Ferrovial Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ferrovial Bundle

Ferrovial's marketing strategy is a masterclass in infrastructure development, blending innovative product offerings with strategic pricing and extensive distribution networks. Their promotional efforts effectively communicate their commitment to sustainability and technological advancement.

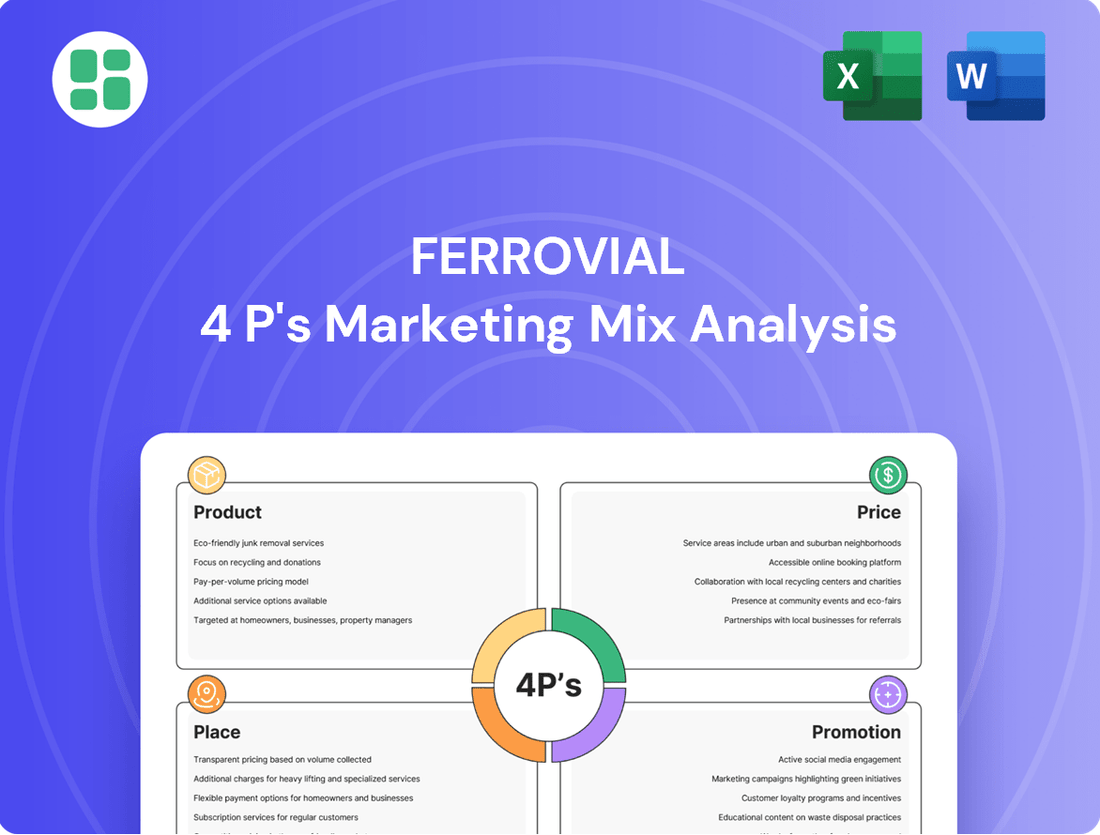

Go beyond the basics—get access to an in-depth, ready-made Marketing Mix Analysis covering Ferrovial's Product, Price, Place, and Promotion strategies. Ideal for business professionals, students, and consultants looking for strategic insights into a global leader.

Product

Ferrovial's product in highways and toll roads encompasses the full spectrum of development and operation, from initial promotion and investment to long-term management. This integrated approach ensures efficient and sustainable mobility solutions across the entire project lifecycle.

The company targets high-concession-value projects, with a strategic emphasis on managed lanes, particularly in lucrative U.S. markets. For instance, Ferrovial recently secured a contract for the I-66 Outside the Beltway project in Virginia, a significant undertaking that highlights their focus on this segment.

In 2024, Ferrovial's infrastructure portfolio, including highways, continued to demonstrate robust performance. The company reported strong revenue growth from its toll road concessions, reflecting successful project execution and increasing traffic volumes in key operational areas.

Ferrovial's investment and management of airport infrastructure directly addresses the Product element of its marketing mix by developing, constructing, and operating vital global hubs. This commitment enhances worldwide connectivity and fuels economic growth. For instance, Ferrovial's significant involvement in the New Terminal One at JFK International Airport, a project valued in the billions, showcases its dedication to modernizing and expanding key aviation assets.

Ferrovial is actively broadening its reach beyond traditional infrastructure, venturing into comprehensive mobility and urban infrastructure solutions to address evolving transportation needs. This strategic expansion anticipates future demands by developing innovative projects that fuse diverse transport modes with smart city technologies, ultimately aiming to enhance urban living.

The company's commitment to this sector is underscored by significant investments and project wins. For instance, Ferrovial's involvement in smart city initiatives, such as the development of intelligent traffic management systems and sustainable urban mobility plans, reflects a forward-looking approach. In 2024, Ferrovial secured contracts for projects valued in the hundreds of millions of euros, focusing on integrated transport networks and digital solutions designed to optimize urban flow and connectivity.

Ferrovial's vision for mobility and urban infrastructure is centered on creating seamless, integrated solutions that connect communities more effectively. This includes leveraging digital platforms and data analytics to manage traffic, improve public transport efficiency, and promote sustainable transportation options, thereby fostering more livable and efficient urban environments.

Integrated Construction Services

Ferrovial's Integrated Construction Services offer a comprehensive design and build capability for major civil engineering, building, and industrial projects. This division is instrumental in supporting the company's concession business by ensuring high-quality and efficient execution across the entire project lifecycle. By controlling these aspects, Ferrovial delivers superior engineering for its infrastructure assets, a strategy that has proven highly effective.

This integrated approach has yielded significant commercial success. As of early 2025, Ferrovial's construction order book reached an all-time high, underscoring the strong demand for their end-to-end project delivery capabilities. This robust pipeline reflects confidence in their ability to manage complex infrastructure development.

- Design and Construction: Expertise in large-scale civil engineering, building, and industrial projects.

- Concession Support: Crucial role in enabling and enhancing Ferrovial's concession operations.

- Quality and Efficiency Control: Management of the entire project lifecycle for best-in-class engineering.

- Record Order Book: Achieved an all-time high order book in early 2025, indicating strong market demand.

Sustainable & Digital Infrastructure Innovation

Ferrovial's product strategy heavily features sustainable and digital infrastructure innovation. This involves developing assets that are environmentally sound and incorporating digital technologies to boost efficiency and value. The company is actively pursuing new ventures in renewable energy, electrification, and water management.

This focus is backed by concrete actions and targets. For instance, Ferrovial's 2023-2025 strategic plan highlights a commitment to decarbonization, aiming for a 30% reduction in Scope 1 and 2 emissions by 2030 compared to 2019. They are investing in digital solutions like predictive maintenance and real-time monitoring to improve asset performance and safety across their portfolio.

Key initiatives include:

- Investment in Renewable Energy Projects: Ferrovial is expanding its presence in solar and wind power generation, contributing to a cleaner energy mix.

- Digitalization of Operations: Implementation of IoT sensors and data analytics platforms to optimize asset management and enhance operational safety.

- Water Infrastructure Development: Focus on sustainable water solutions, including desalination and wastewater treatment, addressing growing global water scarcity.

- Commitment to Decarbonization Targets: Aligning infrastructure development with ambitious climate goals, evident in their 2030 emission reduction objectives.

Ferrovial's product offering spans the entire lifecycle of infrastructure, from initial design and construction to long-term operation and management. This integrated approach is particularly evident in their highways and toll road concessions, where they focus on high-value projects like managed lanes, as seen with the I-66 Outside the Beltway project in Virginia. Their airport infrastructure development, including significant involvement in the New Terminal One at JFK International Airport, further demonstrates their commitment to creating vital global hubs that enhance connectivity and drive economic growth.

The company is also proactively expanding into comprehensive mobility and urban infrastructure solutions, integrating diverse transport modes with smart city technologies. This forward-looking strategy is supported by substantial investments, with Ferrovial securing contracts for smart city projects valued in the hundreds of millions of euros in 2024, focusing on integrated transport networks and digital solutions to optimize urban flow.

Ferrovial's product strategy is deeply rooted in sustainable and digital innovation, encompassing renewable energy, electrification, and water management. Their 2023-2025 strategic plan emphasizes decarbonization, targeting a 30% reduction in Scope 1 and 2 emissions by 2030. They are actively investing in digital solutions like predictive maintenance and real-time monitoring to enhance asset performance and safety across their portfolio.

| Product Area | Key Initiatives/Projects | Financial/Performance Data (2024/Early 2025) |

|---|---|---|

| Highways & Toll Roads | Managed lanes, I-66 Outside the Beltway (Virginia) | Strong revenue growth from toll road concessions in 2024. |

| Airport Infrastructure | New Terminal One at JFK International Airport | Billions invested in key aviation asset modernization. |

| Mobility & Urban Infrastructure | Smart city initiatives, intelligent traffic management | Contracts secured in 2024 valued in hundreds of millions of euros. |

| Sustainable & Digital Infrastructure | Renewable energy, water management, digitalization | Record order book for construction services in early 2025. |

What is included in the product

This analysis offers a comprehensive breakdown of Ferrovial's marketing mix, detailing its Product, Price, Place, and Promotion strategies with real-world examples and strategic implications.

It's designed for professionals seeking a deep understanding of Ferrovial's marketing positioning, providing a solid foundation for benchmarking and strategic planning.

This analysis streamlines Ferrovial's marketing strategy by clarifying how Product, Price, Place, and Promotion address customer pain points, making complex decisions more manageable.

Place

Ferrovial's global project acquisition strategy centers on securing large-scale infrastructure opportunities, particularly in North America. The company actively participates in competitive bidding processes for critical projects like roadway upgrades, bridge construction, and water infrastructure development. In 2023, Ferrovial secured key wins in the US, including a significant portion of the $1.5 billion I-70 East project in Colorado, demonstrating their commitment to this vital market.

Ferrovial’s strategic geographic presence is a cornerstone of its global infrastructure operations. The company boasts a substantial operational footprint across key markets, including the United States, Canada, the United Kingdom, Spain, Poland, Chile, Colombia, and Peru.

North America stands out as the most critical region for Ferrovial, significantly contributing to its EBITDA. For instance, in the first half of 2024, North America represented approximately 60% of the company's total EBITDA, underscoring its strategic importance.

Ferrovial actively explores expansion into new markets, with a particular focus on Asia and Latin America. This forward-looking approach aims to diversify revenue streams and capitalize on emerging infrastructure development opportunities in these dynamic regions.

Ferrovial’s strategic use of Public-Private Partnerships (PPPs), especially within the United States, forms a cornerstone of its distribution and market access. These collaborations enable Ferrovial to secure large-scale infrastructure projects, leveraging private sector expertise and capital to deliver public services. For instance, Ferrovial was a key player in the $3.9 billion I-77 Express project in North Carolina, a significant PPP that showcases their capability in managing complex, long-term infrastructure development.

Long-Term Concession Agreements

Ferrovial's long-term concession agreements are the cornerstone of its market placement strategy for infrastructure assets. These agreements, often spanning 30 to 50 years, dictate how the company operates and generates revenue, effectively securing its position in the market for extended periods.

These concessions are crucial for ensuring a predictable and stable revenue stream, which is vital for long-term value creation and investment planning. For instance, Ferrovial's involvement in projects like the M-30 highway in Madrid or the Heathrow Airport in the UK exemplifies how these agreements provide a consistent revenue base over decades.

The financial benefits are substantial, with concessions providing the visibility needed for significant capital investment and future growth. As of early 2024, Ferrovial's portfolio of concessions continues to be a key driver of its financial performance, contributing significantly to its overall revenue and profitability.

- Secured Revenue Streams: Concessions provide predictable income over many years, reducing revenue volatility.

- Long-Term Value Creation: Stable operating environments allow for sustained investment and asset development.

- Market Dominance: Securing concessions often grants exclusive or primary rights to operate key infrastructure.

- Risk Mitigation: Long-term contracts can offer protection against short-term market fluctuations.

Direct Client & Government Engagement

Ferrovial's direct engagement strategy is paramount, focusing on securing major infrastructure projects through partnerships with government entities and public bodies. This approach is vital for navigating the complexities of large-scale development and ensuring regulatory adherence. For instance, in 2024, Ferrovial secured significant contracts for public transport infrastructure in various European cities, underscoring the importance of these direct relationships.

The company's investor relations and corporate governance frameworks are meticulously designed to foster trust and transparency with these key stakeholders. This includes clear communication regarding project progress, financial performance, and adherence to environmental and social governance (ESG) standards, which are increasingly critical for government tenders and long-term partnerships.

- Focus on Public Sector Contracts: Ferrovial's business model heavily relies on winning bids for public infrastructure, such as toll roads, airports, and public transport networks, directly from government agencies.

- Regulatory Compliance and Relationship Management: Direct engagement facilitates understanding and adherence to complex regulatory frameworks and builds the essential long-term relationships needed for sustained project pipelines.

- Investor and Stakeholder Transparency: Ferrovial prioritizes clear communication with its investors and government partners, detailing project execution, financial health, and commitment to ESG principles, as evidenced by its 2024 annual reports highlighting strong stakeholder engagement metrics.

- Securing Future Projects: Successful direct engagement in current projects directly influences Ferrovial's ability to secure future government contracts, creating a feedback loop for business growth.

Ferrovial's physical presence is strategically distributed across key global markets, with a pronounced emphasis on North America. This geographic concentration is not merely about location but about accessing and dominating vital infrastructure development hubs. The company's operational footprint extends across the United States, Canada, the United Kingdom, Spain, Poland, Chile, Colombia, and Peru, ensuring a broad yet focused reach.

North America is the powerhouse for Ferrovial, contributing a substantial portion of its earnings. In the first half of 2024, this region accounted for approximately 60% of the company's total EBITDA, highlighting its critical importance to Ferrovial's financial health and growth strategy.

Ferrovial's market placement is heavily influenced by long-term concession agreements, often spanning 30 to 50 years. These agreements dictate operational terms and revenue generation, effectively securing Ferrovial's position in vital infrastructure sectors for extended periods. This strategy ensures predictable revenue streams, crucial for long-term value creation and investment planning.

The company's direct engagement with public sector entities is a cornerstone of its market access. By partnering with government bodies, Ferrovial secures large-scale infrastructure projects, demonstrating a commitment to public service delivery through private sector expertise. This direct approach, exemplified by securing public transport contracts in various European cities in 2024, is vital for navigating regulatory landscapes and building enduring relationships.

| Region | EBITDA Contribution (H1 2024) | Key Projects (Examples) |

|---|---|---|

| North America | ~60% | I-70 East (Colorado), I-77 Express (North Carolina) |

| United Kingdom | Significant | Heathrow Airport (concession) |

| Spain | Significant | M-30 Highway (concession) |

Full Version Awaits

Ferrovial 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Ferrovial 4P's Marketing Mix Analysis is fully complete and ready for immediate use. You're viewing the exact version of the analysis you'll receive, ensuring you get precisely what you need.

Promotion

Ferrovial actively cultivates its corporate reputation as a global leader in sustainable infrastructure, a key element in its marketing mix. This focus is evident in its consistent emphasis on Environmental, Social, and Governance (ESG) principles, prominently featured in its integrated annual reports. For instance, in 2023, Ferrovial reported a 20% reduction in Scope 1 and 2 greenhouse gas emissions compared to its 2019 baseline, underscoring its commitment to sustainability.

This strong, positive reputation is instrumental in securing new project bids and fostering enduring trust among investors, customers, and the wider community. In 2024, the company secured a significant contract for the development of a new high-speed rail line in Texas, a testament to its recognized expertise and commitment to responsible development.

Ferrovial actively participates in and contributes to key industry conferences, solidifying its position as a thought leader in infrastructure, mobility, and sustainability. This strategic engagement allows the company to highlight its expertise and share forward-looking insights.

These platforms are crucial for building B2B relationships and expanding market influence, enabling Ferrovial to connect with potential partners and clients. For instance, participation in events like the International Transport Forum (ITF) Summit provides visibility and networking opportunities.

Ferrovial actively engages with media to highlight its achievements, such as securing a significant €1.1 billion contract for the M-30 ring road maintenance in Madrid during 2024. This proactive approach ensures stakeholders are informed about its financial health and strategic direction, fostering trust and transparency.

The company's commitment to open communication is evident through its consistent press releases detailing key project wins and robust financial reporting. For instance, Ferrovial reported a 10.7% increase in revenue for the first quarter of 2024, reaching €2,121 million, a fact widely disseminated through its media channels.

Stakeholder Relationship Management

Ferrovial's promotion strategy heavily emphasizes stakeholder relationship management, crucial for maintaining trust and support across diverse groups. This involves proactive engagement with investors, government bodies, and local communities, ensuring they are well-informed about the company's operations and impact.

Key promotional activities include transparent financial reporting, investor calls, and direct communication channels. These efforts aim to clearly articulate Ferrovial's performance, strategic direction, and its contributions to society. For instance, in 2023, Ferrovial reported revenues of €8,530 million, demonstrating its substantial economic footprint.

- Investor Relations: Regular investor calls and detailed annual reports, such as the one detailing their 2023 financial results, are vital for transparency.

- Government Engagement: Maintaining open dialogue with government entities is essential for securing infrastructure projects and navigating regulatory landscapes.

- Community Outreach: Direct communication and engagement with local communities affected by projects foster goodwill and social license to operate.

- Shareholder Meetings: Annual General Meetings serve as a platform for direct interaction and information dissemination to shareholders.

Digital Presence and Sustainability Reporting

Ferrovial leverages its robust digital presence, including its corporate website and active social media channels, to communicate its activities and engage stakeholders. This digital infrastructure is key to disseminating information about its projects and corporate strategy.

The company's commitment to transparency is evident in its online availability of detailed sustainability reports and integrated annual reports. These documents are vital promotional assets, highlighting Ferrovial's dedication to environmental, social, and governance (ESG) principles and its strategy for sustainable growth.

- Digital Engagement: Ferrovial's website and social media platforms are central to its communication strategy, reaching a broad audience with updates on its global operations and strategic initiatives.

- Sustainability Reporting: The company's comprehensive sustainability reports, readily accessible online, serve as powerful promotional tools, underscoring its commitment to responsible business practices.

- Investor Relations: Ferrovial's investor relations portal provides crucial data and insights, facilitating informed decision-making for the financial community and showcasing long-term value creation.

- Online Accessibility: The availability of integrated annual reports online ensures broad access to the company's financial performance and sustainability efforts, reinforcing its commitment to transparency.

Ferrovial's promotional efforts center on building a strong reputation as a sustainable infrastructure leader, utilizing ESG principles and transparent reporting. This focus is crucial for securing new projects and maintaining stakeholder trust, as demonstrated by their 2023 emissions reduction of 20% against a 2019 baseline.

The company actively engages in thought leadership through industry conferences and media outreach, highlighting achievements like the €1.1 billion M-30 ring road maintenance contract secured in 2024. This consistent communication reinforces their financial health and strategic direction, fostering transparency and trust among investors and the public.

Ferrovial's digital presence, including its website and social media, plays a key role in disseminating information about its global operations and strategic initiatives, such as its Q1 2024 revenue increase of 10.7% to €2,121 million.

These promotional activities, including robust investor relations and community engagement, are vital for maintaining support and demonstrating the company's commitment to responsible growth and long-term value creation.

| Promotional Activity | Key Focus | Example/Data Point |

|---|---|---|

| Corporate Reputation Building | Sustainability & ESG Leadership | 20% reduction in Scope 1 & 2 GHG emissions (2023 vs. 2019 baseline) |

| Thought Leadership | Industry Conferences & Media | Secured €1.1 billion M-30 ring road maintenance contract (2024) |

| Digital Engagement | Website & Social Media Communication | Q1 2024 Revenue: €2,121 million (+10.7%) |

| Stakeholder Relations | Transparency & Direct Communication | 2023 Revenue: €8,530 million |

Price

Ferrovial's pricing for its infrastructure assets, like toll roads, hinges on long-term concession agreements. Revenue streams are directly tied to the tolls collected from users, reflecting a patient, infrastructure-focused investment approach.

Dynamic pricing is a key element, allowing Ferrovial to adjust toll rates based on real-time traffic volume and demand. This strategy aims to maximize revenue capture while also incentivizing off-peak travel, thereby helping to manage congestion on its networks.

The company balances revenue optimization with a strong emphasis on cost efficiency. For instance, in 2023, Ferrovial reported €7.1 billion in revenue, with a significant portion derived from its toll road operations, underscoring the effectiveness of its pricing and operational models.

Ferrovial's approach to project pricing is deeply embedded in complex, long-term financing structures. Instead of a simple price tag, the cost is spread over decades via user tolls, availability payments from governments, or other contractual revenue streams, reflecting the substantial upfront capital required for infrastructure development.

The company actively diversifies its funding sources, attracting capital from a broad investor base and increasingly utilizing green bonds to finance sustainable infrastructure. For instance, in 2023, Ferrovial raised €500 million through its inaugural green bond issuance, earmarked for projects with environmental benefits.

Investment decisions are guided by stringent criteria, prioritizing projects that offer robust returns and consistent, predictable cash generation over their lifecycle, ensuring financial viability and shareholder value.

Ferrovial frequently wins infrastructure projects through competitive bidding. The price submitted is a careful balance of estimated project costs, potential risks, and desired profit margins, all while remaining competitive enough to secure the contract.

For instance, in 2024, Ferrovial secured a significant contract for the construction of a new high-speed rail line in Spain, a process heavily influenced by the pricing strategy presented. This approach ensures their bids are both attractive to clients and aligned with their financial objectives.

A strong existing project pipeline, as evidenced by Ferrovial's substantial backlog in late 2023 and early 2024, enables the company to be more selective in the tenders it pursues, focusing on those offering the best risk-reward profile.

Value-Based Pricing for Integrated Solutions

Ferrovial utilizes value-based pricing for its integrated infrastructure solutions, aligning costs with the long-term benefits delivered to clients. This strategy emphasizes the enhanced connectivity, reduced travel times, and improved safety that its projects provide, ultimately maximizing the operational value of assets.

This approach considers the total economic value generated over the asset's lifecycle, not just initial construction costs. For instance, in a major highway concession, the pricing reflects projected toll revenues, reduced maintenance needs due to advanced materials, and the economic stimulus from improved transportation efficiency.

- Value Proposition: Pricing reflects improved connectivity, reduced travel times, and enhanced safety for end-users.

- Lifecycle Focus: Aims to maximize the long-term value and efficiency of operating infrastructure assets.

- Client Benefits: Pricing is tied to tangible economic advantages and operational efficiencies gained by clients.

Risk-Adjusted Returns & Shareholder Remuneration

Ferrovial's approach to risk-adjusted returns underpins its investment decisions, particularly in large-scale infrastructure. The company meticulously models potential returns against project risks, a crucial factor in its long-term strategy. This focus ensures that capital is deployed efficiently, aiming for sustainable growth even in complex environments.

This commitment to robust financial planning directly translates into shareholder remuneration. Ferrovial consistently aims to deliver value to its investors through various mechanisms. For instance, the company has historically maintained a policy of consistent dividend payments, reflecting confidence in its operational performance and future cash flows.

Further enhancing shareholder returns, Ferrovial has also engaged in share buyback programs. These initiatives reduce the number of outstanding shares, potentially increasing earnings per share and overall shareholder value. Such actions demonstrate a proactive management of capital and a dedication to rewarding investors.

- Risk-Adjusted Returns: Ferrovial prioritizes investments where projected returns adequately compensate for identified risks, a strategy crucial for long-term infrastructure viability.

- Shareholder Remuneration Focus: The company's financial strategy is geared towards enhancing shareholder value through consistent returns.

- Dividend Policy: Ferrovial has a track record of stable dividend distributions, providing a reliable income stream for investors.

- Share Buybacks: The company utilizes share repurchase programs to boost earnings per share and return capital to shareholders.

Ferrovial's pricing strategy for its infrastructure assets is deeply tied to long-term concession agreements and dynamic toll adjustments based on demand. The company's €7.1 billion revenue in 2023, largely from toll roads, highlights the success of this model.

Pricing reflects the total economic value delivered over an asset's lifecycle, not just initial costs, aiming to maximize operational value for clients. This is exemplified by their €500 million green bond issuance in 2023, funding sustainable projects and demonstrating a commitment to long-term, value-driven pricing.

Ferrovial secures projects through competitive bidding, balancing costs, risks, and desired profit margins, as seen in their 2024 high-speed rail contract win in Spain. This ensures bids are attractive and financially sound.

The company's pricing is also influenced by its focus on risk-adjusted returns and shareholder remuneration, including consistent dividends and share buyback programs, to enhance overall investor value.

| Metric | 2023 Value (€ billions) | Significance |

|---|---|---|

| Total Revenue | 7.1 | Demonstrates strong operational performance and effective pricing strategies. |

| Green Bond Issuance | 0.5 | Highlights commitment to sustainable financing and long-term value creation. |

4P's Marketing Mix Analysis Data Sources

Our Ferrovial 4P's Marketing Mix Analysis is built upon a foundation of official company disclosures, including annual reports and investor presentations, alongside comprehensive industry reports and competitive intelligence. This ensures a data-driven understanding of their product offerings, pricing strategies, distribution networks, and promotional activities.