Fortune Brands SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fortune Brands Bundle

Fortune Brands demonstrates robust brand recognition and a diversified product portfolio, but faces increasing competition and potential supply chain disruptions. Understanding these dynamics is crucial for navigating the market effectively.

Want the full story behind Fortune Brands' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Fortune Brands Innovations boasts a powerful portfolio of highly recognized brands, including Moen, Master Lock, and Fiberon. This strong brand equity translates into significant competitive advantages, fostering deep customer loyalty and ensuring strong market positioning across various product categories.

The widespread trust and familiarity with these brands allow Fortune Brands to often command premium pricing. For instance, in Q1 2024, Moen continued to show resilience, contributing to the company's overall performance, reflecting the pricing power derived from its established reputation for quality and reliability.

Fortune Brands boasts a robust and diversified product portfolio, encompassing plumbing fixtures, cabinets, security products, and outdoor living solutions. This wide array of offerings allows the company to tap into various consumer needs and market trends, from essential home upgrades to lifestyle enhancements.

This strategic diversification across plumbing, cabinets, security, and outdoor living significantly reduces the company's vulnerability to downturns in any single sector. For instance, while new residential construction might fluctuate, the repair and remodeling market, along with the steady demand for security products, provides a crucial buffer.

The company's ability to serve both the residential repair/remodeling and new construction segments, alongside security applications, demonstrates its broad market reach. In 2023, Fortune Brands reported net sales of $2.8 billion, with its Plumbing segment alone contributing approximately $1.9 billion, highlighting the scale of its operations across these diverse areas.

Fortune Brands is making significant strides in innovation, particularly with its digital and connected product lines. For instance, the Moen Flo Smart Water Monitor and Master Lock's cLOTO solutions exemplify this commitment. This strategic push places the company as a leader in the burgeoning smart home market, opening up new avenues for revenue and increasing the appeal of its products through sophisticated features and data analytics.

This focus on connected products not only drives new sales but also fosters opportunities for cross-selling and establishing recurring revenue streams. A notable example is their collaboration with insurance providers, which leverages smart home data to offer enhanced value and potentially new service models.

Solid Financial Management and Cash Flow Generation

Fortune Brands exhibits robust financial management, consistently producing positive free cash flow. This financial health allows for strategic investments and share buybacks, offering resilience in fluctuating markets. The company's focus on cost control and margin improvement bolsters its financial stability.

Key financial highlights supporting this strength include:

- Consistent Free Cash Flow: Fortune Brands has a track record of generating substantial free cash flow, a critical indicator of operational efficiency and financial strength. For example, in the first quarter of 2024, the company reported approximately $130 million in operating cash flow.

- Healthy Balance Sheet: The company maintains a sound balance sheet with manageable debt levels, providing financial flexibility.

- Shareholder Returns: The strong cash flow generation enables consistent returns to shareholders through dividends and share repurchases, demonstrating confidence in ongoing financial performance.

- Operational Efficiency: Effective cost management and ongoing efforts to expand operating margins contribute directly to its financial resilience and ability to weather economic uncertainties.

Commitment to ESG and Sustainability

Fortune Brands Innovations demonstrates a robust commitment to Environmental, Social, and Governance (ESG) principles, evident in its proactive decarbonization strategies and the development of sustainable product lines. This dedication is further underscored by significant community engagement efforts, bolstering its corporate image and appealing to an increasingly eco-conscious consumer base and regulatory landscape. The company's recognition as one of America's Most Responsible Companies in 2024 highlights its leadership in sustainable business practices.

Fortune Brands possesses a portfolio of highly recognized and trusted brands, including Moen and Master Lock, which allows for premium pricing and strong customer loyalty. This brand equity is a significant asset, contributing to market leadership across its diverse product categories.

The company's diverse product offerings, spanning plumbing, cabinets, security, and outdoor living, provide resilience against sector-specific downturns. This diversification, as seen in its 2023 net sales of $2.8 billion, allows it to capture demand across various market segments, from new construction to repair and remodeling.

Fortune Brands is actively innovating with connected products like Moen Flo and Master Lock's cLOTO solutions, positioning itself for growth in the smart home market. This focus on digital integration not only drives new sales but also opens avenues for recurring revenue and enhanced customer value.

Financially, the company demonstrates strength through consistent free cash flow generation, exemplified by approximately $130 million in operating cash flow in Q1 2024. This, coupled with a healthy balance sheet and effective cost management, supports shareholder returns and financial stability.

| Key Strength | Description | Supporting Data (2023/Q1 2024) |

|---|---|---|

| Brand Equity | Strong portfolio of trusted brands (Moen, Master Lock) leading to customer loyalty and premium pricing. | Moen's continued resilience in Q1 2024 performance. |

| Product Diversification | Broad range of products across plumbing, cabinets, security, and outdoor living reduces sector risk. | 2023 Net Sales: $2.8 billion; Plumbing segment sales: approx. $1.9 billion. |

| Innovation & Connectivity | Focus on smart home technology and connected products expands market reach and revenue streams. | Development of Moen Flo and Master Lock cLOTO. |

| Financial Strength | Consistent free cash flow generation and sound financial management. | Q1 2024 Operating Cash Flow: approx. $130 million. |

What is included in the product

Delivers a strategic overview of Fortune Brands’s internal and external business factors, highlighting its brand strength and market opportunities while acknowledging potential economic headwinds and competitive pressures.

Offers a clear, actionable framework to identify and leverage Fortune Brands' competitive advantages while mitigating potential threats.

Weaknesses

Fortune Brands' significant reliance on the housing market presents a key weakness. As a provider of home and security products for new construction and renovations, the company's sales are directly influenced by housing market cycles. For instance, a slowdown in new home builds, a common occurrence during periods of rising interest rates, can significantly dent revenue streams.

The company's exposure to the repair and remodeling segment also means its fortunes are tied to consumer spending on home improvements. Economic downturns or increased interest rates, like the Federal Reserve's rate hikes throughout 2022 and 2023, can curb discretionary spending, impacting this vital revenue source. This cyclical dependency makes Fortune Brands particularly vulnerable to broader economic shifts affecting the residential sector.

Fortune Brands has encountered headwinds with sales declines in specific areas. For instance, their Security segment experienced a downturn, attributed to market softness, inventory reduction efforts by customers (destocking), and internal execution issues, which resulted in a notable drop in operating income.

Furthermore, the company's performance in the China market is projected to decline, posing a significant challenge to its overall revenue growth trajectory. This geographical weakness, coupled with segment-specific issues, highlights areas requiring strategic attention and improvement for Fortune Brands.

Fortune Brands grapples with the persistent impact of tariffs, which directly affect its bottom line and can force price adjustments for consumers. For instance, in 2023, the company noted that tariffs continued to be a factor influencing its cost structure, even as it implemented mitigation strategies.

While Fortune Brands actively works to offset these tariff-related pressures through supply chain optimization and internal cost-saving initiatives, the unpredictable nature of global trade policies and the potential for wider supply chain disruptions present ongoing risks. These external forces can lead to increased operational expenses and create challenges in ensuring consistent product availability for its customers.

Integration Risks from Acquisitions

Fortune Brands faces integration risks with its acquisitions. Unfavorable deal terms, operational integration challenges, and the possibility of acquired businesses not meeting performance expectations can hinder value creation. For instance, in 2023, Fortune Brands completed the acquisition of Aqualisa, a UK-based shower manufacturer, for $224 million. Successfully merging Aqualisa's operations and realizing expected synergies will be crucial.

These integration hurdles demand substantial management focus and resources, diverting attention from core business operations. The company's strategy relies on acquiring and integrating brands to fuel growth, making the execution of these integrations a critical factor in its overall success. In 2024, the company continues to evaluate strategic acquisition opportunities, underscoring the ongoing importance of managing integration risks effectively.

Key integration risks include:

- Cultural Clashes: Difficulty in merging different corporate cultures and employee mindsets.

- Operational Inefficiencies: Challenges in harmonizing IT systems, supply chains, and business processes.

- Synergy Realization: Failure to achieve projected cost savings or revenue enhancements from the acquisition.

- Management Bandwidth: Overextension of management resources, impacting both integration efforts and existing operations.

Competitive Pressures in Fragmented Markets

Fortune Brands operates in a fragmented home and security products market, facing significant competition from a multitude of players. This intense rivalry can exert downward pressure on pricing, potentially impacting profit margins and requiring increased investment in marketing and sales efforts to maintain market share.

The company's strong brand portfolio, while an asset, is constantly challenged by competitors who also offer a wide array of products. For instance, in the smart home security segment, which saw significant growth in 2024, numerous new entrants and established tech companies are vying for consumer attention, necessitating continuous innovation and substantial R&D spending for Fortune Brands to stay ahead.

- Intense Competition: The home and security market features a broad spectrum of competitors, from large conglomerates to niche specialists.

- Pricing Pressure: High competition often leads to price wars, potentially squeezing margins for companies like Fortune Brands.

- Market Share Erosion: Without constant innovation and strong brand positioning, market share can be lost to more aggressive or innovative rivals.

- Increased Marketing Costs: To combat competitive pressures and maintain brand visibility, marketing and advertising expenditures often need to rise significantly.

Fortune Brands' dependence on the housing market makes it susceptible to economic downturns and interest rate fluctuations, which can significantly impact sales volumes. For example, rising interest rates in 2023 led to a slowdown in new home construction, directly affecting demand for the company's products.

The company also faces challenges from intense competition within the fragmented home and security products market. This competitive landscape can lead to pricing pressures and necessitate increased spending on marketing and innovation to maintain market share, as seen in the rapidly evolving smart home security segment in 2024.

Integration risks associated with acquisitions, such as the 2023 purchase of Aqualisa for $224 million, pose another significant weakness. Failure to effectively merge operations or realize expected synergies can hinder growth and divert management resources from core business activities.

Furthermore, ongoing impacts from tariffs, as noted by the company in 2023, can increase costs and force price adjustments, potentially affecting consumer demand and profit margins.

Full Version Awaits

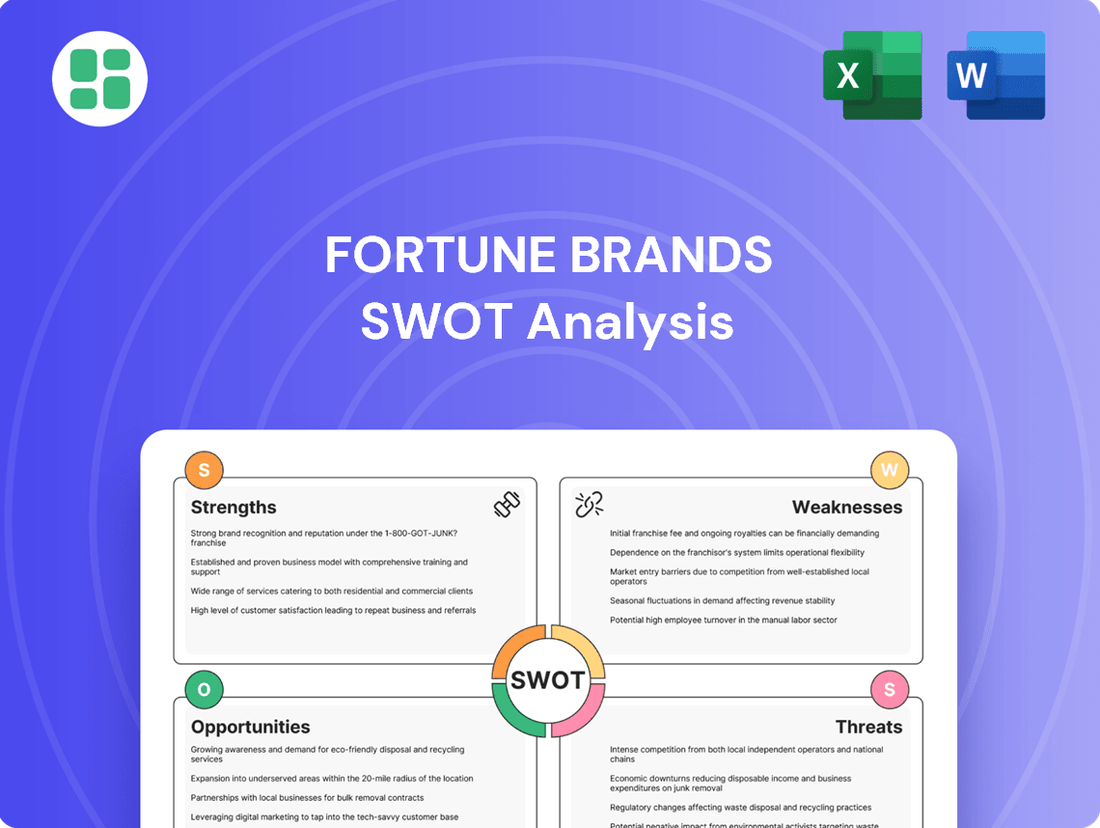

Fortune Brands SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It provides a comprehensive overview of Fortune Brands' Strengths, Weaknesses, Opportunities, and Threats, offering valuable insights for strategic decision-making.

Opportunities

The increasing consumer interest in connected living and smart home technology offers a substantial avenue for Fortune Brands to broaden its digital offerings. Products such as Moen Flo, which monitors water usage and detects leaks, and Master Lock's cLOTO smart lock system exemplify this trend.

These smart products unlock the potential for recurring revenue through subscription services and strategic alliances with sectors like the insurance industry, which can benefit from enhanced home monitoring capabilities. For instance, smart water leak detectors can lead to reduced insurance claims.

By channeling further investment into research and development for these digital solutions, Fortune Brands can solidify its position and capture a greater share of the rapidly expanding smart home market, which is projected to see continued robust growth through 2025 and beyond.

Fortune Brands has a proven acquisition strategy, evidenced by its purchase of SpringWell Water Filtration Systems in 2022 for $340 million and a minority investment in Value Hybrid Global. These moves highlight a commitment to inorganic growth.

Further strategic acquisitions are a key opportunity to accelerate expansion, broaden its product portfolio, and deepen market penetration, especially in high-growth segments.

Collaborations, particularly in burgeoning sectors such as advanced water filtration technologies and smart home security solutions, offer pathways to foster innovation and explore novel business models, potentially enhancing competitive positioning.

Fortune Brands' dedication to Environmental, Social, and Governance (ESG) principles presents a significant market opportunity. By highlighting its sustainability efforts, the company can attract a growing segment of consumers who prioritize eco-friendly products and ethical business practices, differentiating itself from competitors.

The development of more sustainable product lines and enhanced energy efficiency, coupled with a commitment to reducing carbon emissions, directly addresses increasing global environmental concerns and evolving regulatory landscapes. This alignment could lead to opportunities for premium pricing and access to new, environmentally conscious market segments. For instance, in 2024, consumer preference for sustainable home goods saw a notable increase, with reports indicating that over 60% of consumers consider sustainability when making purchasing decisions.

Furthermore, a consistent and transparent focus on ESG initiatives can foster deeper brand loyalty among its customer base and significantly boost investor confidence. This enhanced appeal is crucial in attracting capital and supporting long-term growth, especially as investors increasingly integrate ESG factors into their valuation models.

Growth in Repair and Remodel (R&R) Spending

The repair and remodel (R&R) market presents a significant opportunity for Fortune Brands. Despite some recent cooling, the long-term forecast for R&R spending remains robust. This is largely due to the aging housing stock across the US, with many homes requiring updates and modernization. For instance, the median age of owner-occupied housing units in the U.S. was 40 years in 2022, indicating a sustained need for renovations.

Fortune Brands is strategically positioned to benefit from this trend. Their diverse product offerings, spanning plumbing, cabinets, and outdoor living, directly address the needs of homeowners undertaking renovation projects. The increasing consumer interest in smart home technology and energy-efficient upgrades further bolsters this segment. In 2023, the smart home market was valued at approximately $115 billion globally, with a significant portion driven by home improvement integration.

Capitalizing on this growth will require continued focus on strategic marketing initiatives and ongoing product innovation. Developing new products that incorporate smart features or enhanced energy efficiency can attract a wider customer base and command premium pricing. For example, smart thermostats and water leak detectors are becoming increasingly popular in R&R projects.

Key aspects of this opportunity include:

- Sustained Demand: An aging housing stock provides a consistent, long-term driver for R&R spending.

- Product Alignment: Fortune Brands' comprehensive portfolio directly caters to renovation needs across multiple home categories.

- Emerging Trends: The growing adoption of smart and energy-efficient home products offers a valuable niche for product development and marketing.

Outperforming End Markets and Gaining Market Share

Fortune Brands has shown resilience, outperforming its end markets even amidst broader economic headwinds. This ability to gain market share, particularly in its key water and outdoors segments, highlights the strength of its brand portfolio and strategic execution.

For instance, in the first quarter of 2024, Fortune Brands reported a 2% increase in net sales, with its Water segment seeing a 3% organic sales increase, demonstrating growth ahead of a potentially softer overall housing market. This suggests effective strategies are in place to capture consumer demand and outmaneuver competitors.

- Strategic Focus: Continued investment in brand building and product innovation in water and outdoors.

- Channel Strength: Leveraging strong relationships with distributors and retailers to enhance market penetration.

- Competitive Advantage: Capitalizing on market softness to acquire share from less agile competitors.

- Future Outlook: Positioned to accelerate growth as market conditions normalize and demand rebounds.

The company's strategic acquisitions, such as the 2022 purchase of SpringWell Water Filtration Systems for $340 million, demonstrate a clear path for inorganic growth and portfolio expansion. These moves allow Fortune Brands to quickly enter or bolster its presence in high-growth areas like advanced water filtration.

Collaborations and partnerships, particularly in emerging sectors like smart home security and innovative water treatment, offer avenues for shared innovation and the development of new business models. This can lead to enhanced competitive positioning and access to new customer bases.

Fortune Brands' commitment to ESG principles is a significant opportunity to attract environmentally conscious consumers and investors. Highlighting sustainability, such as energy-efficient product development, can lead to premium pricing and stronger brand loyalty, aligning with the growing consumer preference for eco-friendly options, with over 60% of consumers considering sustainability in 2024 purchasing decisions.

Threats

Economic uncertainties, such as a potential slowdown in U.S. housing starts, could significantly impact Fortune Brands' performance. For instance, if housing starts, which were projected to reach around 1.5 million units in 2024, were to decline notably, it would directly affect demand for building materials and home products.

Reduced consumer confidence, often a precursor to economic downturns, also presents a threat. A dip in consumer sentiment can lead to decreased spending on home improvement and new construction projects, directly impacting Fortune Brands' revenue streams across its various segments.

A prolonged recessionary environment would exacerbate these issues, potentially leading to a substantial contraction in the residential construction and repair/remodel markets. This could translate into lower sales volumes and pressure on profit margins for the company.

The home and security products sector is intensely competitive, with numerous established companies and emerging players actively seeking market share. This robust competition often translates into significant pricing pressures, potentially squeezing profit margins for companies like Fortune Brands.

To counter these pressures, companies may need to increase their investment in marketing and promotional activities, further impacting profitability. For instance, the home improvement retail market, a key channel for many security products, saw significant shifts in 2024 with increased promotional activity from major players to attract and retain customers.

Global supply chain vulnerabilities, exacerbated by geopolitical tensions and trade policy shifts in 2024, pose a significant risk to Fortune Brands' operations. These disruptions can impact the timely delivery of essential components for their plumbing and home products. For instance, disruptions in the availability of copper and resins, key materials for plumbing fixtures and composite decking respectively, could lead to production delays and increased costs.

Fluctuations in raw material prices present another considerable threat. The cost of metals used in plumbing fittings and the chemicals integral to composite decking materials can be volatile. In 2024, rising energy prices and increased demand for construction materials have contributed to upward pressure on these costs, potentially squeezing profit margins for Fortune Brands if hedging strategies are not robust.

Geopolitical Risks and Market Contraction in Key Regions (e.g., China)

Fortune Brands faces significant threats from geopolitical instability and potential market contractions, especially in key international regions like China. The company's exposure to these markets means that shifts in trade policies, the imposition of tariffs, or broader economic slowdowns can directly impact its sales and profitability. For instance, a projected decline in the China market, a significant revenue contributor, could lead to substantial financial setbacks.

Ongoing geopolitical tensions further amplify these risks, creating an unpredictable operating environment. These tensions can disrupt supply chains, affect consumer demand, and increase the cost of doing business internationally.

- Exposure to China: Fortune Brands has substantial operations and sales in China, making it vulnerable to the country's economic performance and policy changes.

- Trade Policy Uncertainty: Fluctuations in international trade agreements and the potential for new tariffs can negatively affect the cost of goods and market access.

- Geopolitical Tensions: Broader geopolitical conflicts or strained international relations can lead to market volatility and reduced consumer spending in affected regions.

Failure to Adapt to Evolving Consumer Preferences and Technology

Fortune Brands faces a significant threat from the rapid evolution of consumer preferences, especially in areas like smart home technology and sustainability. For instance, the global smart home market is projected to reach over $150 billion by 2025, a substantial shift in consumer demand that requires immediate attention. If the company cannot quickly integrate and scale these new technologies, it risks falling behind competitors who are more agile in adapting to these changing tastes.

A failure to keep pace with these evolving demands, or to effectively scale new digital product offerings, could lead to a tangible loss of relevance and market share. Consider that in 2024, consumer spending on sustainable home goods saw a notable increase, indicating a clear market direction. Not meeting these expectations could directly impact Fortune Brands' top-line performance and long-term viability.

- Smart Home Market Growth: Projected to exceed $150 billion by 2025, highlighting a key area for adaptation.

- Sustainability Trend: Increased consumer spending on sustainable home goods in 2024 signals a critical market shift.

- Digital Product Scaling: The ability to effectively scale new digital offerings is crucial for maintaining market competitiveness.

- Market Share Risk: Inaction on evolving preferences could directly lead to a decline in market share and brand relevance.

The company faces significant threats from economic downturns, such as a potential slowdown in U.S. housing starts, which were projected to hover around 1.5 million units in 2024. Reduced consumer confidence can also dampen spending on home improvement and new construction, directly impacting Fortune Brands' revenue. Furthermore, intense competition in the home and security products sector can lead to pricing pressures, potentially squeezing profit margins.

Global supply chain vulnerabilities, amplified by geopolitical tensions and trade policy shifts in 2024, pose a risk to timely delivery of components. Fluctuations in raw material prices, such as metals for plumbing and chemicals for composite decking, also present a threat, with rising energy prices in 2024 contributing to upward cost pressures.

Geopolitical instability, particularly in key international markets like China, represents another significant threat. Economic slowdowns or policy changes in these regions can directly impact sales and profitability, with broader geopolitical conflicts further creating an unpredictable operating environment.

The rapid evolution of consumer preferences, especially in smart home technology and sustainability, poses a challenge. The global smart home market is expected to exceed $150 billion by 2025, and failure to adapt to these trends, like the increased consumer spending on sustainable home goods observed in 2024, could lead to a loss of market share and relevance.

SWOT Analysis Data Sources

This Fortune Brands SWOT analysis is built on a foundation of reliable data, drawing from the company's official financial filings, comprehensive market research reports, and expert industry analysis to provide a clear and actionable strategic overview.