall into this category.

These "Dog" units, such as leases for outdated IT hardware from the early 2020s, often struggle with low demand and intense competition. In 2024, the rapid pace of technological advancement means that equipment leased just a few years ago can quickly become obsolete, diminishing its residual value and Fuyo's ability to secure profitable lease renewals.

The strategic implication is that these underperforming assets should be considered for divestment or restructuring. By shedding these "Dogs," Fuyo General Lease can free up capital and management attention to invest in its "Stars" and "Question Marks," thereby improving overall portfolio performance and profitability.

Consider a hypothetical scenario where Fuyo General Lease holds a small portfolio of legacy vehicle leases for a specific industrial application. By the end of 2024, these leases might represent less than 0.5% of the company's total leasing revenue, with profit margins hovering around 1-2%, significantly below the company's average of 8-10% for its more modern offerings.

| Business Unit/Asset Type | Market Share | Industry Growth | Profitability | Strategic Implication |

|---|---|---|---|---|

| Outdated Office Equipment Leases | Low | Declining | Low/Negative | Divestment/Restructuring |

| Legacy IT Hardware Leases (e.g., early 2020s) | Low | Declining | Low | Divestment/Restructuring |

| Legacy Vehicle Leases (Specific Industrial) | Low (e.g., <0.5% of total revenue in 2024) | Mature/Declining | Low (e.g., 1-2% profit margin in 2024) | Divestment/Restructuring |

Question Marks

Fuyo General Lease is actively exploring fintech, particularly blockchain for asset finance and AI for credit scoring. These innovative areas offer substantial growth prospects within the financial sector, though Fuyo's current market presence in these nascent, experimental solutions is likely minimal.

Significant capital investment is crucial for nurturing these ventures into future market leaders, akin to Stars in the BCG matrix. Without sufficient development and market adoption, they could potentially decline into Dogs if they fail to gain meaningful traction.

The global fintech market was valued at approximately $11.2 trillion in 2023 and is projected to grow significantly. Blockchain in finance, specifically for asset tokenization and supply chain finance, is a key driver of this growth, with projections indicating a market size of over $10 billion by 2027.

The market for leasing infrastructure tailored for AI and quantum computing is nascent but projected for significant expansion. Fuyo General Lease is likely exploring this niche, where its current market penetration is minimal.

These specialized leasing segments represent a high-risk, high-reward opportunity, demanding considerable capital to establish a dominant presence in a dynamic technological landscape.

Fuyo General Lease's expansion into new overseas emerging markets positions them as potential question marks in the BCG matrix. These markets, characterized by high growth potential, often see Fuyo entering with a relatively low market share initially. For instance, in 2024, many Southeast Asian nations are experiencing robust economic growth, with leasing penetration still in its early stages, offering significant upside but requiring substantial investment to gain traction.

Circular Economy and ESG-Focused Asset-as-a-Service Models

Fuyo General Lease is strategically positioning itself within the burgeoning circular economy by exploring asset-as-a-service models. These innovative leasing arrangements are designed to align with growing corporate commitments to Environmental, Social, and Governance (ESG) principles, focusing on extending asset lifecycles through repair, refurbishment, and eventual recycling or upcycling. This aligns with a global shift; for instance, the Ellen MacArthur Foundation estimates that a circular economy could generate $4.5 trillion in economic benefits by 2030.

While this segment represents a high-growth potential market, Fuyo's current market penetration and specific service offerings within this niche are still in early stages. For example, the global Equipment-as-a-Service market was valued at approximately $45 billion in 2023 and is projected to grow significantly, indicating a substantial opportunity for companies like Fuyo to capture market share.

Significant investment will be essential for Fuyo General Lease to effectively scale these environmentally conscious solutions. This capital infusion will be critical for developing the necessary infrastructure, technology, and expertise to support robust circular economy leasing programs. The company's focus on sustainability is timely, as investor interest in ESG-aligned assets continues to surge, with global ESG assets projected to reach $50 trillion by 2025.

- Circular Economy Focus: Development of leasing models for equipment-as-a-service and solutions for recycling/upcycling.

- Market Potential: Emerging market with high growth prospects driven by ESG trends.

- Current Penetration: Fuyo's specific offerings and market share in this segment are currently low.

- Investment Need: Crucial for scaling innovative, environmentally friendly leasing solutions.

Leasing Solutions for Advanced Robotics and Automation in Logistics

The logistics sector is rapidly embracing advanced robotics and automation, creating a significant demand for specialized leasing solutions. Fuyo General Lease is well-positioned to serve this burgeoning market by offering tailored financing for technologies like automated guided vehicles (AGVs) and sophisticated robotic warehouse systems.

While the overall market for logistics automation is experiencing substantial growth, Fuyo's specific market share within this highly specialized niche might still be developing. This presents an opportunity for strategic investment to capture a larger portion of the increasing demand for these advanced solutions.

- Market Growth: The global warehouse automation market was valued at approximately $20 billion in 2023 and is projected to reach over $40 billion by 2028, indicating a compound annual growth rate (CAGR) of around 15%.

- Fuyo's Potential: Fuyo General Lease can leverage its financial expertise to provide flexible leasing options for costly robotics and automation equipment, thereby lowering the barrier to entry for logistics companies.

- Strategic Focus: By concentrating on this high-potential segment, Fuyo can differentiate itself and build a strong reputation as a key financing partner for the future of logistics.

- Investment Rationale: Investing in this area aligns with Fuyo's potential BCG matrix positioning as a 'question mark' or 'star' in the making, depending on current market penetration and growth prospects.

Fuyo General Lease's expansion into new overseas emerging markets positions them as potential question marks in the BCG matrix. These markets, characterized by high growth potential, often see Fuyo entering with a relatively low market share initially. For instance, in 2024, many Southeast Asian nations are experiencing robust economic growth, with leasing penetration still in its early stages, offering significant upside but requiring substantial investment to gain traction.

The global leasing market, excluding real estate, reached approximately $1.1 trillion in 2023. Emerging markets in Asia, particularly Southeast Asia, are projected to see leasing market growth rates exceeding 10% annually in the coming years, driven by increasing industrialization and infrastructure development.

Fuyo's strategic focus on these regions, while offering substantial long-term rewards, necessitates significant capital outlay to build brand recognition and establish a robust operational presence. Without continued investment, these ventures risk remaining in the question mark category or even declining if competitors capture the market share.

The circular economy focus, particularly asset-as-a-service models, also represents a question mark for Fuyo. While the global Equipment-as-a-Service market was valued at approximately $45 billion in 2023 and is projected for significant growth, Fuyo's current penetration in this niche is likely minimal. Significant investment is crucial for scaling these environmentally conscious solutions, with investor interest in ESG-aligned assets surging, as global ESG assets are projected to reach $50 trillion by 2025.

| BCG Category | Fuyo General Lease Segment | Market Growth Potential | Current Market Share | Investment Requirement |

|---|---|---|---|---|

| Question Mark | Emerging Overseas Markets (e.g., Southeast Asia) | High (e.g., >10% annual growth projected for Asian leasing) | Low to Moderate | High (for market penetration and infrastructure) |

| Question Mark | Circular Economy / Asset-as-a-Service | High (e.g., $45B market in 2023, significant projected growth) | Low | High (for scaling ESG solutions) |

BCG Matrix Data Sources

Our Fuyo General Lease BCG Matrix is constructed using comprehensive financial disclosures, detailed market research reports, and expert industry analysis to provide strategic insights.