Ferrovial Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ferrovial Bundle

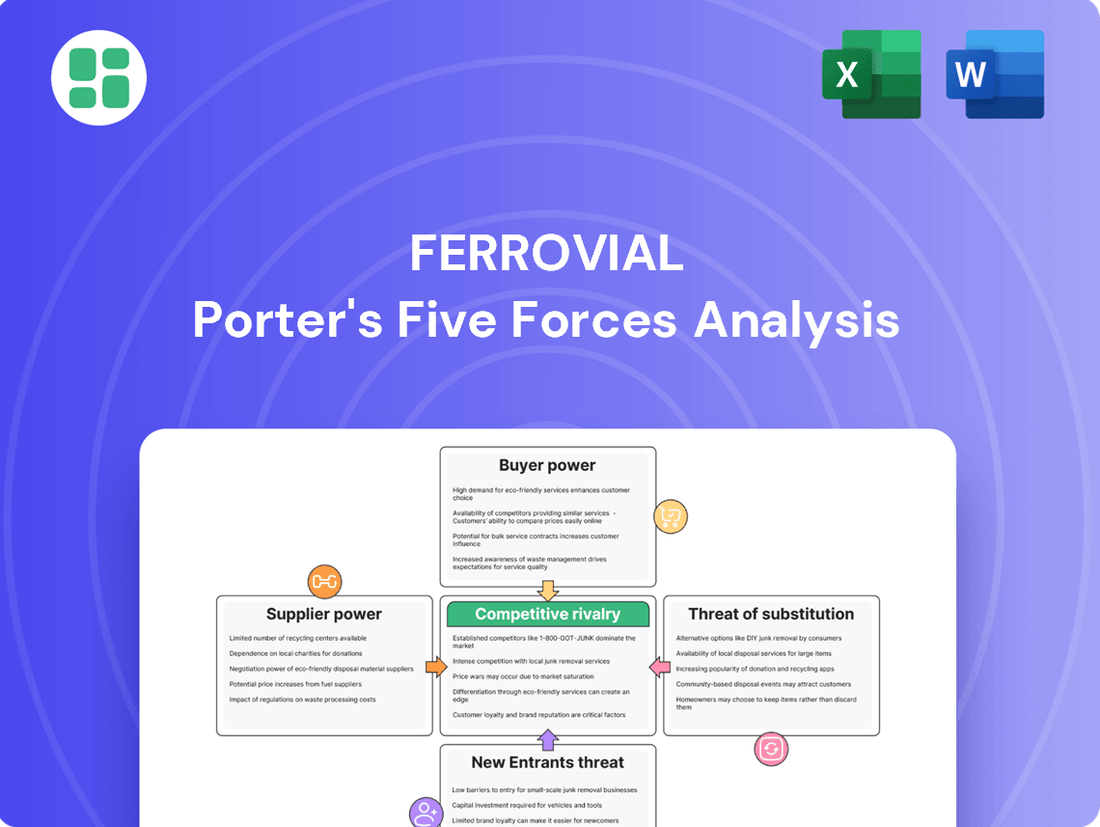

Ferrovial navigates a complex competitive landscape, where the bargaining power of buyers and the threat of new entrants significantly shape its strategic options. Understanding these forces is crucial for grasping the company's market position and future growth potential.

The complete report reveals the real forces shaping Ferrovial’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The concentration of suppliers significantly impacts Ferrovial's bargaining power. For instance, in the construction sector, a limited number of providers for specialized heavy machinery or advanced engineering services can grant those suppliers considerable leverage. If Ferrovial relies on a few key players for critical components or expertise, these suppliers can dictate terms more effectively, potentially increasing costs for Ferrovial.

Ferrovial's reliance on specialized inputs, like advanced construction materials or proprietary tunneling technology, can significantly influence supplier bargaining power. If these inputs are unique and difficult to source elsewhere, suppliers gain leverage. For instance, in large infrastructure projects, the availability of specific, high-performance concrete mixes or specialized heavy machinery can dictate terms.

High switching costs further amplify supplier power. If Ferrovial faces substantial expenses or operational disruptions when changing suppliers—such as the need for extensive retooling, redesigning of components, or lengthy requalification processes for new vendors—suppliers can command higher prices or more favorable contract terms. This is particularly relevant in long-term projects where supply chain stability is paramount.

In 2024, the global construction industry faced ongoing supply chain challenges, including the availability of raw materials and specialized equipment. For example, the cost of key construction materials like steel and cement saw fluctuations, impacting project budgets and supplier negotiations. Companies like Ferrovial, heavily involved in large-scale infrastructure, must carefully manage these relationships to mitigate risks associated with input uniqueness and supplier dependency.

The threat of suppliers integrating forward into Ferrovial's core business, such as infrastructure development or operation, could significantly increase their bargaining power. If suppliers, for example, construction firms or technology providers, were to develop the capability to manage and operate infrastructure projects themselves, they would effectively become competitors. This potential shift transforms them from mere input providers into entities that could directly vie for contracts or concessions currently held by Ferrovial.

Importance of Ferrovial to Suppliers

Ferrovial's significance to its suppliers plays a crucial role in its bargaining power. If a substantial portion of a supplier's revenue comes from Ferrovial, that supplier will likely be more accommodating to Ferrovial's demands, thus weakening the supplier's bargaining power. Conversely, if Ferrovial is just one of many clients for a supplier, the supplier holds more leverage.

For instance, consider the suppliers of specialized construction materials or advanced engineering services. If Ferrovial constitutes a significant percentage of their annual sales, these suppliers are more inclined to offer competitive pricing and favorable terms to retain Ferrovial as a key customer. This dynamic directly impacts Ferrovial's ability to negotiate lower input costs.

- Supplier Dependency: The degree to which suppliers rely on Ferrovial for their revenue is a primary determinant of their bargaining power.

- Market Concentration: If Ferrovial sources from a few dominant suppliers, those suppliers may have greater leverage. However, if the market offers numerous alternatives, Ferrovial's power increases.

- Switching Costs for Ferrovial: High costs associated with changing suppliers for critical components or services can reduce Ferrovial's leverage, empowering those suppliers.

- Supplier's Own Market Position: A supplier with a strong market position and limited competition for its products or services will naturally possess more bargaining power.

Availability of Substitute Inputs

The availability of substitute inputs significantly influences the bargaining power of suppliers for Ferrovial. If there are readily available alternatives for critical materials or services, suppliers face diminished leverage. For instance, if Ferrovial can easily source concrete from multiple providers or switch to different types of construction materials without substantial cost or performance degradation, suppliers of traditional concrete would have less power to dictate terms.

In 2024, the construction materials sector, a key area for Ferrovial, saw a notable increase in the adoption of sustainable and alternative materials. For example, the market for recycled aggregate in road construction has expanded, offering a viable substitute for virgin aggregate. This trend reduces reliance on traditional quarrying suppliers, thereby weakening their bargaining position. Similarly, advancements in modular construction techniques can lessen the dependency on site-specific labor and material suppliers.

- Reduced Supplier Leverage: The presence of viable substitutes erodes a supplier's ability to command higher prices or impose unfavorable terms on Ferrovial.

- Material Substitution Example: In 2024, the growing availability of recycled construction materials, like crushed concrete and asphalt, provided Ferrovial with alternatives to virgin aggregate, impacting supplier power in that segment.

- Technological Advancements: Innovations in construction technology, such as pre-fabricated components, offer substitutes for traditional on-site labor and materials, further diversifying sourcing options.

- Cost-Benefit Analysis: Ferrovial can switch to substitute inputs if suppliers attempt to increase prices, provided the substitutes offer comparable quality and cost-effectiveness.

The bargaining power of suppliers for Ferrovial is significantly influenced by the concentration of suppliers in key input markets. In 2024, the global supply chain for specialized construction equipment and advanced materials remained consolidated in certain segments, giving dominant suppliers leverage. For example, a limited number of manufacturers for large tunnel boring machines or advanced composite materials can dictate terms, impacting Ferrovial's project costs and timelines.

| Factor | Impact on Ferrovial's Bargaining Power | 2024 Relevance |

|---|---|---|

| Supplier Concentration | High concentration empowers suppliers. | Continued consolidation in specialized equipment markets. |

| Input Uniqueness | Proprietary or highly specialized inputs increase supplier leverage. | Demand for advanced materials in sustainable infrastructure projects. |

| Switching Costs | High costs to change suppliers reduce Ferrovial's power. | Significant investments in training and integration for new technologies. |

| Supplier Dependency on Ferrovial | Low dependency strengthens supplier power. | Ferrovial's scale can offer some leverage against smaller suppliers. |

| Availability of Substitutes | Abundant substitutes weaken supplier power. | Growth in alternative construction materials like recycled aggregates. |

What is included in the product

This analysis specifically examines the competitive forces impacting Ferrovial, detailing the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the impact of substitutes on its infrastructure and services businesses.

A dynamic, interactive dashboard that visualizes the impact of each force, allowing for rapid identification of key competitive pressures.

Customers Bargaining Power

Ferrovial's customer base is highly concentrated, with governmental bodies and public agencies forming the core of its concession projects. This concentration means a few key clients can wield significant influence, potentially demanding better pricing or contract terms. For example, in 2023, Ferrovial's revenue from concession operations was a substantial part of its overall income, highlighting the importance of these large, often public, clients.

Ferrovial's infrastructure services, such as toll road operation and construction, tend to be largely standardized. This lack of significant differentiation means that clients, often government entities or large corporations, can readily compare offerings and switch providers if terms are more favorable elsewhere. For instance, in the competitive infrastructure development sector, a project's success often hinges on efficient execution and cost management, areas where many firms can compete on similar grounds.

Ferrovial's customers, particularly governments and large corporations for infrastructure projects, often exhibit low price sensitivity. This is due to the critical nature of these projects, where reliability, quality, and long-term performance outweigh minor cost differences. For instance, a delay or failure in a major infrastructure project can incur significantly higher costs than any initial savings from a lower bid.

However, for certain services like airport operations or toll roads, where there might be more direct consumer interaction or alternative providers, price sensitivity can be higher. In 2024, the increasing focus on public spending efficiency and the competitive bidding processes for large-scale projects means that while quality is paramount, cost-effectiveness remains a significant consideration for clients. Ferrovial's ability to demonstrate value beyond just price is therefore crucial.

Threat of Backward Integration by Customers

The threat of backward integration by customers is a significant factor influencing Ferrovial's bargaining power. If Ferrovial's clients, such as governments or private entities, possess the technical expertise, capital, and resources to develop, construct, or operate infrastructure projects themselves, they gain considerable leverage.

This capability or credible threat allows customers to negotiate more favorable terms or even to bypass Ferrovial entirely. For instance, a large municipality with a substantial public works department might consider bringing certain construction or maintenance activities in-house if they perceive Ferrovial's pricing or service levels to be uncompetitive. This potential for self-sufficiency directly amplifies customer bargaining power.

- Customer Capabilities: Assess if key clients have existing internal capabilities in project development, engineering, construction management, or operational management.

- Threat Credibility: Evaluate whether customers have the financial capacity and strategic intent to develop these capabilities if not already present.

- Market Dynamics: Consider if the industry trend favors vertical integration for large infrastructure clients, thereby increasing the perceived threat.

- Contractual Safeguards: Examine existing contracts for clauses that might deter or enable backward integration by clients.

Information Availability and Bidding Processes

The infrastructure sector, particularly public tenders where Ferrovial often operates, is characterized by high information transparency. This means potential clients, often government entities, have access to detailed project scopes, budget allocations, and frequently, information on previous bids and awarded contracts. For instance, in 2023, the European Union continued to emphasize open procurement, making tender documents and award criteria widely accessible, which directly impacts the bargaining power of these public customers.

The competitive nature of public tenders further amplifies customer bargaining power. With multiple firms vying for the same contracts, clients can leverage this competition to negotiate more favorable terms. Ferrovial, like its peers, faces situations where clients can solicit multiple bids, compare them directly, and select the most cost-effective or value-driven proposal. This dynamic is evident in major infrastructure projects globally, where the number of bidders can range from a handful to over a dozen, depending on the project's scale and complexity.

- Increased Information Access: Public tender portals and industry reports provide clients with extensive data on pricing benchmarks and competitor capabilities.

- Competitive Bidding Environment: The presence of numerous qualified bidders for large infrastructure projects allows clients to play firms against each other.

- Negotiating Leverage: Clients can use the availability of alternative suppliers and detailed cost breakdowns to demand lower prices or better service levels from Ferrovial.

- Focus on Value Proposition: Customers can more easily assess and demand a strong value proposition beyond just the lowest bid, pushing firms to differentiate on quality and innovation.

Ferrovial's customers, particularly government entities in its concession business, hold considerable bargaining power due to the concentrated nature of its client base. This means a few large clients can significantly influence contract terms and pricing. For instance, in 2023, concessions represented a substantial portion of Ferrovial's revenue, underscoring the importance of these key relationships.

The standardized nature of many infrastructure services offered by Ferrovial, such as toll road operations, allows clients to easily compare providers. This lack of differentiation means customers can switch suppliers if more favorable terms are available, increasing their leverage. In 2024, the emphasis on cost-efficiency in public spending further empowers these clients to seek competitive pricing.

Customers' ability to integrate backward, meaning undertaking projects themselves, poses a significant threat. If clients possess the technical and financial capacity, they can negotiate better terms or bypass Ferrovial. This potential for self-sufficiency is a key factor amplifying customer bargaining power in the infrastructure sector.

Same Document Delivered

Ferrovial Porter's Five Forces Analysis

This preview showcases the complete Ferrovial Porter's Five Forces Analysis, providing an in-depth examination of industry competition and profitability. You are viewing the exact, professionally formatted document that will be available for immediate download upon purchase, ensuring no discrepancies or missing information. This comprehensive analysis is ready for your strategic use, offering valuable insights into the competitive landscape of Ferrovial's operations.

Rivalry Among Competitors

The global infrastructure sector, where Ferrovial competes, is characterized by a substantial number of players. This includes large, diversified multinational corporations like Vinci, ACS Group, and Bouygues, alongside numerous specialized regional firms. For instance, in 2024, the infrastructure construction market alone was valued at trillions of dollars globally, featuring a wide array of companies vying for projects.

The transportation infrastructure and mobility sector is experiencing moderate but steady growth. Globally, infrastructure spending is projected to reach trillions by 2030, indicating a generally positive outlook. This growth, while not explosive, creates opportunities for companies like Ferrovial to expand their operations and secure new projects.

However, even in a growing market, intense competition can emerge. When the industry is expanding, companies are motivated to capture as much of that new market share as possible. This can lead to aggressive bidding and a focus on efficiency to win contracts, especially in areas like toll roads and airport management where established players are present.

Ferrovial's infrastructure and mobility services, such as toll roads and airports, often feature significant differentiation through advanced technology, customer experience enhancements, and integrated digital platforms. For instance, their investments in smart airport solutions and efficient tolling systems create a distinct value proposition. This differentiation helps to mitigate direct price-based competition, as clients are often willing to pay a premium for superior service and operational efficiency.

High Exit Barriers

The infrastructure sector, including companies like Ferrovial, faces substantial exit barriers. These are rooted in the industry's capital-intensive nature and the long-term commitments involved.

High asset specificity means that specialized equipment and facilities used in infrastructure projects have limited alternative uses, making it costly to divest. For instance, a large-scale construction equipment fleet or a specialized port facility is difficult to repurpose or sell quickly without significant loss. This ties companies to their existing operations, even in less profitable periods.

Long-term contracts, often spanning decades for concessions or maintenance, further lock companies in. Breaking these contracts can incur substantial penalties. Ferrovial, for example, operates under numerous long-term concessions for roads and airports, which provide stable revenue but also limit flexibility to exit specific markets or projects. The company's portfolio includes concessions with durations extending well into the future, creating a commitment to maintain operations.

Significant sunk costs, including investments in research and development for new construction techniques or the initial capital outlay for infrastructure projects, are also a major factor. These costs cannot be recovered if a company decides to leave.

Furthermore, social and governmental obligations, such as maintaining service levels or adhering to environmental regulations, add to the difficulty of exiting. Companies may be required to continue operations to fulfill these duties, even if financially unviable. This can intensify competitive rivalry as companies remain in the market despite low profitability.

- Asset Specificity: Specialized infrastructure assets have low resale value, trapping capital.

- Long-Term Contracts: Concessions and maintenance agreements often commit companies for 20-50 years or more.

- Sunk Costs: Massive initial investments in projects and equipment are often irrecoverable.

- Social/Governmental Obligations: Requirements to maintain services and meet regulatory standards can prevent closure.

Strategic Stakes and Aggressiveness of Competitors

The infrastructure sector holds immense strategic importance for Ferrovial and its rivals, driving substantial investment and aggressive competition for market share. Companies view these long-term projects as crucial for growth and diversification.

This high strategic stake translates into a willingness to bid aggressively, often pushing margins to secure lucrative contracts. For instance, in 2024, major infrastructure tenders globally saw intense bidding wars, with companies like Vinci and ACS also vying for significant projects.

- Strategic Importance: Infrastructure projects are vital for long-term revenue streams and market positioning for global construction and concessions giants.

- Aggressive Bidding: Competitors frequently engage in price competition to win large-scale projects, impacting profitability.

- Market Share Focus: Gaining or maintaining market share in key regions and project types is a primary driver of competitive behavior.

- Investment Willingness: Companies demonstrate a high propensity to invest capital in bidding processes and project execution to secure future growth.

Competitive rivalry within the infrastructure sector, where Ferrovial operates, is significant due to the presence of numerous global and specialized players. This intense competition is fueled by the sector's strategic importance and the aggressive bidding strategies employed by companies like Vinci and ACS Group, particularly evident in 2024's global infrastructure tenders. While differentiation through technology and customer experience helps Ferrovial, the sheer number of competitors vying for projects means rivalry remains a key force.

SSubstitutes Threaten

The threat of substitutes for Ferrovial's infrastructure services is a significant consideration. For its highway concessions, customers have alternatives like enhanced public transportation networks, including expanded bus routes and commuter rail services. In 2024, many urban areas are investing heavily in public transit upgrades to reduce reliance on private vehicles. For instance, several European cities are planning or implementing new tram lines and dedicated bus lanes, aiming to improve travel times and accessibility.

Similarly, for airport operations, substitutes exist, particularly for shorter to medium-haul travel where high-speed rail offers a competitive alternative. The increasing efficiency and network expansion of high-speed rail in countries like Spain and France present a viable option for business and leisure travelers, potentially diverting passengers who might otherwise fly. Furthermore, the continued advancement of virtual communication technologies can reduce the need for business-related air travel, impacting airport passenger volumes.

The cost-effectiveness and efficiency of substitute solutions significantly influence their threat level to Ferrovial. For instance, in the infrastructure sector, alternative construction materials or modular building techniques might offer faster deployment and lower upfront costs compared to traditional methods Ferrovial often employs. If these substitutes provide comparable durability and performance at a reduced price point, their appeal grows.

In 2024, the global construction market saw increased adoption of prefabrication and modular construction, with some projects reporting cost savings of up to 20% and faster completion times. This efficiency gain directly impacts the value proposition of traditional infrastructure development, potentially increasing the threat of substitution for companies like Ferrovial if they do not adapt their service offerings.

The propensity for customers like governments and commuters to substitute away from Ferrovial's infrastructure services, such as toll roads or airports, is generally low but can vary. Established habits and the significant investment required to develop alternative transportation networks mean switching isn't easy. For instance, building a new high-speed rail line or expanding an existing airport involves massive capital expenditure and long lead times, making immediate substitution unlikely.

However, political will and the availability of public funding can influence this. If a government decides to heavily invest in public transportation alternatives, like expanding bus rapid transit systems or improving national rail networks, it could gradually reduce demand for toll roads or private airport services. For example, in 2024, many European countries are increasing their focus on sustainable transport initiatives, which could indirectly impact the long-term demand for traditional road infrastructure.

Innovation in Substitute Technologies

The threat of substitutes for traditional infrastructure, particularly in transportation and urban development, is escalating due to rapid technological innovation. Emerging technologies like autonomous vehicles and hyperloop systems offer entirely new paradigms for mobility, potentially reducing reliance on conventional roads and rail networks. For instance, the global autonomous vehicle market was valued at approximately $20 billion in 2023 and is projected to grow significantly, presenting a long-term substitute for traditional car ownership and public transport infrastructure.

Integrated smart city solutions also represent a growing substitute threat. These platforms aim to optimize urban living through interconnected digital services, potentially reducing the need for certain physical infrastructure components. By 2024, investments in smart city technologies are expected to reach hundreds of billions of dollars globally, indicating a shift towards more digitally enabled, and potentially less physically dependent, urban environments.

- Autonomous Vehicles: These could decrease demand for traditional road maintenance and expansion by optimizing traffic flow and potentially reducing the number of privately owned vehicles.

- Hyperloop Technology: This high-speed transportation system offers a potential substitute for short to medium-haul air and rail travel, impacting the demand for conventional rail infrastructure.

- Smart City Solutions: Integrated digital platforms can offer alternative ways to manage urban services, potentially reducing the need for some physical infrastructure investments in areas like traffic management or public transit.

- Shared Mobility Platforms: Services like ride-sharing and bike-sharing, often integrated into smart city initiatives, can reduce individual car usage and thus the demand for extensive parking infrastructure and road capacity.

Regulatory and Policy Support for Substitutes

Government policies can significantly bolster the appeal and market penetration of substitute infrastructure. For instance, in 2024, many nations continued to roll out incentives for electric vehicle charging infrastructure, directly supporting alternatives to traditional fossil-fuel-based transport. This includes tax credits and grants, making these new solutions more economically viable for both consumers and businesses.

Environmental regulations, particularly those aimed at reducing carbon emissions, also act as a powerful catalyst for substitutes. Stricter emissions standards for conventional vehicles, for example, push consumers and fleet operators towards electric or hydrogen-powered alternatives. By 2024, the European Union's Fit for 55 package, which aims to reduce net greenhouse gas emissions by at least 55% by 2030, has been a key driver in this shift, indirectly favoring substitute transport modes.

Public funding initiatives, such as direct investment in high-speed rail projects or the expansion of public digital networks, further enhance the competitiveness of substitutes. These investments not only improve the quality and reach of these alternatives but also signal government commitment, encouraging private sector participation and innovation. For example, significant public funding was allocated in 2024 to upgrade national broadband networks, making digital communication a more robust substitute for physical travel for many business interactions.

- Government Incentives: Tax credits and grants for EV charging infrastructure in 2024.

- Environmental Regulations: EU's Fit for 55 package driving adoption of lower-emission transport.

- Public Funding: Investments in high-speed rail and digital networks in 2024.

- Policy Impact: Increased viability and competitiveness of sustainable and digital alternatives.

The threat of substitutes for Ferrovial's infrastructure services is growing, driven by technological advancements and shifts in consumer behavior. For instance, the global autonomous vehicle market was valued at approximately $20 billion in 2023, signaling a future where traditional road infrastructure might be used differently. Similarly, integrated smart city solutions, with global investments reaching hundreds of billions of dollars by 2024, offer digitally enabled alternatives that could lessen reliance on certain physical infrastructure components.

Government policies are actively promoting these substitutes. In 2024, incentives for electric vehicle charging infrastructure and environmental regulations like the EU's Fit for 55 package are making sustainable and lower-emission transport more competitive. Public funding for high-speed rail and digital networks further enhances the appeal and viability of these alternatives, directly impacting the traditional infrastructure market.

| Substitute Type | Impact on Ferrovial | 2024 Trend/Data Point |

|---|---|---|

| Autonomous Vehicles | Potential reduction in demand for road maintenance and expansion | Global market valued at ~$20 billion in 2023, with significant growth projected. |

| High-Speed Rail | Competition for short-to-medium haul travel, impacting airport passenger volumes | Continued network expansion in Europe, with increased public funding in 2024. |

| Smart City Solutions | Reduced need for some physical infrastructure components (e.g., traffic management) | Global investments expected to reach hundreds of billions of dollars by 2024. |

| Electric & Sustainable Transport | Shift away from traditional fossil-fuel transport infrastructure | Government incentives for EV charging and stricter emissions standards (e.g., EU's Fit for 55). |

Entrants Threaten

The infrastructure sector, a core area for companies like Ferrovial, demands immense upfront capital. Developing and operating large-scale projects such as highways, airports, or renewable energy facilities requires billions of dollars in investment. For instance, a major airport expansion or a new high-speed rail line can easily cost tens of billions. This sheer financial scale acts as a formidable barrier, deterring potential new players who may lack the necessary resources or access to significant financing.

Ferrovial, like many major infrastructure players, faces significant hurdles from regulatory and legal barriers. Undertaking large-scale projects requires navigating a labyrinth of approvals, permits, and licensing, often involving extensive environmental impact assessments and public consultations. For instance, securing planning permission for a major transport project can take several years, as seen with the lengthy approval processes for high-speed rail lines in various European countries, sometimes exceeding five to seven years from initial proposal to final sign-off.

Ferrovial, as an established infrastructure and construction giant, benefits immensely from significant economies of scale. Its vast operational footprint allows for bulk purchasing of materials and equipment, driving down per-unit costs. For example, in 2023, Ferrovial's revenue reached €15.16 billion, indicating the sheer volume of its operations, which new entrants would find difficult to match, thus creating a substantial cost disadvantage for them.

The experience curve also plays a crucial role in protecting Ferrovial from new entrants. Years of successfully managing complex, large-scale projects, from highways to airports, have honed its operational expertise and risk management capabilities. This accumulated know-how translates into greater efficiency and a higher probability of project success, making it challenging for newcomers to compete on both cost and quality without a similar track record.

Established Relationships and Reputation

Ferrovial benefits significantly from its deeply entrenched relationships with governments and local authorities worldwide. These long-standing partnerships, built over decades, are crucial for securing lucrative infrastructure concessions. For instance, in 2023, Ferrovial continued its extensive work on projects like the expansion of the M-30 ring road in Madrid, a testament to its established presence and trust with Spanish authorities.

A proven track record in successfully delivering complex, large-scale infrastructure projects is another formidable barrier for new entrants. Ferrovial's portfolio includes major undertakings such as the Heathrow Airport expansion and the Sydney Metro City & Southwest project, demonstrating a consistent ability to manage and execute projects of immense scale and complexity. This history fosters confidence among awarding bodies, making it challenging for newcomers to gain initial traction.

New companies entering the infrastructure sector often struggle to replicate the level of trust and established reputation that Ferrovial and similar incumbents possess. This lack of a proven history and existing governmental ties makes it exceedingly difficult to compete for the high-value, long-term concessions that are the lifeblood of this industry. As of early 2024, the global infrastructure market remains dominated by established players due to these entry barriers.

- Established Government Relationships: Ferrovial's long-standing ties with public administrations facilitate access to project pipelines.

- Proven Project Delivery: A history of successfully completing major infrastructure projects builds credibility and trust.

- Reputational Advantage: Decades of reliable performance create a significant barrier for new, unproven entities.

- Financial Institution Trust: Established firms have stronger relationships with banks and investors, easing project financing.

Access to Distribution Channels (Concessions)

The threat of new entrants in the infrastructure sector, particularly concerning access to distribution channels like major concessions, is notably low. These concessions represent the primary avenues for delivering large-scale infrastructure services, and their limited availability creates a significant barrier.

Established players often benefit from existing relationships, a proven track record, and substantial capital reserves, giving them an edge in the highly competitive bidding processes. For instance, in 2024, major global infrastructure projects often involve consortia of experienced firms, making it difficult for newcomers to secure a foothold without significant prior success and strategic alliances.

- Limited Concession Availability: The scarcity of large, high-value infrastructure concessions restricts the entry points for new companies.

- Intense Bidding Competition: Processes for securing these concessions are highly competitive, often favoring incumbents with established reputations and financial strength.

- Preferential Treatment for Incumbents: Existing players may possess advantages such as pre-qualification status or a stronger pipeline of future projects, further hindering new entrants.

- Capital Intensity and Risk: The immense capital required and the inherent risks associated with large infrastructure projects deter many potential new entrants.

The threat of new entrants for Ferrovial in the infrastructure sector is generally low, primarily due to the immense capital requirements, extensive regulatory hurdles, and the need for a proven track record. These factors create significant barriers to entry, making it difficult for new companies to compete effectively for large-scale projects and concessions.

Established relationships with governments and a strong reputation for project delivery are critical advantages for incumbents like Ferrovial. For example, in 2023, Ferrovial's substantial revenue of €15.16 billion underscores its scale, which new entrants would struggle to match, creating a significant cost disadvantage.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | Billions of dollars needed for projects like highways or airports. | Deters companies lacking substantial financing. |

| Regulatory Hurdles | Lengthy approval processes, permits, and environmental assessments. | Can take years to navigate, delaying project commencement. |

| Economies of Scale | Lower per-unit costs due to bulk purchasing and high volume. | New entrants face higher initial operating costs. |

| Experience Curve | Accumulated know-how in managing complex projects and risks. | Newcomers lack operational efficiency and risk mitigation expertise. |

| Government Relationships | Long-standing partnerships with authorities for concessions. | New firms struggle to access project pipelines and secure contracts. |

| Proven Track Record | History of successful, large-scale project execution. | Lack of credibility makes it hard to win bids against established players. |

Porter's Five Forces Analysis Data Sources

Our Ferrovial Porter's Five Forces analysis is built upon a robust foundation of data, drawing from Ferrovial's official annual reports, investor presentations, and sustainability reports. We supplement this with industry-specific market research from reputable firms and relevant regulatory filings to ensure a comprehensive understanding of the competitive landscape.