Fortune Brands Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fortune Brands Bundle

Fortune Brands faces moderate bargaining power from buyers and suppliers, with a growing threat from substitutes in the home and security solutions market. The intensity of rivalry among existing competitors is a key factor influencing profitability.

The complete report reveals the real forces shaping Fortune Brands’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Fortune Brands Innovations, like many manufacturers, navigates the challenge of raw material price volatility. Their 2024 annual report highlights this exposure, particularly for key inputs. Fluctuations in the cost of these materials can directly impact their cost of goods sold and overall profitability.

To counter this, Fortune Brands employs financial instruments like commodity swaps. These derivative contracts are used to lock in prices for anticipated raw material purchases. This strategy is crucial for stabilizing costs and providing greater predictability in their financial planning, especially given the inherent swings in commodity markets.

Fortune Brands Innovations' broad product range, encompassing plumbing fixtures, cabinets, and security products, naturally leads to a diverse supplier base for a wide array of components and raw materials. This extensive network of suppliers significantly dilutes the bargaining power of any individual supplier. For instance, in 2023, Fortune Brands Innovations reported sourcing materials from numerous vendors globally, preventing over-reliance on any single entity.

Fortune Brands Innovations actively manages its supply chain through strategic sourcing, aiming to secure favorable terms and ensure a consistent flow of materials. This approach is central to their 'Fortune Brands Advantage,' allowing them to leverage their global scale to meet robust product demand.

In 2024, the company's focus on supply chain resilience, including strategic supplier partnerships, is crucial. For instance, their commitment to innovation and product development, as highlighted in their financial reports, necessitates reliable access to raw materials and components, underscoring the importance of strong supplier relationships.

Impact of Tariffs on Sourcing

Fortune Brands Innovations is actively working to manage the financial effects of tariffs. The company anticipates a continued unmitigated impact from tariffs through 2025.

Despite these challenges, Fortune Brands Innovations is on track to fully offset the financial burden of these tariffs. This is being achieved through a combination of strategic mitigation efforts, which may include diversifying sourcing locations and renegotiating supplier agreements.

- Tariff Impact Management: Fortune Brands Innovations anticipates ongoing tariff impacts through 2025.

- Mitigation Strategies: The company is employing strategies like sourcing diversification and supplier negotiations to offset these costs.

- Supplier Cost Control: These actions highlight a proactive approach to managing external cost pressures from suppliers.

Innovation and Proprietary Components

The bargaining power of suppliers for Fortune Brands Innovations is significantly shaped by the nature of its components. If the company relies heavily on highly specialized or patented parts sourced from a narrow supplier base, those suppliers gain considerable leverage. This is particularly true for innovations that depend on unique technologies or materials.

Fortune Brands Innovations' commitment to new product development and process innovation aims to mitigate this supplier power. By investing in research and development, the company seeks to control critical aspects of its product design and manufacturing, potentially reducing dependence on external suppliers for key innovations.

For instance, in the plumbing sector, while many components are standardized, proprietary valve mechanisms or smart water technology could create supplier concentration. In 2023, Fortune Brands Innovations reported approximately $2.1 billion in net sales, underscoring the scale at which component sourcing occurs and the potential impact of supplier power.

- Proprietary Component Dependence: The degree to which Fortune Brands Innovations utilizes unique, patented components directly influences supplier power.

- Supplier Concentration: Reliance on a limited number of suppliers for specialized parts increases their bargaining leverage.

- Innovation Strategy: The company's R&D efforts to develop in-house technologies can reduce dependence on external suppliers.

- Market Scale: With significant sales figures, the company's purchasing volume can be a counter-lever against suppliers, but this is offset by the uniqueness of components.

The bargaining power of suppliers for Fortune Brands Innovations is generally moderate due to its diverse product lines and extensive global supplier network, which prevents over-reliance on any single entity. However, this power can increase if the company depends on highly specialized or patented components from a limited number of vendors.

Fortune Brands Innovations' proactive supply chain management, including strategic sourcing and diversification, helps mitigate supplier leverage. For example, their 2024 focus on supply chain resilience and strategic partnerships aims to secure favorable terms and ensure material flow, even as they navigate ongoing tariff impacts through 2025.

The company's commitment to innovation, such as developing proprietary technologies in plumbing, can either reduce or increase supplier power depending on whether it internalizes critical components or relies on specialized external providers.

| Factor | Impact on Supplier Power | Fortune Brands' Mitigation |

|---|---|---|

| Supplier Diversity | Lowers power | Extensive global sourcing network |

| Component Specialization | Increases power | R&D for in-house technology development |

| Tariffs | Increases supplier cost pressure | Diversifying sourcing, renegotiating agreements |

What is included in the product

This analysis of Fortune Brands' competitive landscape reveals the intensity of rivalry, the power of buyers and suppliers, and the barriers to entry within its diverse markets.

Easily identify and mitigate competitive threats with a visual representation of Fortune Brands' Five Forces, streamlining strategic planning.

Customers Bargaining Power

Fortune Brands Innovations' diverse customer channels, encompassing retail, wholesale, and new construction, significantly dilute customer bargaining power. This multi-faceted approach means no single channel or customer segment holds a disproportionate sway over the company's sales, fostering a more balanced power dynamic. For instance, their engagement with major national homebuilders, a key segment in the construction market, provides a stable demand base.

Fortune Brands Innovations benefits from strong brand equity across its portfolio, including names like Moen and Master Lock. This brand strength fosters customer loyalty, as consumers and professionals often associate these brands with quality and reliability.

This established reputation can lessen the bargaining power of customers. For instance, in 2023, Fortune Brands Innovations reported that its plumbing segment, largely driven by the Moen brand, saw a net sales increase, indicating continued consumer preference and willingness to pay for trusted products.

Fortune Brands is enhancing its customer bargaining power by investing heavily in digital and connected products, like Moen's smart water systems and Yale smart locks. These advanced offerings create unique value, making customers less sensitive to price when they desire integrated, tech-forward solutions.

This strategic push into digital is expected to drive a significant sales run rate by late 2025, demonstrating a commitment to innovation that can reshape customer expectations and reduce their ability to negotiate lower prices.

Professional Customer Relationships

Fortune Brands Innovations cultivates strong ties with professional customers like builders and remodelers through long-term partnerships and integrated supply chain solutions. This strategy aims to foster loyalty and reduce the likelihood of these customers leveraging their purchasing power to demand lower prices. By providing valuable category insights, Fortune Brands enhances its role as a strategic partner, not just a supplier.

The company’s focus on building these professional relationships can translate into more predictable sales volumes. For instance, in 2023, Fortune Brands Innovations reported net sales of $2.2 billion, with a significant portion likely attributable to these established professional channels. This stability helps mitigate the inherent bargaining power that large customer groups can exert.

Key aspects of managing professional customer relationships include:

- Long-term partnership development: Building enduring relationships with key builders and remodelers.

- Integrated supply chain solutions: Offering seamless delivery and inventory management.

- Actionable category insights: Providing data and analysis to help customers succeed.

- Reduced transactional pressure: Fostering loyalty that lessens price-based negotiations.

Market Demand Fluctuations

Customer bargaining power often intensifies when markets soften or when inventory levels are high, a dynamic observed in Fortune Brands' Security segment during Q2 2025. This increased leverage for buyers is directly tied to prevailing economic conditions.

Even as Fortune Brands strives to outpace the broader market, a general downturn in residential repair, remodeling, and new construction projects can significantly bolster customers' negotiating positions. This means buyers have more options and can demand better terms.

Reflecting these market realities, Fortune Brands Innovations has revised its full-year 2025 guidance. This adjustment acknowledges the current challenging environment and its impact on sales and profitability.

- Market Softness Impact: Customer power rises during periods of reduced demand, as seen in the Security segment in Q2 2025.

- Industry Downturns: Declines in residential repair, remodeling, and new construction grant customers greater negotiation leverage.

- Guidance Adjustment: Fortune Brands Innovations updated its 2025 outlook to align with current market conditions.

Fortune Brands Innovations' broad customer base, spanning retail, wholesale, and new construction, inherently limits customer bargaining power. This diversification means that no single customer segment can dictate terms, creating a more balanced relationship. The company's significant investment in digital and connected products, such as smart water systems, further reduces price sensitivity among customers seeking advanced solutions.

Strong brand equity, exemplified by Moen and Master Lock, fosters customer loyalty, lessening the impact of price-based negotiations. For instance, in 2023, the plumbing segment, heavily influenced by Moen, saw a net sales increase, underscoring brand strength. However, market softness, as seen in the Security segment in Q2 2025, can temporarily increase customer leverage, prompting adjustments like the revised 2025 full-year guidance.

| Customer Channel | Impact on Bargaining Power | Supporting Factor |

|---|---|---|

| Retail | Moderate | Brand loyalty, diverse product offerings |

| Wholesale | Moderate to High | Volume purchasing, potential for alternative suppliers |

| New Construction | Moderate to High | Large project volumes, sensitivity to project costs |

| Professional Installers/Builders | Moderate | Long-term partnerships, integrated solutions |

Preview Before You Purchase

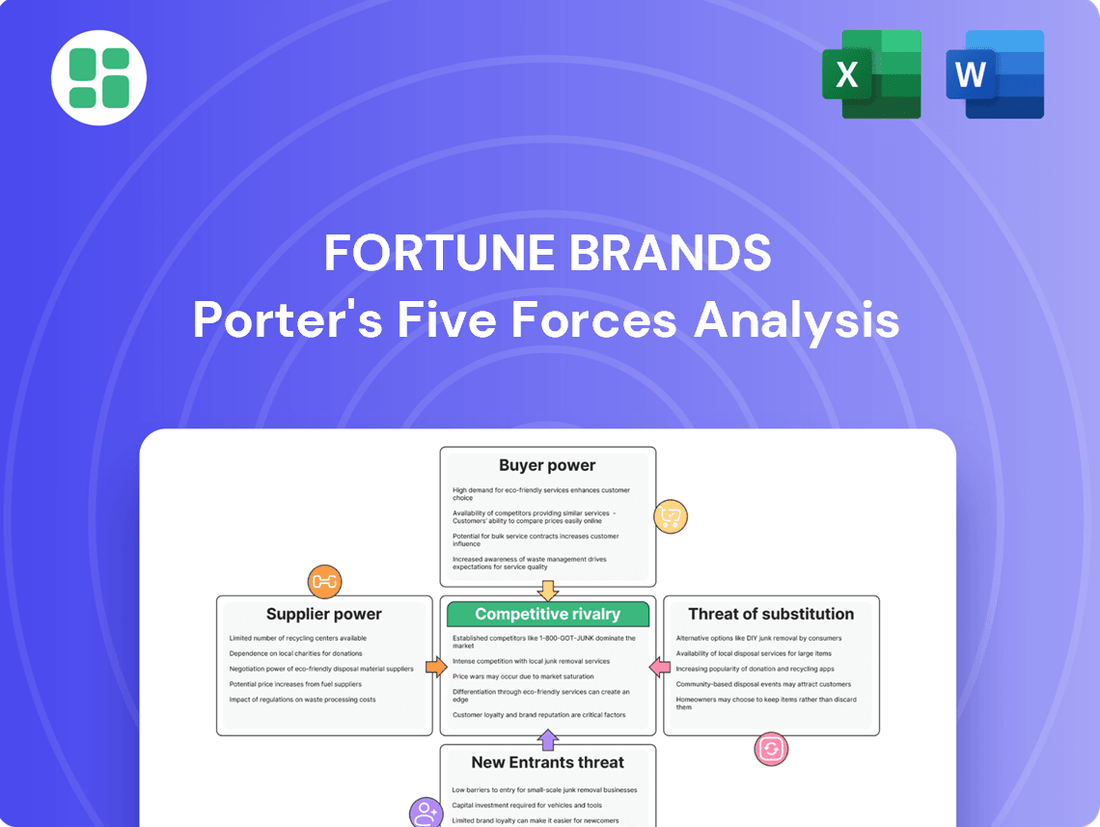

Fortune Brands Porter's Five Forces Analysis

This preview displays the complete Fortune Brands Porter's Five Forces Analysis, offering a thorough examination of competitive pressures within its industry. You'll gain insights into the bargaining power of buyers and suppliers, the threat of new entrants and substitute products, and the intensity of rivalry among existing competitors. The document you see here is exactly what you’ll be able to download after payment, providing a professionally formatted and ready-to-use strategic assessment.

Rivalry Among Competitors

Fortune Brands Innovations navigates a competitive landscape that's a mix of fragmented niches and consolidated strongholds. While some areas might see numerous smaller players vying for attention, the presence of major industry titans means intense battles for market share are a constant. This dynamic plays out across all its key segments: Water, Outdoors, and Security.

In 2024, the home improvement sector, where Fortune Brands Innovations is a key player, continued to see robust competition. For instance, the plumbing fixtures market, a significant part of Fortune Brands' Water segment, is characterized by both specialized manufacturers and large conglomerates. While companies like Kohler and Moen are major rivals, there are also many smaller, regional brands contributing to the fragmentation.

Fortune Brands Home & Security faces significant competitive rivalry from major players in the home and security sectors. Companies such as Masco, Newell Brands, LIXIL Group, Kohler, and ASSA ABLOY boast comparable product offerings, established brand loyalty, and extensive distribution channels. This parity among competitors fuels a highly competitive market environment, compelling Fortune Brands to consistently invest in product development and maintain a strong strategic market presence.

Competitive rivalry within the home and security products sector is intense, demanding constant innovation and distinct product offerings. Fortune Brands Innovations, for instance, highlights its commitment to leading in smart home technology and connected devices as a key differentiator against competitors.

The company's strategy to introduce novel, high-value products is crucial for solidifying its market standing amidst fierce competition. For example, in 2023, Fortune Brands Innovations reported a significant increase in sales driven by new product introductions, particularly in its smart water solutions and advanced security systems.

Brand and Channel Leadership

Fortune Brands Innovations' competitive rivalry is significantly shaped by its brand and channel leadership. The company boasts a robust portfolio of recognized brands like Moen, Master Lock, and Fiberon, which are critical assets in both consumer and professional sectors. These strong brand identities, coupled with deep-rooted channel relationships, provide a substantial competitive moat, allowing Fortune Brands to effectively reach and serve its diverse customer base.

The company's 'Fortune Brands Advantage' model is designed to capitalize on these strengths, fostering innovation and operational efficiency across its brands and distribution networks. This integrated approach enables Fortune Brands to maintain a competitive edge by ensuring product availability and consistent brand messaging through established channels. For instance, in 2023, Fortune Brands reported net sales of approximately $2.1 billion, underscoring the market's embrace of its leading brands and channel strategies.

- Brand Equity: Moen, a key brand, consistently ranks high in consumer preference for kitchen and bath fixtures, driving significant sales volume.

- Channel Penetration: Fortune Brands maintains extensive distribution through big-box retailers, wholesale plumbing suppliers, and direct-to-consumer channels, ensuring broad market access.

- Market Share: In segments like residential plumbing fixtures, Moen holds a leading market share, reflecting the power of its brand and channel presence.

- Innovation Pipeline: Continued investment in R&D, as evidenced by new product launches in 2024, reinforces brand leadership and channel relevance.

Market Share Gains and Performance

Fortune Brands Innovations demonstrates robust competitive rivalry by consistently outperforming its end markets and capturing market share within its core water and outdoors segments. This performance, even amidst a dynamic economic landscape, signals effective strategies and strong execution against competitors.

For instance, in 2023, Fortune Brands Innovations reported a net sales increase of 1% to $2.2 billion, with their Water segment growing 2% year-over-year. This growth outpaced the broader North American plumbing market, indicating successful share gains.

- Outperformance in Core Segments: Fortune Brands Innovations has actively gained market share in its key water and outdoors businesses, demonstrating its competitive edge.

- Strategic Execution: The company's ability to outperform its end markets highlights successful strategic planning and implementation in a challenging environment.

- Financial Indicators: A 1% net sales increase to $2.2 billion in 2023, with the Water segment showing 2% growth, underscores their competitive traction.

- Market Dynamics: These gains are particularly noteworthy given the competitive nature of the markets in which Fortune Brands Innovations operates.

Fortune Brands Innovations faces a highly competitive environment where established brands and extensive distribution networks are paramount. The company's success hinges on its ability to innovate and maintain strong channel relationships against formidable rivals like Kohler, Moen, and ASSA ABLOY.

In 2024, the home improvement sector continued to be a battleground, with Fortune Brands Innovations demonstrating resilience. For example, its Water segment, anchored by the Moen brand, is in direct competition with other major players, yet it managed to achieve a 2% year-over-year growth in 2023, outpacing the broader market.

This competitive intensity necessitates continuous investment in product development and marketing to defend and expand market share. Fortune Brands Innovations' strategy of focusing on high-value, differentiated products, such as smart home solutions, is crucial for standing out.

The company's robust brand portfolio, including Moen and Master Lock, coupled with its deep channel penetration, provides a significant competitive advantage. In 2023, Fortune Brands Innovations reported net sales of $2.2 billion, a testament to its strong market position despite the rivalry.

| Key Competitor | Primary Segments | 2023 Revenue (Approx.) | Key Strengths |

|---|---|---|---|

| Kohler | Water, Outdoors | $8 Billion+ | Strong brand, broad product range, global presence |

| Moen (A Fortune Brands Company) | Water | Included in FBIN's $2.2 Billion 2023 Net Sales | Leading brand recognition, innovation in smart water tech |

| ASSA ABLOY | Security | $11 Billion+ | Global leader in access solutions, diverse security offerings |

| Masco Corporation | Water, Building Products | $5.7 Billion | Diversified portfolio, strong presence in plumbing and cabinetry |

SSubstitutes Threaten

The threat of substitutes for Fortune Brands Innovations is significant, particularly from the Do-It-Yourself (DIY) segment and lower-cost generic alternatives. Consumers increasingly undertake home improvement projects themselves, bypassing professional installation and branded products. This trend was amplified in 2024 as homeowners sought cost savings, directly impacting demand for premium offerings.

Fortune Brands Innovations counters this by focusing on quality, durability, and brand reputation, aiming to justify a higher price point. Their product portfolio, serving both consumers and professionals, is designed to offer superior performance and aesthetic appeal compared to generic options. For instance, in the plumbing sector, while generic faucets might be cheaper, Fortune Brands' Moen brand emphasizes longevity and water-saving technology, appealing to those prioritizing long-term value.

In the security and water segments, traditional, non-connected products represent a significant threat of substitutes for Fortune Brands Innovations' expanding smart home portfolio. For instance, a basic deadbolt lock or a standard faucet can still fulfill their core functions, offering a simpler and often more affordable alternative to their smart counterparts. This is particularly relevant as consumers weigh the benefits of connectivity against potential costs and complexity.

While Fortune Brands is actively investing in and promoting its digital and connected offerings, the availability of these less technologically advanced substitutes means that not all consumers will be swayed towards smart home solutions. In 2024, the smart home market continues to grow, but the established presence and lower price points of traditional products mean they remain a viable and attractive option for a substantial segment of the market, posing a constant competitive pressure.

In the outdoor decking sector, where Fortune Brands Innovations operates with its Fiberon brand, traditional materials like wood and competing composite brands represent significant substitute threats. Similarly, within its plumbing segment, consumers might opt for alternative fixture designs or simpler, less technologically advanced plumbing solutions, potentially impacting demand for Fortune Brands' offerings.

Fortune Brands Innovations actively addresses these substitute threats by highlighting the material conversion advantages and the inherent sustainability benefits of its composite decking and innovative plumbing products. For instance, in 2023, the global composite decking market was valued at approximately $5.9 billion, and the company's focus on eco-friendly alternatives aims to capture market share from less sustainable options.

Shift in Consumer Preferences

A significant shift in consumer preferences poses a threat to Fortune Brands. For instance, economic pressures in 2024 might push consumers away from premium brands, making them more receptive to lower-cost substitute products in areas like home fixtures and cabinetry. This trend could erode market share if not addressed proactively.

Fortune Brands Innovations actively combats this by consistently investing in its brands and ensuring a strong value proposition. The company's focus on enhancing products with elements of luxury, safety, and sustainability aims to retain customer loyalty even amidst economic fluctuations. For example, their commitment to water-saving technologies in plumbing fixtures aligns with growing consumer demand for eco-friendly options.

The company's strategy is evident in its product development and marketing efforts, which highlight these key attributes. By emphasizing the long-term benefits and quality of their offerings, Fortune Brands seeks to differentiate itself from potential substitutes. This approach is crucial in a market where consumers are increasingly discerning about both price and perceived value.

Key areas where substitutes could gain traction include:

- DIY and lower-cost alternatives: Consumers might opt for less established brands or even do-it-yourself solutions for home improvement projects, especially if discretionary spending tightens.

- Private label brands: Retailers could expand their private label offerings in home goods, directly competing with Fortune Brands' established product lines.

- Rental and shared economy models: While less direct, shifts towards renting rather than owning certain home amenities could indirectly reduce demand for new purchases.

Economic Downturn Impact

During economic downturns, consumers often delay home improvement projects or seek out more budget-friendly alternatives, directly increasing the threat of substitutes for Fortune Brands' products. This economic sensitivity can lead to a shift towards lower-cost brands or even DIY solutions that bypass traditional product purchases.

Fortune Brands Innovations itself acknowledged a dynamic consumer demand backdrop in 2025, implying that economic conditions are a significant factor influencing purchasing decisions and the appeal of substitute offerings.

- Economic Sensitivity: Reduced consumer spending power during recessions makes cheaper substitutes more attractive.

- Deferred Purchases: Consumers may postpone upgrades, opting for repairs or delaying projects altogether.

- DIY Trend: In tough economic times, more individuals may attempt to fix or improve their homes themselves, bypassing the need for new products.

- Brand Switching: Consumers may switch to private label or lower-tier brands that offer similar functionality at a lower price point.

The threat of substitutes for Fortune Brands Innovations remains a key consideration, especially with the rise of DIY projects and the availability of lower-cost generic alternatives. In 2024, economic pressures encouraged consumers to seek cost-effective solutions, making them more open to these substitutes, which can fulfill basic needs at a lower price point.

Fortune Brands aims to mitigate this by emphasizing superior quality, durability, and brand trust, justifying premium pricing. For example, in the plumbing sector, brands like Moen offer advanced water-saving features and extended warranties, differentiating them from cheaper alternatives that may compromise on performance or longevity.

The company's strategic focus on innovation, such as smart home technology in security and water management, also faces competition from traditional, non-connected products. While smart solutions offer enhanced features, simpler, less expensive traditional options continue to appeal to a significant market segment, especially when budget is a primary concern, as observed throughout 2024.

The global composite decking market, where Fortune Brands' Fiberon brand competes, was valued at approximately $5.9 billion in 2023, highlighting the significant presence of substitute materials like wood and other composite brands. Fortune Brands counters this by promoting the sustainability and material conversion advantages of its products.

| Substitute Category | Example for Fortune Brands | Consumer Motivation | 2024 Market Trend Impact |

|---|---|---|---|

| Lower-Cost Generic Brands | Generic faucets, basic cabinetry | Price sensitivity, immediate cost savings | Increased adoption due to economic pressures |

| DIY Solutions | Homeowners performing own installations | Cost reduction, perceived control over project | Amplified as consumers sought savings |

| Traditional Products | Non-smart locks, standard plumbing fixtures | Simplicity, lower upfront cost, familiarity | Continued strong demand alongside growing smart home market |

| Alternative Materials | Wood decking, different composite brands | Varying aesthetics, price points, perceived durability | Ongoing competition, with emphasis on eco-friendly alternatives |

Entrants Threaten

The home and security products sector, where Fortune Brands Innovations operates, demands substantial upfront capital. Manufacturing plumbing fixtures, cabinetry, and security systems requires significant investment in state-of-the-art facilities, advanced technology, and robust supply chain networks. This high capital requirement acts as a formidable barrier, discouraging many potential new players from entering the market.

Fortune Brands Innovations benefits from a robust portfolio of highly recognized brands, including Moen, Master Lock, and Fiberon. These brands have cultivated deep customer trust and loyalty through consistent quality and performance over many years.

For any new competitor aiming to enter this market, overcoming the established brand equity of Fortune Brands presents a formidable hurdle. Significant investment in marketing and brand building would be essential, likely requiring substantial capital outlay to even approach the recognition levels currently enjoyed by Fortune Brands.

In 2024, the home and security products market continues to see strong consumer preference for trusted names. Fortune Brands' market leadership is a direct result of this brand strength, making it difficult for newcomers to gain traction without a compelling and well-funded differentiation strategy.

The home and security products industry relies heavily on robust distribution networks, encompassing retailers, wholesalers, and professional contractors. Fortune Brands Innovations has cultivated extensive relationships and a significant market presence, creating a substantial barrier for newcomers aiming to secure effective routes to market.

New entrants face considerable challenges in replicating Fortune Brands Innovations' established channel leadership. In 2023, Fortune Brands Innovations reported that its Water Brands segment, a significant contributor, saw continued strength in its distribution channels, indicating the ongoing importance of these relationships.

Regulatory and Certification Requirements

Fortune Brands Innovations faces a moderate threat from new entrants due to significant regulatory and certification hurdles, particularly in its plumbing and security segments. Many of its products must comply with stringent safety certifications and building codes, which can be costly and time-consuming for newcomers to satisfy. For instance, plumbing fixtures often require certifications like WaterSense or NSF/ANSI 61 to ensure public health and safety, adding a layer of complexity to market entry.

These requirements act as a barrier, deterring potential competitors who lack the resources or expertise to navigate the approval processes. Fortune Brands, with its established infrastructure and experience, is well-positioned to manage these compliance demands across its diverse product lines, including Moen faucets and Master Lock security solutions.

- Regulatory Compliance: Products in plumbing and security must meet specific standards, increasing new entrant costs.

- Certification Hurdles: Obtaining necessary safety certifications adds time and financial burden for new competitors.

- Market Entry Costs: Navigating complex regulations significantly raises the barrier to entry for potential new players.

- Fortune Brands' Advantage: Established players like Fortune Brands possess the experience and resources to manage these compliance requirements efficiently.

Innovation and Digital Transformation Pace

The rapid pace of innovation and digital transformation presents a significant threat of new entrants. Companies like Fortune Brands Innovations are heavily investing in connected products, such as smart water systems and smart locks, which require substantial technological expertise and upfront capital to replicate. For instance, as of early 2024, the smart home market is projected to continue its robust growth, with many consumers showing increased interest in integrated home technology solutions.

New players entering this space must not only match existing product quality but also possess the capability to develop and maintain sophisticated digital ecosystems. This dual challenge of traditional product competitiveness and advanced technological investment can deter many potential entrants. The need for significant R&D spending and the development of seamless user experiences are high barriers.

- High R&D Investment: New entrants must commit substantial resources to research and development to compete with established players' innovation pipelines.

- Digital Ecosystem Development: Creating and maintaining a connected product ecosystem requires significant investment in software, data analytics, and cybersecurity.

- Technological Expertise: Attracting and retaining talent with expertise in IoT, AI, and digital platforms is crucial, posing a challenge for newcomers.

- Consumer Adoption of Smart Tech: While growing, consumer adoption rates for smart home devices can influence the viability of new entrants relying heavily on this technology.

The threat of new entrants for Fortune Brands Innovations is generally moderate, primarily due to high capital requirements for manufacturing and establishing robust distribution networks. However, the increasing importance of technological innovation in smart home products introduces a more dynamic element, requiring significant R&D investment and digital expertise.

In 2024, the home and security market continues to favor established brands, making it difficult for newcomers to gain immediate traction without substantial marketing investment. Regulatory hurdles in plumbing and security also add complexity and cost for potential new players.

Fortune Brands Innovations' established brand equity, strong distribution channels, and experience navigating regulatory landscapes provide significant advantages against new competitors. For example, in 2023, their Water Brands segment demonstrated continued channel strength, underscoring the value of these relationships.

New entrants must also contend with the growing demand for smart home technology, which necessitates considerable investment in R&D and digital capabilities, further raising the barrier to entry.

| Barrier Type | Description | Impact on New Entrants | Fortune Brands' Position |

|---|---|---|---|

| Capital Requirements | High investment in manufacturing facilities and technology. | Significant hurdle. | Established infrastructure. |

| Brand Equity | Customer trust and loyalty for brands like Moen and Master Lock. | Requires substantial marketing to overcome. | Strong and recognized. |

| Distribution Networks | Extensive relationships with retailers, wholesalers, and contractors. | Challenging to replicate. | Well-established and extensive. |

| Regulatory Compliance | Stringent safety certifications and building codes. | Adds time and cost. | Experienced in navigating. |

| Technological Innovation | Investment in connected products and digital ecosystems. | Requires significant R&D and expertise. | Actively investing in smart home tech. |

Porter's Five Forces Analysis Data Sources

Our Fortune Brands Porter's Five Forces analysis is built upon a foundation of publicly available financial reports, investor presentations, and industry-specific market research from leading firms. We also incorporate data from trade associations and economic indicators to provide a comprehensive view of the competitive landscape.