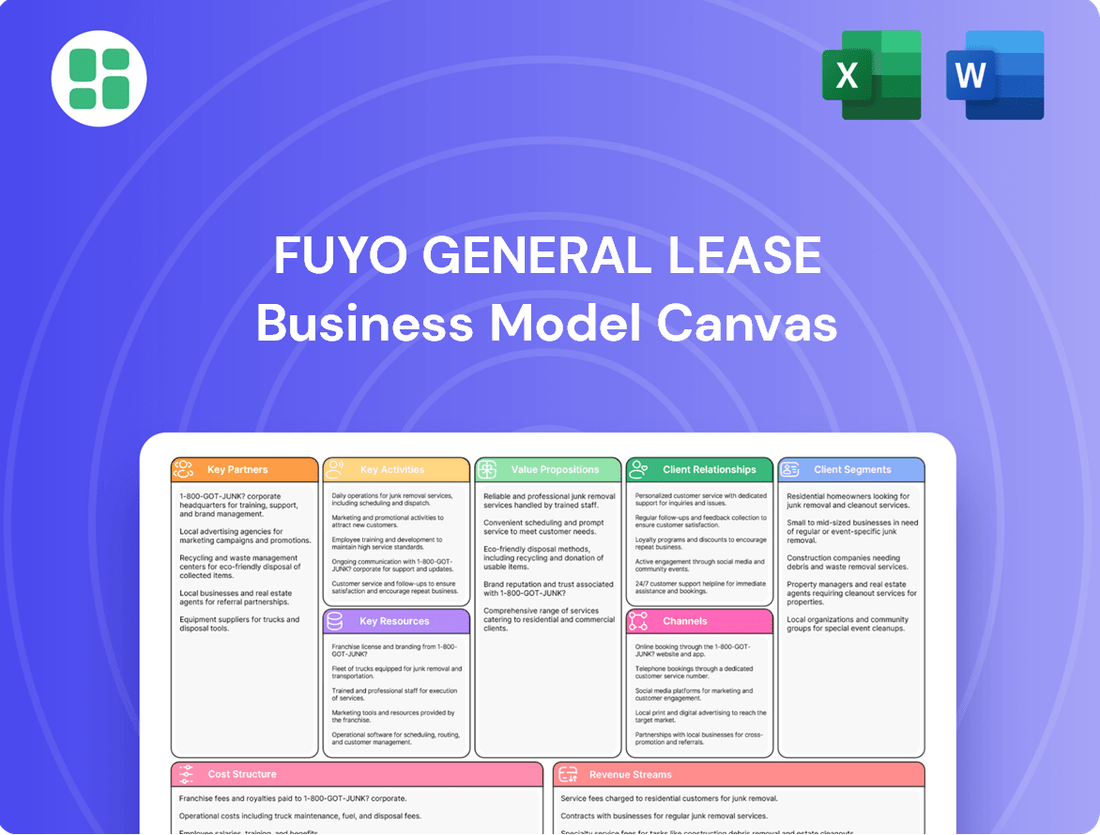

Fuyo General Lease Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fuyo General Lease Bundle

Uncover the strategic genius behind Fuyo General Lease's success with our comprehensive Business Model Canvas. This detailed breakdown illuminates their customer relationships, revenue streams, and key resources, offering a powerful blueprint for aspiring businesses. Gain actionable insights to refine your own strategy and competitive edge.

Partnerships

Fuyo General Lease benefits significantly from its strategic alliances within the Fuyo Group, notably with Mizuho Bank and Marubeni Corporation. These foundational relationships ensure stable funding sources and provide extensive market access, critical for its leasing operations. For instance, Mizuho Bank's robust financial backing is a cornerstone of Fuyo's capital structure.

Beyond the Fuyo Group, Fuyo General Lease actively cultivates partnerships with a diverse range of financial institutions. These collaborations are instrumental in developing specialized investment vehicles, such as the region-specific healthcare funds it has launched. These ventures allow Fuyo to tap into niche markets and diversify its investment portfolio, demonstrating a proactive approach to market expansion and specialized financial product development.

Fuyo General Lease actively cultivates partnerships with a wide array of equipment manufacturers and technology vendors. This strategic approach is fundamental to their business model, ensuring a consistent and diverse inventory of assets available for leasing and installment sales. For instance, in 2024, their collaborations spanned critical sectors like IT, industrial machinery, and medical devices, providing clients with access to cutting-edge technology.

These collaborations are more than just supply chain arrangements; they enable Fuyo General Lease to offer highly customized leasing solutions. By working closely with vendors, they can tailor asset specifications and service packages to precisely meet the unique operational requirements of their clients across various industries. This ensures Fuyo remains a competitive and adaptive partner.

Fuyo General Lease strategically partners through joint ventures and equity stakes to broaden its services and reach. For instance, its involvement with Yokogawa Rental & Lease Corporation and expansion into Thailand's forklift sector underscore this approach.

These investments bolster Fuyo's capabilities in niche markets and new business areas, deepening its specialized asset knowledge. This also diversifies its income sources and enhances its operational strength.

Real Estate and Energy Sector Partners

Fuyo General Lease's strategic engagement in real estate and renewable energy financing hinges on robust partnerships with key industry players. Collaborations with real estate developers and property owners are crucial for accessing and participating in substantial real estate ventures. Similarly, partnerships with energy project developers are fundamental to Fuyo's expansion into solar power operations and battery storage solutions, directly supporting its growth in the energy and environmental sectors.

These alliances are not merely transactional; they enable Fuyo General Lease to participate in and finance large-scale projects, driving its involvement in significant renewable energy infrastructure. The company actively seeks to deepen these relationships to enhance profitability, especially within the dynamic and active real estate market. For instance, in fiscal year 2023, Fuyo General Lease reported a consolidated ordinary profit of ¥120.9 billion, reflecting the success of its diversified leasing operations, which include these vital sector partnerships.

- Real Estate Developer Alliances: Enable access to prime development projects and facilitate financing for commercial and residential properties.

- Property Owner Collaborations: Secure long-term leasing agreements and investment opportunities in existing real estate assets.

- Energy Project Developer Partnerships: Drive participation in renewable energy projects, including solar and battery storage, by providing essential financing and leasing solutions.

- Focus on Profitability Enhancement: Strengthened collaborations aim to boost returns in the competitive real estate and energy financing markets.

Digital and BPO Service Providers

Fuyo General Lease partners with digital and Business Process Outsourcing (BPO) service providers, notably its subsidiary INVOICE Inc., to deliver integrated back-office solutions and crucial decarbonization support. These collaborations are vital for enhancing client operational efficiency and productivity through value-added services.

The company is strategically reorganizing its BPO subsidiaries to consolidate capabilities, aiming to offer seamless, one-stop solutions. This streamlining is designed to meet the evolving needs of businesses seeking comprehensive support for their operations.

- Key Partnerships: Digital and BPO Service Providers

- Objective: Offer integrated back-office solutions and decarbonization support.

- Example Partner: INVOICE Inc. (subsidiary).

- Strategic Goal: Reorganizing BPO subsidiaries for one-stop solutions to boost client efficiency.

Fuyo General Lease's key partnerships are crucial for its operational success and market expansion. These alliances span across the Fuyo Group, financial institutions, equipment manufacturers, and specialized service providers, ensuring access to capital, diverse asset portfolios, and innovative solutions.

The company's strategic collaborations, particularly with entities like Mizuho Bank and Marubeni Corporation within the Fuyo Group, provide a stable financial foundation and broad market reach. These relationships are instrumental in supporting Fuyo's leasing operations and capital structure.

Furthermore, Fuyo General Lease actively engages with equipment manufacturers and technology vendors, as seen in its 2024 collaborations across IT, industrial machinery, and medical devices. This ensures a steady supply of up-to-date assets, enabling customized leasing solutions tailored to client needs.

| Partner Type | Key Partners/Examples | Strategic Importance |

| Fuyo Group | Mizuho Bank, Marubeni Corporation | Stable funding, extensive market access |

| Financial Institutions | Various | Development of specialized investment vehicles |

| Equipment Manufacturers/Tech Vendors | IT, Industrial Machinery, Medical Devices (2024) | Diverse asset inventory, customized leasing |

| Real Estate Developers/Owners | Various | Access to prime projects, long-term agreements |

| Energy Project Developers | Various | Financing for renewable energy (solar, battery storage) |

| BPO/Digital Service Providers | INVOICE Inc. | Integrated back-office, decarbonization support |

What is included in the product

A comprehensive, pre-written business model tailored to Fuyo General Lease's strategy, covering customer segments, channels, and value propositions in full detail.

Reflects the real-world operations and plans of Fuyo General Lease, organized into 9 classic BMC blocks with full narrative and insights.

The Fuyo General Lease Business Model Canvas provides a clear, structured framework that helps businesses identify and address their most significant operational challenges.

By visually mapping out key business elements, it allows for rapid problem-solving and strategic adjustments to overcome specific pain points.

Activities

Fuyo General Lease's core activity revolves around originating and managing diverse leasing and installment sales contracts. This includes everything from IT equipment and industrial machinery to medical devices and transportation assets, demonstrating a broad market reach.

The origination process involves a deep dive into client needs, meticulously structuring financial agreements, and then procuring the specific assets required. This hands-on approach ensures tailored solutions for each customer.

The company's primary lease business is the bedrock of its operations, representing a substantial portion of its total operating assets. For instance, in the fiscal year ending March 2024, Fuyo General Lease reported lease and installment sales receivables of approximately ¥2,683 billion, highlighting the significance of this segment.

Fuyo General Lease goes beyond traditional leasing by offering a broad spectrum of financial services. These include commercial loans, real estate financing, and asset finance, all designed to support clients' capital needs across diverse industries.

The company also provides factoring services, further diversifying its revenue streams and assisting clients with working capital management. This multi-faceted approach allows Fuyo General Lease to offer integrated solutions for business growth and expansion.

In fiscal year 2023, Fuyo General Lease reported total assets of ¥5,518.8 billion, highlighting its substantial capacity to fund a wide range of client requirements through these diversified financial activities.

Fuyo General Lease actively manages its extensive portfolio, encompassing machinery, real estate, and aircraft, to maximize utilization and value. This involves diligent maintenance scheduling and strategic remarketing to ensure optimal asset performance and timely turnover. For instance, in 2024, the company continued to refine its aircraft remarketing strategies, a key segment for flexible asset sales and value realization.

The company’s approach to asset management is designed to enhance profitability and mitigate risks across the entire asset lifecycle. By focusing on efficient turnover and proactive maintenance, Fuyo General Lease ensures that its leased assets remain productive and valuable. This strategic oversight is fundamental to its operational success and financial resilience.

Strategic Investment and Business Development

Fuyo General Lease actively channels management resources into burgeoning sectors like mobility, energy and environment, BPO/ICT, and healthcare to fuel future expansion. This strategic allocation includes pinpointing emerging market prospects, engaging in mergers and acquisitions to bolster its service portfolio, and creating novel financial instruments.

The company prioritizes differentiation within pivotal strategic domains such as real estate and aviation. For instance, Fuyo General Lease's real estate segment demonstrated robust performance, with a significant portion of its portfolio focused on high-demand urban development projects contributing to its overall revenue streams.

- Strategic Investment Areas: Mobility, Energy & Environment, BPO/ICT, Healthcare.

- Growth Drivers: Identifying new markets, M&A, innovative financial product development.

- Key Differentiated Fields: Real Estate, Aircraft.

- 2024 Focus: Continued investment in high-growth sectors and strengthening core competencies.

Risk Management and Financial Operations

Fuyo General Lease's key activities in risk management and financial operations are crucial for its stability. This includes conducting thorough credit analyses and risk assessments for its diverse lease and loan agreements. For instance, in fiscal year 2023, the company reported total assets of ¥5,879.7 billion, underscoring the scale of financial operations requiring meticulous management.

Effective financial management is paramount, encompassing the control of funding costs and the maintenance of a robust balance sheet. Adherence to stringent financial regulations is also a core activity, ensuring compliance and stakeholder trust. This focus on sound financial operations directly supports the company's long-term growth trajectory.

- Rigorous Risk Assessment: Evaluating creditworthiness and potential financial exposures across all lease and loan portfolios.

- Financial Management: Optimizing funding costs, managing liquidity, and maintaining a strong capital structure.

- Regulatory Compliance: Ensuring adherence to all relevant financial laws and industry standards.

- Balance Sheet Health: Proactively managing assets and liabilities to ensure financial stability and profitability.

Fuyo General Lease's key activities center on originating and managing a wide array of leasing and installment sales contracts, spanning IT equipment, industrial machinery, and transportation assets. The company also offers diverse financial services like commercial loans and real estate financing, alongside factoring to support client working capital. A significant portion of its operations involves managing a substantial portfolio of assets, including machinery, real estate, and aircraft, with a strategic focus on remarketing and value enhancement. The company actively invests in growth sectors such as mobility, energy, and healthcare, while prioritizing differentiation in real estate and aviation, as evidenced by its continued investment in high-growth sectors and strengthening of core competencies in 2024.

| Key Activity | Description | Fiscal Year 2024 Data/Focus |

| Lease and Installment Sales Origination & Management | Structuring and managing contracts for diverse assets. | Lease and installment sales receivables of ¥2,683 billion (FY ending March 2024). |

| Diversified Financial Services | Offering commercial loans, real estate financing, and factoring. | Continued support for client working capital and capital needs. |

| Asset Portfolio Management | Managing and remarketing leased assets to maximize value. | Refined aircraft remarketing strategies. |

| Strategic Investment & Differentiation | Investing in growth sectors and differentiating in real estate and aviation. | Continued investment in mobility, energy & environment, BPO/ICT, and healthcare. |

Delivered as Displayed

Business Model Canvas

The Fuyo General Lease Business Model Canvas you are previewing is the exact document you will receive upon purchase. This isn't a sample or mockup; it's a direct snapshot of the complete, ready-to-use file. You'll gain full access to all sections and content, ensuring you have the professional tool you need without any surprises.

Resources

Fuyo General Lease's robust financial capital is a cornerstone of its business model. As of March 31, 2024, the company reported paid-in capital of ¥10,532 million, demonstrating a solid equity base. This substantial financial backing enables Fuyo General Lease to engage in extensive leasing and financing activities.

The company's operating assets surpassed ¥3 trillion as of March 31, 2024, highlighting its capacity for significant investments and the management of a broad asset portfolio. This scale allows Fuyo General Lease to serve a wide range of client needs and undertake complex financial arrangements.

Furthermore, Fuyo General Lease actively accesses diverse funding sources, including a growing emphasis on sustainable finance. This strategic approach to capital management ensures financial stability and supports the company's long-term growth objectives and its ability to adapt to evolving market demands.

Fuyo General Lease leverages a substantial base of over 4,000 consolidated employees, whose specialized knowledge across various industries and financial sectors is a cornerstone of its operations. This skilled human capital is indispensable for cultivating strong client relationships, accurately assessing risks, and crafting bespoke financial products.

The company's commitment to its workforce is evident in its strategic focus on human resource development. As outlined in its medium-term management plan, Fuyo General Lease actively invests in its employees, recognizing that their expertise is critical for maintaining a competitive edge and delivering value to clients.

Fuyo General Lease's extensive asset portfolio is the bedrock of its operations. This diverse collection includes everything from essential IT equipment and heavy industrial machinery to specialized medical devices, prime real estate, aircraft, and even renewable energy facilities. This wide variety of tangible assets is what enables them to serve a broad spectrum of industries and customer needs.

The company actively grows this portfolio, with new contract volumes constantly adding to its tangible asset base. For instance, in fiscal year 2023, Fuyo General Lease reported a significant increase in its leased asset balance, demonstrating a consistent expansion strategy. This continuous investment in acquiring and managing these assets is crucial for maintaining its competitive edge and catering to evolving market demands.

Established Brand and Network

Fuyo General Lease leverages its deeply entrenched brand, established in 1969, to foster immediate trust and recognition among its clientele. This strong brand equity, cultivated over decades, is a cornerstone of its market presence.

The company benefits immensely from an extensive network, encompassing the broader Fuyo Group and a wide array of industry partners. This interconnectedness is crucial for generating new business avenues and solidifying its competitive edge.

- Brand Recognition: Fuyo General Lease, founded in 1969, enjoys significant brand recognition in Japan and internationally.

- Fuyo Group Synergy: Access to the Fuyo Group's extensive network facilitates cross-selling and partnership opportunities.

- Industry Partnerships: Long-standing relationships with diverse industry players enhance market reach and service offerings.

- Credibility and Trust: The company's historical presence builds substantial credibility, a key differentiator in the leasing sector.

Proprietary Systems and Data

Fuyo General Lease leverages proprietary systems, such as its Fuyo Lease Platform Concept, to drive efficiency in specialized sectors like healthcare. This technological backbone supports digital tools for sales activities, enhancing engagement and streamlining transactions.

These advanced technological resources are fundamental to Fuyo General Lease's operational strategy. They are key to optimizing internal processes, improving the overall customer journey, and facilitating informed, data-driven choices in the creation of financial products and the management of associated risks.

The company's investment in proprietary data analytics allows for a deeper understanding of market trends and customer needs, directly influencing product innovation and risk mitigation strategies. For instance, in 2024, Fuyo General Lease reported a significant increase in its digital service adoption rates, directly attributable to the enhanced user experience provided by these systems.

- Proprietary Systems: Fuyo Lease Platform Concept for healthcare and digital sales support.

- Data Analytics: Enabling informed decision-making in product development and risk management.

- Operational Efficiency: Streamlining processes and enhancing customer experience.

- Digital Adoption: Increased usage of digital services in 2024, a testament to system effectiveness.

Fuyo General Lease's key resources are its substantial financial capital, exceeding ¥3 trillion in operating assets as of March 31, 2024, and its extensive portfolio of tangible assets ranging from IT equipment to aircraft. The company also relies on its skilled workforce of over 4,000 employees and its strong brand equity, established in 1969. Furthermore, proprietary systems like the Fuyo Lease Platform Concept and advanced data analytics are crucial for operational efficiency and informed decision-making.

| Resource Category | Key Resource | Data Point (as of March 31, 2024) | Significance |

|---|---|---|---|

| Financial Capital | Paid-in Capital | ¥10,532 million | Provides a strong equity base for leasing activities. |

| Operating Assets | Total Operating Assets | Exceeded ¥3 trillion | Enables management of a broad and diverse asset portfolio. |

| Human Capital | Consolidated Employees | Over 4,000 | Specialized knowledge drives client relationships and risk assessment. |

| Intellectual Property | Proprietary Systems | Fuyo Lease Platform Concept | Drives efficiency in specialized sectors and enhances customer experience. |

Value Propositions

Fuyo General Lease provides a broad spectrum of financial services, encompassing various leasing structures, installment sales, and a diverse array of financing options. This comprehensive offering empowers clients to secure capital investments with significant flexibility, enabling them to acquire essential equipment and assets without the burden of substantial upfront capital expenditures.

In 2024, Fuyo General Lease continued its commitment to delivering customized financial strategies. The company's ability to tailor solutions across numerous industries highlights its dedication to meeting the unique requirements of each client, fostering a client-centric approach that drives mutual growth and success.

Fuyo General Lease's value proposition centers on optimizing capital efficiency and mitigating risk for its clients. By offering leasing and other financial services, businesses can deploy their capital more effectively, sidestepping the upfront costs and ongoing burdens of asset ownership, including depreciation and maintenance.

This strategic approach allows companies to preserve crucial cash flow, enabling them to reallocate resources towards core business growth and innovation. For instance, in 2024, many sectors experienced significant supply chain disruptions, making asset acquisition more volatile; leasing provided a stable and predictable cost structure, a key risk mitigation benefit.

Clients benefit by avoiding the direct financial exposure to asset obsolescence, a particularly relevant concern with rapidly advancing technology in fields like IT and manufacturing. Fuyo General Lease effectively transfers these ownership risks, allowing businesses to focus on operational excellence rather than asset management headaches.

Fuyo General Lease offers clients access to a vast array of assets, encompassing everything from essential IT and office equipment to specialized industrial machinery, advanced medical devices, aircraft, and commercial real estate. This comprehensive selection ensures that businesses across virtually all sectors can secure financing tailored to their specific capital investment requirements.

The company's deep understanding and operational reach extend across critical and expanding industries. By 2024, Fuyo General Lease has solidified its presence in dynamic sectors such as energy and environmental solutions, the rapidly evolving mobility market, and the vital healthcare industry, demonstrating its commitment to supporting key economic drivers.

Comprehensive Support Beyond Financing

Fuyo General Lease goes beyond just providing financing, offering a suite of services designed to support clients' broader business objectives. This includes Business Process Outsourcing (BPO) to streamline operations and consulting services specifically tailored for businesses looking to expand internationally. For example, in 2023, Fuyo's BPO services assisted over 500 companies in optimizing their administrative functions, leading to an average 15% reduction in operational costs.

Furthermore, Fuyo General Lease is actively involved in providing energy solutions, aligning with the growing demand for sustainability. These offerings aim to help clients manage their energy consumption more effectively and reduce their environmental footprint. In 2024, Fuyo launched a new solar power generation support program, which has already seen participation from 150 clients seeking to integrate renewable energy into their business models.

- Comprehensive Service Offering: Fuyo provides financing, BPO, overseas expansion consulting, and energy solutions.

- Operational Efficiency: BPO services aim to reduce back-office burdens and costs for clients.

- Global Growth Support: Consulting services assist businesses in navigating international market entry.

- Sustainability Focus: Energy solutions help clients achieve environmental and operational goals.

Commitment to Sustainability and Social Value

Fuyo General Lease stands out by embedding sustainability deep within its operations. This isn't just a side project; it's central to their business model, offering innovative 'circular economy leases' and actively supporting decarbonization efforts.

Their strategy focuses on achieving growth that benefits both society and the economy. By tackling social challenges head-on, they also unlock economic value, a dual approach that appeals to a growing market.

This dedication to ESG principles is a significant draw for clients. In 2024, for instance, a significant portion of corporate investment decisions were influenced by ESG factors, with many companies setting ambitious sustainability targets.

- Circular Economy Leases: Fuyo General Lease provides leasing solutions designed to extend product lifecycles and reduce waste, aligning with global sustainability trends.

- Decarbonization Support: The company actively promotes initiatives that help clients reduce their carbon footprint, contributing to a greener economy.

- Dual Value Creation: Fuyo General Lease aims to simultaneously address societal issues and generate economic returns, demonstrating a commitment to shared value.

- Client Alignment with ESG: Their focus on sustainability resonates strongly with businesses prioritizing Environmental, Social, and Governance (ESG) performance, a key driver in corporate strategy in 2024.

Fuyo General Lease offers clients unparalleled access to a vast asset portfolio, spanning IT, industrial machinery, aircraft, and real estate, ensuring tailored financing for diverse needs.

The company's value proposition is built on optimizing capital for clients, enabling them to acquire essential assets without large upfront costs, thereby preserving cash flow for growth initiatives.

Fuyo's integrated services, including BPO and international consulting, streamline operations and support global expansion, with BPO services reducing operational costs by an average of 15% for over 500 companies in 2023.

Furthermore, Fuyo's commitment to sustainability, exemplified by its solar power support program launched in 2024, helps clients meet environmental goals while securing predictable energy costs.

| Value Proposition Component | Description | Key Benefit for Client | 2024/2023 Data Point |

| Comprehensive Asset Financing | Access to a wide range of assets (IT, machinery, aircraft, real estate) | Flexibility in acquiring necessary capital assets | Broad industry coverage |

| Capital Efficiency & Risk Mitigation | Leasing and financing structures avoid large upfront expenditures and asset obsolescence risk | Preserves cash flow, reduces financial exposure | Stable, predictable cost structures during 2024 supply chain volatility |

| Operational Support Services | Business Process Outsourcing (BPO) and international expansion consulting | Streamlined operations, reduced administrative burdens, facilitated global growth | BPO reduced operational costs by 15% for 500+ firms in 2023 |

| Sustainability Solutions | Energy solutions, circular economy leases, decarbonization support | Helps clients achieve environmental targets and manage energy consumption | 150 clients joined solar power program in 2024 |

Customer Relationships

Fuyo General Lease prioritizes cultivating enduring relationships with its corporate clientele by assigning dedicated account managers. These professionals act as direct liaisons, facilitating a profound understanding of each client's unique business model and anticipating their future requirements. This personalized support is key to forging robust, long-term partnerships.

Fuyo General Lease provides valuable advisory and consulting services, acting as more than just a financier. These services include crucial support for capital investment planning, helping clients make sound financial decisions. They also offer guidance on overseas expansion strategies and energy management solutions, demonstrating a commitment to their clients' broader business success.

This consultative approach transforms Fuyo General Lease into a strategic partner. For instance, in 2024, their energy management consulting helped numerous clients achieve an average reduction of 15% in operational energy costs, directly impacting profitability and sustainability. This deepens customer engagement by providing tangible value beyond the leasing agreement itself.

By offering these expert advisory services, Fuyo General Lease builds stronger, more trusting relationships. This strategic positioning fosters long-term loyalty and encourages repeat business, as clients rely on their expertise for critical business planning and execution.

Fuyo General Lease builds deep customer relationships by co-creating tailored solutions. This means understanding a client's specific industry, like the healthcare sector, and developing financial and operational packages that fit their exact needs. For example, they offer comprehensive 'one-stop services' to streamline operations for businesses.

This collaborative approach focuses on directly addressing client challenges and investment requirements. By working together to develop these customized solutions, Fuyo General Lease aims to foster long-term partnerships that drive mutual value and support client business growth. This strategy was evident in their continued expansion of specialized leasing services throughout 2024.

Digital Engagement and Support

Fuyo General Lease is actively blending its traditional relationship-centric approach with digital advancements. This means while personal connections remain vital, the company is also investing in digital tools to support sales and offer clients more convenient ways to access information and manage their leasing needs. This dual focus aims to enhance the overall customer experience.

By integrating digital engagement, Fuyo General Lease is streamlining processes and improving the efficiency of its customer interactions. For instance, in 2024, many financial services firms reported a significant increase in customer satisfaction scores when digital self-service options were introduced, complementing traditional support channels. This trend is likely reflected in Fuyo's strategy.

The company is exploring digital platforms that could allow clients to manage aspects of their lease agreements independently. This move towards client self-service is a growing trend, with many businesses seeking to provide 24/7 access to information and services. This not only benefits the customer but also frees up internal resources.

- Digital Support for Sales: Fuyo is enhancing digital tools to aid its sales teams, making information more readily available and processes smoother.

- Potential Client Self-Service: The company is considering platforms that would allow customers to manage their leases online, offering greater convenience.

- Efficiency Gains: Digital channels are being leveraged to make customer interactions more efficient, reducing friction and response times.

- Complementing Personal Interactions: These digital efforts are designed to work alongside, not replace, the valued personal relationships Fuyo maintains with its clients.

Community and Social Value Engagement

Fuyo General Lease cultivates community and social value by actively addressing societal challenges through its operations. A prime example is their dedication to promoting a circular economy, which not only minimizes waste but also creates new value streams. In 2023, the company reported a significant increase in the utilization of recycled materials across its leasing portfolio, contributing to a reduction in carbon emissions.

Their commitment extends to supporting decarbonization initiatives, aligning Fuyo General Lease with the sustainability objectives of its diverse client base. This shared vision fosters a sense of partnership, moving beyond transactional relationships to a collaborative effort towards a more sustainable future. This proactive stance builds substantial goodwill and cultivates enduring client loyalty.

- Circular Economy Promotion: Fuyo General Lease actively integrates recycled materials and promotes refurbishment of leased assets, contributing to waste reduction and resource efficiency.

- Decarbonization Support: The company facilitates client transitions to lower-emission equipment and operational models, aligning with global climate goals.

- Social Issue Resolution: By tackling environmental challenges, Fuyo General Lease demonstrates a commitment to societal well-being, enhancing its corporate reputation.

- Long-Term Loyalty: This focus on shared values and sustainability strengthens client relationships, fostering loyalty and repeat business.

Fuyo General Lease builds deep customer relationships through dedicated account management and value-added advisory services. They act as strategic partners, assisting with capital investment, overseas expansion, and energy management, as demonstrated by a 15% average energy cost reduction for clients in 2024 through their consulting. This consultative approach fosters trust and long-term loyalty.

The company is also integrating digital tools to enhance customer experience and streamline interactions, complementing their personal touch. This blend of digital engagement and personalized service aims to improve efficiency and client satisfaction, reflecting a broader industry trend observed in 2024.

Fuyo General Lease further strengthens relationships by focusing on social value, such as promoting a circular economy and supporting decarbonization. This commitment to sustainability aligns with client goals, fostering collaborative partnerships and enhancing corporate reputation.

| Customer Relationship Aspect | Key Actions | 2024 Impact/Trend |

| Dedicated Account Management | Personalized liaison, understanding client needs | Fosters robust, long-term partnerships |

| Advisory & Consulting Services | Capital investment planning, overseas expansion, energy management | 15% average energy cost reduction for clients |

| Co-creation of Solutions | Tailored packages for specific industries (e.g., healthcare) | Streamlined operations, mutual value creation |

| Digital Integration | Digital tools for sales, potential client self-service | Enhanced efficiency, improved customer satisfaction |

| Social Value & Sustainability | Circular economy promotion, decarbonization support | Strengthened shared values, increased client loyalty |

Channels

Fuyo General Lease's direct sales force is the primary channel for reaching its corporate clientele. These dedicated account managers engage directly with businesses across a wide array of sectors, fostering personalized consultations and crafting bespoke leasing and financial solutions. This direct approach is particularly vital for navigating the intricacies of complex financial products.

Fuyo General Lease leverages its extensive domestic branch network across Japan to provide localized support and achieve deep market penetration. This physical footprint is crucial for building strong, face-to-face relationships with regional clients, fostering trust and understanding. For instance, as of March 31, 2024, the company operated approximately 100 branches nationwide, enabling them to effectively manage assets and collection processes across diverse economic landscapes.

Fuyo General Lease leverages its overseas subsidiaries in key markets such as China, Hong Kong, Ireland, the US, Thailand, and Mexico to cater to international clients and facilitate cross-border transactions. This expansive global network is crucial for supporting Japanese corporations venturing into foreign markets and for serving the needs of local businesses internationally.

Online Platforms and Digital Interfaces

Fuyo General Lease strategically utilizes its corporate website as a primary conduit for investor relations and disseminating crucial company information. This digital presence ensures transparency and accessibility for stakeholders seeking financial data and corporate updates. In 2024, the company continued to prioritize enhancing its online investor portal, reflecting a commitment to clear communication with the financial community.

Significant investments are being channeled into digital platforms designed to streamline internal operations, notably through core system updates aimed at optimizing sales activities. This focus on digital transformation supports greater efficiency and data-driven decision-making across the organization. For instance, the company reported progress in its digital core system development in its 2024 fiscal year disclosures.

While not always a direct sales channel for every service offered, Fuyo General Lease's digital interfaces play a vital role in fostering customer engagement and bolstering overall operational efficiency. These platforms facilitate smoother interactions and provide valuable touchpoints for clients. The company is also actively developing Business Process Outsourcing (BPO) services that are delivered entirely through digital means, expanding its service offerings.

Key digital initiatives and their impact include:

- Enhanced Investor Relations: The corporate website serves as a central hub for financial reports and investor communications, with ongoing updates in 2024.

- Internal Operations Digitization: Core system updates for sales activities are improving internal workflows and efficiency.

- Customer Engagement: Digital interfaces support client interactions and service accessibility.

- BPO Service Expansion: Development of digitally delivered BPO services broadens the company's service portfolio.

Strategic Partnerships and Joint Ventures

Fuyo General Lease leverages strategic partnerships and joint ventures to significantly broaden its market reach and enhance its specialized service delivery. For instance, its collaboration with Yokogawa Electric Corporation for rental and lease services exemplifies this approach, allowing Fuyo to tap into Yokogawa's established client base and expertise.

These alliances function as crucial indirect channels, effectively extending Fuyo General Lease's access to new markets and enriching its portfolio of product and service offerings. By teaming up with industry leaders, Fuyo can offer more comprehensive solutions, such as integrated energy solutions, which might be beyond its standalone capabilities.

- Yokogawa Electric Corporation Partnership: Focuses on rental and lease services, expanding Fuyo's market penetration.

- Energy Solution Collaborations: Broadens service offerings and taps into growing demand for sustainable solutions.

- Indirect Channel Extension: Fuyo's partners act as conduits to new customer segments and geographical areas.

- Enhanced Market Access: Joint ventures and partnerships provide entry into specialized industries or regions.

Fuyo General Lease utilizes a multi-faceted channel strategy, combining direct sales, an extensive domestic branch network, and overseas subsidiaries to reach its diverse clientele. Digital platforms, including its corporate website and internal system updates, are increasingly important for investor relations, operational efficiency, and customer engagement. Strategic partnerships further extend market reach and service capabilities.

| Channel Type | Description | Key Role | Data Point (as of FY2024) |

|---|---|---|---|

| Direct Sales | Dedicated account managers engaging directly with corporate clients. | Personalized solutions for complex financial products. | Primary channel for corporate leasing. |

| Domestic Branches | Extensive physical network across Japan. | Localized support, market penetration, relationship building. | Approximately 100 branches nationwide. |

| Overseas Subsidiaries | Presence in key international markets (e.g., China, US, Ireland). | Supporting international clients and cross-border transactions. | Operations in multiple key global markets. |

| Digital Platforms (Website) | Corporate website and investor portal. | Investor relations, information dissemination, transparency. | Continued enhancement of online investor portal. |

| Strategic Partnerships | Collaborations with other companies (e.g., Yokogawa Electric). | Expanding market reach, offering integrated solutions. | Partnerships for rental/lease services and energy solutions. |

Customer Segments

Fuyo General Lease caters to large corporations across a wide array of industries, offering robust financial services designed to facilitate substantial capital expenditures and ongoing operational requirements. These enterprise clients frequently necessitate intricate, customized leasing and financing arrangements for high-value assets, such as fleets of vehicles or specialized industrial equipment.

The company's demonstrated capacity to manage and execute large-scale financial transactions positions it as a highly sought-after partner for major businesses. For instance, in 2024, Fuyo General Lease reported a significant portion of its leasing portfolio was dedicated to corporate clients, underscoring its commitment to serving the enterprise market with tailored financial solutions.

Small and Medium-sized Enterprises (SMEs) are a core focus for Fuyo General Lease, as they often require adaptable financial solutions to acquire essential assets like machinery, vehicles, and technology. These businesses, which form the backbone of many economies, frequently have tighter cash flow and seek ways to spread out the cost of significant investments. For instance, in 2023, SMEs in Japan accounted for over 99% of all businesses, highlighting their sheer volume and need for accessible financing.

Fuyo General Lease caters to these needs by providing leasing and installment sales options that help SMEs manage their capital expenditures without a large upfront outlay. This approach allows them to invest in the equipment they need to operate efficiently and expand their services. The flexibility offered by leasing is particularly attractive to growing SMEs, enabling them to upgrade technology or scale up operations as their business demands increase.

Fuyo General Lease strategically focuses on specific industry verticals where its expertise is most pronounced. These include real estate, energy and environment, aircraft, mobility and logistics, and healthcare.

This targeted approach enables Fuyo General Lease to craft highly specialized and value-added solutions. These offerings are meticulously designed to meet the distinct demands and navigate the complex regulatory landscapes inherent to each sector.

For instance, in the real estate sector, Fuyo General Lease's leasing solutions can support the development of energy-efficient buildings, aligning with growing environmental regulations and investor demands for sustainable properties. In 2023, global green building investments reached an estimated $1.1 trillion, highlighting the market's appetite for such solutions.

Real Estate Developers and Investors

Real estate developers and investors represent a key customer segment for Fuyo General Lease, leveraging its comprehensive leasing and financing solutions for diverse property ventures. This includes funding for the acquisition and development of commercial properties, such as retail centers and office buildings, as well as specialized facilities like hospitals.

Fuyo General Lease's involvement in these projects is crucial for capital deployment and risk management. For instance, in 2024, the Japanese real estate market saw continued activity, with major urban areas like Tokyo experiencing sustained demand for commercial spaces. Fuyo General Lease's financing capabilities directly support developers seeking to capitalize on these opportunities.

- Financing for Property Development: Facilitating the acquisition of land and funding construction phases for commercial and hospital facilities.

- Leasing Solutions: Offering tailored leasing agreements for developed properties, ensuring predictable revenue streams for investors.

- Investment in Diverse Projects: Participating in a range of real estate developments, from large-scale commercial complexes to essential healthcare infrastructure.

- Market Participation: Actively engaging in the real estate sector, contributing to urban development and economic growth.

Public Sector and Social Infrastructure Projects

Fuyo General Lease actively supports government bodies and organizations undertaking crucial social infrastructure development. This includes providing essential financing for public facilities, vital transportation networks, and critical environmental protection initiatives. For instance, in 2024, Fuyo's involvement in public sector leasing facilitated the acquisition of new public transport vehicles, contributing to improved urban mobility.

This engagement underscores Fuyo's dedication to tackling societal challenges and fostering sustainable growth. Their leasing solutions enable public entities to acquire necessary assets without significant upfront capital expenditure, thereby optimizing public funds. The company's portfolio in this segment saw a notable increase in projects related to renewable energy infrastructure throughout 2024, reflecting a growing demand for green solutions.

- Public Sector Financing: Providing capital for essential public services and infrastructure.

- Social Infrastructure Focus: Supporting projects in transportation, healthcare, and education.

- Environmental Initiatives: Facilitating investments in sustainability and climate resilience.

- 2024 Impact: Contributed to the modernization of public transportation fleets and expansion of green energy projects.

Fuyo General Lease serves a broad spectrum of clients, from large corporations requiring complex financial solutions for significant capital expenditures to SMEs needing adaptable options for essential asset acquisition. The company also targets specific industry verticals like real estate and healthcare, offering specialized leasing to meet sector-specific demands. Furthermore, Fuyo General Lease actively partners with government bodies for social infrastructure development, demonstrating its commitment to societal progress and public service enhancement.

| Customer Segment | Key Needs | Fuyo's Offering | Example/Data Point (2023-2024) |

|---|---|---|---|

| Large Corporations | High-value asset financing, customized leasing | Robust financial services for substantial CAPEX | Significant portion of 2024 leasing portfolio dedicated to corporate clients |

| SMEs | Spreading asset costs, flexible financing | Leasing and installment sales for machinery, vehicles | SMEs accounted for over 99% of Japanese businesses in 2023 |

| Real Estate Sector | Property development funding, investment support | Financing for commercial/hospital properties, leasing agreements | 2023 global green building investments reached $1.1 trillion |

| Public Sector | Infrastructure financing, social development capital | Capital for public facilities, transport, environmental projects | 2024 saw increased projects in renewable energy infrastructure |

Cost Structure

Fuyo General Lease's cost structure is heavily influenced by interest expenses, a direct result of borrowing to finance its extensive asset portfolio. In 2024, the company's financial statements indicate a substantial portion of its operating costs are tied to servicing these debts, reflecting the capital-intensive nature of the leasing business.

The sensitivity of these funding costs to prevailing interest rates is a key consideration. For instance, if domestic interest rates saw an upward trend in early 2024, Fuyo General Lease would experience a corresponding increase in its interest payments, directly impacting its profit margins.

Effectively managing the cost of capital is therefore paramount for Fuyo General Lease's profitability. Strategies to mitigate interest rate risk and secure favorable financing terms are critical to maintaining a competitive edge in the leasing market.

Fuyo General Lease faces significant upfront investment in acquiring a diverse portfolio of assets, from industrial machinery and vehicles to specialized equipment and even aircraft, which are then leased out to clients. These substantial capital expenditures form a core part of their cost structure.

The depreciation of these acquired assets is a continuous expense. For example, in fiscal year 2023, Fuyo General Lease reported depreciation and amortization expenses amounting to ¥115.5 billion, reflecting the gradual reduction in the value of their leased assets over time.

Fuyo General Lease's cost structure is significantly influenced by its operational and administrative expenses. These include essential personnel costs, covering salaries and benefits for its workforce, as well as broader Sales, General, and Administrative (SG&A) expenses. Back-office support functions, crucial for smooth operations, also contribute to this cost base.

The company's strategic focus on investing in human capital and enhancing operational efficiency directly impacts these expenditures. For instance, in 2024, Fuyo General Lease continued to invest in training programs aimed at upskilling its employees, reflecting a commitment to quality service and innovation, which naturally elevates personnel-related costs. This investment is balanced against efforts to streamline back-office processes, aiming to mitigate overall administrative overhead.

Technology and System Investment

Fuyo General Lease makes substantial investments in its technology and system infrastructure. These outlays are critical for updating core systems, driving digital transformation, and bolstering operational efficiency across all facets of the business, including sales support and business process outsourcing (BPO) services.

These technology-related expenditures are not merely operational costs; they represent strategic investments aimed at securing a competitive advantage. By continually upgrading its IT backbone, Fuyo General Lease ensures it can effectively support existing operations and pave the way for expansion into new and emerging business sectors.

- IT Infrastructure Upgrades: Fuyo General Lease allocates significant capital to maintaining and enhancing its IT infrastructure, ensuring robust and scalable systems.

- Digital Transformation Initiatives: The company invests in digital transformation to streamline processes, improve customer engagement, and unlock new service offerings.

- Core System Modernization: Continuous updates to core leasing and operational systems are crucial for efficiency and adapting to market changes.

- BPO Service Enhancement: Technology investments directly support the delivery and improvement of their Business Process Outsourcing services, boosting client value.

Risk Management and Compliance Costs

Fuyo General Lease allocates significant resources to robust risk management and compliance. These costs are essential for maintaining low default risk, a critical factor in the leasing industry. For instance, in 2024, companies within the equipment leasing sector often saw compliance-related expenses rise due to evolving financial regulations, with some reporting increases of 5-10% year-over-year in this area.

These expenses cover rigorous credit assessment processes for all lessees, ensuring the financial health of their customer base. Furthermore, Fuyo General Lease invests in systems and personnel to ensure adherence to all relevant financial regulations and industry standards, which is paramount for operational integrity and trust.

- Credit Assessment: Investing in advanced credit scoring models and dedicated analysts to minimize default rates.

- Regulatory Adherence: Allocating budget for legal counsel, compliance officers, and technology to meet evolving financial regulations.

- Risk Mitigation: Implementing strategies and systems to proactively identify and manage potential financial risks across the lease portfolio.

- Adaptation to Change: Ongoing costs associated with updating processes and training staff to comply with new or amended regulations, a continuous challenge in the financial services sector.

Fuyo General Lease's cost structure is dominated by interest expenses from financing its asset portfolio and depreciation of those assets. In fiscal year 2023, depreciation and amortization alone were ¥115.5 billion, highlighting the capital-intensive nature of its leasing operations.

Operational and administrative costs, including personnel and SG&A, are also significant. The company's investment in employee training in 2024, while boosting human capital, naturally increases these personnel-related expenditures.

Technology investments for digital transformation and system upgrades are crucial, representing strategic outlays rather than just operational costs. Furthermore, robust risk management and compliance, including credit assessment, are essential expenditures for maintaining low default risk, with compliance costs often rising due to evolving financial regulations.

| Cost Category | Description | 2023 Impact (if available) | 2024 Focus | Strategic Importance |

|---|---|---|---|---|

| Interest Expenses | Cost of borrowing to finance leased assets. | Significant portion of operating costs. | Managing funding costs amidst interest rate sensitivity. | Directly impacts profitability; requires favorable financing. |

| Depreciation & Amortization | Gradual reduction in the value of leased assets. | ¥115.5 billion in FY2023. | Continuous expense reflecting asset usage. | Key non-cash expense impacting asset valuation. |

| Operational & Administrative | Personnel costs, SG&A, back-office support. | N/A | Investment in employee training, process streamlining. | Supports service quality and operational efficiency. |

| Technology & Systems | IT infrastructure, digital transformation, core systems. | N/A | Upgrading systems for efficiency and new sectors. | Drives competitive advantage and future growth. |

| Risk Management & Compliance | Credit assessment, regulatory adherence, risk mitigation. | N/A | Maintaining low default risk, adapting to new regulations. | Ensures operational integrity and customer trust. |

Revenue Streams

Fuyo General Lease's primary revenue source is its lease fee income, consistently exceeding 80% of its total sales. This predictable income is derived from clients paying regular fees for the utilization of various leased assets, including machinery, equipment, and real estate.

Fuyo General Lease generates revenue through installment sales, offering customers a path to asset ownership via structured payment plans. This segment provides a flexible financing alternative to traditional leasing, appealing to clients who prefer outright purchase over temporary usage. In 2024, installment sales represented a significant portion of their diversified revenue, reflecting strong demand for this ownership-oriented financing solution.

Fuyo General Lease generates significant interest income from its broad spectrum of financing activities. This includes earnings from commercial loans, crucial for supporting businesses, and specialized real estate financing, catering to property market demands.

The company also benefits from income derived from credit card services, a key component of its consumer finance operations. Furthermore, factoring services contribute to this revenue stream, demonstrating Fuyo General Lease's diverse approach to financial intermediation.

For the fiscal year ending March 2024, Fuyo General Lease reported total interest income of approximately ¥240 billion, reflecting the substantial contribution of these financing activities to its overall revenue.

Fee-Based and Non-Asset Earnings

Fuyo General Lease diversifies its income through fee-based services, generating revenue beyond its core asset leasing. This includes Business Process Outsourcing (BPO) solutions, offering operational efficiencies for clients, and specialized consulting services that leverage the company's industry expertise.

Asset management fees also form a significant part of these non-asset earnings, reflecting the value provided in managing leased assets. These diversified revenue streams not only contribute to profit growth but also strengthen customer relationships by offering comprehensive solutions.

- Fee-Based Services: Income generated from BPO, consulting, and asset management.

- Value Addition: Services extend beyond financing to provide operational and strategic support.

- Profit Growth: These streams contribute to overall profitability and reduce reliance on asset-heavy operations.

- Customer Base Expansion: Offering broader services attracts and retains a wider range of clients.

Gains from Asset Sales

Fuyo General Lease also generates revenue through gains on asset sales. This occurs when leased assets, such as real estate or aircraft, are sold at the end of their lease terms or due to strategic portfolio adjustments. These sales can provide significant profit boosts.

- Real Estate Sales: Fuyo General Lease benefits from capital appreciation on its real estate holdings, realizing gains when properties are sold.

- Aircraft Remarketing: The company earns revenue by selling aircraft at the conclusion of lease agreements, often at favorable prices.

- Strategic Asset Turnover: Beyond lease expirations, Fuyo actively manages its asset portfolio, selling assets to optimize returns and reinvest in new opportunities.

Fuyo General Lease's revenue streams are robust and diversified, with lease income forming the bedrock. Beyond this, installment sales offer a path to ownership for clients, a segment that saw significant demand in 2024. Interest income from commercial loans and real estate financing, alongside credit card and factoring services, further bolster their financial intermediation activities.

| Revenue Stream | Description | 2024 Contribution (Approx.) |

|---|---|---|

| Lease Fee Income | Regular payments for asset utilization | >80% of total sales |

| Installment Sales | Revenue from asset sales via structured payments | Significant portion of diversified revenue |

| Interest Income | Earnings from commercial loans and real estate financing | ¥240 billion (fiscal year ending March 2024) |

| Fee-Based Services | BPO, consulting, and asset management fees | Value-added services contributing to profit growth |

| Gains on Asset Sales | Profits from selling leased assets like real estate and aircraft | Provides significant profit boosts through strategic turnover |

Business Model Canvas Data Sources

The Fuyo General Lease Business Model Canvas is built upon a foundation of extensive market research, internal financial data, and competitive analysis. These diverse sources ensure each component of the canvas accurately reflects current industry conditions and Fuyo's strategic position.