Ferrovial PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ferrovial Bundle

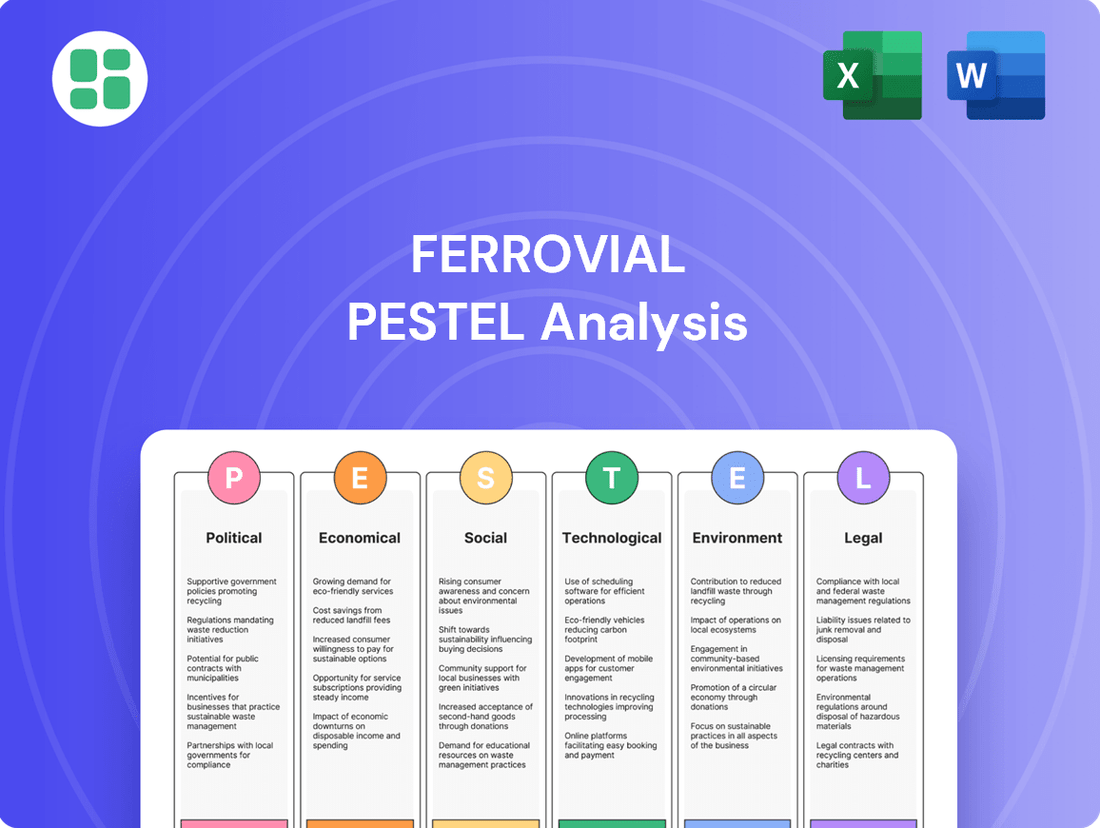

Navigate the complex external forces shaping Ferrovial's future with our comprehensive PESTEL Analysis. Understand the political, economic, social, technological, legal, and environmental factors that influence its operations and strategic decisions. Gain a competitive edge by leveraging these crucial insights for your own market strategy. Download the full version now for actionable intelligence.

Political factors

Government infrastructure spending is a cornerstone for companies like Ferrovial. Policies that prioritize public works directly translate into opportunities for large construction and maintenance contracts. For example, the U.S. Infrastructure Investment and Jobs Act, enacted in 2021, allocated $1.2 trillion to upgrade roads, bridges, and public transit, creating a robust pipeline for infrastructure firms.

This significant legislative push, with a substantial portion dedicated to infrastructure improvements through 2026, directly fuels the demand for public-private partnerships (PPPs). Ferrovial, with its expertise in managing and operating infrastructure, is well-positioned to secure these lucrative projects, thereby enhancing its revenue streams and market presence.

Political stability and clear, efficient regulatory frameworks are crucial for Ferrovial's long-term infrastructure ventures. Uncertainties in permitting, environmental approvals, or changes to concession agreements can lead to substantial delays and increased costs. For instance, the ongoing debate around infrastructure spending in the United States, a key market for Ferrovial's subsidiaries like Webber, highlights the potential for policy shifts impacting project timelines and profitability.

The global push towards privatization of public infrastructure, especially in transportation, creates significant avenues for Ferrovial. Many governments are looking to reduce their financial commitments and operational responsibilities by tendering concessions for both existing and new projects.

Ferrovial's proven track record in the end-to-end management of these large-scale, long-term assets, from initial development and financing to ongoing operation, aligns perfectly with this political trend. This strategic positioning allows Ferrovial to capitalize on opportunities arising from government divestment strategies, potentially securing lucrative contracts. For instance, in 2023, the UK government continued its program of asset sales, with infrastructure assets being a key focus, signaling ongoing opportunities for private sector involvement.

Geopolitical Risks and International Relations

Ferrovial's global operations mean it's susceptible to geopolitical shifts. For instance, ongoing trade tensions, particularly between major economic blocs, could impact supply chains for infrastructure projects and the cost of materials. Political instability in regions where Ferrovial has significant investments, such as certain parts of Latin America or the Middle East, can delay or even halt project development, directly affecting revenue streams and profitability.

Changes in international investment policies, like new regulations on foreign ownership or increased protectionism, can also pose challenges. For example, a country might introduce stricter local content requirements for infrastructure bids, making it harder for a multinational like Ferrovial to compete. The company's ability to navigate these evolving international relations and adapt its strategies is crucial for continued global growth and project success.

- Trade Disputes: Ongoing trade friction between the US and China, for example, could lead to increased tariffs on construction materials, raising project costs for Ferrovial.

- Political Instability: As of early 2025, several regions face heightened political uncertainty, potentially impacting the security of assets and the continuity of large-scale infrastructure contracts.

- Investment Policies: Shifts in foreign direct investment (FDI) policies, such as those seen in emerging markets seeking to prioritize domestic firms, can alter the competitive landscape for international contractors.

Public-Private Partnership (PPP) Frameworks

Ferrovial's reliance on Public-Private Partnerships (PPPs) is directly tied to governmental support. When governments actively promote private sector participation in infrastructure projects, it creates a fertile ground for Ferrovial's business. This willingness is often codified in legislation and financial incentives, making large-scale projects more feasible.

Favorable PPP frameworks are crucial. Clear legal structures and predictable financial arrangements significantly de-risk investments for companies like Ferrovial. This reduces uncertainty and makes projects more appealing, directly impacting Ferrovial's ability to secure and execute contracts. For instance, in 2023, Ferrovial secured a significant contract for the expansion of the I-66 highway in Virginia, a testament to the strength of the US PPP framework.

- Governmental support for PPPs directly influences Ferrovial's project pipeline.

- Clear legal and financial frameworks within PPPs reduce investment risk for Ferrovial.

- Ferrovial strategically targets markets with established and supportive PPP policies.

Governmental commitment to infrastructure development remains a primary driver for Ferrovial's growth. The continued emphasis on upgrading transportation networks and energy infrastructure across major economies, including the United States and European Union, directly translates into a robust pipeline of potential projects. For example, the EU's €800 billion NextGenerationEU recovery plan, with a significant portion allocated to green and digital transitions, includes substantial infrastructure components through 2027.

What is included in the product

This Ferrovial PESTLE analysis examines the impact of Political, Economic, Social, Technological, Environmental, and Legal factors on the company's operations and strategic planning.

It provides actionable insights into emerging trends and potential challenges within Ferrovial's global operating landscape.

A Ferrovial PESTLE analysis provides a structured framework to proactively identify and mitigate external threats, thereby alleviating potential business disruptions and enhancing strategic decision-making.

Economic factors

Global economic growth significantly shapes demand for infrastructure, directly impacting Ferrovial's business. For instance, the International Monetary Fund (IMF) projected global GDP growth of 3.2% for both 2024 and 2025, a slight moderation from 2023. This steady, albeit moderate, growth suggests continued, albeit not explosive, demand for the types of infrastructure Ferrovial develops and operates.

Higher economic activity translates to increased usage of Ferrovial's assets, such as toll roads and airports. When economies expand, people travel more for business and leisure, leading to higher traffic volumes and, consequently, greater revenue for the company. For example, robust economic recovery in key markets where Ferrovial operates would directly benefit its concessions.

Conversely, economic slowdowns pose risks to Ferrovial's profitability and project pipeline. A recession can curb consumer spending and business investment, reducing traffic and potentially delaying or canceling new infrastructure projects. Ferrovial's diversified geographic presence, spanning countries like the United States, Spain, and Australia, helps mitigate these risks by not being overly reliant on a single economy.

Inflationary pressures directly impact Ferrovial's operational costs. For instance, the rising cost of construction materials, such as steel and cement, coupled with increased labor expenses, can significantly squeeze profit margins on ongoing and future projects. The annual inflation rate in the Eurozone was 2.4% in May 2024, a slight decrease from previous months but still a factor to manage.

Rising interest rates present a dual challenge for Ferrovial. Higher borrowing costs make financing new, large-scale infrastructure projects more expensive, potentially delaying investment decisions. Furthermore, servicing existing debt becomes costlier, impacting the company's financial flexibility. The European Central Bank's key interest rates remained at 3.75% as of June 2024, reflecting a sustained higher cost of capital.

Ferrovial, as a global infrastructure and transport operator, faces significant exposure to foreign exchange rate fluctuations. With operations spanning multiple continents and revenues generated in various currencies like the US Dollar, Pound Sterling, and Canadian Dollar, the company's reported financial results can be materially impacted by currency volatility. For instance, a strengthening Euro against these currencies would reduce the Euro-equivalent value of its foreign earnings.

These fluctuations directly affect the translation of international earnings into Ferrovial's reporting currency, the Euro. A weaker US Dollar, for example, would mean that dollar-denominated profits translate into fewer Euros, potentially dampening overall profitability. This impact was evident in 2023, where currency movements contributed to a mixed performance in reported earnings across different segments.

To manage this inherent risk, Ferrovial employs hedging strategies, such as forward contracts and options, to lock in exchange rates for anticipated transactions. Furthermore, its diversified geographical presence and revenue streams across various currencies naturally provide a degree of natural hedging, mitigating the impact of adverse movements in any single currency pair.

Public and Private Investment Levels

The level of public and private investment in infrastructure is a critical economic factor for Ferrovial. Governments worldwide are increasingly relying on private capital to fund major projects, especially in light of fiscal constraints. For instance, the European Union's Recovery and Resilience Facility, a significant post-pandemic investment program, aims to channel substantial funds into infrastructure, presenting opportunities for companies like Ferrovial.

However, shifts in government spending priorities or austerity measures can directly affect the pipeline of public infrastructure projects. Similarly, changes in investor sentiment towards long-term, capital-intensive assets, such as infrastructure, can impact Ferrovial's ability to secure private financing for new concessions and expansion. The company actively works to attract a broad spectrum of investors, from pension funds to infrastructure-focused private equity, to ensure robust project funding.

- Government Infrastructure Spending: In 2024, many OECD countries are expected to maintain or increase infrastructure investment, driven by climate adaptation and digital transformation needs. For example, the United States' Bipartisan Infrastructure Law continues to unlock significant project funding.

- Private Capital Flows: Global infrastructure investment by private entities reached an estimated $1.2 trillion in 2024, with a growing interest in renewable energy and digital infrastructure.

- Investor Appetite: Infrastructure funds saw net inflows of over $100 billion in 2024, indicating sustained investor confidence in the sector's long-term stability and returns.

- Ferrovial's Funding Strategy: Ferrovial aims to diversify its funding sources, leveraging both public-private partnerships and direct private investment to support its project portfolio.

Energy Prices and Commodity Costs

Fluctuations in energy prices and the cost of key commodities such as asphalt, steel, and concrete significantly impact Ferrovial's construction and operational expenditures. For instance, the average price of Brent crude oil, a benchmark for global energy costs, saw considerable volatility in late 2023 and early 2024, influencing transportation and material processing expenses. Similarly, global steel prices have experienced shifts, with some reports indicating a rise in early 2024 driven by supply chain adjustments and demand in infrastructure projects.

To counter these volatile commodity markets, Ferrovial places increasing importance on sustainable practices and efficient resource management. This includes optimizing logistics, exploring alternative materials, and investing in technologies that reduce energy consumption across its projects. The company's strategic diversification into renewable energy, such as wind and solar power, also serves as a crucial mechanism for managing its own energy costs and hedging against price volatility in traditional energy sources.

Key commodity cost considerations for Ferrovial in 2024-2025 include:

- Steel Prices: Global steel prices have shown resilience, with some forecasts suggesting a moderate increase in 2024 due to ongoing demand from infrastructure development and manufacturing sectors.

- Asphalt and Concrete Costs: These are closely tied to oil prices (for asphalt binder) and energy costs for cement production, making them susceptible to energy market fluctuations.

- Energy Efficiency Investments: Ferrovial's commitment to reducing its carbon footprint and operational costs is reflected in its ongoing investments in energy-efficient technologies and renewable energy generation.

Global economic growth is a primary driver for Ferrovial, influencing demand for its infrastructure services. The IMF projected global GDP growth of 3.2% for both 2024 and 2025, indicating a stable environment for infrastructure development and usage. This steady growth suggests continued, though not explosive, demand for Ferrovial's toll roads and airports, as increased economic activity typically leads to higher traffic volumes and revenues.

Inflationary pressures directly impact Ferrovial's operational costs, with rising prices for construction materials like steel and cement, as well as labor, squeezing profit margins. The Eurozone's inflation rate was 2.4% in May 2024, a figure that necessitates careful cost management. Higher interest rates, such as the European Central Bank's key rates remaining at 3.75% as of June 2024, also increase financing costs for new projects and debt servicing, affecting financial flexibility.

Ferrovial's international operations expose it to foreign exchange rate fluctuations, impacting the Euro-equivalent value of its earnings. A strengthening Euro against currencies like the US Dollar or Pound Sterling can reduce reported profits. To mitigate this, the company utilizes hedging strategies and benefits from its diversified geographical presence, which offers a degree of natural hedging against currency volatility.

Government infrastructure spending and private capital flows are crucial for Ferrovial's project pipeline. Many OECD countries are expected to maintain or increase infrastructure investment in 2024, driven by climate adaptation and digital needs, with the US Bipartisan Infrastructure Law being a key example. Global infrastructure investment by private entities was estimated at $1.2 trillion in 2024, with growing interest in renewables and digital infrastructure, reflecting sustained investor confidence in the sector.

Preview the Actual Deliverable

Ferrovial PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Ferrovial PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic decisions.

Sociological factors

Global population is projected to reach 8.5 billion by 2030, fueling a significant demand for enhanced transportation networks. Urbanization is a key driver, with over 55% of the world's population currently living in urban areas, a figure expected to rise to 68% by 2050 according to UN data. This escalating concentration of people in cities directly translates to a greater need for improved highways, airports, and public transit systems, areas where Ferrovial actively operates.

Societal shifts towards more sustainable and flexible transportation are reshaping how people move. The increasing popularity of ride-sharing services, the rapid adoption of electric vehicles, and a growing demand for integrated, multimodal transport options are directly influencing infrastructure planning and investment priorities.

Ferrovial is responding by adapting its services to align with these evolving mobility patterns. This includes integrating smart technologies into its road and airport operations to improve user experience and efficiency, reflecting a broader trend towards connected and user-centric infrastructure.

For instance, by 2024, urban mobility is expected to see a significant increase in shared mobility services, with the global ride-sharing market projected to reach hundreds of billions of dollars. Ferrovial's strategic investments in digital solutions for its infrastructure assets, such as smart tolling and predictive maintenance, directly address the need for adaptable and technologically advanced transportation networks to meet these changing user behaviors.

Ferrovial's large-scale infrastructure projects, like airport expansions or major road construction, frequently encounter significant public scrutiny. Concerns often revolve around environmental impacts, such as noise pollution or habitat disruption, and the social implications of land acquisition and construction-related inconveniences. For instance, public opposition can significantly delay or even halt projects, impacting timelines and budgets.

Securing and retaining a social license to operate is therefore paramount for Ferrovial. This involves proactive and transparent engagement with local communities, clearly communicating project benefits and mitigation strategies for any negative impacts. By addressing local concerns directly and fostering trust, Ferrovial can reduce the risk of opposition, which historically has caused project delays costing millions. For example, in 2024, a proposed wind farm project in Scotland faced substantial local opposition, leading to a two-year delay and increased consultation costs.

Workforce Availability and Skills

The availability of a skilled workforce, encompassing engineers, construction professionals, and specialized technical experts, is a critical sociological factor for Ferrovial. Labor shortages or a deficit in particular skill sets can directly influence project delivery schedules and overall expenses.

Ferrovial's ability to secure and maintain a competent workforce is paramount for its large-scale infrastructure projects. This necessitates strategic investments in attracting, developing, and retaining talent.

- Talent Shortages: Reports from the International Labour Organization (ILO) in late 2024 highlighted persistent shortages in skilled trades and engineering roles across Europe, a trend expected to continue into 2025.

- Skills Gap: The World Economic Forum's 2025 Future of Jobs report indicates a growing demand for skills in areas like digital literacy, project management, and sustainable construction practices, areas where a skills gap may exist.

- Demographic Shifts: Aging workforces in many developed nations, coupled with lower birth rates, present a long-term challenge for labor availability in the construction and engineering sectors.

Health, Safety, and Well-being Standards

Societal expectations and regulatory demands for health, safety, and well-being are on an upward trajectory, impacting how companies like Ferrovial operate. This means a constant need to adapt and improve practices to meet these evolving standards, ensuring a secure environment for both employees and the communities where projects are undertaken.

Ferrovial's commitment to stringent safety protocols is crucial. By prioritizing health and safety, the company not only safeguards its workforce and the public but also bolsters its brand image and mitigates operational risks, including potential legal liabilities. For instance, in 2023, Ferrovial reported a significant reduction in its accident frequency rate, a testament to its ongoing safety initiatives.

- Workplace Safety: Implementing robust training programs and advanced safety equipment to minimize incidents.

- Project Execution: Ensuring all construction and operational phases adhere to the strictest safety regulations.

- Employee Well-being: Promoting mental and physical health initiatives to support a healthy workforce.

- Public Safety: Designing and managing projects to protect the general public from any potential hazards.

Public perception and community engagement are crucial for infrastructure projects. Ferrovial must navigate local concerns regarding environmental impact and land use, as public opposition can cause significant delays and cost overruns. For example, a 2024 study by the National Association of Home Builders found that community opposition was a leading cause of construction project delays, costing an average of 15% in additional expenses.

The availability of skilled labor is a significant sociological factor, with persistent shortages in engineering and construction trades reported by the International Labour Organization in late 2024, a trend expected to continue into 2025. This necessitates strategic talent acquisition and development to ensure project success.

Evolving societal expectations around sustainability and mobility influence demand for integrated, user-centric transport solutions. Ferrovial's adaptation to these trends, including investments in smart technologies for its road and airport operations, directly addresses the growing preference for efficient and connected infrastructure, with the global ride-sharing market projected to reach hundreds of billions of dollars by 2024.

| Sociological Factor | Impact on Ferrovial | 2024/2025 Data/Trend |

|---|---|---|

| Public Opinion & Community Relations | Project approval, delays, reputational risk | Community opposition cited as a major cause of project delays, adding an average of 15% to costs (National Association of Home Builders, 2024). |

| Labor Availability & Skills | Project execution capacity, cost efficiency | Persistent shortages in skilled trades and engineering roles across Europe, expected to continue into 2025 (ILO, late 2024). |

| Mobility Trends & User Expectations | Demand for services, investment priorities | Growing demand for integrated, multimodal transport and smart technologies; global ride-sharing market projected to reach hundreds of billions by 2024. |

Technological factors

Ferrovial is actively embracing smart infrastructure and digitalization to boost its operations. The integration of IoT sensors and real-time data analytics, for instance, allows for more efficient management of assets like highways and airports. This digital transformation is key to improving user experiences and unlocking new revenue possibilities within its infrastructure concessions.

The company is particularly focused on leveraging AI and advanced digital tools. These technologies are being implemented to enhance operational efficiency, improve the accuracy of data analysis, and bolster safety across its projects. For example, AI-driven traffic management systems can optimize traffic flow, reducing congestion and improving journey times for users.

Ferrovial is actively embracing technological advancements in construction, such as modular building and 3D printing. These innovations promise quicker project completion and cost savings. For instance, in 2023, Ferrovial's subsidiary, Broadspectrum, completed a modular hospital expansion in Australia ahead of schedule, demonstrating the efficiency gains from these methods.

The company's commitment to advanced materials is also a key factor. Utilizing lighter, stronger, and more sustainable materials not only improves project durability but also aligns with growing environmental regulations and client demands for greener infrastructure. This focus was evident in their 2024 bid for a major UK infrastructure project, where the proposed use of recycled aggregates and low-carbon concrete was a significant differentiator.

The accelerating development of autonomous vehicles (AVs) presents a critical technological factor for Ferrovial. By 2025, major cities are expected to see increased testing and limited commercial deployment of AVs, requiring substantial upgrades to road infrastructure for enhanced safety and connectivity.

Ferrovial needs to proactively invest in smart infrastructure, such as sensor-embedded roadways and advanced traffic management systems, to support this future mobility shift. Anticipating this, the company is exploring new business models in connected transportation, aiming to capture value from data-driven services and integrated mobility solutions.

Cybersecurity and Data Management

As Ferrovial increasingly digitizes its infrastructure, the threat landscape for cybersecurity expands significantly. Protecting vital systems and sensitive data from cyberattacks is crucial for maintaining uninterrupted operations and public confidence. For instance, in 2023, global spending on cybersecurity solutions reached an estimated $215 billion, highlighting the scale of investment required to combat evolving threats.

Ferrovial's commitment to smart infrastructure, such as intelligent traffic management or connected utility networks, necessitates advanced cybersecurity protocols. A breach in these systems could lead to widespread disruption and significant financial losses. The company's strategic focus on digital transformation means that cybersecurity is not just an IT issue, but a core component of business resilience and future growth.

- Increased Attack Surface: Digitalization of infrastructure creates more entry points for cyber threats.

- Operational Continuity: Robust cybersecurity is essential to prevent disruptions to critical services.

- Data Protection: Safeguarding sensitive operational and customer data is paramount for trust and compliance.

- Investment in Defense: Significant resources are allocated globally to cybersecurity, a trend expected to continue.

Renewable Energy Technologies Integration

Technological advancements in solar and wind power offer Ferrovial significant opportunities to diversify its energy sources and reduce its carbon footprint. The company is strategically investing in renewable energy infrastructure, such as solar farms, to meet its decarbonization targets and explore new revenue streams.

Ferrovial's commitment to sustainability is evident in its growing renewable energy portfolio. For instance, in 2023, the company continued to expand its solar power generation capacity, contributing to its goal of powering its operations with increasingly cleaner energy. This focus on renewables is not just about environmental responsibility but also about building a more resilient and cost-effective energy model for its infrastructure projects.

- Solar Power Growth: Ferrovial is actively developing and operating solar power plants, enhancing its energy independence.

- Wind Energy Potential: The company is exploring opportunities in wind energy to further diversify its renewable asset base.

- Decarbonization Alignment: Investments in renewables directly support Ferrovial's ambitious decarbonization objectives.

- New Business Avenues: Expanding into renewable energy generation opens up new commercial and operational possibilities for the group.

Ferrovial is leveraging advanced technologies like IoT and AI for smarter infrastructure management, enhancing efficiency and user experience in assets such as highways and airports. The company is also adopting innovative construction methods, including modular building and 3D printing, to accelerate project delivery and reduce costs, as seen with a 2023 modular hospital expansion completed ahead of schedule.

The rise of autonomous vehicles by 2025 necessitates infrastructure upgrades for safety and connectivity, prompting Ferrovial to invest in smart roadways and explore data-driven services in connected transportation. Simultaneously, the increasing digitalization of its operations expands the cybersecurity threat landscape, requiring robust protection for critical systems and data, with global cybersecurity spending estimated at $215 billion in 2023.

| Technology Area | Ferrovial's Focus | Impact/Opportunity | Example/Data Point |

|---|---|---|---|

| Digitalization & AI | IoT sensors, real-time analytics, AI-driven traffic management | Improved asset management, enhanced user experience, operational efficiency | AI optimizing traffic flow, reducing congestion |

| Advanced Construction | Modular building, 3D printing | Faster project completion, cost savings | 2023: Broadspectrum's ahead-of-schedule modular hospital expansion |

| Future Mobility | Smart infrastructure for autonomous vehicles | Adaptation to AV deployment, new revenue from data services | Increased AV testing expected by 2025 |

| Cybersecurity | Protecting digitalized infrastructure and data | Ensuring operational continuity, data integrity, public trust | Global cybersecurity spending ~$215 billion in 2023 |

| Renewable Energy | Solar and wind power development | Decarbonization, energy independence, new revenue streams | Expansion of solar power capacity in 2023 |

Legal factors

Ferrovial's operations are deeply intertwined with concession and contract law, as many of its major infrastructure projects, such as toll roads and airports, are secured through long-term concession agreements. For instance, its significant presence in the United States, including the recent win of a $2.3 billion contract for the I-77 Express Lanes in North Carolina, underscores the reliance on these legal frameworks.

Fluctuations in how contract law is interpreted or any legal challenges to existing agreements can directly affect Ferrovial's revenue streams and project timelines. The company's substantial international footprint means navigating a complex web of different legal systems and contract enforcement mechanisms, making strong legal counsel essential for mitigating risks and ensuring compliance.

Ferrovial navigates a landscape of stringent environmental regulations and intricate permitting procedures, particularly for its large-scale infrastructure ventures. Compliance with emission standards, biodiversity preservation mandates, waste management rules, and thorough environmental impact assessments are non-negotiable across its global operations.

Failure to adhere to these legal frameworks can result in substantial financial penalties and significant project timelines being extended. For instance, in 2024, the European Union continued to strengthen its environmental legislation, with directives like the Nature Restoration Law aiming to reverse biodiversity loss, impacting how infrastructure projects are planned and executed.

Ferrovial's global operations necessitate navigating a complex web of labor and employment laws across numerous jurisdictions. This includes strict adherence to varying regulations concerning minimum wages, working hours, and employee benefits, which differ significantly from country to country. For instance, in 2024, the average minimum wage in the European Union countries where Ferrovial operates can range from as low as €332 per month in Bulgaria to over €2,500 per month in Luxembourg, demanding meticulous compliance.

Ensuring fair labor practices and maintaining safe working conditions are paramount, especially given the company's extensive infrastructure projects. In 2023, workplace accidents in the construction sector across OECD countries averaged around 3.5 per 100 workers, highlighting the critical importance of robust health and safety compliance, which is often legally mandated and rigorously enforced.

Managing a diverse international workforce also involves understanding and respecting collective bargaining agreements and employee representation rights, which vary widely. Failure to comply with these legal frameworks can lead to significant disputes, fines, and reputational damage, underscoring the need for proactive legal counsel and consistent policy implementation.

Anti-Trust and Competition Laws

Ferrovial, operating in the global infrastructure sector, must navigate a complex web of anti-trust and competition laws. These regulations are designed to prevent monopolistic behavior and ensure a level playing field for all market participants. For instance, in 2023, the European Commission continued its scrutiny of large infrastructure projects and potential market concentrations, impacting how companies like Ferrovial can operate and bid for contracts across the EU.

Mergers, acquisitions, and strategic joint ventures undertaken by Ferrovial are subject to rigorous regulatory review by competition authorities worldwide. This oversight can significantly shape the company's strategic direction, influencing its ability to expand into new markets or consolidate its position in existing ones. For example, any significant acquisition Ferrovial might consider in 2024 or 2025 would likely undergo extensive antitrust clearance, potentially delaying or even blocking the deal if it's deemed to harm competition.

- Regulatory Scrutiny: Competition authorities globally, including the European Commission and the US Federal Trade Commission, actively monitor infrastructure markets for potential anti-competitive practices.

- Merger Control: Ferrovial's M&A activities are subject to mandatory pre-merger notification and approval processes in numerous jurisdictions, requiring detailed analysis of market share and competitive impact.

- Fair Market Access: Laws ensure that smaller players and new entrants can access infrastructure markets, preventing dominant firms from unfairly excluding competitors.

- Compliance Costs: Adhering to these regulations involves significant legal and administrative costs, including expert advice for merger filings and ongoing competition law training for relevant personnel.

International Trade and Investment Agreements

International trade and investment agreements significantly shape Ferrovial's global footprint. For instance, the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), which includes countries where Ferrovial operates, aims to reduce trade barriers and enhance investment protections, potentially streamlining cross-border projects. Conversely, shifts in bilateral investment treaties or the imposition of new tariffs, such as those impacting construction materials, could directly affect project costs and profitability.

Ferrovial's international legal strategy must proactively navigate these evolving trade landscapes. The company's exposure to diverse regulatory environments means that changes in agreements, like potential adjustments to the EU's trade policies with third countries or the renegotiation of investment clauses in specific jurisdictions, require constant monitoring. For example, in 2024, ongoing discussions around the future of global trade frameworks could introduce new compliance requirements or opportunities for companies with extensive international operations like Ferrovial.

- Trade Facilitation: Agreements like the CPTPP can reduce tariffs and streamline customs procedures, easing Ferrovial's import of materials and export of services.

- Investment Protection: Bilateral Investment Treaties (BITs) offer legal recourse and protection against expropriation or unfair treatment for Ferrovial's foreign direct investments.

- Regulatory Impact: Changes in trade rules, such as new environmental standards or labor requirements stipulated in trade pacts, can necessitate costly adjustments to project execution.

- Geopolitical Risk: Trade disputes or sanctions between nations can disrupt supply chains and impact the financial viability of projects in affected regions.

Ferrovial's reliance on concession agreements means legal interpretations of contract law are critical, as seen with its $2.3 billion I-77 Express Lanes contract in North Carolina. Changes in contract law or legal challenges can directly impact revenue and project timelines, necessitating robust legal counsel to manage risks across diverse international legal systems.

Compliance with stringent environmental regulations and permitting processes is paramount for Ferrovial's infrastructure projects. The EU's Nature Restoration Law, strengthened in 2024, exemplifies the evolving legal landscape impacting project planning and execution, with non-compliance leading to substantial penalties and delays.

Navigating varied labor laws globally is essential for Ferrovial, from minimum wage adherence to workplace safety. Given the construction sector's accident rate, estimated at 3.5 per 100 workers in OECD countries in 2023, robust health and safety compliance is a legal imperative.

Ferrovial must adhere to global anti-trust and competition laws, as scrutiny from bodies like the European Commission intensified in 2023. Any significant acquisitions in 2024-2025 would face rigorous antitrust clearance, potentially impacting strategic expansion.

Environmental factors

Ferrovial's extensive portfolio of long-term infrastructure assets, from toll roads to airports, faces significant physical risks due to climate change. Extreme weather, such as the 2023 European heatwaves impacting transport infrastructure or increased flood risks in coastal regions, can disrupt operations and necessitate costly repairs. For instance, the company reported in its 2023 sustainability report that it is actively assessing and adapting its assets to withstand a 1.5°C warming scenario.

Consequently, designing and constructing infrastructure with enhanced resilience against these escalating climate-related threats is a critical strategic imperative for Ferrovial. This includes incorporating advanced materials and engineering solutions to mitigate damage from more frequent and intense storms, droughts, and rising sea levels. The company's commitment to climate adaptation is reflected in its ongoing investments in climate risk assessments across its global operations, aiming to future-proof its assets.

Ferrovial is navigating increasing global pressure to reduce carbon emissions, a significant environmental factor influencing its construction and transportation sectors. The company has committed to ambitious, Science Based Targets initiative (SBTi) validated goals for cutting Scope 1, 2, and 3 emissions, with a clear aim for net-zero by 2050 or even earlier.

This commitment translates into substantial investments in decarbonization strategies and the adoption of renewable energy sources across its operations. For instance, Ferrovial's 2023 sustainability report highlighted a 15% reduction in absolute Scope 1 and 2 emissions compared to its 2019 baseline, demonstrating tangible progress towards its targets.

Growing concerns about resource scarcity, particularly for essential materials like water and aggregates, are significantly shaping how infrastructure projects are planned and executed. This is driving a strong push towards a circular economy model, which emphasizes minimizing waste, maximizing resource utilization, and promoting recycling throughout the project lifecycle.

Ferrovial is actively integrating circular economy principles into its operations to address these environmental pressures. For instance, in its 2023 sustainability report, the company highlighted a 12% increase in recycled materials used in its construction projects compared to the previous year, demonstrating a tangible commitment to resource efficiency and waste reduction.

Biodiversity Protection and Land Use

Ferrovial's infrastructure projects, by their nature, can have a substantial impact on biodiversity and the land they occupy. This necessitates careful planning and execution to mitigate negative effects on natural habitats and ecosystems.

The company operates under increasing environmental scrutiny, facing stringent regulations related to land use, potential habitat disruption, and the implementation of biodiversity offset programs. For instance, in 2024, the European Union continued to emphasize nature restoration targets, impacting how large-scale projects are approved and managed.

Integrating robust biodiversity protection measures and actively working to minimize its ecological footprint are therefore crucial for Ferrovial. This commitment is not only vital for regulatory compliance but also for upholding its corporate responsibility and maintaining its social license to operate.

- Habitat Impact: Infrastructure development can fragment or destroy critical habitats, affecting species populations.

- Regulatory Landscape: Ferrovial navigates evolving environmental laws, including those concerning protected areas and species.

- Biodiversity Offsets: The company is increasingly expected to implement measures that compensate for unavoidable environmental impacts.

- Ecological Footprint: Minimizing land disturbance and promoting ecological restoration are key components of sustainable project delivery.

Waste Management and Pollution Control

Ferrovial's commitment to effective waste management and pollution control is paramount, particularly given its extensive construction and infrastructure operations. The company actively manages construction waste, aiming to reduce landfill reliance and promote recycling. For instance, in 2023, Ferrovial reported a significant portion of its construction waste was diverted from landfill, with specific figures available in their annual sustainability reports.

Preventing water and air pollution is another critical focus. This involves implementing robust measures at project sites to safeguard water bodies and minimize atmospheric emissions. Ferrovial adheres to stringent environmental standards, often exceeding regulatory requirements to mitigate ecological harm. Failure to do so could result in substantial regulatory penalties, impacting both financial performance and corporate reputation.

- Waste Diversion: Ferrovial actively pursues waste diversion from landfills, with a growing percentage of construction and operational waste being recycled or reused.

- Pollution Prevention: The company employs advanced technologies and practices to minimize air and water pollution across its global projects.

- Regulatory Compliance: Strict adherence to environmental regulations is a core operational principle, safeguarding against penalties and ensuring sustainable practices.

- Sustainability Reporting: Ferrovial transparently reports on its environmental performance, including waste management and pollution control metrics, in its annual sustainability disclosures.

Ferrovial faces increasing pressure to reduce its environmental footprint, particularly concerning carbon emissions and resource utilization. The company has set ambitious targets, aiming for net-zero emissions by 2050, and is investing in decarbonization and circular economy principles. For instance, Ferrovial reported a 15% reduction in absolute Scope 1 and 2 emissions by 2023 compared to a 2019 baseline, and a 12% increase in recycled materials used in construction projects in the same year.

Climate change poses significant physical risks to Ferrovial's infrastructure assets, necessitating adaptation strategies. Extreme weather events can disrupt operations and require costly repairs, prompting the company to assess and adapt its assets for a 1.5°C warming scenario.

Biodiversity protection and minimizing habitat impact are critical considerations for Ferrovial's projects, driven by evolving regulations and public scrutiny. The company is committed to implementing biodiversity protection measures and reducing its ecological footprint, aligning with initiatives like the EU's nature restoration targets.

Effective waste management and pollution control are paramount, with Ferrovial actively diverting waste from landfills and employing advanced technologies to minimize air and water pollution across its operations. This commitment is crucial for regulatory compliance and maintaining its corporate reputation.

| Environmental Factor | Ferrovial's Action/Commitment | Key Data/Metric (2023/2024 unless specified) |

| Climate Change & Emissions | Net-zero by 2050 target; SBTi validated goals | 15% reduction in Scope 1 & 2 emissions (vs. 2019 baseline) |

| Resource Scarcity & Circularity | Integration of circular economy principles | 12% increase in recycled materials used in construction |

| Biodiversity & Habitat Impact | Minimizing ecological footprint; adhering to regulations | Ongoing assessment and adaptation of assets for climate resilience |

| Waste Management & Pollution Control | Waste diversion from landfills; pollution prevention | Significant portion of construction waste diverted from landfill |

PESTLE Analysis Data Sources

Our Ferrovial PESTLE Analysis is constructed using a robust blend of data from official government publications, leading international financial institutions, and reputable industry-specific research. This ensures that our insights into political, economic, social, technological, legal, and environmental factors are grounded in credible and current information.