Ferrovial Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ferrovial Bundle

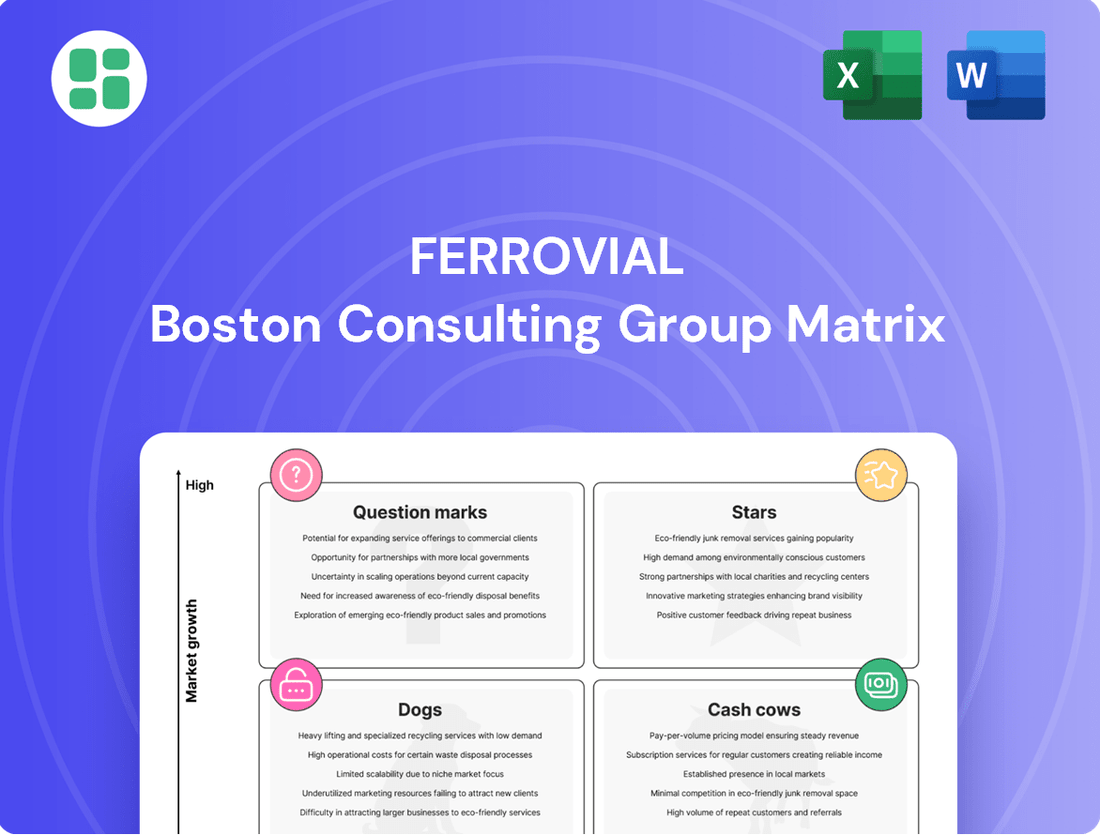

Curious about Ferrovial's strategic product portfolio? This preview offers a glimpse into how their offerings might be categorized within the BCG Matrix, hinting at their market share and growth potential. To truly understand which ventures are fueling growth and which require careful consideration, dive into the full analysis.

Unlock the complete Ferrovial BCG Matrix to gain a definitive understanding of their Stars, Cash Cows, Dogs, and Question Marks. This comprehensive report provides the actionable insights needed to optimize resource allocation and drive future success. Purchase the full version today for a clear strategic roadmap.

Stars

North American managed lanes, including Ferrovial's U.S. Express Lanes and the Canadian 407 ETR, are key growth engines. These assets consistently deliver strong revenue per transaction, outperforming inflation. In 2023, Ferrovial reported significant revenue growth from its toll roads, with North America being a major contributor to its overall financial strength.

The New Terminal One (NTO) project at JFK Airport is a significant undertaking for Ferrovial, representing a strategic investment in a high-growth aviation market. Construction is well underway, with operations anticipated to commence in 2026 or 2027.

Ferrovial's substantial equity contributions, exceeding €500 million as of early 2024, highlight their confidence in the project's potential. Securing agreements with major airlines further solidifies NTO's position for a strong market presence.

Ferrovial is actively pursuing a robust pipeline of managed lane projects across the United States, a key growth market. The company has been shortlisted for significant opportunities, including the I-285 Eastside Express Lanes in Atlanta and the I-24 Southeast Choice Lanes in Tennessee.

These potential concessions, alongside further prospects in cities like Nashville and Charlotte, underscore Ferrovial's ambition to extend its leadership in this sector. The strategic focus on securing these new projects is designed to build future revenue streams, positioning them as potential new stars in the company's portfolio.

Strategic Investment in IRB Infrastructure Trust

Ferrovial's strategic acquisition of a 24% stake in IRB Infrastructure Trust in India marks a significant move into a burgeoning toll road market. This investment is poised to be a key growth engine, tapping into India's substantial infrastructure development requirements. As of early 2024, India's infrastructure sector is experiencing robust growth, with government initiatives like the National Infrastructure Pipeline aiming to invest trillions of dollars over the coming years.

This venture, though relatively nascent for Ferrovial, holds considerable promise. India's expanding economy and increasing vehicle density are strong drivers for toll road revenue. The trust's existing portfolio and development pipeline provide a solid foundation for Ferrovial to leverage its expertise.

- Strategic Market Entry: Ferrovial's stake in IRB Infrastructure Trust offers direct access to India's high-growth road infrastructure sector.

- Future Growth Potential: The investment is positioned as a future Star due to India's significant infrastructure needs and economic expansion.

- Revenue Diversification: This move allows Ferrovial to diversify its revenue streams beyond its traditional markets.

- Operational Synergies: Potential exists for operational efficiencies and knowledge sharing with IRB Infrastructure Trust.

Ferrovial Construction's Record Order Book

Ferrovial Construction is a powerhouse, boasting a record order book that surpassed €17.3 billion by the end of 2023. This substantial backlog, with a significant chunk secured in North America, highlights its dominant position in the construction sector. The division's consistent profitability, evidenced by improved adjusted EBIT margins, underscores its operational efficiency and strong market share.

The sheer size of this order book is a testament to Ferrovial Construction's ability to win and execute large-scale projects, a key factor in its contribution to the Group's overall growth. This performance solidifies its status as a cash cow within the Ferrovial portfolio.

- Record Order Book: Exceeded €17.3 billion by the end of 2023.

- Geographic Strength: Significant portion of the order book is in North America.

- Profitability: Demonstrates strong and improving adjusted EBIT margins.

- Market Position: High market share in a stable and essential sector.

Ferrovial's investment in India's IRB Infrastructure Trust positions it as a potential Star. This venture taps into India's robust infrastructure development, with the sector poised for significant growth driven by government initiatives and increasing vehicle density. The trust's existing assets and development pipeline offer a strong foundation for Ferrovial to leverage its expertise in a high-growth market.

The North American managed lanes, including the U.S. Express Lanes and Canada's 407 ETR, are clear Stars. These assets consistently generate strong revenue per transaction, outpacing inflation. Ferrovial's significant revenue growth from toll roads in 2023, with North America as a primary contributor, underscores their leading performance.

Ferrovial's strategic pursuit of new managed lane projects across the U.S., such as the I-285 Eastside Express Lanes and I-24 Southeast Choice Lanes, marks them as emerging Stars. These potential concessions, alongside opportunities in Nashville and Charlotte, are designed to build future revenue streams and extend the company's leadership in this sector.

| Asset/Project | Market | Status | Growth Potential | Ferrovial's Role |

|---|---|---|---|---|

| IRB Infrastructure Trust | India | Investment/Nascent | High | Strategic Stake |

| North American Managed Lanes (e.g., 407 ETR) | North America | Established/Performing | Strong | Operator/Owner |

| U.S. Managed Lane Pipeline (e.g., I-285, I-24) | United States | Pipeline/Prospective | High | Developer/Operator |

What is included in the product

The Ferrovial BCG Matrix provides strategic insights into its business units, categorizing them as Stars, Cash Cows, Question Marks, or Dogs to guide investment decisions.

The Ferrovial BCG Matrix offers a clear, one-page overview, instantly relieving the pain of complex portfolio analysis.

Cash Cows

The 407 ETR Toll Road in Canada stands as a prime example of a Cash Cow for Ferrovial. This mature infrastructure asset consistently delivers robust and predictable cash flows, a testament to its established market dominance and efficient operations.

In 2024, the 407 ETR continued to showcase its strength, reporting impressive double-digit EBITDA growth. This performance not only highlights its profitability but also its ability to generate significant dividends, reinforcing its status as a reliable income-generating asset for Ferrovial.

Ferrovial's strategic decision to increase its stake in the 407 ETR further underscores its perceived value. This move signals confidence in the toll road's ongoing ability to generate substantial cash, requiring minimal reinvestment due to its mature lifecycle and strong market position.

Ferrovial’s mature U.S. highway concessions, like the I-77 and I-66 Express Lanes, are now robust cash cows, consistently returning substantial dividends. These established assets benefit from a stable market and predictable revenue streams, requiring less capital for ongoing development.

Ferrovial's overall liquidity position is exceptionally strong, bolstered by its core infrastructure assets which consistently generate substantial cash flow. This robust performance, evident in its net cash position excluding ongoing infrastructure projects, provides significant financial flexibility.

In 2024, Ferrovial's ability to fund new investments and manage its debt obligations is directly supported by this healthy liquidity. The company's established portfolio effectively generates the necessary cash to maintain operations and pursue growth opportunities, underscoring its status as a cash cow.

Dalaman Airport (Turkey)

Dalaman Airport exemplifies a Cash Cow within Ferrovial's portfolio. Its steady performance, projected to see traffic increases in 2025, underscores its stable market position.

As an established operational asset, Dalaman Airport is a reliable generator of consistent revenue and cash flow. This mature regional market requires less intensive investment compared to growth-focused projects.

Ferrovial benefits from Dalaman Airport's contribution to its diversified asset base, providing a dependable income stream.

- Projected 2025 traffic growth

- Consistent revenue and cash flow generation

- Mature market requiring lower investment

- Stabilizing influence on Ferrovial's portfolio

Operational Construction Division Profitability

Ferrovial's Construction division stands out as a robust cash cow within its portfolio. This segment has not only seen its order book expand but has consistently exceeded its adjusted EBIT margin targets, showcasing strong operational profitability. For instance, in 2023, the division reported an adjusted EBIT margin of 6.3%, surpassing its target of 5.5-6.0%.

This reliable cash generation is a significant advantage. By concentrating on local markets and minimizing its involvement in high-risk design-and-build contracts, Ferrovial's construction arm generates stable financial resources. These funds are crucial for supporting other business units within the company.

- Consistent Profitability: Achieved adjusted EBIT margins above targets, demonstrating operational efficiency.

- Stable Cash Flow: Generates reliable funding through its construction activities.

- Strategic Focus: Prioritizes local markets and reduces exposure to high-risk projects.

- Funding Support: Provides essential capital for Ferrovial's other business ventures.

Ferrovial's Construction division is a prime example of a cash cow, consistently delivering strong financial results. In 2023, this segment achieved an adjusted EBIT margin of 6.3%, exceeding its target range of 5.5-6.0%. This robust profitability, coupled with a strategic focus on local markets and a reduction in high-risk projects, ensures a stable and reliable generation of cash flow.

This dependable cash generation is vital for Ferrovial's overall financial health, providing essential capital to support other business units and new investments. The consistent performance of the Construction division solidifies its position as a core contributor to the company's liquidity and financial stability.

| Segment | 2023 Adj. EBIT Margin | Target Margin | Cash Flow Contribution |

|---|---|---|---|

| Construction | 6.3% | 5.5%-6.0% | High & Stable |

Delivered as Shown

Ferrovial BCG Matrix

The Ferrovial BCG Matrix preview you are viewing is the identical, fully formatted report you will receive immediately after purchase. This means no watermarks or demo content, ensuring you get a professionally designed and analysis-ready document for strategic planning. You can trust that this preview accurately represents the comprehensive BCG Matrix analysis you'll download, ready for immediate use in your business strategy discussions or presentations.

Dogs

Ferrovial's divestment of its services business, including Serveo and mining services in Chile, signals a strategic pivot toward its core infrastructure operations. These divested units likely represented areas with more mature growth profiles or those that didn't perfectly align with the company's future infrastructure-centric ambitions.

This move, completed in 2023, allowed Ferrovial to concentrate resources and capital on high-growth infrastructure sectors. For instance, Ferrovial's infrastructure backlog stood at €23.5 billion as of the first half of 2024, highlighting the company's commitment to expanding its core business.

Ferrovial's divestment of its stakes in Heathrow Airport and AGS Airports in 2023 for approximately £2.3 billion exemplifies a strategic move to shed mature, lower-growth assets. This decision aligns with the 'dog' quadrant of the BCG matrix, indicating these businesses, while historically significant, no longer meet the company's criteria for substantial future growth. The capital freed up is being redeployed into more promising ventures.

Ferrovial's asset rotation strategy often involves divesting smaller, non-strategic legacy concessions. These might be assets with limited growth potential or those that don't fit the company's long-term vision for scale and market leadership.

For instance, the Azores toll road, while a revenue-generating asset, likely falls into this category. Its relatively smaller scale means it doesn't contribute significantly to Ferrovial's overarching global ambitions, prompting its consideration for divestment.

This approach allows Ferrovial to reallocate capital towards more promising, high-growth opportunities, ensuring its portfolio remains dynamic and aligned with its strategic objectives. In 2023, Ferrovial reported a net profit of €1.81 billion, a significant increase from €1.15 billion in 2022, highlighting the success of its strategic capital management.

Non-Core or Low-Margin Construction Projects

Within Ferrovial's construction segment, certain projects might be classified as 'dogs' in a BCG matrix context. These are typically ventures characterized by low profit margins, elevated risk profiles, or a lack of strategic alignment with the company's core infrastructure development. Such projects can become a drain on resources, offering little in terms of future value creation.

Ferrovial's stated strategy in 2024 emphasizes a more selective approach to bidding and a heightened focus on risk mitigation. This strategic pivot indicates a conscious effort to move away from or divest from projects that fall into this 'dog' category, aiming to optimize resource allocation towards more promising and strategically vital endeavors.

- Low Margin Projects: Construction projects with thin profit margins that do not contribute significantly to overall profitability.

- High Risk Ventures: Projects carrying substantial financial or operational risks that outweigh their potential rewards.

- Non-Strategic Alignments: Construction activities that do not align with Ferrovial's long-term infrastructure focus, potentially diverting attention and capital.

- Resource Drain: Projects that consume significant management time, capital, and operational resources without generating commensurate returns or strategic benefits.

Underperforming Regional Assets

Underperforming regional assets, often termed 'dogs' in a BCG matrix context, represent business units or holdings within Ferrovial that exhibit weak traffic, stagnant revenue growth, or declining profitability. These assets typically lack a strong competitive position and do not align with the company's strategic expansion into key growth markets.

For instance, if a particular regional toll road in a mature market experiences a traffic decline of 3% year-over-year in 2024, and its revenue growth remains flat compared to the company's overall 5% average, it might be classified as a dog. Such assets consume resources without generating significant returns and do not offer substantial future growth potential.

- Weak Performance Metrics: Assets showing consistent negative or below-average growth in traffic volumes and revenue.

- Strategic Misfit: Holdings located in regions not prioritized for Ferrovial's future investment or expansion plans.

- Profitability Concerns: Operations that are either loss-making or yield significantly lower profit margins than the company's benchmark.

- Divestment Potential: Such assets are candidates for divestment to reallocate capital towards more promising 'stars' or 'question marks'.

Ferrovial's strategic divestments, such as the sale of its UK airport stakes in 2023 for approximately £2.3 billion, align with the 'dog' quadrant of the BCG matrix. These assets, while historically valuable, likely exhibited lower growth prospects compared to the company's core infrastructure focus. This proactive portfolio management allows Ferrovial to shed underperforming or mature businesses, freeing up capital for more promising investments.

The company's construction segment may also contain 'dog' projects characterized by low margins or high risks, as indicated by its 2024 strategy emphasizing selectivity and risk mitigation. Similarly, underperforming regional toll roads with stagnant revenue growth, such as a hypothetical 3% traffic decline in 2024 for a specific asset, are candidates for divestment. Ferrovial's overall net profit of €1.81 billion in 2023 reflects the positive impact of such strategic capital allocation.

Question Marks

Ferrovial's newly formed Energy Division, focusing on renewables, is a strategic move into a rapidly expanding market. Its investments in solar projects, such as those in Texas, highlight a commitment to this high-growth sector.

Given the division's recent establishment and the competitive landscape of renewable energy, Ferrovial's current market share is likely modest, positioning it as a potential 'Question Mark' in the BCG matrix. This classification suggests the division requires significant capital and focused strategy to capture a larger market share and evolve into a 'Star'.

Ferrovial's AIVIA Smart Roads initiative represents a significant investment in the burgeoning digital infrastructure sector, particularly in AI-driven traffic management. This places it squarely in a high-growth market, a key characteristic of a question mark in the BCG matrix.

While the market for smart roads and AI traffic solutions is expanding rapidly, Ferrovial currently holds a relatively small share. For instance, the global smart roads market was projected to reach USD 25.8 billion by 2024, with significant growth expected in the coming years. This low market share necessitates substantial investment to capture future market potential.

The company's commitment to developing and scaling these innovative digital solutions, including advanced sensor networks and data analytics platforms, aims to establish a strong competitive position. This strategic focus on innovation and market penetration is crucial for transforming AIVIA Smart Roads from a question mark into a future star performer.

Ferrovial's exploration of Asian and Latin American markets positions these regions as potential Stars or Question Marks in its BCG matrix. These markets represent significant growth potential, but also carry substantial risk due to Ferrovial's limited existing presence. For instance, in 2024, infrastructure spending in emerging Asian economies like India was projected to reach over $1 trillion, offering a vast opportunity but demanding considerable investment to navigate local regulations and competition.

Early-Stage New Mobility Ventures

Ferrovial's strategic expansion into new mobility and electrification ventures places these early-stage businesses within the question marks of the BCG matrix. These areas, while offering significant growth potential, are characterized by ongoing development and substantial investment needs in R&D and pilot programs. For instance, the global electric vehicle market was valued at approximately $380 billion in 2023 and is projected to reach over $1.5 trillion by 2030, indicating the high-growth nature of electrification.

These ventures are in their nascent stages, necessitating considerable capital to foster technological advancement and market validation. Success hinges on their ability to navigate evolving regulatory landscapes and consumer adoption curves, with the aim of transitioning into future Stars. The venture capital funding for mobility startups globally saw significant activity in 2024, with over $20 billion invested across various sub-sectors, highlighting the appetite for innovation in this space.

- High Growth Potential: New mobility and electrification sectors are experiencing rapid expansion, driven by technological innovation and increasing demand for sustainable transportation solutions.

- Substantial Investment Required: These ventures demand significant capital for research, development, and pilot projects to establish market presence and prove viability.

- Market Uncertainty: The early-stage nature means there's inherent uncertainty regarding market acceptance, regulatory frameworks, and competitive dynamics.

- Transformation to Stars: Successful navigation of these challenges could see these question mark ventures evolve into Stars, generating substantial returns as the market matures.

Unawarded Bids for Complex, New-Concept Projects

Unawarded bids for complex, new-concept projects, like those involving entirely novel infrastructure or unproven technologies, would likely fall into the Dogs category of the BCG matrix for Ferrovial. These ventures demand substantial upfront investment in proposal development and research, often with a low probability of securing the contract. For instance, a bid for a pioneering autonomous vehicle-only toll road, while innovative, might not have a clear market or regulatory framework yet, making its success uncertain.

Such projects represent high risk due to their nascent nature and potential for market rejection or significant technical hurdles. Ferrovial's strategic evaluation would need to weigh the potential long-term rewards against the immediate costs and the likelihood of winning the bid. For example, if a competitor secured a similar, albeit less complex, project in 2024, it might indicate a nascent market but also highlight the challenges of pioneering entirely new concepts.

- High Investment, Uncertain Returns: Bids for projects with unproven market acceptance or significant technological challenges require substantial proposal investment without guaranteed market share.

- Strategic Re-evaluation Needed: These ventures demand careful strategic evaluation to assess the risk-reward profile, especially when compared to established infrastructure projects.

- Potential for "Dog" Status: Unawarded bids in this category, particularly those with low success rates and limited market traction, align with the characteristics of a "Dog" in the BCG matrix.

Ferrovial's nascent energy division and smart roads initiative are prime examples of "Question Marks." These ventures operate in high-growth sectors with substantial future potential but currently hold modest market shares, demanding significant investment to climb the BCG matrix. For instance, the global smart roads market was valued at USD 25.8 billion in 2024, a testament to the growth opportunity that Ferrovial aims to capture with its AIVIA Smart Roads. Similarly, the company's expansion into new mobility and electrification, areas projected to see the global electric vehicle market exceed $1.5 trillion by 2030, also fits this classification due to the high capital requirements and market uncertainties inherent in these early-stage businesses.

| Business Unit/Venture | Market Growth | Relative Market Share | BCG Category | Strategic Focus |

|---|---|---|---|---|

| Energy Division (Renewables) | High | Low | Question Mark | Increase market share through investment and project development. |

| AIVIA Smart Roads | High | Low | Question Mark | Scale technology and secure market penetration in digital infrastructure. |

| New Mobility & Electrification | High | Low | Question Mark | Invest in R&D, pilot programs, and market validation for future growth. |

BCG Matrix Data Sources

Our Ferrovial BCG Matrix is constructed using robust data from company annual reports, industry growth forecasts, and internal performance metrics to ensure accurate strategic insights.