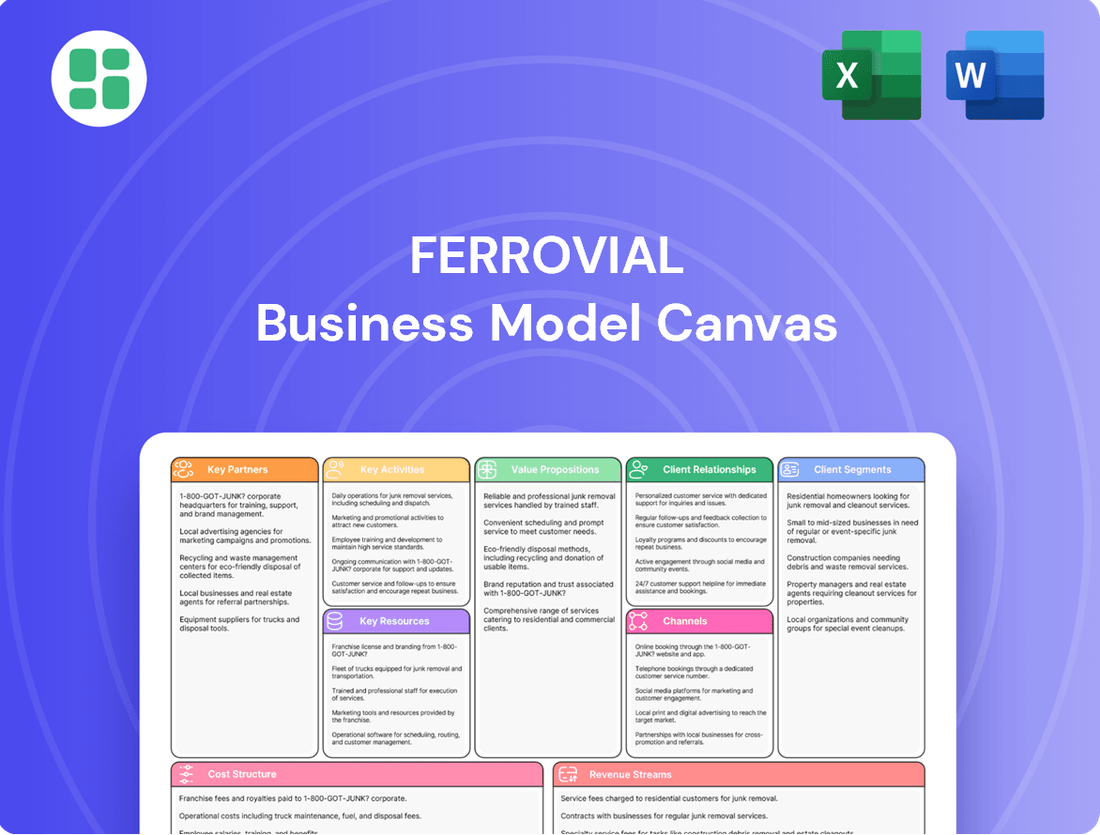

Ferrovial Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ferrovial Bundle

Discover the strategic framework powering Ferrovial's global infrastructure and services empire. This comprehensive Business Model Canvas dissects their approach to value creation, customer engagement, and sustainable growth. Unlock the full blueprint to understand how they build, operate, and maintain critical assets worldwide.

Partnerships

Ferrovial's key partnerships with government agencies and public authorities are foundational, as these entities act as both major clients and crucial regulators for its extensive infrastructure development and management activities. For instance, in 2024, Ferrovial continued its significant involvement in public-private partnerships (PPPs) across various regions, including the United States and Europe, where government bodies are the primary drivers of large-scale projects like toll roads and airport expansions.

These collaborations often manifest as long-term concession agreements, where Ferrovial takes on the responsibility for financing, constructing, and operating public infrastructure, such as the management of the M40 motorway in the UK, a partnership that highlights the long-term nature of these governmental relationships. The company's ability to secure and successfully execute these contracts is directly tied to its capacity to build and maintain trust with public sector stakeholders and navigate complex regulatory environments, ensuring compliance and project viability.

Ferrovial's infrastructure ventures necessitate robust financial backing, leading to strategic alliances with a variety of financial institutions and investors. These partnerships are vital for securing the substantial capital required for large-scale projects. For instance, in 2024, Ferrovial continues to engage with major global banks and institutional investors to structure complex debt financing and attract equity investments. This collaboration is essential for managing the financial risks inherent in long-term infrastructure development and ensuring project viability.

The company actively seeks diverse capital pools, including private equity firms and pension funds, to fund its extensive portfolio. Ferrovial's commitment to sustainability is also reflected in its partnerships, with a notable focus on securing green bonds to finance environmentally friendly projects. This strategy, which saw significant activity in 2023 and is projected to grow in 2024, allows Ferrovial to tap into a growing market of ESG-conscious investors, further diversifying its funding sources and reinforcing its financial resilience.

Ferrovial's construction arm, including its US subsidiary Webber, frequently partners with other construction and engineering firms. These collaborations are especially common for large-scale or highly specialized infrastructure projects, allowing Ferrovial to tap into complementary expertise and share the inherent risks. For instance, in 2023, Webber was part of a joint venture that secured a significant contract for highway improvements in Texas, demonstrating the value of these strategic alliances in enhancing project execution capabilities.

Technology and Innovation Providers

Ferrovial actively collaborates with technology providers and innovative startups to embed cutting-edge solutions into its diverse infrastructure portfolio. This includes leveraging artificial intelligence for predictive maintenance on toll roads and integrating advanced data analytics to optimize traffic flow in urban environments.

These partnerships are crucial for enhancing operational efficiency and safety across Ferrovial's assets, ultimately improving the user experience for millions. For instance, in 2024, Ferrovial continued to explore pilot programs with AI firms to enhance safety monitoring on its highway concessions.

- AI Integration: Implementing AI for predictive maintenance and operational optimization in infrastructure management.

- Data Analytics: Utilizing data to improve traffic flow, resource allocation, and service delivery.

- Smart Mobility: Partnering on solutions that enhance connectivity and user experience in transportation networks.

- Startup Engagement: Collaborating with emerging technology companies to pilot and scale new solutions.

Local Communities and NGOs

Ferrovial actively collaborates with local communities and non-governmental organizations (NGOs) to secure its social license to operate and to effectively address local needs. This engagement is crucial for implementing meaningful social responsibility initiatives that resonate with the people and places where Ferrovial operates.

These partnerships are vital for ensuring that Ferrovial’s projects contribute positively to the social fabric. By working hand-in-hand with community stakeholders, the company can better understand and respond to local priorities, fostering trust and mutual benefit.

Ferrovial demonstrates its commitment through tangible actions, such as resource allocation to projects targeting improved water access and enhanced food security in vulnerable communities. For instance, in 2024, Ferrovial continued its support for initiatives aimed at providing clean water to remote villages, impacting thousands of lives.

- Community Engagement: Ferrovial’s partnerships with local communities and NGOs are foundational for social license to operate.

- Social Impact Projects: Resources are directed towards critical areas like water access and food security in underserved regions.

- Sustainable Development: These collaborations underscore Ferrovial's dedication to creating lasting positive change and contributing to sustainable development goals.

- 2024 Focus: Continued investment in water access projects in vulnerable areas, benefiting thousands of individuals.

Ferrovial's key partnerships are diverse, ranging from government bodies for infrastructure projects to financial institutions for capital, and technology providers for innovation. These collaborations are essential for securing contracts, funding large-scale developments, and integrating advanced solutions.

In 2024, Ferrovial's continued engagement with public-private partnerships (PPPs) across the US and Europe highlights its reliance on government agencies as primary clients for major infrastructure. These often take the form of long-term concessions, such as managing the M40 motorway in the UK.

Strategic alliances with global banks and institutional investors are crucial for securing the substantial capital required for projects, with Ferrovial actively structuring debt and attracting equity investments in 2024. The company also taps into diverse capital pools like private equity and pension funds, increasingly utilizing green bonds for sustainable projects.

Furthermore, partnerships with other construction firms, exemplified by Webber's joint venture for Texas highway improvements in 2023, allow Ferrovial to leverage complementary expertise and share risks. Collaborations with AI firms in 2024 aim to enhance safety monitoring on highway concessions.

| Partnership Type | Key Collaborators | Purpose | 2024 Focus/Example |

|---|---|---|---|

| Government Agencies | National & Regional Governments | Infrastructure Development & Management (PPPs, Concessions) | US/Europe Toll Roads, Airport Expansion |

| Financial Institutions | Global Banks, Institutional Investors, Private Equity, Pension Funds | Project Financing, Capital Raising, Debt Structuring | Green Bond Issuance for Sustainable Projects |

| Construction & Engineering Firms | Specialized Contractors | Risk Sharing, Expertise Augmentation | Joint Ventures for Large-Scale Projects |

| Technology Providers | AI Firms, Data Analytics Companies | Innovation, Operational Efficiency, Safety | AI for Predictive Maintenance, Smart Mobility Solutions |

What is included in the product

A strategic overview of Ferrovial's business model, detailing its infrastructure development and management, customer relationships, and revenue streams across diverse global markets.

The Ferrovial Business Model Canvas offers a structured framework to pinpoint and address operational inefficiencies, acting as a pain point reliver by clarifying value propositions and cost structures.

By visually mapping out key resources and activities, the Ferrovial Business Model Canvas helps identify and alleviate pain points related to resource allocation and operational bottlenecks.

Activities

Ferrovial's project development and financing activities are central to its business. This includes identifying promising infrastructure opportunities, conducting thorough feasibility studies, and navigating the complex process of obtaining permits and approvals.

A critical component is structuring and securing financing for these large-scale projects. Ferrovial frequently utilizes public-private partnerships (PPPs) and actively works to attract a broad range of investors.

In 2023, Ferrovial secured significant financing for projects like the expansion of the I-66 highway in Virginia, USA, demonstrating its capability in financial engineering and risk management.

Ferrovial's Construction and Engineering division is central to its operations, focusing on the physical building of major transportation projects like highways, bridges, and airport terminals. This requires sophisticated engineering know-how, meticulous project oversight, and a commitment to safety and operational excellence.

In 2023, Ferrovial's construction activities were a significant driver of its overall performance. The company secured substantial new contracts, including key infrastructure projects in countries like the United States and Spain, underscoring its global reach and technical prowess in this domain.

Ferrovial's core activities include the long-term operation and maintenance of its concession assets, like toll roads and airports. This ensures these vital infrastructures remain functional, safe, and efficient throughout their entire lifespan, thereby maximizing their value. For instance, in 2023, Ferrovial managed over 1,200 kilometers of toll roads, handling millions of vehicles annually.

Key operational tasks involve sophisticated traffic flow management, employing dynamic tolling systems to optimize usage and revenue. Furthermore, the company focuses on maintaining facilities to the highest standards, ensuring a positive user experience and operational continuity. This commitment to upkeep directly impacts asset longevity and profitability.

Asset Rotation and Portfolio Management

Ferrovial actively engages in asset rotation, a core activity for optimizing its business. This involves strategically selling off mature assets to free up capital. For instance, in 2023, Ferrovial completed the sale of its stake in Heathrow Airport Holdings, a significant mature asset.

The capital generated from these divestments is then channeled into new, high-growth opportunities, particularly in markets like North America. This proactive approach ensures capital is allocated to areas with the greatest potential for future returns.

- Asset Rotation: Divesting mature assets like Heathrow Airport Holdings in 2023.

- Capital Reinvestment: Funding new growth areas, especially in North America.

- Strategic Focus: Optimizing the portfolio for long-term value creation.

Innovation and Digitalization

Ferrovial's commitment to innovation and digitalization is central to its operational strategy. The company actively invests in research and development, channeling resources into cutting-edge technologies like artificial intelligence and advanced data analytics. This focus allows for the creation of smart infrastructure, such as intelligent roads, and the continuous optimization of operational processes.

The implementation of these digital tools directly enhances efficiency, boosts accuracy in project execution, and significantly improves safety across all of Ferrovial's diverse operations. By embracing these advancements, Ferrovial aims to solidify its position as a forward-thinking leader in the sustainable infrastructure sector.

- AI and Data Analytics: Ferrovial leverages AI and data-driven insights to optimize maintenance schedules and predict potential infrastructure failures, enhancing operational resilience.

- Smart Roads: The company is developing and implementing smart road technologies that improve traffic flow, reduce congestion, and enhance driver safety through real-time data.

- Digital Transformation: Ferrovial invests in digital platforms to streamline project management, improve collaboration among teams, and enhance overall project delivery efficiency.

- Cybersecurity: A significant portion of digitalization efforts is dedicated to strengthening cybersecurity measures to protect critical infrastructure data and systems.

Ferrovial's key activities revolve around developing, constructing, and operating infrastructure. This includes identifying opportunities, securing financing, and building projects like highways and airports. They also manage these assets long-term, ensuring functionality and optimizing revenue streams.

A significant aspect is asset rotation, where mature assets are sold to fund new ventures, particularly in growth markets. This strategic approach, exemplified by the 2023 sale of its Heathrow stake, allows for capital reallocation and portfolio optimization.

Innovation and digitalization are also core, with investments in AI and data analytics for smarter infrastructure and improved operational efficiency. This focus on technology enhances safety, accuracy, and overall project delivery.

| Activity | Description | 2023 Relevance |

|---|---|---|

| Project Development & Financing | Identifying, planning, and securing funding for infrastructure projects. | Secured financing for I-66 highway expansion (USA). |

| Construction & Engineering | Physical building of infrastructure like roads, bridges, and terminals. | Won substantial new contracts globally, including in the US and Spain. |

| Operation & Maintenance | Long-term management of concession assets for functionality and revenue. | Managed over 1,200 km of toll roads, serving millions of vehicles. |

| Asset Rotation | Strategic sale of mature assets to free up capital for new investments. | Completed sale of stake in Heathrow Airport Holdings. |

| Innovation & Digitalization | Investing in AI, data analytics, and smart technologies for efficiency and safety. | Focus on AI for predictive maintenance and smart roads for traffic optimization. |

Full Version Awaits

Business Model Canvas

The Ferrovial Business Model Canvas preview you are viewing is the exact document you will receive upon purchase. This means you are seeing a direct representation of the final, comprehensive analysis, ensuring no discrepancies or altered content. Upon completing your order, you will gain full access to this professionally structured and ready-to-use Business Model Canvas for Ferrovial.

Resources

Ferrovial's financial capital is a cornerstone of its business model, providing the substantial liquidity and access to capital markets necessary for its extensive infrastructure projects. This financial strength allows the company to undertake large-scale, long-term developments, a critical advantage in securing and executing complex projects.

The company leverages a mix of equity, debt financing, and strong relationships with institutional investors to fund its operations and growth. For instance, in 2024, Ferrovial successfully raised €1.5 billion through a green bond issuance, demonstrating its capacity to tap into diverse funding sources for sustainable infrastructure development.

Ferrovial’s human capital is a cornerstone, encompassing a vast pool of engineers, project managers, and operational experts. Their collective experience in infrastructure development and management is crucial for executing large-scale, complex projects.

In 2024, Ferrovial continued its emphasis on talent development, with significant investment in training programs designed to enhance the technical skills and problem-solving capabilities of its workforce. This focus ensures the company maintains its edge in delivering high-quality infrastructure solutions.

The commitment to safety and operational excellence, embedded within its human capital, is paramount. This expertise directly translates into the successful and efficient delivery of projects, a key differentiator for Ferrovial in the competitive global infrastructure market.

Ferrovial's business thrives on concession rights and long-term contracts, primarily with governments, granting them the ability to develop, fund, build, and manage crucial transportation infrastructure. These agreements are the bedrock of their long-term asset strategy, ensuring predictable revenue and control over valuable assets for extended periods.

For instance, in 2023, Ferrovial managed a portfolio of concessions representing a significant portion of its revenue, with many contracts extending for decades, providing a highly stable financial foundation. This focus on long-term infrastructure projects, secured through these rights, allows for consistent cash flow generation and strategic planning.

Proprietary Technology and Intellectual Property

Ferrovial's proprietary technology and intellectual property are cornerstones of its business model, particularly evident in its digital platforms and advanced construction methodologies. This includes AI-driven solutions designed to fine-tune traffic flow and streamline operational workflows across its infrastructure projects. These technological assets are crucial for maintaining a competitive edge and boosting overall efficiency.

The company's investment in innovation is reflected in areas such as dynamic tolling systems and smart infrastructure development. For instance, Ferrovial has been a pioneer in implementing intelligent traffic management systems that adapt in real-time to changing conditions. This focus on technological advancement allows Ferrovial to offer enhanced services and optimize asset performance.

- Proprietary Technologies: Development and application of AI for traffic optimization and operational efficiency in infrastructure management.

- Digital Platforms: Creation of integrated digital solutions for smart infrastructure, including dynamic tolling and real-time data analysis.

- Intellectual Property: Patents and know-how in advanced construction techniques and sustainable infrastructure solutions.

- Competitive Advantage: Leveraging these assets to drive efficiency, innovation, and superior service delivery in its concessions and construction activities.

Strong Brand Reputation and Track Record

Ferrovial's strong brand reputation is a cornerstone of its business model, built over decades of successful global infrastructure development. This long-standing trust is a critical intangible asset, enabling the company to secure high-value contracts and foster enduring relationships with governments and private partners worldwide.

The company's proven track record in delivering complex projects, from major airports to extensive road networks, underpins its credibility. For instance, Ferrovial's involvement in significant projects such as the Sydney Airport expansion and the development of the E-40 highway in Poland demonstrates its capacity and reliability. This consistent performance is vital for winning future bids, as clients prioritize experienced and dependable partners.

- Reputation as a reliable global infrastructure developer.

- Proven track record in delivering complex, high-quality projects.

- Builds trust with governments, partners, and investors.

- Critical for winning new bids and maintaining stakeholder relationships.

Ferrovial’s key resources include its substantial financial capital, enabling large-scale project funding, and its skilled human capital, comprising experienced engineers and project managers. The company also relies heavily on its concession rights and long-term contracts, which provide stable revenue streams and control over valuable infrastructure assets. Furthermore, proprietary technologies and a strong brand reputation are vital for maintaining a competitive edge and securing new business opportunities.

| Resource Type | Description | Key Data/Examples |

|---|---|---|

| Financial Capital | Liquidity and access to capital markets for project funding. | €1.5 billion green bond issuance in 2024. |

| Human Capital | Expertise in infrastructure development, project management, and operations. | Continued investment in talent development and training programs in 2024. |

| Concession Rights & Contracts | Long-term agreements for developing and managing infrastructure. | Portfolio of concessions representing significant revenue, with contracts extending for decades. |

| Proprietary Technologies & IP | AI for traffic optimization, digital platforms, advanced construction methods. | Pioneering intelligent traffic management systems. |

| Brand Reputation | Trust built through successful delivery of complex global projects. | Involvement in projects like Sydney Airport expansion and E-40 highway development. |

Value Propositions

Ferrovial offers end-to-end solutions for creating and managing sustainable transportation infrastructure like highways and airports. These are long-term investments built to serve future societal demands and promote environmental responsibility.

The company's dedication to green infrastructure and resilience is a key value proposition, aligning with growing global emphasis on sustainability. For instance, Ferrovial's commitment is reflected in its 2023 sustainability report, highlighting investments in renewable energy sources for its operations and a focus on reducing the carbon footprint of its projects.

Ferrovial's infrastructure projects are designed to boost connectivity, enabling smoother movement of people and goods. This enhanced flow directly fuels economic growth by making regions more accessible and efficient. For example, their work on toll roads often leads to reduced travel times, a key factor in stimulating local commerce and productivity.

By tackling congestion, Ferrovial's solutions unlock economic potential. Less time stuck in traffic means more time for productive activities, benefiting businesses and individuals alike. This focus on efficiency translates into tangible economic gains for the communities they serve, fostering greater regional prosperity.

Ferrovial's deep expertise in Public-Private Partnerships (PPPs) is a core value proposition, enabling governments to tap into private capital and operational efficiencies for vital infrastructure. This specialization allows for the effective transfer of project risks and ensures that crucial projects are completed on schedule. For example, Ferrovial's involvement in the A-66 highway concession in Spain, a significant PPP project, demonstrates their capability in managing large-scale infrastructure development and operation.

Risk Management and Operational Excellence

Ferrovial's integrated approach and deep experience are cornerstones of its risk management strategy for major infrastructure. This allows them to navigate the complexities from initial bidding through to long-term operation, a crucial element for project success.

The company's commitment to operational excellence ensures services and assets are delivered efficiently and safely. This dedication is a significant competitive advantage in the infrastructure sector.

- Risk Mitigation: Ferrovial's extensive track record in managing large-scale infrastructure projects, from conception to ongoing operation, allows for proactive identification and mitigation of inherent risks.

- Operational Efficiency: A focus on high operational standards ensures the safe and efficient delivery of services and assets, contributing to project viability and client satisfaction.

- Integrated Expertise: The company leverages its integrated business model, encompassing design, construction, and operation, to create a holistic risk management framework.

- Safety Standards: Ferrovial consistently upholds stringent safety protocols, a critical component of operational excellence and risk reduction in infrastructure development and management.

Innovation for Future Mobility Solutions

Ferrovial is committed to pioneering solutions for the future of mobility, actively developing and implementing technologies that cater to evolving transportation demands. This includes advancements in smart road infrastructure, the expansion of electric vehicle charging networks, and exploration into urban air mobility concepts.

By embedding advanced technologies into its projects, Ferrovial strives to engineer transportation systems that are not only more efficient and secure but also contribute to a reduced environmental footprint. This dedication to innovation is crucial for maintaining a competitive edge in a sector undergoing rapid transformation.

- Smart Road Technologies: Ferrovial's investments in intelligent transportation systems, including sensor integration and data analytics for traffic management, are designed to optimize road usage and enhance safety.

- EV Charging Infrastructure: As of early 2024, Ferrovial has been actively expanding its electric vehicle charging station network across its concessions, supporting the transition to sustainable transport.

- Urban Air Mobility: The company is exploring partnerships and investments in the nascent urban air mobility sector, positioning itself for future growth in this innovative area.

Ferrovial's value proposition centers on delivering sustainable, high-quality infrastructure that enhances connectivity and drives economic growth. They excel in managing complex, long-term projects through public-private partnerships, ensuring efficient and safe operations. Their commitment to innovation, particularly in smart mobility and green technologies, positions them as a leader in shaping future transportation networks.

The company's dedication to sustainability is a key differentiator, aligning with global environmental goals. For instance, Ferrovial's 2023 sustainability report detailed significant investments in renewable energy sources to power its operations and a strong focus on reducing the carbon footprint of its projects. This commitment resonates with stakeholders increasingly prioritizing environmentally responsible infrastructure development.

Ferrovial's expertise in public-private partnerships (PPPs) is a core strength, enabling governments to leverage private capital and operational efficiencies for essential infrastructure. Their proven ability to manage large-scale development and operation, exemplified by projects like the A-66 highway concession in Spain, underscores their capability in this complex domain.

The company's focus on operational excellence ensures the safe and efficient delivery of services and assets, a critical advantage in the infrastructure sector. This commitment to high standards contributes to project viability and client satisfaction, reinforcing their reputation for reliability.

| Value Proposition | Description | Supporting Data/Examples (as of early 2024) |

|---|---|---|

| Sustainable & Connected Infrastructure | End-to-end solutions for sustainable transportation infrastructure like highways and airports, promoting environmental responsibility and future societal demands. | Ferrovial's 2023 sustainability report highlights investments in renewable energy and carbon footprint reduction initiatives for its projects. |

| Public-Private Partnership Expertise | Deep expertise in PPPs, enabling governments to access private capital and operational efficiencies for vital infrastructure projects. | Successful management of projects like the A-66 highway concession in Spain demonstrates capability in large-scale PPPs. |

| Operational Excellence & Risk Management | Commitment to operational excellence ensures efficient and safe delivery of services and assets, coupled with integrated expertise for robust risk management. | Consistent adherence to stringent safety protocols is a critical component of their operational excellence. |

| Future Mobility Innovation | Pioneering solutions for future mobility, including smart road infrastructure, EV charging networks, and urban air mobility concepts. | Active expansion of electric vehicle charging stations across concessions and exploration into urban air mobility partnerships. |

Customer Relationships

Ferrovial's long-term concession partnerships with government bodies are the bedrock of its infrastructure operations, often lasting 30 to 50 years. These enduring alliances are forged through a commitment to transparency and a shared vision for public service delivery, fostering trust that underpins ongoing collaboration. For instance, in 2023, Ferrovial continued to manage key infrastructure projects under these concession models, demonstrating the sustained value and reliability of these relationships.

Ferrovial actively engages in strategic alliances and joint ventures with other key industry participants, including construction companies and financial institutions, to pursue specific, large-scale projects. These partnerships are built on collaboration, aiming for mutual goals, distributing project risks, and capitalizing on each partner's unique capabilities.

These collaborative ventures are essential for Ferrovial to tackle projects demanding substantial resources and intricate execution. For instance, in 2024, Ferrovial's involvement in the High Speed Rail Lot 2 project in Spain, a multi-billion euro undertaking, was facilitated through a joint venture structure, highlighting the critical role these alliances play in securing and executing major infrastructure developments.

Ferrovial assigns dedicated project teams and account managers to each significant undertaking. This ensures direct and consistent communication, allowing for swift responses and customized solutions that precisely meet client requirements. This focused engagement fosters robust relationships from project inception through completion.

In 2023, Ferrovial's infrastructure division, which heavily relies on these dedicated teams, reported revenues of €7.4 billion, underscoring the scale and importance of their project-based client relationships. This structure is crucial for managing complex, long-term projects, leading to high client satisfaction and successful project delivery.

Stakeholder Engagement and Community Relations

Ferrovial prioritizes robust stakeholder engagement, fostering positive community relations to ensure its infrastructure projects align with societal needs and values. This proactive approach involves transparent communication channels and active participation in public consultations, aiming to build trust and mitigate potential social impacts. For instance, in 2023, Ferrovial reported investing €45 million in social programs and community initiatives across its global operations, demonstrating a tangible commitment to local development.

The company's strategy includes significant investment in employee development and well-being. In 2024, Ferrovial committed to providing over 500,000 hours of training to its workforce, enhancing skills and fostering a culture of continuous improvement. This focus on its people is crucial for maintaining operational excellence and driving innovation.

- Community Investment: Ferrovial's commitment to social responsibility is evident in its consistent investment in local communities, aiming to create shared value and enhance quality of life.

- Transparent Communication: Maintaining open dialogue with stakeholders, including environmental groups and local residents, is key to addressing concerns and ensuring project sustainability.

- Employee Development: Investing in training and development programs for its workforce of over 23,000 employees globally is central to Ferrovial's operational strategy and long-term success.

- Social Impact Mitigation: By actively engaging stakeholders, Ferrovial seeks to minimize negative social impacts and maximize the positive contributions of its infrastructure projects.

Performance-Based Contracts and Service Level Agreements

Ferrovial formalizes customer relationships in operations and maintenance through performance-based contracts and robust service level agreements. This structure directly links their compensation to achieving pre-defined service quality and efficiency metrics.

These agreements are crucial for ensuring Ferrovial's accountability and aligning its operational incentives with client expectations for high-quality service delivery. For instance, in 2023, Ferrovial's infrastructure maintenance contracts often included penalties for missed response times or failure to meet specific uptime targets.

- Performance Metrics: Contracts specify key performance indicators (KPIs) such as response times, asset availability, and energy efficiency targets.

- Service Level Agreements (SLAs): These define the minimum acceptable service standards and outline remedies for non-compliance.

- Client Satisfaction: The commitment to measurable performance directly contributes to client satisfaction and long-term partnerships.

- Accountability: Performance-based structures ensure Ferrovial is directly incentivized to deliver excellent and efficient services.

Ferrovial cultivates deep, long-term relationships with government entities through concession agreements, often spanning decades, built on transparency and shared goals. Strategic alliances with industry peers and financial institutions are vital for undertaking large-scale projects, as seen in their 2024 involvement in Spain's High Speed Rail Lot 2. Dedicated project teams ensure tailored solutions and consistent communication, fostering client satisfaction and successful project execution, as evidenced by their 2023 infrastructure division revenues of €7.4 billion.

Ferrovial's customer relationships are further solidified through performance-based contracts in operations and maintenance, with clear service level agreements (SLAs) that link compensation to achieving specific quality and efficiency metrics. This ensures accountability and aligns incentives with client expectations, with penalties often in place for missed targets, as observed in their 2023 maintenance contracts.

| Relationship Type | Key Characteristics | Examples/Data Points |

|---|---|---|

| Concession Partnerships | Long-term (30-50 years), transparency, shared vision | Ongoing management of key infrastructure projects (2023) |

| Strategic Alliances & JVs | Collaboration, risk distribution, capability leveraging | High Speed Rail Lot 2 project (2024) |

| Dedicated Project Teams | Direct communication, customized solutions, swift response | Supported €7.4 billion infrastructure division revenue (2023) |

| Performance-Based Contracts | Service Level Agreements (SLAs), KPIs, penalties for non-compliance | Penalties for missed response times/uptime targets in maintenance contracts (2023) |

Channels

Ferrovial secures the majority of its new infrastructure projects by actively engaging in competitive public bidding and tender processes. These are typically organized by national, regional, and local government bodies or public sector agencies.

This direct participation in tenders is the cornerstone of Ferrovial's strategy for acquiring new concession agreements and substantial construction contracts for large-scale infrastructure development.

Success in these competitive tenders hinges on submitting highly robust and compelling proposals, backed by a proven history of successful project delivery and a strong reputation. For instance, in 2024, Ferrovial was awarded a €1.2 billion contract for the construction of a new section of the M-50 ring road in Madrid through a public tender process.

Ferrovial frequently engages in strategic partnerships and consortia to tackle massive infrastructure projects. This collaborative approach allows them to pool specialized knowledge and financial resources, increasing their ability to win bids and deliver complex undertakings. For instance, in 2024, Ferrovial was part of consortia awarded significant contracts, such as the expansion of a major highway in Texas, demonstrating the ongoing importance of these alliances in securing large-scale work.

Ferrovial actively cultivates relationships with the financial community, including institutional investors, analysts, and banks, via its dedicated investor relations team. This engagement is vital for securing the necessary capital to fuel its growth and strategic initiatives.

The company utilizes financial reports and roadshows to communicate its performance and strategic vision, fostering market confidence. Ferrovial's listing on the Nasdaq exchange in early 2024, for instance, was a significant event aimed at broadening its investor base and enhancing its visibility in key global markets.

These channels are instrumental in attracting investment and maintaining a strong market perception. For example, as of the first quarter of 2024, Ferrovial reported a significant increase in revenue, underscoring the positive reception of its strategic direction by the financial sector.

Industry Conferences and Associations

Ferrovial actively participates in key industry gatherings like the International Road Federation (IRF) World Meeting and the American Association of State Highway and Transportation Officials (AASHTO) Annual Meeting. These events are crucial for networking, allowing Ferrovial to connect with potential clients and partners, and to showcase its expertise in infrastructure development and management. In 2024, the company leveraged these platforms to highlight its advancements in sustainable construction and digital solutions for transportation networks.

Membership in professional associations such as the European Construction Industry Federation (FIEC) and the American Society of Civil Engineers (ASCE) provides Ferrovial with valuable insights into evolving regulations and best practices. These affiliations enable the company to stay ahead of industry trends, influence policy, and identify emerging markets. For instance, Ferrovial's engagement with FIEC in 2024 contributed to discussions on the future of green building materials and circular economy principles within the construction sector.

- Industry Conferences: Ferrovial's presence at events like the Global Infrastructure Summit in 2024 facilitated discussions on major project pipelines and investment opportunities, particularly in renewable energy infrastructure.

- Trade Shows: Exhibiting at specialized trade shows, such as the Intertraffic Amsterdam, allowed Ferrovial to demonstrate its latest intelligent transport systems and secure new contracts.

- Professional Associations: Membership in associations like the International Tunneling Association (ITA) helps Ferrovial maintain its technical edge and collaborate on research and development for complex underground projects.

- Networking and Business Development: These channels are vital for identifying new business opportunities and strengthening relationships with existing stakeholders, contributing to Ferrovial's global expansion strategy.

Digital Platforms and Corporate Website

Ferrovial's corporate website and digital platforms are central to its communication strategy, offering a comprehensive view of its operations. These channels effectively share details on ongoing projects, financial performance, and commitments to sustainability and innovation. For instance, in 2024, Ferrovial continued to update its investor relations section with quarterly reports and presentations, ensuring timely access to key financial data for stakeholders.

These online presences function as a vital conduit for engaging with a broad audience, including investors, media representatives, prospective employees, and the wider public. They are instrumental in fostering transparency and facilitating effective corporate dialogue. The company's newsroom, updated regularly, provides press releases and media kits, supporting transparent reporting.

- Corporate Website: Serves as the primary hub for all company information, including project portfolios, financial reports, and sustainability initiatives.

- Newsroom: Disseminates official company announcements, press releases, and media-related content, ensuring timely updates for journalists and the public.

- Digital Platforms: Encompass social media channels and other online tools used for broader stakeholder engagement and brand building.

- Information Dissemination: Key to sharing project progress, financial results, and strategic updates, enhancing corporate transparency.

Ferrovial's channels for engaging with the financial community are multifaceted, encompassing direct investor relations, participation in industry events, and robust digital communication. These efforts are designed to attract capital, maintain market confidence, and communicate its strategic direction effectively. The company's listing on the Nasdaq in early 2024 highlights its commitment to broadening its investor base and enhancing global visibility.

Key channels include active participation in industry conferences and trade shows, where Ferrovial showcases its expertise and identifies new opportunities. Membership in professional associations further allows the company to stay abreast of regulatory changes and industry best practices. These engagements are crucial for fostering partnerships and securing new contracts, as evidenced by its €1.2 billion Madrid M-50 contract win in 2024 through public bidding.

Ferrovial's corporate website and newsroom serve as central hubs for disseminating information about projects, financial performance, and sustainability efforts. These digital platforms are vital for engaging with a wide audience, ensuring transparency, and facilitating corporate dialogue. As of Q1 2024, the company reported a significant revenue increase, reflecting positive market reception.

| Channel | Purpose | 2024 Example/Data |

|---|---|---|

| Public Bidding & Tenders | Securing infrastructure contracts | Awarded €1.2 billion M-50 Madrid contract |

| Strategic Partnerships | Pooling resources for large projects | Involved in Texas highway expansion consortium |

| Investor Relations & Roadshows | Capital raising and market communication | Nasdaq listing in early 2024 |

| Industry Conferences (e.g., IRF, AASHTO) | Networking, showcasing expertise | Highlighted sustainable construction at events |

| Professional Associations (e.g., FIEC, ASCE) | Regulatory insights, best practices | Contributed to green building discussions |

| Corporate Website & Digital Platforms | Information dissemination, stakeholder engagement | Regularly updated investor relations section |

Customer Segments

National and regional governments are Ferrovial's most significant clients, entrusting the company with the development, financing, and operation of extensive transportation infrastructure. These public entities, from national ministries of transport to regional development agencies, commission major projects such as national highway systems and large-scale airport expansions. They rely on private sector partners like Ferrovial for specialized expertise and the substantial capital required for these critical public assets.

Ferrovial's business model is strategically aligned with the needs of these governmental bodies, particularly through its focus on long-term concessions. This approach allows governments to leverage private investment and management capabilities for infrastructure development while ensuring the assets are operated and maintained efficiently over extended periods. For instance, Ferrovial's involvement in projects like the NTE highway in Texas, a public-private partnership, exemplifies this relationship, where the government secures vital infrastructure while benefiting from private sector operational efficiency.

Ferrovial's municipal authority and local council segment focuses on delivering urban mobility, road improvements, and community infrastructure. These entities often seek customized solutions to tackle unique local issues and align with their existing urban development strategies.

For instance, in 2024, Ferrovial secured contracts for various local road maintenance and public transport upgrades across several European municipalities, demonstrating its commitment to connecting communities at a granular level. These projects often involve integrating new public transport routes or enhancing pedestrian and cycling infrastructure, directly impacting daily life for residents.

Public agencies and concessionaires represent a crucial customer segment for Ferrovial, particularly in its infrastructure and mobility divisions. These entities, often public-private partnerships or government bodies, contract Ferrovial for the development, construction, and long-term operation of major infrastructure projects, such as toll roads, airports, and rail networks. Ferrovial’s role can range from a primary contractor to a co-investor, leveraging its extensive engineering and project management capabilities.

In 2024, Ferrovial continued to secure and manage significant concessions. For example, its involvement in the Texas State Highway 130 (SH 130) toll road in the US demonstrates its commitment to this segment. This concession, extending for decades, highlights the long-term revenue streams generated from such partnerships. The company’s ability to offer integrated solutions, from design and build to operations and maintenance, makes it an attractive partner for public sector clients seeking reliable infrastructure delivery.

Private Sector Developers and Corporations

Ferrovial's construction division also caters to private sector developers and corporations, offering specialized infrastructure solutions. This segment is crucial for projects like private airport terminals or bespoke logistics facilities, where Ferrovial's expertise in complex construction is leveraged.

While Ferrovial's core often lies in public infrastructure, its engagement with the private sector is strategic. For instance, in 2024, the company continued to secure contracts for private infrastructure projects, demonstrating its adaptability. This includes contributing to the development of specialized industrial parks and corporate campuses that require advanced engineering and construction capabilities.

- Private Airport Terminals: Ferrovial's construction arm has experience in developing and upgrading private terminals at airports, enhancing passenger experience and operational efficiency.

- Logistics Infrastructure: The company undertakes projects for specialized logistics hubs and distribution centers, crucial for supply chain optimization for corporations.

- Corporate Campus Development: Ferrovial provides construction services for large-scale corporate headquarters and campuses, integrating advanced building technologies.

- Public-Private Partnerships (PPPs): While not exclusively private, Ferrovial actively participates in PPPs that often involve private sector developers, bridging public needs with private investment and expertise.

Institutional Investors and Equity Partners

Institutional investors and equity partners, while not direct service customers, are vital stakeholders for Ferrovial. The company offers them compelling investment prospects in durable, predictable infrastructure projects. Ferrovial's commitment to delivering robust returns and effectively mitigating risks forms the core of its value proposition to this segment.

These partners are drawn to Ferrovial's track record and its strategic focus on high-quality, long-term assets. For instance, as of late 2024, Ferrovial's significant investments in projects like the expansion of the Port of Melbourne, a critical Australian logistics hub, demonstrate the kind of stable, revenue-generating opportunities that appeal to institutional capital.

- Investment Opportunities: Ferrovial provides access to large-scale, essential infrastructure projects with predictable cash flows.

- Risk Management: The company's expertise in managing complex projects and regulatory environments is a key attraction.

- Return Generation: Ferrovial aims to deliver attractive, long-term returns, appealing to the capital preservation and growth objectives of institutional investors.

- Strategic Alignment: Partnerships are often built on shared long-term visions for sustainable infrastructure development.

Ferrovial serves a diverse client base, with national and regional governments being paramount, entrusting the company with major infrastructure development and operation. Municipal authorities also rely on Ferrovial for localized urban mobility and road improvements, often seeking tailored solutions. Additionally, public agencies and concessionaires engage Ferrovial for long-term projects like toll roads and airports, valuing its integrated development and operational expertise.

The company also partners with private sector developers for specialized construction, such as private airport terminals and logistics facilities, showcasing its adaptability. Institutional investors and equity partners are attracted to Ferrovial's infrastructure projects as stable, long-term investment opportunities, drawn by its proven track record in managing complex assets and delivering returns.

| Customer Segment | Key Needs/Interests | Ferrovial's Offering | Example (2024 Focus) |

|---|---|---|---|

| National & Regional Governments | Large-scale infrastructure, public service delivery, long-term asset management | Development, financing, operation of highways, airports, rail | Securing concessions for major transport infrastructure projects |

| Municipal Authorities & Local Councils | Urban mobility, local road improvements, community infrastructure | Customized urban solutions, public transport upgrades, road maintenance | Contracts for local road maintenance and public transport enhancements |

| Public Agencies & Concessionaires | Long-term infrastructure operation, PPPs, reliable delivery | Integrated solutions for toll roads, airports, rail networks | Managing concessions like Texas SH 130, focusing on operational efficiency |

| Private Sector Developers & Corporations | Specialized construction, logistics facilities, corporate campuses | Expertise in complex infrastructure, advanced building technologies | Contracts for private industrial parks and corporate campus developments |

| Institutional Investors & Equity Partners | Stable returns, risk mitigation, access to infrastructure assets | Investment opportunities in durable, predictable infrastructure projects | Attracting capital for projects like Port of Melbourne expansion |

Cost Structure

Ferrovial's cost structure is heavily influenced by the expenses associated with constructing and executing infrastructure projects. These include substantial outlays for labor, raw materials like steel and concrete, and specialized heavy machinery. For instance, in 2023, Ferrovial's construction segment generated revenues of €11,406 million, indicating the scale of operations and the associated direct costs involved in delivering these large-scale projects.

Ferrovial's capital-intensive operations, particularly in infrastructure, mean financing and capital costs are significant. Interest payments on debt, equity financing, and other financial charges are a substantial part of their expenses. For instance, the JFK New Terminal One project, a major investment, highlights the importance of managing these costs effectively to ensure profitability.

Ferrovial's operation and maintenance expenses are a significant part of its cost structure, covering the ongoing upkeep of its infrastructure assets like toll roads and airports. These costs include essential elements such as staffing, energy consumption, regular maintenance, and necessary technology advancements. For instance, in 2023, Ferrovial reported operating expenses of €7,398 million, reflecting the substantial investment in keeping its diverse portfolio of assets in prime condition.

Effectively managing these operational expenditures is crucial for ensuring the long-term profitability of its concessions. By optimizing these costs, Ferrovial can enhance the financial returns generated over the lifespan of its infrastructure projects. The company's adoption of dynamic tolling systems is a strategic move to better align revenue generation with these ongoing operational costs, aiming for a more efficient and profitable asset management approach.

Personnel and Administrative Costs

Personnel and administrative costs are a significant part of Ferrovial's operational expenses, reflecting its large global workforce and diverse business activities. These costs encompass salaries, benefits, and ongoing training for employees across its infrastructure, mobility, and construction segments. In 2023, Ferrovial's personnel expenses amounted to €3,057 million, highlighting the substantial investment in its human capital.

Ferrovial's commitment to attracting and retaining top talent translates into considerable spending on employee well-being and professional development programs. These initiatives are crucial for maintaining operational excellence and fostering innovation across its worldwide operations. The company's focus on talent development is a key driver for its long-term success and competitive advantage.

- Global Workforce: Ferrovial employs a vast international team, necessitating significant expenditure on compensation and benefits.

- Talent Investment: The company allocates resources to training, development, and employee well-being to ensure a skilled and motivated workforce.

- 2023 Personnel Costs: Ferrovial reported €3,057 million in personnel expenses for the fiscal year 2023.

- Administrative Overhead: General administrative expenses supporting the global operations also form a substantial cost component.

Regulatory Compliance and Sustainability Investments

Ferrovial's cost structure includes significant outlays for regulatory compliance and sustainability. These expenses are driven by adherence to evolving environmental, social, and governance (ESG) standards, securing necessary permits, and investing in green technologies. For instance, in 2023, the company continued its focus on decarbonization, with sustainability initiatives representing a growing portion of operational expenditures.

These investments are crucial for maintaining Ferrovial's license to operate and aligning with stakeholder demands for responsible business practices. The company actively commits resources to reducing its carbon footprint, aiming for ambitious targets such as achieving net-zero emissions by 2050. This proactive approach also involves enhancing community impact through social programs and responsible resource management.

- Costs associated with meeting ESG regulations and obtaining permits.

- Investments in sustainable technologies and practices to reduce environmental impact.

- Expenditures on initiatives aimed at enhancing community engagement and social responsibility.

- Ongoing operational costs for monitoring and reporting on sustainability performance.

Ferrovial's cost structure is dominated by the substantial expenses tied to its core business of infrastructure development and concessions. These include significant capital expenditures for construction materials, labor, and equipment, alongside ongoing operational and maintenance costs for its diverse portfolio of assets like toll roads and airports.

Financing costs, driven by the capital-intensive nature of its projects and associated debt, represent another major component. Furthermore, personnel expenses, reflecting its global workforce and commitment to talent development, are a significant outlay.

| Cost Category | 2023 Expense (Millions EUR) | Key Drivers |

|---|---|---|

| Construction Costs | (Implied from Revenue) €11,406M | Labor, materials (steel, concrete), heavy machinery |

| Operating Expenses | €7,398M | Asset upkeep, staffing, energy, technology |

| Personnel Expenses | €3,057M | Salaries, benefits, training for global workforce |

| Financing Costs | (Significant, project-dependent) | Interest on debt, equity financing |

| Sustainability & Compliance | (Growing expenditure) | ESG standards, permits, green technologies |

Revenue Streams

Ferrovial's toll revenues from highways and express lanes, especially in North America, form a core part of its business. These earnings are directly tied to the usage of its concessioned infrastructure.

Dynamic pricing strategies are employed on many of these routes, adjusting tolls based on real-time traffic volume to maximize revenue. This approach helps ensure consistent cash flow even with fluctuating demand.

Key contributors to this revenue stream include assets like the 407 ETR in Ontario, Canada, and various express lane projects across the United States. For instance, in 2023, the 407 ETR alone generated over CAD 1.4 billion in revenue, demonstrating the significant financial impact of these concessions.

Ferrovial secures revenue through availability payments from public bodies for infrastructure like roads and hospitals. These are fixed sums paid for the asset's readiness, independent of usage, offering a steady income stream. For instance, in 2023, Ferrovial's infrastructure division, which includes these payment mechanisms, generated significant revenue, highlighting the stability these contracts provide.

Concession fees also contribute to Ferrovial's earnings. These fees can be paid by the end-users of the infrastructure or by governments, compensating Ferrovial for the privilege of operating certain assets. This dual approach ensures diverse revenue generation, bolstering financial predictability.

Ferrovial generates substantial revenue through its construction arm, primarily from contracts to build new infrastructure and upgrade existing ones. This includes work for its own concession projects as well as for external clients.

The company earns fees for comprehensive Engineering, Procurement, and Construction (EPC) services, covering the entire project lifecycle. In 2023, Ferrovial's construction business was a major revenue driver, reflecting its significant role in the company's financial performance.

Dividends from Equity Investments in Infrastructure Assets

Ferrovial generates significant revenue through dividends derived from its equity investments in a diverse portfolio of infrastructure assets. These are typically long-term holdings, such as airports and toll roads, where Ferrovial holds a substantial stake. The dividends received are a direct return on these capital-intensive investments and play a crucial role in the company's overall financial health.

These dividend payments are a consistent income stream, reflecting the operational performance and profitability of the underlying infrastructure. For instance, Ferrovial has historically benefited from dividends originating from its North American infrastructure assets, underscoring the geographic diversification of its revenue sources within this category.

- Dividend Income: Ferrovial receives substantial dividends from its equity stakes in infrastructure assets like airports and toll roads.

- Return on Investment: These dividends represent direct returns on Ferrovial's long-term capital commitments in these essential infrastructure projects.

- Financial Performance Driver: Dividend income is a key component contributing to Ferrovial's overall financial results and profitability.

- Geographic Diversification: Recent reports highlight dividends from North American assets as a significant contributor, showcasing geographic spread.

Revenue from Airport Operations and Services

Ferrovial's airport operations are a significant revenue engine, drawing income from passenger fees, charges levied on airlines, and lucrative retail concessions. This diversified approach means revenue is directly tied to the number of travelers and the commercial vibrancy of the airport environment.

The company's involvement in major projects, such as managing JFK's New Terminal One, highlights its capacity to generate substantial revenue from large-scale airport infrastructure. These operations are crucial for Ferrovial's financial performance, reflecting global travel trends.

- Passenger Fees: Revenue generated directly from individuals using the airport facilities.

- Airline Charges: Fees collected from airlines for services like landing, parking, and passenger handling.

- Retail Concessions: Income from leasing space to shops, restaurants, and other commercial outlets within the airport.

- Ancillary Services: Revenue from parking, car rentals, advertising, and other supplementary services.

Ferrovial's revenue streams are multifaceted, encompassing toll road usage, construction contracts, and income from airport operations. These segments collectively contribute to a robust financial profile, with toll revenues, particularly from North America, forming a substantial base. For instance, the 407 ETR in Ontario alone generated over CAD 1.4 billion in 2023.

Availability payments from public entities for infrastructure readiness and concession fees also provide stable income. Furthermore, dividend income from equity investments in infrastructure assets, such as airports and toll roads, offers a consistent return, with North American assets being a notable source.

The company's construction division is a significant revenue generator, undertaking projects for both internal concessions and external clients, including comprehensive EPC services. Airport operations contribute heavily through passenger and airline fees, alongside retail concessions, as seen in major projects like JFK's New Terminal One.

| Revenue Stream | Key Drivers | 2023 Contribution (Illustrative) |

|---|---|---|

| Toll Road Usage | Traffic volume, dynamic pricing | CAD 1.4 billion (407 ETR alone) |

| Construction Services | Project pipeline, EPC contracts | Significant contributor to overall revenue |

| Airport Operations | Passenger numbers, retail sales, airline charges | Major revenue engine, linked to travel trends |

| Availability Payments | Infrastructure readiness, public contracts | Provides stable, usage-independent income |

| Dividend Income | Equity stakes in infrastructure assets | Consistent return on capital investments |

Business Model Canvas Data Sources

The Ferrovial Business Model Canvas is constructed using a blend of internal financial data, extensive market research, and strategic insights derived from industry analysis. These diverse data sources ensure that each component of the canvas is grounded in empirical evidence and actionable intelligence.