Fortune Brands PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fortune Brands Bundle

Fortune Brands operates within a dynamic external environment, influenced by evolving political landscapes, economic fluctuations, and technological advancements. Understanding these PESTLE factors is crucial for strategic planning and identifying potential opportunities and threats. Our comprehensive analysis delves into these critical areas, providing you with the actionable intelligence needed to navigate this complex market.

Gain a competitive edge by downloading our meticulously researched PESTLE analysis for Fortune Brands. This report offers deep insights into the political, economic, social, technological, legal, and environmental forces shaping the company's trajectory. Equip yourself with the knowledge to make informed decisions and secure your market position—get your full copy now.

Political factors

Changes in global trade policies and tariffs directly affect Fortune Brands Innovations, given its international operations. The company projects a $200 million impact from tariffs in 2025, escalating to an annualized $525 million in 2026. This necessitates proactive adjustments in supply chains, cost management, and pricing strategies to offset these financial pressures.

Political developments, especially following the 2024 US elections, introduce further uncertainty. Potential shifts in trade agreements or the implementation of new tariffs could increase raw material costs and disrupt supply chain stability, impacting the manufacturing and construction industries where Fortune Brands operates.

Government regulations, encompassing building codes and sustainability mandates, significantly shape the demand and required specifications for Fortune Brands' product portfolio. These regulations directly impact how homes are built and renovated, influencing the materials and technologies that are incorporated.

New European Union rules, effective from January 2025, are placing a heightened emphasis on the safety and sustainability of construction products. This regulatory shift could necessitate adjustments in product design and potentially affect market access for Fortune Brands' offerings within European markets, requiring adherence to stricter standards.

In parallel, California's updated 2025 Energy Code and CALGreen Code are implementing mandates for energy-efficient designs and the use of sustainable materials. This proactive approach by California is compelling companies like Fortune Brands to accelerate innovation in product categories such as heat pumps and to focus on reducing embodied carbon in their materials.

Political stability in major markets significantly impacts consumer and professional spending on home and security products. Economic uncertainty, often fueled by political volatility, can make consumers more hesitant, leading to cautious spending patterns. This sensitivity to broader political-economic sentiment was evident in Fortune Brands' Q1 2025 earnings, which reported a soft demand environment, particularly in the repair and remodel sector, partly due to this cautious consumer behavior.

Infrastructure Spending Initiatives

Government investments in infrastructure, such as those outlined in the Infrastructure Investment and Jobs Act (IIJA) and the Inflation Reduction Act (IRA), are poised to stimulate demand for Fortune Brands' diverse product portfolio. These initiatives are expected to fuel new construction and renovation projects, directly benefiting segments like plumbing fixtures and security systems used in commercial and public infrastructure. For instance, the IIJA allocated $1.2 trillion in 2021, with a significant portion directed towards transportation and infrastructure upgrades, creating a robust pipeline for construction materials and components.

While the broader housing market may experience fluctuations, public spending on infrastructure projects offers a counterbalancing growth avenue. This public investment is particularly impactful in North America, where it is actively driving construction activity in sectors that rely on durable goods and building materials. The construction economy in 2024 is projected to see continued support from these public works, offering a more stable demand environment for companies like Fortune Brands.

The anticipated growth in manufacturing and energy segments, bolstered by these legislative acts, also presents a positive outlook for Fortune Brands. Suppliers to these expanding sectors, including those providing essential components for building and energy infrastructure, stand to benefit. The IRA, for example, includes substantial incentives for clean energy manufacturing and deployment, which will likely translate into increased demand for related construction and industrial products.

Key aspects of infrastructure spending initiatives impacting Fortune Brands include:

- Increased demand for plumbing and security products in new commercial and public building projects funded by government initiatives.

- Support for manufacturing and energy sectors through legislation like the IIJA and IRA, benefiting suppliers to these industries.

- Growth in the North American construction economy driven by public spending on infrastructure, offsetting potential slowdowns in other construction segments.

- Projected government investment in infrastructure upgrades, creating a sustained demand for building materials and components through 2025.

International Relations and Market Access

The broader geopolitical climate significantly influences Fortune Brands' global operations and market access. For instance, ongoing trade disputes and the potential for new tariffs, particularly between major economies, can directly impact the cost of imported components and the competitiveness of exported finished goods. The company must actively monitor and adapt to these shifts to maintain profitability and market share.

Navigating complex international trade agreements and fostering positive diplomatic ties are paramount for Fortune Brands' expansion strategy. As of early 2025, the global trade environment remains dynamic, with ongoing negotiations and evolving regulations affecting supply chains. The company's ability to secure favorable terms for import and export activities is critical for its diverse product portfolio, which spans kitchen and bath, water treatment, and hardware.

- Tariff Impact: Anticipated tariffs on materials or finished goods could increase operational expenses by an estimated 5-15% depending on the specific product category and origin.

- Market Access: Fluctuations in international relations can create or close off access to key growth markets, potentially affecting revenue streams from regions like Europe and Asia.

- Supply Chain Resilience: Strong international relations facilitate more predictable and cost-effective supply chain management, crucial for a company with a global manufacturing footprint.

- Regulatory Alignment: Harmonized trade policies and standards across different countries simplify compliance and reduce the risk of market entry barriers for Fortune Brands' products.

Political factors significantly shape Fortune Brands' operational landscape, from trade policies to domestic regulations. The company anticipates a substantial impact from tariffs, projecting a $200 million hit in 2025, potentially rising to $525 million annually by 2026, necessitating agile supply chain and pricing adjustments.

Government investments in infrastructure, such as those from the Infrastructure Investment and Jobs Act and the Inflation Reduction Act, are expected to boost demand for Fortune Brands' products, particularly in plumbing and security. These initiatives are projected to stimulate new construction and renovation projects across North America.

New regulations, like California's updated 2025 Energy Code and EU product safety rules effective January 2025, are driving innovation towards energy efficiency and sustainable materials, influencing product design and market access.

Political stability and international relations are critical for market access and supply chain predictability. Trade disputes and evolving global regulations can impact costs and competitiveness, requiring Fortune Brands to actively monitor and adapt to these dynamic geopolitical shifts.

What is included in the product

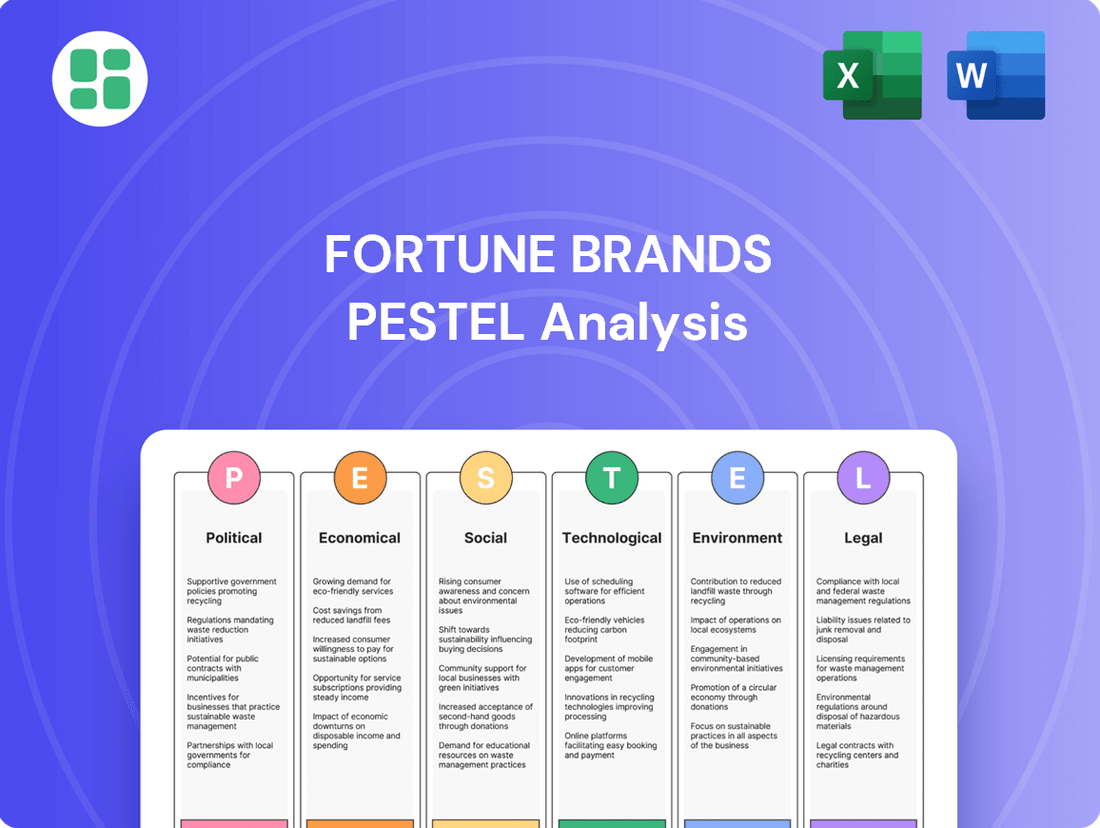

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Fortune Brands, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights by detailing how these global trends translate into specific opportunities and threats for Fortune Brands's diverse portfolio of brands.

A digestible summary of Fortune Brands' PESTLE analysis, offering clarity on external factors impacting the business for informed strategic decision-making.

Economic factors

Elevated interest rates and the resulting higher mortgage rates directly influence the housing market, impacting Fortune Brands' core businesses of new construction and home renovation. The expectation for interest rates to remain high through 2025, often termed a 'higher-for-longer' scenario, is likely to dampen demand and keep existing home sales subdued. For instance, the Federal Reserve maintained its benchmark interest rate in the 5.25% to 5.50% range through early 2025, contributing to average 30-year fixed mortgage rates hovering around 6.5% to 7.0% during this period, making new home purchases less affordable.

This sustained high-rate environment discourages homeowners with lower, pre-existing mortgage rates from selling their properties. This reluctance to move further constricts the overall housing supply, contributing to a slowdown in market activity and potentially impacting sales volumes for companies like Fortune Brands that rely on a healthy housing turnover.

The overall health of the housing market significantly impacts Fortune Brands, influencing both new construction and remodeling activities. While new home sales experienced a slowdown, the repair and remodeling sector is showing resilience.

Home renovation spending is projected to stabilize and potentially increase through mid-2025, following a modest dip in 2024. Homeowners are increasingly prioritizing upgrades to their existing residences over moving, focusing on major projects like kitchens and bathrooms.

This trend presents a sustained market opportunity for Fortune Brands' product offerings, particularly in kitchens and bathrooms, even amidst softer demand conditions observed in early 2025.

Consumer spending is a major driver for Fortune Brands' home and security products. When economic conditions are uncertain, people tend to focus on essential home repairs rather than cosmetic upgrades. This cautious approach was evident in 2024, where overall spending on renovations saw a slight decline.

Despite the dip, there's still a strong appetite for substantial renovation projects, particularly for smaller kitchen and bathroom remodels. Consumers are also increasingly making more deliberate purchasing decisions. Fortune Brands' success is closely tied to this consumer sentiment; a boost in financial confidence could lead to increased sales volumes.

Inflation and Raw Material Costs

Inflationary pressures and the escalating cost of raw materials directly impact Fortune Brands' production expenses and overall profitability. For instance, the Consumer Price Index (CPI) in the U.S. saw a notable increase, with annual inflation rates hovering around 3.4% in early 2024, affecting the cost of lumber, metals, and plastics essential for their product lines.

High interest rates, a tool used to combat inflation, have also dampened demand in the residential and commercial construction sectors, which are key markets for Fortune Brands. As of mid-2024, the Federal Reserve's benchmark interest rate remained elevated, making new construction projects more expensive and potentially slowing down sales for the company's plumbing, cabinets, and water filtration products.

Fortune Brands' capacity to navigate these economic headwinds hinges on its strategic management of costs through supply chain optimization and judicious pricing adjustments. The potential for tariffs on imported components could further exacerbate raw material and finished goods costs, necessitating agile operational strategies to maintain margins.

- Inflationary Impact: U.S. annual inflation averaged 3.4% in early 2024, increasing input costs for Fortune Brands.

- Interest Rate Sensitivity: Elevated interest rates by mid-2024 continue to pressure the construction industry, impacting demand for Fortune Brands' products.

- Cost Management: Strategic supply chain adjustments and pricing power are critical for Fortune Brands to offset rising material and component expenses, especially with potential tariff risks.

Labor Market and Wage Growth

The availability and cost of skilled labor are critical for Fortune Brands, particularly in the construction and home improvement sectors. Shortages of skilled tradespeople directly impact project timelines and the overall demand for building products.

As of early 2024, the U.S. construction industry continues to grapple with significant labor deficits. Reports indicate that millions of construction jobs remain unfilled, leading to intensified competition for qualified workers. This scarcity is driving up wages and the overall cost of benefits as companies strive to attract and retain essential talent.

The ongoing scarcity of skilled tradespeople, such as carpenters, electricians, and plumbers, has a tangible effect on the pace of both remodeling projects and new residential construction. This slowdown can directly influence the demand for Fortune Brands' diverse range of products, from plumbing fixtures to cabinetry and doors. For instance, a slower housing market due to labor constraints could translate to reduced sales for new home construction materials.

- Labor Shortage Impact: The U.S. Bureau of Labor Statistics projects a continued need for construction laborers, with the sector expected to add 1.2 million jobs by 2032.

- Wage Inflation: Average hourly earnings in the construction sector saw a notable increase throughout 2023 and into early 2024, reflecting the competitive labor market.

- Project Delays: Industry surveys from 2024 frequently cite labor availability as a primary cause for project delays and increased costs.

The economic landscape continues to shape Fortune Brands' performance, with interest rates and consumer spending being key influencers. While elevated interest rates, with the Federal Reserve maintaining its benchmark rate between 5.25% and 5.50% through early 2025, have impacted the housing market, the repair and remodeling sector shows resilience. Projected stabilization and potential growth in home renovation spending through mid-2025, as homeowners prioritize upgrades over moving, offer a sustained opportunity for Fortune Brands, particularly in kitchen and bathroom segments.

Inflationary pressures remain a concern, with U.S. annual inflation averaging around 3.4% in early 2024, increasing input costs for materials like lumber and metals. This, coupled with high interest rates affecting construction demand, necessitates strategic cost management and pricing adjustments for Fortune Brands. Potential tariffs on imported components could further challenge margins, requiring agile operational strategies.

The labor market in the construction sector, marked by a deficit of skilled tradespeople, continues to impact project timelines and costs. Millions of construction jobs remained unfilled as of early 2024, driving up wages and competition for talent. This scarcity directly affects the pace of both remodeling and new construction, potentially influencing sales volumes for Fortune Brands' product lines.

Preview the Actual Deliverable

Fortune Brands PESTLE Analysis

The Fortune Brands PESTLE Analysis preview you see here is the exact document you’ll receive after purchase—fully formatted and ready to use. It provides a comprehensive overview of the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Fortune Brands, offering valuable insights for strategic planning.

Sociological factors

Homeowners are prioritizing smart technology, eco-friendly materials, and sophisticated design, signaling a shift from basic upgrades to holistic living space enhancements. For instance, a 2024 survey indicated that 65% of new homeowners consider smart home features a high priority.

The demand for customization and well-designed outdoor living areas is also on the rise, with outdoor living spaces seeing a 15% increase in renovation spending in 2024 compared to the previous year. This directly impacts Fortune Brands Innovations' product development, pushing for smart plumbing, energy-efficient water heaters, and attractive, durable outdoor building materials.

The increasing consumer demand for smart home technology, fueled by a desire for enhanced convenience, robust security, improved energy efficiency, and anticipated long-term cost reductions, creates a substantial growth avenue for Fortune Brands. This trend is evident in the market's willingness to invest in smart product upgrades that deliver clear advantages.

Fortune Brands is well-positioned to capitalize on this shift, with offerings like Master Lock's smart security systems and Moen's Flo water management solutions directly addressing these consumer priorities. The smart home sector is projected for considerable expansion, indicating a persistent appetite for sophisticated, value-added products.

The demographic landscape is evolving, with an aging population increasingly opting to stay put rather than move. This trend is amplified by current economic conditions, where high home prices and elevated interest rates make relocating a less attractive proposition for many homeowners. In 2024, the median existing-home price reached approximately $410,000, a significant barrier for those considering a move.

Consequently, homeowners are channeling more resources into improving their existing residences. This sustained residency fuels robust demand for renovation and remodeling projects, encompassing everything from kitchen and bathroom upgrades to enhancements for energy efficiency. Data from the U.S. Census Bureau indicates that spending on home improvements and repairs reached an estimated $477 billion in 2023, a figure expected to see continued growth in 2024.

Fortune Brands is well-positioned to leverage this societal shift by focusing its product development and marketing efforts on the renovation and remodeling sector. By offering solutions specifically designed for these homeowner needs, the company can tap into a growing market driven by people investing in their current homes rather than seeking new ones.

DIY vs. Do-It-For-Me (DIFM) Trends

The home improvement landscape is evolving, with a noticeable trend towards Do-It-For-Me (DIFM) for more significant projects. While DIY remains popular for smaller tasks, homeowners are increasingly seeking professional help for complex renovations. This shift is evident in market data, with reports indicating a growing preference for professional installation services for major remodels.

This dynamic impacts companies like Fortune Brands, which must strategically cater to both the DIY enthusiast and the DIFM consumer. The increasing complexity of modern home projects means that even DIYers might require more specialized tools and higher-quality materials, often sourced through professional channels. Fortune Brands' ability to serve both the consumer and professional markets is crucial for its continued success.

- Growing DIFM Preference: Reports from 2024 suggest a 5-7% year-over-year increase in demand for professional home renovation services, particularly for kitchen and bathroom remodels.

- DIY Resilience: Despite the DIFM trend, the DIY segment for smaller repairs and maintenance is projected to grow by 3-4% in 2025, driven by cost-consciousness and a desire for personalization.

- Channel Strategy: Fortune Brands' dual-channel approach, serving both retail consumers and trade professionals, positions it to capitalize on these divergent market demands.

- Product Innovation: The company's focus on developing products that are both user-friendly for DIYers and robust enough for professional use is key to adapting to these evolving consumer preferences.

Emphasis on Health and Well-being in Homes

Consumers are placing a higher premium on health and well-being within their homes, a trend that significantly shapes purchasing decisions. This shift is evident in the growing demand for features that enhance indoor air quality, ensure clean water, and bolster home security. For instance, a 2024 survey indicated that 65% of homeowners consider indoor air quality a top priority when making home improvement decisions.

Fortune Brands' product portfolio is well-positioned to capitalize on this societal emphasis. Their security solutions, such as smart locks and advanced alarm systems, directly address the increasing consumer need for a safe living environment. Furthermore, innovations in water filtration and purification systems align with the desire for healthier hydration and overall well-being within the household.

- Growing demand for healthy home features: A significant portion of consumers prioritize indoor air and water quality.

- Security as a key driver: Home security products are increasingly sought after by homeowners concerned about safety.

- Fortune Brands' alignment: The company's offerings in security and water management directly meet these evolving consumer needs.

Societal shifts are profoundly influencing homeownership and renovation trends, with homeowners increasingly prioritizing smart technology, eco-friendly materials, and personalized design. A 2024 survey revealed that 65% of new homeowners consider smart home features a high priority, driving demand for products like Master Lock's smart security and Moen's water management systems.

An aging population choosing to age in place, coupled with high housing costs, is fueling significant investment in home improvements. In 2024, the median existing-home price was around $410,000, making renovations a more appealing option than moving. This trend is supported by an estimated $477 billion spent on home improvements and repairs in 2023, with continued growth projected for 2024.

Consumer demand for healthy living environments is also on the rise, with 65% of homeowners in a 2024 survey prioritizing indoor air quality. Fortune Brands' product lines in security and water management directly address these growing consumer needs for safety and well-being within the home.

Technological factors

The proliferation of Internet of Things (IoT) technology is fundamentally reshaping the smart home landscape, fostering seamless communication between devices and creating truly integrated living environments. Fortune Brands, through its prominent brands such as Moen and Master Lock, is strategically positioned to capitalize on this burgeoning trend. The company is developing smart plumbing fixtures, advanced smart locks, and sophisticated water management systems designed to enhance convenience and security.

The smart home device market is experiencing robust expansion, fueled by consumer demand for enhanced security, improved energy efficiency, and greater convenience. Fortune Brands is actively accelerating its digital strategy to capture this growth, reporting over 200,000 digital product activations in the first quarter of 2025, underscoring the market's positive reception to its connected offerings.

Investment in automation, robotics, and AI within construction and manufacturing is surging, projected to reach $200 billion globally by 2025, aiming to counter labor scarcity and boost productivity. This trend necessitates a workforce adept in technological skills, potentially lessening the dependency on traditional manual labor. For Fortune Brands, embracing these advanced manufacturing techniques can significantly improve output, trim operational expenses, and facilitate the creation of intricate product designs, thereby solidifying its market position.

The home improvement sector's growing shift towards online purchasing makes robust digital sales channels essential for Fortune Brands to connect with both homeowners and trade professionals. The company recognizes this trend and is actively investing in enhancing its e-commerce capabilities to align with changing consumer preferences.

Fortune Brands has demonstrated a strong commitment to digital expansion, with a clear objective to generate significant revenue from these initiatives. This strategy is underpinned by the introduction of innovative products and the formation of key strategic alliances, aiming to capture a larger share of the digital marketplace.

Material Science Innovation

Advances in material science are driving the development of more durable, sustainable, and high-performance products, a trend strongly favored by environmentally aware consumers and increasingly strict building regulations. The market is seeing a significant uptake in eco-friendly materials, such as advanced composite materials and products made from recycled content, highlighting a persistent demand for ongoing innovation in this sector. For instance, the global market for sustainable building materials was valued at approximately $250 billion in 2023 and is projected to grow substantially.

Fortune Brands can leverage this by prioritizing research and development into novel materials for its core product lines, including plumbing fixtures, cabinetry, and security systems. This strategic investment could solidify its competitive advantage. By integrating these advanced materials, the company can enhance product longevity and appeal to a broader market segment seeking greener solutions.

- Increased demand for sustainable building materials: The global market for sustainable building materials is projected to reach over $400 billion by 2027, indicating a strong consumer preference.

- Material innovation in plumbing: New composite materials offer enhanced durability and reduced water consumption in faucets and showerheads.

- Recycled content in cabinetry: The use of recycled wood and plastics in cabinet manufacturing is rising, appealing to eco-conscious homeowners.

- Performance enhancements: Advanced polymers and alloys are improving the security and weather resistance of home security products.

Data Analytics and AI in Product Development

The integration of artificial intelligence (AI) and data analytics is revolutionizing product development at Fortune Brands, allowing for the optimization of product performance and the enhancement of user experiences. This technology enables the creation of personalized routines for smart home devices, directly addressing evolving consumer expectations. For instance, AI-powered navigation algorithms in robot vacuums, a segment relevant to Fortune Brands' portfolio, can significantly improve efficiency and user satisfaction.

Leveraging data insights allows Fortune Brands to move beyond reactive product improvements to proactive innovation. By analyzing usage patterns and consumer feedback, the company can anticipate future needs and refine existing offerings, ensuring products remain competitive and desirable. This data-driven approach is crucial for developing more intuitive and effective smart home solutions.

- AI in product design: AI can analyze vast datasets to identify design trends and predict consumer preferences, leading to more successful product launches. For example, in 2023, companies investing heavily in AI for R&D reported an average 15% faster product development cycle.

- Personalized user experiences: Data analytics enables the tailoring of product features and functionalities to individual user habits, enhancing engagement and loyalty. Smart appliance usage data can inform personalized energy-saving recommendations.

- Predictive maintenance: AI algorithms can predict potential product failures, allowing for proactive customer support and reducing warranty claims, thereby improving brand reputation and operational efficiency.

- Enhanced product performance: AI can optimize parameters in smart devices, such as improving the cleaning efficiency of robot vacuums or the temperature regulation in smart thermostats, directly impacting product value.

The increasing integration of smart technologies, particularly the Internet of Things (IoT), is transforming the home environment. Fortune Brands, through its brands like Moen, is actively developing connected plumbing and security solutions, responding to a market eager for enhanced convenience and safety. This strategic focus aligns with the robust growth in the smart home device sector, evidenced by Fortune Brands' over 200,000 digital product activations in early 2025.

Legal factors

Fortune Brands Innovations must navigate a complex web of product safety and quality regulations. For instance, the updated EU Construction Products Regulation, effective January 2025, mandates enhanced product safety and performance data, including the implementation of Digital Product Passports. This regulation signifies a proactive move by the EU to bolster consumer protection and product traceability.

Evolving building codes, especially those emphasizing energy efficiency and sustainability, significantly shape product design for both homes and businesses. California's 2025 Energy Code, for instance, requires heat pumps in new homes and pushes for energy-saving improvements and lower embodied carbon.

Fortune Brands must ensure its product offerings meet these varying regional and national construction standards to maintain market relevance and legal adherence. Non-compliance could lead to significant financial penalties and market access restrictions.

Intellectual property laws are paramount for Fortune Brands, a company built on design and innovation across its key brands like Moen and Master Lock. These laws are the bedrock for preventing the unauthorized replication of its unique product designs and patented technologies, which is essential for maintaining market differentiation. In 2024, the global market for smart home devices, a sector where Fortune Brands is active, was valued at approximately $80 billion, highlighting the significant competitive landscape and the need for strong IP protection.

The company's ability to vigorously defend its patents and trademarks directly impacts its brand equity and competitive advantage. For instance, successful enforcement against counterfeit products can prevent market dilution and protect consumer trust. Fortune Brands' legal teams actively monitor for infringements, employing strategies to safeguard its innovations and ensure its market position remains secure against competitors seeking to leverage its R&D investments.

Consumer Protection Laws

Fortune Brands, as a prominent player in home and security products, navigates a landscape shaped by robust consumer protection laws. These regulations cover critical areas such as product warranties, ensuring customers receive fair recourse for defects. For instance, the Magnuson-Moss Warranty Act in the United States sets standards for written consumer product warranties, impacting how Fortune Brands communicates product guarantees.

The company must also adhere to stringent advertising standards, preventing deceptive practices and ensuring transparency in product claims. In the rapidly evolving smart home sector, data privacy and security are paramount. Regulations like the California Consumer Privacy Act (CCPA) and its successor, the California Privacy Rights Act (CPRA), grant consumers rights over their personal data collected by smart devices, requiring Fortune Brands to implement clear data handling policies.

Compliance is not merely a legal obligation but a strategic imperative. For example, in 2023, the Federal Trade Commission (FTC) continued its focus on data security, issuing guidance and penalties for companies failing to protect consumer information, underscoring the financial and reputational risks of non-compliance.

- Warranty Compliance: Adherence to federal and state warranty laws, such as the Magnuson-Moss Warranty Act, ensures product guarantees are clearly communicated and honored.

- Advertising Integrity: Maintaining truthful and non-deceptive advertising practices is crucial to avoid regulatory scrutiny and maintain consumer trust.

- Data Privacy for Smart Devices: Compliance with evolving privacy regulations like CCPA/CPRA is essential for smart home product offerings, with significant penalties for breaches.

- Consumer Rights Protection: Upholding consumer rights regarding product returns, repairs, and information access is vital for brand reputation and avoiding legal challenges.

Labor and Employment Laws

Fortune Brands must strictly adhere to labor and employment laws, covering fair wages, safe working conditions, and workforce diversity across its manufacturing and operational sites. For instance, in 2024, the U.S. Department of Labor continued to enforce minimum wage standards, impacting labor costs for companies like Fortune Brands. The construction sector, where Fortune Brands operates, is grappling with persistent labor shortages, with the U.S. Bureau of Labor Statistics projecting a need for 805,000 additional construction workers by 2030.

This challenging labor market, characterized by increasing wage demands, makes compliance with labor laws and cultivating a positive work environment crucial for attracting and retaining skilled talent. Failure to do so can lead to increased recruitment costs and operational disruptions. For example, in 2024, average hourly wages in the construction industry saw a notable increase, putting pressure on companies to offer competitive compensation packages while remaining compliant with wage regulations.

Potential shifts in labor market regulations or an increase in unionization efforts present significant risks for Fortune Brands. Such changes could directly affect operational expenses through higher labor costs and potentially reduce the company's flexibility in workforce management. The National Labor Relations Board (NLRB) has been active in 2024, addressing unfair labor practices, underscoring the importance of proactive compliance and fair employment practices.

Key considerations for Fortune Brands regarding labor and employment laws include:

- Compliance with Fair Labor Standards Act (FLSA) regulations regarding minimum wage and overtime pay.

- Adherence to Occupational Safety and Health Administration (OSHA) standards to ensure safe working conditions.

- Maintaining diversity and inclusion policies in line with Equal Employment Opportunity Commission (EEOC) guidelines.

- Monitoring and adapting to potential changes in unionization laws and collective bargaining agreements.

Fortune Brands must navigate an increasingly complex environmental regulatory landscape. For example, the EPA's proposed regulations in 2024 targeting PFAS chemicals in drinking water could impact manufacturing processes and product materials, requiring significant investment in compliance. Furthermore, evolving state-level regulations on embodied carbon in building materials, such as those being considered in New York for 2025, will necessitate product redesign and supply chain adjustments.

The company's commitment to sustainability, evidenced by its 2023 ESG report which highlighted a 15% reduction in Scope 1 and 2 emissions compared to a 2019 baseline, will be crucial for meeting future environmental mandates and consumer expectations. Failure to adapt to these evolving environmental laws could result in fines and reputational damage.

| Environmental Regulation Area | Potential Impact on Fortune Brands | 2024/2025 Relevance |

|---|---|---|

| PFAS Chemical Regulations | Increased compliance costs for material sourcing and manufacturing; potential product reformulation. | EPA's proposed drinking water standards and state-level actions are driving stricter controls. |

| Embodied Carbon in Building Materials | Need for product lifecycle assessments; potential shifts in material sourcing and product development. | States like New York are considering mandates for 2025, impacting construction material choices. |

| Energy Efficiency Standards | Demand for products that meet higher energy performance criteria; innovation in efficient technologies. | Ongoing updates to building codes globally push for more energy-conscious products. |

Environmental factors

There's a powerful surge in demand for sustainable and eco-friendly building materials, fueled by heightened consumer awareness and tightening regulations. Fortune Brands, with its broad range of products, must actively incorporate recycled content, bio-based materials, and low-embodied carbon options to stay competitive.

This strategic pivot not only satisfies evolving market preferences but also supports broader environmental objectives, mirroring the significant trends observed in the home remodeling sector. For instance, the green building market is projected to reach $171.2 billion in the US by 2027, a clear indicator of this growing demand.

Energy efficiency standards are becoming tougher globally. For instance, California's 2025 Energy Code and new European Union regulations are pushing manufacturers to create more energy-saving products. This directly affects how companies like Fortune Brands design and build items such as plumbing fixtures and smart home technology, which are expected to help consumers conserve energy and water.

Fortune Brands needs to adapt its product lines to meet these evolving requirements. By focusing on developing and highlighting the energy-saving features of its offerings, the company can gain a competitive edge. For example, advancements in low-flow plumbing technology or smart thermostats that optimize heating and cooling can be significant selling points, aligning with both regulatory demands and growing consumer interest in sustainability.

Stricter waste management regulations, such as expanding bans on single-use plastics and new recycling mandates, are compelling manufacturers like Fortune Brands to adopt circular economy principles. This shift requires a comprehensive lifecycle approach, focusing on minimizing waste from sourcing through disposal and enhancing product recyclability. For instance, the EU's Circular Economy Action Plan, updated in 2020 and with ongoing implementation, sets ambitious targets for waste reduction and resource efficiency across various sectors.

Fortune Brands must integrate product lifecycle thinking, from raw material acquisition to end-of-life management, to reduce waste and boost recyclability. This involves exploring innovative product designs, such as modular components, that facilitate easier disassembly and repurposing, thereby extending product life and minimizing landfill contributions. The global waste management market was valued at approximately $1.7 trillion in 2023 and is projected to grow, underscoring the economic imperative for sustainable practices.

Water Conservation Initiatives

Fortune Brands, particularly through its Moen brand, is directly impacted by water conservation initiatives. New regulations are increasingly focusing on reducing water consumption in both residential and commercial buildings, pushing for the mandatory adoption of low-flow fixtures and advanced irrigation systems. This trend is expected to accelerate, with many regions implementing stricter water efficiency standards in new construction and renovations throughout 2024 and into 2025.

The company's strategic focus on developing innovative water-saving technologies and smart water management solutions positions it to capitalize on these environmental demands. For instance, Moen's digital shower systems and smart water leak detectors offer consumers greater control and awareness of water usage, aligning with both consumer desire for efficiency and regulatory pressures. The global smart water management market, valued at approximately $11.5 billion in 2023, is projected to grow significantly, driven by these very initiatives.

- Regulatory Push: Expect continued tightening of water efficiency standards for plumbing fixtures in key markets like California and Texas during 2024-2025.

- Consumer Demand: Growing environmental awareness is driving consumer preference for water-saving products, impacting purchasing decisions.

- Technological Advancement: Investment in smart water technology is crucial for meeting evolving consumer and regulatory expectations for water conservation.

- Market Opportunity: The increasing focus on water scarcity presents a substantial growth opportunity for companies offering efficient water management solutions.

Climate Change Impact and Resilience

Climate change continues to reshape the building products industry. Extreme weather events, such as the increased frequency and intensity of hurricanes and wildfires observed in recent years, are driving demand for more durable and resilient construction materials. This trend presents an opportunity for Fortune Brands to innovate and expand its offerings in weather-resistant windows, doors, and plumbing fixtures.

Companies like Fortune Brands are facing mounting pressure from regulators, investors, and consumers to demonstrate strong environmental stewardship. This includes actively working to reduce their carbon footprint across their supply chains and operations. For instance, in 2023, the building products sector saw a continued push towards sustainable sourcing and manufacturing processes, with many companies setting ambitious emissions reduction targets.

Fortune Brands must therefore prioritize investments in cleaner technologies and sustainable practices to mitigate risks and capitalize on emerging opportunities. This includes transparent emissions reporting and exploring circular economy principles within its product lifecycle. By enhancing its environmental resilience, the company can strengthen its brand reputation and long-term competitive advantage.

- Increased demand for resilient building products due to more frequent extreme weather events, such as the 2023 hurricane season which saw significant damage in coastal regions.

- Growing pressure to reduce carbon footprint, with many companies, including those in the building materials sector, setting science-based targets for emissions reductions by 2030.

- Investment in cleaner technologies and sustainable operations as a key strategy for environmental stewardship and long-term business resilience.

The increasing focus on sustainability is driving demand for eco-friendly building materials, with the green building market in the US projected to reach $171.2 billion by 2027. Fortune Brands must integrate recycled content and bio-based materials to meet evolving consumer preferences and regulatory demands.

Stricter waste management regulations, like the EU's Circular Economy Action Plan, are pushing manufacturers towards circular economy principles, aiming to reduce waste and enhance recyclability. The global waste management market was valued at approximately $1.7 trillion in 2023, highlighting the economic incentive for sustainable practices.

Climate change is also influencing the industry, with extreme weather events increasing demand for resilient building products. Companies are under pressure to reduce their carbon footprint, with many in the building materials sector setting emissions reduction targets for 2030.

| Environmental Factor | Impact on Fortune Brands | Key Data/Trend |

|---|---|---|

| Demand for Sustainable Materials | Increased need for recycled, bio-based, and low-carbon products. | US Green Building Market: $171.2 billion by 2027. |

| Waste Management Regulations | Emphasis on circular economy, product recyclability, and waste reduction. | Global Waste Management Market: ~$1.7 trillion in 2023. |

| Climate Change & Resilience | Growing demand for durable, weather-resistant building products. | Increased frequency of extreme weather events driving product innovation. |

PESTLE Analysis Data Sources

Our Fortune Brands PESTLE Analysis is built on a robust foundation of data from leading economic databases, government publications, and reputable industry research firms. This ensures that our insights into political, economic, social, technological, legal, and environmental factors are current and accurate.