Ferrovial SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ferrovial Bundle

Ferrovial's robust infrastructure expertise and global diversification are significant strengths, but potential regulatory shifts and economic downturns present key challenges. Understanding these dynamics is crucial for navigating the competitive landscape.

Want the full story behind Ferrovial's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Ferrovial stands as a preeminent global force in infrastructure, particularly renowned for its extensive portfolio of transportation assets, including major highways and airports. This strong, established market position offers a substantial competitive edge and a robust platform for future expansion.

The company's comprehensive expertise covers the full spectrum of infrastructure development, from initial planning and financing through to construction and ongoing operation. This end-to-end capability allows Ferrovial to deliver integrated, high-quality solutions and manage assets effectively throughout their lifecycle.

Ferrovial has showcased impressive financial performance, with significant revenue and adjusted EBITDA growth reported throughout 2024 and into Q1/H1 2025. This consistent upward trend highlights the company's operational efficiency and market demand for its services.

The company maintains a robust liquidity position and a net cash balance, even when excluding its extensive infrastructure project investments. This financial health provides substantial flexibility for strategic capital allocation.

This strong financial footing empowers Ferrovial to readily fund new growth opportunities, manage shareholder returns effectively, and navigate potential economic downturns with resilience, ensuring continued operational stability and expansion.

Ferrovial's strategic emphasis on North America, especially the U.S. and Canada, is a major strength. This region now represents a substantial part of the company's equity value and its backlog of projects.

This concentrated effort in a stable and expanding market is paying off. Successful projects like managed lanes and the significant JFK New Terminal One development at JFK Airport are prime examples of this strategic success, setting the stage for ongoing strong performance.

The North American market presents a robust pipeline of critical infrastructure projects. This provides Ferrovial with ample opportunities for future growth and continued business development.

Integrated Business Model and Expertise

Ferrovial's strength lies in its integrated business model, spanning Highways, Airports, Construction, and Energy. This allows for vertical integration across project lifecycles, from initial design to long-term operation. Such a comprehensive approach, as demonstrated by their involvement in major infrastructure projects, ensures greater efficiency and quality control.

This integrated capability is crucial for undertaking complex, large-scale developments. For instance, Ferrovial's Airports division, which managed over 230 million passengers in 2023, benefits from the company's construction expertise for terminal expansions and upgrades. This synergy reduces reliance on external contractors and enhances overall project value creation.

- Vertical Integration: Controls all stages of infrastructure development and management.

- Efficiency Gains: Streamlined processes from design to operation reduce costs and timelines.

- Risk Mitigation: Reduced dependence on external partners for critical project phases.

- Complex Project Capability: Ability to manage large-scale, multifaceted infrastructure initiatives.

Commitment to Sustainability and ESG

Ferrovial demonstrates a significant commitment to sustainability by embedding Environmental, Social, and Governance (ESG) principles across its business. This dedication is underscored by ambitious goals for reducing emissions and water usage, coupled with substantial investments in renewable energy infrastructure like solar farms, reflecting a forward-looking approach to environmental stewardship.

This strong ESG focus is not merely aspirational; it translates into tangible actions and strategic advantages. For instance, Ferrovial has pledged to achieve carbon neutrality by 2050 and has set interim targets to reduce its Scope 1 and 2 emissions by 42% by 2030 compared to a 2019 baseline. The company's investment in green energy projects, such as the 600 MW solar farm in Texas, showcases its active role in the energy transition.

- Ambitious Emission Reduction Targets: Ferrovial aims for a 42% reduction in Scope 1 and 2 emissions by 2030 (vs. 2019).

- Investment in Green Energy: Significant capital allocated to renewable energy projects, including a 600 MW solar farm in Texas.

- ESG Appeal: Enhanced attractiveness to investors and stakeholders prioritizing sustainable and responsible business practices.

- Water Footprint Management: Active strategies to minimize water consumption and impact across operations.

Ferrovial's strong financial health is a significant asset, demonstrated by its robust liquidity and net cash position, even after accounting for substantial infrastructure investments. This financial stability provides considerable flexibility for strategic capital deployment, enabling the company to pursue new growth avenues and manage shareholder returns effectively.

The company's strategic focus on North America, particularly the U.S. and Canada, is a key strength, with this region now constituting a large portion of its equity value and project backlog. Successful projects like managed lanes and the JFK New Terminal One development highlight the effectiveness of this regional concentration, positioning Ferrovial for continued strong performance in a market with a rich pipeline of infrastructure needs.

Ferrovial's integrated business model, encompassing Highways, Airports, Construction, and Energy, allows for vertical integration across the entire project lifecycle, from planning and financing to construction and long-term operation. This end-to-end capability, as evidenced by their management of over 230 million passengers in their Airports division in 2023, fosters greater efficiency, quality control, and risk mitigation, particularly for complex, large-scale developments.

The company's commitment to sustainability, with ambitious ESG goals including a 42% reduction in Scope 1 and 2 emissions by 2030 (compared to 2019) and significant investments in renewable energy like a 600 MW solar farm in Texas, enhances its appeal to investors and positions it favorably in the evolving energy landscape.

| Strength | Description | Supporting Data/Examples |

| Financial Stability | Robust liquidity and net cash position. | Provides flexibility for strategic capital allocation and funding growth. |

| North American Focus | Significant presence and project backlog in the U.S. and Canada. | JFK New Terminal One development; strong pipeline of projects. |

| Integrated Business Model | End-to-end capabilities across infrastructure lifecycle. | Airports division handled over 230 million passengers in 2023; efficiency in complex projects. |

| Sustainability Commitment | Ambitious ESG goals and investments in renewables. | Targeting 42% Scope 1 & 2 emission reduction by 2030; 600 MW solar farm in Texas. |

What is included in the product

Delivers a strategic overview of Ferrovial’s internal and external business factors, highlighting its strengths in infrastructure development and international presence, while identifying potential weaknesses in project execution and opportunities in sustainable infrastructure.

Offers a clear, actionable framework to identify and address Ferrovial's strategic challenges and opportunities.

Weaknesses

Ferrovial's reliance on concession-based infrastructure, a significant portion of its portfolio, leaves it exposed to macroeconomic volatility. Factors like inflation, interest rate shifts, and currency fluctuations can directly impact project profitability and financing costs. While some toll roads are indexed to inflation, sustained high inflation can still erode margins by increasing operational expenses faster than toll revenue can adjust.

The company's financial health is also sensitive to interest rate environments. For instance, rising interest rates in 2023 and projected for 2024 could increase the cost of servicing existing debt and make new project financing more expensive. This sensitivity was highlighted in their 2023 financial reports, where financing costs were a notable factor in their results.

Ferrovial's significant strategic focus and investment concentration in North America, particularly in the United States, presents a notable weakness. While this market offers substantial growth prospects, an over-reliance on a single geographic region exposes the company to specific economic downturns, regulatory shifts, or political instability within those countries.

For instance, as of the first half of 2024, North America accounted for approximately 60% of Ferrovial's revenue, highlighting this concentration. This dependence means that adverse events impacting the US or Canadian markets could disproportionately affect the company's overall financial performance, despite its efforts towards broader geographic diversification.

Ferrovial's commitment to developing and operating large-scale infrastructure, particularly new greenfield projects, necessitates significant upfront capital. This high capital expenditure profile can strain financial resources, especially in the current climate of elevated interest rates, potentially increasing financial risk.

The extended payback periods typical for these infrastructure assets mean that capital can remain tied up for considerable lengths of time. For instance, major projects like airport expansions or toll road constructions often have multi-decade concession periods, impacting liquidity and requiring robust long-term financial planning.

Intense Competition in the Infrastructure Sector

Ferrovial navigates a fiercely competitive global infrastructure and construction landscape, contending with established multinational players. This intense rivalry directly impacts pricing strategies and can compress profit margins during the crucial bidding phases for lucrative projects. The drive to secure new, high-value contracts necessitates substantial investment in tender preparation, further straining resources.

For instance, in the 2023 fiscal year, the global infrastructure market saw significant bidding activity, with major players like Vinci and ACS frequently competing for large-scale projects. Ferrovial's success in these tenders is vital, but the pressure to offer competitive bids can limit the profitability of secured contracts. The company must continuously innovate and demonstrate value to stand out against a backdrop of numerous capable competitors, each vying for a share of global infrastructure development.

- Intense Global Competition: Ferrovial faces strong rivalry from major multinational infrastructure firms.

- Pricing Pressure: Competition leads to pressure on pricing and potentially lower profit margins on bids.

- Tender Costs: Securing new contracts requires significant expenditure on competitive bidding processes.

Workforce and Supply Chain Challenges

The construction and infrastructure sector, including Ferrovial, continues to grapple with significant workforce and supply chain disruptions. Skilled labor shortages remain a persistent issue, impacting project execution and potentially extending timelines. For instance, in the UK, a recent industry report indicated a shortage of around 200,000 skilled workers needed to meet projected infrastructure demand through 2027, a trend likely to affect companies like Ferrovial.

Material cost volatility and supply chain disruptions pose further risks. The ongoing global economic climate means that the price of key construction materials, such as steel and concrete, can fluctuate unpredictably. This volatility, coupled with potential delays in material delivery, can directly impact Ferrovial's operational costs and the profitability of its extensive order book, which stood at €16.3 billion as of the first quarter of 2024.

- Skilled Labor Shortages: Affecting project timelines and increasing labor costs across the industry.

- Material Cost Volatility: Fluctuations in prices for steel, concrete, and other essential materials impact project budgets.

- Supply Chain Disruptions: Potential delays in material delivery can lead to project scheduling issues.

- Profitability Impact: These challenges could compress profit margins on existing and future projects for Ferrovial.

Ferrovial's significant exposure to concession-based infrastructure makes it vulnerable to economic downturns and interest rate hikes. The company's heavy reliance on North America, accounting for around 60% of its revenue in the first half of 2024, also poses a risk due to potential regional economic or political instability.

High capital expenditure for new projects, coupled with long payback periods, can strain financial resources and liquidity. Furthermore, intense global competition in the infrastructure sector exerts pressure on pricing and profit margins, while labor shortages and material cost volatility in 2023-2024 impact project execution and profitability.

| Weakness | Description | Impact |

| Macroeconomic Sensitivity | Reliance on concessions vulnerable to inflation, interest rates, and currency fluctuations. | Erodes margins, increases financing costs. |

| Geographic Concentration | Over 60% of H1 2024 revenue from North America. | Exposes company to specific regional economic or political risks. |

| High Capital Expenditure | Significant upfront investment for large-scale projects with long payback periods. | Strains financial resources, increases financial risk, ties up liquidity. |

| Intense Competition | Facing established multinational players in global infrastructure. | Leads to pricing pressure and reduced profit margins on bids. |

| Operational Challenges | Skilled labor shortages and material cost volatility (2023-2024). | Impacts project timelines, increases costs, compresses profit margins. |

Same Document Delivered

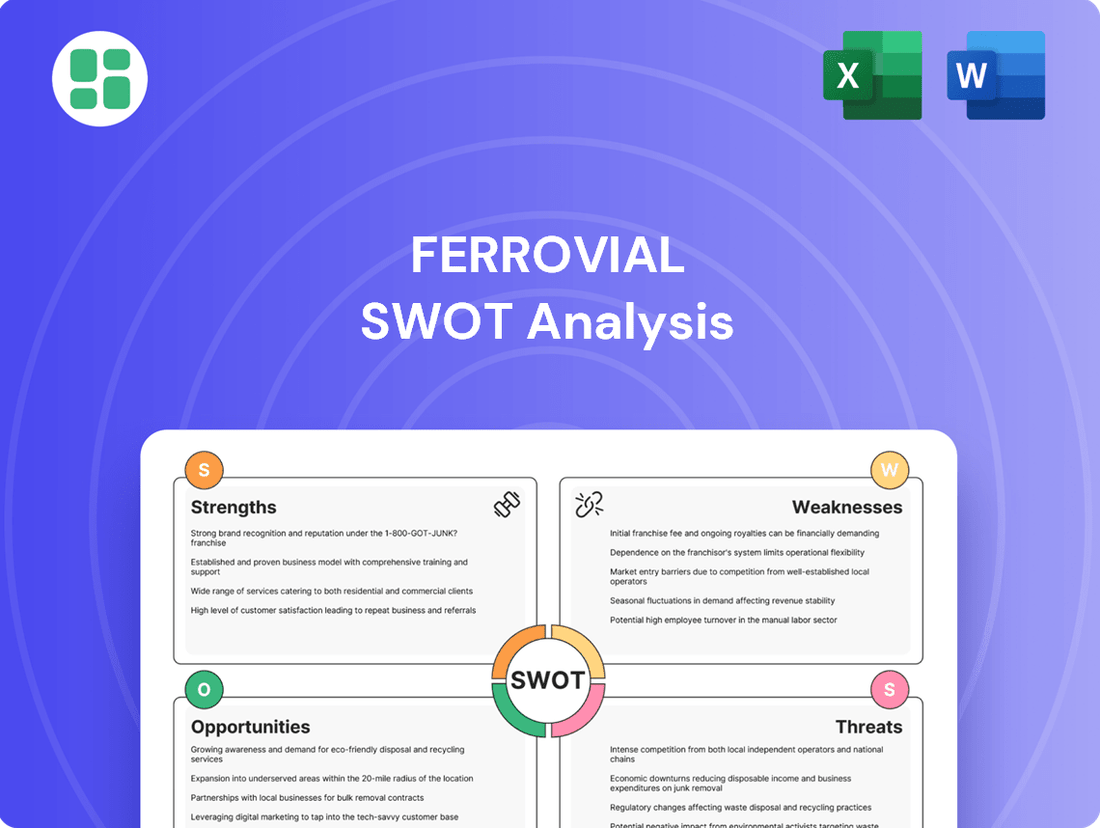

Ferrovial SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. You're seeing a genuine snapshot of the comprehensive Ferrovial SWOT, ready to inform your strategic decisions.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, offering a complete picture of Ferrovial's strategic landscape.

This preview reflects the real document you'll receive—professional, structured, and ready to use. It showcases the depth and clarity of our Ferrovial SWOT analysis.

Opportunities

A substantial global infrastructure funding gap presents a significant opportunity. In the United States alone, the Infrastructure Investment and Jobs Act (IIJA) has earmarked billions for crucial improvements, highlighting the scale of unmet needs.

Ferrovial is ideally positioned to leverage this gap, given its extensive experience in Public-Private Partnerships (PPPs) and its proven ability to manage large-scale, complex infrastructure projects.

Ferrovial is well-positioned to capitalize on the growing demand for new infrastructure asset classes beyond traditional roads and airports. The company's strategic focus on green energy infrastructure, including solar and electric vehicle charging facilities, directly addresses the global shift towards sustainability. This diversification into sectors like digital infrastructure, such as data centers and cell towers, further expands its market reach.

The company’s investment in renewable energy projects is a significant opportunity, with global renewable energy capacity expected to grow substantially. For instance, the International Energy Agency projected that renewable energy sources would account for over 90% of global electricity capacity expansion in the coming years, a trend Ferrovial is actively participating in. Furthermore, Ferrovial's foray into AI-driven smart roads and smart city solutions taps into the burgeoning market for technologically advanced urban development.

With governments globally facing fiscal constraints, the demand for private sector capital in infrastructure development is escalating. This presents a significant opportunity for Ferrovial, particularly as it has a strong history of success in public-private partnerships (PPPs). For instance, its involvement in North American managed lanes demonstrates a capability to deliver complex projects under these collaborative models.

Ferrovial's expertise in PPPs, especially its experience with managed lanes in regions like Texas, positions it favorably to bid on and secure new, substantial concession projects. These ventures are attractive due to their provision of stable, long-term contracted cash flows and the inherent high barriers to entry, which can limit competition.

Technological Advancements and Innovation

Ferrovial can leverage technological advancements like AI-powered analytics and digital twins to boost efficiency and cut costs. The company's AIVIA Smart Roads initiative, for instance, highlights its commitment to innovation, aiming to create more intelligent infrastructure and secure a stronger market position.

Embracing sustainable construction methods also presents a significant opportunity. By integrating these technologies, Ferrovial can improve project delivery and outcomes, aligning with growing global demand for environmentally responsible infrastructure development.

Specific opportunities include:

- Enhanced Project Management: Implementing BIM and AI can lead to more accurate planning and execution, reducing delays and cost overruns.

- Operational Optimization: Digital twins allow for real-time monitoring and predictive maintenance, improving asset performance and lifespan.

- New Service Development: Innovations like smart roads can open up new revenue streams and create a competitive advantage in infrastructure services.

Expansion into High-Growth Markets

Ferrovial can capitalize on its expertise by targeting infrastructure development in rapidly expanding economies. For instance, India's infrastructure spending is projected to reach $1.4 trillion by 2025, presenting substantial opportunities for construction and toll road concessions.

Australia's ongoing investment in transportation networks, including major projects like the Western Sydney Airport, offers another avenue for growth. Ferrovial's track record in managing complex projects makes it well-positioned to secure significant contracts in these markets.

Colombia's developing infrastructure sector, particularly in areas like urban mobility and energy, also represents a promising frontier. The country's commitment to improving its infrastructure could lead to lucrative long-term projects.

These emerging markets often feature less saturated competition compared to established regions, allowing Ferrovial to potentially achieve higher profit margins and secure a stronger market position.

Ferrovial is well-positioned to benefit from the global infrastructure funding gap, with the US alone dedicating billions through the Infrastructure Investment and Jobs Act. The company's expertise in Public-Private Partnerships (PPPs) and large-scale project management allows it to effectively address these unmet needs. Furthermore, Ferrovial's strategic expansion into green energy infrastructure and digital assets like data centers taps into growing market demands driven by sustainability and technological advancements.

The company's focus on renewable energy aligns with projections that renewables will constitute over 90% of global electricity capacity expansion. Ferrovial's investment in AI-driven smart roads and smart city solutions also targets the expanding market for advanced urban development. Emerging economies like India, with projected infrastructure spending of $1.4 trillion by 2025, and Australia, with significant transportation network investments, offer substantial growth opportunities due to less saturated competition.

| Opportunity Area | Key Drivers | Ferrovial's Advantage | Market Potential (Illustrative) |

|---|---|---|---|

| Global Infrastructure Funding Gap | IIJA in US ($1.2 trillion total), global need for upgrades | PPP expertise, large-scale project management | Trillions globally |

| Green Energy Infrastructure | Sustainability shift, renewable energy capacity growth (IEA >90% expansion) | Investment in solar, EV charging | Significant growth |

| Digital Infrastructure | Demand for data centers, cell towers | Diversification into new asset classes | Growing market |

| Emerging Markets | India ($1.4T by 2025), Australia (Western Sydney Airport) | Track record in complex projects, less competition | High growth potential |

Threats

Global economic slowdowns and recessions pose a significant threat to Ferrovial. For instance, a widespread economic downturn in 2024 could dampen consumer spending and business activity, directly impacting traffic volumes on its toll roads and at its airports. This reduced usage translates to lower revenue for Ferrovial's infrastructure assets.

Geopolitical instability further exacerbates these economic risks. Ongoing conflicts or trade tensions can disrupt supply chains, increase construction costs, and create a climate of uncertainty for new infrastructure investments. This uncertainty might lead to delays or cancellations of planned projects, impacting Ferrovial's future growth and project pipeline.

The combined effect of economic downturns and geopolitical instability can significantly reduce Ferrovial's profitability. For example, if key markets experience a recession in 2025, the company might see a decline in toll revenue and airport passenger fees, while simultaneously facing higher financing costs due to increased market volatility.

Rising interest rates, such as those seen with the US Federal Reserve's continued hikes through 2024, directly increase Ferrovial's borrowing costs for new infrastructure developments and debt refinancing. This escalation impacts the financial feasibility of major projects and can reduce overall earnings.

Persistent inflation in 2024 and 2025 continues to drive up expenses for materials and labor. This squeezes profit margins, particularly on long-term, fixed-price contracts, even as some revenue streams are adjusted for inflation.

Ferrovial faces intensifying regulatory and political risks as infrastructure projects are frequently governed by intricate and shifting rules, encompassing environmental, social, and governance (ESG) standards and political interference. For instance, in 2024, the European Union continued to emphasize stricter ESG reporting for infrastructure projects, potentially increasing compliance burdens for companies like Ferrovial operating within the bloc.

Alterations in government strategies, the imposition of new tariffs, or heightened regulatory oversight can result in project postponements, elevated compliance expenses, or even the termination of concessions, presenting substantial threats to Ferrovial's ongoing and future ventures. The ongoing geopolitical shifts in 2024, particularly concerning trade relations and national security concerns, have led to increased scrutiny of foreign investment in critical infrastructure across various regions where Ferrovial operates.

Competitive Landscape and Pricing Pressures

The infrastructure sector is intensely competitive, with many large domestic and international companies actively seeking major projects. This competition often results in aggressive bidding strategies, which can significantly reduce profit margins on awarded contracts and make securing new business more challenging for Ferrovial.

Competitors’ ability to innovate or employ more aggressive pricing models presents a direct threat to Ferrovial’s market position. For instance, during 2024, several major infrastructure tenders saw bids come in significantly lower than initial estimates, reflecting the high level of price competition. This trend is expected to continue into 2025, putting pressure on Ferrovial to maintain its competitive edge through efficiency and strategic pricing.

- Intense Competition: Numerous global players are competing for infrastructure contracts.

- Margin Erosion: Aggressive bidding tactics can lead to lower profitability on projects.

- Innovation Threat: Competitors’ technological advancements or novel approaches could disrupt market share.

- Pricing Pressures: The need to offer competitive pricing may limit Ferrovial’s pricing power.

Climate Change and Extreme Weather Events

Ferrovial's extensive portfolio of long-term infrastructure assets faces significant risks from climate change. The increasing frequency and intensity of extreme weather events, such as floods, heatwaves, and storms, can lead to physical damage, operational disruptions, and substantial repair costs. For example, in 2023, extreme weather events globally resulted in hundreds of billions of dollars in economic losses, a trend expected to continue and potentially worsen.

These climate-related impacts directly threaten Ferrovial's profitability and the longevity of its infrastructure. Adapting assets to be more climate-resilient requires significant capital investment. The company's exposure to these threats is amplified by its global operations, where diverse climate vulnerabilities exist across different regions.

- Vulnerability of Infrastructure: Ferrovial's roads, airports, and utilities are susceptible to damage from rising sea levels, extreme temperatures, and severe precipitation.

- Operational Disruptions: Extreme weather can halt construction, disrupt transportation networks, and impact service delivery, leading to revenue loss.

- Increased Capital Expenditure: Significant investment will be needed for climate adaptation and mitigation measures, potentially straining financial resources.

- Regulatory and Reputational Risks: Failure to address climate risks could lead to regulatory penalties and damage Ferrovial's reputation among investors and stakeholders.

Ferrovial must navigate a landscape of intense competition, where aggressive bidding can erode profit margins, a trend evident in 2024 infrastructure tenders seeing significantly lower bids. Competitors' innovation in technology or pricing models poses a direct threat, potentially diminishing Ferrovial's market share. Furthermore, the company faces mounting regulatory and political risks, with evolving ESG standards and potential trade policy shifts in 2024 and 2025 creating uncertainty for project development and compliance costs.

SWOT Analysis Data Sources

This Ferrovial SWOT analysis is built upon a robust foundation of data, drawing from official company financial reports, comprehensive market intelligence, and expert industry analyses to provide a thorough and accurate strategic overview.