Fortune Brands Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fortune Brands Bundle

Fortune Brands masterfully leverages its diverse product portfolio, from Moen faucets to MasterBrand cabinets, to meet a wide range of consumer needs. Their pricing strategies reflect a balance of premium quality and accessible options across their brands, ensuring broad market appeal. Discover how their strategic distribution channels and targeted promotional campaigns create a powerful market presence.

Go beyond the basics—get access to an in-depth, ready-made Marketing Mix Analysis covering Product, Price, Place, and Promotion strategies for Fortune Brands. Ideal for business professionals, students, and consultants looking for strategic insights.

Product

Fortune Brands Innovations boasts a diverse product portfolio, encompassing plumbing fixtures, cabinetry, and security solutions. This breadth allows them to serve both homeowners and commercial clients across various needs, from renovation projects to new builds.

Key brands like Moen, known for its innovative faucets and showerheads, and Master Lock, a leader in security products, highlight the company's commitment to quality and consumer trust. In 2023, Fortune Brands Innovations reported net sales of $3.1 billion, demonstrating the market's strong demand for their home and security offerings.

Fortune Brands heavily emphasizes innovation, especially in digital and connected offerings, to cater to changing consumer needs. This focus is evident in products like the Moen Flo Smart Water Monitor and Shutoff, which has experienced robust sales growth and secured key insurance partnerships, demonstrating market acceptance of smart home water management solutions.

Further illustrating this commitment, Yale smart locks are integrating Matter technology, enabling seamless connectivity with platforms like Google Home. This move positions Yale locks as versatile components within the growing smart home ecosystem, appealing to a wider consumer base seeking integrated home automation.

The company's Master Lock division also showcases this innovative drive with its Connected Lockout Tagout (cLOTO) solutions. These offerings merge advanced safety protocols with smart technology, reflecting Fortune Brands' strategy to enhance security and operational efficiency through connected devices across its diverse product lines.

Fortune Brands places a significant emphasis on design, quality, and sustainability across its portfolio. Brands like Moen and Fiberon are central to this strategy, consistently delivering products that offer both innovation and enduring value.

Moen faucets, for instance, are recognized for their sophisticated designs and practical features, such as the Reflex technology for easy hose retraction. The availability of diverse finishes further caters to consumer preferences, underscoring a commitment to aesthetic appeal and user experience. In 2023, Moen reported strong consumer demand, contributing to Fortune Brands' overall revenue growth.

Fiberon composite decking exemplifies the company's dedication to sustainability. Its products boast realistic wood aesthetics and exceptional durability, but crucially, they are manufactured using a significant percentage of recycled materials. This focus on eco-friendly practices resonates with a growing segment of environmentally conscious consumers, a trend expected to continue driving sales in 2024 and beyond.

Tailored Solutions for Consumer and Professional Customers

Fortune Brands' product strategy is finely tuned to serve both everyday consumers and industry professionals. For DIY enthusiasts, they offer accessible home improvement products, while for builders and contractors, the focus is on durable, high-performance solutions designed for demanding commercial use. This dual approach ensures broad market appeal.

The company crafts distinct product lines and features to resonate with each customer group. This means some products are geared towards ease of use for homeowners, while others are engineered for the rigorous demands of professional installations and commercial environments. This segmentation is key to their value proposition.

Fortune Brands aims to deliver strong value to both segments. For instance, in 2024, they reported that their Home, Security & Brands segment, which heavily features consumer products, saw significant revenue growth driven by innovation and strong demand in the renovation market. This demonstrates their commitment to providing compelling offerings across their customer base.

- Consumer Focus: Accessible, user-friendly products for home improvement projects.

- Professional Focus: Robust, high-performance solutions for builders and commercial applications.

- Value Proposition: Tailored features and benefits designed to meet the specific needs of each customer segment.

- Market Reach: Broad appeal through diverse product lines catering to both DIYers and trade professionals.

Brand-Specific Enhancements and Expansions

Fortune Brands Innovations actively drives growth through brand-specific product enhancements and category expansions. This strategy ensures each core brand remains competitive and relevant in its market. For example, Moen is significantly investing in its smart water ecosystem, aiming to capture a larger share of the connected home market. In 2023, smart home device sales continued their upward trend, with the smart water segment showing particular promise.

Master Lock is undergoing a strategic rebranding and expansion into smart security solutions, reflecting a broader consumer demand for connected home safety. This move positions Master Lock to capitalize on the growing smart lock market, which is projected for substantial growth through 2025. The company's efforts signal a clear commitment to innovation beyond its traditional lock offerings.

Fiberon, a leader in composite decking, is broadening its product portfolio by introducing new composite cladding and railing systems. This expansion allows Fiberon to offer more comprehensive outdoor living solutions, catering to a wider range of customer needs and preferences. The outdoor living market saw robust activity in 2024, with composite materials gaining popularity due to their durability and low maintenance.

- Moen's smart water ecosystem expansion

- Master Lock's strategic move into smart security

- Fiberon's introduction of new composite cladding and railing systems

Fortune Brands' product strategy centers on innovation, quality, and sustainability, with key brands like Moen and Master Lock leading the charge. The company is actively expanding its smart home offerings, as seen with Moen's Flo Smart Water Monitor and Yale's integration of Matter technology, reflecting a strong push into connected living solutions. This focus on advanced features and user experience aims to capture evolving consumer demands in the home improvement and security sectors.

The company's product portfolio is designed to appeal to both everyday consumers seeking accessible home improvement solutions and professionals requiring durable, high-performance products for commercial use. This dual approach ensures broad market penetration and caters to diverse needs, from DIY renovations to large-scale construction projects.

In 2023, Fortune Brands Innovations reported net sales of $3.1 billion, with its Home, Security & Brands segment showing significant revenue growth driven by innovation and strong demand in the renovation market. This financial performance underscores the market's positive reception to their product development and strategic market positioning.

| Product Category | Key Brands | 2023 Net Sales Contribution (Illustrative) | Key Product Innovation/Focus | Market Trend Alignment |

|---|---|---|---|---|

| Plumbing Fixtures | Moen | Significant portion of $3.1B | Smart water technology, advanced faucet features (e.g., Reflex) | Growing smart home adoption, demand for water conservation |

| Security Solutions | Master Lock, Yale | Significant portion of $3.1B | Smart locks, connected lockout tagout (cLOTO) | Increased demand for home security, smart home integration |

| Cabinetry & Outdoor Living | MasterBrand Cabinets, Fiberon | Significant portion of $3.1B | Sustainable composite decking, new cladding and railing systems | Growth in outdoor living spaces, consumer preference for eco-friendly materials |

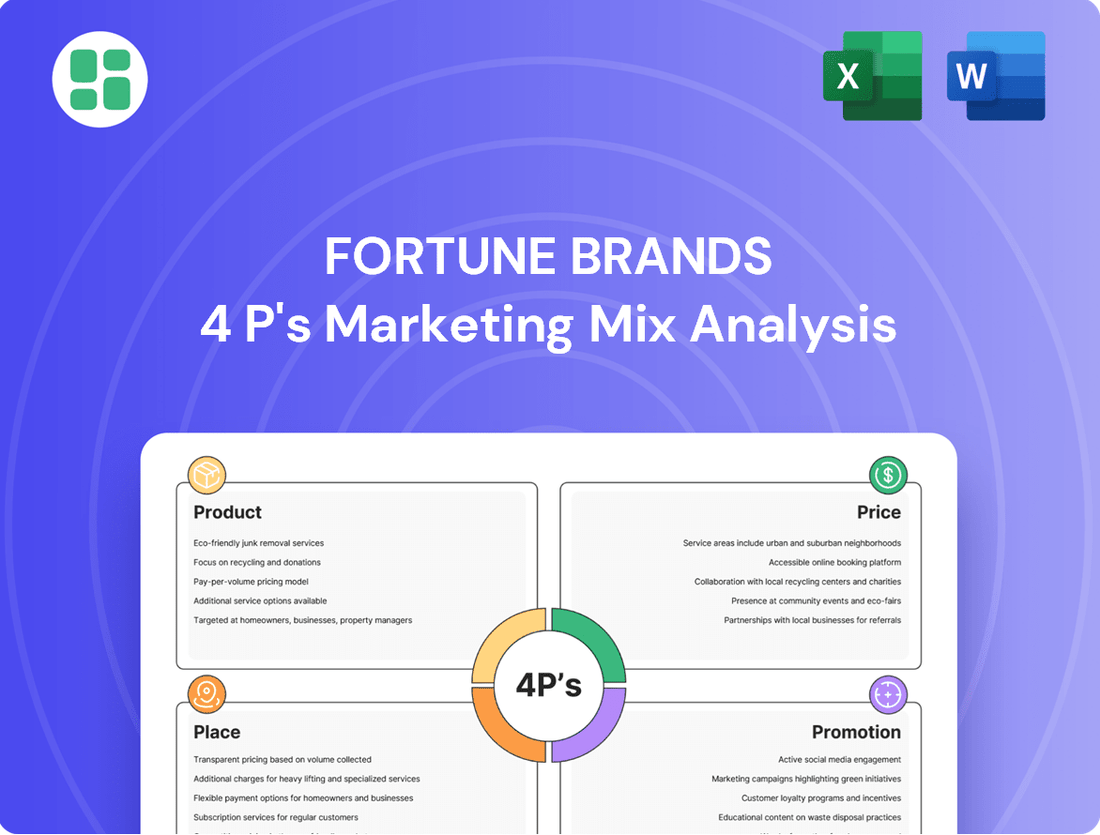

What is included in the product

This analysis provides a comprehensive 4P marketing mix overview for Fortune Brands, detailing their product portfolio, pricing strategies, distribution channels, and promotional activities.

It's designed for professionals seeking to understand Fortune Brands' market positioning and competitive advantages through a structured examination of their marketing efforts.

Simplifies the complex Fortune Brands 4Ps strategy into actionable insights, alleviating the pain of understanding intricate marketing plans.

Provides a clear, concise overview of Fortune Brands' 4Ps, easing the burden of deciphering broad marketing strategies for busy executives.

Place

Fortune Brands Innovations utilizes a robust, multi-channel distribution strategy to ensure its diverse product portfolio, spanning plumbing, security, and outdoor living, reaches a wide customer base. This network includes significant presence in major home improvement retailers, a growing e-commerce footprint, and direct engagement with professional contractors and builders.

In 2023, Fortune Brands Innovations reported that its wholesale segment, which heavily relies on this distribution network, generated approximately $2.8 billion in net sales, highlighting the critical role these channels play in its revenue generation and market penetration. The company's commitment to expanding its online sales channels and strengthening relationships with key retail partners in 2024 and 2025 is expected to further solidify its market reach.

Fortune Brands leverages strong relationships with major national retailers like Home Depot, a key distribution channel for its Moen and Therma-Tru brands. In 2024, Home Depot alone accounted for a significant portion of retail sales across the home improvement sector, underscoring the importance of these partnerships for broad consumer access and consistent product availability.

Fortune Brands is aggressively expanding its digital footprint, particularly through e-commerce platforms. This includes a dedicated focus on brands such as Master Lock and Moen's innovative connected home products, aiming to capture a larger share of online sales.

The company is witnessing significant growth in digital sales for key items like the Moen Flo Smart Water Monitor. This trend highlights a strategic pivot towards enhancing online accessibility and embracing direct-to-consumer strategies, especially for their smart home technology offerings.

Strategic Supply Chain Optimization and Logistics

Fortune Brands focuses on optimizing its supply chain and logistics for greater efficiency and product availability. This involves strategic sourcing and automation to bolster its operations and meet market demand, particularly when facing shifting economic conditions and trade policies.

The company leverages its global scale to enhance its business, ensuring it can effectively manage product flow and inventory. This strategic approach is crucial for navigating the complexities of international trade and maintaining a competitive edge.

- Strategic Sourcing: Fortune Brands actively engages in strategic sourcing to secure reliable and cost-effective raw materials and components, aiming to mitigate risks associated with supply chain disruptions.

- Automation and Technology: Investment in automation and advanced logistics technologies is a key strategy to improve operational efficiency, reduce lead times, and enhance overall supply chain performance.

- Global Scale Utilization: The company capitalizes on its global manufacturing and distribution network to achieve economies of scale, optimize inventory levels, and ensure timely product delivery to diverse markets.

- Adaptability to Market Dynamics: Fortune Brands' supply chain strategy is designed to be agile and responsive to dynamic market conditions, including managing the impact of tariffs and fluctuating consumer demand, as seen in its 2024 projections for continued supply chain resilience.

Geographic Focus on North America and China

Fortune Brands Innovations strategically concentrates its sales and distribution on North America and China, despite operating globally. This dual focus is crucial as performance in these key regions heavily influences the company's broader distribution strategies and market penetration efforts across its Water, Outdoors, and Security segments.

In 2023, North America remained the dominant revenue driver for Fortune Brands Innovations. For instance, the company reported that approximately 85% of its net sales originated from North America, underscoring its deep penetration and reliance on this market. China, while smaller, represents a significant growth opportunity.

- North American Dominance: In 2023, North America accounted for the vast majority of Fortune Brands Innovations' net sales, highlighting its established market presence.

- China as a Growth Market: While specific 2024/2025 data is still emerging, China is recognized as a key strategic market for future expansion and increased market share.

- Segment Impact: Sales performance in both North America and China directly shapes how Fortune Brands Innovations approaches distribution and market access for its Water, Outdoors, and Security product categories.

- Distribution Strategy Alignment: The company's investments in sales and distribution infrastructure are heavily weighted towards these two geographic areas to maximize reach and efficiency.

Fortune Brands Innovations' place strategy centers on a multi-channel approach, prioritizing North America and China. This geographic focus is key, as demonstrated by North America generating approximately 85% of net sales in 2023. The company leverages strong relationships with major retailers like Home Depot for broad consumer access.

Expansion into e-commerce is a significant part of their place strategy, particularly for smart home products. This digital push aims to capture a larger share of online sales, complementing their physical retail presence.

Fortune Brands also optimizes its supply chain and logistics for efficient product flow and availability. This includes strategic sourcing and automation to meet market demand, especially in dynamic economic conditions.

| Region | 2023 Net Sales % (Approx.) | Strategic Focus |

|---|---|---|

| North America | 85% | Dominant revenue driver, extensive retail partnerships |

| China | Smaller % | Key growth opportunity, expanding market share |

Full Version Awaits

Fortune Brands 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis of Fortune Brands' 4P's Marketing Mix is fully complete and ready for your immediate use.

Promotion

Fortune Brands Innovations strategically employs integrated brand-building campaigns to elevate its diverse portfolio, aiming to boost consumer awareness and stimulate demand. This approach is central to their marketing efforts, ensuring a cohesive brand message across various touchpoints.

A prime illustration of this strategy is the 'Master It' campaign for Master Lock. This initiative effectively communicates a message of responsibility, resonating with consumers and contributing to a notable surge in website traffic, thereby revitalizing the brand's image.

The success of such campaigns is reflected in tangible results. For instance, Master Lock's 'Master It' campaign saw a substantial uplift in website engagement, demonstrating the power of integrated messaging in reinforcing brand identity and driving consumer interest in 2024.

Fortune Brands leverages digital marketing and social media to connect with consumers, highlighting product features and benefits. This strategy is particularly crucial for their expanding range of smart, connected home products, where online engagement drives awareness and consideration.

In 2023, Fortune Brands' digital advertising spend contributed significantly to their overall marketing efforts, aiming to capture market share in a competitive landscape. Their social media presence focuses on engaging content that showcases innovation and lifestyle integration, fostering brand loyalty.

Fortune Brands leverages strategic public relations to underscore its commitment to innovation and corporate responsibility. This focus is evident in accolades like being named to Newsweek's America's Most Responsible Companies list for 2024, a testament to their ethical operations and sustainable practices.

Partnerships play a crucial role in promoting product value and driving adoption. For instance, Moen's collaboration with insurance providers for its Flo Smart Water Monitor directly showcases the product's benefits in preventing water damage, a significant value proposition for consumers.

Participation in Trade Shows and Industry Events

Fortune Brands leverages trade shows and industry events as a critical component of its marketing strategy, fostering direct engagement with its professional customer base. For instance, participation in events like the International Builders' Show (IBS) allows brands such as Moen and Therma-Tru to unveil cutting-edge product lines and gather immediate feedback from builders, remodelers, and distributors. These events are crucial for demonstrating product capabilities and reinforcing brand presence within key industry channels.

These engagements are not merely about product display; they are strategic touchpoints for relationship building and market intelligence gathering. In 2024, the homebuilding and remodeling sector saw continued activity, with events like IBS attracting tens of thousands of attendees, providing Fortune Brands with unparalleled access to decision-makers. Such participation directly supports the 'Promotion' aspect of the marketing mix by creating visibility and driving leads.

The value derived from these events can be seen in the direct interaction opportunities, which are vital for understanding evolving market needs and competitive landscapes. Fortune Brands' presence at these shows allows for:

- Showcasing new product innovations and technologies

- Directly engaging with builders, contractors, and specifiers

- Gathering real-time market feedback and competitive insights

- Strengthening relationships with distribution partners and key customers

Leveraging Value Proposition and Customer Insights

Fortune Brands' promotional strategies are deeply rooted in understanding consumer purchasing behavior and effectively communicating their core value proposition. Their campaigns focus on highlighting not just product features but also the intrinsic benefits consumers gain, such as dependability, peace of mind, and solutions to everyday problems.

This approach is supported by their 2023 financial performance, where they reported net sales of $3.05 billion, indicating strong market reception to their brand messaging. For instance, their Moen brand consistently emphasizes the reliability and innovation in their plumbing fixtures, resonating with homeowners seeking long-term value and ease of use.

The company leverages customer insights to tailor their communication, ensuring that the benefits of their products align with consumer needs and aspirations. This focus on emotional and functional value drives brand loyalty and purchase decisions.

- Value Proposition Focus: Communicating dependability, peace of mind, and problem-solving capabilities.

- Customer Insight Integration: Tailoring campaigns to align with consumer needs and aspirations.

- Brand Example: Moen's emphasis on reliability and innovation in plumbing.

- Financial Backing: Supported by $3.05 billion in net sales for 2023, reflecting market trust.

Fortune Brands' promotional activities aim to build strong brand equity by highlighting product benefits and problem-solving capabilities. Their integrated campaigns, like Master Lock's Master It, drive consumer engagement and brand recognition. This focus on value proposition, supported by customer insights, underpins their market success.

The company's 2023 net sales of $3.05 billion reflect the effectiveness of these promotional efforts, with brands like Moen consistently communicating reliability and innovation. Strategic use of digital marketing, social media, and public relations, including recognition as one of Newsweek's America's Most Responsible Companies in 2024, further strengthens their brand image and consumer trust.

Partnerships and industry events are also key promotional tools. Moen's collaboration with insurance providers for its Flo Smart Water Monitor showcases tangible product benefits, while participation in events like the International Builders' Show (IBS) in 2024 allows for direct engagement with professional customers, demonstrating new product lines and gathering market intelligence.

| Promotional Tactic | Key Brands/Examples | Objective | 2024/2025 Relevance |

|---|---|---|---|

| Integrated Brand Campaigns | Master Lock (Master It campaign) | Boost awareness, stimulate demand, enhance brand image | Continued focus on cohesive messaging across touchpoints |

| Digital Marketing & Social Media | Smart home products | Drive awareness, consideration, highlight features/benefits | Crucial for expanding connected home offerings |

| Public Relations | Newsweek's America's Most Responsible Companies 2024 | Underscore innovation and corporate responsibility | Reinforces ethical operations and sustainable practices |

| Partnerships | Moen Flo Smart Water Monitor with insurers | Showcase product benefits (e.g., preventing water damage) | Highlighting tangible value propositions |

| Trade Shows & Industry Events | Moen, Therma-Tru at IBS 2024 | Direct engagement with professionals, showcase innovation, gather feedback | Access to tens of thousands of industry decision-makers |

Price

Fortune Brands Innovations employs strategic pricing, notably aligning with perceived value. For premium brands like Moen, this means a premium price point, while other segments adopt competitive pricing to ensure broad market appeal. This careful balance supports brand equity and market positioning across their diverse product lines.

Fortune Brands' pricing strategies are highly responsive to market shifts, including fluctuating supply costs and changing tariff environments. For instance, in 2024, the company has been actively assessing the impact of potential tariffs on imported components, which could necessitate price adjustments to maintain profitability.

The company employs a suite of mitigation tactics to counteract the financial strain of tariffs and other market volatilities. These may involve strategic price increases on specific product lines, particularly those with less price-sensitive demand, or exploring alternative sourcing options to reduce reliance on tariff-affected goods.

Navigating the uncertain macroeconomic climate of 2024-2025, Fortune Brands prioritizes pricing flexibility to ensure competitiveness and manage cost pressures. This dynamic approach allows them to adapt to evolving consumer spending patterns and supply chain disruptions, aiming to protect margins without alienating their customer base.

Fortune Brands positions its products like Fiberon composite decking and Master Lock security items at competitive price points, focusing on the superior quality and lasting value they offer. This strategy allows them to stand out against rivals who may offer similar goods but lack the same emphasis on durability and long-term cost-effectiveness.

Discounts, Financing Options, and Subscription Models

Fortune Brands actively uses discounts to enhance product affordability and reach a broader customer base. This strategy is crucial for driving sales volume across its diverse portfolio, from plumbing fixtures to outdoor living products.

For its digital innovations, such as the Moen Flo smart water monitor, the company is experimenting with subscription models. These recurring revenue streams aim to lower initial purchase barriers for consumers and foster ongoing customer engagement, potentially boosting lifetime value.

- Discount Strategy: Fortune Brands likely employs seasonal sales, promotional bundles, and loyalty programs to incentivize purchases, particularly during key retail periods.

- Subscription Piloting: The Moen Flo subscription service could offer tiered plans covering advanced leak detection alerts, water usage analytics, and extended warranty services, creating predictable income.

- Revenue Diversification: By exploring subscriptions, Fortune Brands aims to diversify its revenue streams beyond one-time product sales, building a more resilient financial model.

Consideration of Customer Segments (Consumer vs. Professional)

Fortune Brands likely tailors its pricing strategies to distinguish between consumer and professional customer segments. For consumers, pricing might focus on perceived value and accessibility, perhaps through tiered product offerings or promotional bundles. Professionals, on the other hand, often require volume discounts, project-specific quoting, and potentially longer payment terms, reflecting their larger purchasing power and different service needs.

The company's approach to professional clients would involve a robust job quoting system to ensure competitive pricing for large-scale projects. This ensures that contractors and builders receive pricing that aligns with market expectations and their project budgets. This strategy is crucial for securing B2B contracts and maintaining strong relationships within the professional trades.

For instance, in the plumbing sector, a consumer might purchase a faucet at a retail price point, while a large construction company could negotiate bulk pricing for hundreds of units for a new development. This difference accounts for volume, reduced per-unit sales and marketing costs, and the potential for ongoing business. Fortune Brands' ability to manage these distinct pricing structures is key to its market penetration across diverse customer bases.

Value delivery is paramount across all channels, whether direct-to-consumer or through professional distributors. This means ensuring that pricing reflects not just the product itself, but also the associated support, warranty, and availability. For 2024, market analysts anticipate continued price sensitivity among consumers, while professional segments may prioritize reliable supply chains and consistent quality, influencing how Fortune Brands structures its value proposition and pricing.

Fortune Brands' pricing strategy is multifaceted, balancing premium positioning for brands like Moen with competitive pricing for broader market appeal. In 2024, the company is keenly aware of consumer price sensitivity and the need for pricing flexibility amidst economic uncertainties and supply chain disruptions. This dynamic approach aims to protect margins while maintaining customer engagement.

The company leverages discounts and promotional bundles to drive sales volume across its diverse product categories, from plumbing fixtures to outdoor living solutions. For digital products, such as the Moen Flo smart water monitor, subscription models are being explored to create recurring revenue and enhance customer lifetime value.

Fortune Brands differentiates pricing for consumer and professional segments, offering volume discounts and project-specific quotes to trade customers. This dual approach ensures competitiveness in both B2C and B2B markets, reflecting varying purchasing power and needs.

Market analysts project that the overall price increase for consumer goods in the home improvement sector could range from 3-7% in 2024, influenced by raw material costs and inflation. Fortune Brands' ability to navigate these pressures while maintaining perceived value will be critical for its market performance.

| Pricing Strategy Element | Description | 2024/2025 Considerations |

|---|---|---|

| Value-Based Pricing | Aligning prices with the perceived value of premium brands like Moen. | Maintaining premium perception amidst economic pressures. |

| Competitive Pricing | Setting prices to be attractive within specific market segments. | Adapting to competitor pricing and market demand shifts. |

| Discounting & Promotions | Utilizing sales, bundles, and loyalty programs to drive volume. | Targeted promotions to boost sales during key retail periods. |

| Subscription Models | Experimenting with recurring revenue for digital products (e.g., Moen Flo). | Building predictable income streams and customer engagement. |

| Segmented Pricing | Differentiating prices for consumers vs. professional clients. | Offering volume discounts and project quotes for trade partners. |

4P's Marketing Mix Analysis Data Sources

Our 4P analysis for Fortune Brands is grounded in comprehensive data from official company disclosures, including SEC filings and investor relations materials. We also leverage insights from industry reports, competitor analysis, and direct observations of their product offerings and pricing strategies.